Why you should attend this UW Economics JPGI talk by Kenneth Rogoff tomorrow (Wednesday) at 4:30 pm:

…The United States, because of the Federal Reserve, is paying a MUCH higher Interest Rate than other competing countries. They can’t believe how lucky they are that Jay Powell & the Fed don’t have a clue. And now, on top of it all, the Oil hit. Big Interest Rate Drop, Stimulus!

— Donald J. Trump (@realDonaldTrump) September 16, 2019

’nuff said!

Update, 5PM Pacific, Sep 18:

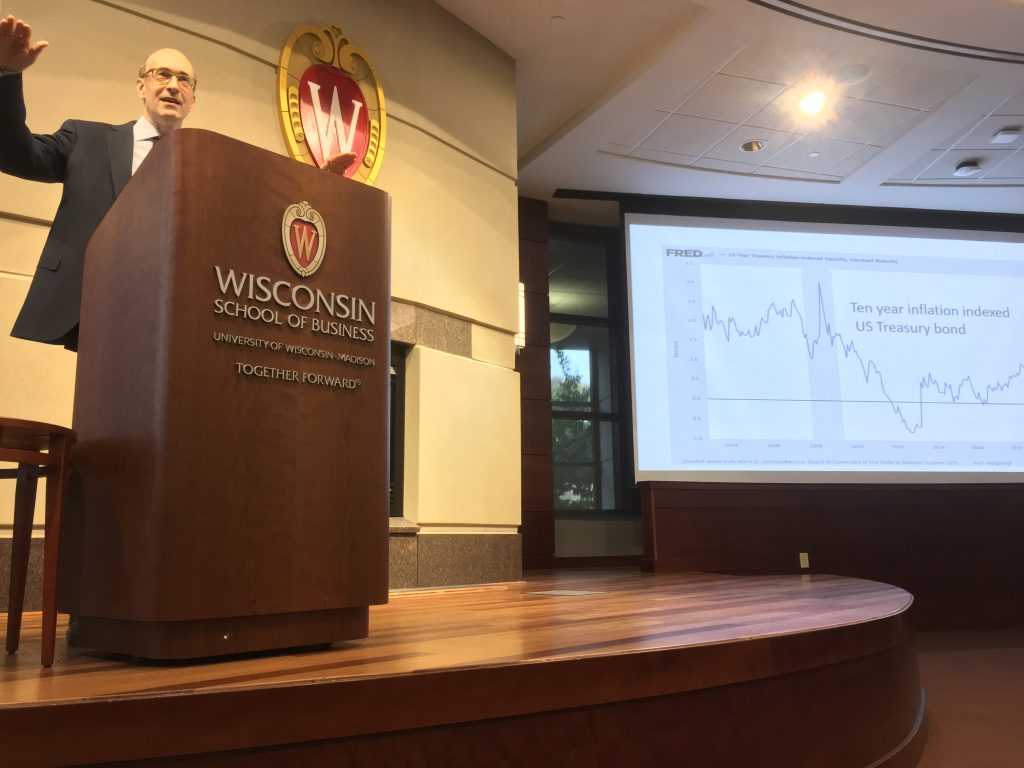

And the talk begins — Ken Rogoff and the 10 year TIPS yield, at Grainger Hall.

“but now they are under attack from the ascendant left for expanding their balance sheets too little”

I hope he names names on this “ascendant left”. Most of the “lefties” I read, such as Krugman, have stressed the fact that FISCAL policy is the effective policy tool here, not rate moves or monetary policy. Every “lefty” I read and respect has stated that monetary policy is at this point a largely ineffective tool at this point, and is only used because Republican legislators refuse to do their damned jobs. Hopefully Rogoff will run down this supposed “laundry list” of “ascendant left” that prefers monetary policy to fiscal because I sure would love proof of their existence. Maybe he can also tell us which part of western Canada Sasquatch is hiding out at. I suspect Saquatch could be at some sketchy bar on the outskirts of Calgary, Alberta but that’s all hearsay at this point.

Looks like an interesting paper but I first need to get that stupid Trump tweet about China’s producer prices out of my head. What is his source for this claim? Is he measuring these prices in Chinese currency or in terms of US$? I have no idea as Trump has no idea WTF he is babbling about. For what is worth, here is a series from Trading Economics:

https://tradingeconomics.com/china/producer-prices

They are a claiming a huge increase starting in 2016 with a partially offsetting decline over the past year or so.

The United States, because of the Federal Reserve, is paying a MUCH higher Interest Rate than other competing countries.”

So sayeth THE DONALD but Fatso in Chief lies about everything so let’s check with Bloomberg:

https://www.bloomberg.com/markets/rates-bonds

This provides the interest rate on 10-year government bonds which was only 1.8% for the US. Canada is a wee bit lower at 1.45% so this “MUCH higher” is the usual BS from Fatso in Chief. OK, German bonds rates are slightly negative while the UK rate is 0.7%.

Now if I want to get snarky I could say we compete with India, Mexico, and Brazil which all have MUCH higher interest rates than we do. Yes – THE DONALD is one very stupid FATSO.

