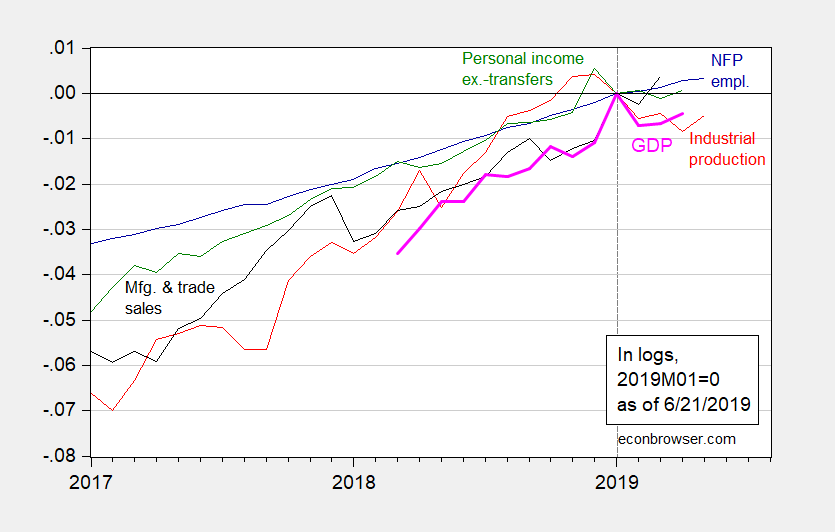

Industrial production, personal income ex-transfers, and Macroeconomic Advisers’ monthly GDP are all below recent peak; manufacturing and trade industry sales and nonfarm payroll employment are still rising (although barely, in the latter case). Here’s a graph of these five indicators.

Figure 1: Nonfarm payroll employment (blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), and monthly GDP in Ch.2012$ (pink bold), all log normalized to 2019M01=0. Source: BLS, Federal Reserve, BEA, via FRED, Macroeconomic Advisers (5/30 release), and author’s calculations.

The first principal component of the four BCDC indicators (NFP, IP, pesonal income, sales) has been flat since January 2019.

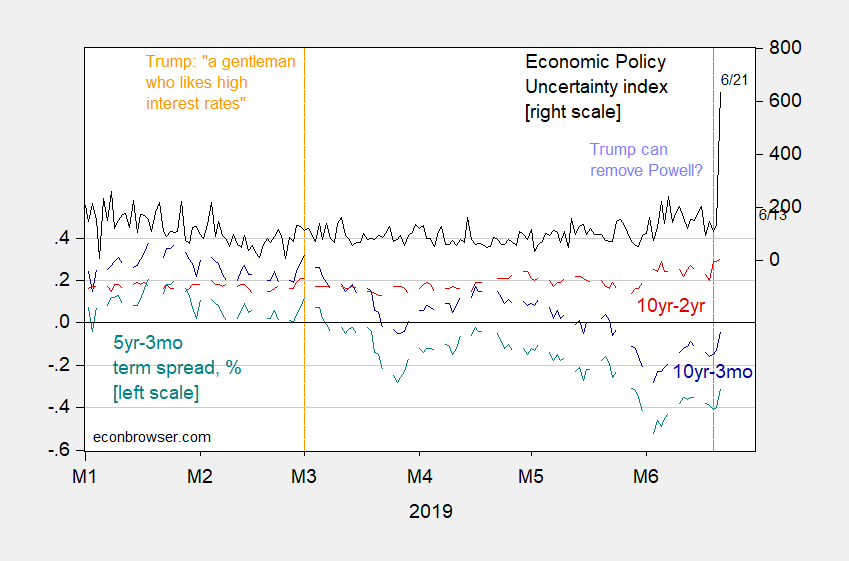

I haven’t updated the prospective recession indicators shown in this post, but here are the term spreads and uncertainty index for this year.

Figure 2: Treasury 10yr-3mo spread (blue, left scale), 10yr-2yr (red, left scale), 5yr-3mo (teal, left scale), in %; and Economic Policy Uncertainty index (black, right scale). Source: Fed via FRED, US Treasury, and policyuncertainty.com, accessed 6/21/2019.

Despite the very recent shrinking in the 10yr-3mo spread, the spread has been inverted for nearly a month now.

Saw this over on VOX, and it seemed to be a topic you had batted around a decent amount and thought you might take an interest in it, on the small chance you hadn’t seen it already:

https://voxeu.org/article/quantifying-impact-leverage-ratio-regulation-dollar-basis

Professor Chinn,

If it is not too much trouble to program, it may be interesting to have an anonymous vote each month during the recession watch to see how Econbrowser readers rate the likelihood of a recession over the next one month, six month and twelve month horizons. Rather than submitting probabilities, readers could indicate with a (0,1) vote for recession over the mentioned time periods. For example, I think most readers would indicate a “0” for recession within the next month.

Interesting update from the New York Fed DSGE Model Forecast for June 2019. The forecast is from The Liberty Street group associated with the NY Fed.

https://libertystreeteconomics.newyorkfed.org/2019/06/the-new-york-fed-dsge-model-forecastjune-2019.html

The forecast from Liberty Street provides the following disclaimer:

Disclaimer

The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the authors.

@ AS

I often like these kind of ideas, and have a certain enthusiasm for them. In fact I am often the one bringing up these type of ideas to blog hosts, to which the hosts often pat me on the head, and then try to kill my enthusiasm with whatever practical view applies. However they are hard to carry out for multiple reasons. 1) How much do readers’ political views affect their predictions on recession?? 2) How does Menzie control for people who have an ability to hide or even change their real IP address?? 3) How do you control for (differentiate) regular readers and new readers who just want to participate in a fun kind of survey?? 4) Can we gauge the actual economic education of the readers?? On average—Probably better than “Joe Six Pack” on the streetcorner, probably worse than someone with a 4-year bachelor’s degree in business—but in fact we have no idea.

