Today’s March trade release brought unwelcome news, making the advance release (discussed by Jim here) appear optimistic by comparison. From Reuters:

A surge in imports lifted the U.S. trade deficit in March to its highest level in nearly 6-1/2 years, suggesting the economy contracted in the first quarter.

Growth, however, is regaining momentum as other data on Tuesday showed activity in the services sector, which accounts for more than two-thirds of the economy, accelerated to a five-month high in April.

“It looks like we are going to have negative GDP for the first quarter, just based on trade, but we expect a robust rebound in the second quarter. A lot of the headwinds we saw in the first quarter have unwound,” said Jacob Oubina, senior U.S. economist at RBC Capital Markets in New York.

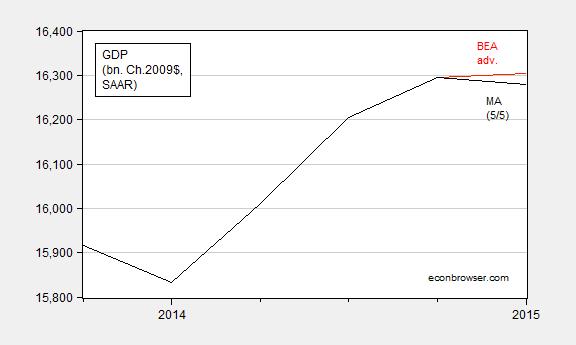

Macroeconomic Advisers has provided some estimates of the impact on GDP and the trade balance. Figure 1 depicts real GDP.

Figure 1: GDP in billion Ch.2009$ SAAR from advance release (red), and as estimated by MA, based on March trade release (black). Source: BEA 2015Q1 advance release and MA.

Q/q SAAR growth is estimated down to -0.4%, from the BEA’s advance of 0.2%.

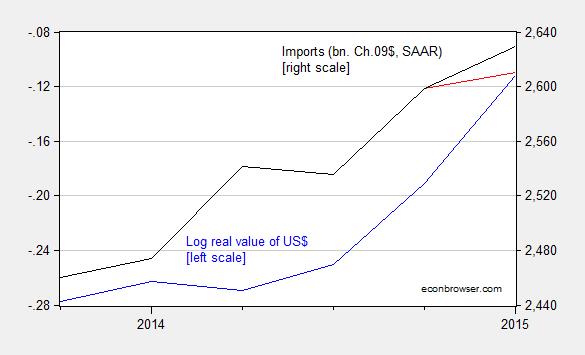

Both imports and exports were revised, but imports were more noticeably affected, as shown in Figure 2.

Figure 2: Log trade weighted value of US dollar (broad) (blue, left scale), and real imports of goods and services estimated by BEA (red), and estimated by MA (black), in bn. Ch.2009$, SAAR. Source: Federal Reserve Board, BEA, and MA.

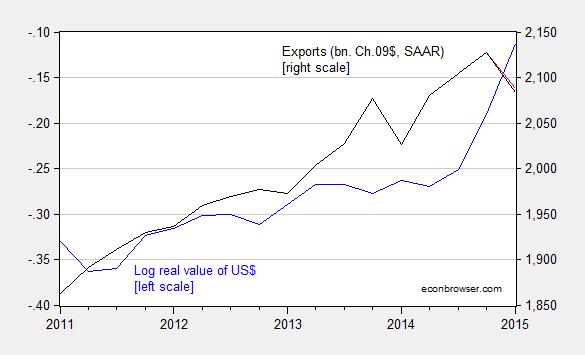

The impact on estimated exports was smaller — but the drop in exports is (particularly) worrisome nonetheless.

Figure 3: Log trade weighted value of US dollar (broad) (blue, left scale), and real exports of goods and services estimated by BEA (red), and estimated by MA (black), in bn. Ch.2009$, SAAR. Source: Federal Reserve Board, BEA, and MA.

The correlation of the surging dollar and the drop in exports is suggestive, but in order to identify the relative importance of this factor, one would want to use a regression model to estimate what share of the decline is coming from slowing overseas growth. In this post, I recount that a 20% appreciation would eventually knock off about 14% of exports relative to baseline (in this case of non-agricultural goods exports — the exact figure for total exports would be different).