Sorry, not going to forgive Rogoff for his BS paper and his complicity in helping Republicans make the case for austerity at a time when it counted. He helped Republicans make life worse for millions of Americans. A time of national crisis is when you find out who are the heroes and villains.

@ joseph

While a sympathize with this view to a degree, and I think the error should be remembered, I don’t think Rogoff is “the devil” and he may have some constructive points very well worth listening to. Although he may ideologically chafe my brain, he is sharp, and certainly on this topic he seems to be on the right side of the fence. Plus I think it’s good for the young students to interact with him. Maybe it’s a sign I’m getting mushy in my old age, but I see more positive than negative in him interacting with UW students.

Cokie Roberts has passed way. Always had a certain degree of respect for her. A little bit too much “establishment protecting” type for me. Too much satisfied with the current power structure. But I don’t think she was ill-intentioned, and always tried to represent the truth of politics as she herself saw it. I wouldn’t go so far as to say she’s “a dying breed” but a rare bird in today’s world nonetheless. Always enjoyed Miss Roberts’ “banter” with Sam Donaldson “back in the day”. There’s an older contingent out there (age 50+) that will miss Cokie Roberts for sure.

Anyone remember the old David Brinkley show?? To give you any of an idea what a social misfit I was as a teenager, I used to watch that show semi-regular in my teen years. That show’s time or “era” had passed before Brinkley went off the air, but I’d STILL take it over some stuff we have today. David Gregory?? The word douche comes to mind suddenly.

https://youtu.be/AJ279bDDL_w?t=58

Well, this is a paper my uncle could have written.

Some questions:

1. If indeed, a problem of central banking is that nominal interest rates are too low and threaten to fall to the ZLB, isn’t MMT — unsterilized injections of helicopter money — actually the central banker’s friend? Doesn’t that create inflation which allows interest rates to rise above the zero lower bound and thereby make interest rate policy effective once again?

2. Rogoff’s primary argument against large government borrowing is that interest rates might rise. But isn’t Exhibit 1 in this debate Japan, which has run sizeable deficits since 1995 and has a 200% debt-to-GDP ratio with no visible consequences after nearly 25 years? Why would this deter politicians from running up a tab?

3. What would make interest rates rise? Wouldn’t that presage a more robust global economy?

4. A search for the term ‘demographics’ in the text returns zero results. That speaks for itself.

I like Ken Rogoff. My fundamental impulses are Rogoffian. But I think the world has changed, and Rogoff is still using pre-2007 paradigms, which are in important ways no longer sufficient to describe the world today.

RE: your #1- https://www.advisorperspectives.com/dshort/updates/2019/09/16/a-long-term-look-at-inflation

Realities of “Demand” and purchase parity of USD for the majority of consumers eventually gets revealed, regardless of interest-rate policy and any kinds of fiscal policies.

Thanks. Interesting graph.

The point in question is ‘eventually’.

In a depression, I think the analysis suggests that MMT — helping ‘Main Street’ — is in fact the correct policy. Interest rates at the ZLB are ineffective because the issue is the compromise of collateral, housing values, and until equity is rebuilt, the consumer remains locked down. So you can pay down the debt with real money, which takes about seven years, or do helicopter drops that put cash into consumers’ pockets. Because consumers will not borrow until collateral is rebuild, incremental dollars will find their way back into the banking system rather than into inflation.

If instead interest rate policy is the chosen tool, it will prove ineffective, and the population will turn restive and nativist, leading to a rise in fascist sentiment. Thus, an economic problem is transposed into a political problem.

My analysis therefore suggests that MMT is in fact the right prescription, but only in the case of a depression, which is characterized by a material loss of home values and a prolonged (eg, 7 year) stretch at the ZLB. The whole point is not to wait for ‘eventually’, because by that time you’ll have populist government in power which will do you no favors.

The legitimate counter-argument, to which I think Rogoff is alluding, is that printing money is the crack cocaine of public policy, the fairy dust of the political class. Once you get started, it can be hard to stop. Just ask Argentina.

“My analysis therefore suggests that MMT is in fact the right prescription”. WTF? This is from the same person who also just said he is an inflation hawk and a deficit hawk. In all of your arrogance – you are one really stupid person. I doubt you even know what MMT even is. You certainly have not provided any real analysis. Just a lot of cheap shots at an actual economist on a topic he understands but you do not.

“printing money is the crack cocaine of public policy”.

Of course Ken would put this a lot more eloquently as he would also wonder if you are on crack.

That chart is fascinating, but I have to wonder what an 1870 dollar’s purchasing power would be used to buy, relative to a 2019 dollar’s purchasing power. The chances that the dollar would be used for the same things is about zero. Even food is different now. That kind of chart is amusing to look at. It’s also a bit of a parlor trick if viewed in isolation from the goods and services actually being purchased. If you consider technology, labor savings, and life-span, you could argue that the dollar’s purchasing power is greater now than it has ever been. It’s all a matter of placing priorities and making sure that your priorities and assumptions are laid out clearly.

