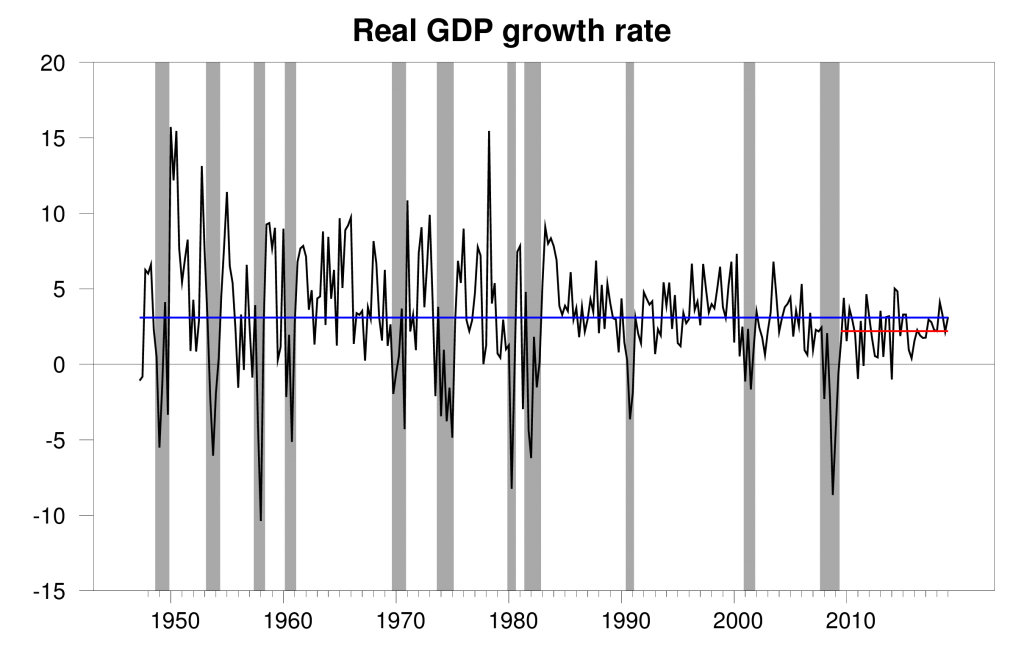

The Bureau of Economic Analysis announced today that U.S. real GDP grew at a 3.2% annual rate in the first quarter of 2019. That’s better than the 2.2% average rate since the recovery from the Great Recession began in 2009:Q3, and even a little better than the average 3.1% growth over the last 70 years.

Real GDP growth at an annual rate, 1947:Q2-2019:Q1, with the 1947-2018 historical average (3.1%) in blue and post-Great-Recession average (2.2%) in red.

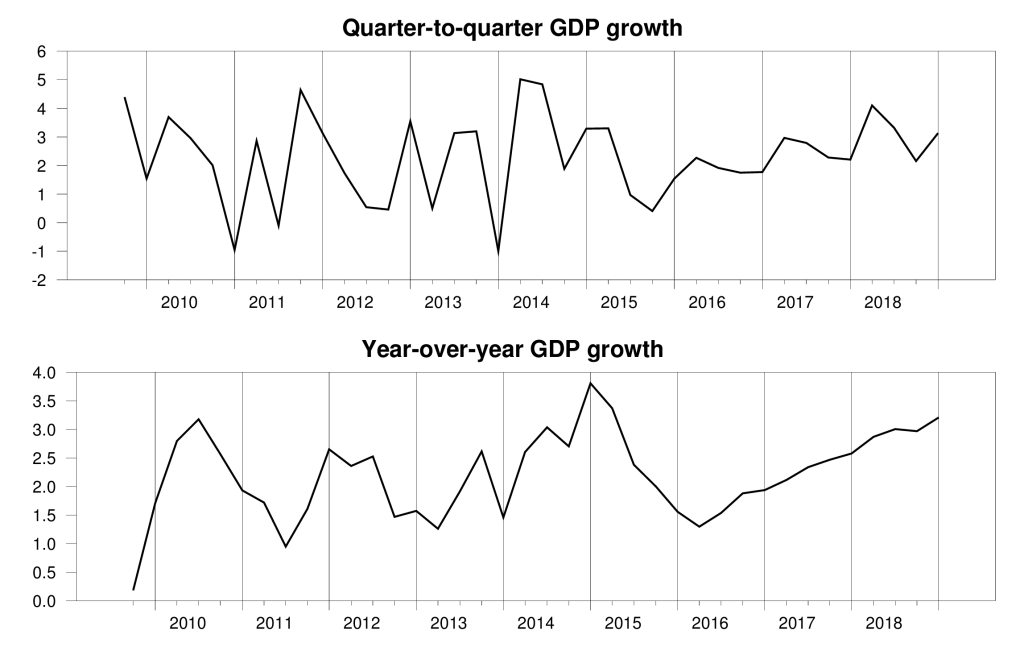

And year-over-year growth keeps climbing.

Top panel: quarter-to-quarter real GDP growth, quoted at an annual rate, 2009:Q4 to 2019:Q1. Bottom panel: year-over-year real GDP growth. Vertical lines denote first-quarter observations.

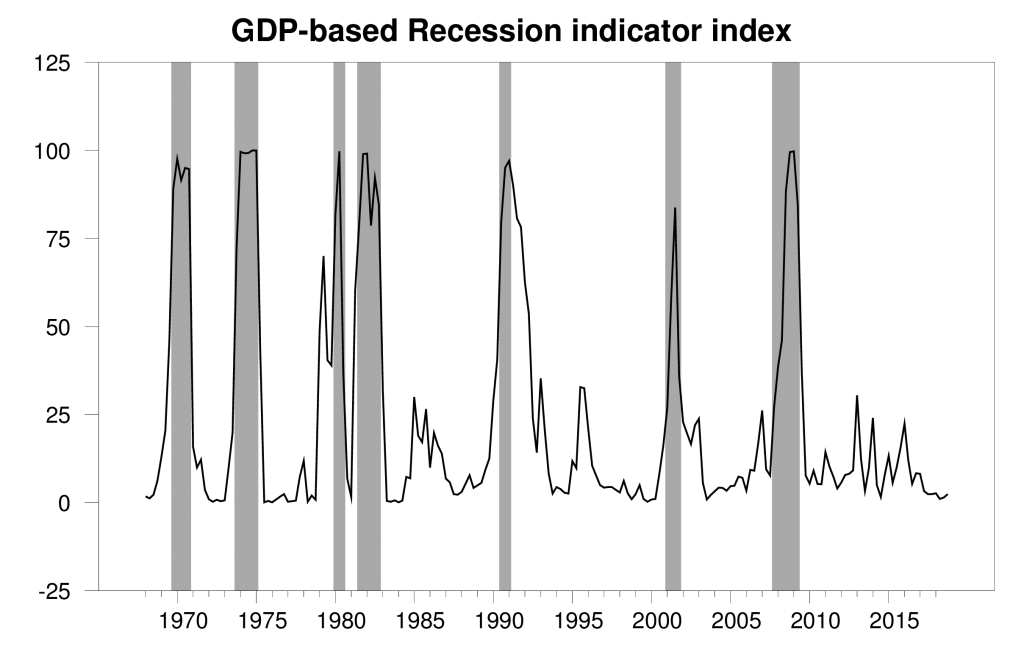

That brings the Econbrowser Recession Indicator Index in at 2.4%, among the lowest levels we ever see. That means the U.S. economic expansion has now been under way for 9-3/4 years, 1 quarter shy of the longest expansion on record (1991:Q2-2001:Q1).

GDP-based recession indicator index. The plotted value for each date is based solely on information as it would have been publicly available and reported as of one quarter after the indicated date, with 2018:Q4 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index, and which were sometimes not reported until two years after the date.

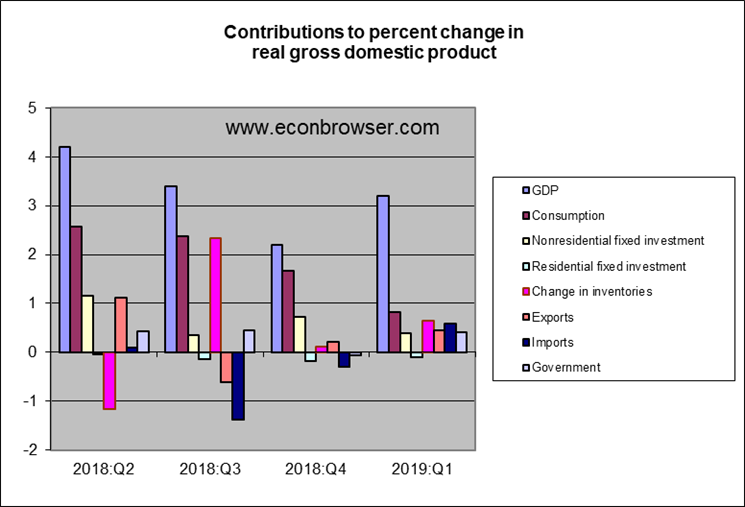

The details behind the GDP report, however, are a little disappointing. Inventory accumulation contributed 0.65% of the 3.2%; that’s not sustainable. Lower imports added 0.6%. That’s another measure that’s volatile at the quarterly frequency and often revised. Higher state and local government spending added 0.4%. These factors helped compensate for weaker than usual consumption growth. Housing continues to be a slight drag on the economy.

