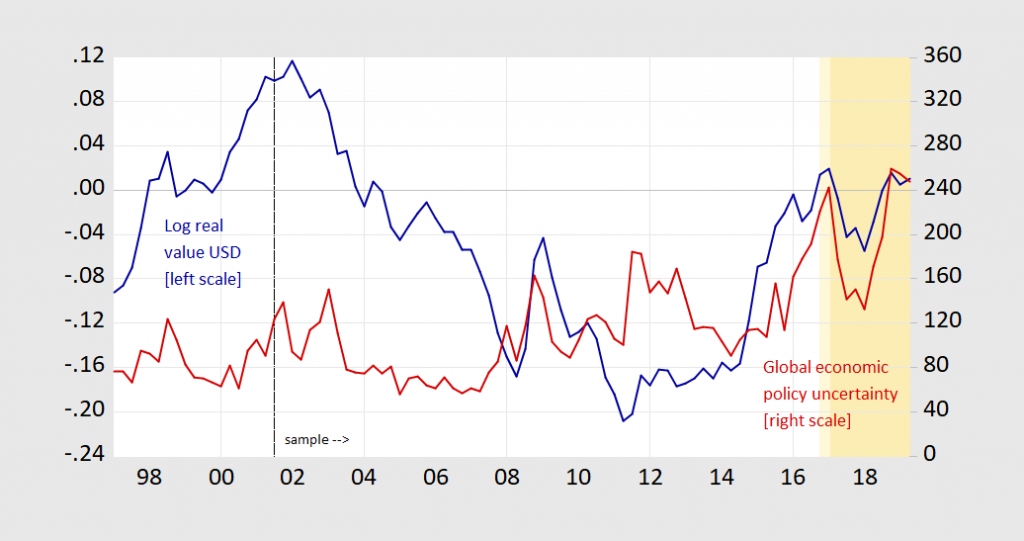

Figure 1: Log real value of US dollar against a broad basket of currencies (blue, left scale), and global Economic Policy Uncertainty (red, right scale). Light orange shading denotes post election, orange shading denotes Trump administration. Source: Federal Reserve Board, policyuncertainty.com, and author’s calculations.

Suppose you thought a hybrid real interest differential/Taylor fundamentals model worked for explaining the real trade weighted dollar. One might estimate over the 2001Q3-2019Q1 period the following:

rt = –0.81 – 0.74(πUSt – πRoWt) + 1.09(yUSt – yRoWt) + 10.6(iUSt – iRoWt) + 0.20epuGlobalt + ut

Adj-R2 = 0.65, SER = 0.0506, NOBS = 71, DW = 0.44. Bold denotes significance at 5% msl, using HAC robust standard errors.

Where r is the log real trade weighted value of the US dollar against a broad basket of currencies (r increase implies appreciation, 1973M03=0), π is one-year inflation, y is log real GDP, i is the 10 year nominal interest rate, and epuGlobal is the log Economic Policy Uncertainty global index, market GDP weighted from Baker, Bloom and Davis. RoW is the rest-of-the-world, all RoW data from Dallas Fed DGEI. Interest and inflation rates are in decimal form (10% = 0.10).

The coefficients match up roughly with theory — or at least a theory. Higher inflation relative to the rest-of-the-world weakens the dollar, higher relative US GDP and higher US long term interest rates appreciate the dollar. Most significantly, a greater degree of global economic policy uncertainty, as measured by the Baker, Bloom and Davis methodology, strengthens the dollar.

What can we say about the Trump effect? In general, Trump’s economic policies have involved (1) increased fiscal stimulus via the Tax Cut and Jobs Act (TCJA), (2) stimulus via the budget agreement which relieved spending constrainst, (3) higher long term interest rates due to increased borrowing, and higher short interest rates due to Taylor rule induced Fed tightening, and (4) elevated global economic policy uncertainty. Armed with the estimates in the estimated regression equation, one can tabulate the impact on the value of the US dollar.

The combined TCJA and budget agreement induced an increase in GDP relative to otherwise of between .43 or 1.86 percentage points (depending on state dependent or linear multipliers, according to Cohen-Sutton et al. (2018). That implies roughly 0.4 to 2 percentage points appreciation of the dollar by mid-2019 — not major. The fiscal stimulus would’ve also put on upward pressure on interest rates, so long term US interest rates would’ve likely been lower than recorded. CBO (2017) estimated a 0.2 ppt increase in 10 year rates associated with TCJA along. That implies a 2% appreciation of the dollar, from TCJA alone.

