Following up on Jim’s post on the GDP release, here are four observations.

- GDP Growth Is Good, but Not Spectacular, Either on q/q or y/y basis

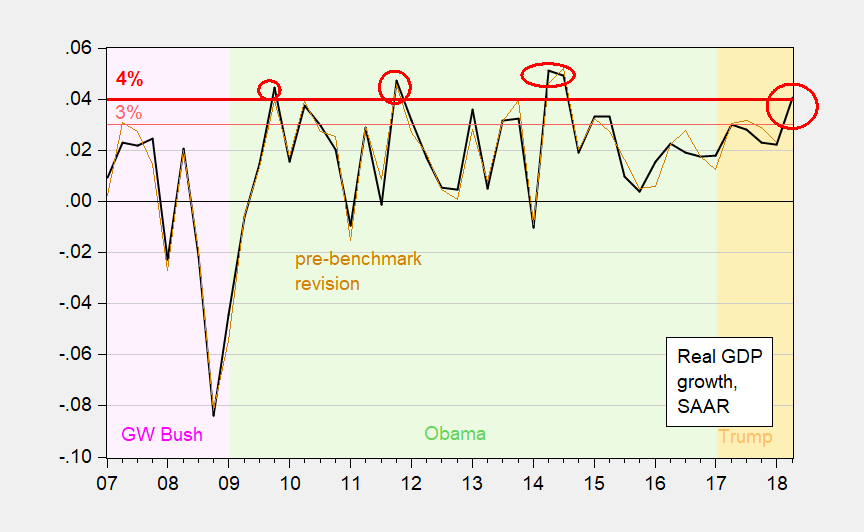

Over the past 11-1/2 years, there have been several instances of q/q growth exceeding 4%, and many exceeding 3%, including during the Obama years.

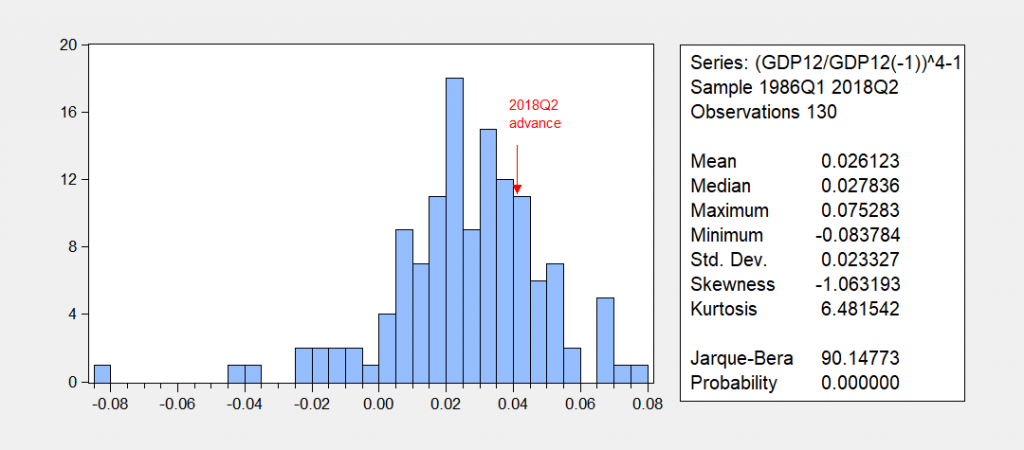

Figure 1: Quarter on quarter annualized GDP growth, from pre-annual revision (brown), and from 2018Q2 advance release (bold black). Horizontal red line at 3% growth, horizontal bold red line at 4%. Instance of growth in excess of 4% using latest series circled red. GW Bush administration shaded light pink, Obama light green, Trump light orange. Source: BEA.Indeed, over the Great Moderation (1986 onward), we’ve seen many instances of over 4% q/q growth, as shown in the below histogram.

Figure 2: Histogram of annualized quarter-on-quarter GDP growth, 1986-2018Q2. Red arrow at advance estimate of 2018Q2 q/q growth rate. Source: BEA, author’s calculations.

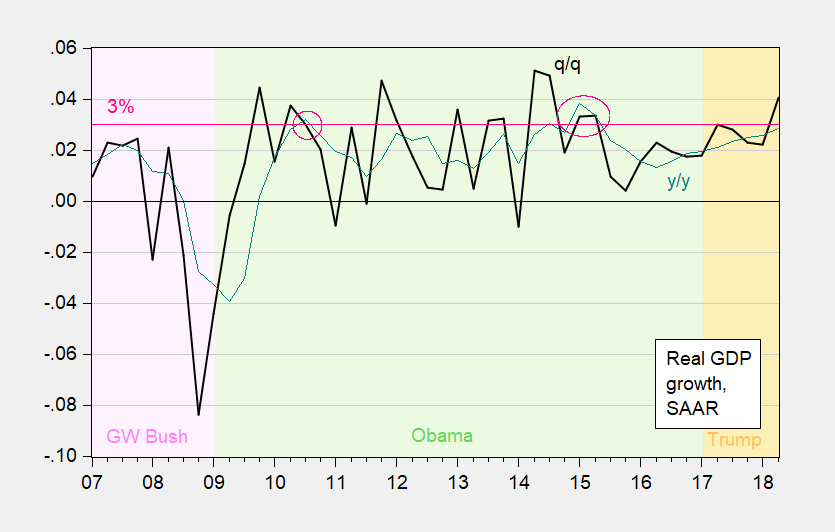

On a year-on-year basis, there were several instances of growth exceeding 3% over the past decade-plus, including during the Obama years.

Figure 3: Year-on-year growth rate of quarterly GDP (teal), and quarter-on-quarter annualized growth rate (bold black). Horizontal red line at 3% year-on-year growth. Instance of growth in excess of 3% using latest series circled red. GW Bush administration shaded light pink, Obama light green, Trump light orange. Source: BEA.Note that even with this growth surge in 2018Q2, growth under Trump has not yet breached 3% on a quarterly y/y basis…

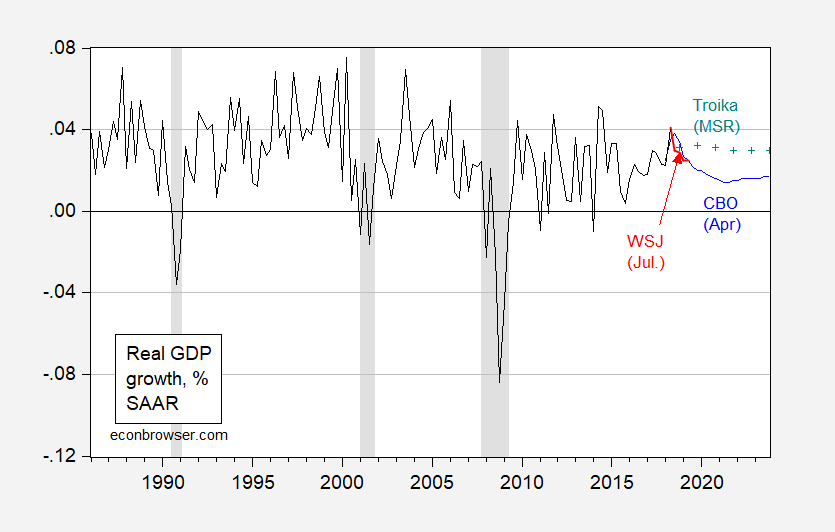

- Mnuchin’s 3% Growth over Years Is Daring (For the Nondelusional)

The Mnuchin prediction of growth in excess of 3% for several years is actually in the Administration’s forecast. One can see how much of a divergence there is between the Troika (CEA-OMB-Treasury) and CBO (April) projections in the figure below.

Figure 4: Real GDP q/q annualized growth (black), Wall Street Journal July 2018 survey mean forecast (red), Administration projection of q4/q4 growth (teal +) and CBO (blue). NBER defined recession dates shaded gray. Source: BEA, WSJ, OMB, Table 2, CBO, NBER, and author’s calculations.The Administration scenario was dubious when I last looked at in April. It still is.

