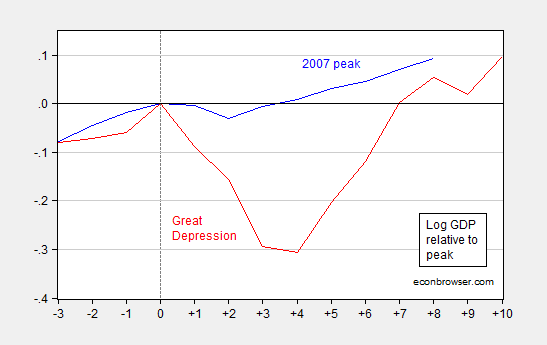

I keep on seeing comparisons between the Great Depression and the Great Recession (e.g., [1]), and how a big fiscal stimulus could result in a big and sustained jump in output. I think it useful to visually compare the extent of downturn in both cases.

Figure 1: Log real GDP relative to 2007 peak (blue), relative to 1929 peak (red). Source: BEA and author’s calculations.

In other words, while the deep output drop during the Great Depression was followed by rapid growth, the drop by 2009 of 3% (relative to peak) was dwarfed by the 1933 drop of 31%.

In any case, the proposition that a deep recession necessarily implies subsequent fast growth, as forwarded in the 2009 Economic Report of the President (the last one produced under the Bush Administration), is a dubious one.

The foregoing, in conjunction with stable core CPI inflation (3.5% m/m AR, 2.2% y/y), suggests to me an output gap that is smaller (in absolute value) than 18% implied by a 1984-2007 linear deterministic trend and 11% as Gerald Friedman suggests.

Stable inflation on the downside may suggest stable on the upside as well as the controlled variable becomes less sensitive and detaches from the real economy towards anchored expectations.

Perhaps We Could Try Some Stimulus and See What Happens?

In the “hard” sciences, experiments are done all the time. Real scientists don’t sit around arguing about models. They actually look at evidence and draw conclusions from facts.

Would it be wrong to rebuild some of our infrastructure before it fails catastrophically? Why let the nation fall to ruin while we argue about output gaps?

“Why let the nation fall to ruin while we argue about output gaps?”

because we have a bunch of ideologues who believe government spending is a waste, period. the nations infrastructure of bridges, buildings, dams, airports, etc have simply always existed, to a growing percentage of the population, with no thought given to how they were even built. it is as if an ancient alien civilization left them here, and we simply occupied them. their response to your question is simply “you mean we actually have to pay for new infrastructure?” they may be interested in closing the gap, but not to the benefit of the current administration.

“Perhaps We Could Try Some Stimulus and See What Happens?”

We run deficits every single year. How much more stimulus do you want to experiment with? Obama, whether it was his fault or not, has averaged over a TRILLION dollars a year in deficits. We have PLENTY of stimulus. The problem is the engine is broken.

obama has averaged about $530 billion in deficits over his second term. This has corresponded to around 3.1% of gdp. st reagan ran an average of 4.1% of gdp during his tenure. your argument for plenty of stimulus is either ignorant of the proper way to measure, or intentionally disingenuous. the TRILLION dollars is only important relative to the size of the economy, and it occurred years ago. have you never seen dr evil and austin powers?!

Obama and the Deficit

President Obama reduced the deficit by 75% (as a % of GDP) from FY 2009 through FY 2015 during the worst recession since WWII—something that has never been done during any previous recession—and that is responsible for our slowest recovery from any recession since then.

https://www.whitehouse.gov/blog/2015/10/16/deficit…

Even President Hoover increased the deficit during the Great Depression from FY1931 through FY1933. He also was responsible for construction of the Hoover Dam—the largest construction project in history to that time.

bizarre choice of end points.

Getting rid of tax cuts, adding new taxes and fees, and more regulations don’t help.

Anyway, there isn’t much money to spend anymore:

https://research.stlouisfed.org/fred2/series/GFDEGDQ188S

Japan has more than TWICE the debt to gdp ratio that we have and the interest rate on their 10 year government bond is ZERO.

We can borrow for 30 years at less than 3% with NO collateral. Why wouldn’t we do that?

Yet, high government debt coincided with low per capita real GDP growth:

https://research.stlouisfed.org/fred2/series/JPNRGDPC

So Peak, you are a balanced budget guy then?

Following the GOP mantra that balanced budgets will grow the economy and create more jobs? Really?

Paul, I’m not a fiscal conservative when debt to GDP is low or moderate. However, I’m a fiscal conservative when it’s high. As the saying goes, “a day late and a dollar short.”

Bank for International Settlements study – 2011:

“At moderate levels, debt improves welfare and enhances growth. But high levels can be damaging. When does debt go from good to bad?…Our results support the view that, beyond a certain level, debt is a drag on growth. For government debt, the threshold is around 85% of GDP.”