The big impact is from the uncertainty channel. Over the 2017Q1-2019Q2 period, global economic policy uncertainty is 60% higher (log terms) than that recorded over the 2001Q3-17Q4 period (from regression of log EPU on constant and Trump dummy). With a log(EPU) coefficient of 0.2, that implies a 12% appreciation ( 0.6 x 0.2 = 0.12) of the US dollar from the uncertainty channel alone. Of course, while not all of global economic policy uncertainty is due to Mr. Trump, a large portion does seem attributable to particularly the trade policies of the Trump administration.

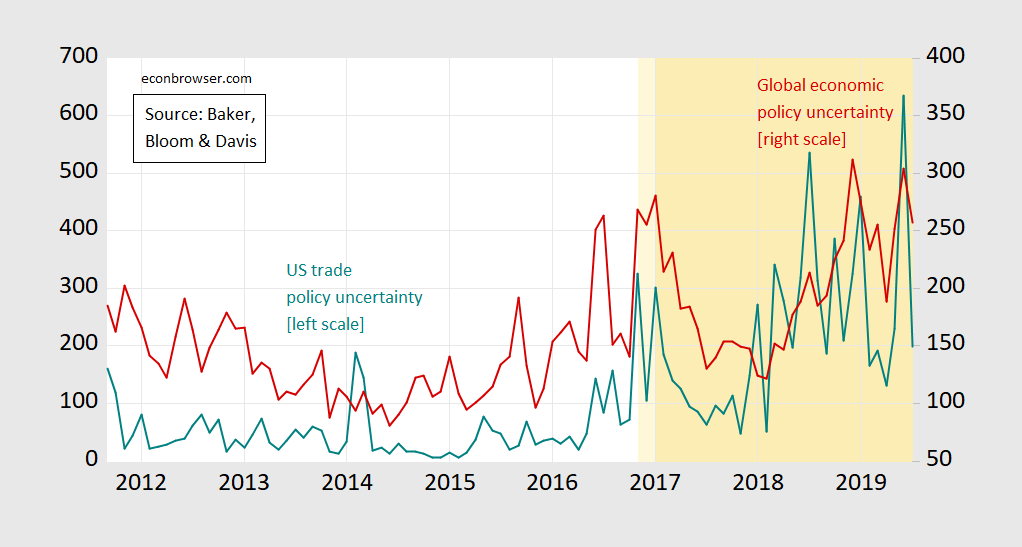

Figure 2: US Trade Policy Uncertainty categorical index (teal, left scale), and global Economic Policy Uncertainty (red, right scale). Light orange shading denotes post election, orange shading denotes Trump administration. Source: policyuncertainty.com.

For 2017M01-2019M06, one can reject null US trade policy uncertainty does not Granger cause global uncertainty at the 1% msl; one cannot reject the null global uncertainty does not cause US trade policy uncertainty.

The foregoing implies that, when Mr. Trump searches for villains causing the strong value of the US dollar, he should look to himself for something on the order of 10 percentage points or more of the appreciated value.

I think Kamala Harris’s big goal is, if she can turn Medicare For All into a felony crime (like she did marijuana use) and then she can just put people in prison for it. That would be very cost effective. Or Kamala could just raise her hand whenever during a debate and say when she raised he hand it was “misinterpreted”. That seems to be a tactic that suits her well:

https://www.newsweek.com/kamala-harris-healthcare-medicare-all-bernie-sanders-1455106

Then if anyone has the hutzpah to point this out during a debate Kamala can say “yah, but you met with a foreign leader” just like Roosevelt met with Stalin and Nixon met with Chairman Mao “so that means you’re an “apologist”. And all of Harris’s illiterate SJW fans can cheer. Then Harris can tell us “I put thousands in prison for Marijuana, and I’m proud of my record.” “I put black parents in jail for their children’s truancy, I’m PROUD of my record.” “I watched Steven Mnuchin fraudulently take peoples’ homes by illegal seizure and did NOTHING to stop it, I’m PROUD of my record”. And then we can start in about the make believe stories of her riding the public school bus crying herself silly because both her parents had white-collar jobs and that’s what you do when your parents are well off—you cry yourself senseless on the public school bus every morning.