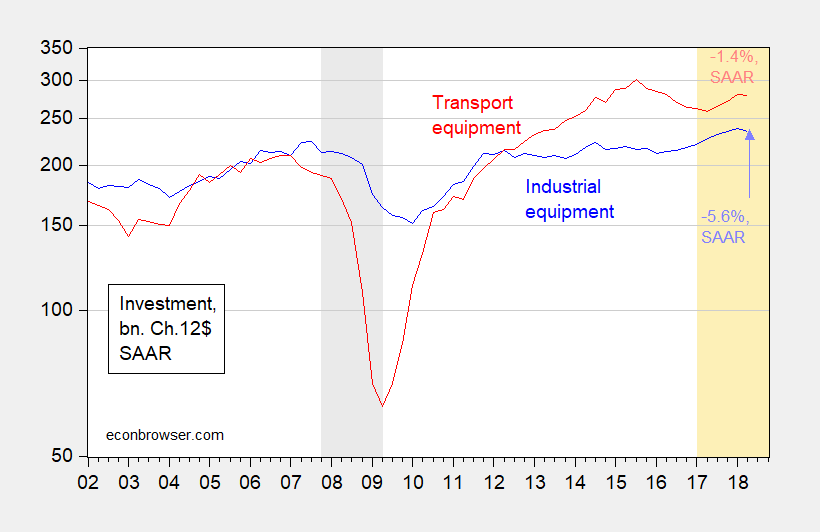

- Industrial Equipment and Transportation Equipment Investment Are Down

Total fixed investment is up, as is total nonresidential investment. So too are computer and information technology investment. One could worry a little if one thought the housing sector were a leading indicator (à la Leamer), since residential investment is down.

However, if one were to look at where one might think investment related to the tradables sector (e.g., manufacturing) were to be showing effects from trade policy uncertainties, one might think of industrial and transportation equipment. Both are down, but the former more profoundly: 5.6% q/q at an annualized rate.

Figure 5: Investment in industrial equipment (blue) and transportation equipment, in billions Ch.2012$, SAAR, on log scale. Source: BEA 2018Q2 advance release, Table 1.5.6, expanded detail.To the extent that investment is a forward looking indicator, and susceptible to economic and policy uncertainty, this series does not augur well for the sustainability of the growth spurt.

- Beware Extrapolation: How Did Things Look on the Eve of the Financial Crisis?

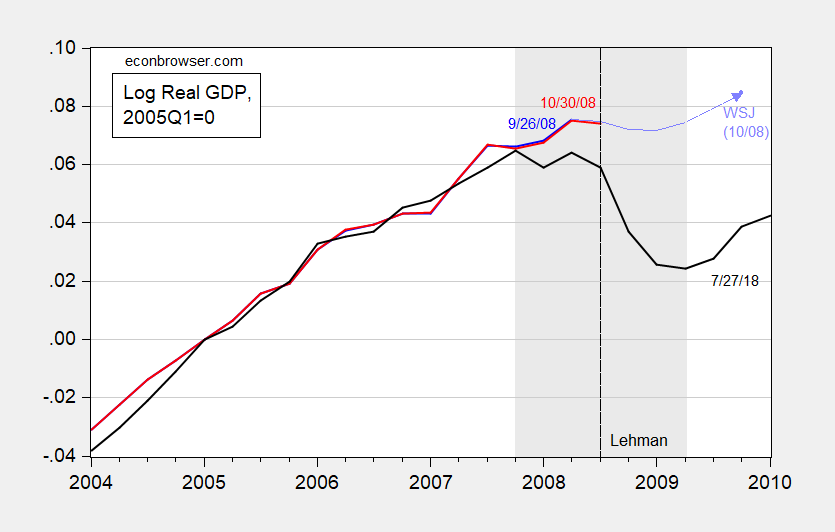

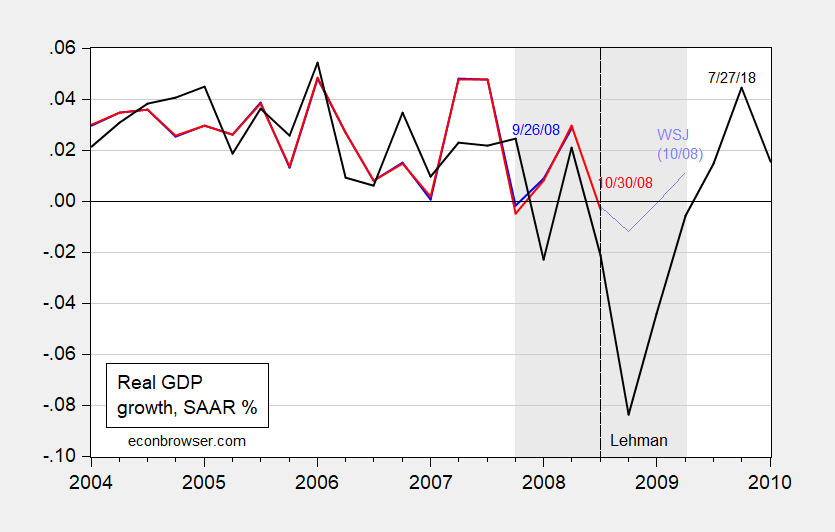

It’s important to remember that measurement of an economy as complex as that of the United States is challenging. There is a continuous stream of incoming data which eventuates — sometimes substantial — revisions. For instance, as of September 26, 2008, 2nd quarter GDP q/q growth had recorded a respectable 2.8% annualized rate. Even after the Lehman collapse, the October WSJ forecast for Q4 q/q growth was -1.2%. As of October 30, 2008 the 3rd quarter growth advance estimate was for -0.2% annualized growth rate. In the end (as of the last annual revision), 3rd quarter growth was -2.1%.

Figure 5: Log real GDP as of 9/26/2008 (blue), as of 10/30/2008 (red), as of 7/27/2018 (black bold), and WSJ Oct 2008 survey mean forecast (light blue), all normalized to 2005Q1=0. NBER defined recession dates shaded gray. Source: BEA, various vintages, WSJ October 2008 survey, NBER, and author’s calculations.

Figure 6: Quarter-on-quarter real GDP as of 9/26/2008 (blue), as of 10/30/2008 (red), as of 7/27/2018 (black bold), and WSJ Oct 2008 survey mean forecast (light blue). NBER defined recession dates shaded gray. Source: BEA, various vintages, WSJ October 2008 survey, NBER, and author’s calculations.

None of the foregoing should be construed as asserting that we are currently in a recession; rather one can creep up much faster than one might think, particularly with the term spreads (10yr-3mo, 10yr-2yr) shrinking. So, rejoice today, for for tomorrow… who knows.

I don’t believe that 4% number for GDP. And I am one to usually trust “the experts”. Overall I tend to believe the official numbers. I would guess it’s more like 2%. You might say “Moses, did you just pull hat number out of your A__ ??”. Uhm yeah, I did, but I think the real number is closer to 2% than 4%. Now for trump, if he can sustain that 2%, that’s still enough to win in 2020. I have held strongly to the belief that there are enough illiterate fools out there (the roughly 35%–40% of Americans who will vote for trump no matter what)—-that if trump just keeps GDP at or above 1.5% over his term, he wins 2020.

This is coming from a Democrat, and it’s also coming from someone who would nearly rather see negative economic numbers, than another 4 years of trump.

Moses Herzog I don’t think we want to go all “shadowstats” on the GDP numbers. The GDP numbers may well be revised, but I don’t think there’s any reason to believe that the good folks at BEA aren’t providing their best good-faith effort. A long, long time ago there was a geezer called “Ricardo” who used to peddle that shadowstats crap. Haven’t heard from him in years. Maybe he went to that great blogosphere in the sky. Who knows.

