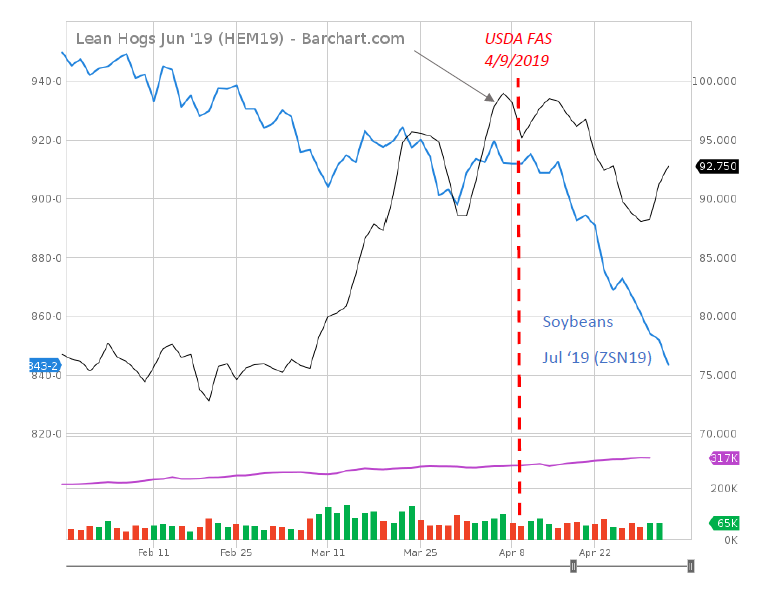

Soybean prices continue to plunge (July ’19 futures). Some have argued that decreased demand for soybeans, due to the ongoing African swine fever epidemic in China. The April 9th USDA FAS report contained information on both this, and soy market conditions. If decreased demand for soybeans was due to news about Chinese swine stocks, we would have expected rising US hog and declining soy prices. Yet hog prices have fallen for most of the time since then.

Figure 1: Lean Hog (June 2019) futures (black, right scale), and Soybean (blue, left scale). Red dashed line at 9 April release of USDA FAS Livestock and Poultry report, WASDE briefing. Source: Barchart.com, accessed 2 May 2019.

The USDA FAS report notes:

Official ASF Outbreaks Slow while Hog Inventory Plummets 17 percent

China has reported 123 outbreaks in 30 provinces through April 8, 2019, covering nearly all of mainland China. The number of outbreaks peaked in November and December but declined thereafter, reaching 7 in March. While official data on cull levels account for a fraction of China’s total hog supply, unofficial reports from China suggest far greater losses. The rapid and wide geographic spread of outbreaks, the extreme density of hog production, and lack of biosecurity across many farms may imply a greater incidence of disease.

While exact losses are impossible to calculate, monthly data published by China’s Ministry of Agriculture and Rural Affairs indicate that producers began liquidating during the fall and accelerated during the first quarter of 2019. The sow herd at the end of February 2019 was down 19 percent from a year earlier while total hogs were down 17 percent. The continued decline of the sow herd implies that pig supply will decline rapidly during the remainder of 2019 and into 2020, notwithstanding aggressive rebuilding. Despite a recent slowing of outbreaks, ASF remains a problem and there is little indication that producers have begun to restock. Authorities have sought to speedily clear quarantine zones and reduce the transit restrictions that affected markets last year. However, producers still face significant

risk in whether they will be able to market their hogs when ready.

The continued decline in soybean prices is all the more surprising given the constant hyping of the imminent deal between the US and China. Such “news” if credible should result in a rise in soybean prices. And yet, July contracts are at 843.

A apt summary of the soybean farmer’s lot: “cash contracts around $2 below break-even. The only solace is that matters can’t get much worse.”

(NB: for CoRev – On July 15, 2018, futures for July 2019 were trading at 876, within 4% of the current price.)

So, do we know how much donald trump’s USDA has already and is going to hand out this year in government welfare for farmers that’s completely unnecessary??