Nonetheless, the numbers unambiguously tell us that U.S economy keeps growing. Those who for several years have been predicting disaster around the corner will have to wait for at least a few more corners.

The headline number of 3.2% was certainly unexpected, but a deeper dive into the data is not reassuring. As JDH pointed out, a good chunk of that 3.2% was due to increased inventories. Consumption of goods actually fell by 0.7% and durable goods fell by a whopping 5.3%. Services increased by a respectable 2.0%, but it was banking and financial services that saw the biggest increase. Perhaps due to the uncertainties of the Trump tax changes??? This makes three consecutive quarters of falling residential investment. And investment in equipment was a pitiful 0.2% increase. In fact, the only nonresidential fixed investment number that looked good was intellectual property. But the most worrisome thing is this little note:

Current-dollar personal income increased $147.2 billion in the first quarter, compared with an increase of $229.0 billion in the fourth quarter. The deceleration reflected downturns in personal interest income, personal dividend income, and proprietors’ income that were partly offset by an acceleration in personal current transfer receipts.

Interesting and disturbing details on the components of consumption demand.

Crucial one here looks to be the increase in inventories, worth about an extra half a percent compared to previous quarter. Take that out, and not too far ahad of what was being forecast. Of course highly likely that will decline for next quarter.

Correction. This is the fifth consecutive quarter of negative Residential Investment.

It’s also worth noting that the fall in durable goods was the largest drop since 2009:Q4, and only the third negative quarter over the last thirty-seven quarters.

If Trump was President in 2009, we would’ve had much stronger job growth, much stronger GDP growth, more tax revenue, many of the problems kicked down the road would’ve been settled, and had better resolutions.

Unfortunately, Trump inherited many constraints, because of many failed policies.

Seriously Peaky? Had Trump been President, he would have listened to the gold bugs and the fiscal restraint bozos and we would still be in the Great Recession.

More analysis/wishful thinking whatever from the usual uniformed peanut gallery.

When Obama had yet to take the oath of office, CBO was predicting a 2009 deficit of $1.2 Trillion (eventually around $1.4). “economists” like Moore were upset with the Fed’s policies, urging instead tough measures to curb inflation and to raise, not lower interest rates. That combined, of course, with unemployment approaching 10% and the Dow on its way below 9000, with a couple of months left to tumble.

Enter in your fertile imagination the self-proclaimed King of Debt in 2009? The guy whose policies were guaranteed to decrease deficits and wipe out the national debt in eight years? The guy who loves cheap money who would have nonetheless been thrilled with higher interest rates AND increased taxes? ( Albeit, the guy who was quite familiar with bankruptcies and bad business deals)

But you’re positive Trump coulda and woiulda. Hindsight is wonderful, although perhaps not the kind where sight is blinded by the position of the head in relation to the rest of the body.

Sorry, PT, but if Trump had been in and played his trade wars game it might have worked out like the Smoot-Hawley tariff of 1930 did, which led to a full-blown trade war and all=out collapse of international trade. This was not the most important factor in turning a bad recession into the Great Depression, but it seriously added to the problems.

As of right now, the world economy is growing so nations are less desperate and more willing to tolerate to some extent the unjustified and uncalled for and borderline illegal protectionist moves by Trump, which have not led to much in the way of satisfactory resolutions despite his claims about how easy it is to “win” a trade war. Things would have gone much worse if he had pulled this in 2009, with much worse consequences.

Again, keep in mind that IMF and others see Trump’s trade moves as having pushed the world to slower growth, not faster growth, although fortunately not so much as to overcome the positive growth elements currently operating. But in a situation of basically global decline, such policies could have had awful results. We should all be grateful that back in 2009 the most important world leaders avoided the temptation to engage in this sort of “beggar thy neighbor” policies.

Nope. 4th quarter GDP is heading for a downward revision as inventories fell, probably close to 0%. This was noted blunder by my source in the BEA and yes, this happens often. This was just a nominal rebound in inventories, not unlike Q1 1990. Obama era growth, especially in the Mid-13 to mid-15 oil bubble era was a big surge in growth fed by the pop in oil extraction, which is also freezing now after a mini-bubble. No more purchases for future wells unless the oil price goes persistently above 80$. This will drag down growth the rest of the year and feed into steel unless the price rises, preferably to 100$. Couple this with overproduction in auto, means some inventory issues Peak. Big inventory issues. Prices are plunging because auto companies refused to cut production after the secular peak in March 2016. I don’t see how a NBER recession is avoidable in that regard, despite being a small inventory recession. Trump has got problems in 2020. Big problems. Even if unemployment only peaks at 5.5% in November 2020, it won’t help his cause.

I haven’t posted here in awhile, but I have work for manufacturers related to many industries and have many contacts in government data centers. It sure helped forecasting the last 2 recessions, which I was pretty much on the dot with.

This more or less confirms what my outhouse economist nose is telling me that it is smelling. It may not come home to roost right away, but there is only so much production and so much inventory that we really need. The supply chain is a little like playing crack the whip – the lower tier suppliers get whipped back and forth by huge percentages and in a rapid onset manner. When the economy came back after the Bush crash, it was coming back from such a low level, and with so much room to spare that the usual whiplash was a bit muted. Now we are at a point that the whiplash will be more perceivable. When people perceive a downturn, their political mood changes. If the economy is booming in 2020, then Trump will get reelected. If it’s not booming, even if it’s growing, he won’t. If we are in a recession, it’s likely to be a blowout. I have no doubt he and the Senate will try some kind of shenanigan if the economy isn’t booming. Anyone think invading Iran is a good idea?

PeakTrader Your point is 100% certain. The recovery from the Fed-caused 2008 debacle was the poorest recovery in the nation’s history. Point of fact per the historical data. As the 2009 trough was so deep, the rebound should have been stronger but wasn’t. Why was that? Because Obama was anti-business. He will live in the annuals of history as the You-didn’t-built-that president. The second worst president economically — after FDR. And the absolutely beyond a shadow of a doubt most un-American. What makes Obama’s track record a magnitude worse is that the injection of liquidity to the economy was the greatest in history. He also crammed down the throat of the American people the travesty of ObamaCare. 60% of the people did not want it. No broad domestic piece of policy should ever be forced on the people without a majority wanting it.

And then as election year 2016 came, Obama helped run a soft coup against candidate and then president-elect Trump. Treasonous! The greatest act of treason this country has ever known. And it is all in the process of coming out where the fake news media will be forced to cover it.

“PeakTrader Your point is 100% certain. The recovery from the Fed-caused 2008 debacle was the poorest recovery in the nation’s history.”

Gibberish endorsing gibberish. Bernanke was do all the FED could do to offset the damage from a residential investment bust fueled weak regulatory control of excessive bank risk taking – endorsed by right wing dorks like you and Peakyboo. But hey – right wingers always love to blame others for their mistakes.

“The second worst president economically — after FDR.”

FDR inherited the Great Depression from Hoover’s mess and Obama inherited the Great Recession after Bush43’s mess which some moron just blamed on Bernanke. Like I said – rightwingers always love to blame others for their mistakes.

Hey JBH – this comment was even dumber than your comment about the skating rink at Rockefeller Center!

pgl,

” rightwingers always love to blame others for their mistakes.”

Another ad hominem!

Credulity

It will all be Alexandra Ocasio-Cortez’s fault from now on. It’s gotta be some “liberal’s” fault.

JBH the Fed-caused 2008 debacle was the poorest recovery in the nation’s history. Point of fact per the historical data

The recovery from the Great Recession was weak, but your statement is not entirely correct. For one thing, the Great Recession began in Dec 2007, so it’s a little hard to see how the Fed’s actions in 2008 could have caused a recession that started in Dec 2007. And most economic historians would say that the Panic of 1837 was far more severe and the recovery was much weaker. And then there’s that Great Depression.

As the 2009 trough was so deep, the rebound should have been stronger but wasn’t.

This is one of those urban legends. In fact, financial recessions are typically very deep and very slow to recover. You like to cite Reinhart & Rogoff, so perhaps you should read this: https://www.nber.org/papers/w15795

One of their findings is that financial recession are qualitatively different from most recessions and recoveries are usually weak. To quote R&R: “Broadly speaking, financial crises are protracted affairs.”

No broad domestic piece of policy should ever be forced on the people without a majority wanting it.

Well, a clear majority now want Obamacare, so GOP efforts to kill it should be equally onerous, right? But what’s really bad is when a President is forced on people even though a majority voted against that President. Agree?

Obama helped run a soft coup against candidate and then president-elect Trump.

