Modern asset-based models are based upon fundamentals such as money stocks, incomes, interest and inflation rates mattering. But the dollar — in which safe assets like Treasurys are denominated — is special in that risk also matters.

This point is quantitatively described in this post, and illustrated in the below graph:

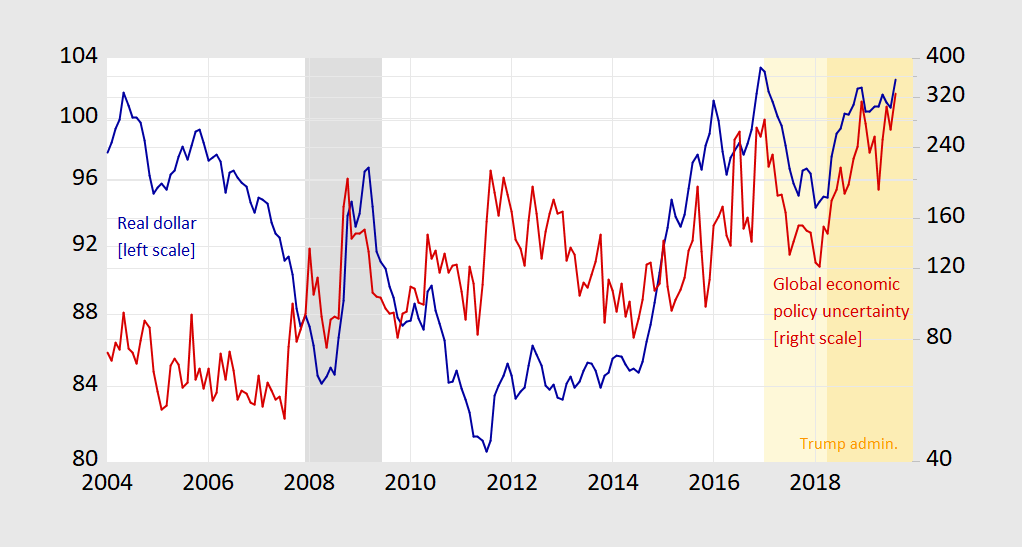

Figure 1: Real dollar against broad basket of currencies (blue, left log scale), global economic policy uncertainty (market weights) index (red, right scale). NBER defined recession dates shaded gray; Trump administration shaded light orange; period encompassing US Section 301 actions and retaliation shaded orange. Source: Fed via FRED, policyuncertainty.com, and NBER.

So, let me re-iterate — if Trump wants a weaker dollar and hence smaller trade deficit, he should relent on the trade threats (and last minute backtracking). The elevated uncertainty accounts for about 12% appreciation of the US dollar.

OK, I’m going to commit my grand sin of going off-topic again. It’s a horrible thing having a mind that ponders a plethora of topics, but my parents didn’t teach me any better I guess.

I’m looking at all the discussion of the Repo markets lately–which is related to banks—or what are sometimes alternatively called the “broker/dealers” (you know….. the people who cajole financial activities to make commissions for themselves in the name of being “market makers”, which is next to being God of course, or so I’m told anyway, and you know I so loath being argumentative).

Why is it we are told if we give money to the poor, or have universal income, or provide a living income for anyone other than those punished by donald trump’s tariffs, (we have to save those donald trump voters on the USDA dole of course……) that it is rewarding people for not being productive, and it is “killing incentive to work”, “killing the market mechanism”, but when we give free money to banks in the Repo market out of thin air (because of “low liquidity” kids, not crappy management), not nary a single word is said how this might “kill the market function” by rewarding banks for bad/inefficient management of capital??? Funny how that works for the different sectors of society, isn’t it?? With not a single mumble from “middle class Joe” or senile Pelosi or the rest of them—-who “defend” us from Republicans.

https://www.youtube.com/watch?v=cFods1KSWsQ

Now my next question after that is, where do terms like “Republican-lite” come from??? I really have “no idea”……..

https://www.c-span.org/video/?c4810033/cheney

Robert Mundell at age 86 is still with us. I can only imagine an interview with him:

Reporter: Professor Mundell – how would your pathbreaking model incorporate the role of these Presidential twitter rants?

Mundell: I think I understand what you mean by “rant” but pray tell. What is twitter?

Oh, my. It seems that Dear Leader Donald J. Trump was involved in trading arms for campaign dirt.

Trump used $250 million in taxpayer funds to bribe a foreign government into giving him information on his election opponent.

Just another day in Republican governance.

Just another day for the Traitor in Chief.

Wait, there’s an update on this story from FOX news:

https://www.youtube.com/watch?v=veZs75jlAlw

“Published on Jan 11, 2017”. Yep he has been babbling FAKE NEWS for a long, long time. Only problem – even his buddy RUDY admitted the latest scandal. But of course it was all Hunter Biden’s fault. Lock him up!

When I look at the by-country data in the PolicyUncertainty database, it looks like most of the increased global uncertainty is coming from China; however, prior to 2018 China’s policy uncertainty index was relatively stable. It really took off when Trump decided trade wars were easy to win. The natural interpretation is that Trump is inducing trade policy uncertainty in both the US and in China. At least that’s the theory. There’s a good way to test that theory; viz., remove Trump from office and see if the global and Chinese uncertainty indices fall back to normal levels.