Growth is already slated to decelerate, but in the absence of the Tax Cuts and Jobs Act, it might have decelerated even more; on the other hand in the absence of crazy high policy uncertainty, growth might have been faster…

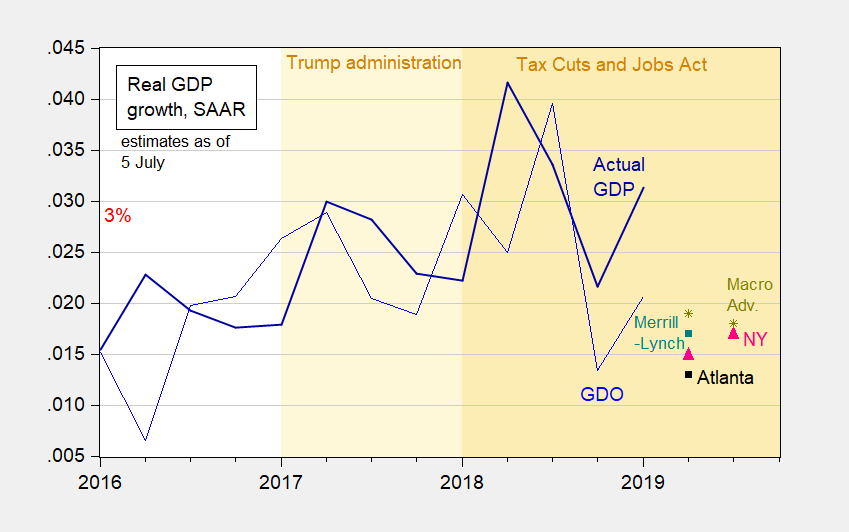

Figure 1: Real GDP growth as reported (dark blue), GDO (blue), Atlanta Fed GDPNow (black square), NY Fed Nowcast (pink triangle), Macroeconomic Advisers (chartreuse *), Merrill-Lynch (teal square). Source: BEA 2019Q1 3rd release, all forecasts as of July 5, except for NY Fed (July 3), and author’s calculations.

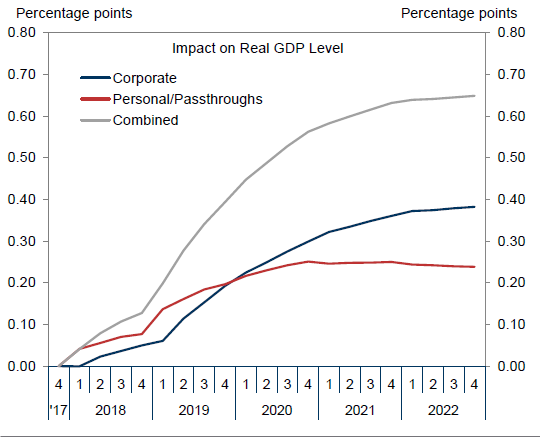

What is the Trump factor in all this. The Tax Cuts and Jobs Act is the signature legislative accomplishment of the Trump era. Goldman Sachs’s estimated the impact of the TCJA on GDP as follows:

Source: Phillips, Mericle, “US Daily: Tax Reform Through the Eyes of the Fed,” Goldman Sachs Economic Research, 5 December 2017.

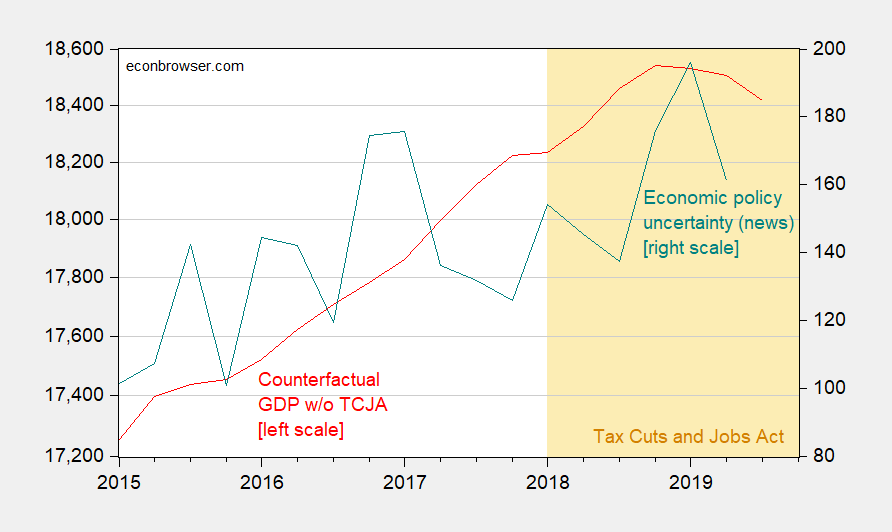

If these estimates are correct, then we can back out an implied counterfactual GDP path that does not incorporate passage of the TCJA. This is shown in Figure 2 (where I have used the Macroeconomic Advisers’ forecasts through 2019Q3).

Figure 2: GDP as reported (black), as forecasted by Macroeconomic Advisers (blue), and counterfactual w/o TCJA passage (red) all in billion Ch. 2012$ SAAR. Source: BEA 2019Q1 3rd GDP release, Macroeconomic Advisers July 5, 2019 forecasts, and estimates from Goldman Sachs of TCJA impact, and author’s calculations.

Obviously, the counterfactual is contingent upon the estimates of the TCJA impact. I myself believe the impact is likely smaller than the GS estimates (see Congressional Research Service report) given that their estimates implied a big boost to equipment investment growth, while 2019Q1 equipment investment declined 1% (SAAR).

The decline in equipment investment suggests that the Trump factor includes other components; one highlighted in my previous discussions is heightened economic policy uncertainty.

Figure 3: GDP counterfactual w/o TCJA passage (red, left log scale) in billion Ch. 2012$ SAAR, and economic policy uncertainty index (teal, right scale). Source: BEA 2019Q1 3rd GDP release, Macroeconomic Advisers July 5, 2019 forecasts, and estimates from Goldman Sachs of TCJA impact, policyuncertainty.com and author’s calculations.

The decline in counterfactual GDP coincides with the elevation of economic policy uncertainty. And that phenomenon has much to do with Mr. Trump.

(See this post which calculates a counterfactual recession probability holding economic policy uncertainty at Obama levels.)

This graph is pretty good I think.

https://www.realclearpolitics.com/epolls/2020/president/us/2020_democratic_presidential_nomination-6730.html

In head to head only Biden and Sanders win out. Here is what I think on Harris, She loses Iowa and she loses New Hampshire (“loses”= 3rd place). Most of your western states vote late. Can Harris hold on if she’s “playing catch-up” on delegates count?? At some point even lesser-educated Democrats are going to say “Let’s get this over with and have our winner”. From my viewpoint Harris has to take those early votes (minimum 2nd place) as even Californians are going to dump on her if she’s behind on delegates when their particular states chooses their nominee.