If that were the case, then he should have intervened before the election to ensure the Russians didn’t succeed in getting their candidate elected. In any event, in the summer of 2016 it wasn’t the Obama Administration that was wondering about having to stage a coup if Trump won; those discussions were over at the Pentagon by folks with lots of stars on their shoulders who worried about having to execute an illegal order.

The greatest act of treason this country has ever known.

Some of us might regard Robert E. Lee’s actions as the greatest act of treason this country has ever seen. Let’s see…Robert E. Lee…wasn’t that the guy that Trump was praising the other day while talking to the press on the WH lawn? Why yes it was.

Good point by point rebuttal but 2 addendums. The FED was already lowering interest rates to offset the recession. Does JBH thinks lower interest rates made the recession worse? That might be the stupidest idea EVER except for the insanity just now from PeakStupidity that tax cuts for the rich would have been better stimulus than more government purchases. Yes the 2009 fiscal stimulus had too little infrastructure investment and too much in the way of tax cuts for the rich. WHY? Because that was the only way to get it past that stupid GOP filibuster. But again – right wingers refuse to blame their team so they make up intellectual garbage to blame Obama.

For the last six years of Obama’s presidency, when the Republicans controlled Congress, they refused to cooperate with him at all. On the budget, this created the “sequester.” As a consequence, restricted government spending was a serious drag on the economy for those six years. After Trump was elected, they opened up the floodgates–not only by lowering taxes, but by also increasing spending. This huge combination fiscal boost fully explains the “booming” economy (also the booming deficit).

Good point. The elephant in the room that PeakLiar, JBH, and CoRev deny, deny, deny.

The federal spending sequester restricted the growth of federal spending in the discretionary accounts… those are the outlays that pay for Obama’s war on Libya. Yemen, Afghanistan and Syria and assorted pork. For pentagon “investment” accounts the impact (checks not cut or less) on national income accounting is delayed. The fiscal tool was not cut back it was slowed.

What’s gotta be obvious, even to the Trump haters, isTrump has shown how easy a better economy is and could have been following Republican economic policies.

2slugs points out the obvious about a complex, multi-part measurement. Some parts will be up and/or down from previous versions, because … change happens.

“complex, multi-part measurement”. You love these big words which have no substantive meaning!

” Big picture: The acceleration in growth in the first quarter is all the more remarkable considering the doom and gloom that surrounded the first-quarter outlook in December. Before the new year began, the Atlanta Fed’s “nowcast” model projected 0.5% growth and the flattening of the yield curve was fueling talk of recession. The partial government shutdown, which limited economic data, added to unease.

Instead, the economic data improved steadily as the quarter progressedEconomists think the strong gain in retail sales in March bodes well for second-quarter growth. ” From here: https://www.marketwatch.com/story/economy-grows-32-in-first-quarter-gdp-shows-much-stronger-than-anticipated-2019-04-26

“” Big picture:???? Who are you quoting here? Yourself? What part of inventory accumulation did you not get?

Inventory is a lot different from the days of my youth……. today we have supply chains, iOT and big data. I started out retiring hand written ‘stock cards’ and a mainframe with 32K RAM!!

CoRev does it again – read the headline but not the rest of his own link!

“See: The big mystery in the GDP report – where did the inventories come from

Final sales to domestic purchasers, which excludes trade and inventory behavior, rose 2.3% in the first quarter,”

Maybe CoRev read this but had no clue what this meant. And does he understand what this means?

“One unexpected factor behind the acceleration in GDP growth in the first quarter was a sharp upturn in state and local government spending.”

C’mon CoRev – a conservative applauding SOCIALISM?!

Pgl, only you can be this desperate! by asking: “Who are you quoting here?” Are you that dense? How often do you miss the link in a comment?

You also make some kind of absurd leap from: “… a sharp upturn in state and local government spending.” to SOCIALISM?! Socialism? Even you can;t be that dense, although you have shown this penchant repeatedly and even more so lately.

Government spending, all levels, is a sub-component of the GDP calculations, unless of course you are recommending its removal? Like the other GDP components they can go up and down each measurement cycle. But if you insist many of us would be happy to emphasize private sector growth over public sector by its removal.

You are complaining about missing something in a link? You missed just about every damn detail in your own link. As usual!

“Government spending, all levels, is a sub-component of the GDP calculations, unless of course you are recommending its removal?”

No – that would be your boy Kudlow (see Spencer’s excellent comment). Of course you never grasped the fact that the drivers of this 3.2% figure were: (a) drop in imports which Kudlow would omit; (b) the surge in state and local government purchases which you missed; and (c) the surge in inventory accumulation which you are still ignoring.

Why don’t you go back and READ the details and then take your shoes off so you can count past ten!

Pgl, so desperate he repeats the same points, but does he understand that they are only parts of the same moving complex metric? Nope!

BTW, I noticed I you missed the ending of my quote: “Instead, the economic data improved steadily as the quarter progressed Economists think the strong gain in retail sales in March bodes well for second-quarter growth. ”

I know its hard to accept your own failings, but you really do need to do MUCH better. You nit picking is too obvious. What’s your prognostication for next quarter? You and yours were EMBARRASSINGLY WRONG on this quarter.

“CoRev

April 27, 2019 at 3:01 pm

Pgl, so desperate he repeats the same points, but does he understand that they are only parts of the same moving complex metric? Nope!

*****

I have to repeat the FACTS to get through gibberish such as “the same moving complex metric”. What monkey typing away came up with that crap?

*****

BTW, I noticed I you missed the ending of my quote: “Instead, the economic data improved steadily as the quarter progressed Economists think the strong gain in retail sales in March bodes well for second-quarter growth. ”

*****

One might hope so but I guess the weak growth in consumption during the 1st quarter got fogged out by your “moving complex metric”. Oh CoRev forget the fancy gibberish you do not even understand and look at something called REALITY!

I’ve never been able to tell if Professor Hamilton is a Democrat or a Republican. I’m pretty certain he’s more to the right than Menzie, but if that tips him over to Republican I can’t be certain. That’s much to Professor Hamilton’s credit as an academic. (Although it’s not a “sin” to profess your political proclivities, on the whole, certainly as to how people are “judged” by peers, it might be better).

Personally, if the leader of your own country has many characteristics that mirror Fascists and even some slight shades of Hitler, it would be hard for me to sit there and go “Well, folks, the economy still seems to be humming a long nicely, you big buncha nattering nabobs of negativity”. But hey, I’m just a goofball, waiting to see what gifts lay for us just past all these great corners.

Moses,

I am probably not the one who should be informing you of this, and I think you get it, but I think you should not press Jim Hamilton to express political views here. I have known him for over 30 years, and I have never heard him express political views of any sort. I sort of assume he is an independent of some sort, but again, I have never heard him express political views, and he never has here to the best of my knowledge on this blog

It should be kept in mind that he is the senior person here, with Menzie coming on some time later after Jim ran it for some time. Jim’s posts have always emphasized factual data and fairly wonky analysis of theoretical and econometric issues. He has bee much less involved in policy work in Washington than Menzie (who actually did serve on the CEA staff for both GOP and Dem presidents, even though these days he comes across as very Dem). I believe Jim has done a lot of advising of people at the Fed, but he has always remained in his academic positions, long at the University of Virginia and for many years since then at UC-San Diego.

I would note that he is very respected and distinguished within the economics profession. He is the author of a widely used and respected grad level textbook, Time-Series Analysis, published by Princeton University Press. His earliest work was on the relationship between oil prices and economic growth, and he continues to be viewed within the profession as one of the leading experts in the world on that topic, which he does occasionally post on here, although not much recently. He has also done econometric modeling of foreign exchange rate dynamics, a topic that both he and Menzie have studied (they may even have coauthored on that, although I do not remember seeing any such papers). He has also done important work on a variety of other topics in macroeconomics and finance, including on the difficult problem of the misspecified fundamental, a serious econometric problem involved in the study of speculative bubbles. Aside from writing the textbook he has also invented several time-series econometric techniques.

Since I am praising him highly, I shall note that he is not always right, and I note that when he is not he does not hesitate to admit it. One such item I am aware of was that he was slow to see that there was a bubble in the US housing market back in the last decade, which he fully admitted later. But he is always a very careful and straightforward observer and commentator of economic events and data. I do not think anybody should demand that he get into making overtly political statements and getting into such debates, as Menzie has.

It was not a criticism of Professor Hamilton per se. From a purely professional standpoint one can argue Professor Hamilton’s path is the wise choice. And I don’t presume to able to sway a man who is already well established and set in his thoughts on the matter—which are very legitimate, and is a very legitimate and viable stance as a University professor. I only ask that in Professor Hamilton’s more bored moments of life (say over a bland flavored breakfast) he consider what 1930s professors in Germany may have silently weighed in their mind when watching their country morally crumble and quoting positive looking economic barometers.

