Professor Tyler Cowen’s anti-Keynesian manifesto has been ably discussed by Professor Simon Wren-Lewis at Mainly Macro. I thought what merited additional attention is Professor Cowen’s first assertion:

1. Keynesians predicted disaster following the American fiscal sequester, and the pace of the recovery accelerated.

I don’t think of myself as a Keynesian (the material I teach in my courses are what have been termed the (old) neoclassical synthesis, i.e., Keynesian short run plus Classical long run — and some New Keynesian), but I thought it useful to take a look at what I wrote about the impact of the sequester. On February 19, 2013, I wrote, citing a Macroeconomic Advisers assessment, the following:

…we now put the odds of a sequestration at close to 50%, and rising.

- Our baseline forecast, which shows GDP growth of 2.6% in 2013 and 3.3% in 2014, does not include the sequestration.

- The sequestration would reduce our forecast of growth during 2013 by 0.6 percentage point (to 2.0%) but then, assuming investors expect the Federal Open Market Committee (FOMC) to delay raising the federal funds rate, boost growth by 0.1 percentage point (to 3.4%) in 2014.

- By the end of 2014, the sequestration would cost roughly 700,000 jobs (including reductions in armed forces), pushing the civilian unemployment rate up ¼ percentage point, to 7.4%. The higher unemployment would linger for several years.

