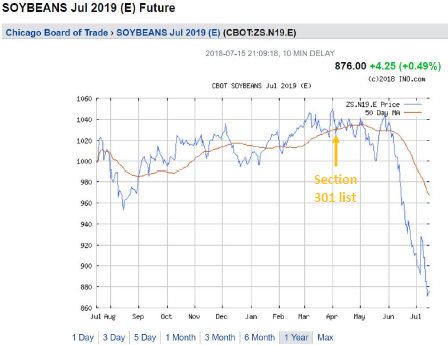

AKA CoRev Memorial Post. The quote is from CoRev, and motivated a July 15 post that contained this graph:

Figure 1: Soybean futures for July 2019. Source: ino.com.

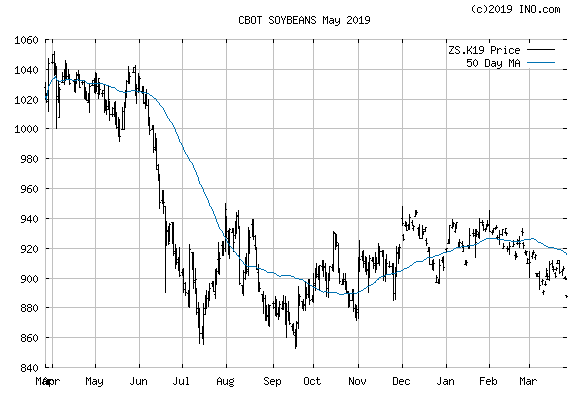

We haven’t made it to July 2019 yet, but so far we’re on track…Here’s the front month (May) contract.

It’s at 888 right now, pretty darn close to the 876 value.

The current July 2019 contract is at 902.

Now, this could be just happenstance. Maybe one could get repeated instances of futures contracts, and check out how ex post prices compare. Maybe, formally assess how futures prices and ex post spot rpices move…using perhaps statistical analysis. Oh, yes, one has done that! See Chinn and Coibion (2014).

CoRev

It’s time CoRev…….. Put the laptop and the i-phone down and back away slowly. You brought this on yourself CoRev:

https://www.youtube.com/watch?v=mkd6JkfI4yk

March 27, 2019

“Since July 2018, the United States has imposed duties on $250 billion worth of Chinese imports, including $50 billion in technology and industrial goods at 25 percent and $200 billion in other products including furniture and construction materials, at 10 percent.

China has hit back with tariffs on about $110 billion worth of U.S. goods, including soybeans and other commodities.

Washington wants Beijing to end practices it says involve the theft of U.S. intellectual property and the forced transfer of American technology to Chinese companies. It wants improved access for American companies to China’s markets and a reduction in Chinese industrial subsidies.

…intellectual property and enforcement of an eventual deal continued to be sticking points.

China wants the United States to lift its tariffs as part of a deal. Washington, which is cognizant that the tariffs give it leverage to ensure Beijing follows through on any commitments it makes, is wary of lifting them right away.

China had put proposals on the table that went further than in the past, creating hope for a deal that the United States insists must include structural changes in the Chinese economy.“

https://www.cnbc.com/2019/03/28/china-makes-unprecedented-offers-to-us-on-tech-transfer-trade.html

There was this troll using the name PeakTrader who told us that Trump was going to get us a great trade deal so all these tariffs would disappear. It seems that troll got it all wrong per your latest link. BTW – Trump said his tariffs would lower our trade deficit with China. Just the opposite has been happening.

I guess you are consistent about one thing – you are consistently WRONG!

Pgl, you’re the biggest Trump hater here and you have lots of fierce competition here.

You make CNN and the other wacko leftists “mainstream” stations and newspapers look unbiased.

I said before, Trump is making progress, but a regressive progressive like you wouldn’t know progress from catastrophe.

Your fake news in caps doesn’t make your fake news genuine, but that’s all you got.

Gee a Trump rant that had zero to do with trade policy. Peaky – just because Trump is losing his mind does not mean you should follow suit! Oh wait – too late!

Pgl, you’ve been reading too much Huffpost and Vanity Fair.

“I said before, Trump is making progress,…”

actually, we were making progress with items like the TPP. after canceling such actions, and invoking tariffs, we have regressed.

Baffling, TPP would have consequences.

It would’ve resulted in lost manufacturing jobs and lower wages.

“It’s a race to the bottom on wages,” said Robert E. Scott, senior economist for the Economic Policy Institute.

A better deal is needed, like improving the Iran deal.

The editors of the American Economic Review are STILL waiting for CoRev’s seminal paper on this issue to be submitted. C’mon CoRev – lay off the day job lying 24/7 for Team Trump and start writing!

And the upper Midwest floods aren’t helping farmers get soybeans (at least those not already washed away!) to the market:

Barge movement has slowed to the lowest unloading in years from Midwest flooding and other infrastructure difficulties will be expensive.

While the initial estimate for damages in Iowa is $1.6 billion, Mike Steenhoek with the Soy Transportation Coalition says the transportation side will be a sizable price tag, and he isn’t sure if the total number is known. Rural roads and bridges are washed out along with highways and interstates, there are damaged locks and dams, and river dredging costs. That does not factor in opportunity costs from farmers unable to get their products off the farm.

Rail specifically is a key factor in transporting grain from the farm and it has a lot of washout.