Bill McBride looks at the details:

https://www.calculatedriskblog.com/2019/04/bea-real-gdp-increased-at-32-annualized.html

“Personal consumption expenditures (PCE) increased at 1.2% annualized rate in Q1, down from 3.2% in Q4. Residential investment (RI) decreased 2.8% in Q1. Equipment investment increased at a 0.2% annualized rate, and investment in non-residential structures decreased at a 0.8% pace.”

https://www.calculatedriskblog.com/2019/04/q1-gdp-investment.html

“Investment was weak in Q1 (although private inventories increased). Also personal consumption expenditures (PCE) was weak (only increased at a 1.2% annual rate).”

Inventories are piling up! If we take this figure out, investment growth was very weak and consumption growth was also weak.

Of course Trump will not tell the truth so I’m listening to his CEA chair now. Oh wait – Kevin Hassett could not be bothered to tell the truth either!

“The details behind the GDP report, however, are a little disappointing. Inventory accumulation contributed 0.65% of the 3.2%; that’s not sustainable. Lower imports added 0.6%. That’s another measure that’s volatile at the quarterly frequency and often revised. Higher state and local government spending added 0.4%. These factors helped compensate for weaker than usual consumption growth. Housing continues to be a slight drag on the economy.”

Excellent points! I noted a while back the fall in real state/local government purchases during 2018QIV so the rise in 2019QI is reassuring. We should note, however, that real nondefense Federal purchases have fallen for the last two quarters.

The inventory accumulation point is similar to what Bill McBride details – weak fixed investment but inventories piling up. “That’s not sustainable”! But does the President, the CEA, or even the business goofballs at MSNBC mention this? Of course not!

Looking at one line here:

https://www.bea.gov/system/files/2019-04/gdp1q19_ad Onv.pdf

Final sales of domestic product: annualized growth only 2.5%

I looked at this as it takes out the abnormal rise in inventories, which is a much more meaningful way of thinking about growth. One would hope the CEA chair gets this but has Kevin Hassett noted this statistic? Of course not.

The fall in imports contributed +0.58 percentage points to real GDP growth and private inventories contributed another +0.67 percentage points.

has a long history of

Together these two accounted for about 40% of the 3.2 % growth in real GDP.

It is really hard to see how you can count on these two factor continuing to make major contributions to growth, especially with investment being as weak as it was.

Larry Kudlow has a long history of making fun of BEA subtracting imports in the GDP calculations. Maybe someone should ask him about the role of imports in this quarters growth. Apparently he does not know that when a domestic purchaser buys imports, it enters the GDP calculation twice.

“Larry Kudlow has a long history of making fun of BEA subtracting imports in the GDP calculations. Maybe someone should ask him about the role of imports in this quarters growth.”

Nice! Kudlow is a clown but I betcha this two faced hack could cobble together a couple of sentences applauding an improvement in the current account. Of course that would contradict the babble you note here but when did consistency ever constrain Kudlow?

I have two words for you PY. Structural break. It aint there.

you would expect both inventories and imports to change next quarter unless the economy is slowing sharply.

Mind you why you have an ‘advanced’ estimate only Yanks would know. Everyone else waits for what you call your 2nd estimate and even that is revised quite a bit

“Everyone else” is a rather broad statement. Have another Dogbolter beer mate. I think these numbers are too high, but let’s keep the criticisms of the honest nature.

Originally the advanced estimate was suppose to be strictly a “confidential” number for internal use only and it was not made public.

But it was leaked so often and so widespread that they decided to go ahead and make it public.

I was on the “buy side” in Boston and I remember one brokerage house economist in particular, who was a retired BEA economist, who would always make a

big deal that he could confidentially provide us with the advanced number.

@ spencer

Don’t misunderstand, I am glad you shared this, and find it interesting—but—Why does this not surprise me at all?? (rhetorical question)

I remember when CNBC etc had some conniption fit over an important number being “leaked” from the Philadelphia Fed, and I think there may have even been something that got out from the FOMC once, but I am hazy on the latter one. I could probably find links to both if I was in the mood to go on one of my wild goose link chases. I am in a decent mood right now and I would rather not.

The fact that CNBC and other financial media outlets had a fit about it wouldn’t upset me, if I wasn’t well aware what a bunch of damned hypocrites their on-air “personalities” are and that they know damned well this “stuff” (I have other words for it) happens all the damned time.

Professor Hamilton,

Happily I was able to use your method to arrive at the 2.4% recession index for 2018Q4. I realize that as you mention, original data is used to calculate index values and that the 2018Q4 index is the only index value that I should be able to calculate that agrees with your calculation if I am using data as of 2019Q1.

Is there an easy explanation as to why updated data significantly changes some of the past index percentages? For example, looking at your chart the 1970 index value appears to be close to 100%. Using revised data published as of 2019Q1, my calculation shows the 1970 index at about 50%. Another example, your 2000 index seems to be above 75%. Using the revised data, the index drops to about 32%.

I realize that different input causes different output, but just wondering why such large differences.

I like the real GDP growth rate chart. It clearly shows that the economy does its best to ignore whomever is in charge and generally gets into trouble when the Fed decides its time for a recession (read that as a series of interest rate increases). It doesn’t appear that there was much of a qualitative or quantitative difference between Obama’s economy and Trump’s.

There are many unfounded fears about Trump, whipped up by “journalists.”

Trump was correct his business tax cuts and deregulation would ramp-up job and GDP growth.

Trump was correct the Fed was too aggressive tightening the money supply and the Fed adjusted appropriately, fueling a stock market boom.

Trump is correct predatory pricing, IP theft, and other uncompetitive trade practices are doing more harm to the economy than many people think.

In 2009, we needed a Reagan or a Trump, not a Carter or a Obama, to close the output gap in two or three years rather than in more than 10 years!

PeakLiar writes some much gibberish in his idol worship of Trump that it may be a full time job keeping up. Let me pick just one sentence:

“Trump was correct the Fed was too aggressive tightening the money supply and the Fed adjusted appropriately, fueling a stock market boom.”

WTF? Higher interest rates fueled a stock market boom. Good God Peaky – learn to write some day as this is just gibberish. Of course if PeakLiar presented a chart of the S&P 500, one would see we have not had a booming market since Trump was elected:

https://finance.yahoo.com/quote/%5EGSPC?p=%5EGSPC

I’ll leave the rest of Peaky’s gibberish to others.

Everything written about/against Trump has a tinge of “Saddam’s WMD’s are going to hit NY if we don’t take out…..”

Under Obama, we had a sharp increase in federal debt to GDP, because the massive additional spending generated little economic growth, even with quantitative easings!

Trump inherited high debt to GDP with persistently weak economic growth.

Trump would’ve gone all out to generate economic growth in 2009, including a bold permanent tax cut for workers, to strengthen household balance sheets and strengthen banks, rather than the small and slow tax cuts with some tax hikes; large business tax cuts, including lower corporate taxes, reducing capital gains taxes, and repatriate money; deregulation, rather than heavily regulating many industries; facilitate domestic production of fossil fuels, including oil and coal; not squandering spending on a massive scale, etc..

We would’ve had much stronger economic growth, with a much stronger military and afforded more infrastructure spending, and taxes could be raised to slow the economic boom to a sustainable rate. And, the Fed would’ve had more ammunition to deal with the next recession.

Oh, you have decided to drop his protectionism now that it has been pointed out this would have been a very bad idea?

As for the rest, counterfactual cannot be proven, but you overstate the performance of the Trump economy compared to the Obama one, especially if you start counting after 2009, which i know you refuse to do. But, while you whine that Trump arrived with a higher debt/GDP ratio than Obama did when he came in, he arrived with a growing economy, not one in the midst of the worst decline and worst financial crisis since the Great Depression.

Complaining about deficits and calling for a permanent tax cuts at the same time? Lord – you’re beyond stupid. BTW – Robert Barro would tell you that giving rich people tax cuts without slashing and burning government purchases would NOT raise consumption. Every economist who gets it and is not a liar realizes that your vaunted Reagan 1981 tax cuts LOWERED investment. Greg Mankiw (Republican economist) explained it quite well in his first macroeconomic text. Oh wait – you refuse to read actual economics so I know you have NO clue.

Now more infrastructure would have been a great idea. Obama’s economists pushed this idea but they had to get past the Republican morons in the Senate so we got more ineffective tax cuts and less government purchases stimulus.

Of course PeakMoron keeps repeating the same stupid garbage those Senate Republicans dishonestly preached. Go figure!

“Trump would’ve gone all out to generate economic growth in 2009, including a bold permanent tax cut for workers”.

That is a LIE. Any puny benefits workers got from this massive tax cut for the rich will sunset. Way to go PeakMoron – can’t be bothered to read actual economics. Can’t be bothered to read the actual 2017 tax law change. Babble on!

Imagine alternating shutdown government with shutdown liberal academe. The perfect recipe for 3.2% growth forever!

Yes, by all means. Shut down schools, colleges, and universities until they learn how to properly appreciate their leaders. That will show all the Stalinists in this blog.