Barkley Junior says she’s ahead of Joe Biden by 1% in one of the polls though. That 1% equates to 6 potential voters in that specific poll, but Barkley Junior has a sixth sense about these things–and Barkley can smell victory for Kamala soon.

Oh, Moses, you are yet again bringing up this off-topic matter of the poll in Iowa that you still owe me an apology for since you falsely claimed that it did not exist. Where is that apology, Moses?

The same poll had Warren 3 percent ahead of Biden, which, I guess amounts to something like 18 people, more than the apparently 6 that Harris had on him. I thought you were down on Warren’s case; at least you certainly were quite vigorously so for quite some time, with that whole silly off-topic business about population genetics driven by your efforts to put her down. You are not upset that Warren was even more ahead of Biden than Harris was? Warren is the one who is surging, with Harris down, and Bernie stagnant, and Biden stumbling (and Gabbard nowhere and staying there). Have you forgiven Warren her sins now that she has more thoroughly apologized to various Native American Indian chiefs?

@ Barkley Junior

I think your apology “must have been lost” in Menzie’s comment trash bin—where most of my true and unpolished thoughts of you go. That, or you forfeited it because you couldn’t type the number “6”. Fortunately for you, Menzie is a prof who takes some concern for his professional respect and only allows the blog to descend to a level above where I can properly describe you.

You were very proud you brought up that poll—so we will make sure everyone who reads this blog knows you were very fervent about Harris’s 1% lead (which equated to 6 potential voters) over Biden and that you thought it was a big deal. Men who acquired PhDs in the horse and buggy days thought sample size is “an after thought”. Who knew??

Did you want me to back-link your comment so you have proof?? I am happy to do it, just let me know and I’ll hunt it down for you and put it in this thread, and also every other thread you request it, and maybe some you don’t—that’s my penance to you Barkley—to make sure everyone knows about your “Harris is leading over Biden” poll.

Be my guest, Moses. My memory was that I mentioned it once, maybe a second time in response to something out of you, did not make all that big of a deal about it, and at the same time or in my very next comment noted that there was also at the same time another poll in Iowa that had Biden ahead of all the other Dems. You are the one who pounced on the thing and made it into a big deal. For me it was one among several competing polls, but it did have both Warren and Harris ahead of Biden.

Also, again, most of those one-state polls do not have large sample sizes, with 600 about typical for them, which is why they can vary a lot even at the same time as those two competing ones out of Iowa did, which I noted. You making a big fuss about the supposedly small sample size of that particular one just makes you look foolish, Moses, along with the unethical you already look for not apologizing. Cute remarks about a Menzie trash bin do not get you off the hook.

And again, this is one of those off-topic items you keep bringing up that you receive absolutely zero support from anybody here on. I challenge you to name a single contributor here who has even slightly or remotely supported your whining about this poll, your claim that an even distribution across a genome implies an even distribution across a population, or that Nancy Peolosi is senile. Actually you have received quite a bit of push back on those last two items with nobody supporting you, while nobody has bothered to comment on the Iowa poll matter since you clearly humiliated yourself with your flagrantly false claims followed by your flagrant refusal to apologize, and the whole thing is just so petty and silly.

@ Barkley Junior and assembled

Let’s select out the better parts of Barkley Junior’s quote here for Menzie and Jim’s readers. But I will put the entire link here for context:

https://econbrowser.com/archives/2019/07/of-sugar-highs-uncertainty-and-recession#comment-227560

Barkley Junior said “Last poll in Iowa has her second to Warren, with Biden in third place and Bernie in fourth. Warren and Bernie clearly have an edge in NH, but Harris is likely to do well in next-up SC. You really do not know the order of the races do you, Mose? SC will be the serious Harris-Biden showdown.”

Barkley Junior continues: “Oh, and in WaPo this morning the head to heads were Biden 53-Trump 43, Bernie 49-Trump 48, Harris 48-Trump 46, with both Warren and Buttigieg tying Trump in the low 40s. So, Harris does second best against Trump head to head after Biden and ahead of Bernie, who is gradually sinking.”

