Suppose you (the UK) are in a tariff-ridden world, getting butter from your former colony and current Commonwealth partner New Zealand, the global low cost producer. Then you (the UK) decide to join a customs union that encompasses Denmark, which produces butter at a lower cost than the UK, but higher than New Zealand. In plain words, the tariffs between UK and Denmark on butter go to zero, while those between UK and NZ remain.

Is the UK better or worse off?

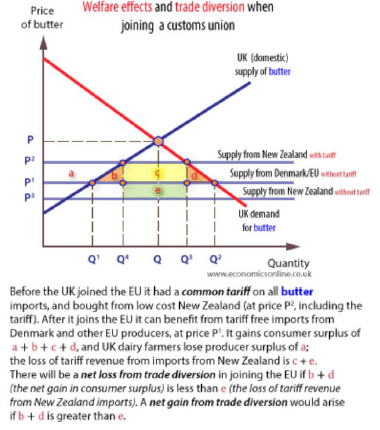

This depends on whether the benefits of trade creation (increased amount of trade with the lowest cost producer within the customs union) outweigh the costs of trade diversion (no longer sourcing imports from the global lowest cost producer). This can be shown simply (albeit in a partial equilibrium setting):

Source: EconomicsOnline.

There is always a gross loss from trade diversion unless the global low cost producer is in the customs union. The question is the net effect.

Is the home country better or worse off than before? This is an empirical question. If areas b and d sum to less greater than that of e, then benefits of trade creation exceed that of costs of trade diversion, and vice versa. (Assuming the marginal utility of a dollar to producers and consumers is equal, as is usually the case in simple welfare analysis.)

I never thought I’d have to explain this, but apparently I do, because of this comment:

…trade diversion was being presented as bad and due to the current ZTE sanction/tariff actions, but trade diversion has many other causes (taxes, sanctions, political changes, trade agreements, etc.) and is not necessarily bad. What amazes me is the the lack of understanding of the bigger picture surrounding Trump’s actions. Negotiation leverage may be manufactured and alleviated when needed.

Trade Diversion, a 1950s term/finding, was coined before the major implementations of the VAT. It assumes efficiency of production of products naturally means lowest price for products and subsequent purchases of them in international trade. The VAT changed that assumption. There are far more changes that impacted international trade since the 50s. It is, therefore, more difficult to determine the negative impacts of Trade Diversion on “NATIONAL” economies today than in the 50s.

The specific reference is Jacob Viner, “The Customs Union Issue” (1950).

If the US imposes sanctions on China and the rest of the world is in a global free trade area with the US (that is the idea of a WTO), and China is the low cost producer of, say, carpet sweeper parts, it may very well be the case the benefits outweigh the costs. It depends.

To my knowledge, imposition of a VAT does not change the analysis. In fact, all it does is make the relevant costs inclusive of taxes and fees. One might as well say the presence of sales taxes invalidates the trade creation/trade diversion analysis. (In point of fact, I suspect that since a VAT is typically less distortionary than other taxes, the idea of VATs invalidating the analysis makes the least sense — but I’m not an expert on this issue, so I leave to others to debate).

I could see that the development of global value chains might impact the standard analysis. However, to the extent that rules of origin along with content requirements are in force, I don’t see how.

About the only thing I can think of that might affect the bottom line is macro in nature; in a world with exchange rate fluctuations, who is the lowest cost producer might vary over time (depending on the extent of the cost advantage; if it’s sufficiently large, the lowest cost producer might remain the lowest cost producer, although profit margins will then vary).

I thought I’d finished teaching international trade last week; apparently I was wrong…

Thanks for the clear and quite thorough discussion (love the incorporation of VAT here). I have nothing to add except to encourage CoRev to carefully read this discussion. He could also read Viner’s 1950 paper while he is at it but if he doesn’t – this captures it.

Is there a type here?

“If areas b and d sum to less than that of e, then benefits of trade creation exceed that of costs of trade diversion, and vice versa. ”

e is the cost. b + d are the benefits. So “less” should be “more”. Right?

pgl: Yes, corrected it, thanks! The note accompanying the graph itself is correct.

Here’s another online tutorial, very similar to the one Menzie provided except the graphs are larger and it’s based on a (more or less) real world case:

https://www.economicshelp.org/blog/glossary/trade-diversion/

Thanks – that is a very nice tutorial.