Peak Trader — Obama inherited a federal defict of almost 10% of GDP from the Bush tax cut and recession. Obama’s original stimulus increased the debt modestly,

but it was still under 10% of GDP. Over the next eight years he regularly reduced the deficit to about 4% of GDP — one of the largest debt reduction on record.

That 4% debt to GDP was what Trump inherited and he has already increased that to over 6% of GDP in the last quarter of 2018.

I’m using BEA data and as far as I’m concerned your comments of the debt under Obama is strictly fake news.

Did Leon Panetta call our Usual Suspects “chumps”?

https://econospeak.blogspot.com/2019/04/panetta-and-trump-who-are-you-calling.html

In Panetta’s youth (relative) he was in military intelligence (oxymoron) ……. made him fully qualified to be Obama’s Director of CIA, then SECDEF after a stint In Clinton White House.

He may have helped Hillary, Iraq WMDs are real just like pgl’s Russia bots, vote to depose Saddam, and help Obama get out of Iraq, not!

My first thought about the surprisingly large real GDP increase for the first quarter was that BEA appeared to largely solve the residual seasonality issues that tended to suppress Q1 growth and raise Q2 growth above what it would otherwise be.

However, if this analysis is correct Q2 growth could be surprisingly large: https://www.clevelandfed.org/en/newsroom-and-events/publications/economic-commentary/2019-economic-commentaries/ec-201905-residual-seasonality-in-gdp-remains-after-bea-improvements.aspx

This kind of thing is why trying to figure out economics is so much fun. As an outhouse economist, I don’t know the mathematical analyses and don’t have a basis for following them. But, that doesn’t make it impossible to get an overall picture and to see that there are cause and effect anomalies to solve. All the political stuff is fine and good, but the business cycle has not been repealed, nor does supply care much where demand comes from. Which leads to surprises.

I still expect growth through the end of 2019 and maybe even into 2020. If the growth rate is high now, I would expect it to fall off more sharply later. What I cannot see is an obvious bubble like .coms or real estate this time around. There probably is one, I just don’t know what it is.

It’s amazing how leftists show up with nonsense, even after showing them it’s all nonsense.

The Bush tax cuts in early 2008 put us on a path to another mild recession, till Lehman failed in September, and TARP was paid back under Obama.

The Obama expansion was very weak, because economic growth was moving away from trend growth, not closer to it. We didn’t recover the 2009 job losses, till late 2012, and that doesn’t include the 100,000 jobs needed per month from 2009 to 2012 for population growth.

Although, we were closer to full employment in 2017, although much potential output was destroyed under Obama, the Trump business tax cuts and deregulation added over 1 million more jobs than otherwise.

This is what Trump inherited:

https://fred.stlouisfed.org/series/GFDEGDQ188S

And, see Real Per Capita GDP Growth:

https://www.advisorperspectives.com/dshort/updates/2019/04/26/q1-real-gdp-per-capita-2-50-versus-the-3-17-headline-real-gdp

The Obama-Pelosi-Reid Administration, House, and 60-vote Senate restructured the economy in 2009-11, and not in a good way, which the data show.

“This is what Trump inherited:”

Seriously? Try graphing the employment situation Obama inherited from Bush43. I do think Team Trump needs to reprogram its Russian bot as your gibberish is actually making their PR campaign totally untenable!

It is telling that PeakTrumpIdolWorshiper has decided his new economic gurus are this crowd:

https://www.advisorperspectives.com/about

“Advisor Perspectives is the leading interactive publisher for Registered Investment Advisors (RIAs), wealth managers, and financial advisors.”

Ah yes – shills for rich people who run banks that rip off the system in ways that led to the Great Recession. But they do summarize data which is often used by the dumbest trolls on the internet to completely distort reality. Peaky’s kind of people!

“The Obama-Pelosi-Reid Administration, House, and 60-vote Senate restructured the economy in 2009-11, and not in a good way”

Yes it was a really bad idea to address the health care of those with pre-existing conditions.

Yes it was a bad idea to end the unregulated financial institutions behavior that led to the Great Recession.

Yes it was a bad idea to do something about restoring aggregate demand that was free falling during the Great Recession.

PeakTrader must have been Herbert Hoover’s chief economic adviser!!!

PT,

Your presentation here is seriously distorted. I have news for you: most of the worst of the decline happened before Obama entered the White House on 1/20/09. The sharpest quarter of GDP decline was the last one of 2008 at a -8.2% rate while Bush still in office. First quarter 09 was second worst at -5.4%, with Bush still in office for fist quarter or so of that. There was still decline in the second quarter, but it was at less than a -1% rate, and after that the economy turned around and grew.

Yes, the economy took a permanent dive as the FRED graph shows, although it does not show the detail I just described. Again, if you start with 2010 and look on, Trump economy not clearly growing faster than Obama one. You just keep lying when you deny this, PT, but like Trump you just keep repeating your lies.

Yes this recession did start in Dec. 2007. But did you see that absurd claim that the FED caused the Great Recession with its 2008 policies. Of course the FED lowered short-term interest rates from 3.5% to 0.5%.Yep – our Usual Suspects all flunked basic macroeconomics. Which I guess is why they think Stephen Moore belongs on the FED!

PeakTrader House, and 60-vote Senate restructured the economy in 2009-11

You need a history lesson. The Democrats only had 59 votes in the Senate when the ARRA was passed. Sen. Al Franken wasn’t admitted into the Senate until after the ARRA passed. One reason the ARRA was watered down and made less effective was because the Administration had to find at least one GOP Senator to vote for it.

And given today’s demographics, wouldn’t you expect GDP per capita to be lower today than it was over the last 70 years? What you should be worried about is multifactor productivity. And somehow I don’t think the latest GDP numbers for fixed investment for equipment will do much to improve future labor productivity.

‘It’s amazing how leftists show up with nonsense, even after showing them it’s all nonsense.’ You are a leftist?! Who knew? Talking about nonsense:

‘The Bush tax cuts in early 2008 put us on a path to another mild recession, till Lehman failed in September, and TARP was paid back under Obama.’

Oh yea – Bush did everything possible to reverse his recession. Snicker! Lehman failed because of stupid banking deregulation that dummies like you applaud and a timid response from the Bush administration. TARP was paid back made the recession worse? OMG – the Russian bot is writing some really stupid gibberish. Or do you want us all to line the pockets of failed banks forever. C’mon Peaky – learn to effing write!

Using CoRev/ Dow metrics (he constantly crows about increases in the DOw) : the Dow bottomed at 6507 March9, 2009. Two years later( March 11, 2011), the Dow closed at 12044, an increase of 85%.

On inauguration day, 2017, the Dow closed at 19827. Two years later, it was up 25% to 24737. Simply put–unless numbers lie– the Dow grew at a much slower rate under Trump.

Even more telling, late April 2017 the Dow closed at 20940. Friday it closed at 26543, an increase of–still–25%. While those numbers are impressive, they’re not nearly as impressive as those compiled during Obama’s first two years.

SImple math. You gotta love it.

We should’ve had much stronger growth following the severe recession, not an expensive L-shaped recovery.

TARP was paid back under Obama, which helped reduce the spectacularly high Obama budget deficits.

What were the budget deficits the first four years? Five, six trillion? For the L-shaped recovery from a deep recession!

The Obama-Pelosi-Reid government were more interested in restructuring the economy than cyclical growth.

Trump has reversed some of the damage to get the economy back on track.

It was the weakest RECOVERY (need to spell it out for some people) in U.S. history.

It’s accurate to call it a depressed expansion.

The 2001-07 expansion was on top of the 1982-00 economic boom and the very mild 2001 recession.

The 1990-91 recession was also preceded by an economic boom with a U-shaped recovery from the “no new taxes” Bush.

We had a V-shaped recovery under Reagan, and would’ve likely had at least close to a V-shaped recovery, if Trump was President in 2009, i.e. filling the output gap by the end of 2011. It’s unnecessary to have substantial idle or underemployed resources for many years.

The Obama stimulus plan was inappropriate.

And, there were counter-cyclical structural changes.

Barro predicted its failure.

Barro predicted its failure? WTF – Barro was scared of hyperinflation. It didn’t happen. And if Barro understood his own Ricardian theorem he would not your call for tax cuts to stimulate aggregate demand would be totally ineffective. AND Romer’s call for a large surge in infrastructure investment was the right approach.

Peaky – the more gibberish you write, the more we realize you have no clue what any of this means. Please stop as your mother has endured too much embarrassment already!

NBER is calling. They want you to stop abusing their dating of business cycles to write utter gibberish.

TARP succeeding is a sign that Obama screwed up? I’m sorry Peaky but your writing has gone off the rails and over to the Cuckoo’s Nest. I would ask what your point is but we all know – you have no clue.

The Usual Suspects come up with some doozies to deny all reality. The latest is CoRev’s moving complex metric – whatever that means. Let’s contrast the usual intellectual garbage as to how Trump’s tax cut might lead to some alleged economic miracle to the latest from the BEA.