Here’s some educational links for you Barkley:

https://www.realclearpolitics.com/epolls/2020/president/sc/south_carolina_democratic_presidential_primary-6824.html

The Post Courier poll ALONE surveys more than 1200 potential voters, which is more than twice what Barkley Junior apparently thinks is a reliable sample size number for an entire state.

Barkley, my eyesight is getting bad—can you tell me what Harris’s % number is in those latest August polls for South Carolina?? I’m squinting and it’s really hard for me to make it out, it looks like 12%, but if you could confirm that would be so awesome—just, you know, type that here in this thread so I can see it?? I know it must be higher than 12%, because I rank you up there with the great “Princeton”Kopits on your political analysis and I know Harris’s numbers have to be higher than that, as you said, what was it, again?? Let me see directly from Barkley Junior’s own words here….. here it is!!!—- “SC will be the serious Harris-Biden showdown.”

You ever think of doing “political analysis” on network or cable TV Barkley?? I think we can get you a seat right next to that fat porker Chris Christie on ABC, you just nudge him with your elbow and he’ll scoot on over for a heavy hitting political prognosticator like you Barkley. If you’re nice Governor Christie might even let you take a bite off his unfinished hotdog.

Moses,

I have repeatedly said more recently that Harris has lost ground, with that picking up after the second debate. My remarks in that one post were at her high point, although she is not out of the game and could yet recover. I did not go on and on about her, but you have.

The point that between Biden and Harris SC is crucial remains true, which is where the issue of who is getting black women in particular comes to a head. As of now Biden has managed to hang on to them, while Harris has fallen back. But this is not over, and it remains the case that SC is the crucial showdown between Biden and Harris. As of now it looks like Biden would clobber Harris there. But, again, this is far from over. Biden may yet collapse, and if so, Harris might be the big gainer. She has done a lot of moving up and down, more than the other top Dems.

What I find sort of funny here and frankly mysterious is that the Dem candidate who has been gaining, as I have repeatedly noted, is Elizabeth Warren. There was a time when you were endlessly denouncing her in the most fervent terms. Now you are saying nothing about her, so worked about Harris you are, although Warren is eating your guy Bernie for lunch. As of now it looks to be Warren versus Biden, with Harris down in fourth place. Have you now reconciled yourself to Warren after all that ranting and raving you engaged in against her?

BTW, I am fine with either Warren or Harris. I worry that Biden just does not have it, and Bernie is just so narrow and old (as is Biden, a major part of the problem with him). There really are none beyond those four that look serious, certainly not war criminal-loving Gabbard whom you have touted several times here.

Again, Moses, this is all very off-topic. Have you seen either Menzie or Jim post anything about political trends between these Dem candidates? No. Not once.

Oh, and you do still owe me an apology for you claim that I was lying about that poll, and it remains the case that not a single person here has supported you at all. You remain in your corner with your dunce cap on and and a big sign over your head saying “Apologize!”

Congratulations, Moses. I see that my challenge to you to name one individual supporting your various views has brought forth a voluminous response from supporters.

First off we have James D. Hamilton himself weighing in on the importance of always reporting sample sizes whenever somebody here mentions any poll or survey or empirical study. Indeed, he has made it clear that if Menzie Chinn does not enforce this new rule, he will remove Menzie as a co-blogger on Econbrowser, this being such an ovearchingly important matter.

Nest was when 2slugbaits stepped forward to reveal that while he comments on economics issues here under a pseudonym, he is actually a distinguished professor of population genetics who published the definitive four volume work, Population Genetics, under the pen name “Sewall Wright.”. He expresses his thanks for you revealing that when a characteristic is evenly distributed across a genome, it is also evenly distributed across a population. He will add that point as Footnote 243 in the fotthcoming Volume 5 of his magnum opus.

Then we have had pgl stepping forth to reveal that he not only has a PhD in geriatric studies, but owns a firm that tests people for Alzheimer’s Disease. Furthermore, his firm was hired by certain members of the Democratic leadership in the House of Representatives to test Nancy Pelosi, and indeed you are right: she is suffering from an advanced stage of senility.

