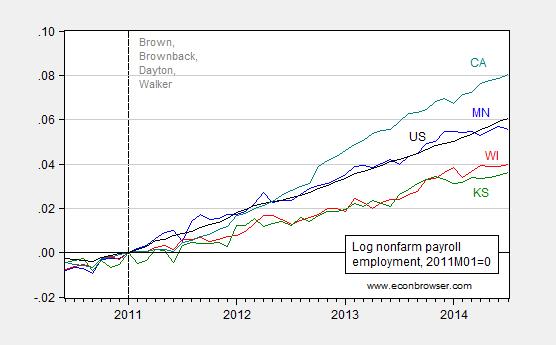

Following up on last Thursday’s post, here is a depiction of how Wisconsin and Kansas — ALEC darlings — fare against Minnesota and California.

Figure 1: Log nonfarm payroll employment for Wisconsin (red), Minnesota (blue), California (teal), Kansas (green) and the US (black), all seasonally adjusted, 2011M01=0. Vertical dashed line at beginning of terms for indicated governors. Source: BLS, and author’s calculations.

The negative correlation between a high ALEC-Laffer economic outlook ranking and economic growth remains negative.

ALEC’s 2014 economic outlook:

Kansas – 15th

Wisconsin – 17th

Minnesota – 46th

California – 47th

source–http://www.alec.org/publications/rich-states-poor-states/

What predictive power the ALEC people seem to possess, and the author of the study? a certain Dr. Laffer (PhD. – Clown Univ.).

So why is purchasing power greater in Wisconsin than in Minnesota;

http://taxfoundation.org/blog/real-value-100-each-state

patrick, purchasing power increases in states with less income-ie lower demand drops the prices of goods. minnesota has less purchasing power because it has a more vigorous economy. wisconsin and kansas have less vigorous economies-and hence more purchasing power.

Your Bafflingship, could it be that the state governmental unit accounts

for over 16% of GNP? The Badger state is still a very Red state.

Hear is the real news about the state of California.

http://news.investors.com/ibd-editorials/081814-713768-plunge-in-tax-revenues-signals-more-red-ink-for-golden-state.htm

As time progresses, we will see the real test of whether states which increased taxes

upon the productive verse these which reduced them.

Hans: You should get your news from someplace else than the appropriately abbreviated IBD. The decline in 2014Q1 was a nationwide phenomenon. You will note that, according to the Rockefeller Institute, in the Fiscal Year to Date (March), California tax revenue was up 3.7%.

Try again…

Patrick R. Sullivan: I have two words for you: “Penn Effect”.

(as baffling notes…)

You think that Wisconsin and Minnesota use different currencies?

Patrick R. Sullivan: The existence of the Penn Effect is not predicated upon the use or non-use of different currencies. Maybe you should read a little more closely the description. One could have the Penn Effect even in a currency union (gee, did you ever wonder why there are different entries for countries within the euro area?). Your refusal to think about the mechanisms underlying the Penn Effect is, frankly, astounding. (Now, if you were to assert there are no nontradable goods or factors of production within the US, that might be a more useful way of attacking the argument. What’s your view on LOOP?)

local exchange rates are different. you see it all the time in Canada-it was even more pronounced years ago. different cities would have different us-canadian exchange rates. in the present case, just exchange of dollars for products rather than dollars for dollars.

Why is purchasing power greatest in Mississippi? Obviously because it’s the wealthiest state with the most desirable places to live, work, eat and play.

I was thinking about making this point last night, but my inertia overcame whatever motivation I had. I am glad you made it. There’s are reasons Mitt Romney chose to build his car elevator in nasty ol’ California and not in god fearing freedom loving Mississippi.

Obviously the logs again, although it may be difficult to explain to ALEC types the meaning of “negative correlation”.

A former California state congressman begs to differ:

http://www.breitbart.com/Big-Government/2012/08/20/state-tax-levels-do-impact-economic-growth-even-if-libs-claim-they-dont

I’m inclined to believe that how taxes are used and overall government policies regarding business are more important than state tax rates which pale in comparison with the burden of all federal taxes. For years, Michigan has poured money into a bottomless pit called Detroit. It was a complete waste of tax dollars because Detroit government was corrupt, inefficient, and anti-business based on its regulatory environment. One can argue that higher rates could have fixed that, but Detroit received not only state tax monies, but had its own city taxes which raised the cost of doing business and living there. Given the negative other aspects of the city government, a one or even two percent difference in tax rates would not have solved anything.

