From The Hill:

Instead of crediting Obama for any of the economic gains that have occurred in the last seven years, Ryan argued that the Fed’s policies pushed the recovery. He added that the central bank’s controversial efforts to drive down borrowing costs may have driven growth, but the benefits failed to spread to everyone.

I find it interesting that Speaker Ryan credits the Fed, because six years ago, he warned of inflation arising from quantitative easing and Federal deficits. From Representative Ryan’s website, on October 16, 2009:

…One of my key concerns is on the inflation front.

This may seem like an odd preoccupation right now because the recession is generally keeping a lid on price increases. Data released just this week showed that the overall consumer price index (CPI) has actually declined slightly over the past year. The Federal Reserve generally feels that the slack in our nation’s factories and labor markets (the so-called “output gap”) should keep wages and prices contained for some time, allowing interest rates to remain low for “an extended period.” Yet, although inflation is not an immediate concern, I believe it represents a key risk to our economy over the medium and longer term.

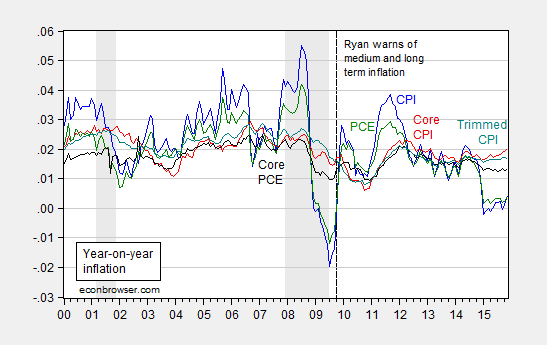

Here is a picture of how inflation has evolved since that dire warning.

Figure 1: Year-on-year inflation, as measured by CPI-all (blue), core CPI (red), personal consumption expenditure deflator (green), core personal consumption expenditure deflator (black), and trimmed CPI (teal). NBER defined recession dates shaded gray. Source: BLS, Dallas Fed, via FRED, NBER, and author’s calculations.

In any case, Representative Ryan has not provided a quantitative assessment backing his claims. His last quantitative assessment of fiscal policies is here.

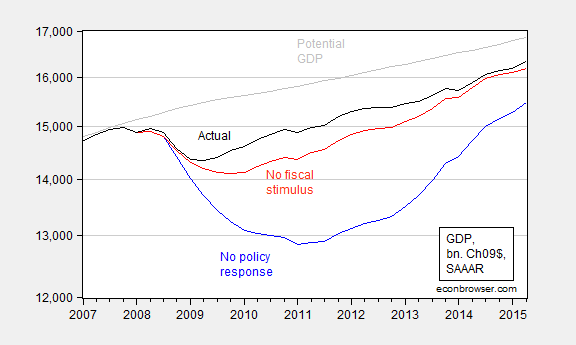

For a serious attempt to do a decomposition, see this post, based upon the Blinder-Zandi analysis. Here is a figure based on the analysis:

Figure 2: Actual GDP (black), counterfactual GDP under no economic response (blue), counterfactual GDP under no fiscal response (red), potential GDP (gray bold), all in billions Ch.2009$, SAAR; log scale. Source: Blinder and Zandi (2015), appendix tables B1, B2; and CBO, Budget and Economic Outlook (August 2015), via FRED.

Note that TARP (which to his credit, Representative Ryan did vote for [1]) and other policies were included in the policy responses, but not in the fiscal stimulus.

Dodd-Frank created a financial boom that lead to a severe recession. Then, they created a financial bust in a recession that lead to a deep depression.

that statement is completely unhinged from reality.

That’s because you’ve refuse to consider the possibility despite the evidence I’ve shown you before. You’re simply closed-minded.

then show me the deep depression that was CAUSED by dodd-frank.