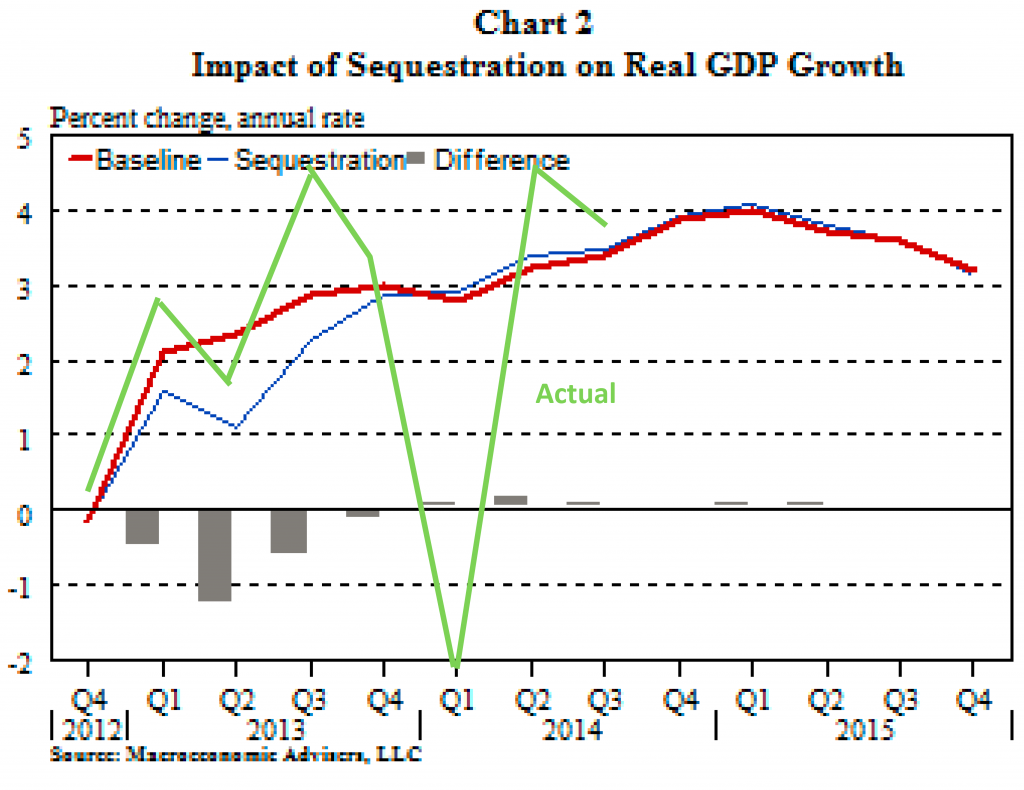

The macroeconomic impact of the sequestration is not catastrophic. Nevertheless, the indiscriminate fiscal restraint would come on the heels of tax increases in the first quarter that total nearly $200 billion, with the economy still struggling to overcome the legacy of the Great Recession, and when the FOMC is constrained in its ability to offset the additional fiscal drag with a more accommodative monetary policy. …Here is a graphical depiction of Macro Advisers’ estimates of the impact of the sequester.

Source: Macroeconomic Advisers (2/20/2013).

We now have observations on eight of the quarters depicted in Figure 2 from the Macroeconomic Advisers forecast. Over the 2012Q4-2014Q3 period, MA forecast 2.20% average q/q SAAR growth. The actual average was 2.37%. Below, I reprise Figure 2, with an overlay (in green) of actually realized GDP growth data.

Figure 2: from Macroeconomic Advisers (2/20/2013), with actual GDP growth (green line). GDP data from (2014Q3 2nd release).

Returning to Professor Cowen’s first point, I will note that both the MA baseline and alternative were for acceleration of growth. The fact that growth did accelerate hence does not appear dispositive with regard to the Keynesian perspective.

As an aside, Professor Cowen’s point 12 befuddles me completely:

12. Whether we like it or not, large chunks of Asia still seem to regard Keynesian economics with contempt. They prefer to stress supply-side factors.

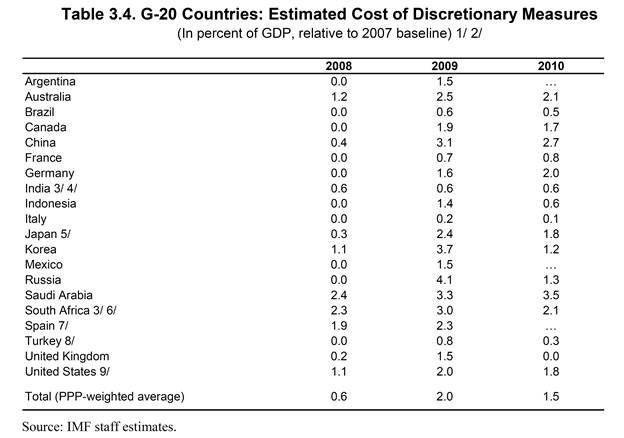

I would say that the Chinese government’s response to the global recession of 2008-09 was quintessentially Keynesian. I don’t mean to imply that the approach adopted was the ideal one — merely to highlight the fact that Professor Cowen’s characterization is not, in my view, apt. (In any case, it would not be surprising that leaders castigate a particular approach while implementing it vigorously.) See Table 3.4 from an IMF Staff Position Note written for the G20 meetings in June 2009, which indicates a substantial (discretionary) fiscal stimulus in China.

Table 3.2 from “Fiscal Implications of the Global Economic and Financial Crisis,” IMF Staff Position Note SPN/09/13 (June 9, 2009)

I will note that there were additional quasi-fiscal costs incurred when the government encouraged (state-owned) banks to lend. To the extent that some of these loans eventually become nonperforming, and the government has to pick up the tab, the extent of stimulus is even greater than indicated in Table 3.2.

And, of course, Abenomics is Asian Keynesian. Cowen knows where his bread is buttered. He is paid extremely well to crank out justifications that the Koch’s like. His pleasant personal demeanor, and general high level of net etiquette, is meant to confuse you into thinking he is making reasoned arguments that should be taking seriously. But he is paid hack. He writes well constructed nonsense, just ignore it. No one under-40 believes in the efficient-market hypothesis etc. Keynesianism is winning.