We were told that the tax cut would lead to an investment boom. Well – fixed investment growth was a mere 1.5%. Residential investment has been falling for a while.

We were told that the tax cut would lead to more private consumption. Well – it rose by only 1.2%. Consumption of goods actually fell.

So WTF is this moving complex metric? Oh yea – we did have a temporary surge in state and local government purchases. That was not due to the Trump tax cut.

We did see a fall in imports last quarter but something tells me this is a temporary event.

And a lot of the “good” news was from stockpiling inventories, which was certainly a temporary boost.

So WTF does CoRev mean by his moving complex metric? Trust me – this fool has no idea!

Robert Waldman nails this nonsense about how Republican tax cuts are good for long-term growth:

https://rjwaldmann.blogspot.com/2019/04/reply-to-pgl-comment-on-brad-delong.html

“Reply to PGL comment on Brad DeLong Post on Stealing Candy From Fish in a Barrel …

Also the GOP supply side story is about non residential fixed investment. They have been promising for 39 years that their tax cuts will cause a huge increase in business investment and that Democrats’ tax increases will cause it to collapse. Also there has been a very clear pattern, which happens to be the exact opposite. The ratio of non residential fixed investment to GDP is high when a Democrat is in the White House (especially if he is a peanut farmer from Georgia) and collapses when a supply-sider is in the White House.”

And unlike our Usual Suspects, he provides the data!

Although I agree with the gist of Brad DeLong’s comment, I have a quibble with his use of real/real variables in his chart. Here’s why:

https://econbrowser.com/archives/2013/12/using_chain_wei

As expected, the GDP report got a lot of attention, but what deserved more attention was this little noticed BLS release last Tuesday:

Manufacturing sector multifactor productivity declined 1.4 percent in 2017, the U.S. Bureau of Labor Statistics reported today. (See table A.) The multifactor productivity decline in 2017 reflected a 0.4-percent increase in sectoral output and a 1.9-percent increase in combined inputs. The decrease in multifactor productivity followed a 2.8-percent decrease in 2016.

https://www.bls.gov/news.release/prod5.nr0.htm

Thirteen of eighteen manufacturing sectors saw declining multifactor productivity. Labor productivity in the 2016-2017 period actually fell to a minus 0.4 annualized percentage rate. Yikes.

Arguing with PeakTrader and JBH is a thankless task. PeakTrader doesn’t understand the difference between business cycle macro and growth theory macro. He says he does, but it’s pretty clear from his comments that he really doesn’t. I seriously doubt that he’s ever read any of the old school Domar or Harrod stuff or even the neoclassical Solow model papers, never mind the endogenous saving models…and forget about the endogenous technological growth stuff from Romer, et al. PeakTrader writes about business cycle demand side management macro as though it somehow is the same thing as growth theory macro. It’s all a jumble in his head. As to JBH, he’s hopelessly confused as well. One day he’ll be singing the praises of Hayek and Schumpeter and the next day he’s blaming liberals for recessions. Apparently he never got the memo from Austrian headquarters that recessions were good and necessary things that purge the system of rottenness.

This morning I saw Stephen Moore on one of the talking head shows. What a train wreck. He blathered on about a permanent 4% growth rate without inflation and below 4% unemployment. Just what we need, someone on the Fed who doesn’t believe in any kind of Phillips curve.

” I have a quibble with his use of real/real variables in his chart.”

Note Waldman uses nominal investment / nominal GDP so he agrees with you.

2slugbaits, you have no idea how variables change in any growth model.

And, never been close to explaining a general equilibrium macroeconomy model.

I’ve shown many times, your explanations are products of “jumble” headed ignorance.

However, at least, you’re not a bigger hypocrite than Pgl or Barkley.

“2slugbaits, you have no idea how variables change in any growth model.

And, never been close to explaining a general equilibrium macroeconomy model.”

My Lord at the gibberish. How variables change? Are you taking growth theory at the preK level? Uh Peaky – the other 5 year olds are laughing at you as they know what “general equilibrium” means and they also know you do not.

Quite pretending – your own babble proves to all of us that you have no clue what any of these words mean.

What;s interesting is reading the Trump denialists taking apart the GDP report and finding negative movement in categories and often sub-categories in the sub components and trying to link them to the components of a VERY GOOD REPORT.

Why are they working so hard to negate the positive news of this report? It’s simple, because they and their fe3llow denialists have been wrongly predicting Trump’s economic performance for over 2 years.

CoRevC? You have two names now! Hey CoRev(C) – maybe the details are too difficult for your little brain to grasp but they are important for reasons we have noted. Oh wait – all this discussion is why over your head as it is economics after all!

CoRev It is a surprisingly good report, but don’t forget what GDP means. It’s a gross measure of what was produced over the last quarter at an SAAR. The concerns over the components and subcomponents are about what those numbers portend for the future. An increase in state & local spending is a good thing…especially if you’re someone who isn’t a Republican and has been arguing for more government spending. But is that sustainable given GOP dominance of state legislatures and governorships coupled with GOP calls for cuts in state and local taxes? Probably not. An increase in private inventory levels was good news for those who earned money while producing that surplus inventory, but that also implies less money in the future unless there is an uptick in consumer spending. And consumer spending on durable goods fell sharply. That fall in durable goods might have been due to Trump’s trade wars affecting the price of cars and household appliances. The anemic growth in equipment investment is also worrisome, especially when coupled with the BLS reports on weak multifactor productivity and labor productivity. Residential investment tends to be a leading indicator, and we’ve now had five consecutive quarters of negative growth in that category. There were a few bright spots, such as intellectual property as well as banking & finance, although I’m not sure our current NIPA accounting practices are doing a good job of distinguishing between value added and simple monopoly rents when it comes to those categories. Do we really want banking & finance to become growth sectors??? If you take away the volatile and transient components that go into GDP, the central tendency of the latest report is more or less in line with what were the consensus estimates.

2slugs opines: “It is a surprisingly good report, but… blah, blah, blah..” to clarify how the TDS-plagued over emphasize those ole sub-categories and sub-components of the GDP report.

Hoe many more times will Trump prove them wrong?

CoRevC complains about looking at details (“often-categories in the sub components” whatever that babble means) but CoRev insists we follow “the same moving complex metric” – whatever that babble means. Could you two make up your damn mind!

What was it that brought the house down in 2007-09? What single word captures and suffices whereas no other does? Think carefully for a moment before answering. Does the word that your mind throws up come from surface pronouncements then and since in the mainstream media? Or does it come from a slightly deeper place as what macro economists in the peer-reviewed literature and elsewhere have said? Do you take the word of these? Or have you actually dug even deeper. Digging deeper requires that you first think to do so. That simultaneously you are aware of what other seemingly qualified experts are saying. And then if you have the actual ability to dig deeper, do so.

The actual ability to dig deeper in this complex field requires a working familiarity with the tools at the disposal of economists. Equally if not more so, though, it requires an understanding of how the economy really does work. If you think that the received theory in the textbooks gives you an understanding of how the real-world economy works, have you asked yourself why 95 out of 100 economists who specialize in forecasting completely missed this largest most damaging event since the Great Depression? It was not something that struck out of the dead of night. It was a slow-motion train wreck that could be seen coming from miles away by those who had eyes not blinded by the immense gaps in the reigning paradigm. If you knew about and had studied the works of Hyman Minsky, you would have been keenly aware of what was coming. Not having known of Minsky’s work, you also on your own could still have been aware of what Nouriel Roubini, Steve Keen, and the other rare few were saying, well in advance. This would have required casting the net of your mind wide, which is an intrinsic part of digging deeper than others.

I first got onto this in real time in 2006 when a CEO client of mine running a multi-million-dollar institution asked me about what he was seeing in the housing market. This was not an economist, rather someone who made his daily bread in the trenches of the real world. I went to work on his question, and by July 2007 wrote up my findings in a short essay on systemic risk, which clearly and correctly warned about the danger of what was to come. Needless to say, the earlier one gets onto something of magnitude like this, the more attention you pay to all the nuances of what is happening in real time. As well, if you are truly a professional, you get to work right away examining the empirical past, as far back as the Great Depression if that’s what it takes. Present sheds light on past; past sheds light on present and future. Greater understanding then clarifies on all fronts. It helped to have read Kuhn’s The Structure of Scientific Revolutions and then for years have seen how the reigning paradigm simply did not cut the mustard. Allowing pure fiat money backed by nothing to come into existence. Stagflation of the 70s. On and on for God’s sake.

