The IMF released several chapters of the World Economic Outlook; one chapter entitled Financial Stress and Economic Downturns provides some insights into the ramifications of the current financial turmoil.

Figure 4.7 from WEO (Oct. 2008). Notes: Sources: Haver Analytics; OECD, Analytic Database; OECD, Economic Outlook (2008); and IMF staff calculations. The difference between banking-related and non-banking-related episodes is significant at a minimum of 10 percent for quarters 0, 1, 2, 3, and 4. The sample is constant for all quarters.

The difference between slowdowns preceded by banking-related financial stress and slowdowns not preceded by financial stress is significant at a minimum of 10 percent for t – 6 to t + 6. The sample is constant for all quarters.

So financial stress before a recession presages a statistically significantly more severe recession; the fact that it’s a banking type of financial stress (as opposed to say exchange rates or interest rates) suggests that it will be even worse than otherwise. Finally, the prevalence of arm’s-length finance (as compared to the bank-centric systems dominant in Europe) means that the impact will likely be even more negative in the US case.

From the chapter written by Subir Lall,

Roberto Cardarelli, and Selim Elekdag:

Implications for the Current Crisis in the United

States and Euro Area

Figure 4.15 compares data for the current

crisis in the United States and euro area against

the medians of selected macroeconomic variables

around the beginning of the six major

financial stress episodes examined above and

against the averages for these variables across all financial stress episodes that were followed by

recessions. The current imbalances and adjustments

appear generally much smaller than those

for the six episodes examined here, except for

U.S. residential real estate investment and the

U.S. current account.23 The patterns of credit

and asset prices in the United States prior to

the current crisis are very similar to those for

the typical financial-stress-driven recession.

The deleveraging process by households in the

United States is proceeding faster than in the

typical recession, although deleveraging by firms

seems to be proceeding somewhat more slowly

and from a stronger initial position. Finally,

although bank assets remained robust during

the second half of 2007, partly reflecting the

reintermediation of off-balance-sheet commitments,

the ratio of credit to GDP declined significantly

in the first quarter of 2008, suggesting

that the pace of deleveraging may have picked

up (see also Chapter 1).

The current crisis is different for the United

States in important ways from previous episodes.

Corporate balance sheets and firms’

reliance on external financing were on a more

solid footing entering the current crisis, which

should provide some resilience. However, the

sheer size of the U.S. mortgage market, which

is at the heart of the crisis, and the role of residential

investment suggest that household saving

and consumption behavior may play a much

larger role in the current downturn than in the

past. On a positive note, the policy stance in the

United States has been proactive, as exemplified

by the aggressive cuts in policy rates and the

measures taken to shore up liquidity in both

commercial banks and investment banks. Moreover,

banks have raised substantial amounts of

capital, although continuing declines in the

mark-to-market value of assets suggest that

substantially more capital will be needed before

the financial system can resume significant

discretionary lending.

…

Overall, these results suggest that the economic

impact of financial stress may be greater

in the United States than in the euro area.

The U.S. economic downturn may well become

more severe and could evolve into a recession.

The evidence for the euro area is more consistent

with the pattern for a slowdown than a

recession, and the dynamics also appear to be

evolving with some lag.

While this last paragraph might seem obvious given recent events, it’s important to recall that this chapter would have been written at least several weeks ago (before being approved by the Executive Board), if not longer. Had this report come out before the collapse of Lehman Brothers, I would have bet a lot of criticism would have been leveled at the authors, arguing that the conclusions were alarmist. Indeed, a lot has changed in three weeks.

Some related findings were reported in a paper I discussed a couple months ago, here.

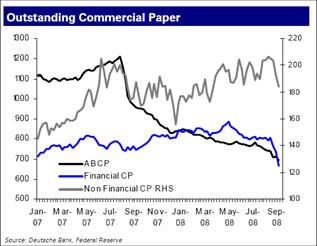

Financial picture of the day:

Figure from S. Sadeesh, Fixed Income Special Report:

Money Market Monitor Deutsche Bank (October 6, 2008).

Technorati Tags: recession, financial crisis,

banking crisis, arm’s-length finance,

and deleveraging.

The charts are very difficult to read and the acronyms are not defined. Charts should be expandable.

Hal: I’ve done what I could with the first figure. Now you can download that chart, and use your tecnical prowess to expand it (I’ve hit my limits). Alternatively, you can use the hyperlink provided to download the chapter itself). Regarding the acronyms in the second figure, well, here goes: “ABCP” is “asset backed corporate paper”; “financial CP” is “financial corporate paper”; “non financial CP RHS” is “non financial corporate paper right hand side”.

All fixed now.

Nice job with the graphs. Much, much better now.

It is amazing that we have come this far after the housing market cratered (when did that start? 2006?) without recession. But if the financial industry goes the way of the homebuilding industry, where exactly is growth going to come from?

Exports and commodities were good for a couple of quarters, but they seem to have petered out.

The things that we’ve relied on for 5 or 6 years for growth (low taxes and low interest rates) are gone or going away (if Obama takes the ring, for sure).

Why wouldn’t we be in a recession, or going from a slowdown into a recession?

Don’t worry, Bernake is thinking of cutting rates again. Everything will be fine.

Nice to see the comparison with other economic downturns, but I wonder if this comparison is too kind for a world that has never seen this level of financial saturation?

aaron,

It looks like Bernanke cut rates without telling anyone. The over night rate since September 19 has averaged about 1.36%.