2slugbaits: Ricardo/RicardoZ/DickF/Dick does seem to have disappeared, as does Patrick R. Sullivan (who famously claimed that the Canadian Great Depression was deeper than the US Great Depression), Rich Berger, Buzzcut and tj. Rick Stryker on the other hand has only been absent for about four months.

@2slugbaits and @ Professor Chinn

I’m relatively open to criticism from either one of you, I have so much as admitted I am on thin ice (empirically speaking) saying I believe the GDP is closer to 2% than 4.1%. But I have a right to my opinions. And I strongly believe that it is closer to say 2.5% in reality than 4.1%. I have seen respected economists such as Krugman use “napkin jottings” and common sense proclamations before.

Now I am happy, again to take criticism from Menzie (as well as being told I’m flat out wrong, when I am). Your argument(s) are valid arguments. However if either one of you could prove to me, maybe 9 months from now, that that number is in reality over 4%, I think you will be hard-pressed.

Also, I would like to say, I have admitted to being wrong on this site before, more than once, and not gone running off “into the oblivion”. Which, not many commenters here or who have left this blog seem to able to do. That includes BOTH our “usual suspects” AND I assume those putting themselves into the “econometrics camp”.

@Menzie

I don’t mean to sound petty, as I am often want and inclined to be, but you are welcome to bookmark that comment and give me the “CoRev/EdHanson Treatment”. That being said, I don’t desire it, and feel that treatment is months off in the making if you want to bash me with the real numbers.

Be gentle, I’m a sensitive soul.

Moses Herzog It may well turn out that the revised number is closer to 2% than 4.1%. And I’m perfectly open to econometric concerns that someone might have regarding BEA’s estimate. For example, it’s possible that they made a yugely big mistake in the new seasonal weighting. So I want to distinguish skepticism over BEA’s estimate that’s based on econometric reasons versus skepticism that’s based on one’s gut belief. Sometimes gut beliefs turn out to be right, but you can’t engage in rational discourse over gut feelings. That’s my beef with a lot of the junk we get from CoRev and Ed Hanson and PeakTrader. OTOH, I seldom agreed with Rick Stryker, but he at least offered rational arguments as opposed to gut feelings or instinct. When a blog descends into a platform for expressing gut feelings, that’s when a blog turns into zerohedge.com.

2slugbaits, I’ve often proven your economic assumptions wrong and you never proven me wrong.

It’s most of your comments that are “gut feelings,” or based on partial equilibrium models at best.

However, I’m not surprised you making another ridiculous comment, since you obviously live in a politically biased bubble.

actually peak, you have never proven 2slugs wrong on anything. 2slugs has a firm grasp of economics. you on the other hand, with your jr phd, know enough to be dangerous but not enough to be well spoken. if you were to stay quiet and listen to 2slugs and menzie, you may actually learn something about economics.

Baffling, no one really believes your fairy tales.

You call others political hacks.

Yet, you’re the biggest political hack here and there’s lots of intense competition!

You have no credibility. And, you always sound like an ex-government bureaucrat still pouting over the loss of your meaningless job, and blaming Republicans.

No worries about those absent trolls as we will always have PeakNonsense with his latest:

“2slugbaits, I’ve often proven your economic assumptions wrong and you never proven me wrong.”

Of course we do not have to prove he is wrong as it is a given that he’s gets everything wrong on purpose.

peak, i never lost a job and am not a government bureaucrat. try again. however, you are a failed banker who lost his job in the financial crisis which you created, and continue to this day to try and blame others for the abhorrent behavior of financial types like yourself. you tagged along with your wealthy mommy to this country, but now want to impose restrictions on others who would like to immigrate to this great nation and contribute something positive. i know you are an old grumpy man, but its still not too late to learn from menzie and 2slugs on this blog (and jim when he posts). grumpy, old and lonely is not a good way to waste away the twilight of ones life, peak.

Moses Herzog: A delayed response, because this is a very difficult question to answer. You would have to answer a series of difficult questions in order to come up with an appropriate response.

1. What is “the true” level of GDP (off of which to calculate the q/q growth rate)? Is it the 3rd release number? Is it the annual revision number? Is it the once a decade revision number?

2. Depending on the quarter examined, and when, one will have a mix of annual-revision and non annual-revision numbers, since annual-revision numbers are only announced in the July release. And one of the non-annual revision numbers will be advance, 2nd and 3rd release figures, others might be 3rd release numbers. How does one handle that in the weighting scheme?

3. Hence, I don’t have a good answer to your question. If all the revisions averaged out to zero, I think current practice would be to do some sort of Bayesian averaging.

That’s about the extent of my thought.

By the way, I agree, throwing up one’s hands and saying “gotta wait six or seven years” is just an excuse to pooh-pooh the data. Excepting recession periods, we do have some idea of the gradient from the advance through 3rd release.

@Menzie and @2slugbaits

I guess the 3rd revision would be the fair time of criticism of what I had stated. The 3rd revision with some kind of SAAR applied, yeah?? That seems like the fair number to say “OK, Moses, admit you were wrong.” With a “touchback” on the issue on the “annual revision number”. The decade revision I don’t give a sh*t because if you have to wait 10 years to settle a debate it’s had all the fun zapped out of it.

Although (and I know this sounds like hedging) it’s hard to believe if the 4.1% number is wrong, that whatever BEA had originally done wrong would be corrected inside of a 2 month time frame. I just don’t see how anyone in their right mind can believe that 4.1% number, I really don’t. I’m willing to swallow my medicine on the 3rd revision SAAR number though, whatever that ends up being—that’s a fair “arbiter”.

rick stryker has been absent since menzie “outed” him. now i do not believe menzie would have actually called him out by name, but rick was shaken by the fact menzie does know who he is. and the silence we have heard from rick since then indicates that rick knows the propaganda he spewed on this site would not be popular with his friends, family and coworkers. apparently rick did not believe in his propaganda as much as he promoted it on this blog. he was not a shock jock in real life.

I know how Alan Dershowitz feels being criticized by a bunch of wacko Jeffery Toobins.

Then, Baffling comes along and presents total fantasies.

peak, you care to try and cite what is inaccurate about my description of rick?

And let’s not forget Jim Hamilton.

My comment from the previous post by James Hamilton:

https://econbrowser.com/archives/2018/07/thinking-about-macro-data-and-revisions-and-recessions-a-cautionary-tale

We might have to wait 5 or 6 years before we can be sure: https://www.nytimes.com/2018/07/27/business/economy/revised-gdp-report.html

For example, companies appear to have invested $110 billion more in 2012 than previously thought, largely because the statisticians more or less missed some huge corporate spending on cloud computing technology. The revisions employed improved measures of I.T. investments, and voilà.

UPDATE ON PUERTO RICO from PBS NewsHour. This is about 7 minutes long

https://www.youtube.com/watch?v=aZ6jm1pn-xQ

good article Menzie, goo d to see the SAAR Y/Y instead of this yankee annualised nonsense.

I thought there was one or two one-offs in these figures which boosted this quarters rate. The proposed Chinese tariffs for example. This should mean the next quarter will be a tad weaker

If so you should add number 5

I would add a 5th comment. Don’t count the soybean exports before they hatch!

pgl: Yes, that’s coming in the next post. Brad Setser estimates 0.5 ppts increase in GDP from accelerated soybean exports. I don’t know if he controlled for the big drop in farm inventories.

Speaking of farm inventories, there’s starting to be some concern about the corn crop. Visually the crop looked great, but the hot June weather in corn country accelerated growth. Yesterday I heard that the Midwest corn crop was 81% silked out, which is well ahead of the 5 year average of 62% at this point in the crop season. That could be bad news because corn that silks out too early usually means smaller yields per acre. A few weeks ago they were talking about a record corn harvest. Now the thinking is that average yields won’t break 177 bushels per acre in corn country.

