Bryan Riley at NTU brings my attention to this press release:

The Coalition for a Prosperous America (CPA) has won the prestigious Edmund A. Mennis Award from the National Association for Business Economics (NABE) for a study showing that a permanent tariff on China would benefit the US economy. The award from the nation’s leading association of business economists confirms a growing acceptance of pro-US trade policies needed to address the nation’s economic challenges.

The press release continues:

The study, Decoupling from China – An Economic Analysis of the Impact on the U.S. Economy of a Permanent Tariff on Chinese Imports, co-authored by CPA Chief Economist Jeff Ferry and Senior Economist Steven Byers, modeled the effects of a 25 percent tariff on imports from China. It found that after five years the tariff would add $156 billion to annual GDP and 948,000 jobs to the US economy.

The paper is here. The granting of this award to this paper is quite astounding. Here is what I wrote about the “study” in July.

The Coalition for a Prosperous America publishes another study imbued with “secret sauce” structure…From the “working paper” (more akin to a press release):

Specifically, we introduce the effects of Chinese retaliation with tariffs on US exports to China; we add the effects of the US Department of Agriculture’s (USDA) programs to support farmers and food processors negatively affected by Chinese retaliation; and, we add the impact of the US government spending the revenue generated by the China tariffs. We find that Chinese retaliation reduces the benefit to the US economy by 14 percent, but the net benefit remains large. The USDA programs provide relief to the agricultural industry and restore the net benefit to almost the same level as before the retaliation. Finally, we look at the impact of the government reinvesting the tariff revenue in the US economy by boosting government spending…

I’ve read the “working paper” (and the preceding paper) a couple of times, and am not clear what is going on — the results are based on splicing two models (REMI and BCG data) and running out the results.

Alarm bells went off in my head when I read this:

“Our forecast results differ from many others because ours incorporate more real-world evidence than other forecasts, which tend to rely excessively on unrealistic assumptions based on neoclassical economics. For example, forecasters who have found that tariffs depress US GDP often assume that all or most of the tariff price is passed onto consumers, and that spending on these goods falls substantially as a result of price increases. These assumptions are unwarranted, noting the evidence from the tariffs of 2018-2019, where we have seen minimal price increases from Section 201 and China tariffs.”

This is counter to the most recent research on the subject. From Amiti et al. (2019), an empirical finding:

This paper explores the impacts of the Trump administration’s trade policy on prices and welfare. Over the course of 2018, the U.S. experienced substantial increases in the prices of intermediates and final goods, dramatic changes to its supply-chain network, reductions in availability of imported varieties, and complete passthrough of the tariffs into domestic prices of imported goods. Overall, using standard economic methods, we find that the full incidence of the tariff falls on domestic consumers, with a reduction in U.S. real income of $1.4 billion per month by the end of 2018. We also see similar patterns for foreign countries who have retaliated against the U.S., which indicates that the trade war also reduced real income for other countries.

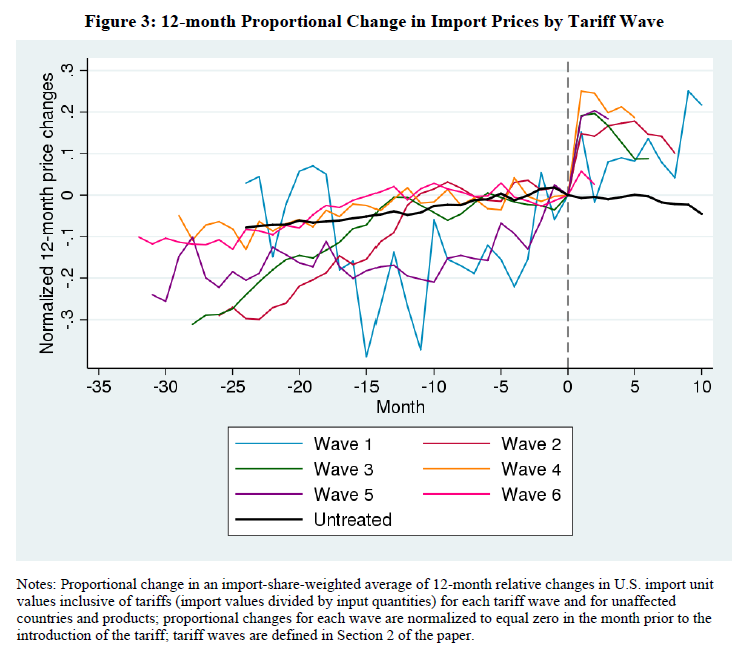

If you are skeptical, a graph of the data on goods subject to the different waves of tariffs is useful. From Amiti et al.