Gee – I did not know you were Ben Bernanke’s nephew. Oh wait – you are not. No you are just another bloviating troll. Such an insulting opening sentence in a comment that shows you clearly do not understand basic macroeconomics. Hey Stevie – stick to writing posts on your blog that the whole world simply ignores.

“I think the world has changed, and Rogoff is still using pre-2007 paradigms, which are in important ways no longer sufficient to describe the world today.”

I guess you did not notice he noted the zero interest lower bound several times. Or did you just not read the paper before babbling your usual arrogant stupidity per usual?

https://www.calculatedriskblog.com/2019/09/update-predicting-next-recession.html

I’m aware of that. But, I expect a recession or at the very least a significant softening of economic activity in mid-2020. That assumes no complete bone-head moves, no shocks, no wars, and no other fiascos. I would be extremely surprised if the Chinese agreed to any kind of deal with Trump, knowing that whatever deal they make with him has a minimal chance of getting enacted and also knowing that a deal with Donald Trump is only a deal with Donald Trump until the tv camera looks somewhere else.

So, here we go. McBride looks at the world in rational terms and assumes a certain level of rational behavior. We do not have rational actors with executive power, and their rationality is diminishing over time.

Dear Folks,

Perhaps I am the only one old enough to remember the 1980s vividly. Though Rogoff is not always my cup of tea, he is right in that you do want Central Bank Independence. If you are in an inflationary situation, and it is really overriding, an independent central bank can restrict spending through monetary restraint enough for the political process to have time to come up with a politically feasible solution to the inflation. You’re not going to get this in the U.S., God willing, but Israel in the mid-1980s had an inflation rate of 500% per year. The Central Bank there was not independent enough to act decisively to prevent this. The situation in India over the years, with a virtually supine Central Bank, has been similar, but not as bad.

Is the unemployment this monetary restraint generates horrible? Yes, absolutely. But if the political process is going to allow promises that don’t even have a prayer of being reconciled to be made, eventually the markets may catch on – it is in their interest to do so – and people are going to suffer badly. If you don’t assume stupidity, this can happen again, and it is in the interest of honest citizens to avoid it.

Julian

I remember the ’80s well, Julian. I am a fiscal and inflation hawk as a result.

But the world’s changed. Japan demonstrates that very clearly. In a world of population — or at least, workforce — decline, it’s very hard to generate inflation and interest rates tend to fall close to zero. If real estate is facing a secular decline in demand, how do you maintain positive interest rates? Not clear that you can. Furthermore, with a declining population, business demand for capital is limited (or at least more limited) to replacement capex and perhaps to underwrite some innovation. But you don’t need capital to fund growth. In this world, businesses can be a net source of capital, rather than a net user. For example, if auto sales are not rising, then there is no need for new plants. Indeed, efficiency gains may imply a need for fewer plants. In such an event, it’s not hard to conceive of, say, Ford, as a net generator of savings, that is, operating cash flow + depreciation is more than sufficient to keep the company humming along.

Moreover, off balance sheet replacement capex — by which I mean rising healthcare expenditure related to an again population — is also rising. This reduces resources available for growing sectors of the economy — another reason not to have children.

So, I appreciate Ken Rogoff’s work and perspective, but if you haven’t emphasized the importance of demographic changes compared to the 1980s, you’re missing a critical part of the story.

Dear Steven Kopits,

You may be right, and I will not argue it, as I am not a Japan expert. Barkley Rosser is well-informed about Japan, by the way. To really evaluate the idea that business may be a net source of capital, I would like to see some sort of aggregate balance sheet for the businesses, in any sector, in Japan. (I haven’t looked at the Federal Reserve reports in detail, or the Commerce Department reports in detail, for use of capital in the U.S., in a while, but it would be something like that.) To me, the Japanese industries can sell to China and Latin America, whether they sell to the U.S. or domestically or not, So put me down as amenable to persuasion, but as someone who would still like to see aggregate data.

Julian

Here’s a piece I wrote on Japan:

Japan’s Lost Century. I still consider this an important piece, at least for myself.

http://www.prienga.com/blog/2017/7/20/japans-lost-century

I’d that Japanese labor force participation, particularly of women, has largely offset age-related losses in the workforce to date. I should probably update the analysis at some point, but it is well down the queue.

“If you want to see the future of the advanced economies, Japan might be a good place to start. Despite full employment, Japan is showing muted wage pressures, minimal GDP growth, low interest rates, and continued high government deficits. How do these seemingly contradictory elements fit together? Are they unique to Japan, or symptoms of a more general malaise?”

Did you cut and paste this from Krugman’s 1998 paper? Oh gee – your novel (cough, cough) piece was written a mere 19 years after his paper.

“The loss of workers constrains GDP growth. In essence, the loss of workers offsets productivity gains, such that Japan’s GDP in 2050 will be not materially higher than it is today. Importantly, worker productivity gains are expected to continue at a reasonable pace, about 1.4% per year.”

Of course anyone would learned about the Solow growth model would not this means a lot higher output per worker. OK output per person is what matters and there may be a wee bit to this demographics issue but you think it is the only thing that matters. No Stevie pooh – it is one factor. And if you think you are the first person who note “demographics” people like Krugman and Dean Baker have been talking about this for the 20 years as well.