OK Peak, Here is the List

http://www.tradingeconomics.com/country-list/government-debt-to-gdp

Looks like the major economies with the best growth prospects according to your 85% threshold are Russia and China. OTOH, U.S., U.K. and Canada look like bad bets. Are you going to put your money where your mouth is? LOL

A fool will believe anything in their simple world. It’s the result of numerous rigorous studies.

http://www.nber.org/digest/apr10/w15639.html

Yep, the FACTS are really compelling for your theory Peak.

Just look at the good news from the world’s 7th largest economy with a debt to GDP ratio of only 66:

http://news.yahoo.com/brazil-growth-plunges-3-8-percent-biggest-fall-005105335.html

You and Ken Rogoff should do another spreadsheet!

Anonymous We run deficits every single year. How much more stimulus do you want to experiment with?

You’re confusing deficit levels and the change in the deficit. Increasing the deficit stimulates aggregate demand. Reducing the deficit contracts aggregate demand. Leaving the deficit unchanged has no effect on aggregate demand. Yes, we still have deficits, but the direction has been to have smaller deficits each year; i.e., the change in the deficits is contractionary. If you pick up any macro textbook you will see that the comparative statics are based on the difference (or differential), not the absolute level of the deficit.

Nope.

The textbook explanation is the size of the deficit now compared prior to the start of the recession. “Stimulus” is measured against “slack” or”output gap”. The relevant comparison is the deficit now vs the deficit at the outset of the recession.

is it the magnitude of the deficit, or the size compared to gdp, which is important?

@ baffling

An argument could be made either way, but I think the stronger argument is the size of the deficit in nominal terms.

Well, I’m looking at a textbook right now and it says the fiscal multiplier works through changes in the deficit. And then there’s some guy named “Menzie Chinn”…maybe you’ve heard of him. Anyway, he has some lecture notes from 2013 and he defines the impact multiplier as “…the change in output for a change in the fiscal instrument”, or dY(t) / dZ(t) where Y is output and Z is a fiscal instrument; i.e., a change in the deficit. Note the word “change.”

Or another very simple textbook illustration: dC = (mpc_d / (1 – mpc_d) * (dG – dT), where (dG – dT) is the net change in the deficit. If there is no net change in the deficit, then consumption does not increase.

Stimulus may well be measured against slack or the output gap, but that’s not what we’re talking about here. What we’re talking about is whether stable or declining deficits should increase aggregate demand. In other words, Anonymous seems to believe that the stimulative effect of deficits is cumulative, so if a deficit of 1% of GDP this year increases GDP by 1.5%, then a deficit of 1% next year should (according to Anonymous) increase next year’s GDP by another 1.5% on top of that; i.e., ~3%. That’s wrong. It sounds like Anonymous was making the same kind of mistake that Romer & Romer accused Friedman of making.

bacon

“An argument could be made either way, but I think the stronger argument is the size of the deficit in nominal terms.”

just curious why you would think this? percentage of gdp would be a rather accurate measure of the importance of the deficit directly on the economy.

“The relevant comparison is the deficit now vs the deficit at the outset of the recession.”

over time, if you use nominal terms you lose track of the baseline comparison. $1 at the outset is different from $1 today. in addition, the contribution of that $1 to the economy would also be different if the size of the economy changed. it seems as though measuring your deficit against gdp helps to eliminate these discrepancies, and gives you a better idea whether your deficit (and debt) are actually growing relative to the economy as a whole. over time, nominal terms, as you favored, would skew your results?

“Note the word “change.””

Change with respect to what? Example one

The deficit is $1 trillion in 2007, the recession starts in Dec 2007, the deficit in 2008 is 1.1 trillion, and the deficit in 2009 is 1.05 trillion. By one interpretation we have 0.15 trillion in stimulus across 2 years. By another interpretation we have 0.05 trillion over 2 years. By a 3rd interpretation where we take the trend of deficits from 200X-2007 we could have zero, or negative, or positive stimulus depending on that trend (and how we extrapolate).

Example two

Two countries have deficits of $1 trillion in 2007(and the same trend leading up to this point), recession starts in Dec 2007. Country A has a deficit of 1.1 tillion in 2008 and 1 trillion in 2009. Country B has a deficit of 0.9 trillion in 2008 and 1 trillion in 2009. If you use the start of the recession as the baseline the country A had 0.1 trillion in stimulus over 2 years and country B had -0.1 trillion in stimulus. If you go year by year then both countries had 0$ in net stimulus.

