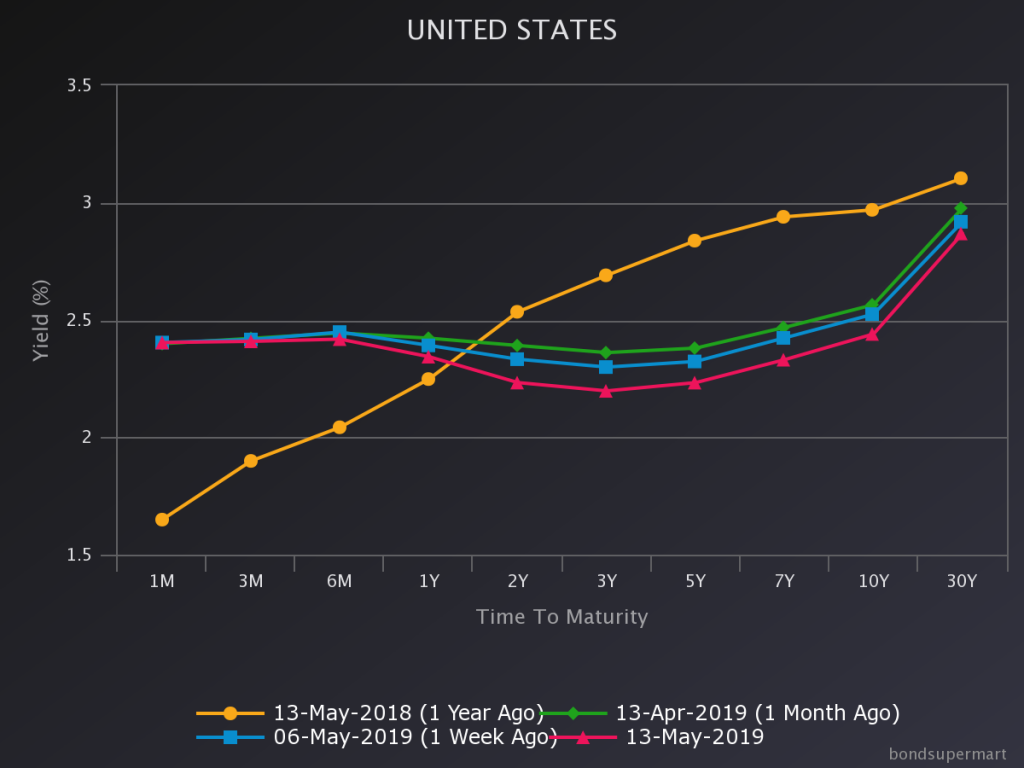

According to constant maturity rates reported by US Treasury, the 10 year-3 month yield curve was inverted as of today’s close (-0.01%). The 10 year-2 year spread is -0.22%, and the 5 year-3 month spread favored by Cam Harvey is -0.23%.

On the run yields are depicted below:

Source: BondSuperMart.

For discussion of inversions and recessions, see empirical evidence in Chinn and Kucko (2015), recounted in The Economist (July 2018).

I suspect that, if Mr. trump is betting on a strong US economy to leverage against the Chinese, he shouldn’t be too confident.

Off-topic

Recommended reading for all troublemakers of the Kopits clan. Of course any regulars on this blog will know the true attraction and eye-catching part for Uncle Moses was a below $5 sticker price:

https://www.amazon.com/When-Was-Puerto-Rican-Lawrence/dp/0306814528

https://www.nytimes.com/2019/04/11/books/esmeralda-santiago-lilliam-rivera.html

When Mr. Gundlach talks, goofballs from middle America (me) listen:

https://www.bloomberg.com/news/articles/2019-05-07/gundlach-says-yield-curve-inversion-harder-with-rates-so-low

https://www.amazon.com/Inside-Yield-Book-Classic-Analysis/dp/111839013X/ref=sr_1_1?qid=1557807549&refinements=p_27%3AMartin+L.+Leibowitz&s=books&sr=1-1&text=Martin+L.+Leibowitz

Duration is an important topic which wasn’t in the first edition.

He’s warned again about Corporate debt and Mark Zandi within the prior 6 months has also mentioned Corporate debt as a huge pitfall. Folks, pay attention. You know at certain times even money markets can get shaky and you also have stock index funds which could have a hell of a time “liquidating” when the ____ hits the fan blades just above your head.