Let’s assume all of Stevie pooh’s forecasts turn out to be right (I’m being really generous given the intellectual junk Stevie pooh usually writes). Take two key sentences:

“By 2050, Japan will have 23% fewer citizens….Thus, we should expect GDP in Japan in the coming decades to be stagnant, with periods of gains alternating with periods of retrenchment, and no visible trend in either direction – much as we have seen for the last fifteen years or so.”

OK Stevie – you may have flunked preK arithmetic but the simple fact is that your own numbers are suggesting real income per person will have risen by 23% by 2050. This is not the disaster you potray at all. Oh wait – I should note your next sentence:

“Importantly, a decline in Japan’s GDP cannot be unambiguously interpreted as a cyclical downturn.”

I guess you had no idea what Rogoff was writing about but it was business cycles not long-term trends. So #1 your harping proves you have no clue what this post was about. And #2 – your own little predictions only prove you suck at basic arithmetic.

Like I have been saying – you are incredibly arrogant for someone who is beyond stupid.

I understand what Rogoff is saying.

I am saying this: In an economy with a declining workforce, interest rates look to fall towards zero. In such an environment, economic growth will be weak, and the government will be tempted to juice the economy with deficit spending or monetary easing. Because interest rates tend towards zero, there is no budgetary constraint of borrowing — the money is free from an outlays perspective.

As a result, politicians will have an incentive to run a deficit until they are unable to refinance it. The system will run in dysfunction until it blows up. When it blows up, there will be no fiscal resources to save the economy, which will be showing no growth as far as the eye can see, even as the workforce is declining and the number of retirees keeps growing.

If the country loses access to capital markets, say, because Iran shut down the Strait of Hormuz, then the adjustment has to be made real time–the country has no additional borrowing capacity. Ugly, and I think this is a main point of Rogoff.

Into this comes MMT. If no one will lend you money, print your own. How does this work? If Rogoff took a closer look at the implication of demographics, he might form a different opinion of MMT. If a country’s population is falling, and demand is falling, and prices are consequently falling, well, what should the government do? Is it ok to just let inflation and interest rates go where they want? Or should there be some inflation target, achieved with MMT if necessary?

The BoJ says it has ‘super easy’ monetary policy. Not necessarily, if demand growth is structurally negative. So maybe you use MMT to create some inflation and give monetary policy a chance to act above the ZLB. I don’t know, but I do know this is a question worth asking.

By the way, just over a year ago, BoJ was still using QE. So they certainly hadn’t read the article. How do you stimulate an economy with a 2.45% unemployment rate (Japan’s in 2018) and decent productivity growth? By definition, that economy is running flat out. What is there to stimulate?

Clearly, neither BoJ nor Rogoff has correctly assessed the impact of demographics on aggregate GDP, unemployment, housing values, interest rates, the business cycle, borrowing tendencies, and associated political pressures — all of which are now manifest in the US as well (save housing values, to an extent).

https://www.businessinsider.com/the-bank-of-japan-quietly-made-a-big-change-to-its-monetary-policy-program-2018-1

@ Julian Silk

Something tells me a Mr. Raghuram Rajan would agree with a large portion of your comments. Maybe even ALL of your comments.

Israel (as exceedingly sharp people tend to do) learned their lesson over time. India….. not yet. I think it’s safe to say, much to Mr. Raghuram’s frustration and annoyance which as the gentleman he is, he somehow manages to (for the most part) contain internally. Wish I had his temperament for horde stupidity.

If not for his excellent econ work, you should respect Ken for his chess grand mastership. Not many GMs

I agree, Bob. Ken is the only economist who is one, and at one point he was ranked as the 40th best chess player in the world. He is very smart.

Of course, he has made mistakes, most notoriously the infamous matter of the paper with Reinardt on a 90 percent debt/GDP ratio as a critical cutoff for growth. But that seems to have been carelessness and trusting to RAs or somebody not to mess data up.

BTW, I apologize for earlier intemperate remarks. They were due to me being upset about the fairly sudden death of my sister a week ago. I am still upset, but I am trying not to take it out on other people inappropriately as I did with you.

“But that seems to have been carelessness and trusting to RAs or somebody not to mess data up”

i would argue somebody in a position such as rogoff should be held more accountable to these issues. from an academic perspective, if you cannot hold the top tier accountable, how can you expect those trying to climb the mountain to act ethically and morally responsible? certainly mistakes can be made, but when they are made by the top people in the field, whose work has significant impact beyond just an academic journal but also the real world, the idea of “carelessness” cannot be treated so cavalierly. there was a price to be paid, around the globe as well as here, due to that “carelessness”. that should not be overlooked. he may be intelligent, but his work should also be considered dangerous to others. now there were politicians who weaponized his “mistake” to further their ideology, and he cannot control that, but he can control the quality of his published work. i found it a bit disheartening for the authors of the paper to lay blame on some poor ra’s coding mistake. the ra was not the author of the paper. the entire episode was a disservice to academia in general.

baffling,

And what do you mean by “holding accountable” him for this error? Do you think Harvard should remove his chaired professorship or even maybe his tenure and fire him?