Gold: Well, if you talk to some of the people, the agronomists, they’re saying that this rapid maturation of the crop isn’t good for yield. And we’ve certainly seen as we had the early pollination in a lot of parts in Iowa we’re seeing a lot of tip back, we’re seeing that the heat and the dryness that occurred during that unusual pollination period is doing some damage. Now, we always have problems with the crop in difference places. Is it enough to really shrink the yields nationally? The rest of the country is in pretty good shape. We’ve had drought in Kansas, Nebraska, they’ve gotten some rains and are going to get some more over the weekend it looks like. But the vast majority of the country we’re looking at still pretty decent yields as evidenced by the crop ratings. But again, the crop ratings don’t necessarily unfold into yield results.

Howell: Exactly. With that being said, what do you think the market is pricing into this date for a national yield average?

Gold: I would guess 177. I’m a little under that.

Howell: Probably not a record year?

Gold: I find that hard to believe with some of the conditions we’ve had out there.

http://www.iptv.org/mtom/story/31106/market-analysis-mark-gold

Speaking of inventories – what ever happened to the CoRev thesis? Oh wait – he had multiple thesis on the role of inventories and soybean prices which were mutually inconsistent.

Pgl, I’ll just refer to the WaPo article confirming most oF what I have said: https://www.washingtonpost.com/business/economy/soybean-farmers-are-surviving-trumps-trade-war–even-without-his-12-billion-aid-package/2018/07/30/c3340bb6-91bb-11e8-8322-b5482bf5e0f5_story.html?utm_term=.2c49a2b49bc8

The farmers are surviving? Is that all you said? Gee CoRev – what a BOLD prediction!

only half of crop has been sold in futures market, according to the article

“Soybean growers have been cushioned by the widespread use of forward contracts that allowed many to lock in high prices last spring, and analysts predict they will be buoyed at harvest by strong global demand for soybeans.”

This statement clearly does not mean what CoRev thinks it means. Menzie never said future prices set well before the trade wars were announced were down. What Menzie kept documenting was the drop in future prices after the trade wars were announced. And CoRev kept dismissing what Menzie wrote even though the market evidence was right in front of him.

If CoRev thinks this backs up with he has been saying either (a) he has forgotten about all that incredibly stupid babble we had to endure from him; or (b) he has no clue what forward contracts are even about.

Lying Komrad pgl, now you are beginning to see what we have been telling y’all all along. I see you ignored the comment about storing until sales prices were up. And, you completely ignored that farmers had already in-hand contracts for later delivery, which mitigated their potential financial loss. But, this comment is what many of us expected from the first article: “…and analysts predict they will be buoyed at harvest by strong global demand for soybeans”. Understanding this made it easyfor many of us to dismiss what Menzie and especially what you and 2lugs wrote because of knowing the market.

Pgl, you have been wrong so many times in this series it is difficult to follow all your denials of the obvious truths we’ve presented. To say you are clueless would be an insult clues.

CoRev: Let’s say for the sake of argument 1/2 of the crop is hedged. Hedging is not costless, so cost incurred there. The other half is stored — unless the farm does not have the storage capacity. Storing is not costless, as it ties up capital (so opportunity cost is interest rate facing the farm), on top of crop degradation. Some farms will have to sell to cover the operating costs. The remaining will have to sell at the price at the end of the year. What will be the selling price then? If it is below what it could’ve sold for in let’s say May/June, then there’s a loss there. Well, as of right now, November futures (which are the best predictor of November prices) are at 910, while the price of soybeans (conforming to the CBOT specifications) was around 1050. That’ll be around at $1.40/bushel loss…

Menzie, I agree with everything you said with the exception of potential loss. I believe most farmers and Ag. schools calculate profit/loss from the from actual price received and the “break even” price to produce differences (discussed in earlier comment threads). Break even price can include all your discussed cost factors, or not, depending on the farmer’s practices and the farm’s condition.

Your example: “Well, as of right now, November futures (which are the best predictor of November prices) are at 910, while the price of soybeans (conforming to the CBOT specifications) was around 1050. That’ll be around at $1.40/bushel loss…” describes potential profit/loss for that 1/2 harvest not already contracted. For the remaining 1/2 harvest it is speculative depending on the variables you already defined, his yield, other disruptions (tariffs) effecting prices, any weather effecting world supply and demand, etc. All of these factors and even more effect the daily price moves. The key is the farmer won’t know until AFTER harvest, unless already contracted.

After harvest, other factors, crop insurance and any price subsidy can take precedence over sale price to determine a final profit/loss calculation.

CoRev Very simple example. Suppose a farmer has two acres, one that can produce 50 bushels and the other less productive acre that can produce 40 bushels. Supposed that the operating cost (i.e., seed, herbicide, fertilizer and fuel) works out to $399/acre. If at planting time the farmer expects a price of $10/acre, then he will plant in both acres, expecting to get $500 from the first acre and $400 from the second acre. The expected revenue would be $900 and the cost would be $798. So a tidy profit. If the farmer expects to only get $9/acre, then the farmer would only plant the first acre with an operating profit of $450 – $399 = $51. The farmer would not plant the second acre because the cost of planting the marginal acre ($399) exceeds the expected marginal return ($360). In this case the cost would still be $399 to plant the second acre, but the expected return would only be $360. If you asked the farmer why he didn’t plant the second acre, then he’d tell you that he’d being losing money…and he’d be right. With me so far?

Of course, the farmer doesn’t actually know what the final price would be. But if he goes ahead and plants both acres, then we can assume that it must be something above $399 acre / 40 bushels/acre = $9.975 per bushel. So let’s say the farmer expects $10/bushel. But then President Trump gets in a trade war with China in mid-July and the price drops to $9/bushel. How is that any different from the first case in which the farmer would not have planted the second acre if he had known with certainty that the price would only be $9/acre? It isn’t. The only difference is when the farmer knew the price would only be $9/acre. If he had known in advance, then he wouldn’t have planted the second acre because he would see it as a loss. In the second example the loss is no less real, the only difference is that by mid-July the planting decision is out of the farmer’s hands. It’s still a loss. In the first example anyone would admit that the farmer would lose money by planting the second acre, but for some reason you seem to think the farmer didn’t lose money in the second case. Your claim is that the farmer didn’t lose money in the second case because the net operating profit is still positive; i.e., he received (50 + 40) x $9 = $810 in revenue and the cost was $399 x 2 – $798 in costs.

As I tried to point out once before, your problem is that you keep thinking in terms of average costs and average returns rather than marginal costs and marginal returns. Farmers do not just reflexively plant fence row to fence row unless they believe at planting time that the marginal revenue from the marginally least productive acre will exceed the cost to plant that acre. A farmer than only looked at average costs and net operating costs won’t be a farmer very long. And all of this is before we even get into the problem with storage costs and carried interest, capital depreciation, etc.

2slugs has given corev 2 beatdowns inside of a weak. but the lovable loser is spunky, continuing to get up and take it on the chin again. appears to be the case of somebody who cannot have any sense beaten into him. the question becomes, do farmers think like 2slugs, economically, or are they more of the “common sense” variety of corev? unfortunately i fear for the economic literacy of many farmers…gut instinct economics is probably what is practiced by the individual farmers.

2slugs, you just took 3 paragraphs to say what I just said earlier. Some farmers may use marginal cost estimates, but the Ag. schools teach breakeven costs. Also yield is only one of the parameters to calculate costs. BTW, did you know that 40 & 50 bushels/acre were averages also? None of these examples matter except after harvest, when actual values can be used. Are YOU with me so FAR?

You have some timing issues with your example: “You seem to think that farmers don’t use tools, experience and logic to make pre-planting decisions what crops, how many acres, which acres, etc (examples of my farm conditions statement.). Your example: ” If at planting time the farmer expects a price of $10/acre (sic), then he will plant in both acres, expecting to get $500 from the first acre and $400 from the second acre.” You have forgotten the many other factors considered to make the pre-plant decisions.