@ 2slugbaits

Thanks for putting this link up. I like Menzie’s graph also, but having 2 examples is definitely a plus. I Appreciate that.

What is generally overlooked in the effort to maximize the net effect of trade agreements is who are the individual winners and losers in each country. If the gains primarily accrue to the top 1% and the losses to the other 99%, then citizens may rationally prefer a less than maximal outcome.

Economists too often seem to concentrate on quantity and not equity. I attribute this to the Streetlight Effect. Economists limit their search to what is easiest to measure and that is usually GDP.

https://en.wikipedia.org/wiki/Streetlight_effect

Fair enough, but politicians like Trump tend to rely upon the Gaslight Effect. The Streetlight Effect at least increases the size of the pie even if it doesn’t always do a good job of slicing the pie. The Gaslight Effect promises voters blueberry pie and gives them magic mushrooms.

Street Light Effect!

I hope my former Angrybear colleauges – Kash Mansori – gets a kick of this term!

http://streetlightblog.blogspot.com/

“It is also called a drunkard’s search, after the joke about a drunkard who is searching for something he has lost”.

This is great! Funniest line all year!!!

joseph: Agree. That’s why I mentioned the caveat about equal marginal utility of a dollar’s worth of benefits. One could re-jigger the calculation to put higher weight on consumers. Or on producers (not clear who is the 1% in a given case without knowing what the actual product is).

Low income workers likely benefit the most from the lower price. If they lose their job, they can get another low income job.

Of course, real wages of low income workers have been stagnant or falling.

Actually, not true by this measure.

https://www.princetonpolicy.com/ppa-blog/2018/3/25/minimum-wage-and-pct-of-hourly-workers-at-or-below-min-wage

steven, do you have similar data describing wages as we move up from minimum? for instance, what % of workers are making 10% or 15% higher than minimum wage? or 5%? further, how many of those minimum wage earn benefits? or are those taken into account in your analysis? your numbers show a surprising few workers at minimum wage, compared to the narrative we hear. thanks.

Steven Kopits and Baffling, I define low income wages below $15 an hour. I’ve shown data before a large percentage of the workforce earns less than $15 an hour. There are a lot of jobs paying around $11 an hour, like around $10 in 2000. It hasn’t improved much in about 20 years.

Also, the teen labor force participation rate has declined substantially. Instead of teens mowing lawns, you have low skilled Hispanic “landscapers.” Also, Hispanics work in much of the food industry, and other low paying jobs.

Some needs to learn the Stopler-Samuelson theorem.

And, some need to learn low income wages would be higher without the flood of low-skilled immigrants desperately looking for work, including the illegal immigrants you favor over low-skilled U.S. citizens.

It’s actually not at all clear that low end wages would be higher absent immigrants, legal and illegal. If supply is greater than demand in any given period, then wages will fall in the short run. In the long run, however, the capital stock adjusts and wages go back to their original level.

Interestingly, the data suggest that undocumented wages in the US would have been higher without border controls in the 2010-2015. period, as border enforcement acted primarily as a barrier to exit, rather than a barrier to entry, during this stretch.

https://www.princetonpolicy.com/ppa-blog/2018/5/15/the-economics-of-being-illegal-and-how-the-wall-increased-the-illegal-population

peak, there are very few illegal immigrants replacing low skilled us citizens in the job place. and don’t reply with your usual anecdotal “evidence” where you sight one sob story and extend it to the entire argument. we have a lot of jobs in the us that will simply never be filled by us citizens, because a) they do not (or cannot) want to do that type of work and b) you cannot offer enough money to sway them to do the work and still have a profitable business. real wages of low income workers have been falling because at that level there is a clear asymmetry in power between the employer and employee, especially with the loss of labor unions.

See above why low-skilled wages haven’t changed much – it’s amazing there are still so many jobs paying only around $11 an hour, e.g. in food service, warehouse, retail, landscaping, delivery using your own car, etc.. And, I hear Uber drivers don’t make much.

Peak, your low wage job descriptions are not held by illegal immigrants. When you intentionally insert such political hackery into your arguments, you lose all credibility in your argument. Try making your arguments without the falsehoods and innuendo please.

Baffling, you have no credibility with your false narratives.

Peak,you might add construction in the mix of your job categories.