I think you are again arguing with Ayn Rand cultists (Koch) and their paid hacks (Cowen), and pretending they are not Ayn Rand cultists or paid hacks. Get real, Menzie.

i like to keep these things tied to the historical concepts they come from for example, rational expectations, efficient markets etc would be similar to smiths invisible hand

And is that where the Kochs, Mark Cuban, Peter Theil and so on derive their beliefs? Reading Smith and Ricardo? No, they openly cite and discuss Atlas Shrugged. So, there is no need to give it a false academic glazing. The only reason they are not dismissed as crazies is their money, and their weird little obsessions get justified by the Cowen’s of the world.

Well, you’re making a pretty good argument against deficit spending if the effect fades after two quarters.

On the other hand, Japan is a true deficit junkie, and China has been more than willing to splurge on real estate and infrastructure projects to maintain GDP growth. Of course, it’s also true that Korea’s public debt grew only modestly during the recession, and it experienced one of the highest rates of GDP growth in the world during that period. On balance, I think your criticism of Cowen in this regard is fair.

I don’t think you can really make your analysis, by the way, without accounting for shale oil production, which would support your case, Menzie, but would have the downside of highlighting the central role of oil in the economy (which of course, is where it has been).

Did you read Evan’s interview in Upshot? He says: “I think 3 percent growth [for the US] is really quite good at the moment relative to what we’ve experienced in the last few years. And it’s hard to identify from my corporate contacts exactly why we have growth that good.” [My italics]

http://www.nytimes.com/2014/12/04/upshot/q-and-a-with-charles-evans-of-the-fed-low-inflation-is-primary-focus-.html?_r=0&abt=0002&abg=1

Now, if you run a supply-constrained oil markets model, then it’s duh-obvious. I could show you all this on a single graph.

‘Well, you’re making a pretty good argument against deficit spending if the effect fades after two quarters.’

Cast not your pearls before swine.

Patrick R. Sullivan: Welcome back! I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Cowen has a long history of latching on to any plausible explanation that will discredit Keynesian analyst.

My personal favorite was his conclusion that Hitlers expansionary policies in the 1930s, that is generally considered a prime example of Keynesian policies working did not really work because real wages fell during the period of very strong German growth in the 1930s.

Cowen should remember that the right wing generally accepts the idea of Keynesian military spending.

Kudos for writing as an economist: when possible — as in the case of China — look at what people do, not what they say. If I want a dose of political ideology, why go to an economist? Talk radio is more honest about what they’re doing…

The sequester was far to small to have any serious effect on the economy.

it did have short term effects at a time when we really did not need headwinds.

Such a small impact from sequestration in a liquidity trap doesn’t strike me as Keynesian analysis.

I don’t think Cowen wqa responding to that analysis.

Cowen has offered a(nother) remarkable document. It is remarkable in that his his points a so all over the place. Krugman’s claim is that Keynesian analysis has done a good job in just the economic conditions that Keynes addressed and that the world is beginning to make policy accordingly. Cowen tries to address the claim about getting things right in a very narrow way, citing the sequester as his only example, and he still has to close one eye to claim success. The rest of his points avoid the performance of Keynesian analysis, or claim that Keynes got things right that other, mostly newer points of view which have had the benefit of Keynes, also could get right. Wow.

Cowen really looks bought-and-paid-for when he does this stuff, and he does it pretty often. Krugman’s claim, that Keynesian thinking has done a good job in recent years and that the evidence is being noticed, is pretty strong on the face of it. If Cowen is really just part of the right-wing noise machine, then the quality of his argument is not the point. Chattering light-weights will pick up his points and repeat them. If Brooks or CNBC or Fox spouts the same stuff, the Cowen gets paid – indirectly, of course.