Harris got an early bump because she’s physically attractive and is still very unknown. When her DA and AG record are exposed, it’s not going to be such smooth waters as she’s getting now. If those things are in the local paper 2–3 days before the vote, they’re going to peel off to Warren and Klobuchar. And when Klobuchar pulls out of the race with no funding for TV adverts (and she will) Harris better pray she gets ALL of Klobuchar’s 2%, and it’s not going to happen. Probably Warren takes that 2% of Klobuchar’s when she drops out. California is not “optional” for Harris, she either takes it or she’s black toast. And who knows Harris’s record BETTER than Californians?? I’m not ready to take California delegates winner to Vegas as of this moment, but I would strongly argue that familiarity with Harris’s record is not going to be a benefit for her on the Cali delegate count. Harris will get the Chris Christie Jersey treatment.

The CA. primary is March 3rd.

Not only that, but in fact Harris is popular there, having just won solidly a race for Senate. She also served two terms as CA AG, both with solid statrewide wins, along with her earlier record ad DA in SF. They already know her record. California is not where revelations about Harris’s record, which she will have to deal with in other parts of the country, will hurt her. She has never lost an election in CA, and, indeed, that primary is March 3.

Last poll in Iowa has her second to Warren, with Biden in third place and Bernie in fourth. Warren and Bernie clearly have an edge in NH, but Harris is likely to do well in next-up SC. You really do not know the order of the races do you, Mose? SC will be the serious Harris-Biden showdown.

Oh, and in WaPo this morning the head to heads were Biden 53-Trump 43, Bernie 49-Trump 48, Harris 48-Trump 46, with both Warren and Buttigieg tying Trump in the low 40s. So, Harris does second best against Trump head to head after Biden and ahead of Bernie, who is gradually sinking.

Oh, and since you love to diss older powerful women, let me fill you in from an inside source I heard over the weekend on this matter. No, it it not Pelosi, not temotely, who is the smartest person in the Congress, smarter even than Warren and Harris, both of whom are very smart. It is Dianne Feinstein who should not have run for reelection. It has not gotten into the news media yet, but apparently about half the time she simply does not know what people are talking about when they speak with her. Definitely going senile and seriously so.

Oh. and the idea that Klobuchar is going anywhere is total joke. She has never been above 2 percent, and she never will be. She is the one with the creepy smile who has massive staff turnover problems. There might be lower level players who might still break out, maybe Booker or Castro, but it will not be klobuchar. She may not be as dead as Gillibrand, but, heck, even Tulsi Gabbard (or whatever her name is) is more likely to break out than Klobuchar. She at least is one of the few candidates not only to talk about foreign policy but to say intelligent things about it, ans, in fact is currently ahead of Klobuchar, if only by a percent or so, but at the level they are, that is a lot.

@ Barkley Junior

No links to your Iowa poll that has Harris in “2nd place” to Warren’s “1st place”?? You’re not in the other Prof’s thread so you can’t hide out from challenges to your false statements here. Are you going to play “doddering old man” again and not be able to do a copy/paste when it doesn’t go to your own writing on other blogs?? Let’s see this Iowa poll that has Warren “1st” and Harris “2nd” to Warren. I wanna see the LINK Barkley, not JUST the typing of a half-senile old man. This I gotta see from your fictional playworld. Show me the link that says Warren is in “1st place” in Iowa. You’re so jam-packed with crap Barkley, I don’t have to prod or poke you before it starts oozing out of your ears.

Wow, Mose, you are really losing it.

It is in Politico from July 3, Warren at 20%, Harris at 18, Biden at 17, Bernie at 12, http://ww.politico.com/story/2019/07/bidens-iowa-support-poll-1397998 .

Another poll from Vox on July 2 has Biden in the lead in Iowa at 24, Harris still second at 16, Warren at 13, Bernie at 9, and Buttigieg at 6. See “A new Iowa poll shows Kamala Harris on the rise” https://www.vox.com/policy-and-politics/2019/7/2/8960/poll-kamala-harris .

Satisfied, Mose? Or should I dodder over and ooze crap all over you from out of my ears?

BTW, while I have said he is sinking, I do not think Bernie is completely without chances of getting the nomination, even if he is currently in fourth place probably behind in whatever order Biden, Harris, and Warren, is that each of those top three could implode at some point for reasons we cannot even forecast at this time, while Bernie will pretty much chug along. We already know about him pretty much. His weakness is his strength. It is pretty much all out there, and he has a consistent and clear platform, whether one likes it or not. He does have a strong and loyal base, and if those other three have major unforeseen problems, he may still pull it off.

The first link of course, doesn’t work—what a surprise, we’ve never seen that one from Barkley Junior—the link given from the dumb-F**K doesn’t even work. There’s a “shocker”. So we’re left to guess 3 possibilities here:

A) Barkley Junior is a F’king LIAR

B) Barkley Junior is a F’king LIAR

C) Barkley Junior is a F’king LIAR

Your second link doesn’t support your original contention, that you had an IOWA-based poll where Warren was polling “first” and Harris “second” in the same damned poll. Let’s assume for the moment that you are not BOTH senile and an A1 class LIAR—let’s assume that false premise for about 25 seconds here. Are you so damned dumb that every time you have NOTHING to support your contention you think you can type a bogus link that goes to nowhere and people won’t catch on what a piece of shit “Professor” you are?? Have you no shame AT ALL???

Just tell me you have no shame or self-consience—it’d be the FIRST and ONLY thing I’ve ever seen you type I won’t have to back-check as being true. Even CoRev is intelligent enough to know—if he’s telling 20 lies in a row congruently, not to leave made-up links or links to Quora after leaving 5 links that go to nowhere. Even CoRev manages to crawl his way above that much f’king “intelligence”.

Please do not post from the Alzheimer’s critical care unit. ok!?!?!?! PLEASE for the love of God do not post from the Alzheimer’s critical care unit—-think of all the academics who used to pass you in the hallways connected to your career before you started getting high snorting hemorrhoid cream.

Heck, now I left out a slash I had in before. Again.

https://www.politico.com/2019/07/03/bidens-iowa-support-poll-1397998

Looking for an apology from you, “Moses Herzog,” and it had better be a good one.

@ Barkley Rosser

I’ll make you a deal—if you can tell me what Harris’s 1% lead (in the one single poll you are quoting, “Focus on Rural America”) over Biden equates to in people surveyed (without other commenters here posting it before you do) you’ll get your apology—an apology BTW, you don’t deserve based on the number of false statements you have made prior to this time, and never apologized for yourself. But you will get that apology, if you can tell me what that 1% Harris over Biden lead equates to in number of people surveyed.

