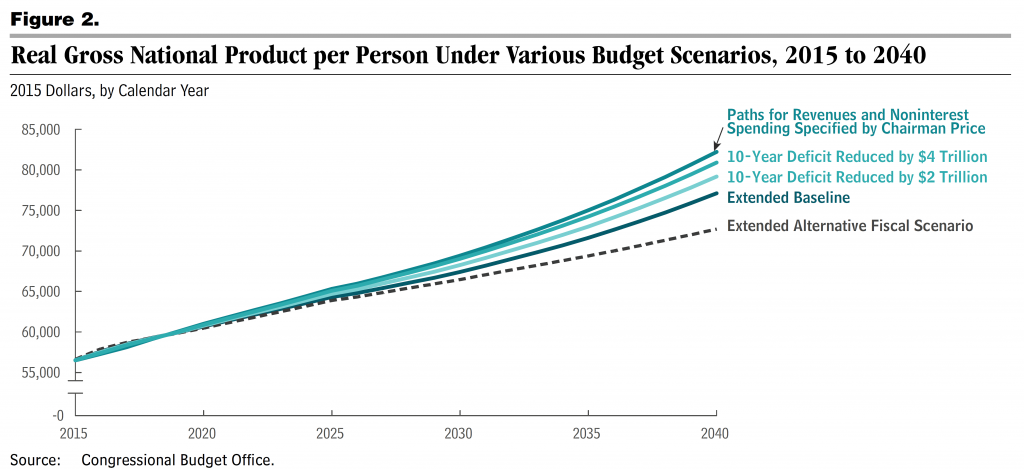

The CBO took at face value the revenue and spending levels in the House Budget, FY2016, and assessed the impact on GNP per capita (remember, this is not a score, as there are few details on specific provisions to hit the targets). The impact is shown in Figure 2 from the CBO.

Figure 2 from CBO (2015). Notes: “These results account for the following macroeconomic effects (“feedback”): the ways in which changes in federal debt affect investment in capital goods (such as factories and computers), the ways in which changes in after-tax wages (resulting from changes in capital investment) affect the supply of labor, and the ways in which those economic effects in turn affect the federal budget. The analysis incorporates the assumption that the budget scenarios do not alter the contributions that government investment makes to future productivity and output; those contributions are assumed to reflect their past long-term trends.

Unlike the more commonly cited gross domestic product, real (inflation-adjusted) gross national product includes the income that U.S.

residents earn abroad and excludes the income that foreigners earn in the United States.

The 10-year baseline used in this report refers to the projections for the budget and the economy that CBO released in January 2015. For

information about CBO’s analysis of the extended baseline and other scenarios considered here, see the notes to Figure 1.”

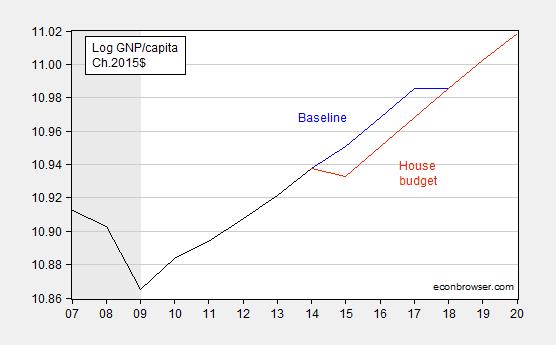

I thought it was of use to investigate what happens in the short term — so zooming in on 2007-2020. Unfortunately, 2014 GNP per capita was not reported in the document, so I had to do some estimating. But in the end, this is what I obtained.

Figure 1: Log GNP per capita in Ch.2015$ (black), extended baseline (blue), and assessment of House budget (red). NBER recession dates shaded gray. Historical GNP per capita series adjusted from Ch.2009$ to Ch.2015$ assuming CBO forecasts of GDP deflator hold for 2014 and 2015; 2014 growth in real GNP per capita assumed to equal actual real GDP per capita growth. NBER defined recession dates shaded gray. Source: BEA via FRED, NBER, CBO, Budget and Economic Outlook (January 2015), and CBO, Budgetary and Economic Outcomes Under Paths for Federal Revenues and Noninterest Spending Specified by Chairman Price, March 2015.