CoRev has stepped forward to congratulate you on revealing how I lied about the existence of a poll in Iowa after the first Dem debate that showed Warren ahead of Biden by 3 percent and Harris ahead of him by 1 percent. He is so impressed, he will be sending you his most treasured plaque that his grandson adores that he was given for his service to the US Apollo space program.

Finally, Ed Hanson had been so impressed by all your comments here that he declares you to be a “0% Keynesian” and all around politically wise good guy.

I cannot congratulate you enough for all these achievements, Moses.

“when Mr. Trump searches for villains causing the strong value of the US dollar, he should look to himself for something on the order of 10 percentage points or more of the appreciated value.”

Well let’s see – it was Orrin Hatch that pushed that tax cut. And it was Peter Navarro that pushed that stupid trade war. So Trump is not at fault here at all. He does not know what is going on with respect to policy so how can anyone blame him? MAGA!

One of the roles of the American President is to sign bills into law. Which, Trump did.

Single Statistic Bruce “no relationship to Robert” Hall was questioning one of Menzie’s post by citing an economist at JP Morgan. Funny thing – Brucie forgot to note this:

https://www.cnn.com/2019/08/20/business/tariffs-cost-trade-war-consumers/index.html

“President Donald Trump and his advisers insist their trade war with China won’t hurt American consumers. But analysts say otherwise. The tariffs Trump has already imposed on China are estimated to cost the average American household $600 per year, according to a report by JPMorgan Chase. That will rise to $1,000 if Trump carries through on his plan to levy tariffs on another $300 billion of US imports from China, the bank added.”

Our Usual Suspects tend to just skip over such things. Wonder why!

Trump declares himself the Chosen One (to economically take on China):

https://www.realclearpolitics.com/video/2019/08/21/trump_i_am_the_chosen_one_to_take_on_china.html

Economically Trump repeats stupid claims over and over:

“Over the last five or six years, China has made $500 billion. $500 billion. Ripped it out of the United States. And not only that, if you take a look, intellectual property theft, add that to it. And add a lot of other things to it.”

Yea we may import $500 billion per year from China. Of course we export goods to them. And having to pay for goods is not being ripped off. The Chosen One seems to be the dumbest troll ever.

He has also reportedly repeated somebody’s assertion that he is the “king of Israel” and the “second coming of God.” Sheesh.

I think Brad DeLong said it best: “If he were not president, Trump’s family would already have moved for a guardianship ad litem, given the quality of decisions he has been making.”

notice there was not much family resistance to him giving up running the trump family business as president. now granted, that decision making has moved to his two idiot sons, who are probably worse off than their senile father. but guardianship of the trump empire has already been shifted. if only we could say the same for the gaurdianship of our great nation….

Menzie

Throw away that envelope and go find a monetary envelope. Value of the dollar is a function of monetary policy and also is a measure how well the FED implements its policy to current fiscal policy. Stated policy is 2% inflation target which the FED has consistently missed on the low side. This “tightness’ alone has affected the value of the dollar. Looking further into FED policy and you can see it is competing with other major currencies who reduced their short term interest rates even to negative levels. By not reducing interest rates in response to these pressures, the dollar increased in relative value against them. If the FED had hit its 2% target, then such increased dollar value might be excused, but that is not the case.

The FED has failed badly in implementing its policy. The blame lies there.

Ed

Ed Hanson: Oh. OK. Don’t know what I was thinking writing and publishing those 30-odd articles on exchange rate determination…

Menzie Chinn

So you are saying 0 -for 30? About average for any Keynesian.

Ed

Ed,

What an incredibly stupid as well as offensive remark. Do you have any idea what you are talking about aside from spouting some very out-of-date third rate monetarism that even Milton Friedman abandoned before he died?

Does your 0 for 30 remark mean that you are dismissing Menzie’s 30 odd papers on this topic because they do not appear to have followed what you the big expert claim to how this should be done? Sorry, but you are just plain dead wrong as well as being a complete idiot. No, it is not all about monetary policy. Lots of other things enter into determining foreign exchange rates, and claiming that the Fed had “failed” because inflation has run slightly below its target rate of 2 percent is also moronic in the extreme.

Oh, and it is the “Fed,” not the “FED.” It looks like you are trying to make it into a boogy man, probably because you are just Trumpshit who is spouting his idiotic rantings about the Fed. Please keep in mind that this is a lunatic who has just announced that he is the “king of Israel,” and “the second coming of God,” not to mention “the chosen one.” Really.