Dodd-Frank contributed to the deep depression. Other regulations on health care, energy, transportation, housing, education, etc., and on businesses in general, added to the depression. After Dodd and Frank helped facilitate a financing boom, they put their boots on the neck of the financial sector:

Too Big Not To Fail

The Economist

Feb 18th 2012

“…demands for fees and paperwork with which Dodd-Frank will blanket a vast segment of America’s economy…the massive cost and complexity of its regulations…The law that set up America’s banking system in 1864 ran to 29 pages; the Federal Reserve Act of 1913 went to 32 pages; the Banking Act that transformed American finance after the Wall Street Crash, commonly known as the Glass-Steagall act, spread out to 37 pages. Dodd-Frank is 848 pages long…Like the Hydra of Greek myth, Dodd-Frank can grow new heads as needed…For the same reasons that bankers are worried, lawyers are rubbing their hands… litigation is just beginning…Another product of Dodd-Frank is a plethora of new government powers and agencies (see chart 2) with authority over areas of the American financial system and economy…power to regulate more intrusively and to make arbitrary or capricious rulings,,The lack of clarity which follows from the sheer complexity of the scheme will sometimes, perhaps often, provide cover for such capriciousness… the unnecessarily harsh impact of current regulations…And Dodd-Frank has hardly touched Fannie Mae and Freddie Mac.

For the first time I think I agree with you. I must have missed the Dodd-Frank recession.

The Dodd Frank financial reform bill passed in July 2010 caused the recession which started in 2007 and ended June 2009?

That’s the most fascinatingly ridiculous comment I’ve ever read on this site.

It’s pretty unhinged.

I didn’t say “The Dodd Frank financial reform bill.”

You did.

Don’t be ridiculous.

Usually “Dodd-Frank” implies that bill. My mistake.

Dodd & Frank were working together before the financial crisis:

Bush Administration Tried to Reform Freddie and Fannie Five Years Ago

February 19, 2009

“Fannie Mae and Freddie Mac “accelerated their imprudent behavior after we attempted to regulate them. They bought almost as much mortgage debt from 2005 through 2008” as they bought in their first 30 years of their existence.

In 2003, when we sent our first members of the Cabinet up to talk about this on Capitol Hill, Barney Frank had a hearing in which they basically beat up everybody we sent up there in pretty vociferous language.

In fact, we moved aggressively in 2004 to regulate Fannie and Freddie, actually got a bill through the Senate Banking and Finance Committee only to have it filibustered by [Sen.] Chris Dodd.”

“The Federal Reserve has given us liberal-style, trickle down economics.” This is a quote taken from Speaker Ryan’s Twitter feed today. What does this mean? Is it meaningless gibberish? Should we try and make sense of it? Is this a policy he is advocating that the Federal Reserve follow?

He’s saying boosting stocks which are owned 80%+ by the very wealthy was supposed to create a wealth effect that would cascade into spending and trickle down to the masses as a stronger economy.

Doesn’t your Blinder & Zandi (2015) source actually support Ryan’s assertion that “the Fed’s policies pushed the recovery”? Their “No Policy Response” is a hypothetical of zero action – $policy or fiscal – whereas “No Fiscal Stimulus” includes the FOMC’s actions. The chart you’ve provided seems to show that the current gap is almost entirely FOMC-driven.

rtd: It could — but as I tried (clearly unsuccessfully) to convey, it’s not clear from the Blinder-Zandi decomposition whether most can be attributed to the Fed, given the stimulus component did not include TARP, and other measures, such as FDIC guarantee of bank debt and Federal conservatorship of the GSEs. I’m okay with the majority being attributed to the Fed, but it doesn’t pop out of the graph.

I don’t understand. It seems the “No Fiscal Stimulus” scenario does include the above.

“To isolate the economic impacts of the fiscal stimulus, the “No Fiscal Stimulus” scenario assumes that policymakers do not implement any discretionary tax cuts and government spending increases. Policymakers in this scenario do bail out the financial system, and the Federal Reserve does take extraordinary steps to provide liquidity to the financial system and engages in quantitative easing. But there is no fiscal response.”

Keep in mind that the Republicans in Congress in 2009 and thereafter were deliberately sabotaging the economy with government shut downs, debt ceiling crises and austerity in fiscal policy. Their goal was clearly stated by Senate Majority Leader Mitch McConnell: make Obama a one-term president.