I note that according to Google Scholar his work has been cited nearly 100,000 times. His h-index is 101. That means ha has 101 publications that have been cited more than 101 times. Are we to throw him out on the street because one paper had an error in it?

As it is, he has been “held accountable” in the court of public opinion. Many people have sharply criticized him (an his coauthor) for the error in this paper. Obviously this is because this paper got a lot of attention and ended up being used by various people pushing controversial and highly questionable policies. Lots of people publish papers that have mistakes in them, but they generally get little attention even when those errors are found and publicized because nobody is paying attention. Should Ken be especially severely punished because his error occurred in a paper that was getting a lot of attention?

“Do you think Harvard should remove his chaired professorship or even maybe his tenure and fire him?”

that is a very good question barkley, and i do not have a good answer. i do not believe he should lose tenure. one should consider the perks of a chaired professorship to be a privilege and not a right. without those funds, one tends to have fewer ra’s, and therefore must do more of the actual work themselves. perhaps that coding error does not occur, or at least it cannot be blamed on the ra in the future? 🙂

but i pose a bigger question to the economics professionals. is there a professional licensing process in their field? i do not know. but there does exist such a process in other professions, such as law, medicine and engineering. and when significant mistakes or “carelessness” occurs, it can result in the loss of professional license and ability to practice that discipline. there typically exists a professional code of ethics for that discipline to help enforcement. this approach does have some effectiveness in holding one “accountable” when their contributions are hazardous. perhaps this would be useful in the world of economics. it could have the added benefit of keeping people like stephen moore and art laffer from calling themselves economists, as they most likely would struggle to maintain professional qualifications 🙂

“The infamous paper wasn’t really a properly refereed paper; it was just a kind of guest note that is commonly extended to folks at the top of their professions.”

as 2slugs noted, this is a potential issue. in reference to being held “accountable”, this is probably not a courtesy that should be extended to these authors in the future. as a profession, if you were to continue to publish their work without legitimate review, you should expect a repeat performance. remember, this episode was as damning to the economics profession as it was to the authors themselves.

at the end of the day, that piece of work was a significant contributor to the austerity implemented around the globe, resulting in real world misery for millions. it did not have to occur. people died because of the way this work was embraced around the globe.

I can forgive the silly Excel mistake. I come down harder on the AER editorial board for publishing his paper. This was a case of the AER giving R&R a pass simply because of their reputations. There were plenty of other problems with the paper even if you forget about the Excel error. The infamous paper wasn’t really a properly refereed paper; it was just a kind of guest note that is commonly extended to folks at the top of their professions. It was more in the nature of something that might have been published in something like The Atlantic Monthly or The Economist magazines. My criticism of R&R is with the way they allowed themselves to be used by Tea Party nuts in Congress. I don’t know if you ever watched their testimony, but it’s clear that they were overawed, intimidated and seduced by the trappings of power. Instead of challenging statements that they knew to be wrong, they tried to be overly deferential and let stuff slide. They had opportunities to correct the record, but they chose to be silent. At the very least they could have been passive aggressive, but they wouldn’t even go that far.

2slugbaits: It’s worthwhile to recall that “Growth in a time of debt” was published in the Papers and Proceedings issue. https://pubs.aeaweb.org/doi/pdf/10.1257/aer.100.2.573

@ 2slugbaits

Interesting……. I probably shouldn’t say this, because I’m telling on myself for my own inability (in this case anyway) to see the broader view of events. While I do think I had a pretty good grasp of it (had actually purchased the book which I semi-regretted later) through Brad DeLong, Mike Konczal (Konczal gave the most masterful take on R&R I have seen this far), I have to confess the Congressional testimony/kabuki theater aspect of it had totally escaped me.

I don’t agree with you on everything, but I have to say 2slugbaits you have once again proven you are possibly the most contributory and insightful person in the comments portion of this blog. Don’t let it go to your head ok?? [wink]

C-SPAN is pretty unbelievable in the motherload of videos they have, but I’ll be damned if I can find it. It is surprising (in a good way) how much of that type stuff you can find in the archive of video in C-SPAN—but eventually it probably just goes to a transcript, which must be in there somewhere.

Moses Herzog I think the R&R book “This Time is Different” covering 800 years of debt is a fine piece of scholarship. And I thought the R&R paper on the history of financial recessions and why they are so persistent was first rate. But their paper on the 90% debt threshold was godawful. Instead of using Excel they would have done better and made fewer errors if they had used some of the more advanced ANOVA capabilities in “R”.

The AER published this:

https://www.jstor.org/stable/pdf/1812704.pdf?seq=1#page_scan_tab_contents

Do Large Deficits Produce High Interest Rates?

Paul Evans

The American Economic Review

Vol. 75, No. 1 (Mar., 1985), pp. 68-87

Evans tried to convince us that the 1981 tax cut had no real effect as he was a true believer in Barro-Ricardian Equivalence. Never mind the fact that people did consume this tax cut. Never mind the fact that real interest rates skyrocketed. Never mind the fact that the dollar appreciated crowding out net exports as higher real interest rates crowded out investment.