I happen to know the answer to that question Barkley—you better type it carefully when you post that number if you want your apology. I politely ask/request Menzie, to PLEASE DELAY posting any comments that contain that answer I am looking for from Barkley Rosser, for about 16 hours to give Barkley time to ferret that number out.

No, Moses, I am not doing RA work for you nor am I submitting to your ridiculous demands. You tell us the number and tell us how important it is. I completely agree that Biden clearly remains the frontrunner, but his main rivals are Harris and Warren, both of whom have moved up since the first debate, Harris more dramatically so, with Bernie probably fourth, although some national polls have him still in second place, although he seems to be gradually declining. Does that not look pretty reasonable.

As for conditioning your apology, sorry, but that is not acceptable. I have apologized numerous times here for making errors. I have never consciously lied, and you should note that while I have criticized you quite harshly on various grounds, I have never accused you of consciously lying, to CoRev, who notoriously does so repeatedly.

If you wish to continue making these accusations of me lying, as opposed to simply making mistakes that I later accepted corrctions on, please procvide them or apologize. Your ranting and cursing and use of large bold letters in all this is quite unhinged.

Oh, and if your example is going to again be that nonsense about claiming that I lied about characteristics being distributed skewly, that is a case where you were simply wrong, although you have never seemed to accept it. Again, a genome is not a population, boy.

Moses,

It looks like I left out a w near the beginning of the url on that first one. That I am bad at typing these things is exactly why I do not put lots of links into my messages, unlike you. You were the one demanding the link. If putting the third w in does not work, then google “Warren 20 Harris 18 Iowa,” which is how I found it, or put “Politico” in there. Oh, and I did not lie about the second link. It says exactly what I said it says, Biden at 24, Harris at 16, Warren at 13, Bernie at 9, and Buttigieg at 6.

Right? Right? Right? So take your accusations of lying and go flush yourself down the nearest toilet.

You are looking as out of it as CoRev here. I did not lie, much less “fucking lie” three times. I said there was a poll that gave that result and there was, and it is easily found, even if I made a mistake and left out one letter from the url.

I suggest you take your really stupid demands for links from me, which only end up making you look both wrong and stupid, as well as like a totally sickening jerk, to CoRev. Demand some links from him, like one to these apparently nonexistent Apollo 11 awards he has told us first that he got one of and then expanded that to “awards.” There is the out and out liar around here, although most of us have figured it out by now. I make mistakes, like leaving out a “w” in a url. I do not lie, and you have never found me out doing so.

So, are you really that against Warren because of her “Pocahontas problem”? What is your beef with Harris, that I like her? Oh, she was a meanie DA? You like the creepy Klobuchar whom staff flee from, but she was also a meanie DA who put pot smokers in jail. I know, I know, it is Bernie uber alles, and especially uber any uppity women. You really are sick, “Moses Herzog.”

“Moses Herzog”

I am going to make it easy for you and retype the link, which is missing an s after http as well as a w. If I get it right, I expect an apology, and I suspect that Menzie and others would consider it appropriate. You have gone completely off the wall making even CoRev look reasonable. If I do not get it, well, google it. it is for real, hard as you may find it to believe (keep in mind Warren has been running the most intensive ground game campaign in Iowa of any of the Dem candidates so far, and they seem not to care about all that Native American stuff that seems to nearly give you a heart attack).

https://www.politico.com/2019/07/bidens-iowa-support-poll-1397998

Oh heck, I also left out the day, 03. I shall try again (I am really not good at this linking stuff).

https:/www.politico.com/2019/07/03/bidens-support-poll-1397998

Proof positive that I am really bad at this, and in future will simply provide google search. I have also left out “story.” Before I try this one more time, I note that the title of this story is “Biden’s Iowa support crumbles in new poll,” and it is by Natasha Korecky for Politico on July 3.

https://www.politoco.com/story/2019/07/03/bidens-iowa-support-poll-1397998

I have closely double checked, and the last url I posted is correct, but when I hit it took to long to open and did not get there. So google it if you really want to see it, and when you get there you can double check that the url is correct, which I am going to type again.

https://www.politico.com/story/20q9/07/03/bidens-iowa-support-polls-1397998

On last one typed an “o” rather than a “0” but the correct one still not working, so google it if you want to see it, and I expect a serious apology out of you, “Moses Herzog.”

https://www.politico.com/story/2019/07/03/bidens-iowa-support-poll-1397998

Ah, last one works finally, at least for me.

Apology, please, MH, although you can denounce me all you want for not being good at typing those links. But I never claimed to be.

FWIW, I really don’t care about the policy differences between the Democratic candidates. The ONLY thing I care about is electability. Come 20 Jan 2021 we’re still going to be stuck with a GOP controlled Senate even if the Democrats maintain control of the House. That will be a very binding constraint on any Democratic president. Medicare-for-All isn’t going to happen no matter which Democrat wins. Fiscal policy will be just as constrained as it was under Obama post-2010. Supreme Court justices will be just as difficult to get through the Senate. The only thing I expect out of the next Democratic president is to stop the bleeding. Stuff like fixes to Obamacare, changes to federal regulations, a sane foreign policy, a good purging of the corrupt EPA, etc. And on those issues there really isn’t a dime’s worth of difference among the Democratic candidates. So at the end of the day the only thing that counts is nominating the man or woman most likely to beat Trump. At the moment that appears to be Biden, but I really don’t care if it’s Harris or Warren or Booker or Mayor Pete. I don’t even care if it’s Bernie. I don’t agree with a lot of Bernie’s economic policies, but the risk of any of those policies ever getting enacted are as slim as a snowball’s chance in hell. The Democratic president we finally get will end up being pretty much the same no matter which one wins. But that Democratic first has to win, and that means nominating the most electable.

Sugar high? Menzie goes all Geithner on us! Or was Menzie listening to The Archies?

https://www.youtube.com/watch?v=h9nE2spOw_o

In just one sentence, Trump undermine all of the pompous self serving self promotion intellectual garbage we have endured from Princeton Stevie Boy:

https://www.buzzfeednews.com/article/adolfoflores/trump-defend-immigrants-border-detention-conditions

‘Following weeks of reports of the “dangerous” and “horrifying” conditions inside border detention facilities, President Donald Trump on Wednesday tweeted that many of the immigrants held in overcrowded facilities “are living far better now than where they came from, and in far safer conditions.”‘

This may be true as conditions in Central America for many of the immigrants were life threatening. But of course Princeton Stevie Boy ignores this to promote his market based visa system as if wage differentials were the only issue. Yes – Princeton Stevie Boy is disgusting in this way.

But Trump is disgusting too. Simply because one is being raped less in U.S. detention centers less than one is being raped in Central America does not make it right.

Uncertainty as an economic brake to perform the function of rate hikes to keep the economy from overheating. Brilliant! Like everything that happens lately, there is no doubt that it is 100% considered and part of a long-term, carefully crafted strategy. One rooted in exhaustive analysis of potential consequences and outcomes. Did I miss anything?