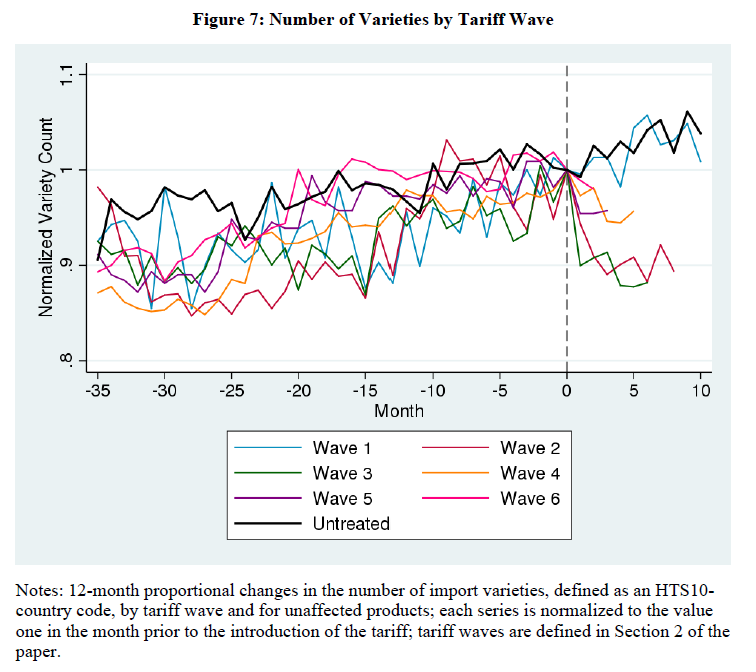

In addition, the variety of goods declined.

If the authors of the CPA study can’t even get the stylized facts right, what hope is there for reasoned analysis?

I will also note that this comment in the CPA working paper (page 5) does not engender confidence:

Our forecast results differ from many others because ours incorporate more real-world evidence than other forecasts, which tend to rely excessively on unrealistic assumptions based on neoclassical economics. For example, forecasters who have found that tariffs depress US GDP often assume that all or most of the tariff price is passed onto consumers…

Well, I hate to tell the authors but that’s not a neoclassical assumption. It might be an assumption in a neoclassical model, but it’s not intrinsically neoclassical. One could just as easily assume in a neoclassical model that the economy is large, so that the terms of trade can be affected by the imposition of a tariff. (Neoclassical means to me “frictionless”, equating marginal conditions either inter- or intra-temporally, with symmetric (full) information).

It seems a lot of the results are driven by (1) government financial support for farmers impacted by Chinese tariffs on US goods, (2) Chinese tariffs on US goods have a relatively small effect, and (3) that the tariff revenue (nearly half a trillion over 5 years!) is spent on infrastructure (which has a high multiplier in most models, presumably also in the REMI model as well). Of course, this works if the US tariffs have a terms of trade effect so that we get Chinese goods (ex-tariffs) more cheaply. As the Amiti et al. paper has documented, that hasn’t happened yet.

On top of the Coalition for a Prosperous America’s crazy currency misalignment paper, it’s clear to me that the group’s studies are mere propaganda.

Menzie, this has to rank as one of your top 5 fails of posting since I have been reading this blog off and on since around 2009. You really disappointed me here. No Seinfeld Youtube link of Jerry and George discussing Bizarro World?? Must I always be the one to carry the heavy burden of degeneracy and juvenile behavior on this blog?? The effort it takes to hold up the massive weight of the infantile banner??

https://youtu.be/yMRmV1Sj6j4?t=68

https://external-preview.redd.it/o6mTEcu5HJNWIwR9zREuVBYNIc-5P2Yy2SeCX4a9jWY.png?auto=webp&s=3cc7324fef8493173f1db5f7b79b1367215fb862

OK…….. I feel better now…….

This lady is one of a kind (in the best of ways), and it’s a crime she’s not currently working in the State Department or otherwise similar type job:

https://www.youtube.com/watch?v=t2-rJaHaWdU

The surprise here is that the NABE would endorse this nonsense. It is my impression that most business leaders are not in favor of Trump’s tariffs, including many in supposedly protected sectors. This suggests that the leasdership of the NABE has been taken over by partisan hack Trumpists against the interests of their employers.

this probably has to do with folks wanting to sit at the “cool kids” table at lunch. they may be partisan hacks, but they still have the behavior of middle school children.