Menzie: First of all why are you focusing on just the effect of the sequester? There were other, more significant, changes to the budget in 2013 (i.e. payroll tax hike). Second, I don’t know what specific model MA is using but the fact that they are clearly incorporating a monetary offsets into their forecast means that it is not the type of “Keynesian” model Tyler was referring too. When Tyler referred to Keynesian predictions, I believe he was referring to predictions based on IS/LM models that result in simplistic multiplier effects, as found here. If you use this framework and consider the total 2013 budgetary impact you will get some very dire predictions indeed and much different than MA’s forecasts. And the fact that actual growth was over 3% in 2013 is clearly a major blow to that type of analysis.

Jeff: I’m focusing on the sequester because, well, that’s what Professor Cowen focused on.

I didn’t focus on the 2013 payroll tax hike because, well, that was already known by February 2013, and was incorporated into the MA baseline.

In terms of Keynesian models, a lot of confusion arises because of different definitions. But the MA model is essentially an IS-LM AD-AS (aka neoclassical synthesis), and not the New Keynesian model that Tyler Cowen says he admires. In other words, unless MA has drastically changed its model since what I saw in my CEA days (and the documentation I saw a few years ago), the MA model is more akin to IS-LM than you assert.

Finally, I find it surprising that you call the CBO analysis “simplistic”, by linking to this post. If you read the CBO document that provides the basis for the post, you will note that they use three different sets of models, VAR, macroeconometric, DSGE. I don’t know what you think is simplistic (I’d guess you think macroeconometric), but in any case CBO is relying upon sophisticated analyses, despite your assertion.

A classic case of treating a parameter with multiple inputs as if it only had one. That is why you need multivariable analysis and models not just graph paper with X, and Y axis. Yes cuts in spending will lower GDP, thats 5’th grade math, but government spending is only a smaller part of the GDP formula so if other parts grow more than government spending falls then you still get growth (just not as much as would have been without those cuts).

Menzie

When I read the part of the title “The Sequester Re-Assessed,” and glanced below that Macroeconomic Advisers predictive charts were of 2013, and 2014 were published, I expected an analysis of where, when and why these predictions were correct or wrong. Instead, we got a vague criticism of part of a Tyler Cowen post. I ask you Menzie, who do you have a more complete and intimate knowledge of their economics, Menzie Chinn, Simon Wren-Lewis, or Tyler Cowen. To answer that question myself, you chose to attempt to analyze the one you least know. So be it.

I respect economists who create a predictive model. And here is a chance to bring an analysis of prediction to your audience. You could start by pointing out the assumptions you made that were correct. From your short excerpt from Feb. 2013, they were the sequester, and the Fed keeping its fund rate at its low level. However the predictions from the model were quite wrong.

Prediction, the sequester would cause a 0.6% drop in GDP to 2.0% for the year. Either the effect of the sequester was wrong or the overall prediction of GDP was wrong, or both.

Prediction. 2014 GDP would be 3.4% for the year. For that to be true, 4th quarter GDP growth will have to be 7.2%. Is that what you expect?

Prediction. Unemployment rate would rise by 0.25% by the end of 2014, with an addition of 700,000 more civilian unemployment. Such high numbers would linger for years. Didn’t seem to happen.

So, Menzie, where did the model go wrong? Was it from other assumptions made? Or was it within the model itself? Or is the model proprietary, that such analysis is impossible in a public forum?

Reviewing in a critical manner of the Macroeconomic Advisers model would be a real service.

Ed

Ed Hanson: The Macroeconomic Advisers blogpost linked to provides some of the assumptions underlying the baseline and the alternative. However, the model is proprietary, so I don’t know the exact parameter values. I know the CEA and the OMB and Treasury had enough money to pay for access — I suspect (like the Bloomberg terminal we had access to), it’s a little outside the size of my personal budget. So, I cannot do the analysis you would like me to do.

I don’t know why you keep on harping on your admiration for people who make predictive models. VARs often do great at forecasting. Do they tell me a lot about how the world works? Sometimes yes, sometimes no.