You know, I was doing my night owl thing, eating donuts about 12 hours old and some coffee that was badly made at home (not by me ‘cuz I make good coffee), and watching one of my favorite Youtubers. Some of these people with youtube channels, I swear to God they are better than regular TV shows or Netflix even, and some of them don’t have more than 200 “followers”/subscribers. And I’m not just talking about the hot chicks either…… Anyways…… I’m sitting here watching this guy discuss at a basic level come semi-complex topics, and my mind is wandering and semi-daydreaming as it is want to do seemingly all the time, and a thought randomly hits me—-

Has anyone on this blog ever straight-out asked CoRev if he’s a “flat-Earther”?? I’m honestly dying to know this. This has actually moved up to somewhere in the top 5 questions of all of life that my feeble mind would like to know “Is CoRev a ‘flat-Earther’??”. People….. good commenters of the Menzie and Jim community of peace and love…….. please contribute to my further edification on this matter related to the great philosopher and metaphysician CoRev.

Of course the Earth is flat. If you have ever tried to stand on top of a ball, you’d immediately realize that we’d be falling down all the time on a round earth.

Some people try to make it so complicated.

: )

My query on CoRev is very serious and intense business. No jovial comments allowed, even if they do make me involuntarily grin.

you should also ask if he is a creationist. most deniers of science tend to fall in this category.

10 year-2 year spread is not inverted.

One day events may not signify much. If it stays inverted for a long time, then it is a reasonable forecast of trouble.

Julian

Julian, yup!

Spreads have either been inverted or flirting with inversion for a while. I’m not sure what that means exactly. About a week ago, Bill McBride officially declined to make any recession calls (about an hour or so after I asked if he had made any predictions – I feel so important!). I don’t personally see anything that looks like a bubble that could pop, although Moses notes corporate debt and I certainly think the amounts of student loan debt that younger people are staggering under is a drag on the economy. The trade tiff with China is a problem, but what really concerns me is the potential shooting war with Iran. Trump is going to have to be the voice of reason and avoid letting Bolton talk him into starting a war with Iran. My take is that a shooting war will tip the economy into recession like the first Iraq war did, and like the second eventually did.

With all that random noise and unclarity, the crystal ball is hopelessly cloudy plastic right now.

Do any of you remember the old joke about bond vigilantes told by political consultant James Carville?? (You know, a true consultant that you actually benefit from taking the advice of, unlike some labeling themselves a “consultant”, supposedly from the New Jersey area….. )

Mr. Carville said: “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

Do you think Carville was correct?? Before answering this question, ask yourself how many Venezuelan women and children are starving to death and have no roof over their heads right now.

https://ftalphaville.ft.com/2019/05/09/1557374439000/Venezuela-is-paying-its-bondholders-/

Neel Kashkari has an interesting op-ed in the WSJ:

Unemployment Isn’t What It Used to Be – The low rate doesn’t take account of low labor-force participation. Wages are a better indication of slack.

Greg Mankiw even liked it:

http://gregmankiw.blogspot.com/2019/05/the-fed-should-monitor-wage-trends.html

Minneapolis Fed President Neel Kashkari had a noteworthy op-ed this week, arguing that monetary policymakers should pay more attention to wage trends than they have in the past. Ricardo Reis and I reached a similar conclusion in a paper back in 2003:

https://dash.harvard.edu/bitstream/handle/1/3415322/Mankiw_WhatMeasure.pdf

What Measure of Inflation Should a Central Bank Target?

‘This paper assumes that a central bank commits itself to maintaining an inflation target and then asks what measure of the inflation rate the central bank should use if it wants to maximize economic stability. The paper first formalizes this problem and examines its microeconomic foundations. It then shows how the weight of a sector in the stability price index depends on the sector’s characteristics, including size, cyclical sensitivity, sluggishness of price adjustment, and magnitude of sectoral shocks. When a numerical illustration of the problem is calibrated to U.S. data, one tentative conclusion is that a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages.’

A much better approach to the Stephen Moore commodity price approach or the Judy Shelton gold bug nonsense!

Great comment. 5-stars even.

A very reasonable argument.