The implication is that the tax cuts prevented at least a three quarter recession, if I am reading Figs 2 and 3 correctly. I have my doubts. Would growth have been a little slower? Probably. Would there have been a recession? Don’t think so. Was it worth adding a structural 1.5% of GDP to the deficit? Absolutely not.

Having track quarterly GDP forecasts, I find they are not a particularly accurate tool.

I’d add I remain baffled that the economics community treats GDP separately from the debt used to create it.

Steven Kopits: I’ll remember to tell “the economics community” that they are constantly ignoring the links between debt and GDP…

Is this like how degreed climatologists are ignoring the connection between global warming and the weather??

https://youtu.be/OsWDohWkkC0?t=48

Can you imagine the dearth of knowledge there would be on this blog without “Princeton”Kopits visiting to drop these pearls of wisdom?? It’s frightening to think about. And to think they only allow Kopits on FOX news pre-6am……

“And to think they only allow Kopits on FOX news pre-6am……”

But can’t he get a Nobel Prize in economics for his comments on Fox & Friends?

Well, ok, Menzie. So we increased debt structurally by 1.5% of GDP wit the tax cuts, something like that. GS says it prevented a three quarter recession. So here’s the question: Was the tax cut a good idea? I can’t tell. Nothing you have presented or anything I have ready access to can tell me whether that was a good idea.

If it were a company, and it levered up to increase revenues — more or less what the tax cut did here — I can look at any number of standard statistics to determine whether or not that was a good idea, things like ROA, ROE, ROI, net income, revenue/equity, etc., etc. Here I don’t have any kind of ready metric to tell me whether levering up the federal balance sheet was a good idea.

Steven Kopits: Actually, we increased the ***deficit*** by 1.5 percentage points of GDP. You should keep in mind the distinction between debt (a stock variable) and deficit (a flow variable). The distinction is important.

Here’s one of *many* posts on the subject of whether the TCJA was a good idea: https://econbrowser.com/archives/2017/12/views-on-fiscal-stimulus-then-and-now

I think I probably have a better sense of income statements v balance sheets than you do. I am actually a pretty good accountant historically.

At best, the US government has cash accounts. We have no accrual based income statement and we have no balance sheet. So here’s a question: Does healthcare spending on seniors increase well-being, or does it just prevent well-being from declining? So, this is a gross asset v net asset (net of depreciation) issue and how that links to the income statement, GDP and productivity, in this case. In a company, if you increase revenues, but depreciation expense increases the same amount, then you are no better off. In essence, you’ll have to pay more in capex to hold the same asset value. In such an event, shareholders are no better off, and you have no resources to increase wages.

Now, when you have a young, fast growing society with low dependency ratios, this issue can be finessed. When you turn the corner though, this becomes a material issue. Therefore, to use the corporate analogy, you could see increasing per capita GDP accompanied by stagnant or declining real household income (after tax) and declining societal welfare. No? I haven’t see a discuss of this, and best I can tell, it seems to be pretty important for all of interest rates, employment rates and business cycles.

Back to you.

Steven Kopits: How would you ever know how my handle on accounting is? And if your understanding is so good, why did you put in “debt” when “deficit” was the right word?

If you had a good handle on accounting, you would have already written a piece on net v gross human capital wrt to healthcare and infrastructure, because it’s literally central to the entire practice of macro today. If you can’t get an up-cycle because of a lack of population growth and an aging population, then you don’t get a mismatch between assets and liquidity, and it’s harder to generate an asset bubble or a price shock and a resulting downturn. On the other hand, you’re always in a kind of twilight, like Japan, where the country seems to be slipping in and out of recession — which we would expect if the workforce is dropping by, say, 1.2-1.5% per year, vs 1.4% productivity growth. And low growth means low interest rates, and that means it’s political expedient to blow out the budget deficit and run up the debt to GDP ratio, per Japan and now the US. And that means countries are going to blow through the 60% debt to GDP ratio thought prudent back before 2007 — without consequence, at least for a while.

So, yes, if you understood depreciation and balance sheets, you would have done that work years ago, because it’s central to macro economics today. At least that’s my sense of it.

Steven Kopits: Well, heck, then the entire economics profession should’ve ended up doing that topic. But we all ended up in different areas of research, even if we are macroeconomists. Wonder why? Maybe it’s not central to the question we are interested in. After all, some of us work on the business cycle, not *growth*. Some of us work on the international aspect — and maybe capital flows matter more to cycles than the trend.

It’s well within your capabilities.

“So we increased debt structurally by 1.5% of GDP wit the tax cuts”.

The deficit is a flow concept whereas debt is a stock concept. That you do not know the difference tells us all we need to know about how you are utterly clueless when it comes to basic concepts.

“If it were a company, and it levered up to increase revenues — more or less what the tax cut did here — I can look at any number of standard statistics to determine whether or not that was a good idea, things like ROA, ROE, ROI, net income, revenue/equity”

Borrowing does not increase revenues. It does allow one to raise new capital without raising new equity. It seems Princeton Stevie flunked finance 101 or basic business. Something tells me you would have no clue what a return on assets analysis would even mean given utter incompetence to even basic business terms. BTW Stevie – an economy is not exactly the same thing as running General Electric.

Ordinarily, businesses borrow money either for capex or to make an acquisition. Both of these would typically be associated with an increase in revenues (except in the case of replacement capex or defensive acquisitions). The borrowing associated with the 2018 tax cuts ended up both with increased government spending and increased cash in the hands of consumers, with this leading to a blow-out of the trade deficit in a near full-employment economy, which we have already discussed. Both of these factors increased GDP per the analysis above, at the expense of increasing the structural deficit materially.

You are correct that government borrowing is not quite the same as business borrowing. Business borrowing is almost always done in the context of some ROI criteria. Not so government borrowing, much of which will go to finance current period consumption. The implication of this, by the way, is that government borrowing to increase spending may actually reduce the rate of long-term GDP growth because it encourages over-consumption and crowds out private investment. That is, capital retained in the private sector will be subject to a ROR test and will thereby insure at least a market rate of return on those funds. By contrast, government spending may earn far below a market rate, indeed, much government spending may represent a loss of capital! Thus, deficits to finance increased government spending, it would appear, reduce GDP growth–almost the exact opposite of the private sector. (I would add this also underscores the notion that high tax / high spending countries will see structurally lower growth over time.)

So, government and business borrowing are not quite the same, as you rightly point out.

“I think I probably have a better sense of income statements v balance sheets than you do.”

This is from the same person who thinks taking on more debt = increasing revenue? Lord – your stupidity is almost as large as your pathetic arrogance!

“At best, the US government has cash accounts. We have no accrual based income statement and we have no balance sheet.”