And if you are trying to say I don’t ever do prediction, well, it’s not my main research area. Somehow, I think you’ve got it in your mind that the main business of economists is forecasting. But if you want to peruse some of my research publications, you’ll see predictions/forecasts in some of them.

Let’s take a celestial dome perspective …

Macroeconomic Advisers (MA) year-ahead Q4-to-Q4 real GDP forecasts made in Februaries: 2008 (MA 2.9%, Consensus 1.6%, Actual -2.8%), 2009 (MA -0.3%, C -0.9%, A -0.2%), 2010 (MA 4.0%, C 3.0%, A 2.7%), 2011 (MA 4.3%, C 3.5%, A 1.7%), 2012 (MA 2.2%, C 2.5%, A 1.6%), 2013 (MA 2.7%, C 2.4%, A 3.1%), 2014 (MA 2.8%, C 2.8%, A 2.2% est).

Observations: (1) Macroeconomic Advisers is not the most reliable source out there. (2) At the peak of the business cycle – when a forecast has the most value to its consumers – modern Keynesian-dominated macro models fail badly. (3) A simple 2.5% straightedge does a reasonably good job during expansions.

Question to ask yourself: If MA can’t even outperform the consensus over the cycle, how much credence can their fiscal analysis have?

Bonus question: Without monetary stimulus from both ZIRP and QE, would the $787 billion stimulus package actuated in 2009 have made much of a difference?

Double bonus question: As the cumulative debt due to one-off fiscal stimulus remains on the books well into the future, might the long-run effect of Keynesian stimulus in fact be negative? Hint: Government stimulus ate the seed corn so that net national saving as a percent of GDP fell to 3-generation low of less than 1% this past 5 years. Not all due to proactive stimulus, of course. Bonus hint: Debt has consequences. In a globe encumbered by a level of debt never before seen – at root due to the ideas of Keynes – the full consequences including potential for yet another financial crisis are still ahead of us. These are uncharted waters. Especially the yet to be seen unintended consequences of ZIRP and QE. Which by the way have yet to merit even a single post on this blogsite.

Hot, hot, hot!

http://www.calculatedriskblog.com/2014/12/november-employment-report-321000-jobs.html

Amartya Sen on China’s “supply side economics” versus India:

“”…

Inequality is high in both countries, but China has done far more than India to raise life expectancy, expand general education and secure health care for its people. India has elite schools of varying degrees of excellence for the privileged, but among all Indians 7 or older, nearly one in every five males and one in every three females are illiterate. And most schools are of low quality; less than half the children can divide 20 by 5, even after four years of schooling.

India may be the world’s largest producer of generic medicine, but its health care system is an unregulated mess. The poor have to rely on low-quality — and sometimes exploitative — private medical care, because there isn’t enough decent public care. While China devotes 2.7 percent of its gross domestic product to government spending on health care, India allots 1.2 percent.

India’s underperformance can be traced to a failure to learn from the examples of so-called Asian economic development, in which rapid expansion of human capability is both a goal in itself and an integral element in achieving rapid growth….””

http://www.nytimes.com/2013/06/20/opinion/why-india-trails-china.html#h%5B%5D

India’s under-performance is the result of mis-aligned incentives. Put in an FAA, and you’d see that economy rocket.

Given where we are in the cycle, Dr. Menzie, show the national budget now not be effectively in balance and moving into surplus?

Steve Kopits: It’s not where you are in the cycle in terms of growth but rather in terms of the output gap. And the output gap is still large (in absolute value). (Of course, the estimated output gap, because reader Tom wants the adjective “estimated” to precede all economic objects discussed.)

Well, let me play devil’s advocate on that, Menzie.

How many years until the next recession? Almost certainly not in 2015, probably not in 2016. But 2017 is quite possible. (In fact, a number of JP Morgan analyses in recent times have assumed 2017 is a recession year.)