@ Menzie

Careful Menzie, anymore outbursts like that and they’ll start calling you a “populist” and your reputation will be shot clear to hell.

@ joseph

This is a really outstanding observation. Something I have thought intermittently from time to time, but doubtful I would have expressed it as well as you did there. A very shrewd observation that takes an ability to see beyond what is readily apparent to the eyes. KUDOS to you Joseph.

Sigh. Another hypothetical.

CoRev Sigh. Another hypothetical.

Please explain.

Obvious. He doesn’t understand hypotheticals.

All of economics is a hypothetical to CoRev. Yes – understanding basic economics gets in the way of his watching Fox and Friends.

Its all about the context

From Merriam – Webster “Definition of hypothetical

: involving or being based on a suggested idea or theory : being or involving a hypothesis : conjectural ”

Definition of conjectural

1 : of the nature of or involving or based on conjecture

Without evidence, his conclusions are only conjectural.”

Throughout this discussion I have used references to terms such as “real world” or “empirical”.

Menzie admitted there were more contingencies than just tariffs that cause “trade diversion” which was my original contention along with “trade diversion” is not always bad. Even most of you there will be winners and losers when “trade diversion” occurs depending from whose eyes we are lookling. Even Menzie admits this: “joseph: Agree. That’s why I mentioned the caveat about equal marginal utility of a dollar’s worth of benefits. One could re-jigger the calculation to put higher weight on consumers. Or on producers (not clear who is the 1% in a given case without knowing what the actual product is). Here he confirms the winners/losers problem and that the example is hypothetical.

Furthermore, since we are talking about context, this discussion commenced with an article not about tariffs, the semantical point you folks are making, but about sanctions If ZTE “Sanctions Are Up For Grabs, What about Additional Section 301 Sanctions?”. Where my original comment appears.

And in context it was Not Trampis who brought up the term “trade diversion” which also did not have a “tariff” context: “Bilateral treaties usually end up causing trade diversion.”. In response we have a pgl agreement confirming Not Trampis’ claim that “trade diversion” does not necessarily have to be associated with tariffs: “Good point. Note to Ed- Jacob Viner wrote a paper on trade diversion. Check it out.”

So just with who are you folks arguing? It appears that you are arguing with yourselves and contradicting your own early comments. I do not intend to go down your semantical rabbit hole. Apparently your reaction has been to my ridicule of your own hypocrisy within the context of these discussion. I stand by that position.

CoRev: The NET welfare effect of trade diversion and trade creation might be positive; but the gross effect of trade diversion is always NEGATIVE (bounded above at zero). How many times do I have to say this?

It is hard for me to think of a case where trade diversion is not associated somehow with tariffs, as Viner conceived it (and since he coined the term, I think he should have some say on this point), since he was writing about customs unions.

Does CoRev understand what Section 301 sanctions even means?

https://www.trade.gov/mas/ian/tradedisputes-enforcement/tg_ian_002100.asp

“Section 301 of the Trade Act of 1974 provides the United States with the authority to enforce trade agreements, resolve trade disputes, and open foreign markets to U.S. goods and services. It is the principal statutory authority under which the United States may impose trade sanctions on foreign countries that either violate trade agreements or engage in other unfair trade practices. When negotiations to remove the offending trade practice fail, the United States may take action to raise import duties on the foreign country’s products as a means to rebalance lost concessions.”

I guess CoRev does not realize “import duties” are tariffs!

‘I do not intend to go down your semantical rabbit hole.’

Odd as it is CoRev who dug this rabbit hole hoping the rest of us will follow him into it. Sorry dude but not playing your games today.

Menzie, I understand your trained mind can not perceive “trade diversion” without being associated with tariffs. And yet you did admit that other possibilities exist. My original comment re: VATS was assuming the real world example of an EU/US Trade Agreement, VAT vs non-VAT countries.

Even Viner was trying to estimate the impact of Trade Agreements as well as pgl’s reference: http://www.facstaff.bucknell.edu/cmagee/trade%20creation%20and%20diversion,%20magee,%20august%202007.pdf

Cmagee also referenced the impacts of Trade Agreements and used Viner’s strict defintions ” Viner (1950, p. 43) discussed trade creation as being increased imports from within a trading bloc that the country “formerly did not import at all.” Trade diversion, on the other hand, means the goods “which one of the members of the customs union will now newly import from the other whereas before the customs union it imported them from a third country.” Pg 8.