In this context, Speaker Ryan’s statements and actions make perfect sense. He voted for TARP to save W and the GOP’s chances to win the 2008 election, but when that failed he switched immediately to being a deficit and inflation hawk which he had not been during W’s presidency.

Unfortunately, Pres. Obama back then naively took GOP leaders seriously and agreed to reduce the deficit by 75% (as a percent of GDP) during the worst recession since WWII—something that has never been done during any previous recession—and which is responsible for our slowest recovery from any recession since then.

Even President Hoover increased the deficit during the Depression from FY1931 through FY1933. He also was responsible for construction of the Hoover Dam—the largest construction project in history to that time.

Paul, keep in mind the Democrats controlled both houses of Congress the first two years of the Obama Administration and needed no help from Republicans in sabotaging the economy. I’m sure, every Republican wants a one-term Democrat, like every Democrat wants a one-term Republican. Obama has veto power and the Democrats kept the Senate, until recently. I guess, you can’t blame Bush now.

You can’t be serious Peak. Do you think we are all ignorant?

I find it hard to believe Paul the Republicans are primarily responsible for the L-shaped recovery, since 2009, when the severe recession ended.

Budget deficits would’ve been worse if TARP wasn’t paid back and GDP growth would’ve been worse if it weren’t for smaller trade deficits.

budget deficits were not the problem. we pursued various paths of austerity-look at government employment during the obama recovery versus the government employment growth during the bush and reagan years. it is striking. and what group pursued these policies?

Obama is also to blame for his federal budget “belt tightening” policies of 2009-11 which enabled the GOP to cut the federal budget deficit 75% (as a percent of GDP) from FY2009 through FY2015. That unprecedented reduction fully explains the slow recovey.

Paul Matrhis

January 13, 2016 at 10:38 am

Obama is also to blame for his federal budget “belt tightening” policies of 2009-11 which enabled the GOP to cut the federal budget deficit 75% (as a percent of GDP) from FY2009 through FY2015. That unprecedented reduction fully explains the slow recovey.

============================================================================================

Wait, so you’re saying we’d all be better off if the Govt had run 800B deficits every year? LULZ

@Anonymous

You are forgetting something:

“Pres. Reagan tripled the federal debt by adding more to it than all previous presidents combined and he increased employment in the federal government by 200,000 jobs. Our national debt in 2015 was 19 times greater than when Reagan took office in part because Reagan ran record budget deficits.

Reagan’s “weaponized” Keynesian policies during the 5 years of economic recovery after unemployment peaked in the 4th quarter of 1982, produced economic growth that averaged 5% each year. On the other hand, Obama’s “belt-tightening” policies during the 5 years of economic recovery after the 2nd quarter of 2009, produced growth that was less than half as much as Reagan’s. http://research.stlouisfed.org/fred2/series/GDPC1

Budget deficits that are spent on infrastructure and to enhance consumer demand have huge multipliers as any legitimate economist knows.

I’m not forgetting anything. RAYGUN is wildly overrated by conservatives. It sure does “feel” good leveraging up. It’s the deleveraging that is painful, and ultimately will occur, one way or the other.

Also, budget deficits to build “infrastructure” only have positive multiplier effects if they actually reduce transaction costs. Bridges to nowhere don’t add value.

in reality we have very few bridges to nowhere. while great for soundbites, it is a really poor example.

Some of the comments about austerity are hilarious. The US did not engage in “austerity” anymore than a paper cut is going to cause one to bleed to death.

So we are potentially on the verge of another recession. Fed rates are still effectively under .75%. Debt to GDP is 15-20% HIGHER than it was last time we were on the verge of a recession. If the economy does enter another recession, economic liberals will again call for higher deficits and QE. Do economic liberals not see how this cycle never unwinds itself and is not sustainable? I need more drugs so I don’t go into withdrawal!!