You see Evans regressed the NOMINAL interest rates (which fell because of lower expected inflation) against the actual government budget deficit, which is not exactly the same thing as fiscal policy.

Menzie,

Many people here may not understand that the P&P AER is only lightly refereed, if at all. These are short papers presented at the annual meetings.

Barkley Rosser: Yes, sorry – I was pressed for time, and did not elaborate. Busy times here at UW…

@ Barkley Junior

This crap of either blaming “RAs” for incompetence, or blaming “RAs” for laziness, or blaming “RAs” for transcribing intentional errors to sell austerity propaganda has gotten way old—and it is ZERO surprise to me the man in this blog trying to endorse/sell the extremely unethical practice. Doris Kearns Goodwin and many other flat out LET’S CALL THEM WHAT THEY ARE—plagiarizers, have tried this stunt for time immemorial. Nobody with any intelligence believes that crap, and no one should—you put your damned name on it—you OWN it. BTW, that includes any Dictionary of Economics errors.

Moses,

What are talking about here? R&R messed up and it contributed to bad policy. But this was not plagiarism. Do you know what that is? It is copying somebody else’s work, not making coding errors in entering data or questionable arguments, both of which they were guilty of.

I largely agree with 2slug on this. The book by R&R and their earlier paper were excellent. This one was flawed in several ways and it should not have received so much attention. I also agree that their performance before Congress was not admirable.

Dear Barkley Rosser,

This is to express condolences over the loss of your sister. I’m sure it has been very hard, like losing an arm, and I hope you recover well.

Julian

Thanks, Julian. Hanging in there.

I have been looking for the graphic of some outer space creature ( a big talking head) invading “Our City” and the pundits having fainting spells. I think it features David Broder in a dress and maybe Cokie too. It was an image that replaced 10,000 words on the incest of the DC pundits.

Google failed to find it. Please will some kind soul post the link. TIA.

@dilbert

This is a slightly confusing description. Can you give me what event it was specifically in reference to (please tell me not the “pizzagate” nonsense) or a specific link that refers to it?? Not the item itself obviously but I link which makes direct reference to it. If you can do that I will try to hunt this down for you.

This isn’t that weird frog meme thing-y that 4chan created is it?? That one should be easy enough to find.

The image I have in mind was from the Clinton or maybe Carter eras. I think Carter too early. The theme was a Democratic Party president was just unacceptable to DC pundits.

I will hunt around, but that’s almost the type of image would be easier to find on old newspaper microfiche at a university library or something. Internet wasn’t that popular until roughly 1997, and even really arguably after that, so I don’t know how to refer to that “pre-internet” or “legacy” type media?? Obviously someone may have put it up but it will be more a task to find. You actually have me curious now, so I will sniff around in my might owl hours here. I have enough caffeine drinks and garbage snacks to cut a path here. Will update at 4am or something, Overall Cokie Roberts was a great lady, the truth is people born in her socioeconomic group just don’t think of poor people that much—it’s just never in their immediate surroundings—so even though Cokie Roberts was lacking in this trait, she was still better than most people in her group on that I think. Not a “snob” I don’t think. I always found her charming on some levels so that may be coloring my view of her as well.

I almost thought I had it, no space creature though—does kind of “imply” incestuous nature of media, DC though.

https://twitter.com/ktumulty/status/1174100516055527430?s=20 (“Spy” magazine 1990)

I always get Broder and Dan Balz mixed up in my mind. They don’t even look similar so I don’t know why.

@ dilbert

Well, I’ve failed you. I tried every keyword search mixture you can imagine. I even tried the Yandex and Dogpile search engines. I found out that if you search “Cokie Roberts cartoon” on Yandex tons of caricature images of Julie Roberts come up…. among other things. Russians have weird search habits. They apparently really like World War 2 American pin-up girls. Who knew?? I am curious to see it as you are to find it. But one can only rationalize these time eaters so much. In some ways Yandex is actually easier (which semi-surprised me) and I got a lot more political cartoons to pop up on Yandex than on Google—I assume because Russians enjoy the voyeurism of watching American politicians continually trip over their own shoe laces. They must wonder if all this “democracy” stuff is worth the effort. I have to admit in the last 3 years I’ve been wondering myself.

Anyways, I’m sorry I couldn’t find it. For at least 90 minutes I gave it “the old college try”.

How do you square central bank independence with western democracy and freedom? I realize the economic arguments for independence. But a central tenet of freedom is that we don’t have rogue agencies doing whatever they want with (only loose, ineffective) oversight by elected officials via Humphrey-Hawkins testimony.

Brian: Well, why should we have a NSF. Why don’t we have each grant application voted on by the electorate? Why not have every environmental regulation similarly decided? Also, why not have doctor’s licenses dictated by vote?

Not denying that there is a legitimate question on the extent to which we insulate the central bank; however, we do have a lot of evidence regarding what happens when the CB is completely supine.

My view is that the Federal Reserve has never been independent. It has worked to the benefit of bankers and against the interests of wage earners. Yellen made a terrible mistake starting to raise rates way back in 2015, arguably helping Trump get elected. Why did the Fed make this mistake? Because they are biased toward the inflation side of their mandate instead of the employment side.