What would the total amount be in government welfare payments to farmers because they were dumb enough to vote for a man who tariffs them into bankruptcy??

Thanks donald tariff skunk trump!!!

“(NB: for CoRev – On July 15, 2018, futures for July 2019 were trading at 876, within 4% of the current price.)”

Wait for it – CoRev will likely post some future price that gives a different answer. After all – he tends to get confused what all of this means!

I’m way too lazy a person to start answering my own questions, so you people need to get your shit together.

https://www.desmoinesregister.com/story/money/agriculture/2018/11/25/federal-trade-assistance-trickles-iowa-farmers-hurt-trade-war/2065652002/

https://www.reuters.com/article/us-usa-trade-aid/usda-says-nearly-840-million-in-aid-paid-to-farmers-to-date-idUSKCN1NK2GT

Menzie, do you know what the average k-12 teacher in Wisconsin makes?? And can you take $840,000,000 and divide it by that number to tell me how many more teachers you could have in Wisconsin with that?? And then if you’re feeling super bored today Menzie, take that number (It has to be around like 14,000 teachers yeah??) Add that to the number of k-12 teachers you have now and then how much would that lower average k-12 class sizes if we’re just looking at Wisconsin alone??

Now people can say “Well that’s ridiculous, you’re taking a nationally devised number (federal dollars wasted on unnecessary farmer welfare payments that would be needed if donald trump didn’t impose sanctions) and looking at what could be done with that money in a single state”. Well, yeah, that’s true. But I still think it gives you a good idea what a nation is forfeiting by willingly throwing $840,000,000 in government money down the toilet (all of this caused by useless tariffs that donald trump was the protagonist for).

That’s basically to the end of 2018. We’re 4 months into 2019, so it’s a very safe bet you can add on another one-third of that $840,000,000 of government welfare going to farmers. That’s another $280,000,000. So correct me if I’m wrong, but that would then take us over $1 Trillion in USDA farmer welfare. And if it’s lower than $280,000,000 then that means whatever amount lower than $280,000,000 that is, then those are pure farmers’ losses—- unnecessary loses that American farmers are taking the burden of due to completely unnecessary trump tariffs. Some, no doubt going bankrupt.

You have two options there—the US taxpayers keep farmers in business with government provided welfare to pay their bills—or the American farmer goes bankrupt—that is the choice many farmers are facing now, because trump puts on a puppet show of “Mr Tough Guy” to all the illiterate CoRev morons out there who can’t do simple addition or simple mathematical division, never mind raising their reading level above a 3rd grader.

inside the first parenthetical of the third portion of my comment above I should have type “that wouldn’t be needed if” instead of what I incorrectly typed “would”. Sorry for the screw up.

I guess Stephen Moore lies about everything. He was less than honest even about the day he was forced to step aside!

https://talkingpointsmemo.com/news/moore-shrugs-misleading-reporters-withdrawal

Fascinating watching the misunderstandings of the AG market. IIRC, my comment to Menzie’s early article about soybean pricing due to the China soybean tariff response to Trump tariffs was that other factors also lead to pricing changes. It was followed by a short list stating with weather and farmer’s planting decisions…. I predicted that the soybean market would recover, while admitting tariffs had reduced the current prices. But, were there other causes than just the tariffs to sustain the price changes?

Weather? How can weather impact pricing? Here’s a recent article about Brazil’s 2018-19 harvest which clarifies both. https://www.nasdaq.com/article/brazils-201819-soybean-crop-could-be-secondhighest-on-record-20190426-00757

” Brazil’s 2018/19 soybean crop is poised to be the second largest on record, as good agricultural yields in late-maturing fields partially offset losses caused by a dry spell in December and January, (weather related) a Reuters poll showed on Friday…. below only last year’s record output of 119.3 million tonnes….

The upward revision reflects a new estimate by Brazil’s food supply and statistics agency Conab earlier this month, the first increase in production expectations since December. Conab said strong yields in regions where soybeans were planted later, (planting decisions)which escaped adverse weather conditions at the turn of the year, (weather related) improved the overall crop’s outlook.”