So if you are to limiting “trade diversion” to just his limited definition, then I can see how you might associate “trade diversion” with tariffs within “custom union” agreements, but even here it is not clear tariffs dominate. “A customs union is a type of trade bloc which is composed of a free trade area with a common external tariff. The participant countries set up common external trade policy, but in some cases they use differimport quotas. Common competition policy is also helpful to avoid competition deficiency.” https://www.bing.com/search?q=customs+union&pc=MOZI&form=MOZSBR Which dominates tariffs or import quotas on any given agreement and time frame?

But none of you have defined these restrictions in your discussion. Everywhere I look I see exceptions to the comments/commenters here and even Viner’s strict defintion.

.

For the trained economists who commented, you have yet to explain the how “trade diversion” is calculated differently between theoretical and empirical usage.

International trade helps create a more dynamic U.S. economy, which is the envy of the world. Even when the top 1% benefits, the other 99% in aggregate benefits.

Although, most of the corporate tax cut went to share buybacks and dividends (which also benefit 401(k)s, IRAs, pension funds, etc.), some will go to new and improved capital spending, raises, and bonuses.

“…first-quarter capital expenditures total $159 billion, up more than 21 percent from a year ago…”

https://www.google.com/amp/s/mobile.reuters.com/article/amp/idUSKCN1II2WO

I see you did not understand this post either so you just babble on.

Equity is secondary to maximizing the national good.

“The inherent vice of capitalism is the unequal sharing of blessings. The inherent virtue of socialism is the equal sharing of miseries.” — Winston Churchill

Of course, richer countries can afford higher standards, e.g. safety standards or wage standards (if a business can’t afford the higher standard, it shouldn’t be in business — other more efficient businesses can take over and expand — of course, most or almost all businesses must be able to absorb the higher standard).

Many businesses are poorly managed, e.g. believing paying the lowest price for labor is the best deal, like buying the cheapest rope for a window washer on the 90th floor 🙂

“Equity is secondary to maximizing the national good.”

We have a new winner for the dumbest statement ever made on an economist blog. There is an entire literature on why such an absurd statement is beyond stoooopid. One has to wonder how one person can write so many dumb things. PeakyBoo is one of a kind!

Are there two very different people posing as PeakStupidity. One wrote equity is secondary and other wrote:

“t’s amazing there are still so many jobs paying only around $11 an hour, e.g. in food service, warehouse, retail, landscaping, delivery using your own car, etc.. And, I hear Uber drivers don’t make much.”

WTF? One pretends he is concerned with the little guy while the other basically tells the little guy go F***yourself.

Of course Trump echoes the last fool he talked to – so why not Peaky?

Hey Menzie,

Given I brought up this ‘leftwing’ policy I think I should get raise!

Trade diversion/creation is a pretty basic point from international economics as we call it down under

Not Trampis, yes, you were the culprit who brought up trade diversion up, not withstanding pgl’s attempt at moving it to me.

You could not be the one who introduced “trade diversion”. That is self evident since you have ot clue what the term even means. BTW – I loved your latest reply to Menzie. You must be some tax attorney as you sure do go on and on over nothing like they tend to do.

Pgl, after this long discussion and reading your own references, it is you folks who are confused over the how “trade diversion” is used in REAL LIFE situations versus class room teachings (empirical Vs theoretical). Each of you claimed I was wrong using non-tariff driven effects for “trade diversion, yet you all did the same thing in examples or references used your complaints of my own non-tariff comment. You perhaps were the more egregious since your reference actually supported my position over yours.

I do appreciate your CMagee reference though. It was enlightening in showing this (empirical Vs theoretical) difference. Just one example from it was:

“The empirical literature often describes any decline in trade with countries outside a regional trading area as trade diversion, but it is clear from the quotation in Viner that a decline in extra-bloc trade measured by equation (7) must be accompanied by a rise in intra-bloc imports to be accurately described as trade diversion.” CMagee also had a plethora of study references to support his/my contentions.