Your 2nd timing issue is you are over emphasizing potential loss over potential gain: ” …the only difference is that by mid-July the planting decision is out of the farmer’s hands. It’s still a loss.” No, it’s a potential loss, unless he contracted for that price, and as you say, he will not be farming long.

His actual loss is what matters and is calculate after harvest and it is sold. If its not yet clear, the break even price can change with conditions. If you want to split more hairs by discussing those conditional break even conditions/costs we can, but they have been listed by Menzie, you and I, several times.

As I tried to point out once before, your problem is that you keep thinking in terms best practices in estimating, rather than calculating profit/loss statements using the real costs/returns data. Everything else is speculation.

On July 16, I wrote:

Nov. ’20 futures up 1.6% so far today. At 907, I’m a buyer.

That soybean contract closed above 950 today. +4.7% in two weeks.

It’s clear markets are adjusting, and I think they will continue to normalize.

By the way, most of the losses will have been incurred by the ‘speculators’, ie, those taking the long positions in the trades. It is likely that farmers will have absorbed some of it, but most will have affected financial intermediaries.

Also, there is not much to store at present. Harvest is in September.

CoRev Some farmers may use marginal cost estimates, but the Ag. schools teach breakeven costs.

Only Trump University. You obviously missed the point of my example. But it’s my own fault. I should have known better than to try and explain something to an old man.

None of these examples matter except after harvest, when actual values can be used.

Like I said, you completely missed the point. In the example, if the price at harvest went to $9/bushel, then the farmer lost money on the second acre. Nothing “potential” about it. It was a loss. And if the farmer had been certain that the price would have been $9/bushel, then he never would have planted that acre in the spring. Come harvest time the best that the farmer can do is try and make the best of a bad situation, but he would still lose money on the second acre at $9/bushel.

You have forgotten the many other factors considered to make the pre-plant decisions.

That’s because they aren’t relevant to the lesson. Ceteris paribus means the derivative of a constant is zero and falls out of the equation. Your tendency to throw in extraneous stuff is what I meant when I said that you always end up fogging the issue.

No, it’s a potential loss, unless he contracted for that price, and as you say, he will not be farming long.

No, in my example the second acre is an actual loss. The cost of the inputs exceeded the value of the revenue. The farmer might be able to mitigate some of the loss by storing grain or whatever, but those strategies are not costless. The farmer is essentially gambling that something will turn up and bail him out. And something might turn out, or it might not. But gambling and playing hunches is not an economic strategy.

I don’t think this analysis is right, Slugs.

We know that a large portion of soybean sales were accelerated into Q2 prior to the imposition of tariffs. In fact, this accounted for 0.6 pp of GDP growth, according to this source (scroll down): https://stevenrattner.com/2018/07/morning-joe-charts-the-trump-economy-is-no-miracle/

The question is whether farmers hedged the coming September crop at recent prices. If so, those losses would already be locked in, regardless of tariffs or no in the future.

Given the magnitude of the drop, some 20%, many farmers may have deferred hedging their crops, or hedged them early.

2slugs you are just BSing now. Your example was in your own words: “: ” …the only difference is that by mid-July the planting decision is out of the farmer’s hands. It’s still a lossYou still won’t accept you are wrong in that your timing is wrong. Unless the farmer accepted a by mid-July contract, he has not accrued any loss at all. Until harvest and/or he accepts a contracted price and delivery profit/loss can not be calculated only estimated as potential.

You arrogance is failing your logic again. I claimed AG. Schools taught how to calculate break even price and even gave examples in previous threads, OSU and IIRC Iowa. Your response: “Only Trump University” More BS.

Or this example of yours: “No, in my example the second acreis an actual loss. The cost of the inputs exceeded the value of the revenue….” Not in you mid-July time frame, because there has been ZERO revenue without a sales contract. It’s all speculative as is your example. Please note Steven Kopits comment about recent price changes in this thread. How many times must you be told you are wrong?

Not once did you use the term harvest. Only at harvest can yield be measured. Yields vary. Some very good years can see a 10% gain in yields even on the poorer acreage, and even higher yield on the better acreage. The inverse is regrettably also true, and the bane of farming.

You clearly do not understand the farming business. You really do need to get outside the economics texts to see how things really are done. Stop trying to BS your way. It’s not working.

Baffled please don’t embarrass yourself again by thinking 2slugs has even made a logical example.

corev, 2slugs is correct. you are either too stoooopid to understand what he is saying, or you continue to be the party of no and disavow his comments out of spite. either way you are still an idiot.

Baffled, I see even another comment string has gone beyond your ken. Can you add any value, ever?

Baffled, let me explain what 2slugs is saying in tax terms. He owns some stocks and is saying that he is claiming a loss on this stock for his 2018 taxes in mid-July because the current price is lower than when he bought it. Note: he has yet to sell it, taxes are not yet due, but just because the price is lower NOW he has a loss. You go right ahead and file your taxes on that logic.

corev, you completely missed the point of 2slugs example. idiot.

Baffled, please point out my error in simple English, so that I can be as smart as you and he. Please, please use your superior intellect to show my missed point. I’ll start by defining a key term: “financial loss – loss of money or decrease in financial value. nonpayment, nonremittal, default – loss resulting from failure of a debt to be paid. capital loss – the amount by which the purchase price of an asset exceeds the selling price; the loss is realized when the asset is sold.”

I’ll wait for your superior explanation using 2slug’s example and the definition defining the point I missed.

Of course without your superior explanation it will point out where the ignorance lies.

corev, a stock is not a physical commodity. i do not need to harvest and store a stock. i am not pressured to sell a stock due to it spoiling (lets not get into technicalities such as bankruptcies). i can hold off on “potential losses” with a stock almost forever. the same cannot be said for a spoiling ag commodity. this was not a good example on your part.

“the loss is realized when the asset is sold”

2slugs has been pointing out that it really is not important for the understanding of profit/loss when the sale price of the commodity is known (at harvest or sold on a futures contract). if the farmer has differential yield and productivity from his fields, then taking “average” values does not allow one to understand where profit and losses actually occurred. farmers need to work on productive fields, and not work money losing fields. this is why he notes marginal versus average values. a farmer who does not understand how to evaluate the marginal profit and loss probably does not stay in business for long. implicitly you understand and have agreed with this. but instinctively you are the party of no, and must react to anything coming from 2slugs as wrong. it is not. you cut off your nose to spite your face.

“He owns some stocks and is saying that he is claiming a loss on this stock for his 2018 taxes in mid-July because the current price is lower than when he bought it. Note: he has yet to sell it, taxes are not yet due, but just because the price is lower NOW he has a loss.”

i do not believe this is what he is saying. this appears to be your straw man.

baffled as I suspected you are clueless about the 2slug example and the Ag business. Your biggest mistake is: “2slugs has been pointing out that it really is not important for the understanding of profit/loss when the sale price of the commodity is known (at harvest or sold on a futures contract). ” That sales price is not known! The example never mentioned a contract transaction nor did it even reference harvest. Without a transaction (sale) there is no known price. Futures contract prices change continuously, so taking any futures contract price for his mid-July time frame tells us nothing unless he had said the Farmer had sold at that price. HE NEVER SAID THAT!

As I have been pointing out for weeks few farmers are selling into this market at these prices. Not their 2017 remaining crop nor their 2018 crop to be harvested is moving. Even the WaPo article said farmers had already hedged 1/2 the 2018 crop by selling at the higher Spring prices for later delivery. Which BTW is a fairly normal situation. Can you guess why only ~1/2 was hedged? Hint: can you predict harvest yield in mid-July, bust or boom? You must have thought it important as you noted: “only half of crop has been sold in futures market, according to the article”

You and 2slugs ranted on the use of averages, and yet that is all that 2slugs used in his examples, but to make it perfectly clear, HE NEVER SOLD ONE SOYBEAN IN HIS EXAMPLE SO NO PRICE COULD BE ESTABLISHED. He did use several assumptions that you never understood, and both of you gas lighted by using marginal costs.