So NABE endorses a dumb paper from the Coalition for a Prosperous America. If you have never been to a NABE conference, you have not missed much. Not the sharpest pencils in the box.

pgl,

I have never been to one of their conferences. Have you?

As it is, I know a few people in that group, and they happen to be reasonably competent, if not top flight economists. But I suspect I know a biased small sample. Too bad that apparently NABE is apparently dominated by partisan hacks so dumb they are willing to go against what the vast majority of economists think that, including most supporters of laissez-faire, and also against the interests of most of their employers.

I’m sure some members of NABE are competent but the two conferences I attended did not bring out their best and brightest. They have do transfer pricing specific conference each year where the presentations are on-line ahead of the conference. I went once and realized it was all kissing up to the lawyers there so since then I skip it and just read the presentations on-line, which are generally a bad joke. General rule – when a session is kissing up to politicians or lawyers, real economists get drowned out.

Who on earth was Edmund A. Mennis?

https://www.questia.com/library/journal/1G1-208461303/in-memoriam-edmund-a-mennis

“Ed was the author of more than 60 articles, contributed chapters, monographs, books, and book reviews in economics and finance. His book, How the Economy Works, has been used in a number of college courses in economics and has been translated into Chinese. He also co-authored a book, Quantitative Techniques for Financial Analysis, initially published by the Financial Analysts Research Foundation in 1971, which was used for many years as the basic text for the statistical component of the Chartered Financial Analysts’ examination program. Known for his research in the area of measuring corporate profits, he demonstrated that corporation reports of profits to shareholders were not the same as those reported on the corporate income tax returns, contrary to widespread belief. Shareholder reports reflected a more profitable figure than tax returns, primarily because of the different treatment of depreciation and overseas earnings.”

Got that – one of his books was translated into Chinese! Sorry but this is not exactly a Nobel Prize winning resume.

Doing my night owl thing, eating homemade lentil soup (tasty but probably geared to my individual taste) and Barq’s root beer, I was wandering around online, and pretty much by happenstance (Menzie will never believe this is coincidence) found this:

http://www.bondeconomics.com/2019/10/the-state-of-mmt.html

Although I don’t expect (or necessarily “blame” him for) this will change his view of MMT one iota after reading this, I think it is something Menzie STILL might find semi-entertaining to peruse.

Even if Menzie has low-regard for MMT, I feel semi-confident he’ll find it on a higher intellectual plain than the next press release from The Coalition for a Prosperous America. Huh?? I should be only very slightly confident?? What….. ??

Moses,

From what i hear the big other discipline out in force at Stony Brook was law.

Romanchuk is correct that the issue of relations with other Post Keynesians (Romanchuk’s adding the hyphen reflects his being Canadian rather than American) is a big one. The more fervent MMTers may wish to say either that they now dominate Post Keynesian economics or have transcended it and left it behind, with Romanchuk sort of pushing that on grounds that MMT is being paid attention to by politicians such as Sanders and AOC. Hey, it certainly gets one out of worrying about having to pay for the Green New Deal, no problem if MMT is true, as long as you borrow in your own currency and especially if it is a strong one like the US$..

On the matter of getting control, well, the editors of the Journal of Post Keynesian Economics (JPKE) are now Jan Kregel and Randall Wray, both of them strongly in the MMT camp, especially Wray (with whom I have coauthored). I am still on the JPKE editorial board, where they keep me because they need somebody who knows the math I do to handle certain kinds of papers they get, even though I am known not to be one of the MMT True Believers (and they do not invite me to their conferences, even though I am friendly with most of them and have had several in to speak at JMU).

The tough part is that probably the harshest critics of MMT are other Post Keynesians. Romanchuk focused on Marc Lavoie, but probably more important, and briefly mentioned by Romanchuk is Tom Palley, who has been quoted by people like Paul Krugman and Larry Summers when discussing MMT, even though those two would not be caught dead citing him (or Lavoie) on other matters. BTW, Palley is (or was, not sure he is still there) one of the editors of the much newer Review of Keynesian Economics. As it is, both the JPKE and ROKE still publish papers by both pro and anti MMTers, near as I can tell, although some polarizing gong on with that.