So when do we close the output gap? In fact, we may not close it before the next recession. In other words, we’ll have deficit spent all the way through a business cycle. And that matters, because we racked up a whole lot of debt, some 35% of GDP, during the last recession. When do we pay that down? If I take your approach, we most likely don’t pay it down at all. It just continues to grow through the cycle, and then through the next recession, and then what?

If we’d borrowed 10% of GDP through the last recession, well, I’d be reasonably sanguine. But we borrowed much, much more. So at some point real soon, we’d better start paying it down.

Will paying down debt hurt growth? An international comparison says ‘no’. http://www.prienga.com/blog/2014/11/28/deficit-spending-and-gdp-growth Indeed, the last time we had really good growth–as you’ll recall–was under Clinton, when government spending was low and falling and the budget was in surplus.

Let me qualify the above just a bit.

If we take a supply-constrained view of the market, then–providing the oil is available–this economy has some hard core catching up to do, and it could run hot for 3-4 years, based on my analyses of transportation markets.

For example, my analysis suggests that departing airline passengers could increase by 24% in the next three years, and commercial airline departures, by as much as 67%.

In addition, asphalt usage could increase by 40% over the same time period. And CR tells us we’re 1.6 million construction jobs short if building returns to more normal levels.

So we could end up really critically short on infrastructure in the next few years, with some truly impressive blue collar wage growth over the period.

From a fiscal point of view, I would be targeting a 2-3% budget surplus from the second half of next year, with an eye to reduce debt-to-GDP by 20% over the next 3-4 years.

should

I’m focusing on the sequester because, well, that’s what Professor Cowen focused on. So you don’t have to confront empirical facts unless they are specifically mentioned by Tyler Cowen? My what a low bar you set for yourself!

Since we don’t know exactly how MA arrived at their forecasts and since I’d rather not rely on your fading memory, why don’t we just evaluate your simplistic multiplier-based methodology found here against the historical record. I’m pretty sure that evaluation would be dispositive. And yes, I am sticking to my characterization of the Keynesian framework as “simplistic.” Regardless of the econometric techniques one uses to estimate parameters, the underlying theory is still simplistic. You may be easily impressed by the dangling keys of a fancy VAR but I tend to be a bit more critical in my thinking.

Jeff: “Fancy VARs”? Are you joking? Really? Do you even understand what a VAR is?

Thank goodness you comment on this blog. I really needed a laugh, and you have provided a bunch. Keep ’em coming!!

Menzie: Of course I do know what a VAR is. If you find the term so hillarious I don’t understand why you felt the need to mention it when trying to justify your framework? I suppose this is just a ruse to try and steer the conversation away from your outdated ideas.

Jeff: I cited VARs because I was paraphrasing the CBO document regarding the sources of the multiplier coefficients.

Jeff: “Hillarious”. I think that typo speaks volumes!!!

Menzie:You weren’t just paraphrasing the CBO document. You were trying to use the fact that their methodology included VARs to someone buttress your argument. Since you seemed to be so impressed with the use of VARs, that’s when I sarcastically referred to them as “fantasy VARs.” And now I’m realizing that you didn’t pick up on that sarcasm. Well I apologize that it wasn’t clearer (hint: More sarcasm. The original post was self-evident). But don’t worry you’ll catch it next time (hint: Sarcasm again. I have doubts about your wit). By the way I’m still eagerly awaiting to hear your thoughts on how you think your multiplier-based predictions played out in 2013.

Jeff: “fantasy VARs” show up nowhere in your comment…

Jeff: It is strange that the idea of contractionary effects from fiscal policy is so hard to take; after business economists seem to believe in it. Consider this typical assessment from Scott Anderson, chief economist of Bank of the West, commenting on the fiscal cliff in January 2013 :

I believe sequestration, whatever size, had the important effect of stemming increased government spending. We will never know how much spending would have increased without it. Now let’s watch and see if congress keeps sequestration in place or jettisons it to increase spending/debt. I’m betting they don’t have the will to keep sequestration for the entire period.