One argument for tightening monetary policy is derived from the argument the Fed needs to raise rates to close a “confidence gap”. Instead of psycho-analyzing the markets, I think it better to focus on data.

From “For Yellen, a September Fed surprise could close confidence gap”:

“Market volatility is low, U.S. census data shows income gains have reached the middle class, and workers are clawing back a larger share of national income. For now, at least, no international risk stands out and inflation may even be picking up.

If Fed Chair Janet Yellen wants to prove that policymakers are not being pulled along by investors who for years have second-guessed them, this week may offer a rare moment of calm to do so.

…

“Let’s get on with it already,” said Michael Arone, chief investment strategist at State Street Global Advisors.”

On the other side, we know that manufacturing and industrial production have taken a hit. And as Governor Lael Brainard has noted, weakness abroad is another reason for caution.

As of 11am (EDT) 9/20, futures indicate a 15% chance of a rate hike.

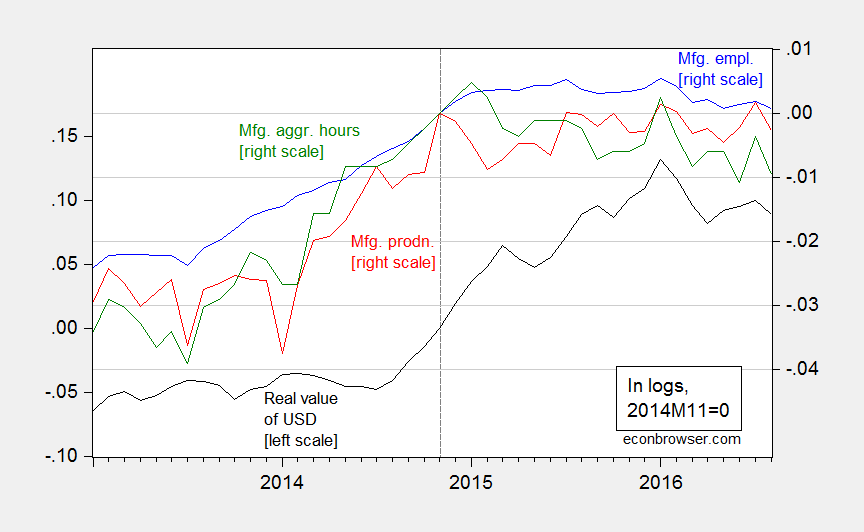

My point has been that one thing we know is linked to the dollar’s value is the interest rate, and the tradables sector is under stress. Manufacturing employment is essentially at 2014M11 levels, while manufacturing output and hours are below.

Figure 1: Log real value of USD against broad basket of currencies (black, left scale), log manufacturing employment (blue, right scale), log manufacturing hours (green, right scale), and log manufacturing production (red, right scale), all normalized to 2011M01. Source: Federal Reserve, BLS, all via FRED, and author’s calculations.

While the dollar has dropped in value since the beginning of the year (about 4%), it is still 13.7% higher than it was in mid-2014.

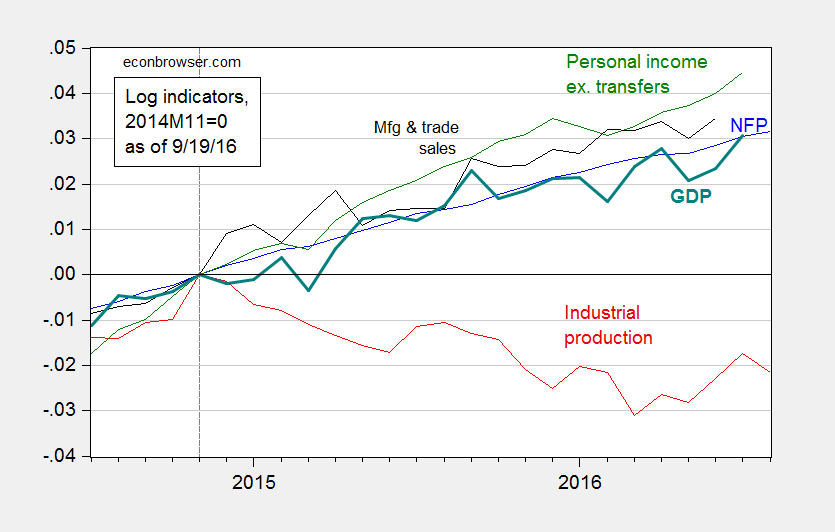

In addition, it could be argued that, while we are likely not in a recession as of July 2016, the indicators are not unambiguously in favor of continued expansion, given the downturn in industrial production. Figure 2 depicts five of the variables the National Bureau of Economic Research (NBER) Business Cycle Dating Committee (BCDC) has traditionally focused on, in deciding whether a recession has begun or ended (see NBER).

Figure 2: Log nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers, in Ch.2009$ (green), manufacturing and trade sales, in Ch.2009$ (black), and Macroeconomic Advisers monthly GDP series (bold teal), all normalized to 2014M11=0, all as of September 19th. Source: BEA, BLS (August release), Federal Reserve (August release), Macroeconomic Advisers (September 16), and author’s calculations.