But, of all your ignorant and stoopid comments this one take the cake for arrogance: “unfortunately i fear for the economic literacy of many farmers…gut instinct economics is probably what is practiced by the individual farmers.” The only ones showing gut instinct economics about profit or losswas you and 2slugs and doing it very poorly.

Here’s your too big hat filled with your A$$. It was just handed to you, the idiot of the month. Find a subject with which you have some knowledge. You clearly are ignorant as a rock on farming.

CoRev: If the farmer committed to sell beans on the futures market, say for delivery on July 13, she would’ve known her loss (or profit) as of say June 13th to the extent that costs through July 13th were known. Or am I missing something.

By the way, we require something called to “mark to market” for our financial institutions, so there is something like an expected loss or gain even before assets are sold or bought…

menzie, you are right. on july 13 the farmer knows the sale price. corev is simply the party of no. if i say the grass is green, he is going to argue about that as well. whether i know my sale price is $9/bushel on july 13, august 22 or december 30 is irrelevant. it is STILL a loss on that second field (plus carrying costs later in the year). not sure why corev continues to deny this? must be an idiot.

Menzie asks: “CoRev: If the farmer committed to sell beans on the futures market, say for delivery on July 13, she would’ve known her loss (or profit) as of say June 13th to the extent that costs through July 13th were known. Or am I missing something. ” That’s been my point with 2slugs example. Why the “if” hypothetical? It was never part of the example. He never made that final sale clear. OTH, that’s what has happened to ~1/2 the 2018 crop already, but the apparently the contracts were mostly earlier than June.

There were so many false or unwritten assumptions in 2slugs example it defied basic logic. If a farmer accepts a contract then they can calculate their profit/loss, and that’s been my point all along with 2slugs’ example. I didn’t have a problem with your earlier opportunity/potential cost example with the exception that the number of cost/return factors were incomplete. They still are. Neither of us can/will define them except for a very specific example.

I presume you know the primary reason why only ~1/2 the 2018 crop was hedged in the early growing season.

Menzie, I’m not sure how: “By the way, we require something called to “mark to market” for our financial institutions, so there is something like an expected loss or gain even before assets are sold or bought…” applies to 2slugs example.

Baffled, finally gets it! “whether i know my sale price is $9/bushel on july 13, august 22 or december 30 is irrelevant. it is STILL a loss on that second field (plus carrying costs later in the year).”

What he never realized that in 2slugs example that sale was never transacted. What was amazing about this whole dialog was my WaPo reference had said this: “Soybean growers have been cushioned by the widespread use of forward contracts that allowed many to lock in high prices last spring…” https://www.washingtonpost.com/business/economy/soybean-farmers-are-surviving-trumps-trade-war–even-without-his-12-billion-aid-package/2018/07/30/c3340bb6-91bb-11e8-8322-b5482bf5e0f5_story.html?utm_term=.2c49a2b49bc8

Baffled even commented on 1/2 the harvest already being contracted, while not understanding its importance

The importance of this WaPo article was it confirmed everything we had been telling these Trump haters wishing the worst on our farmers to assuage their hate. 2slugs, baffled and pgl BSed their way. Most just gas lighted, but none of the commenters accepted the article at face value. And, that’s the sad reality of these Trump;/American farmer haters.

We see you for what you are and it is ugly.

corev, 2slugs used the example of a transaction price of $9/bushel. his example illustrates it does not matter when the transaction occurs, its still a loss. you are doing nothing but complaining. what an idiot. hey corev, bet you didn’t know the grass was green.

apparently in corev’s world, when the bank calls to collect on the loan used by the farmer, he can tell the bank not to worry as he has not lost any money on the farming season. his crop is still sitting in storage, rotting away, but since he never transacted a sale of the crop, he has not taken any loss. the bank will be happy to hear this, and certainly allow the idiot to continue sitting on his rotting crop for years to come as long as he does not sell and take a loss. what an idiot!

Baffled, i know you think you are making a point, but you ARE NOT, and are just illustrating your anger and cluelessness. 2lugs’ example had the price at $9.00/Bu in Mid July. If you read Steven Kopits comment you’d get a feel for what has actually happened.

“Steven Kopits

August 1, 2018 at 2:19 pm

On July 16, I wrote:

Nov. ’20 futures up 1.6% so far today. At 907, I’m a buyer.

That soybean contract closed above 950 today. +4.7% in two weeks.

It’s clear markets are adjusting, and I think they will continue to normalize.

By the way, most of the losses will have been incurred by the ‘speculators’, ie, those taking the long positions in the trades. It is likely that farmers will have absorbed some of it, but most will have affected financial intermediaries.

Also, there is not much to store at present. Harvest is in September.”

Today’s price in well above 2slugs $9.00, and still few will be accepting $9.50/Bu unless they will at least break even.

For all your ranting, without a contract/sale there is no P&L the best that can be said is IF HE SOLD AT THAT $9.50 PRICE HE WOULD …, but repeating the obvious there still is no contract/sale. Not in 2slugs example and probably only a few in today’s market.

When you say: “corev, 2slugs used the example of a transaction price of $9/bushel. ” No, he did not say this: his example illustrates it does not matter when the transaction occurs…” So let’s say the farmer expects $10/bushel. But then President Trump gets in a trade war with China in mid-July and the price drops to $9/bushel.”

Only after being challenged as spouting BS did he even mention harvest and $9.00, but that was to recover from a poor example. At least he had the good sense to try to correct, even if too late.

You also claimed: ” his example illustrates it does not matter when the transaction occurs, its still a loss.” which is obviously wrong as Steven Kopits’ comment and the WaPo article illustrated. ~1/2 the crop has already been contracted well before harvest, it does matter when the transaction .

I fear for those who think the segment of the US population providing nearly all the food we consume are idiots. The idiots are those who disrespect the farmer. You’re an idiot.

i was wrong. corev is actually too stoooopid to learn the simple lesson provided by 2slugs. no wonder he is no longer employed. what an idiot.

Komrad Angry Lying pgl, no, it was that bastion of conservative politics, the Washington Post, that used that term. BTW, surviving? Is this what you meant: “to get along or remain healthy, happy, and unaffected in spite of some occurrence”?

Surviving is a whole lot better than you, baffled and 2slugs were hoping for our farmers, or claiming what was going on for them.

Hey CoRev – I managed to find a copy of this WaPo article getting past the fire wall and actually read it. It does not support your usual stupid rants. If you read it and understood what it really said – you would realize that. Then again you have no clue how forward markets work so yea – you are stupid enough to think it supports your stupid rants. It doesn’t. Now run along and learn a little economics for a change.

Komrad Angry Lying pgl, why all the misdirection? I guess you should school all of us on how a forward contract works other than setting a price for a future deliver date. The talking unicorn you are riding may help explain the nuances to those of us failing to reach your enlightened understanding of the Ag. business.

Now take your talking unicorn and run along to learn a little business for a change so that we can understand your meaningless pontifications.

There may be some holding back in the ninth year of the expansion.

Only three totally nonsensical comments so far? You are slipping. Rudi G is so outpacing you with absurdities on an hourly basis. Get to work!

Econometrics question: When calculating y/y or 4 qtr averages, is there a case to be made for a weighted average such that the more distant observations get a little more weight than the most current observation because those earlier observations are less prone to being revised? If we have less confidence (e.g., higher variability) in the initial GDP estimate, then maybe we shouldn’t put as much weight on that estimate when we compute a y/y or 4 qrt average.

2slugs, why add more uncertainty and an opportunity for more bias to an already uncertain estimate?

corev, 2slugs is proposing a way to reduce more uncertainty and bias by weighting values that are more certain.