I am more in the middle of this, thinking that the MMTers are right about a lot of stuff, and even Summers has agreed with this. But I also have some problems with some of their arguments, which I am not going to get into here as that is a long and also off-topic discussion. As it is, I think they are getting a lot of public attention because of the coup Stefanie Kelton pulled by becoming Bernie’s top economic adviser in 2016, which she is now again, as well as convincing some other piols, notably AOC. She is very articulate and persuasive, indeed, getting a serious following on Wall Street. When I listen to her speak I find myself ready to fully join up, but then later I remind myself of my own issues with it.

@ Barkley Rosser

As is often the case with you, you proffer opinions on topics which you have very little knowledge of, such as capital requirements for banks as it relates to the need for “emergency” repo funding, which again, happened mid-month, not end of month, for the chronologically challenged. This is much more apt to be caused by low capital requirements, NOT high capital requirements (related to Basel III or Fed rules) as your stance on the mid-September repo sales suggests.

I don’t think Stephanie Kelton “convinced” Ocasio Cortez of anything. Reaffirmed or bolstered thoughts she already had as an Economics and International Relations graduate from Boston University??—maybe. But I don’t think Kelton “convinced” Ocasio-Cortez on the efficacy of MMT. Barkley, it’s kind of a hallmark of your over-inflated sense of self, that you think someone who has studied economics from a broad range of reading like Ocasio-Cortez has, and interacted with some members of the profession, that one single woman “convinced” her about some of the better aspects of MMT. Maybe this is what you think your effect is on your prior students—but most people don’t gravitate to an ideology or “school of thought” on the statements of a single person.

Oh my heavens, here you go again, Moses. Having had it pointed out that you are dead wrong on something you double down as if you were Donald Trump on asserting your dead wrong point. No, boy, the repo rumpus was not at all about capital requirements being too low.. It was just the opposite, capital requirements possibly being too high. Banks need liquidity to meet high capital requirements. They do not need it for low capital requirements. You are way dead wrong, completely verifying that it is you, not me, who has “very little knowledge of, such as capital requirements for banks as it relates to the need for ’emergency’ repo funding.” And timing of month not as important as you claim.

So, I guess I need to drag in a source that explains this. Tyler Cowen at Marginal Revolution linked to a twitter discussion by Nathan Tankus on this. You need to read the whole thing, all the comments, although the opening post by Tankus makes it clear that this liquidity crunch that led to the surge in demand for repos was due to high capital requirements, which he blames on the Basel III Accords, which only came into force for the US in March 2018, not low capital requirements as you have massively ignorantly claimed. You look even stupider on this than Steven Kopits does on general macro, and by a country mile, or several of them. He at least has been right about parts of it. You are simply just totally wrong.

Here is the link to the very well informed discussion by Tankus. Read it and learn something.

twitter.com/NathanTankus/status/11749268508782591 .

If I have not gotten that right, then google “Nathan Tankus 2019 Basel.” It is not the first hit, but easily found in the top several. Oh, and he is not the only one out there pushing this Basel III Accord argument, which I am not sure I fully buy. But it sure as hell is not due to overly low capital requirements as you now are iditotically insisting on continuing to argue.

You are in way over your head on this one, Moses, and drowning. Get a life raft and get out of the water, please, the sooner the better..

BTW, Moses, if you want to continue trying to push the matter of timing on this stuff to claim it had nothing to do with end of quarter liquidity demand surges, note that in Tankus’s various comments he a couple of times mentions “settlement accounts.” These are matters important at the ends of quarters and part of why there is a higher demand for liquidity then. So when he refers to these as part of why there was this higher repo demand, he is in fact invoking the end-of-quarter demand theory.

As it is, I am kind of wondering why you seem to be so ignorant about this stuff. Is it not the case that you have a finance degree, from Duke even? Are you using that at all? I have never seen you refer to what you do professionally, although apparently you worked for awhile in China, which you do seem to know quite a bit about. But what is it you do now? Or are you gainfully unemployed?

I certainly doubt you are doing anything related to finance, given your apparent massive ignorance about the subject.

“settlement balances” not “setlement accounts.” Anyway, they are part of what lots of financial firms and corporations are trying to get adjusted at ends of quarters that stimulates liquidity demand.

Moses,

If you are unemployed, which I am increasingly suspecting, is it because you say inappropriate things about “the ladies” when you do have a job? Is that what got you expelled from twitter?