Really? I guess you never heard of government bonds. And some governments do have capital accounts. BTW – doing health care in terms of depreciation of machines is SO YOU. BTW Stevie – most people are not robots even though you appear to be one.

Your comments here are even dumber than treating Hispanics fleeing dangerous conditions as nothing more than seeking higher wages. Can you please stop insulting all of us with this intellectual garbage?

Dear Steven,

Please see the Spring issue of JEP (and the references in the papers):

https://www.aeaweb.org/articles?id=10.1257/jep.33.2.89

This field vibrant and advanced quite a lot since the crisis.

Kind regards,

Vasja

Dear Steven,

I apologize. I posted a link to the Ramey’s paper (which is brilliant in itself and very worthy of a read).

This is the correct link:

https://www.aeaweb.org/issues/547

Please see the Symposium on Fiscal Policy.

Best,

Vasja

Thank you. Terrific. You should think of starting a website. Maybe you could call it ‘Econbrowser’.

Vasja is an extremely kind and gracious gentleman. Unfortunately, Vasja is unaware he’s wasting his time on you. I’m guessing Vasja is Asian Indian or Bangladeshi. In which case, if we were at a bar I would tell him as a “brown person” he had full right to at least one full-forced punch into your shoulder. After which I would encourage a golf gallery style applause from the patrons and give Vasja all the free drinks he wanted until 2:00am.

So you can self promote your intellectual garbage somewhere else? God – you are beyond contempt.

An absurd statement but if you wish to “educate” us please provide the publication in the American Economic Review that discusses this alleged link. BTW – if you have some argument for it over at your worthless blog, I guarantee that no one has read it or even should.

Stephen: There is always an optimal amount of debt. But you won’t find this concept in the literature or the textbooks. In a good economy, debt would grow in synchronized proportion to the growth of the economy so as to simultaneously maintain optimality of debt and maximum potential GDP growth subject to the debt optimality constraint.

However, over the past couple decades debt has risen far above optimum due to the profligate policies of the Federal Reserve. Incremental purchasing on credit raised the empirically measured growth rate of the economy, which is all anyone looks at. Yet a portion of this growth was stolen from the future by taking debt further and further above-optimal, which debt burden then on an ongoing basis extracts its toll by siphoning off purchasing power to repay principal and interest. In effect this is usury, another topic anathema to the profession. All this was hardly noticeable until debt went ballistic post-2008. Empirical GDP during all this time was of two parts: the genuine part due to the circular flow of income earned honestly in the absence of credit in excess of optimal, and an additional sliver of faux growth due to incremental spending on credit in excess of optimal.

Potential GDP growth will be degraded into perpetuity by the burden of excess debt (built up over the past couple decades) unless and until the level of debt is brought back down to optimal. This more than anything else is why the CBO and Federal Reserve have long-run potential growth below 2%.

It of course does not have to be this way. The first order of business, contingent on the context of the economy at the time, should be to reduce the level of debt to optimal. When this gets underway is when the picture laid out here of what’s really going on will emerge. Reducing the growth rate of debt sufficiently to get the job done necessitates that the credit impulse go negative. The first derivative doesn’t have to go negative, but the second derivative absolutely must if ever debt is to get back to optimal.

As the credit impulse goes negative, empirical GDP will fall below what would otherwise be potential in a natural economy with optimal debt. As debt moves back down toward optimal, the amount shaved off of GDP growth, consisting of interest and principal payments in excess of ordinary such payments, will gradually shrink. The lessening debt burden will in effect have a gradually less inhibiting effect on growth. This will slowly move empirically measured GDP growth back toward its true potential until at some point the economy will be back to the desirable rate of growth, that consistent with society’s resources and a level of debt that’s once again optimal.

It is sad indeed that someone like Menzie does not understand this. This is a placeholder for just how out of tune with reality the profession is. It is a tick past time for a paradigm change in economics. Nationalizing the Fed, getting a sound medium of exchange, eliminating usury, guiding the financial sector along the path of optimal debt and maximum potential, these at a minimum hint at what the next paradigm might look like. But in order to get there, corruption in politics, government, academia and elsewhere will have to be rooted out. Making the public aware of just how extensive corruption has become is the first step.

An optimal amount of debt? Stevie Boy is stuck in corporate accounting so let’s remind him what Merton Miller and Franco Modigliani said about this in their path breaking articles on financial economics. The mix of debt v. equity has no effect on the value of a firm’s assets. Optimal amount of debt? Seriously?

Now as Barkley noted – macroeconomics is not corporate finance. But let’s see we had very strong growth from 1947 to 1980. Guess what happened to the Federal debt/GDP ratio? Hint, hint – it fell a lot. Similar story for the 1993 to 2000 period.

Of course the Reagan/Bush41 years saw a debt explosion – and growth rates over this period were actually lower. Same story for the Bush43 years. In a word – Stevie is clueless. Yea – your comment is a wee bit better. But optinal amount of debt?

“It is sad indeed that someone like Menzie does not understand this.”

What a stupid statement. Me thinks you do not even understand what you just said. No one else does either as it was long winded gibberish. But yea – it is not nearly as stupid as the intellectual garbage Princeton Stevie writes!

Sorry, JBH, there is no such thing as an “optimal level of debt.” I notice that you gave no definition or conditions for dtermining what that might be. Also, for the aggregated economy and the national debt, it tends to fall when the economiy grows rapidly, ceteris paribus, and expand when the economy falls due to the automatic stabilizers.

As it is, more important that the debt/GDP ratio is the burden of the debt, which is given by the interest payments on the debt to GDP. Back in 1990 that got as high as 3 percent. Today it is less than 1 percent, although rising.

Oh, and the Federal Reserve has nothing to do with the size of the debt, nothing. That is all about taxes and spending, neither of which the Fed has any say in or control over.

Maybe you need to go back to that grad program in math and econometrics you flunked out of and continue to keep the identity of a secret.

“There is always an optimal amount of debt… In a good economy, debt would grow in synchronized proportion to the growth of the economy so as to simultaneously maintain optimality of debt and maximum potential GDP growth subject to the debt optimality constraint.”

That’s not entirely clear to me. A government can reasonably borrow money to pay for assets which will generate a commensurate return over time. For example, if you build a new airport, you can expect it to generate a stream of appropriable and societal returns that pay for the debt over time. So that’s debt for growth. But what about a reconstruction of the airport, which essentially replaces accumulated depreciation but doesn’t increase revenues, eg, a JFK rebuild? Other examples would be road resurfacing or, say, the proposed new rail tunnels under the Hudson. They would not generate new revenue, or at least much less than the cost of capital. Can you finance those out of debt?