CoRev I think the issue is whether or not weighting the more reliable estimates more and the least reliable estimate less would reduce overall uncertainty in the y/y or 4 qtr average estimates. Simple example. If the once revised GDP estimates have an average variance of only 10% from the final revised estimate, but the most recent quarter’s unrevised estimate typically has a 40% variance from the final revised estimate, then you might want to put less weight on that initial GDP estimate when computing the y/y or 4 qtr average. That’s implicitly what’s going on when economists caution us not to put too much emphasis on the unrevised initial GDP estimate. I’m just suggesting that we might want to make explicit and formal what we effectively regard as implicit.

unfortunately this is simply another example of the party of no. he does not care what you have to say, it simply must be wrong and questioned.

Baffled and 2slugs, I know what weighted averages are and how they are used, but you missed the 2nd term I used, bias. I just don’t think it is as simple as you are proposing. I can easily envision frequent adjustments of the weighting factors as the environment changes. Just another unneeded fudge factor for what is already an estimate.

a default equal weight factor is also a bias, and probably not an educated bias. 2slugs basically points out the issue of using an educated weight average, rather than using a blindly accepted equal weight distribution and accepting this as unbiased and useful. the argument 2slugs makes is that a 4 quarter old estimate is typically more accurate, so why would you not want to take advantage of that information? making it equal weight to the latest quarterly estimate is never going to improve your 4 quarter estimate. equal weight is most appealing to those who do not want complicated calculations-but do not seem to be interested in accurate calculations either.

Baffled, read and understand Spencer’s comment relative to your accuracy assumption. How many more adjustments will it take to an already highly adjusted series to add your accuracy to an ESTIMATE?

spencer’s comment does not change what 2slugs and i have been mentioning.

CoRev why add more uncertainty

How do you know that it would add more uncertainty? You’re assuming away the very thing that’s under question. What were my two first words at the beginning of this thread? “Econometrics question.” I don’t know whether downweighting the initial GDP estimate piece of the 4 qtr average would improve things or not. It’s an empirical question. I was proposing an undergraduate term paper project. Unlike Trump voters, some of us don’t pretend to know the answer to a question before actually studying the question.

It’s strange that you don’t seem to have any problems with using seasonally adjusted data as opposed to unadjusted data, but yet you got exercised about downweighting the least reliable estimate. Do you have any idea how BEA data is seasonally adjusted? Do you understand what goes on inside the X13 ARIMA model used by BEA? Or the TRAMO-SEATS model used by Eurostats? Any unobserved components model? Hint: there’s plenty of statistical manipulation going on.

2skugs, why the reaction to being questioned? Also why do you continue to ignore the bias issue? To answer your basic question: “How do you know that it would add more uncertainty?” actually I don’t know, but like you I can assume that adding even another adjustment variable is adding opportunities for messing up the original data. Never a good thing.

Why react, then make this statement: ” I don’t know whether downweighting the initial GDP estimate piece of the 4 qtr average would improve things or not. It’s an empirical question.”? BTW, that is a rhetorical question NOT requiring an answer.

“but like you I can assume that adding even another adjustment variable is adding opportunities for messing up the original data. Never a good thing.”

i think you need to reassess the quality of your “original data” to begin with. this is the whole point of the discussion. you are implicitly adding too much quality to the original data, applying a poor bias to begin with.

Baffled, uh huh. That’s why we have ongoing, scheduled adjustments. You now wnat to add another factor for inclusion in those adjustments. Go for it! Only you and 2slugs seem to care.

The primary way I use the q/q growth rate is to see if the y/y rate is accelerating or slowing.

Beyond that it is too volatile o hang ones future on.

Lazy type, spot checking things, wishing I had some G*ddamned alcohol to make the time click better. Checked the Atlanta Fed “GDP Now” thingameebopper. They have GDP going from 4.5% July 18 to 3.8% July 26. Now I have said before I think the Atlanta “GDP Now” number jumps around too much, and I trust some of the other GDP Now number more, but what I like about Atlanta site is their blog is more user friendly and they are more transparent in how they tabulate the number.

How are we to perceive a 0.7% drop in a two week frame?? I honestly have no idea, but if anyone wants to chirp in I’d be happy to listen.

Most current NY Fed Nowcast (usually updated Fridays) is 2.78%

I actually trust this number more than the Atlanta Fed “Now” number, but I kind of resent NYFR isn’t more transparent in the calculation. Which sounds contradictory, but the NYFR “Now” number doesn’t zig and zag around so much, so seems more reliable. I confess I check the Atlanta number more often, I think the blog presentation is better and it’s more friendly to readers.

Moses Herzog: I think a nice quick explainer of the differences between these two nowcasts provided by Jim in this post.

Thanks Menzie, it is a terrific archive post by Jim.

I had skimmed it once before but had forgot it was there so I appreciate the link/reminder. I guess the “best” thing to do is average the two?? Which would be 3.29%.

Now there may be some time differentials here, yes (between the BEA number and the Nowcasts, the time interval it is measuring)?? But it’s interesting to note, if you take the 2.5% I think the current GDP is closer to and the 4.1% that I think is a ridiculous number (by BEA and official number standards) you get 3.3% which is only .01% off of the two “Now” GDPs averaged out.

Admittedly, that’s as “back of the envelope” and as sloppy as it gets on my part—-But it gives some credence to the argument I am making that the real GDP number is closer to 2.5% than the BEA’s ridiculous (in my subjective opinion) number of 4.1%.

Menzie, do you see me arguing with BEA numbers often on here?? I think once I argued with the recession timing on the 2008 crisis, but even that I think I at least “walked back” if not admitted I was dead wrong when “rtd” pointed out I was looking at their graph wrong. Now, you now that is painful for me to recall from the memory banks—but I am saying that is the only time I questioned the BEA in this blog (or ever to my memory). I am sorry, the 4.1% number is ridiculous, and I am standing by that—subjective, objective—I am standing by that.

Wow, recalling I admitted I was wrong when corrected by “rtd”—-OF ALL PEOPLE. That was like drinking a milk shake composed 50% out of my own stomach bile.

It would be interesting if q2 is peak or not.

Benlu, if I had to guess, I would guess Q3 numbers will be slightly lower, but establishing a new plateau gong forward from Q2.

a new plateau? You sound like David I. Pankin- PC! Bankruptcy is a new beginning!

https://www.youtube.com/watch?v=SWNTrsrs2Nc

Not all government agencies are the same.

The U.S., e.g. the BEA and BLS, is the best in the world collecting and presenting data in the most accurate and timely manner.

BEA and BLS are trust worthy. But of course you will be saying otherwise when your master (Trump) wants to call them fake news. If reported growth for Q3 is less than 2%, this is exactly what he will command and you will comply.

Do you think the Duncan Leading Indicator is useful? It is thought to peak a few quarters in front of a recession. If you take durable goods consumption and investment divided by real final sales, it suggests continued growth ahead.

Neil: Honestly don’t know. Seems intuitive, but I’ve not seen any academic work comparing it to other leading indicators in terms of forcasting capabilities. Would want to know noise/signal ratios, false positives/false negatives, ROC as discussed in posts by Jim.

great article on this topic in general by Cecchetti and Schoenholtz. some people who comment should read it and digest it.

Enjoy

https://www.moneyandbanking.com/commentary/2018/7/29/gdp-one-size-no-longer-fits-all

Best in the world ??? Our ABS and Canada’s leaves your agencies for dead!!! you should get out more often

Canada’s economy is much smaller and poorer than the U.S. economy.

Also, less diversified and dynamic.

So, it should be much easier to quantify.

“Canada’s economy is much smaller and poorer than the U.S. economy.”

You write a lot of BS without any source. Let’s try FRED:

https://fred.stlouisfed.org/series/NYGDPPCAPKDCAN

Real per capita GDP in 2017 = US$51,316 is not much poorer than real per capita GDP in the U.S.