With more flooding to come:

But while focus is on Southwest Iowa with ongoing flood efforts, Naig said Iowa is not done with floods, there is historic snowpack in Minnesota, “All of that needs to go somewhere, and so places like the Floyd River, the Des Moines River, and places like northern, Northwest Iowa need to be aware of what’s happening in their area. Take precautions, move livestock maybe move some grain but be very mindful of what’s happening in the area. So, we’re not done with flooding for this spring so folks need to be very vigilant.”

For local infrastructure, Steenhoek said that means it’s hard to start fixing rural roads and bridges, “Should I do it today if I’m going to have to redo it tomorrow? Because there’s still a lot of snow that needs to melt in the upper reaches of the region it’s going to continue some of these flooding conditions.”

https://www.kcrg.com/content/news/Flooding-in-the-Midwest-brings-transportation-difficulties-for-the-ag-industry-507775291.html

A stupid trade war, floods, African swine virus killing off Chinese feedstock demand, wet & cold fields, fertilizer shortages….not a good time to be a grain farmer. No wonder two recent high quality polls show Trump badly losing to likely Democratic candidates in three Midwest battleground states (MI, WI and IA).

actually, flood damaged crop is probably covered by insurance and may allow the farmers to get a better price than the lousy market has to offer. climate change may help the trumpsters after all.

i’ve long doubted that futures market in general provide much useful information that is not already incorporated into spot prices.

I’ve never seen futures markets ever call a significant trend change that was also not reflected in sport prices.

Compare significant changes in spot and futures markets and they always seem to move together.

What do the futures market know that the spot market does not know, except for the interest rate cost of carrying a futures position?

Gee – this might in some cases be true almost by definition. Let’s take exchange rates for example where uncovered interest rate parity theory states that the difference in interest rates between two countries will equal the relative change in currency foreign exchange rates over the same period.

https://www.investopedia.com/terms/u/uncoveredinterestrateparity.asp

Of course some folks think their forecasting models are more sophisticated that such simple models so they bet the ranch when then think there is some arbitrage opportunity. CoRev has repeated some silly version about the expected future price of soybeans over and over here. I wonder if he ever put his own money up betting on his model. If so, he’d likely be bankrupt by now!

I remember CoRev had lots of fascinating theories about soybean inventories in grain elevators, silos, or large white bags related to a product that goes bad the longer it’s kept in storage. CoRev seemed to think that if the spot price was low and one of your biggest export markets was closed for business, all you had to do was sit down and whittle on a stick for 10 minutes and then you could get a high price on your soybeans.

https://www.farmprogress.com/soybean/us-farmers-storing-soybeans

https://www.upi.com/Stored-soybeans-could-spoil-before-China-trade-conflict-ends/5911550531187/

https://www.reuters.com/article/us-usa-trade-china-grains/harvesting-in-a-trade-war-us-crops-rot-as-storage-costs-soar-idUSKCN1NQ0GA

Here is Iowa State’s thoughts (one of the better agriculture Universities in the nation/world) about keeping soybeans in storage. CoRev might want to look at this next time he’s “formulating” his “long-term” demand and supply curves on soybeans:

https://crops.extension.iastate.edu/soybean-storage-tips

Maybe CoRev was thinking the soybean and pork farmers would start selling a different product???

https://www.youtube.com/watch?v=lemoVPiK6XQ

It would be fascinating to know who the human mind works (that specific human mind I mean) that says because someone simply observes and comments on the reality that soybeans rot over a certain time frame that means they are “anti-trump”. Yeah, well, maybe they’re proud to be anti-trump, but that has nothing to do with observing a well-known fact of the physical world we live in—soybeans rot over time. And wearing a red MAGA dunce cap on your head is not going to change this reality of the world we live in.

i’ve long doubted that futures market in general provide much useful information that is not already incorporated into spot prices.

I’ve never seen futures markets ever call a significant trend change that was also not reflected in spot prices.

Compare significant changes in spot and futures markets and they always seem to move together.

What do the futures market know that the spot market does not know, except for the interest rate cost of carrying a futures position?

I want to hear from CoRev… where are you?

CoRev got an advanced copy of that 300 page Mueller report so be patient while he write his own 4 page “summary”!

Menzie, don’t forget our dear friend “Princeton”Kopits “deep” theories on arbitrage related to soybeans. That was certainly fun watching our other village idiot give vacuous lectures to a Phd prof on what arbitrage is.

One of my personal favorites of Kopits’ lessons on arbitrage was his “lack of sellers” theory.

https://econbrowser.com/archives/2018/09/trade-wars-are-good-and-easy-to-win-soybean-edition#comment-217285

https://econbrowser.com/archives/2018/07/data-regarding-the-proposition-soybean-tariffs-wont-matter-for-us-soybean-prices#comment-212810

https://econbrowser.com/archives/2018/07/data-regarding-the-proposition-soybean-tariffs-wont-matter-for-us-soybean-prices#comment-212975

Menzie, I know there were some other/more very asinine comments “Princeton”Kopits had made related to arbitrage and the price of soybeans recovering very quickly, but I’ll be damned if I can find them. You’re thinking “What!?!?!?! More asinine than the three links you gave above?!?!?!?” Yup, more asinine. But I wasted enough time searching for comments made by a man whose brain PET scan footnote reads “Hopeless and incurable”.