That single word your mind is searching for? What it should come up with is debt. The horrific 2008 episode could not possibly have happened had not the household and financial sectors been leveraged to the hilt with debt. Of course there were other elements, but too much indebtedness was the one and only thing at the core, without which this particular avalanche could not have broken loose from high up on the slopes and devastated everything in its path. I will not here provide the proof of this. That exercise is left to the reader. It will come as clear as a bell, though, if only you will look back in time at the empirical evidence at each and every catastrophic event of, say, the past 100 years. In 1981-82, for example, that episode went by the name of Credit Crunch. Drs. Doom and Gloom, Al Wojnilower of First Boston and Henry Kaufman of Salomon Brothers, were virtually the only economists in the country to correctly diagnose what was happening to interest rates and the economy as Paul Volcker engaged in monetary targeting to bring down the Fed-initiated double-digit inflation of the 70s. As a young economist employed by a boutique counseling firm, the weekly letters of virtually every economist on Wall Street passed across my desk. What became increasingly and vividly more apparent as rates roller-coastered to their continental divide high in August of ’81 is that Doom and Gloom and they only had predicted this already back in calendar 1980. They were right in real time for the right reasons, and so your digging into the past to understand today should take cognizance not only of the historic empirical data, but also of the reasoning of those few prescient individuals who were right at each critical juncture along the way. And if these individuals thought outside the tenants of the reigning paradigm as they virtually always do, chances are the reigning paradigm would ignore their insights and not reconfigure into a newer better paradigm as eventually it must. As the currently reining Keynesian paradigm certainly has not. This factoid is face value evident in the near complete blindness of the profession ahead of the 2007-08 Crisis, even though a full generation has gone by since the traumatic 1981-82 episode. Another generation of economics students mistaught macro.

Take heed all you students of economics out there reading this. Think you not that another such catastrophe of possibly even greater proportions cannot happen? Though my hopes are that when Donald Trump gets done with the main task of exposing and putting before federal courts and military tribunals the deep state enemies of America, this president will then go to work on avoiding or at least mitigating the next debt catastrophe.

Now who or what institution was at the causal heart of enabling private sector debt to build to such avalanche proportions? If you take the time to do the grindingly-hard but necessary homework to understand history’s debt-episodes, including the Panics during the 1800s and that of 1907 on which whole books have been written, you cannot help but come to the answer. For sure it cannot be any actor in the private sector (the First and Second Banks of the US were not private sector in the meaning here, nor was the banking cabal in the City of London), though the private sector is where excess debt makes its surface appearance. It cannot be the US Congress, though Congress often does play a role in these episodes. It could hardly be the regulators, for if there is no grand build-up of debt in the first place, what role could regulators possibly play? Regulators per se outside the Fed did have some responsibility in what occurred. But only because the Jack-in-the-beanstalk seed had already been planted, had taken root, and was thriving. If the regulators had pruned one side, that would simply have redirected the flow of sap more toward some other side. That seed had to come from somewhere. It didn’t just grow on a tree or drop like manna from heaven. Since you cannot have debt without the prior existence of credit, as credit is the obverse side of the coin, you ineluctably arrive by one logical step after another at the credit creation process.

And who is it that sources credit? The banking system through the lending process. And who at bottom enables the banking system to do so? Why of course since 1913 it has been the Federal Reserve who provides the reserves necessary for the banks to legally increase lending. That is, it is the Federal Reserve who is 100% in control of the monetary base. If the Fed does not let the monetary base grow excessively, credit cannot grow excessively, debt cannot grow excessively, and hence deep snow cannot accumulate on the mountainside to avalanche down upon society and wreak such devastation as took place in 1929, 2008, and multiple recessionary points in between. We have here then arrived at the culprit.

Or have we? Might there be someone or something at an even deeper causal level than the Fed? Need we dig deeper? And if so who might we find? For this you will have to engage in a bit of convergent thinking. Convergent and divergent together making up the sinew of human intelligence. One no less important than the other. Yet the convergent one not possible to the many on this site whose minds are hermetically sealed. A subject I addressed elsewhere.

Recall, then, that Chairman Alan Greenspan in his semi-annual address(es) to Congress told the committee before which he testified that that all was OK on the Western Front. But manifestly things were not all OK, as history proved. Credit was ramping up particularly in the housing sector, and the Fed was doing nothing about it. Greenspan, Bernanke, Yellen, all were dead wrong. Yellen, from her high perch as president of the SF Fed, could not possibly have been more wrong in forecasting 2½% growth the very month before the Great Recession began. Nor of course could Bernanke’s infamous utterance of contained made some short months before the recession have been more wrong. As James Thurber famously said, You could look it up. Imagine then that Greenspan had said what he said, in front of an entire profession who did have it right. Would not one reputable economist after another have thundered down on this Fed chairman economist’s head and have called him on it? The public clamor after seeing an entire profession speaking out in one newspaper headline after another would have been so great that Greenspan would have had no recourse but to pull back on the Fed’s reins. And the great catastrophe of ’08 would and could then never have grown to its full-blown extent.

So who at heart at the deepest level of causality was responsible? The economics profession of course! Unfortunately you cannot look this up. You have to figure it out all on your own. The profession never points the finger of blame at itself. Which is something the liberal dweebs with hermetically-sealed minds that populate Econbrowser, and who so hate Trump that they keep up a steady drumbeat of vitriol for reasons having nothing to do with economics, are wholly incapable of. The more balanced and open-minded like CoRev, PeakTrader, Rick Snyder, and the handful of others who post here regularly may or may not agree with every jot and tittle of what I’ve just said. But it is my reading from the tenor their comments that they honestly strive to present the truth of the economy as best they see it. That is, they come from the place of a moral world where the ends do not and never can justify the means. I welcome any corrections to this that they may have.

This explication of what has gone on for decades in the US economy and its understices is my tribute to these balanced-minded individuals who in their comments exhibit as well that they are persons of wholesome and good character. Their comments have little to do one way or another with being liberal or conservative, or with loving, hating, possibly even being neutral towards this president. Much to the great credit of Jim Hamilton who made this post, one never sees in any of his posts the kind of nasty political bias and downright ignorance so prevalent on this site, either. The kind of man you’d like to have as your next-door neighbor. A neighbor you could get along with and learn from in conversations over the backyard fence, even if you didn’t share the exact same values.

Now it is 100% predictable that one or more of the – let us use the oh so fitting slang term dweebs – will attack this comment. That their attacks will be uniformly on the nasty sarcastic side. That their feeble retorts will be as vacuous of content as mine is packed. And that by this shall you know them.

“What was it that brought the house down in 2007-09? What single word captures and suffices whereas no other does?”

Followed by paragraph after paragraph of sheer gibberish. Oh – a four letter word – DEBT. Yea – thanks to a few right wing politicians, the banks were allowed to lie to people who wanted houses. And your good buddy PeakStupidity wants to return to those crony capitalism days as neither he nor you get what Dodd-Frank was about.

OK – now back to your pointless incessant babbling!

Look. You don’t even have to bait the hook for this one. You need only throw the hook in the water. Predictable as the rising sun on all counts.

So concise this time! And you made as many substantive points as you made in that incredibly long rant – ZERO!

JBH,

Yes, that’s why I rarely comment here anymore. Any sane or objective discussion is drowned out by a few irrational progressive ideologues, encouraged and led unfortunately by one of the authors of this blog. Their goal is to suppress opinions they don’t agree with by means of personal attack and insult.

Rick, yup!

JBH, I have to admit I haven’t had the interest to delve as deeply as you on the Great Recession causes. I do, however, intuitively agree with all or at least most of what you presented. is this the major cause: “So who at heart at the deepest level of causality was responsible? The economics profession </b?of course! " I can't say, but we are seeing a track record of less than exemplary predictions from the profession.

For all the reasons you discussed re: the FED, it is perhaps to have some new businessman blood infused on the Board.

Regrettably your interpretation of the dweeb commenters and their comments is too true.

Let the fun begin.

“I have to admit I haven’t had the interest to delve as deeply as you on the Great Recession causes.”

Seriously – you take that incessant ranting to be a deep delve into the causes of the Great Recession? Lots of words typed off the same type writer you have. You know – the one that the monkeys took over!

JBH they come from the place of a moral world where the ends do not and never can justify the means.

First, you’re thinking of Rick Stryker, not Rick Snyder. But more importantly, Rick Stryker has been quite upfront about saying that the end does justify the means. Early on Rick Stryker opposed Trump and considered him a dangerous buffoon. Stryker’s post-inauguration conversion is due to his belief that it’s natural for wolves to eat sheep and if the poor, clueless sheep who voted for Trump get eaten by wolves like Stryker, then well…that’s just the way the world works.

Your understanding of history is a little weak. To begin with, there were plenty of folks who worried about a housing bubble. Predicting exactly when the bubble would burst is something else again, but that it was unsustainable was hardly a darkly held secret known only to those with deep mystical knowledge of hidden forces. You do have a point in saying that standard macro pre-Great Recession did not pay enough attention to the financial sector, so I assume that you agree with Paul Krugman’s insistence on the importance of Minsky moments. But what you don’t get right are all of the false calls of impending economic doom. If you’re forever predicting economic collapse, eventually you’ll be right. A stopped clock is right twice a day. You remind me of the suckers who play the lottery and only remember the one time they won $100 and forget the hundreds of times they lost.