@ baffling

In Keynesian stimulus the (really quick and dirty) mechanism is pretty straightforward. A country CAN produce X worth of goods, during a recession it produces X-Y worth of goods. Y is then your output gap. Inflation wouldn’t change this. If prices of goods that are currently being produced rose, then the potential dollar value of the goods not being produced would also rise. If you wanted to calculate the output gap it shouldn’t matter if you do it in 2009 dollars or 2016 dollars.

Additionally inflation is supposed to ease AD shortfalls quickly. If there was enough inflation to cause a serious distortion in your baseline then the recession should be over already! If not you (basically by definition) have a structural problem, not a cyclical one, and stimulus won’t help.

“it seems as though measuring your deficit against gdp helps to eliminate these discrepancies”

The issue again is the output gap is what stimulus is working on, not actual GDP. If GDP dropped from 100 down to 1 a stimulus package of 1 would be = 100% of GDP, but would be equal to 1/99 of the output gap. If you compare to GDP you will accidentally find that countries with larger declines will tend to have larger stimulus than countries with smaller declines if they enact the same nominal amount of stimulus.

different experiment. were the control

Your time frame seems odd since the giant stimulus in the Great Depression was WW2, only beginning to be felt at the very end of your graph. In other words, the better analogy to Hekp us understand the effect of massive stimulus today would be the 1940s, no?

More generally I have heard endless talk about the Depression years but almost no talk about the War years. Is there some giant amnesia about how the USA won the war while prospering mightily? Hint: the private sector wasn’t the main mover here. It’s almost as if 50 years of Cold War propaganda made everyone forget the USA’s very successful period as a command economy.

“Is there some giant amnesia about how the USA won the war while prospering mightily?”

If by prospered mightily you mean consumer products were between heavily rationed and non existent, then I guess, but that is a strange definition.

Sorry for my typos–commented from my phone.

I may be “mis-remembering”, but in earlier posts about the recover trends of various states, I postulated that higher recovery rates were related to greater economic falloffs… but was basically told that they were unrelated.

Bruce Hall: If the big drop off is conjoined with financial crisis, then a bounceback is not likely. A big drop off in the absence of a financial crisis is likely to have a faster rebound than a small drop off in the absence of a financial crisis. In other words, it makes sense to condition.

Ah, then we are stuck with what the definition of is is. “Financial crisis” is a rather arbitrary factor when you use Figure 1 as it relates to the “Great Recession” which is quite tame in comparison to the Depression.

Bruce Hall: Well, then we consult various economists’ tabulations. Carmen Reinhart, Michael Bordo, and Luc Laeven and Fabian Valencia have compiled three different data sets. I think we have the stylized facts correct, but you can consult the literature.

Obviously there are differences between then and now. But if you are talking about the scope for increased GDP based on fiscal stimulus, wouldn’t the relevant period include at minimum the following five or six years, when there was an additional increase in log GDP of about .64? If we’re just going by the graphs, it would seem to suggest that with sufficient stimulus we could see an average of well over 8% over the next five years, unless you had more to add.

To counter on the “sustained” basis, you might extend further, to see the smaller fall afterwards such that the 1944 peak was only reached again in 1950. But even that shows about a 5% average growth rate over the period. I simply don’t think that pointing out we’re higher relative to the old peak than 1937 was relative to 1929 is very informative without unpacking a lot of other information about trend growth and the actual output gap at the time.

We had the worst recession in over a half century and the worst recovery since ?.

The fiscal stimulus to start this recovery seemed to be a sideshow to more important things.

We need to do more than just shovel money at problems.

Business cycles became much smoother, causing faster growth, after we went off the gold standard, adopted Keynesian economics, created automatic stabilizers, and utilized more microeconomics.

Also, the economy became more diversified, America dominated the global economy (while Europe and Japan rebuilt after WWII), and attracted the world’s best (including in the Information Revolution, where the U.S. leads the rest of the world combined).

There were huge economic improvements in the 20th century, although America surpassed Britain as the most powerful economy over a hundred years ago. Nonetheless, the economy can improve substantially.

Recessions in the Industrial Revolution – 1871-1914

Period – Percent Decline of Business Activity

1873-79 – 33.6%

1882-85 – 32.8%

1887-88 – 14.6%

1890-91 – 22.1%

1893-94 – 37.3%

1895-97 – 25.2%

1899-00 – 15.5%

1902-04 – 16.2%

1907-08 – 29.2%

1910-12 – 14.7%

1913-14 – 25.9%

“We run deficits every single year. How much more stimulus do you want to experiment with? Obama, whether it was his fault or not, has averaged over a TRILLION dollars a year in deficits. We have PLENTY of stimulus.”

A deficit does not necessarily equal stimulus. Most of the deficit was a result of a sharp decline in revenues, not stimulus spending.

I am sure Menzie is in a panic.