Dornbusch overshooting – which is the core of what Menzie is saying – starts with what we used to call Global Monetarism (more like New Classical macro) but then allows for a bit of sticky pricing. If Ed has even the slightest clue what he is babbling – he would see that his key “insight” is a bit of sticky pricing. But Ed gets lost on dumb slogans as if they were a substitute for putting down one’s actual model.

Bark

The remark is neither stupid nor, at least for Menzie’s posts, particularly offensive. Besides I am much older than Menzie and by age can be blunt. However, if you can fix the impolite, disrespectful, offensive nature that Menzie has allowed into Econbrowser, I will be right in line to change my tone. Anyway, I would not have expected you to have read many of my posts over the last few years, but if you had, you would have realize that I have been quite complimentary about Menzie’s predictions of exchange rates.

However, Menzie is 100% Keynesian, and as such, he, like all of the ilk, confuses cause with results. Menzie is good at results, as good as any I have followed. But he thinks Keynesian analysis also answers the cause of the results question. It seldom does, and on the whole is Keynesian analysis terrible at cause.

Example this case. Menzie says it is fiscal policy that caused the dollar rise in relative value. True that is the result (sort of), but he misses the cause. He writes of stimulus from tax cuts, stimulus from future relaxation of budgetary debt limitations, Taylor rule, and uncertainty.

One at a time. In general, all tax cuts are not stimulus, and all stimulus certainly do not lead to interest rates rise or dollar value rise. If that was true, President Obama who used Keynesian stimulus out the yingyang to cause increased GDP growth would have made our heads spin. That is if that Keynesian solution worked. It did not. But still such stimulus should have caused rise of interest rates and dollar value, it did not. Because it is not cause. But under Trump such things did happen. The difference? The Trump tax cuts, especially the corporate tax rate reduction, caused an increase demand for the dollar. All things being the same, that would cause an interest rate hike and a rise of the relative value of the dollar, except in this case, since the inflation rate remained well under the 2% thresh hold, the FED should have accommodated the rise in demand by not raising short term interest rates. It was the FED that caused interest rate rise, and rise in dollar value by failure to keep its promise of achieving the 2% inflation goal, and resulting in actually restricting GDP growth even as good at it became.

Taylor Rule, a reasonably good rule for the FED but they do not use it, even if sometimes it sometimes achieves the same result. Taylor rule could only be a cause if the FED declared that it is its policy which they do not. And just a side note, Menzie version of the Taylor Rule is not John Taylor’s.

Uncertainty, impossible to determine its effect. If USA caused uncertainty caused the relative rise of dollar, then Brexit, British caused uncertainty, should cause a relative rise in the value of the Pound. It did not. Sorry uncertainty is not the cause, and BTW, measurement of uncertainty, while very interesting, is highly suspect.

Conclusion. Unfortunately, currently all Menzie’s analysis here on Econbrowser is tainted by his political bias. He chose to blame the Trump administration, when he knows short term interest rates are overwhelming the result of FED action. The relative value of the dollar, too, is closely related to FED action. The Trump administration and Congress did increased dollar demand (not stimulus) but it is the FED who dropped the ball. And proof of the pudding: the interest rate inversion is the consequence of poor FED action to achieve its policy. It was their mistake. It is it who retarded GDP growth, and unfortunately, the FED now will be too slow to reduce short term interest to achieve and near term fix. And another side note, being too tight is somewhat normal for for the half the time in its history. The other half of its history is when they are to loose in their policy.

Ed

Ed Hanson: You have no idea what you’re talking about. If you read “The Usual Suspects”, you’ll find an entirely neoclassical approach. Not that I think you understand the distinction between neoclassical and New Keynesian.

“Besides I am much older than Menzie and by age can be blunt.”

ed, that does not mean you cannot also be wrong or stoooopid.

Sorry, Ed, but you are the one dripping with political bias here. Menzie is right that you clearly do not know what you are talking about. Menzie is not a “100% Keynesian.” Your claim to this shows you are an ignorant moron, sorry to be so harsh, but not too sorry.