That’s a more tricky matter. If you had paid down the debt on the original structure, then the answer is ‘yes’. Your free cash flow is likely to get dinged for a while, but sure, that’s not an unreasonable approach. On the other hand, if you haven’t paid down the previous debt, then the answer is ‘no’. So here again we start getting into matters of assets gross and net of depreciation, and replacement capex is quite different from new capex, at least potentially.

Now let’s turn our attention to human capital, for example, to health, in this case, a back surgery. For a young person, this surgery would enable them to work and create income and thus a source of repayment. Therefore, this could be financed out of debt. But what of an 86 year old woman? Here there is no source of repayment, because the person is retired, so the expense has to be paid out of current resources, tax revenues, for example. If this expense for the senior is paid out of debt, then it will have to be paid from current expenses in a future period. In other words, some other senior ten years down the line will be deprived of a back surgery because you committed those funds to a procedure today.

This is the essence of the fiscal challenge facing states like NJ, IL, CT, NY and CA, among others. The retirement and healthcare payments promised to, say, public sectors workers in 1985 should have been fully funded then and the liability stripped from the states’ balance sheets. But they didn’t do that, such that these liabilities are now falling into the current and future periods, requiring sizeable and unsustainable tax increases, on the one hand, and a reduction in current period services, on the other. This is creating a huge wedge between tax paid and services received from the taxpayer’s perspective, leading to an out-migration from many of these states.

The point I am making to Menzie is that the rules of thumb you use in an economy with a fast growing population of young people will not necessarily be applicable to an economy with limited or negative population growth — Japan, Europe, China, partly the US — and an increasing dependency ratio of elderly. I think the macroeconomics business has not adjusted, and it needs to do a better job. If you have failed to account for demographics, you will not have a proper appreciation of business cycles, asset values, interest rates, political pressures, and indeed, the prospects for democracy.

Pres. Obama proudly reduced the federal budget deficit by 75% (as a percent of GDP) from FY 2009 through FY 2015—something that was never done during any previous recovery—and that was the cause of our slowest recovery in the post-WW II era. By 2016, GDP growth had fallen under 2%.

Even Pres. Hoover increased the deficit during the Great Depression from FY 1931 through FY 1933. There was a budget surplus every year in the 1920s and four separate recessions during that decade with the last one ending in the Great Depression. In 1929, the debt-to-GDP ratio was only 16% due to those budget surpluses. In 1933, FDR began massive deficit spending which increased industrial production above its 1929 peak by December, 1936.

You need to distinguish between changes in the deficit from changes in economic activity versus changes in fiscal policy. E. Cary Brown published something on this in the American Economic Review some 65 years ago.

Of course it would be better if the deficit were the result of infrastructure spending instead of tax cuts, especially for billionaires. But politically it is not possible with PAYGO to deficit finance infrastructure from the federal budget. States OTOH, deficit finance infrastructure all the time.

In any event, increasing the federal deficit is stimulative regardless as Keynes pointed out:

“I should add that this particular argument does not apply to a relief of taxation balanced by an equal reduction of Government expenditure (by reducing school teachers’ salaries, for example); for this represents a redistribution, not a net increase, of national spending power. It is applicable to all additional expenditure made, not in substitution for other expenditure, but out of savings or out of borrowed money, either by private persons or by public authorities, whether for capital purposes or for consumption made possible by a relief of taxation or in some other way.” The Means to Prosperity, p. 15-16.

“But politically it is not possible with PAYGO to deficit finance infrastructure from the federal budget.”

PAYGO applies when we are talking about infrastructure investment? It shouldn’t.

But PAYGO does not constrain tax cuts for the rich. It should.

PAYGO has alas become an excuse for letting the Republicans rob the rest of us blind.

Look I get there is a long-run government budget constraint despite the usual babble from the MMT crowd. But the fiscal policy debates have been warped by the right wing agenda.

The long-run government budget constraint is inflation and interest rates. Given current conditions, we should be spending several trillion on infrastructure for the next few years.

Of course the deficit/debt is a cudgel that political opponents have always used to bludgeon each other during elections and 2020 will be no different. Economists need to step up and advocate that more infrastructure spending is needed now.

Interesting article, but the Trump ‘put’ has not been paying off so far. You want to see low growth rates, then elect one of those socialist Democrats!

Have you done an economic analysis of the Green New Deal? Please submit it to the American Economic Review for publication!

Trump puts up a picture with President Reagan praising Trump. Only problem – Reagan never said what Trump claims Reagan said:

https://talkingpointsmemo.com/news/trump-reagan-quote-fact-check

Trump lies even about the words of St. Reagan!

Just as a way of thinking about the GS estimate and the counterfactual, shouldn’t we think a bit about the fiscal multiplier? Since there is no recession assumed in the GS estimate, and were were fairly close to fill employment by 2017, then the multiplier should reasonably have been less than 1. Subtracting the entire GS “lift” in the counterfactual assumes a multiplier of 1, does it not?

If so, then counterfactual might not be recession. Might be, but might not. If we pick some multipliers out of the literature, we could narrow things down a bit.

macroduck: My understanding is GS ran their simulations in some version of FRB/US; FRB/US does not exhibit strong nonlinearities in the multiplier (i.e., is not a lot smaller when output is above potential than when it is below). So while your view is reasonable, it’s not incorporated in their model, and hence estimates of impact on GDP and other macrovariables.

The bigger issue is I think the idea that the impact of the TCJA turned out to be smaller than thought — here we don’t know that for a fact, it’s just my conjecture.

Valery A. Ramey wrote a great paper on where we currently stand on fiscal multipliers. (My interpretation of) her conclusions, drawn from several papers, are:

– the fiscal multiplier is 1 or less and seems to be independent from the buisness cycle (despite Aurbach&Gorodnichenko’s paper),

– there is some evidence that fiscal mutliplier is likely to be above 1 at the ZLB,

– tax multiplier, on the other hand, seems to be extremely large, between -2 and -3 (for a positive tax shock, a revenue increasing shock, i am not sure the effect is symmetric for a negative tax shock that decreases government revenues).

@ Vasja

Discussion of lack of fiscal policy by the American government and the efficacy of it is sadly missing on the internet. You seem to be intelligent and well read Vasja—- PLEASE MAKE YOURSELF A REGULAR COMMENTER/READER ON THIS BLOG Vasja. We need more regular commenters like you and I have the sixth sense I could learn a HELL OF A LOT by interacting with you online.

Please join our belligerent and dysfunctional little blog family. You can play Michael Stivic juxtaposed to my portrayal of Archie.

Vasja,

Congratulations on impressing “Moses Herzog” so much he praises you in capitalized and bold letters. However, in order to keep yourself in his good graces I warn you not to say anything nice about Elizabeth Warren, Nancy Pelosi, Hilary Clinton, or Kamala Harris, although it is OK to say nice things about Gite Gopinath and Amy Klobuchar. Also, if he makes an inaccurate statement about statisitcis or probabiity, do not correct him. If you do so, you will not hear the end of it, and those capitalized and bold letters will be attacking you for all sorts of things rather than praising you.

