Two points from the 2018Q2 2nd release: GDO is smoother, and a breakout has not yet appeared.

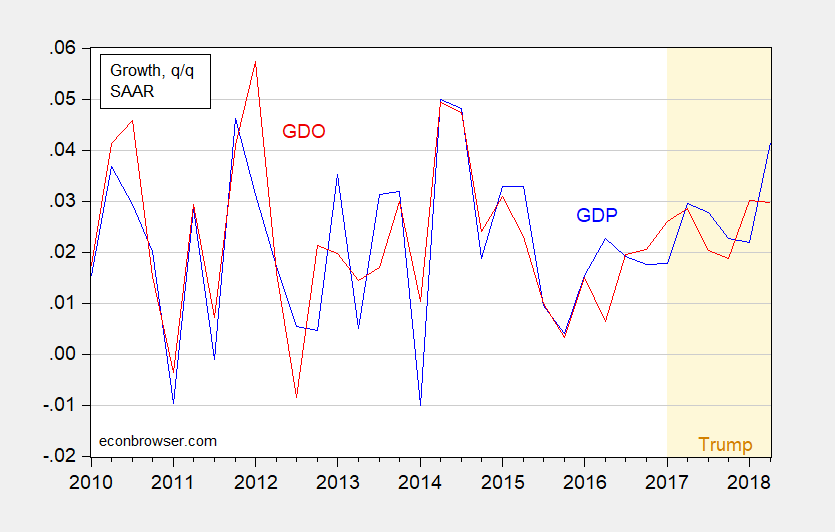

First, consider real GDP and real GDO (average of GDP and GDI) growth, q/q SAAR.

Figure 1: Real GDP growth (blue), and real GDO growth (red), both q/q SAAR, in log terms. Light orange shading denotes Trump administration. Source: BEA, 2018Q2 2nd release, and author’s calculations.

While the quarter-on-quarter GDP growth is high, it’s not unparallelled (see discussion in this post). In addition, GDO, which has shown itself to be a better predictor of revised values of GDP, indicates less rapid growth (see Justin Fox’s article today).

Second, returning to GDP, is there evidence of a breakout in growth? Consider recursive one-step-ahead regression residuals. OLS regressions

Δyt = const

are estimated recursively (i.e., the sample is progressively augmented after a starting sample) over the Great Moderation period, 1986-2018, and a test applied to see if the residual from the one-step-ahead forecast looks like it comes from a different distribution (the null hypothesis is same distribution).

Figure 2: Recursive one-step-ahead residuals (blue, right scale). P-values (blue circles, left scale). Light orange shading denotes Trump administration. Source: BEA, 2018Q2 2nd release, and author’s calculations.

As indicated in the graph, no break occurs after the Great Recession. These results are robust to another specification (ARIMA(1,1,0)), except a structural break is found in early 2014 (at the 10% msl).

I will say I won’t be surprised to see breaks in the future, particularly with volatility in the net export series likely due to both trade measures and the accounting effects of the TCJA.

For Moses Herzog: Since you’ve expressed an interest in R, Menzie’s post might be a good opportunity to highlight an R package with various tests for stability and structural change:

https://cran.r-project.org/web/packages/strucchange/vignettes/strucchange-intro.pdf

Dear 2,

Thank you for this reference. You might also want to see

https://editorialexpress.com/cgi-bin/conference/download.cgi?db_name=IAAE2014&paper_id=215

for a relatively simple introduction to what people are doing with OxMetrics.

J.

I always like these old econometric lessons Menzie. Reminds me of my first year at Uni.

We down under have three measures of GDP, income . Expenditure, Income and Production. I hope you yanks catch up!!

Professor Chinn,

Given the relationship between GDI and GDP is there some forecasting advantage to forecast GDP? Subject to your correction, it seems that the two data series are cointegrated from the testing I did.

AS: Not sure, seems most evidence pertains to what the GDP revisions iterate to; see here, and references contained therein.

Part of the problem is that the information available in GDP and GDI depend on which release you’re looking at, and in general, just using the latest release of each one doesn’t appear to be efficient.

For anyone who really wants to nerd-out on this, there’s a recent paper that works out multivariate, multi-release state-space models for this problem.

(See http://svannorden.org/wp-content/uploads/2018/08/JBES-Submission-August-2018.pdf)