To understand my “sigh, another hypothetical” comment you must have read using Cmagee, because it is here the weakness(es) of the various models used to estimate “trade diversion” are discussed: “Because of data limitations, most studies do not attempt to measure the welfare effects of regional agreements, but instead take the first step down that path by estimating the impacts of the agreements on trade flows. Existing studies estimate changes in trade patterns due to regionalism in two distinct ways. Ex post studies examine trade flows after the RTA has been implemented and compare the actual levels of trade with a prediction of trade in the absence of the RTA. Ex ante studies use trade patterns and

estimated elasticities or computable general equilibrium models prior to the agreement to calculate the predicted effect of eliminating trade barriers with a partner country.”

And these studies/models are only as good as the assumptions of the modeler.

” The effects of the agreement on trade are then measured by RTA dummy variables….

The empirical literature often describes any decline in trade with countries outside a regional trading area as trade diversion, but it is clear from the quotation in Viner that a decline in extra-bloc trade measured by equation (7) must be accompanied by a rise in intra-bloc imports to be accurately described as trade diversion. ”

So from your CMagee reference we can see that we all were talking about “trade diversion” due to TRADE BARRIERS and not Viner’s original interpretation/definition. We all in our examples were clearly never used “trade diversion” due to tariff changes, as you Menzie insisted was the “one true definition”.

I doubt any of us were wrong in our comments, since the modern use of “trade diversion” uses a more expansive definition than Viner. But your insistence that the “one true definition” was the only acceptable use was hypocritical, as we all used other definitions in our examples.

You read what Viner wrote? Give me a break. BTW – those of us who are trained in economics can take a theoretical model and apply it to real world situations without getting one’s panties in a bunch over irrelevant word smithing? Your forte? Having your panties in a bunch 24/7.

Pgl,, it was you folks doing the word smithing. It was “your insistence that the “one true definition” was the only acceptable use was hypocritical, as we all used other definitions in our examples.”

Unknowingly you just made my point: “those of us who are trained in economics can take a theoretical model and apply it to real world situations …”. Exactly so with all of us who presented examples.

Clearly, your point was to try to ridicule a conservative, and yet have miserable failed.

Viner’s 1950 The Customs Union Issue is noted here:

https://global.oup.com/academic/product/the-customs-union-issue-9780199756124?cc=us&lang=en&#

Cover

The Customs Union Issue

Jacob Viner and Edited by Paul Oslington

Description

Jacob Viner’s The Customs Union Issue was originally published in 1950 by the Carnegie Endowment for International Peace. It set the framework for the contemporary debate over the benefits or otherwise of preferential trading agreements such as the European Union, NAFTA, and APEC. Viner developed the concepts of trade creation and diversion in this work as he pioneered the analysis of the global politics of trade agreements. This revival of Viner’s classic work includes an introduction that places this book in the context of his own intellectual development and the economic and political situation of the post-WWII world. The introduction also traces the reception of Viner’s work and discusses its continuing relevance for international economists, political scientists, and historians.

Many thanks for baffling for this:

” there are very few illegal immigrants replacing low skilled us citizens in the job place. and don’t reply with your usual anecdotal “evidence” where you sight one sob story and extend it to the entire argument. ”

He was rebutting the usual intellectual garbage from PeakPathetic. But we should remember why PeakPathetic has his sob stories. It seems most of California’s immigrants have chosen to move to his neighborhood making PeakPathetic all uncomfortable being the only white person for miles around!

California’s low-wage workers earn less than in 1979, study shows

https://www.google.com/amp/www.latimes.com/business/la-fi-0501-low-wage-workers-20150501-story.html%3foutputType=amp

Peaky the left winger cites the work of Annette Bernhardt

http://laborcenter.berkeley.edu/author/annette-bernhardt/

“A leading scholar of low-wage work, Dr. Bernhardt has helped develop and analyze innovative policy responses to economic restructuring in the United States. She was one of the principal investigators of the landmark study Broken Laws, Unprotected Workers, which documented high rates of minimum wage, overtime, and other workplace violations in the low- wage labor market. She has also been a leader in collaborating with immigrant worker centers and unions to develop innovative models of community-based research. Her current research focuses on domestic outsourcing, the gig economy, and the impact of new technologies on low- wage work. Dr. Bernhardt’s most recent book is the co-edited The Gloves-Off Economy: Workplace Standards at the Bottom of America’s Labor Market.”

Her enlightened views of these issues are 180 degrees apart from the right wing babble we get from PeakStupidity. I do believe there are two very different PeakTraders here!