It would seem that higher or lower taxes are marginal influences on whether or not a state enjoys economic prosperity and high employment. It is the larger picture of climate, culture, regulation, educated work force, integrity and cooperation that can drive the economy. North Dakota and Texas are both enjoying strong economies, but with different tax structures. What they have in common is a pro-energy, pro-business approach to regulation that trumps the minor differences in tax rates. Other states use their favorable climate and free-swinging lifestyles to attract highly educated young people. Wisconsin will never lead the nation in economic growth regardless of what the tax rates might be. It is a somewhat under-educated state with a lot of old line businesses and a history of socialist/very liberal pro-labor/anti-business policies and attitudes that leave it mired in cheese and beer. Still, it’s a nice, quiet state that plods along without too much of the highs or lows.

So, do high taxes or low taxes at the state level drive economic prosperity? Yes.

Bruce Hall: I much preferred the description of his other piece of fiction:

Which was reviewed by Armor Magazine:

Good response, Menzie. I do believe he is the first politician to ever write a piece of fiction.

Mr Hall, I am afraid they all do..

It is interesting to note that the three largest employers in Michigan were GM, Ford, and Chrysler (haven’t checked lately.) If the three largest employers in a state and their suppliers were having a extended downward trend (the decade prior to the last recession); is tax policy going to make a difference?

It would be interesting to compare the top 3 employers in all 4 of the states mentioned. How are those companies faring in the time period of interest?

Smaller budget deficits can slow growth and employment.

However, the mix of output can improve.

For example, government can raise taxes and spending to pay people to dig holes and fill them up again.

Or, instead, reduce taxes and spending for a steeper improvement in living standards, although growth and employment are slower.

Would you care to explain how slower growth and employment generate a steeper improvement in living standards.

It does not compute in my book.

spencer I agree. It doesn’t compute in my book either. My hunch is that PeakTrader is one of those sorta-kinda-Austrians that believes government only subtracts value and never adds to it. The usual explanation from those types is that government spending only “artificially” juices GDP growth, so it shouldn’t count as real growth. Whatever. We hear that same junk from Ricardo.

2slugbaits, you and spencer need books on the Scientific Method of Neoclassical Economics.

We need “good” government. You seem to believe there isn’t enough bad government.

PT, where is the applause button?

Do we get a higher standard of living paying workers to dig holes and fill them up again, or paying workers to produce valuable goods?

Income = GDP = output.

Digging holes and filling them up again is output.

PeakTrader That’s a false choice. The rationale for fiscal “pump priming” is this choice: Pay people to dig holes and fill them up again or don’t pay them at all and allow income to leak away. Obviously it would be much better if we paid people to do useful things like build bridges and repair highways; but the GOP won’t allow that. Given their druthers the GOP would prefer to not pay people at all and just let them starve to death…not a smart strategy if you’re worried about long run potential GDP.

Governmental units are not known as drivers of efficiency..

This should be red meat for Mssrs. Chinn and Hamilton.

VOXEU on secular stagnation. Everyone weighs in.

And not a blessed one of them has a clue about oil markets. In 179 pages, not one mention of oil. Not one. That’s how weak the profession is.

http://www.voxeu.org/sites/default/files/Vox_secular_stagnation.pdf

That’s because oil doesn’t have a blessed thing to do with any of the problems they are talking about. Secular stagnation is a demand side problem, not a supply side problem.

Interestingly enough, a few days ago I posted some comments about 401k and pension plans being a contributor to secular stagnation. Last night I settled down to read the vox.org ebook and found to my surprise…lo and behold…some very prominent economists arguing that 401k and pension plans are likely contributors to secular stagnation. Lordy, Lordy. I’m in the wrong profession.

Do you read anything I write? How many times have I written on this?

Here’s a bit in the VOX paper from Bob Gordon (p. 5): He proposes the five causes of secular stagnation. Well, let’s review them:

– “Low TFP growth”: That’s the equivalent of saying, “Well, I don’t know what the hell it is.”

– “Demography”: Oh, please. This is the easiest thing to predict. Did he predict this six years ago?

– “Education: The mass education revolution is complete, no further increase in the average US education level is to be expected.” Same argument as demographics. Could you not tell how many people were being educated? Is he suggesting that state with lower levels of education should expect higher growth rates (because they have more room to catch up) than a state with high levels of education?

– “Inequality: The raising share of the top 10% of the income distribution has deprived the middle class of income growth since 1980.” I don’t even know how to respond to this. Inequality is characteristic, not a causal factor. It’s like saying tallness contributes to height. You want to know who has some of the worst growth in the OECD: Denmark and Finland, allegedly pretty equal places.

– “Public debt: The gloomy outlook for public debt makes current public services unsustainable.” First of all, the relationship of debt to GDP is hotly contested on this very blog (not primarily by me). Second, public debt can be projected and understood. If this the very first time we’ve discussed debt and growth, well, I hardly know what to say. Is he saying we need to deleverage in a hurry?

Everything Gordon contends is stuff that should have been entirely predictable in 2007, 2009, or latest 2010. Did he predict secular stagnation at that time? No, it was all R&R. Deleveraging, and slow recoveries from financial crises, etc. Now it’s 2014 and we’re having some sort of deathbed conversion? And to what? Educational overload?