For me, this outcome merely confirms that in my view it is too early to tighten monetary policy. As I’ve suggested, the dollar is strongly correlated with the shadow policy rates in the US and abroad; to the extent that the Fed can influence the shadow rate by forward guidance, it makes sense to err on the side of caution, and maintain an expansionary monetary policy.

Uh, not seeing it. Looks like consumer spending accelerated more rapidly in March than expected. Exports rose in April.

The Rage: Sorry, how do we know exports rose in April?

Quelle surprise – beggar-thy-neighbor monetary easing works short term, but the effects are eventually reversed. I wonder if raising asset prices and putting greater stress on other economies (many in more dire straits than us) is the best course of action. Maybe if easy monetary policy hadn’t been used to blow the housing bubble to cure the dotcom crash, we would have sustainable long term growth right now. With asset prices stretched and people still levered to the hilt, what will we do if another cyclical downturn comes?

don: Expansionary monetary policy is not beggar thy neighbor, particularly if the price level overall is too high relative to money supply. Obstfeld-Rogoff made this point in their textbook — in the context of monopolistic competition and sticky prices, expansionary monetary policy in an attempt to switch AD will lead to a welfare improvement.

Surely this conclusion must depend on circumstances. Samuelson noted that even mercantilism ‘works’ when the economy is in a liquidity trap. For example, suppose QE had no effect on business investment demand or housing construction, but led primarily to those who sold U.S. Treasury bonds to the government to go overseas to buy foreign sovereign debt. With business flush with cash, and housing construction overdone, it is far from clear to me that QE helped our trade partners. By your lights, I suppose officials in Brazil and other countries that decried the policy were making stupid arguments. I respectfully disagree.

Reuters wrote:

A surge in imports lifted the U.S. trade deficit in March to its highest level in nearly 6-1/2 years, suggesting the economy contracted in the first quarter.

Growth, however, is regaining momentum as other data on Tuesday showed activity in the services sector, which accounts for more than two-thirds of the economy, accelerated to a five-month high in April.

Progressive economic talking heads used to be much more clever than they are today. I guess so many have been educated in the errors of modern economics that they no longer worry about any real analysis of what they say.

First they talk of a surging imports “suggesting the economy contracted…” Duh! That is by definition of GDP. Imports are subtracted from GDP. Why? The theory is that imports somehow demonstrate the economy is declining but this is pure bogus theory that is actually admitted accidentally in the next second sentence. In spite of the generally accepted theory growth continues.

No one notices that during the depths of the economic decline exports were greater than imports actually adding to the GDP. Now that we are having a weak recovery (due to monetary stability, reduced federal spending – thank a Republican, and delays in the implementation of Obamacare, to mention just a few) we are seeing imports.

The truth is that imports and exports balance out. Dollars must be spent in the US so if they go overseas they will come back. But even more silly official “imports” and “exports” don’t even measure all imports and exports.

How many angels can dance on the head of a pin?

Ricardo, how misinformed can you be.

If you buy a foreign made car where is it recorded in the GDP accounts? In the PCE data as a positive and in the trade data as a negative, right?

So the net impact is zero, which it should be. Why?? Because GDP measures what is made in America. So the foreign car is not made in the USA so it

should not be counted.

Remember, we do not directly measure output. We measure consumption and adjust it for the change in trade and inventories to indirectly measure production.

Where did you get the idea that imports imply that the economy is declining?

OK, you have problems with subtracting imports. How do you suggest we handle trade in the GDP accounts?

Spencer,

Apparently you did not read my post. Let me repeat the first sentence of my next to last paragraph: The truth is that imports and exports balance out. All you did was prove my point.

But along this line you might find the following interesting.

NO!!!!

‘NO!!!!!

NO!!!!

Imports and exports do NOT balance out. Most countries run either a surplus or a deficit, but virtually no country runs a trade balance.

What balances out is the current account and the capital account. If a country has a trade deficit it has to have a capital account surplus to finance the deficit. Conversely, if it has a trade surplus it will have a capital account deficit as it finances other countries trade deficits.

Where did you ever get the idea that exports and imports balance? The US has had a current account deficit for every year since 1975.