What I have for 2014 real per capita GNP might not match what CBO has, but as best as I can make out, it sure looks like the short term impact is to set growth to zero for 2015 (my actual calculation is -0.5%, y/y — but like I say, I had to estimate 2014 per capita GNP).

More on the (re-)appearance of the magic asterisk, from CBPP.

The House Budget is timid.

Before turning to that, though, let’s assess it’s key points:

– NGDP rises at 4.6% per year on average during the 2015-2024 period (all percent growths will reflect this period on CAGR basis)

– SS spending increases at 6.1%, Medicare at 5.8% per annum, that is, faster than NGDP by 1.2-1.5% per annum

– Medicaid is cut initially, and severely at that

– Other Mandatory spending declines at a -1.8% pace and Discretionary spending is essentially flat in nominal terms

– The War on Terror is essentially axed (I have always thought these things tend to be driven by events, rather than budgets)

– Most importantly, by far the biggest increase in spending is on interest. This rises by 2.5x over the period, increasing at 10.6% CAGR, due to both rising debt and increasing interest rates (per CBO assumptions)

Spending as a share of GDP falls from 20.2% in 2015 to around 18.7-19.0% of GDP for most of the forecast. The exit rate is 18.4%, but that’s only in the last year. By contrast, Bill Clinton exited his term with spending at 18.2% of GDP. Revenues are 17.9-18.1% of GDP in most years, low by traditional standards.

The budget really never reaches balance, although one might torture it to confess to breakeven in 2024. The budget deficit is generally under 1.0% of GDP, materially so in some years.

Debt (held by the public) as a percent of GDP declines from 73% to 56%. Thus, the shadow of the Great Recession will be in the country’s financials even 17 years after the start of the downturn. (There is no recession in the forecast, by the way.)

As a fiscal conservative, let me characterize this as an inadequate proposal from the Republican side. The budget should be balanced latest in 2017, and frankly, better in 2016.

Menzie, I can’t confirm if this is the governor’s handwriting, but the source seems credible. I’d be interested in your thoughts and possibly performing a thorough & objective analysis (if time permits) of these just released forecasts. Also, Please include all relevant conditioning & potential implications if possible.

http://www.nytimes.com/2015/03/19/upshot/scott-walkers-bracket-wisconsin-over-michigan-state.html?_r=0

Here’s my post on the matter, with my counter-proposal of a budget.

http://www.prienga.com/blog/2015/3/18/yc9bjx5w3ierpj35kl3dniwugqv5si

Budget proposals are smoke and mirrors and this one is Dead On Arrival at the oval office. Isn’t appropriations where the action is?

Alright. I’ve added a Fiscal Accountability Act to the House Budget (my version) to show how it would operate.

You can see the details here: http://www.prienga.com/blog/2015/3/19/a-bonus-plan-for-politicians

“Budget proposals are smoke and mirrors and this one is Dead On Arrival at the oval office. Isn’t appropriations where the action is?”

Budget resolutions have no force of law. They are just hand waving that is internal to Congress. Budget resolutions are not even sent to the oval office because the President cannot sign them. Yes, appropriations is where the real budget becomes law.

Steven Kopits You’re in the energy business, so presumably you’re familiar with optimal control models that tell you how to control key variables that affect the state equation of motion so that you optimally reach some target. A classic example would be a Hotelling model for deriving the optimal rate of extraction for an exhaustible resource like oil. Granted, oil prices don’t seem to follow a Hotelling model, but that’s always cited as the classic textbook case when students first encounter optimal control theory. So I’m assuming you understand all that stuff. If you do and if you’re worried about maximizing intertemporal welfare (as opposed to just reducing your own personal income taxes), then why in hell would you want the House to try and balance the budget by 2017??? As the kids would say, “That’s Cray Cray.” Frankly, that kind of talk smacks of uber-aggressive CEO talk…the kind where after the meeting people roll their eyes and giggle at how stupid the boss is. Tough talk and it makes you sound like you’re a real serious, no non-sense kind of guy; but it’s just completely detached from reality.