And Gordon concludes that these factors will “knock off 1.2% from the 1891-2007 average US per capita growth rate of 2.0%.”

Now, wait, someone else mentioned a 1.2% number. Who was that? Oh yes, that was me, and it was what, two years ago? Three years ago? Did I predict something way back when? Did it hold up? Did I actually walk us through the math? How many times? Four, maybe?

You know, these guys–and you my friend, Slugs–could have done worse than read Jim’s latest article. There are some pretty suggestive graphs in there along the lines of the relationship of GDP and oil. Or hell, maybe they might read something by Kumhof down at the IMF.

Here’s the thing. These guys have no idea why we’re seeing secular stagnation. That’s why we need a big coffee klatch paper so the boys can get together for some semi-structured brainstorming. That’s why you publish a paper like this. But they are so utterly, utterly clueless about oil it’s frightening. Is there secular stagnation in North Dakota? No? Why might that be? Have wages fallen in the oil sector? No. Why not? Is it because we are desperately short on oil and everyone has been working like crazy to find some? Is Detroit on its knees? What do they manufacture in Detroit? What’s the relationship between that product and oil? Does anyone even mention that we fried $2.5 trillion in upstream spend since 2005 in productivity losses? Do you think $2.5 trn of productivity losses might be a sum worth mentioning? Why might US GDP have separated from European GDP in 2011, just as US shale oil production was surging? Why is the UK, which has become a major oil exporter, seen such weak GDP growth even as the US, with a shale surge, has performed reasonably well? Why is Europe is perpetuo recession? Who predicted that in 2007? Or for that matter, in 2011? (Oh, yes, I did, in April 2011.) Did no one ask just how we got our current account back in order, that we reduced oil consumption by 10% and increase production by a phenomenal amount? Did no one wonder how Europe made that same adjustment, what options would be open to the continent? Would reduced economic activity be one such strategy?

So, forgive me if I’m a bit testy, but, good god, these are our very best economics minds, allegedly. And they’re terrible, absolutely terrible. They are sloppy, superficial, hide-bound and completely lacking in curiosity or analytical rigor.

“So, forgive me if I’m a bit testy, but, good god, these are our very best economics minds, allegedly. And they’re terrible, absolutely terrible. They are sloppy, superficial, hide-bound and completely lacking in curiosity or analytical rigor.”

or they recognize the stupidity in allowing oil to continue to be a dominant issue in the economy. it is foolish economically to continue to allow oil to have an important place in the future economy-especially since we have many of the tools necessary to replace it. its like keeping a poisonous snake as a pet-why do something so foolish.

For anybody interested in a critical evaluation of the book that Steven Kopits mentions on Secular Stagnation, see Stephen Williamson’s comments at:

http://newmonetarism.blogspot.com/2014/08/secular-stagnation-useful-ideas-or-hot.html

Love it when Williamson says “If you are a young macroeconomist, you might be thinking of Summers and Krugman as some creaky dinosaurs blowing hot air. “

That’s an interesting take. But why it is that everything for macroeconomists seems to come down to monetary (and occasionally fiscal) policy? The real economy is whisked away into some abstraction. Planes and trains and automobiles: those are mere figments, nothing more than the shadows and reflections of monetary policy.

Steven Kopits I think you’re confusing some terms here. The term “secular stagnation” is not equivalent to “economic stagnation.” Secular stagnation is narrowly defined to refer to slow economic growth due to weak aggregate demand as a consequence of nominal interest rates chronically at or near the ZLB. For example, see page 2 of the VOXEU ebook where secular stagnation is defined as being an economic state in which negative real interest rates are required in order to equilibrate savings & investment with full employment. As the VOXEU introduction says, this is the consensus understanding of the what “secular stagnation” means. It simply doesn’t have much of anything to do with oil. It’s not even supply oriented. Now it is true that Robert Gordon’s contribution does touch on what we would tend to think of as long run supply side issues; however, if that’s all Gordon talked about, then his paper should not have been included in the collection. But Gordon’s paper does belong in the ebook because he relates some of these supply side issues to how they affect investment demand. For example, the demographic changes (fewer workers, longer life expectancies) coupled with higher levels of public debt constraining future government spending will encourage more savings, which will put downward pressure on interest rates. In fact, Gordon goes to great pains to distinguish those parts of his argument that are directly related to “secular stagnation” properly defined and slow growth due to supply side factors. Gordon describes the phenomena he discusses as additional “headwinds” that are above and beyond (but further aggravate) the problem of secular stagnation. In other words, Gordon is quite conscious of the fact that he is not writing directly about secular stagnation, but rather “headwinds” likely to make the problem of secular stagnation even more intractable.