OK, on the second half of this silly post by you, Moses. Why do you keep insisting that I do not know people or things? I am sorry that this goes against your stupid and ignorant prejudice, but two reasons why I was appointed to be the senior coeditor of the New Palgrave Dictionary of Economics, an appointment I dare you to find anybody anywhere questioning or criticizing (heck, they were begging me to do it), is that I know both a very large number of people in the economics profession and I also know a whole lot of economics. There are very few people out there who have published in more sub-disciplines of economics than I have, not going to give the long list, much less in other disciplines outside of economics, also a long list. Indeed, I can name only a handful of such people.

Regarding the people I discussed in my comment on Romanchuk, which i really see no reason for you to get all pissy about, with the exception of Romanchuk, I know every other person I mentioned by name, all of them very well in fact. I have known Stefanie Kelton for several decades since she was an obviously very bright grad student named Stephanie Bell, the name her earliest publications appeared under.

As it is, Stefanie indeed is responsible for AOC becoming aware of MMT and deciding to go for it. As I commented, Stefanie is very articulate and very convincing, and she is the MMT person hanging around Congress thanks to Bernie Sanders, whom AOC is close to. Your silly claim that AOC would have learned about MMT from her undergrad econ courses at BU is simply ridiculous. It was not taught there at all in any courses when AOC was there. No, it was Stefanie.

This source below does not come out right explicitly and say it, but in discussing AOC’s sudden turn to supporting MMT early this year, it is all “Stefanie Kelton, Stefanie Kelton, Stefanie Kelton.” This is really an extremely silly issue for you to get on a high horse about, Moses. Here I am providing useful basically inside information about all this, and you idiotically want to start questioning it on the basis of nothing. Grow up and get real.

politico.com/story/2019/02/06/alexandra-ocasio-cortez-budget.1143024 .

Oh, I do not know either Bernie Sanders or AOC personally.

You are on the beam as usual Bark

MMT is a pop panacea

But

It does no harm

The Latin left populists

Have in effect followed this line

All the way to doom

But here in the global metropolis

We can tolerate its lacunae

These folks are part of a plausible green new deal coalition

Stunning and a black eye on the NABE. Reasonable economists can argue about just how large the benefits of trade with China are in the long run, but I don’t think any educated economist would credibly argue the benefits are negative. Who funds this CPA organization that I’ve never heard of?

“but I don’t think any educated economist would credibly argue the benefits are negative”

of course that is exactly what anybody endorsing this study is saying. and i bet there are many in that position, who have not thought about your point.

Folks are giving NABE way too much credit. This crew is not exactly the brightest of economists. Heck when Glassman and Hassett published DOW 36000 20 years ago, I bet NABE praised that too.

Facts must be neoclassical. They should be ignored.

WTF? You should read Dani Rodrik’s Economist Rules. Neoclassical refers to a theoretical model – not “facts”. This model makes certain predictions like all models do and of course the real world has lots of data points (aka facts I guess) which cannot be explained by a simple model.

Got somebody. I was expecting somebody else to bite. I was commenting obliquely on exactly that point. Professor Chinn’s comment that the data points were not a neoclassical model’s assumption amused me. So, I figured that the guy who wrote the paper decided that they were and should be ignored.

Too dry a sense of humor can be like finding the humor in eating sawdust sometimes.

There are no opportunities for self-righteous diatribes or a feeling of patronizing superiority in humor Willie. Haven’t Barkley Junior and “pgl” taught you anything here all these months?? And I’m not even talking about all the people you (read general “you”) can name drop that you probably haven’t shared 20 words with. Get with the program Willie.

Nah. It was just a dad joke, nothing more. Ask my son. He will set you straight.

One of the more interesting papers showing that all of the cost of tariffs is passed through to consumers was by Aaron Flaanen, Ali Hortaçsu, and Felix Tintelnot, “The Production Relocation and Price Effects of U.S. Trade Policy: The Case of Washing Machines.”.

For whatever reason, the Trump administration chose to put a 25% tariff on washing machines and 0% tariff on clothes dryers. What they found is the producers increased the price of washing machines by 12% and clothes dryers also by 12% even though there was no tariff on clothes dryers. Since washers and dryers tend to be purchased in matched pairs, this allowed producers to conceal half of the tariff increase while still passing on almost all of the tariff to consumers. Pretty clever.

This jiggering is similar to the dead weight loss to the economy spent on complicated income tax avoidance schemes. Which isn’t surprising since tariffs are simply a tax on consumers, no matter what Trump claims.