Your macro is bad because any negative fiscal shock right now would reduce GDP more than it reduced the deficit, so the debt/GDP ratio would actually get worse. There’s a time to run surpluses, but you don’t do that when the economy is stuck at the ZLB. Your proposal effectively cuts Social Security. Since Social Security gets part of its funding from cashing in old Trust Fund bonds, your proposal effectively amounts to asking the Social Security Trustees to surrender the interest earned on those bonds. A less polite word for that is default. If you want to default on bonds, then why not default on bonds held by the Too Big To Fail banks? If you’re worried about Medicare/Medicaid, then urge the GOP to get on board with Obamacare because CBO tells us that Obamacare saves money. Monies in certain categories increase, but overall there is a net reduction in costs.

The bottom line is that you and the House Republicans are in denial. Government spending as a percent of GDP is going to settle in around 23%-24% of GDP. That’s pretty much baked in the cake. As the country becomes older and more urban there will be greater demand for government services. You know, stuff like cleaning up New Jersey’s toxic waste after your illustrious governor sold out New Jersey voters and taxpayers with his corrupt Exxon deal. So in the long run taxes will have to be around 23%-24% of GDP. Get used to it.

Control theory?

Oil production is governed by proximate price signals. Is it profitable to produce oil from the well? If it is, then I’ll produce it.

It’s not much deeper than that.

As for balancing the budget:

In 2013, the budget deficit improved by 2.7% of GDP. In 2014, the improvement was 1.2% of GDP. The sky did not fall. Indeed, the US out-performed the rest of the OECD by a margin.

Now I am suggesting to continue to close the gap at 1% per year for the next two years. Exactly why is this some radical, never-before-tried experiment that will surely end Democracy as we know it? In a cross country comparison, there is no–let me repeat, no–correlation between deficits and GDP growth. I have linked my related post probably half a dozen times.

I always thought Keynesians were about counter-cyclical spending, running deficits in downturns and surpluses in upturns and seeking budget balance over the cycle as a whole. Alright. The typical business cycle in the US has been five years. I don’t know that we’ve ever gone a decade without a recession. The peak of the last cycle was in 2007, now almost seven years ago. By any historical measure, we should expect another recession by 2017.

So how exactly do you balance the budget over the cycle? At least my budget is in balance by the start of the next recession. Yours is, I think, running a deficit as far as the eye can see. The President’s 2016 FY Budget, which will no doubt prove too rosy, is proposing a deficit of 2.3% of GDP heading into 2017–and that’s assuming tax receipts will increase by 1.4% of GDP over the next two years and no recession!

I stand by my earlier statements. The budget should be balanced by 2017 latest.

Steven Kopits Regarding optimal control theory, even though it wasn’t around when Hotelling wrote about optimal extraction rates for exhaustible resources, it’s how we would solve the problem today. Since you’re in the energy business I assumed that you were familiar with a Hotelling model. As I said, in the real world oil prices do not obey what a Hotelling model would predict. There’s no shortage of economic papers that try to address why oil prices don’t agree with what a Hotelling model would predict. In fact, I recall a paper that JDH wrote on this very subject:

http://econweb.ucsd.edu/~jhamilto/handbook_climate.pdf

But the reason I brought up optimal control theory is because it’s at the heart of modern macro. The basic idea is to identify how control variables should optimally change over time in order to maximize some welfare function. A nice visual example of what I’m talking about showed up in today’s post by Simon Wren-Lewis. He reproduces a couple of graphs that show the optimal path for adjusting interest rates. My point is that shoot-from-the-hip declarations that we should reduce deficits by 1% of GDP per year don’t cut it. That kind of talk is just posturing, which is what I’ve come to expect from today’s House Republicans.

Technically we are in a recovery and have been for quite some time; however, we are also a long way from potential GDP. And the Fed believes we are still at the ZLB. As long as those two facts prevail you should not try to run budget surpluses. I don’t think we should run deficits forever…or at least not large ones. Textbook Keynesian economics tells us that we should stop running deficits when the economy is at potential and when the ZLB is no longer binding. If we start to see convincing signs of inflation in the wage market, then we’ll know fiscal policy has done all that it can and it will be time to shrink the deficit. That’s what Carter did in the late 70s. And that’s what Clinton did in the 90s. Contrary to what many believe, Democratic Presidents seem to be a lot more willing to run surpluses during the business cycle peak than Republican Presidents.