For 40 years the Fed has been at the ready to put their boot on the necks of wage earners any time they get a whiff of a real gain. Is there any mystery why real wages have been flat and all of the gains are going to the top?

If you want a real independent Fed it should consist of one third bankers, one third labor representatives and one third consumer representatives.

I approached Rogoff’s paper wanting to like it. Rogoff is a first-rate economist who got caught up in political forces he didn’t understand and allowed himself to be used and abused by Tea Party trash. So I wanted to like it. But reading his paper was a disappointment. To begin with, he is once again demonstrating his political naivete in pretending that both the left and the right are equally guilty in trying to undermine the Fed’s independence. He’s fooling himself here just as he fooled himself about the benign intentions of Tea Party Congress critters years ago. Virtually all of the threat to the Fed’s independence is coming from one man…Donald J. Trump. Only just a few minutes ago Trump couldn’t resist trash talking the Fed for not having the guts to lower interest rates beyond 25 basis points. The supposed “threat” from the left comes from a few politically impotent academic economists advocating MMT. Is Rogoff seriously pretending that those two “threats” are somehow equivalent? Gimme a break.

In the paper Rogoff also claimed that the Fed’s only proper policy instrument is to manage interest rates. Of course, that wasn’t always the case. There was a time when the Fed thought its proper policy instrument was to manage the money supply. And at an even earlier time the Fed thought its proper policy instrument was to manage species flow. Now I’m not arguing for a return to either one of those policy tools, my point is simply that there is nothing eternally sacred about short-term interest rates as the only proper policy instrument available to the Fed. Who’s to say that some clever mind might not envision a new policy instrument?

I believe Rogoff also overstates the consequences of a higher inflation rate. Nobody wants to see Argentina or Zimbabwe or Weimar Germany. Inflation was an issue in the 1960s and 1970s, but it never got to anything like the scary hyperinflation horror stories that some would have us believe. Real GDP growth was no worse than it is today and it was usually higher. Somehow we all managed to survive. People didn’t care all that much about the absolute inflation rate, what they cared about was the accelerating rate in the late 1970s…and that probably had at least as much to do with oil politics as anything else. What we learned was that monetary stimulus is a poor way to offset negative supply shocks. Bottom line is that I think Rogoff overstated the consequences of a less than fully independent Fed. At least in normal times with normal presidents and normal political guardrails. But in Trump World there probably is a greater than normal risk.

Finally, Rogoff’s policy prescription of negative interest rates seems like it might be an interesting seminar topic, but politically it’s DOA. Just today the Fed announced that they won’t even consider negative interest rates. I also don’t quite understand Rogoff’s risk trade-off here. He seems quite confident that going to negative interest rates represents no threat of unintended consequences. So on the one hand he downplays any risks associated with adopting a novel, untested and ill-understood policy solution while on the other hand he overstates the risks of managing inflation, which is a well understood, fully tested and utterly conventional macroeconomic problem. The biggest threat to the Fed’s independence isn’t coming from academic lefties; it’s coming from idiot politicians and idiot voters. And it’s also coming from respectable academics who allowed themselves to be seduced by the trappings of power and stardom, with the unintended effect of prolonging the Great Recession and making a clown show, carnival barker President P.T. Barnum possible.

I happen to agree that I think there are some problems and loose ends in this paper, even as I think Ken is very smart. He used to be at UW-Madison, but I think that was before Menzie got there. I happen to know him pretty well, and while he has held some important somewhat bureaucratic positions such as Chief Economist at the IMF, there is a bit of the absent-minded professor about this chess grandmaster economist.

@ Barkley Junior

The stereotype of the “absent-minded professor” is usually of one who ehF’s-up other sectors or “compartments” of their life as they are so focused on the work itself or their individual discipline’s/field’s obsessions—NOT messing up in the specialization of their research and/or academic work. WOW…….. your ability to rationalize errors must make you wildly popular in faculty meetings discussing potential tenured status.

Moses,

I am guilty of being what I accused my old friend, Ken Rogoff, of being, an”absent minded professor.” Our various wives (both of us are on more than one), accurately accuse of us this crime, “absent-minded professorship.” Guilty, guilty, guilty, and it has become a matter of sexism, supposedly “brilliant” males who are personally irresponsible in their personal conduct. In both of my marriages I have tried not to be too guilty of this, although that I have been very guilty, but I am not remotely as important globally as Ken Rogoff. So this is an old sexist syndrome, and those of us guilty of it should do our best to mitigate the consequencies of our odd behavior.

An independent fed is surely better than any alternative, at least better than any I can imagine. But don’t forget that bankers are solidly represented on the fed, and the banks will not do well with lower interest rates. The banks were probably cowed during the great recession from saying much of anything, but that may no longer be the case.

baffling: “now there were politicians who weaponized his “mistake” to further their ideology, and he cannot control that”

Ah, but Rogoff didn’t just stand passively by as Republicans weaponized his mistake. Rogoff and Reinhart actively went to Congress and in testimony for the Senate Budget Committee pimped their tale of the disaster to befall the U.S. if they didn’t stop spending immediately in the midst of the Great Recession. Republicans used his testimony to justify their austerity policies. It’s not like this happened beyond their control. They were very chummy with Kent Conrad, Tom Coburn and Johnny Isakson in their public testimony.