You may or may not be impressed by this whole notion of secular stagnation. You could just regard it as so much horse hockey. Reasonable people can take different views. But before you dismiss it you need to correctly define it. Secular stagnation is not just another term for economic stagnation. Secular stagnation has a very special meaning, and that meaning does not include oil supplies unless you want to make some very indirect and tortured arguments connecting oil supplies to negative real interest rates at the ZLB. If you tried really hard you could probably do that, but I suspect that it’s more likely that oil supplies will induce positive inflationary shocks that would tend to lift the nominal interest rate above the ZLB.

Slugs –

Let me quote you the first two sentences of the documents:

“Six years after the Crisis and the recovery is still anaemic despite years of zero interest rates. Is ‘secular stagnation’ to blame?”

They assembled this report because growth has been anemic. Why has growth been anemic? Because we have had to ration oil, and OECD oil consumption has had to drop as a result. This means that oil is a binding constraint on economic growth. I have written about this dozens of times, both here in articles, as early as 2009.

Can monetary or fiscal policy help or hinder the process of adjustment? Sure. But there is a meaningful constraint on a commodity representing 5% of global GDP, and one which is an enabler of a big portion of the rest of global GDP. If you’re going to write a long report on stagnation, and you do not address this issue, forgive me, you’re completely clueless as an economist.

steven,

i will keep returning to the point that if oil is a significant constraint-and detrimental constraint to the the economy at that-then the economic decision should be to minimize and/or eliminate oil’s influence on the future economy if at all possible. and it is possible to do this-maybe at short term cost, but long term benefit on a number of issues: economic stability, minimizes revenue in anti-American foreign oil companies, avoid foreign oil wars, promote technological advances in our own country, promote America’s own renewable energy resources, environmental benefits, …the list goes on and on.

Steven Kopits They assembled this report because growth has been anemic.

I don’t think so. The topic de jour is “secular stagnation.” Are there other possible reasons for the weak recovery? Sure. But this ebook was quite upfront about focusing on the secular stagnation thesis. I’m sorry if that’s not a topic that interests you, but that’s the topic they wanted to cover. I think you have to give editors some discretion as to what topics they want to cover.

If you’re going to write a long report on stagnation

Again, they didn’t write a long report on stagnation. They wrote a report on secular stagnation. Let me repeat this one more time; secular stagnation has a very specific meaning. It is a very special kind of stagnation, not stagnation in general. Their question was not “Is ‘stagnation’ to blame?” Their question was “Is ‘secular stagnation’ to blame?” That’s a very different issue. Don’t confuse the two just because they sound similar.

a commodity representing 5% of global GDP

Every time I hear this I think back to old Prof. Robert Fogel shuffling around the lectern reminding students that “small times small equals smaller.” It’s not what percent of GDP oil represents, it’s what percent of oil supplies are disrupted. If oil is 5% of global GDP and supplies are (say) 5% short of demand, then the impact on global GDP will be something like 5% x 5% = 0.25% of global GDP. In any event, if the problem was tight oil relative to robust demand, then we would expect to see strong inflationary pressures. We don’t see those pressures. Anywhere. The price signal just isn’t there. Now it may well be true that we would see those price signals if the global economy was going great guns; but it’s not. And the reason it’s not going great guns is because global demand is weak. And “secular stagnation” is one possible explanation for weak global demand. The other problem with your analysis is that it assumes economic actors don’t react to tighter oil supplies. There is this thing called substitution. Your analysis betrays a kind of training in command economies in which all isoquants are orthogonal to one another, meaning that the elasticities of substitution are zero. That’s a Marxist view. And it’s wrong. It’s very hard to believe that a deep recession going on seven years is all because economic actors refuse to adjust their energy inputs. It’s a basic law of economics that in the long run all inputs are elastic. The reason oil shocks lead to recessions is because the short-run elasticity is very low. Seven years is not the short run It takes people awhile to adjust, but eventually they do adjust. After all these years I think it’s save to assume people have accepted and adjusted to higher oil prices.

I believe Nick pointed out Robbin Mills critique of Jim’s and my view of oil prices. Here’s my response, in the UAE’s National today.

http://www.thenational.ae/business/energy/supply-options-in-the-big-oil-price-debate

The US curve appears to be dominated by Texas, at least if we go back to 2008. As a whole, the US hasn’t recovered employment if you eliminate TX. That suggests that looking at growth since 2011 obscures whether this is reversion to the mean or actual further growth. I’m still not sure why all the graphs only go back to 2010m6. Shouldn’t we be aligning business cycles? It appears to be driven by Walker coming into power, but that suggests there is no hysteresis (which seems an odd assumption).

http://www.aei-ideas.org/2014/08/chart-of-the-day-texas-employment-is-1-3m-jobs-above-dec-2007-level-while-us-minus-texas-is-down-by-1-23m-jobs/