Why am I talking about Brazil’s production? Brazil, today, is our number 1 competitor, and took up the slack in China’s US imports caused by CHINA’S tariff response. Coincidental to the tariffs, Brazil also had a record crop with China as a ready market source, but still planted slightly less soybeans than prior. (planting decisions)

As this article says, couple that ole increased competition, weather, planting decisions, and now a Swine Flu epidemic in China have combined to lower the demand for soybean feed.

Of course, if you are a TDS afflicted Trump hater, you can only consider the Trump China tariffs as the cause of the reduced prices for the US soy bean price drop. There just can’t be any other cause.

Why didn’t Menzie’s article actually explain the importance of the China ASF outbreak in soybean pricing? When he makes this statement: “If decreased demand for soybeans was due to news about Chinese swine stocks, we would have expected rising US hog and declining soy prices.” How can he ignore the ~10% increase hog prices shown in his own graph?

Sometimes it appears that TDS just over rides fundamental training/education. Supply does not affect Demand? His own article shows the inverse! Has his article contradicted what i said? NO!!!!!

JBH, might have some fun with this article. I already have. Now let the fun begin.

CoRev: Simple question: Where are hog prices relative to April 9?

CoRev falsely accuses us of ignoring all economic factors beyond trade protection. Since we are talking about hog prices, let’s see what your link said in the pork section:

https://apps.fas.usda.gov/psdonline/circulars/livestock_poultry.pdf

“Global production is down 4 percent in 2019, driven by a sharp reduction in output in China. African Swine Fever (ASF) outbreaks have resulted in liquidation of breeding herds. Reduced hog supplies will result in a substantial contraction in pork production this year. Outside of China, production is growing moderately, led by strong growth in the United States (4 percent) and Brazil (6 percent). EU production is flat as weak hog prices caused producers to reduce sow herds last year. However, improved export prospects may encourage producers to begin expanding herds later this year. Canada production is forecast just 1 percent higher as producers have been reluctant to expand herds due to low hog prices.”

The supply curve shifted inward. I wonder if CoRev realizes this should have increased hog prices.

“Global exports are forecast 8 percent higher, fueled by rising demand from China and steady economic growth in most major pork markets.”

Rising demand – huh? I bet CoRev does not get that this tends to drive prices higher.

As Menzie notes, hog prices in the U.S. have fallen since April 9. How did this happen? Oh wait – I bet the CoRev sophisticated model blames this on Biden!

ASF was a well known problem in China prior to April 9th. Look at your own chart or do a google search with custom dates.

https://www.reuters.com/article/us-china-swinefever/china-urges-crack-down-on-concealing-african-swine-fever-agriculture-ministry-idUSKCN1QL0XN

mike414: Understood. But then do correlation of soybean prices with hog prices with your preferred event date, and see if consistent with thesis that declining/stagnant soybean prices caused by ASF. I don’t have to do the regression to know it doesn’t. This remark applies as well to CoRev’s remarkably dense comment.

Well, there’s more than one independent variable here. I agree with you that ASF is not solely responsible for the price of soybeans. However, soybean crush is down in China, so it’s having some effect. I mention crush because I think it’s the cleanest proxy given there isn’t great feed data. But, one doesn’t feed hogs soybeans, you feed them soybean meal.

Given soybeans are somewhat fungible, I didn’t expect any meaningful impact on price from the trade war. I suspected origin shifting for compensate. However, beans in the Dakotas were essentially trapped as they normally move to the PNW where there was no demand. So, I was wrong. That said, I still think you may be overestimating the impact of the trade spat on price. The farmers in the Dakotas that planted fewer beans this year (USDA prospective plantings) would agree with you!

Anyways, kudos to you for putting your thoughts out there and creating a dialogue.

mike414: If you can point me out to any statistical analyses on this point, I would be much obliged. I have thought about gathering data together to run regressions – but I have a day job.