Also, if he makes a false accusation against you that is shown to be false, do not expect him to apologize. Rather expect him to keep repeating it, with ever larger and bolder letters, which he thinks are very effective at convincing people of things, especially incorrect things.

So, good luck with keeping on his good side.

@ Barkley Rosser

I feel sad and downcast you haven’t answered my query. When you do (assuming you can supply the correct answer) you will get your very undeserved apology.

You are seriously ill, “Moses Herzog,” and should be banned from this blog.

Oh, Vasja, you are really lucky that he has forgiven you for making an incorrect link. Others not in his favor (e.g. me, see above) get slimed and insulted when we make bad links. Then it is the worst thing in the world, and when “Moses Herzog” gets caught making false accusations, instead of apologizing for it, he starts making demands related to his stupid point and goes running all over the place repeating it, making himself look even stupider and sicker.

So, Vasja, pray to whatever deity or deities you might believe in that you never annoy “Moses Herzog.” It might put him over the top and all the way into a mental institution with unmitigated rage.

@ Vasja

https://www.flickr.com/photos/albinoflea/195844086

Ah, but (fingers crossed here), if there are nonlinearities in the multiplier (seems to be increasingly accepted as true), and the GS estimates assume otherwise, then we are looking at estimates which give too much credit to fiscal policy and too little to the underlying strength of the economy.

The thing that really seems wrong to me is the math showing recession absent fiscal stimulus. Why recession? Looks like an artifact of the GS estimate rather than something that would actually have happened. If the financial shock late in Q4 would have caused a recession, it would have begun in Q1 at the absolute earliest. And as financial shocks go, it wasn’t all that big. Would the government shutdown have caused recession? The loss of income from the shutdown was quite small, too. I think GS got their math wrong.

If the GS estimate is implying a recession that wouldn’t have happened, then it’s attributing too much of the growth in recent quarters to fiscal stimulus. Which is what you get if you wrongly (I’m suggesting) assume that fiscal stimulus works just as strongly at full employment as in recession.

Could be confidence eroding investment. Then why is hiring still strong?

Menzie and others,

Look at the Macro Advisers forecast, and the rates of growth in 2016 and in 2018 prior to the passage of the TCJA. They are parallel and basically the same. Wouldn’t a reasonable forecast be that the same rate of growth would have prevailed with no TCJA? Even if you buy the Goldman Sachs estimate of the effect, which seems vastly overstated to me, isn’t it also reasonable was that you got a speeding up of investment purchases, and no real change in the growth rate? The original paper on the Lucas critique had this sort of effect for the Investment Tax Credit. Isn’t it a real possibility here?

Julian

“Steven Kopits

July 8, 2019 at 1:22 pm

If you had a good handle on accounting, you would have already written a piece on net v gross human capital wrt to healthcare and infrastructure, because it’s literally central to the entire practice of macro today.”

Lord the arrogance of Princeton Stevie. How do you know he has not written on this topic? BTW – where was your article on this issue published? Snicker. There are a lot of articles in macro written on human capital. There are lots of articles written on gross v. net investment. And yes – there is a lot of articles written on health care. I bet you have read none of them. If I’m wrong – link to the best two and provide us your summary of them. This should be a lot of laughs!

“Steven Kopits

July 8, 2019 at 1:39 pm

It’s well within your capabilities.”

It is within Menzie’s capabilities but we know Princeton Stevie could never handle this task!

“Princeton”Kopits can’t even figure out which wealthy white guys and corporate conglomerates are hiring all these illegals.

https://www.bloomberg.com/news/features/2018-12-21/brand-name-companies-no-name-workers-how-ghosts-at-contractors-keep-ice-at-bay

https://www.usnews.com/news/national-news/articles/2018-01-22/is-ice-finally-targeting-employers-of-illegal-workers

When we discuss this section of immigration law—audits and penalties for those hiring illegal immigrants—“Princeton”Kopits becomes the mirror image of Sergeant Schultz:

https://www.youtube.com/watch?v=XlUPhjU–Fw

The Obama administration made greater use of administrative fines to punish employers that hired immigrants who weren’t authorized to work in the U.S. However, as the Congressional Research Service notes in a 2015 report, the number of penalties remained “very low relative to the number of U.S. employers.” Companies fined for such violations represented less than 0.02 percent of all U.S. employers.

“Obama, in his wisdom, I think – and I’m a Republican, I don’t usually say that about Obama – decided that a more effective way to do it is through audits. You don’t get as much media, but it’s more effective. You get many more of them. And you don’t get just people that are there that day, you get anybody in a place’s workforce that isn’t legit,” says Tamara Jacoby, president of the group ImmigrationWorks USA, who advises small- and medium-sized businesses as well as GOP lawmakers. “You go from people who are there in riot gear to people who are in green eyeshades.”

ALAN NEUHAUSER FOR U.S. News and World Report

You know who two of the biggest offenders were around the year of 2010?? Chipotle Restaurants and Abercrombie & Fitch clothes. I’m sure the GOP/Republican snobs who ate there and purchased clothes there around the year of 2010 would be “shocked” that they were consuming food and clothes produced by illegal immigrants. And Mitch McConnell and Ted Cruz cry themselves to sleep every night thinking about it as they market a never-to-be-built wall to the CoRev village idiots

Quite the opposite. I have stated on any number of times before, that demand suppression — cracking down on employers in this case — does work. On the other hand, when you start to do that, you find out that 80% of the US population is against you. That’s why it doesn’t go anywhere, and the various anti-migrant folks are left with supply suppression, which only reduces black market activity by 15% at horrific social costs.

Kopits: “Does healthcare spending on seniors increase well-being, or does it just prevent well-being from declining?”

This fits right in with Kopits claim there were no excess deaths in Puerto Rico, just unfortunately premature ones.

The dude is weird. He has one twisted mind.

As a young person, growing up in America, you may have asked yourself “What kind of character does it take to be a high-paid lawyer in the American legal system??” Let me try to explain this with a very simple example which pretty much covers the whole gambit:

https://twitter.com/AliWatkins/status/1148357641812545536

Now, if you feel that’s “shooting too high” for a career choice, you can always become a policeman and shoot people in the back, and then later tell people you felt threatened and you saw a green colored M&M candy that looked like a large machete in the sunlight.

https://www.youtube.com/watch?v=XKQqgVlk0NQ

Cue national anthem:

https://youtu.be/Zo_mpwmashg?t=8

The defense lawyer first link tried to tell us having sex with a 14 year old is not rape. Seriously? Statutory rape fellows. Come on. Turning children into prostitute is not a crime? WTF?