C’mon Peaky – either you lied again or you really are dumb. I know, I know – most people here realize that these are not mutually exclusive.

Pgl, you’re always defending other countries with lies.

You must hate the U.S..

Canada’s GDP per capita is over $10,000 a year less than the U.S.. Canadians live in much smaller houses, drive smaller cars, there are fewer shopping malls per capita, etc..

One advantage Canada has is their big cities are close to the U.S..

https://en.m.wikipedia.org/wiki/Lists_of_countries_by_GDP_per_capita

The only thing I’m is to report accurate information. Attack Canada if you wish but please make your brazen dishonesty less blatantly transparent.

Pgl, maybe, you’ll believe the Canadians:

https://www.conferenceboard.ca/hcp/Details/Economy/income-per-capita.aspx?AspxAutoDetectCookieSupport=1

I use FRED for data – you cite some bizarre site. But did you even check out your own cite?

“Canada’s income per capita grew in 2012, but at a modest pace of only 1.2 per cent.”

Modest perhaps but faster than US income per capita grew that year.

BTW – your own cite shows we are impoverished compared to those socialists in Norway!

Then again, Canada has a population of 35+Million, or 5million fewer residents than California. However, its economy isn’t too shabby, especially compared to your country. Canada’s GDP world rank is #10 and per capita GDP is far greater than that enjoyed by your fellow Russian citizens.

Canada even tops “booming” South Korea in economic output. So much for less diversification and dynamism.

Noneconomist, you don’t even know my country is the U.S.A.

You desperately need to go to a Trump rally 🙂

And, take Pgl with you.

The other Moscow! Northern Idaho! It figures. The skinheads are obviously ok with your allegiance to Vlad.

Notice how Peaky is totally incapable of citing a single shred of reliable evidence for his incessant BS. I did provide Canada’s real income (2010$) per capita. US$51.3 thousand is darn decent.

Peaky has a choice now – admit he lies about EVERYTHING or concede he is just incredibly stupid. But don’t hold your breath.

PeakTrader The Cecchetti and Schoenholtz article was about BEA’s seasonal adjustment model, known as X13 ARIMA. In case you didn’t know this, X13 ARIMA was developed by the Canadian statistical office. It’s a Canadian export to the US.

2slugbaits, that doesn’t seem entirely true:

https://support.sas.com/rnd/app/ets/procedures/ets_x13.html

Why is that relevant to my response?

PeakTrader The core of X13 comes from the Canadian X11. That’s the guts of the model. It’s relevant because you were replying to the statement by Not Trampis that the statistical agencies of other countries leaves the US in the dust.

2slugbaits, so, you believe that?

Do either of you know who SAS Analytics even is?

https://www.sas.com/en_us/company-information/profile.html

SAS has customers in 147 countries…Our software is installed at more than 83,000 business, government and university sites….Annual revenue in 2017 = $3.24 billion. 14,328 total employees with half in the U.S. Canada alone has 328 employees. Check out where the rest are employed.

BTW – the Canadian operations do R&D on behalf of the rest of the company so 2slug is likely right.

Once again PeakStupidity’s stubborn belief that all IP is created in the U.S. has embarrassed his poor mom for raising such an incredibly stupid son.

SAS has customers in 147 countries

Hey, I took a couple of SAS certification courses (Forecast Studio/Server https://www.sas.com/en_us/software/forecast-server.html and the SAS econometrics package https://www.sas.com/en_us/software/ets.html ) at their worldwide headquarters in Cary, NC. Beautiful 900 acre campus with a great atrium library and terrific cafeteria. SAS is in the research triangle, so they have teaching agreements with NC State, UNC and Duke. Good to learn unit root tests from David Dickey himself.

Pity, slugs, you were unable to attend Trump U. No problem to learn anything, especially where all that icky math (econometrics? Please!) is concerned.

You just make up stuff and say it’s true. And because you’re a Trump alumni (GO, you Magnates!), whatever you say must be correct.

Not Trampis: I have great respect for Cecchetti. That said, even more respect for my own expertise tempered by years in the trenches. The main flaw to their argument is that the leading edge of anything always contains the most valuable information to current decision-making. Be very sure of where you put your foot down next contains more wisdom than a score of academic papers. Their argument is academic-tinged, therefore less real-world based. There is no evidence I’m aware of that the errors, be what they may, are asymmetric. Of course there is always higher frequency data which should be and is used by the more perspicacious. And if GDP were not important on its own above and beyond higher frequency data, the NBER dating committee would not use it as one of a handful of metrics to date the business cycle.

So hey, maybe the final revision will come in at 5.1%. The policy changes of the past year surely still have momentum. MAGA, Mr. President!

The second flaw is that benchmark revisions with base year updates like this one have extraordinary informational content. Scientifically, I will set up this hypothesis: Consensus forecasters are pouring through this revision and from what they find more forecasters than not will raise their forecast for Q3 and immediately beyond. The proof or disproof will come soon via the WSJ consensus survey out mid-month.

The third flaw in C&S’s article is in not separating out the high volatility recession phase of the cycle from the low volatility expansion phase when analyzing past history. For certain, this Q2 is not part of a recession phase. The next recession is a long way off. Hence the general volatility or size of error – say the average difference between advance and final estimates which are the ones that really concern us – will be overstated by any study that does not recognize the differentiation in the cycle’s phases I make here.

There is much more, but I’ll cut short and summarize. Fixler et al on GDP revisions in January’s S of C Business state upfront: “… both the pattern and the magnitude of the revisions indicate that the early estimates are reliable.” This is a far cry from C&S’s unwarranted conclusion “that we should not put too much stock in early estimates of GDP.” Theirs is not a great article other than to illustrate how to not go about it.

Offhand I see no reason for a revision of this quarter’s report to go one way or the other. What seems to have been missed in much of this commentary is that the biggest driver of the report was a strong growth of consumption, with the saving rate falling. That may continue for another quarter or two, but obviously there are limits to that. All the huffing about soybeans, well, it does seem clear that last quarter’s surge in exports was approximately offset by a decline in inventories (although maybe Setser disagrees). But that suggests we sshall see a flip of both this quarter, soybean exports down and inventories up, again leading to roughly a wasn.

The not widely noted matter in Menzie’s post is the question of real growth. The thing creeping up is the rate of inflation, with the increase in prices due to tariffs largely yet to hit. Dean Baker has just posted on Trump bragging about the 2.8% increase in wages, highest year on year since 2008. The problem is inflation was at 2.9%, which means real wages actually down slightly. Ooooops!

Barkley Rosser, a virtuous cycle of consumption-employment will eventually raise wages.

There remains too much slack in the economy, because after nine years of expanding, we haven’t closed the output gap!

Bark

Good analysis of the statistics, economically you pass, politically you fail. That is because those who vote on economic terms look at there own prospects and those close to them. They do not care about national statistics, but rate their own rise in wage and, perhaps more importantly, the prospect of changing to a better paying job. With the current historically low employment rate, most will see the current regime as positive and vote accordingly. But of course, this is only one issue, and voting preference generally has more factors.

Ed

Could we be looking at some of the same issues that were around in mid-2007?

• https://finance.yahoo.com/m/3a41b9a9-9fe2-30da-80d3-a1ed4435fa19/auto-sales-lost-speed-in-july.html

• https://www.bloomberg.com/news/articles/2018-07-25/u-s-new-home-sales-decline-to-eight-month-low-as-prices-fall

• https://www.bloomberg.com/news/articles/2018-07-30/correction-worse-than-february-is-building-morgan-stanley-says

On the optimistic side:

• https://www.marketwatch.com/story/us-companies-create-219000-new-jobs-in-july-adp-says-2018-08-01

• https://www.bloomberg.com/view/articles/2018-07-27/u-s-gdp-report-clears-path-for-two-more-fed-rate-hikes (although the Fed rate hikes could also be part of the first list)