The Malia Obama Administration will be calling for QE42 and more fiscal stimulus as Debt to GDP approaches 400% and you folks will still be like “AUSTERITY DOESN”T WORK!!111!!!11!!”

check out the loss in government jobs for obama, compared to the other presidents. obama has done more with less than any president on that list.

http://www.calculatedriskblog.com/2016/01/public-and-private-sector-payroll-jobs.html

this data is the definition of austerity. imagine if those folks had still been working in the economy. for an economy as a whole, the idea of “belt tightening” is simply foolish as a plan to grow the economy. by definition, it is austerity for the economy as a whole. it is time we learn our lessons properly from the past decade.

He certainly shrunk the military.

does the military really need to be larger? how many wars and nation building efforts to you plan on conducting? foolishness in your statement.

Shrunk the military based on what? We spend far more now than Bush ever did, even inflation adjusted. How did it shrink?

government jobs is not a measure of austerity. Are you a troll? A generic metric of austerity would be tax rates vs spending rates. If the government collected 75% of incomes in taxes and spent nothing, that would be severely austere. Saying he cut a few public sector jobs and therefore that is austerity is ludicrous.

REAL austerity can be seen post WW2 when the federal budget dropped by like 45%, and of course that turned out just fine. Can you imagine how you would howl if real conservatives took control of all parts of govt and cut spending by 45%? Liberals would go ape. But I’d wager we would survive.

“Saying he cut a few public sector jobs and therefore that is austerity is ludicrous.”

there were 700,000 public sector jobs cut during obama’s first administration-during the peak of the financial crisis and ensuing aftermath. that is not cutting a “few public sector jobs”. that is not an insignificant hit to the economy, especially in a recession, where they are not re-employed quickly. not acknowledging that as an austerity policy is “ludicrous”, using your word.

700K jobs in a nation of 330M is a paper cut. Hope this helps.

if you want to take that approach, at least use a fair comparison. we have about 150 million in the workforce, that is what you should compare your lost jobs to. you lost about 1/2% of your workforce, during a recession, for unnecessary belt tightening. when you factor in any multiplier effect, it amounts to a really stupid action to take as one tries to emerge from a recession/depression. calling that a paper cut is not appropriate. when you consider bush ADDED a minimum of 840,000 government jobs per term, that is a huge swing in economic potential. austerity policy was poorly chosen.

What about conjectures regarding the supposedly harmful effects of the federal debt?

By 2015, federal spending was 454% higher and the national debt was 19 times greater than when Pres. Reagan took office in 1981. The debt was 421 times higher than in 1940 when Pres. Franklin Roosevelt was re-elected to his third term and more than 800 times greater than in 1933 when we abandoned the gold standard for our money. https://www.whitehouse.gov/omb/budget/historicals Table 1.1 http://www.treasurydirect.gov/govt/reports/pd/histdebt/histdebt.htm

The consequences: private sector jobs increased 60% since Reagan’s inauguration, real GDP has increased 1190% since 1940 and industrial production has increased 2632% since 1933. Private sector jobs have more than quadrupled since 1940 and total employment today is at a record high over 142 million.

https://research.stlouisfed.org/fred2/series/USPRIV https://research.stlouisfed.org/fred2/series/GDPC96 https://research.stlouisfed.org/fred2/series/PAYEMS https://research.stlouisfed.org/fred2/series/INDPRO

We had our highest debt-to-GDP ratio after WWII, then increased the debt 82% and federal spending 725% over the next quarter century from 1948, producing our greatest prosperity: a 168% increase in real GDP.

When will debt phobia end?

I don’t have a problem with debt. I have a problem with debt/gdp.

Also the dollar was still effectively tied to gold until 1971.

“We had our highest debt-to-GDP ratio after WWII, then increased the debt 82% and federal spending 725% over the next quarter century from 1948, producing our greatest prosperity: a 168% increase in real GDP.”

Your numbers not tied to GDP are meaningless. and that 168% increase in GDP occurred after we cut federal spending by around 45% in the years following WW2, so when will the phobia over decreasing spending end???