On the matter of point estimates and probability distribution of noise in soybean price forecasts, it should be noted that while indeed that noise is probably not all that far from Gaussian normal so the mean is a good estimate of central tendency, this is not necessarily the case for all futures markets. A classic example that Menzie (and also Jim H. and Bob F.) knows about is the “peso problem,” first identified by Ken Rogoff in his 1979 PhD thesis at MIT.

So the peso problem is/was the fact that futures prices of the value of the Mexican peso against the US dollar regularly underforecast the actual eventual spot value of the peso. So not all futures markets forecast on average the actual future spot prices that come about. The reason is that the underlying distribution for the behavior of the Mexican peso is skewed downwards. That is, historically, the Mexican peso goes along on a more or less random walk against the USD, but from time to time there is a large and sudden decline in the value of the peso. So, rational markets take into account that probability of a sudden drop in the value of the peso that is not offset by an approximately equal chance of a large increase in the value of the Mexican peso against the USD.

However, the forces driving the price of soybean do not obviously reflect any sort of skewness like that, with the possible future external shocks that push the price down roughly offset by the possible shocks that would push it up, with there being quite a few of those..

To Steven:

You are very well informed about energy markets, especially oil ones, to the point you can discuss those reasonably even with Jim Hamilton, a top expert. While I think you oversell you solution, you also know a lot about the immigration issue.

However, your comments here suggest that none of these favorable remarks can be made about your knowledge of macroeconomics. All you have done is embarrass yourself here on that front, especially when you choose to criticize Menzie on it. This is not your area of expertise, even if you now a lot about accounting. But, accounting is not macroeconomics.

Steven thinks all one needs to know is accounting if one wants to understand macroeconomics. Which is absurd of course as you note. But based on his comments here – Steven flunked accounting 101. And yet he lectures Menzie? What a sad joke.

That youtube of the TRUMP ANTHEM was unbelievable. Hey Donald – make out like Megan Rapinoe and just stand there silently!

Ticker take parade in south Manhattan for our soccer stars tomorrow morning. Trump not invited!

pgl,

His bungling of debt and deficit is especially embarrassing, stupid for both accounting and macroeconomics.

And yet he lectures Menzie on accounting? Just wow!

Barkley –

Do you really think I don’t know the difference between debt and deficits? I think you know I do.

On the other hand, if you have specific issues with what I write, please don’t hesitate to challenge them. I’m always happy to learn something new.

Steven,

That I would presume that you do know the difference is why I was surprised to see you at least appear not to know the difference. Again, there are many ares where you are clearly knowledgeable and make competent remarks. But on this particular discussion on this thread you have been just the opposite, with so many problems (some not mentioned by other) it is not even worth wasting time pointing out all the nonsense you spouted. Please stick to areas you really do know what you are talking about regarding. This stuff has been worse than embarrassing.

I can’t reply to generalities, Barkley. If you’ve got a specific beef, let’s hear it.

Sorry, Steven, but while maybe in some fantasyland that supposedly serious people like you ridicule, human capital is or should be a part of National Income and Product Accounting is not and will not be the case, not even remotely. This is just one of several totally embarrassing points you made on this thread, and I say this as someone closely linked to Simon Kuznets, who invented the NIPA.

Let’s put together the key arrogant yet incredibly stupid statements made by Princeton Stevie Boy:

“Steven KopitsJuly 8, 2019 at 7:04 am

I’d add I remain baffled that the economics community treats GDP separately from the debt used to create it”

When our host corrected Stevie on the fact that deficits are flows while debt is a stock, we got:

“If it were a company, and it levered up to increase revenues”.

Debt is a stock – right? Revenues are an income statement (flow) item. But wait there’s more!

“I think I probably have a better sense of income statements v balance sheets than you do. I am actually a pretty good accountant historically.”

But he confuses balance sheet items with income statement items. But wait there’s more!

“At best, the US government has cash accounts. We have no accrual based income statement and we have no balance sheet. So here’s a question: Does healthcare spending on seniors increase well-being, or does it just prevent well-being from declining? So, this is a gross asset v net asset (net of depreciation) issue and how that links to the income statement, GDP and productivity, in this case.”

OK this is more utter gibberish but someone Stevie Boy thinks he is all up to date on accounting for the healthcare sector. I had to check my office files for a couple of memos I wrote for two life science companies with respect to the transfer pricing implications of trade receivables not being paid by some of the European nations so I was aware what their 10-K filings had to say.

The Baxter 10-K for fiscal year ended December 31, 2011 states:

“In 2010, the company recorded a charge of $28 million to write down its accounts receivable in Greece principally as a result of the Greek government’s announcement of a plan to convert certain past due receivables into non-interest bearing bonds with maturities of one to three years.”

Covidien’s 10-K for fiscal year ended September 2013 states:

“In addition, many customers, including many governments or entities that rely on government funding, may be unable to pay on a timely basis, or may pay at a significant discount, for our products that they do purchase. We have, for example, experienced significant delays in the collection of trade debtors from the national health care systems in certain countries, including, but not limited to, certain regions in Spain, Italy and Portugal.”

There it is folks. Accrual accounting by governments with specific reference to healthcare programs. Governments with debt related items with specific reference to healthcare programs. But self styled expert Princeton Stevie Boy denies this can even exist. I wonder if this self styled expert even knows what a 10-K filing is!

Oh my – Princeton Stevie boy finally responds to my critiques of his utter gibberish:

“Steven Kopits

July 9, 2019 at 7:37 am

Ordinarily, businesses borrow money either for capex or to make an acquisition. Both of these would typically be associated with an increase in revenues”

Ah Stevie – that is what I said. The firm wants to buy more assets (a balance sheet event). That is not the same thing as increasing flow revenues (an income statement item). Yes if they choose to sell more goods and actually convince customers to buy them, they may need more assets assuming those assets were at full capacity. But buying assets does not necessarily mean more sales. If they did – we could fire all those pesky marketing departments.

BTW – anyone who gets business (which of course excludes you) knows that borrowing sometimes is done so inside shareholders can take out equity. Ask Toys R Us. Then there is Apple borrowing to pay dividends even though they have a ton of liquid assets offshore. Something called tax avoidance.

Now if you understood even basic business and general accounting, you might get this. But you know nothing – except how to stroke your pathetic ego.

Princeton Stevie has this bizarre idea that companies have to incur new debt to increase revenue. Let’s take Johnson & Johnson as one prominent example. Revenues in 2016 were $71.89 billion whereas they were $81.58 billion in 2018. Significant revenue growth – right? Guess what – they reduced their debt over this period.

According to Princeton Stevie’s accounting lectures, this cannot happen. Boys and girls – do not take accounting from Princeton Stevie!

I think this is what David Gilmour used to refer to as “noodling” on the guitar. It’s actually pretty good:

https://www.youtube.com/watch?v=oT5c3NPqX2E