I think I have a better than average understanding of economic history. Way back in the stone age I learned my cliometrics from Robert Fogel, Deirdre (then Donald) McCloskey and Stefano Fenoaltea. I learned cliometrics before I studied advanced econometrics. I would say that your understanding of 19th century financial panics is incomplete at best. In any event, I don’t see how you can reconcile your obsession with leveraged debt and easy credit with your support for Donald Trump who brags about being the King of Debt. Trump told us that he loves debt. Have you been listening to Trump’s picks for the Fed? Trump’s folks have been weakening the consumer protections against credit fraud. Trump’s appointees have been encouraging student loans for private for-profit schools that hand out worthless degrees and a mountain of bad debt. Trump’s personal creditworthiness is so bad that he had to rely upon Russian oligarchs to fund his failed projects because no reputable US bank would deal with him. Your screed against credit & debt is completely at odds with everything Donald Trump stands for, but yet you continue to support Trump. That’s called cognitive dissonance.

2slugs provides the history of TSD economics: “But what you don’t get right are all of the false calls of impending economic doom. If you’re forever predicting economic collapse, eventually you’ll be right” Right after several articles about the possibility of a recession, and we still are discussing the value of this GDP report? Sigh!

That was supposed to be TDS economics.

CoRev When did I or anyone predict a recession in 2019:Q1? It’s fair to say that I expected a slowdown in GDP to something in the 2.0% range and that I sure didn’t expect a 3.2% number; but as I argued earlier, if you look past the volatile and transient components of GDP, the central tendency puts it closer to 2.0% than 3.2%. I certainly don’t expect to see the permanent 4% growth rate promised by Trump, Kudlow, Moore and Rick Stryker. The stimulus from Trump’s tax cut will be fading as we go through 2019, so I would expect growth to slow down as well. But slowing growth is not the same thing as a recession. I have no idea when the next recession is likely to hit. There is some evidence (e.g., bond inversions) that it might happen in early 2020, but that’s a long way off.

Our host has been clear – he wonders if there is a non-zero probability of a recession in 2020 (not 2019). Hassett says no but then his predicted the DOW would hit 36000 some 17 years ago. How did that work out?

2slugbaits, with debt, you can leverage millions into billions of dollars.

And, everyone loves low borrowing costs.

Trump knows how to become a billionaire.

The Trump name is his most valuable asset.

That is, every borrower.

PeakTrader You and JBH should get your stories straight about the consequences of leveraged debt. You seem to think it’s great. JBH sees it as the root of all evil.

Lord – your babbling is really off the effing charts. Someone needs to take you away to the Cuckoo’s Nest!

Trump became rich by defaulting on debt which is why banks still charge him double digit interest rates on debt (which he will also default on). And the Trump name? A lot of Manhattan hotels are taking down his name as it hurts their business!

Can you please share us with more of your incessant stupidity?!!!!!

2slugbaits says: “Trump’s personal creditworthiness is so bad that he had to rely upon Russian oligarchs to fund his failed projects because no reputable US bank would deal with him.”

Another one suffering from Trump Derangement Syndrome.

Here’s what a psychiatrist says about 2slugbaits condition:

“What is most striking is the extent to which individuals suffering from the syndrome distort their perceptions of real world events, especially events in economic, social and political realms.”

Dirk Bezemer, Groningen University, No One Saw This Coming, June 2009. Bezemer describes a broad public search, using four criteria as a screen to find all professional and academic analysts who did see it coming, and who publicly predicted that financial instability would be induced by falling real estate prices and lead to recession. One of the criteria was that the prediction had to have some timing attached. These were Dean Baker, Wynne Godley, Fred Harrison, Michael Hudson, Eric Janszen, Steve Keen, Jakob Brøchner Madsen, Kurt Richebächer, Nouriel Roubini, Peter Schiff, and Robert Shiller.

Yet slugs says my understanding of history is weak. I don’t get it about all the calls of impending doom. I remind slugs of suckers who plunge. I have an obsession with leveraged debt. Trump’s appointees encourage student loans to private for-profits. Trump’s creditworthiness was so bad he had to borrow from Russian oligarchs. I’ve penned a screed here. And because of all the things this president has done – or that slugs thinks he has done but in some cases has no proof — or things slugs believes Trump has done but are not in line with slugs’ values – I continue to support Donald Trump and therefore ipso facto I am subject to cognitive dissonance.

It get it you don’t get it, slugs. To paraphrase Donald Rumsfeld. There are known knowns; also known unknowns; and then there are those truly pesky unknown unknowns. I do get it that you don’t get it that you don’t get it, slugs. And suspect most others do too.

JBH Well, I counted eleven economists on your list of prophets, with at least four of them clearly falling into the “public intellectual” category with a lot of followers. Of course, even though those economists you listed all predicted a collapse in the housing market leading to a recession, that doesn’t mean they all agreed on the details as to how that collapse would turn into a global recession.

The rest of what you wrote leads me to think you’ve been doing some Sunday afternoon drinking, but as best I can tell, you don’t believe that Trump claimed to be the King of Debt. And apparently you never heard Trump tell us that he loves debt. And you don’t believe he had to borrow from Russian oligarchs. And maybe you never heard of Betsy Devos and her support for college loan scams. Have you ever checked to see how much of current student debt is owed by students who got suckered into for-profit colleges issuing worthless degrees? It’s been a while, but I recall where JDH once had a posting on the problem here at Econbrowser:

https://econbrowser.com/archives/2014/03/addressing-growing-student-debt

To its shame, that increasing college debt occurred under the Obama Administration. To its credit, the Obama Administration belatedly recognized the problem and tried to contain the problem. To its shame the Trump Administration has gone out of its way to make the problem worse.

I dunno, maybe you should quit watching Fox News and put down those Daily Mail and National Enquirer papers at the grocery store.

Lord – I thought PeakIdiot babbled incoherently. More pointless gibberish from the peanut gallery!

Someone pull the plugs on these Russian bots!

Actually, JBH, I was one of those two and have never been given an explanation by Bezemer of why I was not on his list. Several of those who are on the list, have publicly said that I should have been and actually did a better job of calling it then they did.

As it is, here is a link from July, 2008, two months before the big crash, when I laid out pretty clearly what was up, especially in more detail in the comments where I made it clear the real danger was in the various derivatives markets that had grown on top of the housing bubble, a bubble on a bubble. I used a model based on Minsky, whom I knew. The paper was finally published in Macroeconomic Dynamics in 2011.

A really curious item for this thread for anybody who really reads through all the comments is that at one point i quote Jim Hamilton quoting Janet Yellen about being very worried about the situation. As it was, I knew Jim was slow to recognize the housing bubble because I had debated with him about it here at the time. The link links to the original post on Econospeak, but there is more commentary on this one at Mark Thoma’s Econnomistsview.

https://economistsview.typepad.com/economistsview/20009/07/gradual-decline.html .

Oh dear, it looks like my link may not be working. But it is correct, supposedly. You can find it alternatively by simply googling “gradual decline before crash Rosser 2008.” It is the top hit.

As an alternative I provide the original Econospeak post, which ha a bit more detail in the post, but not quite as long a comment section and without me quoting Jim Hamilton.

https://econospeak.blogspot.com/2008/07/falling-from-period-of-financial.html .

If you find the Thoma post there is a link there to the Econospeak post. If you read both of them and all the comments, you get a pretty detailed picture. Needless to say, it is funny now to see some of the commentators at that point who were quite convinced that there was no bubble and no problem and that everything was hunky dory. I note, just to link back to current discussions, that among those were both Larry Kudlow and Stephen Moore.

Somebody wasn’t reading Calculated Risk me thinks.

Sluggsy if I maybe so bold what are your thoughts on the debate about statistical significance. We have luminaries such as Andrew Gelman, Dave Giles and Tim Taylor write about it. I think someone wrote a rebuttal to Taylor on Econospeak!

My thoughts on this and $4 (USD) might buy you a cup of overpriced coffee at Starbucks; but for what it’s worth I’ve never worshipped at the temple of p 1.96 for all variables, etc. It just doesn’t happen that way…at least if you want an honest analysis in the social sciences. So we always settle for something less than perfect and I never saw why we should put too much emphasis on a p 0.05.

Ironically, a long time ago in a galaxy far, far away McCloskey used to put a fair amount of emphasis on tests for statistical significance, particularly chi-square tests.

Well, a lot of what I wrote seems to have been cropped and I don’t feel like rewriting it. My point was that we should worry at least as much about pvalues that are too low (e.g., 0.000001) as we worry about pvalues that are greater than 0.05. In the real world of the social sciences you never find cases in which you get t stats of 10 or 20 standard deviations, but yet you don’t have to look too hard to find those kinds of results in published papers. As to the McCloskey debate, I’m in the squishy middle.

Barkley,

Just out of curiosity, how much money did you make by shorting things in the crash? Did you put your money where your mouth was? Serious question.

I just rode it out. Hey, going into a period of mass volatility best just to hold on if you have a reasonable long run allocation, which I did and still do.