Regarding the irrelevance of tariffs, I think it depends. See https://www.jstor.org/stable/2527162?seq=1#page_scan_tab_contents cited in https://econbrowser.com/archives/2018/04/are-soybean-tariffs-irrelevant .

Menzie, CME today’s price is: $. 85525. Their 12 month chart shows this: https://quotes.ino.com/charting/index.html?s=CME_HE.K19&t=f&a=&w=&v=d12

The spot market today is at $.86 up from $.079 on 4/9/2019. Their chart also shows a market adjustment since 2/20/2019 of ~+62%

CoRev: Think about this…hog prices go up due to ASW. If indeed soybean prices are declining over the last two weeks due to ASF, then they should’ve been declining even more rapidly during the period of rapid ascent in lean hog prices. I centered on 4/9 in an attempt to do an event study (on WASDE and USDA FAS meat report). Apparently that subtlety eluded you. Again.

CoRev still thinks supply causes demand. Yes he cannot be bothered with SHIFTS of a curve v. MOVEMENTS along a curve. And you seriously expect him to understand even the basic Econ 101 model???

And yea – he does not even know the difference between spot prices and future prices. Talking to a dead tree would be more productive than talking about these issues with CoRev.

Menzie, please stop the single correlation attempts. “Think about this…hog prices go up due to ASW. If indeed soybean prices are declining over the last two weeks due to ASF, then they should’ve been declining even more rapidly during the period of rapid ascent in lean hog prices.”

The world is more complex. I’ve just in this comment string listed 3-4 different factors, all of which impact prices singly and in combination. Apparently that subtlety eluded you. Again.

Why all the snark at being questioned?

“LEAN HOGS May 2019 Future”

That is the title for your own link. It is a futures prices not a spot price. We have tried and tried to get you to understand the difference. And you still do not.

Pgl, I’ve started to ignore your trolling, unless you embarrass yourself. As you have again. You failed to read the comment. There were 2 prices in that comment and only 1 reference. Sometimes you amaze with your ignorance, but never with your need for attention, even when it is to point out your own failings.

I would better delineate the data/references, but I’ve been trained by you in your BEA references. Any economist should be able to find that data/reference combination. Well, almost, you won’t even try.

@pgl

I told you, stop bringing up this vicious “witch hunt” on Stephen Moore. I’m feeling very verklempt. The women he committed adultery with as an example to his children on how men should treat women have feelings too:

https://www.youtube.com/watch?v=I1hV1ywUmlo

Remember the old Stephen Moore saying kids: “Sideline Hoes Have Feelings Too”

The more we talk about Moore, the less leeway he has to cheat on his 2nd wife and fornicate after the divorce. JBH and CoRev probably don’t want us violating “the Republican Bro code” so let’s keep this on ‘the low down”, ok?? Remember we only discuss these things after whispering the code phrase very very softly “Small p***** wearing glasses spends all his discretionary time in the Reagan Library”. Only after whispering that code phrase can we discuss which girls Moore is b******* outside of whichever number wife he is on at that moment.

“Fascinating watching the misunderstandings of the AG market.”

That babble that followed WAS a fascinating misunderstanding of these markets. You are indeed the master of misunderstanding!

“you can only consider the Trump China tariffs as the cause of the reduced prices for the US soy bean price drop. There just can’t be any other cause.”

OK CoRev – you have followed Bob Barr’s lead with a blatant lie. Pay attention and you will see the rest of us considering all factors within the context of sensible models. Granted you have not yet learned the basics of these models and please proceed with your incessant babbling.

“Sometimes it appears that TDS just over rides fundamental training/education. Supply does not affect Demand?”

The 2nd sentence could only be written by someone who never had a lick of training in economics. Hey CoRev – try talking about SHIFTS of the supply curve and movements along the demand curve VERSUS SHIFTS of the demand curve and movements along the demand curve.

Oh I’m sorry. I’m using a language that is foreign to you.

In case you missed it, CR, JBH has serious other concerns: foremost, the number of forthcoming indictments (and subsequent rousting out of beds of 308,009 traitors in the middle of the night by American patriots ) thus rocking western civilization, yada yada,yada , to its core.