Menzie, look at exhibit 8 in the full release and tables…see for instance that our imports of consumer goods rose by $9,013 million to $54,164 million on a $1,677 increase in imports of cell phones and similar household electronics, a $1,293 increase in imports of synthetic textiles, and a $981 million increase in our imports of furniture and similar household goods..note, however, that our imports of cotton apparel and household goods, footwear, pharmaceutical preparations, toys, games, and sporting goods, televisions and video equipment. other consumer nondurables, non textile apparel and household goods, household appliances cookware, cutlery, tools, and camping apparel and gear all also rose by more that $250 million each, which almost certainly do not indicate an increase in consumption by that much, but rather just an offloading of ships..

that’s gonna all end up as an increase in wholesale and retail inventories, which should offset the GDP hit from the increase in imports…

however, reducing that record stockpile will have a major negative impact on 2nd quarter growth..

Or it could simply be that when the West Coast longshoremen stopped their work slowdown at the end of February, all those ships waiting offshore finally got unloaded in March.

The Atlanta Fed GDPNow model is predicting 0.9% real growth for the second quarter (seasonally adjusted annual rate) as of April 30th.

As of May 5th, it’s 0.8%.

Initial unemployment claims at 265k this week, up from 262k last week.

These are exceptionally strong readings. If this level of claims can be held just two more weeks, the four week moving average will be the lowest since December 1973, when it averaged 266,250.

The First Oil Shock (modern) began in October 1973.

Steven,

Is this because unemployment is down or because the unemployed have used up their right to claim unemployment?

See covered employment.

“For me, this outcome merely confirms that in my view it is too early to tighten monetary policy. ”

The concern for unhinged right wing nutjobs like myself is that you never feel it is time to tighten monetary policy, it’s never time to pay off federal debt, it’s never time to unwind the Fed’s balance sheet. We’ve been out of recession for 6 years as of next month and we average a recession roughly every 8 years since WW2. What if we have another recession before the Fed raises rates or unwinds it’s balance sheet? I won’t bother to comment about ever paying down debt because that’s a bridge too far. It seems to me rates will be sub 2% forever and the Fed’s balance sheet will never unwind. I don’t know what the consequences of this will be, but it doesn’t seem like a healthy economy would need permanent Fed intervention and the outcome can’t be good.

Anonymous: Your assertion is demonstrably false. I have 2005 Council on Foreign Relations special report arguing that in fact we should have been paying back the debt in that decade, instead of running it up. I wish right wing nut jobs like you would actually check facts before making accusations. But I guess that is too much to hope for.

I should not have said “you.” I didn’t mean “you” personally. I meant you as in the type of folks who think monetary and fiscal policy can cure (what I believe are) permanent structural problems.

Can you address what happens if we have another recession before we every pay back debt, shrink the Fed’s balance sheet, or raise rates? It’s likely to take many years to accomplish that, and it is far more likely we have another recession before any of that is materially achieved. We are in a death spiral.

The story that keeps being told and repeated over and over again that GDP fell BECAUSE imports went up is the most stupid statement in economics I routinely encounter. When imports go up, aggregate consumption goes up simultaneously. Someone should make this loud and clear. Media, bloggers, even economists routinely fall into the fallacy of believing and making people believe that, if I buy a foreign car GDP, goes down. NO, that’s not the way accounting works.

Granted, if we stop buying home-produced goods at the expense of foreign goods, eventually, at some point, someone at home will stop “producing” them, and then GDP might go down (assuming the guys who stop producing the home goods don’t find something else to work on). But before we leisurely jump to that conclusion, the Keynesian-style reasoning that the stuff on the right-hand side of the national accounts identity, that is, Consumption + Investment + Net Exports, causes the stuff on the left-hand side, that is GDP, should be deprecated, made feel miserable, and stopped.

Matt: Conditional on knowledge about the level consumption, the additional information about imports and exports should revise one’s estimate of GDP. Now, if all the data came in simultaneously, I’d agree with your comment on accounting.

Matt says “GDP fell because imports went up is the most stupid statement…”

What about GDP rose because exports went up?

Maybe, you believe the summation of every country’s GDP doesn’t equal world GDP.