I agree that the US outperformed Europe and the UK. That ain’t saying much. Growth was still disappointing and could have been better. You said that Democracy as we know it didn’t come crashing down…but that’s not quite true. Austerity policies in Greece threaten democracy there, and you could make a good case that democracy in Hungary collapsed. Worse yet, austerity has gone hand-in-hand with the rise of far right-wing neo-fascist and nativist parties in France, Spain and the UK. As Krugman likes to remind his readers, it wasn’t 1920s Weimar inflation that brought Hitler to power; it was austerity economics in the 1930s.

Control theory: “The basic idea is to identify how control variables should optimally change over time in order to maximize some welfare function.”

What the hell are you talking about, Slugs? Here let me identify some variables for you. All the lefties told us that sequester would crater the economy and that we couldn’t safely reduce the deficit. And we did. And our economy is stronger to boot. You want the relationship? Here it is: Those countries whose deficits increased less grew faster. The R2 is 0.11, which is nothing, in my opinion, but if you’re going to press me for a model, then less deficit = greater growth. And the last time this country had good growth in median income was when the budget was in surplus and spending was 18.2% of GDP. So there’s your variables and model for you, Slugs. Balance the damned budget and reduce spending to increase growth. That’s the model that’s worked best in the last 20 years. In an economy adding jobs at a 3+ million pace, there is no need to be petrified of reducing the deficit by one percent.

And let’s be clear. The Republicans are not calling to close the deficit for another decade. I am the one proposing the near term balancing. I am criticizing the Republicans for being too spineless in bringing the budget back into balance.

As for fascism, yes, I know something about that, having lived in Hungary for fifteen years. The FAA is specifically intended to address fascism and sectarianism. I have written about that here many times. Do you need me to review the reasoning for you?

You’re arguing a strawman. I did not argue that the sequester would “crater” the economy. In fact, I said that Obama was overstating the likely effects that people would see in the short run. But just because idiotic policies don’t “crater” the economy doesn’t mean they still aren’t idiotic.

I think you’ve got the cause and effect all wrong. Deficits didn’t cause weak growth. Deficits were a consequence of weak growth. And under Clinton those surpluses didn’t cause strong economic growth; they were mostly a result of strong economic growth along with a tax hike on higher incomes.

Look, this isn’t difficult. If you reduce government spending but private sector consumption and investment don’t increase, then GDP will fall. It’s really that simple. If the economy were as robust as you seem to think, then businesses should be lining up outside the bank wanting cheap loans for investment. I don’t see those long lines. Unlike your personal finances, a macro economy cannot save its way out of a recession. Saving that is not matched by investment is a leakage that can never be recovered. If you’re going to cut government spending by 1% of GDP, then you better be certain that private sector investment will increase by 1% of GDP.

So are you telling us that FDR should have tried harder to balance the budget during the Depression? Oh wait, he tried that in 1937. How did that work out?

steven

“Balance the damned budget and reduce spending to increase growth.”

that is a great sound bite, but only when the economy is at its potential. we are not there. we had sequester to help balance the budget. did we increase growth? no. it had to come from the private sector, because of the sequester, and it did not occur. you are simply repeating a vacuous statement. there is a huge disconnect among fiscal conservatives regarding how they believe private sector responds to conditions, and how the private sector actually responds to conditions. your statement is a prime example of this disconnect. you need to work with reality, and not ideology.

slugs

“If you reduce government spending but private sector consumption and investment don’t increase, then GDP will fall. It’s really that simple. ”

it really is baffling how sooooo many people cannot understand this reality. or put more locally, does the size of the US deficit change your decision on buying a new car or not? answer is not.

Steven Kopits: “Control theory? Oil production is governed by proximate price signals. Is it profitable to produce oil from the well? If it is, then I’ll produce it. It’s not much deeper than that.”

Seriously? Oil producers are like 4-year-olds that will eat the marshmallow now rather than two later? If true, you oil folks are even dumber and more childish than I thought.