The Fed is not responsible for all the increase in the dollar. At least you got it that Trump’s tax cuts without spending cuts increased demand for the dollar, which both tends to push up interest rates and the value of the dollar, just as happened in the early 80s under Reagan, giving us the famous “double deficit” problem. Where your analysis falls into a pit is that the Fed does not control long term interest rates, or at least not very much, while having near total control over short tern ones, especially very short term ones. So the increase in long tern interest rates resulting from the increased budget deficit with the increased Treasury borrowing, was not due to the Fed and not easily offset by the Fed and contributed to the rise of the dollar, along with such things you have conveniently ignored that Menzie found important, such as increased uncertainty due to Trump’s erratic (and idiotic) trade wars.

I believe you that you are old. That would explain why you would spout a theory taken seriously a half century ago (and even as recently as 30 years ago), but is no longer and as I said was even abandoned by Milton Friedman himself prior to his death.

Oh, I have read most of your posts and do not remember you praising Menzies forex market modeling previously. But if you did so in the past, why on earth are you now giving him a 0 for 30 out of the entirety of his published record on this matter. You are resembling some other people around here who conveniently change their tune when caught with their pants down.

Bark

My pants are not down, nobody would want that. And yes, without an extreme technical designation of Keynesian Economics, Menzie is 100% so. Don’t know why he would deny this, maybe to seem more modern? But Keynesian is not stuck to some past structure, and Menzie is right there at its latest latest.

I only agreed with Menzie, description of his 30 odd, read his post.

Now seriously, never said the FED controlled long term rates. Only said if they had not screwed up its interest rate increases, the inversion seen today would not be the case. No, not expounding Milton Friedman theory, did not come from him. But would be glad for you to explain the theory Milton Keynesian before his death. But be careful, don’t interpret the great man’s word wrongly.

As I said, did not expect you to remember my posts, so what you don’t remember is of no consequence.

Sorry, that you have drunk the kool-aid. The Keynesian methods when use to cause change for the good invariably cause years of distress. Think Carter, think Obama. and thank goodness the country responded to bring the policies of Reagan and Trump, to correct wrong.

Ed

Ed Hanson: I do not think that word means what you think it means. Truly, you are clueless. Would it kill you to read a textbook so you understood key differences between Keynesian, Classical, New Classical, New Keynesian?

Menzie and Barkley Rosser My take is that when Ed Hanson refers to “Keynesian” economics he really means any macroeconomics that is not somewhere between laissez faire and Hayek vintage Austrian economics. Pretty much the same boat as our old friend and likely no longer of this world poster who went by the names of “Ricardo” and “Dick F”. In their view Keynesian economics is just Socialism and New Keynesian economics is just Socialism Lite.

Menzie

By all means, name your brand. I certainly would give great consideration and deference to how you brand yourself.

As for Keynesian and New Keynesian, a distinction with little meaning, no matter how you look at it. Fact is the second is derived from the first, and therefore is properly described as Keynesian. It is based on the the economics espoused by Keynes, and as I have said, absolutely terribly wrong as to cause of economic change.

Am I rejecting your more learned understanding of the distinction between what you call different schools on Keynesian. I certainly am. So be it, I can live with it.

Ed

Ed Hanson: I think Greg Mankiw, formerly GW Bush’s CEA Chair, would disagree. In fact, the New Keynesian approach has at least half its lineage from the real business cycle school, the descendent of the Classical economists. But please, feel free to continue to wallow in ignorance.

2Slug,

I think you are right, although it looks to me that what Ed has in mind is some vague variation of Old Classical Monetarism a la Friedman, which is why I mentioned him, especially given that indeed Uncle Miltie did abandon his own view ultimately.

Pretty clearly Ed is completely out of it and not worth debating with. The sign is his repeated claim that Menzie is “100% Keynesian.” This is wrong and stupid and ignorant. Menizie’s request he actually read something is completely reasonable. There is not much more to say.

sorry to drag a few of you into this statement, but ed is an example of the problem with old white men. they still live in the early 80’s reagan world, and have never grown up. to them, calling somebody a socialist or communist is the ultimate insult. anything that does not adhere to their world view is simply socialist. they are stuck in a world where shareholder profit rules and is a valid excuse for unethical behavior. local rube peak loser said as much when he defended unethical banking practices because that is what they had to do to make money. david koch lasting legacy will be his insistence that profit overrules ethics.

most of these maximizing profit ideologues will be rolling over in their graves to find the modern ceo gives great importance to ethical and social responsibility rather than simply maximum profit.

https://www.cnbc.com/2019/08/19/the-ceos-of-nearly-two-hundred-companies-say-shareholder-value-is-no-longer-their-main-objective.html

hopefully their actions back up their words.