I also respectfully disagree with you, I don’t think most regular readers (emphasis on regular, and that includes “silent” readers who check in but rarely comment) would say we’re going to have a recession inside the next month. In fact, if I were to guess, I think you’d be hard-pressed to get 33% of the regular readers here to tell you there will be a recession by July 31 of this year, if that is what you were indeed saying you thought they would say.

Moses,

Thanks for the comments.

I had thought of some of your comments about the failings of the votes, still thought it may be fun to see what the votes would look like, even given that some may try to “game” the outcome. Maybe just a bad idea as you suggest.

I think we agree on the outcome of what readers think the odds of a recession are within one month. I think most readers would say the odds are small and thus indicate “0” , no recession as opposed to “1” a recession. As to six months and one year, difficult to say. The number of readers who say recession may be close to the posted probabilities as presented on this blog.

It’s not a bad idea. I’m game.

AS: Certainly an interesting idea. Certainly, also, beyond my meager web coding skills…

I’m happy to be on record, with the name you know me as. The blog, including, I assume Menzie, know my email address and because I’m a Luddite, there’s no subterfuge by intent. Any subterfuge in IP addresses or anything else is purely accidental. I’m not worth tracking down, but anybody who wants to probably could.

So, here it goes – I expect a recession or conditions that the average person considers a recession in approximately 12 months. My outhouse economist indicators say we aren’t there yet, and the Seattle economy isn’t showing much sign of tanking just yet. Seattle isn’t a particularly good proxy for the rest of the country anyway. Even so, cranes are coming down, condos are going unsold, and that will lead to a slowdown in construction and real estate. Large commercial projects have a freight train quality to them. Once they are going, the economy may turn, but the project continues to chug along.

I’m seeing evidence of more price sensitivity and less sense of urgency among buyers of various things. Headhunters aren’t calling me on a regular basis to see if I want to manage construction projects nearly as often as they did five years ago. The economy may plateau for a while, and then it will ease back. My take is that it will be a fairly mild downturn, more like a breather. But, it’s still going to be a slowdown. It may or may not be a technical recession with two quarters of negative growth in a row. But it sure won’t be boom times in mid-2020.

The orange guppy may finagle something or get lucky and avoid an economic problem. But, my expectation is that it’s coming and coming about this time next year.

Local newspaper stands up to Trumpian hate:

https://www.sctimes.com/story/opinion/2019/06/21/our-view-cowards-our-downfall-st-cloud-somali-fear-refugees-new-york-times-race-muslim-immigrants/1528035001/

“Our real problem is that there are too many cowards in our midst. Yes, we said it: Cowards. Cowards who blanch at the idea of Somalis “just walking around” on a public trail. Cowards who cost local businesses thousands of dollars by overreacting to a mismarked security vehicle out of fear of Sharia law — which isn’t coming for us. It just isn’t, and only cowards believe it is. Cowards who festoon their pickup trucks with loud mufflers and confederate flags to strike fear in others as they attempt to cover their own inadequacies. Cowards who are too afraid to shop, dine or relax in contrived “no-go zones” also used by people “not from Norway” who like to shop, dine and relax.”

Who are these cowards?

https://talkingpointsmemo.com/edblog/local-newspaper-denounces-islamophobic-cowards

‘On Friday, a New York Times article made the rounds which profiled the Concerned Community Citizens (“or C-Cubed”) of Saint Cloud, Minnesota, an Islamophobic group obsessing over the local population of Somali refugees and fretting about white replacement. “I think of America, the great assimilator, as a rubber band, but with this — we’re at the breaking point,” Kim Crockett, vice president of a think tank called the Center of the American Experiment, told the Times. “These aren’t people coming from Norway, let’s put it that way. These people are very visible.”’

People from Norway are cool with C-cubed but not people who practice Islam. C-cubed are Trump’s kind of people.

@ Menzie

Menzie, I want you to know it was between this and a very obscene scribbling someone did on top of a map of the USA, which “may” have been a kind of a political statement on the South–Southeast portion of our nation. I thought it was funny as hell (like whatever you’re drinking coming out of your nose funny) and then I thought to myself (“Has Menzie let lots of my more crude things past his filter even to the poor professor’s own detriment??” Now, I will not tell you the answer I gave to myself on that, but I decided to post this instead.

https://www.newsweek.com/closethecamps-trends-news-unsanitary-conditions-detention-centers-spreads-1445399

BTW Menzie, I am extremely crabby and bitter with no alcohol in my system for awhile now, so I’m being really good natured on this. Never let it be said Uncle Moses is not contributing to civilized dialogue.

Also, something entered my head related to my above comment. I would get a HUGE kick out of seeing you, Professor Chinn, use that hashtag mentioned in the Newsweek story in your twitter account feed. I would get a semi-chuckle and kind of a shot to the arm seeing that. Though I know you treasure your professional reputation dearly and keeping that (having a hard time with words here), “professional cache” and your respect that you deserve very much and have no doubt moved personal mountains to get. So it’s easy for me to say “it would be cool if you ‘did this’ on twitter”. I don’t have to face any consequences like you do in your university role—just saying I would get a charge out of it.

Arguably the most important economy in Europe, or the most “impactful”, look at the bar graph.

https://tradingeconomics.com/germany/business-confidence

What do the index numbers mean, exactly? They all appear to be different scales.