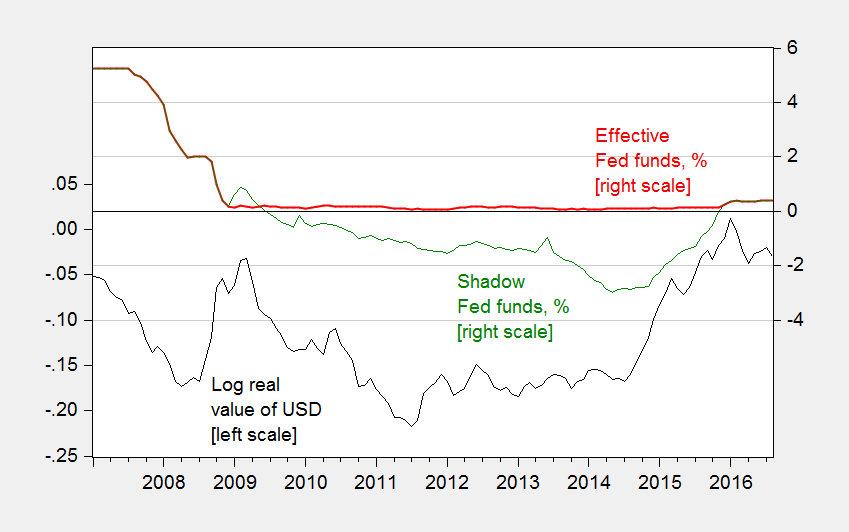

Overarching these arguments, it should be remembered that monetary policy has already tightened considerably, taking into account the end of unconventional monetary policy.

Figure 3: Log real value of USD dollar (black, left scale), effective Fed funds rate, in % (red, right scale), and shadow Fed funds rate, in % (green, right scale). Source: Federal Reserve, Xia-Wu, and author’s calculations.

The short rate has risen nearly 3.4% since mid-2014; in real terms, the rate has risen over 3% (if using 1 year expected CPI inflation rates, as measured by the Survey of Professional Forecasters).

Menzie, you wrote: “…the Fed needs to raise rates to close a “confidence gap”. Instead of psycho-analyzing the markets, I think it better to focus on data.”

I am not sure what a “confidence gap” is and wonder if it implies some kind of reversion to the mean (or is that median?), or that there is somehow some kind of optimal amount of ‘confidence’. I suspect that the answer to that is similar to the answer about the optimal amount of public sector debt. There is none, but perhaps there exists a firmer notion of what constitutes a risky debt burden.

Frankly, I do not believe it is “better to focus on the data” until you present one or more theoretical stories as to why ‘confidence’ should matter be it a Keynesian ‘animal spirits’ story, or some version of rational expectations that get at how expectations condition private investment and household capital formation. Perhaps it could involve perceptions of social equality as a pre-condition for effective, secure economic property rights?

On that score there may exist both theory and data that argues social equality is irrelevant. I do not pretend to have any useful or certainly any rigorous answers here. Simply more questions.

I would be most surprised if data easily answers the ‘confidence’ question. For example, it was apparent to me that American investors and citizens were at some point reacting in a hyper-vigilant manner to the threat of domestic attacks by Da’esh and Da’esh inspired followers.

Americans appeared to exaggerate the risk and minimize the relative success of domestic terror interdiction policies. Then over time, it seemed that Americans became slowly more comfortable with the Da’esh threat. To some extent that increased comfort was reflected in a strong upwards moves by main US stock markets earlier this year. That is my intuition. How you empirically verify these ‘hunches’ is a good question.

The Donald Trump Republican candidacy policies and rhetoric strike me as symptoms of failed policies and a significant lack of ‘confidence’ on the part of many Americans relative to the past. How one might rigorously quantify and test this proposition is again an interesting question.

The “confidence gap” seems to mean monetary policy is predicting more anemic growth and a faster tightening will send the message to markets growth will accelerate, to spur spending and investment.

However, we’re in the eighth year of the expansion. Perhaps, many people believe a recession is very likely within a year or two and they’ll remain cautious, unless the data show a much stronger expansion is underway.

I don’t believe the Fed is creating a self-fulfilling prophesy. There just isn’t enough economic strength to justify a faster tightening cycle. Significant structural changes by Washington politicians are needed to unleash growth first. The Fed can only do so much.

peak, i agree the economic conditions today do not justify a rate increase. nothing seems positive out of such action. you focus on washington politicians, and i agree to an extent. i would argue now is the time to increase our R&D and infrastructure spending-you may disagree.

but people are told the story of a weak recovery, and i question weak compared to what? i think demographics are playing a big role here-especially the baby boomers. the economy grew greatly under the bulge of the boomers-they grew the economy and plowed their savings into retirement accounts, homes and stock markets. the problem is all of that capital is perhaps overloading the system? boomers are no longer the positive contributors to economic growth-retirement tends to slow your contributions. the boomers are no longer opening new businesses like they did over the past decades. they are moving their money out of business formations and the stock market, downsizing and cashing out their homes, and generally moving to a less risky financial profile. this money is not as productive, so it leads to lower growth. in addition, it is all searching for safety which is helping keep down yields.

if we want a better recovery, the boomer generation needs to contribute to that growth. but that does entail risk, which i am not sure is wise for many of those in retirement. i think we do have a cohort that could help grow the economy, but at what risk? the avoidance of risk produces what we have today, a slower economy. this large demographic bulge is a major contributor to the current situation-although it is a transient contributor. a transition of resources from boomers to millennials would probably be beneficial to growth.

If the shadow rate represents stealth tightening does this not mean that the balance sheet is all a flow effect? Seems odd. So, now that the actual FFR is above zero, the Shadow Rate is retired and the stock of the Fed’s asset holdings becomes an afterthought. This seems wrong.