I guess you have mastered the Stephen Moore model of international monetary economics!

So fiscal policy plays no role in the determination of the real exchange rate? You have just set back international economics by over 60 years!

This is incredibly sad:

“Ed HansonAugust 22, 2019 at 10:30 am

Bark

The remark is neither stupid nor, at least for Menzie’s posts, particularly offensive … However, Menzie is 100% Keynesian, and as such, he, like all of the ilk, confuses cause with results …Conclusion. Unfortunately, currently all Menzie’s analysis here on Econbrowser is tainted by his political bias.”

Yes – I skipped most of Ed’s long winded rants as he clearly has no clue what any of these words even means. Especially the word “Keynesian”. BTW – the charge of political bias is telling. I guess Ed is so clueless that he does not know that a lot of Republican economists would use similar economic modeling that Menzie has used. Are they Keynesian? Maybe but then Ed would have no idea what their economic model is as Ed knows nothing about this topic.

Hot breaking news: The president is in negotiations to buy Puerto Rico. After he seals that deal he plans purchasing North Korea!!

Using how much leverage?? That’s what got him hiding his taxes you know, “carrying forward” losses on leveraged debt.

Dear Menzie,

I think this is a perfectly reasonable calculation. But you might give some credit to Jeffrey Frankel, who discussed this a few days ago, without the econometrics.

Julian

Julian Silk: Sure, I’ll add the link, but I did post his article on Econbrowser, on 12 August 2019. Implicitly, Jeff is always credited on anything exchange rate related, since he was my dissertation adviser.

@ Julian Silk

Menzie does some readers a HUGE favor when he makes these posts where he hashes out the econometrics for his “Joe Six Pack” readers, especially when he gives exact variable numbers, mild overviews of why he approaches it this way or that way (methods), and even the .xlsx files which also verify methods used or time frames. I inherently trust Menzie on economics. When Menzie says I can trust that rope that attaches to the top of the canyon on the other side of the gorge, I am ready to take that rope. I don’t need the .xlsx files for that. I need the .xlsx files to help me “reverse engineer” and make sure I am understanding it right. That’s a great gift to blog readers and lower level undergraduate students that Menzie doesn’t “have to” put on a public blog. My guess is, it’s not of much use (or of much lesser use anyway) to his upper level post-graduate students, who in Menzie’s “heart of hearts” (if we gave him truth serum) he enjoys teaching more and has much more pedagogic affection towards.

Menzie, may find this hard to believe, but these are my favorite style posts of his (especially when he tosses out enough bones for it to be pieced together). Whatever my personal peccadillo complaints are about how Menzie manages the blog, that is one thing I am tremendously grateful to this blog for. A lot of people don’t “get that” which makes all the more great of a gift by Menzie.

I should also add, just because Jeffrey Frankel writes a column, doesn’t mean Menzie hasn’t already had thoughts “along those lines”, so it’s a bit ridiculous he would “credit” him for something like that. I think it’s safe to say, the two dudes are “bros”.

P.S. Very good. I also think those who dislike econometrics will find this interesting – thank God for some good trade news – and maybe it could be worked in.

https://www.reuters.com/article/us-usa-trade-tomato-mexico/mexico-and-u-s-reach-deal-to-end-tomato-tariff-dispute-idUSKCN1VB0T5?fbclid=IwAR1IQ3VgNCwDjZprBUEyZOykzd7hSrsbYwQEooAz39hF0qkBHBcAMlJmwB4

That is an interesting story. I did know that we tend to import a lot of tomatoes from Mexico during the winter season when American farmers are not exactly selling fresh tomatoes. And there was an interesting transfer pricing case called GAC Produce v. Commissioner over the appropriate gross margin for related party distributors in Arizona who import tomatoes from their Mexican farming affiliates.

Personally I love fresh roma tomatoes which get rather expensive in my local grocery store during the winter so this is indeed welcome news.