Not just incidentally, Rogoff also used these public opportunities to stump for entitlement cuts and a flat tax.

The latest on the great candidate Kamala Harris.

https://youtu.be/lD5ZbkLPS0I?t=145

I will say this, it’s a little disingenuous of Tracey to say that Yang is leading Copmala in California, as if you average out the polls Harris is still ahead of Yang. However, I do think one can legitimately argue that Yang is gaining ground on Copmala. So, there’s no need to exaggerate here, if you’re losing ground to a guy whose chances looked darn near laughable a few months ago—you have problems with your campaign— both in campaign strategy and just as a candidate. When you’re losing ground in your “home state”—you’ve got problems.

Yes, Mose, Harris is sinking in the polls, now behind Buttigieg nationally in latest. But I still prefer her to B and B and most of the other Dem candidates, even though she is sinking and her chances are fading.

Since you keep insisting on going off topic regularly to give us your opinions about the Dem race, will you continue to make a complete ass of yourself by getting on Warren’s case over all that old Native American stuff? She is the one rising in the polls, increasingly looking like she will be the nominee. No, it will not be Bernie, much less the awful Gabbard. I think Warren looks pretty good, but you keep spouting garbage Trump lines. Maybe Hannity can have you on to chant “Pocahontas!” over and over.

As far as I can tell – there are only two candidates getting any real traction. Biden and Warren. Yes Bernie Sanders has his following but I bet a lot of progressives are thinking – hey Bernie, time to endorse Warren.

I’m middle aged now. I don’t think I’ve straight given my age here, but if you can do simple math you know it. I’ve heard a lot of kookball stories in my life about UFOs from TV, radio, newspaper. Some even I know they are complete BS I listen to on radio, or watch TV series for the entertainment value. NONE of them qualified as believable or credible. NONE. Even the ones that tended to be more realistic could be written off as military tests. Most of them are in Arizona, New Mexico, Nevada, where military flight tests would be done for obvious reasons, such as low population levels over broad areas of land. This thing about “The Nimitz Incident” circa 2004, is the first one I find to be credible—that I have EVER heard in my life. Were they from outer-space?? I’m not saying that, I’m betting against it. But something happened here. Something happened. These guys are for real:

https://www.youtube.com/watch?v=VqdOXfuzDIw

https://youtu.be/PRgoisHRmUE?t=188

Yes, the narrator and some other things of the film have a “hokey” and melodramatic feel—but I think the Navy mens’ witness of what happened is convincing. NYT “confirmed” the video is real U.S. Government video.

No no no, Moses. That video is all due to a coding mistake made by ken Rogoff while he was plagiarizing some work by space aliens, although he forgot what he was doing halfway through, :-).

@ Barkley Junior

Copmala needs your help in South Carolina Barkley. What was it Barkley Junior said?? Oh yeah…. “SC will be the serious Harris-Biden showdown.”

https://econbrowser.com/archives/2019/07/of-sugar-highs-uncertainty-and-recession#comment-227560

It’s going to be exciting. Can’t wait for first exit poll from “Senile In Harrisonburg Virginia Surveys LLC”. Here’s the latest numbers from your “Battle Royale” in SC you rube:

https://www.realclearpolitics.com/epolls/2020/president/sc/south_carolina_democratic_presidential_primary-6824.html

In the most recent tabulated poll Harris has 7% to Biden’s 43%. No one can deny you sure have your finger on the pulse of America’s black voters Barkley. You are a man of “foresighted vision” along with your Larry King style name drop academic “friends” you’ve probably spent about 5 minutes with in your entire life.

Moses Herzog: Seriously?

@ Professor Chinn

You’re welcome to go at me where I have stated what you view to be falsehoods.

I never labeled Rogoff a plagiarizer–that was stated after my reference to Doris Kearns Goodwin—so it is MY words which have been twisted by a sad bitter old man. That obviously doesn’t seem to bother you so much. This is what people like Barkley do, he plays apologetics for academics who blame RAs for their own mistakes (something I would think as a former RA you would sympathize with, or have you forgotten that feeling??) to obfuscate from the real issue—the R&R “error” happened to support their own politics. WOW, that’s an amazing “coincidence” I have to say. Excuse me if I have ZERO respect for that.

https://www.nytimes.com/2002/02/23/us/historian-says-borrowing-was-wider-than-known.html

https://economix.blogs.nytimes.com/2013/04/17/a-history-of-oopsies-in-economic-studies/

Moses Herzog: I thought I was responding to your “Copmala” reference; if it was appended to your Rogoff comment, apologies. I have not comment there. It just seems to me that you are unnecessarily perjorative in your dismissal of several candidates. You can dismiss and critique without resort to such language.

I am now seriously worrying about you, Moses. Hey, I am the one who just had his dear sister die unexpectedly, but you seem to be the one now completely losing it. Please, Moses, get it together, however, some way or another.