Wisconsin’s education reforms under Governor Walker has saved over $5 billion.

Not only that Kansas is seeing record tax receipts.

He needs a little Keynesian magic.

Ricardo says:

“Not only that Kansas is seeing record tax receipts.”

Tax increases have that effect, outside of the Laffer bubble. Kansas increased taxes in 2015.

But, those increases are too little, too late to halt the deterioration of state services.

http://www.kansascity.com/news/politics-government/article63347152.html

MARCH 1, 2016 1:17 PM

Gov. Sam Brownback cuts higher education as Kansas tax receipts fall $53 million short

Kansas tax receipts fell $53 million short of estimates in February, and Gov. Sam Brownback on Tuesday immediately announced a $17 million cut to the state’s university system.

The latest revenue results are a dramatic blow to recent moves by the Legislature to shore up the state budget.

Individual income tax revenue last month was about $27 million below projections, and sales tax receipts missed estimates by about $12 million, according to the state’s Department of Revenue. Corporate income taxes were $7.7 million below estimates.

Just to be clear there was no increase income tax in the last year in KS. It was only sale taxes. If you shop in Johnson County, KS (burbs of Kansas City) you will be paying 9% on food, the 6.5% state sales tax plus the max localities can charge 2.5%. There is no reduced sale tax on food you pay the full amount 9%. If you hop across the boarder to shop in Jackson County, MO the sales tax on food is reduced so that the total you pay is about 5.3%. The politicians in Topeka sure gave 20% of the population of KS (Johnson County has the largest population in KS) a strong incentive to shop in MO.

Another incentive is for any professional to form their own LLC and claim none of their income is from labor that way they pay no state income tax:

http://www.kansasbudget.com/2015/10/an-unfair-tax-policy-persists.html

The lack of revenue is not surprising and it is not primarily from a weakening economy.

Ricardo Kansas is seeing record tax receipts

Where do you get this nonsense? Do you sit around all day watching Faux News? Do you ever bother to check the data? Revenues for February 2016 plunged.

Slug,

The past few posts I have made to Menzie’s threads with source links have disappeared so I have stopped including links.

Oh, Slug, where is your evidence that my comment is wrong?

ricardo, a quick google search appears to show problems with tax revenue. if records exist, they seem to be for record lows not highs.

http://www.kansascity.com/news/politics-government/article57766358.html

http://www.kansas.com/news/politics-government/article52986745.html

http://cjonline.com/news/state/2015-11-02/kansas-tax-revenue-tumbles-fourth-consecutive-month

http://www.khi.org/news/article/kansas-february-tax-revenue-falls-far-short-of-estimates

Dear Menzie,

Sorry, this is a very dopey question, but how did you get the implied growth path with no recession? Or is the blue line the actual path since 2007?

It needs more work to claim the output gap is that small. Let me be precise: labor force participation rate shouldn’t be taken as highly exogenous. If we are hearing every day that we have to cut entitlement spending, and retirement spending (a la Medicare, etc.) is the obvious place to cut, with increases in retirement age and the like, it makes sense for people to retire, or not start up new businesses in their 60s, in order to access some guaranteed funds before they disappear. I would also want to see investment spending relative to capital stock figures, not the usual calculation – just having low percentage growth in capital seems an indication that people won’t buy, which could be changed by having a spending plan that would buy with government spending, and which would also raise potential output. I’m not convinced the candidates can lay this out in a salable way, but this notion that inflation is right around the corner with this looming output at capacity still doesn’t convince me.

Julian

Julian Silk: The blue line is log(GDP/GDP in 2007) where GDP is real reported GDP, in bn ch2009$; and red line is same, but relative to GDP in 1929.

Look, I’ve written extensively on how difficult it is to estimate potential GDP. One can do bean counting, using a production function (Yn=AF(K,N), where A is technological factor, K is capital stock, N is labor stock), or can infer the output gap from the inflation rate as in Ball-Mankiw. CBO’s estimates around 2% slack, with IMF and OECD slightly smaller. My guess is that you wouldn’t get much bigger estimates from New Keynesian type estimates (which are conceptually different). The biggest I’ve seen are the estimates obtained using a modified Ball-Mankiw approach; if I dispense with the accelerationist approach, and assume perfect credibility of the 2% inflation target, I get at most a 7% output gap

I would imagine your response to Kocherlakota would be similar to the above:

https://sites.google.com/site/kocherlakota009/home/policy/thoughts-on-policy/2-21-16

“Ricardo: Kansas is seeing record tax receipts”

“Where do you get this nonsense? Do you sit around all day watching Faux News? Do you ever bother to check the data? Revenues for February 2016 plunged.”

Well, giving Ricardo his due, he didn’t say what kind of record.