Hey on this rainy day in NYC, I more interested in the dryer than the damn washing machine.

As far as what Trump claims – isn’t it a proven fact that 100% of his claims are the opposite of the truth? OK, maybe he has said one or two things that just happen to be true over the past 3 years. He sure does tweet a lot of weird stuff.

A link to Aaron Flaanen, Ali Hortaçsu, and Felix Tintelnot, “The Production Relocation and Price Effects of U.S. Trade Policy: The Case of Washing Machines.”

https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_201961-1.pdf

Uh, oh. It looks like Menzie Chinn might have to apologize to Stephen Moore and Rick Stryker. It turns out that Stephen Moore wasn’t lying when he claimed that the deficit was $1 trillion back in 2017. He was just brilliantly prescient.

Who could have known back then, other than a consummate insider like Moore, that Republicans would blow up the deficit by $380 billion on tax cuts for the rich?

The CBO says that the 2019 deficit will finally hit Stephen Moore’s long promised trillion dollars (actually not a trillion but $984 billion because we know that Rick Stryker is such a stickler for accuracy). Heck of a job, Republicans.

Next up, Larry Kudlow explaining how explosive growth will be kicking in any year now, proving that tax cuts pay for themselves.

Kudlow and Moore were doing some Obama bashing back then. So are you saying that Dec. 2017 tax cut the fault of Obama? Oh wait – Obama did not reign down on the Russian meddling in 2016 on behalf of Trump so yea – that tax cut was Obama’s fault!

“Larry Kudlow explaining how explosive growth will be kicking in any year now, proving that tax cuts pay for themselves.”

Yes – this may actually happen. After all Trump has said impeachment will lead to Civil War. Which means a lot of jobs as we fight each other over whether Trump gets to be crowned King or not. MAGA!

@ jospeph

I talked to the girls, and both Laura Ingraham and Kellyanne Conway said you’re not invited to this year’s slumber party—so you can forget it now dude.

In other news….. the “very stable genius” has now put his stamp of approval on the slaughter and abuse of America’s best allies in the Middle East.

https://www.nytimes.com/2019/10/09/world/middleeast/turkey-attacks-syria.html?action=click&module=Top%20Stories&pgtype=Homepage

“Shocker”—-The military operation has started. Thanks trump !!!!

The Republicans are now criticizing Turkey for doing what donald trump told them to do. Great foreign policy. Imagine if a dark-skinned President pulled this stunt. Republicans—-Rot in hell!!! Along with the mothers who raised you.

Joseph,

Yes, Menzie owes me and Stephen Moore many, many apologies

The new tax cuts will pay for themselves and be the prime eliminator of the national debt by 2024. Providing, of course, we reduce capital gains, index c.g. to inflation, and cut the top income tax rates to something more manageable. Say 10%.

Believe me, that will ensure a money monsoon like we’ve never seen before. Let it rain!

Moses — did you get the chart of average hourly earnings and fed funds I asked Chin to forward to you?

I will look in a few moments here. Again, I doubt if that means causation, but I will give your numbers a good look.

@ spencer

I did see the graph/chart, just so you know. The numbers correlate much closer than I imagined, as far as the Fed Funds rate going down when wages were going down. But you are mistaking correlation with causation. Now, the reason for that most likely is the Fed Funds is being moved down after the Federal Reserve sees that wages are going down (or actually just the general economy is going down). That’s what the Fed Res does. And if you stop and think about it, your comment makes no sense (arguably no sense period) when related to baffling’s comment. Baffling is implying if not out and out stating, he’s upset rates aren’t adjusted downward to help wages to rise. Your graph (at least short term, and really over an extended time there) strongly implies (the way YOU are interpreting it anyway) that lowering rates causes lower wages. On the face of it it’s completely nonsensical.

I can be pretty harsh with people on this blog. Your mistake is an honest one or you wouldn’t have gone to the effort of making the graph. I’m gonna leave it at that. (P.S. Your margin labels were messed up, but your graph is still readable)

The authors attributed to the trade war an increase of 0.3% to the PPI and/or the CPI. My question is an era when the FED trying as hard as they can but not achieving their 2% goal, what does 0.3% increase of CPI mean? To me it means that instead of the FED causing the rise in CPI, the trade war did. But, either cause, FED or trade war, the results are the same to the consumer. And further speculation, current times of low inflation and a FED struggling to achieve its 2% goal, it is as good a time as there is to attempt to reign in the abuses of China, as well correct the tariff imbalance with other nations.