But, if you’re now on board with this omniscient egomaniac and his quazy conspiracy “theories”, you’ll no doubt look forward to the day when only real Americans feel secure enough to post only the correct information on blogs like this one.

Midwest farmers are being sacrificed to protect intellectual property rights of Silicon Valley billionaires.

Typical Trump policy. Maybe farmers will wise up. Maybe.

And the odd thing is that Silicon Valley billionaires are stereotypically left leaning, coastal elite types who are less likely to vote for a guy like Trump. We live in strange times.

What with the great jobs report that just came out, this is just one more conflicting data point in the economy. I don’t remember what all was going on in 2006, but I do remember being a bit confused by the signals. By 2007, the economy was cooling, in my estimation, but hiring was still going on in a big way. At least that’s what I remember. I’ll have to go back and see if I can dig up all the different things that went on in 2007 and 2008, up to the point it was pretty obvious we were on our way into the abyss.

https://www.bls.gov/news.release/empsit.nr0.htm

‘Total nonfarm payroll employment increased by 263,000 in April, and the unemployment rate declined to 3.6 percent, the U.S. Bureau of Labor Statistics reported today.’

Unemployment FELL – Trumpsters doing high fives! Of course none of these clowns will check the details of the household survey. The employment to population ratio did not rise as it still stands at 60.6%. Rather the labor force participation rate fell from 63% to 62.8%. In fact the household survey suggests employment fell by 103 thousand.

This morning Trump spent an hour long phone call with Putin. Press Secretary Sarah Sanders said that they both discussed how “they knew there was no collusion between them.”

I think my irony-meter just broke.

In other words they are still colluding to cover-up their past collusion!

“CoRev

May 3, 2019 at 11:39 am

Menzie, please stop the single correlation attempts.”

Mother of Pearl. Menzie provides us with an intelligent discussion of the market that notes reasons why the global supply curve shifted upwards and the global demand curve also shifted upwards. What other factors should be included in your esteemed model? Oh you did not say. You just whine that the world is complex. Well yea – it would seem complex for someone who never bothered to learn the basic aspects of economic modeling. Heck you do not even know the difference between spot prices and future prices. So a little advice – stop lecturing people who do get economics.

“CoRev

May 3, 2019 at 12:21 pm

Pgl, I’ve started to ignore your trolling, unless you embarrass yourself. As you have again. You failed to read the comment. There were 2 prices in that comment and only 1 reference. ”

I did notice you referenced both spot prices and future prices. Maybe you were confused because I did not color code my points with crayons. As usual you referenced a futures price as if it were the spot price. But then you never got the difference which was my simple point that went right over your head once again!

So here’s today cash prices for corn & soybeans at Iowa grain elevators:

Closing cash grain bids offered to producers as of 1:30 p.m.

Dollars per bushel, delivered to Interior Iowa Country Elevators.

US 2 Yellow Corn Prices were generally steady to 1 cent higher for a state average of 3.43.

US 1 Yellow Soybean Prices were mostly 1 cent lower for a state average of 7.55.

Iowa Regions #2 Yellow Corn #1 Yellow Soybeans

Range Avg Range Avg

Northwest 3.41 – 3.65 3.49 7.44 – 7.56 7.51

North Central 3.31 – 3.46 3.41 7.42 – 7.54 7.48

Northeast 3.29 – 3.43 3.38 7.43 – 7.69 7.55

Southwest 3.42 – 3.53 3.48 7.48 – 7.77 7.61

South Central 3.33 – 3.60 3.42 7.47 – 7.79 7.55

Southeast 3.30 – 3.56 3.38 7.49 – 7.79 7.65

Corn basis to STATE AVERAGE PRICE for the CBOT JULY contract -.28

Soybean basis to STATE AVERAGE PRICE for the CBOT JULY contract -.88

https://www.iowaagriculture.gov/agMarketing/dailyGrainPrices.asp

WINNING!!!!