Ed

Ed Hanson: “reign in the abuses of China”???

Ed,

What “tariff imbalance with other natons”?

“The authors attributed to the trade war an increase of 0.3% to the PPI and/or the CPI. My question is an era when the FED trying as hard as they can but not achieving their 2% goal, what does 0.3% increase of CPI mean?”

I guess you do not know that imports are only 15% of GDP. Hey Ed – what is 2% times 0.15? We’ll wait until you take your shoes off so you can count past 10.

“it is as good a time as there is to attempt to reign in the abuses of China, as well correct the tariff imbalance with other nations.”

Correcting tariff imbalances – eh? Ask soybean farmers how this is working out for them!

“Ed HansonOctober 9, 2019 at 5:27 pm

The authors attributed to the trade war an increase of 0.3% to the PPI and/or the CPI.”

Ed per his usual cherry picking dishonesty is misrepresenting this paper really badly. Let’s see what they wrote beginning on page 4:

“Figure 2 presents evidence of this for one of the first sectors targeted by the Trump administration: washing machines. The first panel shows what happened to the consumer price index (CPI) for major appliances, which is broad category of goods that includes washing machines. As one can see in the figure, despite the fact that the CPI for major appliances had been falling steadily for years prior to the trade war, it began rising sharply after the imposition of the new tariffs.”

And on page 6:

“Figure 3 plots the evolution of these prices for each of the six waves of tariffs. We see a number of important facts in this figure. First, the prices for sectors not subject to tariffs are fairly flat, which suggests that whatever price movements we observe in protected sectors are likely due to the tariffs. Second, we see large increases in prices of goods that were subject to tariffs, with unit values typically rising from 10 to 30 percent in the wake of the tariffs. Given that these numbers are comparable in magnitude to tariffs that were applied, it suggests that much of the tariffs were passed on to U.S. importers and consumers.”

Maybe they did not teach Ed this in his “economic” courses at Trump University but the issue is the impact on relative prices – not the overall inflation rate. Take a look at Figure 2 Ed – the impact on the relative price for major appliances was YUUUGE. Of course we know you never learned how to use a washing machine so you’re good!

Have you forgotten disregard of protection of intellectual property by China? Have you forgotten about forced technology transfer by China.? These are abuses of international norms.

Or perhaps you do not like the expression “reign in”? Fine use “change” or “end”. Or create your own. But the abuses remain. And are unacceptable.

Ed

Ed Hanson: I prefer “rein in” to “reign in”, as that was what I was taught in grade school.

Actually Ed and his “reign” was just channeling his inner Joseph diGenova

http://nymag.com/intelligencer/2019/10/dems-accused-of-regicide-against-king-trump-on-fox-news.html

Democrats Accused of ‘Regicide’ Against King Trump on Fox News

“What you’re seeing is regicide,” said diGenova, who was under consideration for a role on Trump’s legal team last year. “This is regicide by another name, fake impeachment.” He bashed “despicable” Democrats, then called the whistle-blowers who have spoken out against Trump “suicide bombers that the Democrats have unleashed on the Democratic process.”

Well then, Little Donnie Fauntleroy is now the victim another time over. How many times can poor little Donnie be the victim? I assume that when the economy dips, the unhappiness of people who don’t have work will not be his fault at all, and any attempts to point out that he screwed it up with tariffs will just be another example of people being mean to him. It must suck to be poor, put upon little Donnie who should be treated like the royal he obviously thinks he is.

And while we’re working to end these abuses , maybe they will investigate the Bidens and provide you with unfiltered, completely honest information. Oh. Just kidding.

Menzie

Aren’t you sooooo good.

But especially good at diverting from matters you wish not to tackle. Like is 0.3% CPI increase meaningful in today’s ‘too low’ inflation environment. Or the abuses of international norms by China?

Ed

Why do you duck this?

pgl

October 10, 2019 at 2:07 am

“Ed HansonOctober 9, 2019 at 5:27 pm

The authors attributed to the trade war an increase of 0.3% to the PPI and/or the CPI.”

Ed per his usual cherry picking dishonesty is misrepresenting this paper really badly. Let’s see what they wrote beginning on page 4:

“Figure 2 presents evidence of this for one of the first sectors targeted by the Trump administration: washing machines. The first panel shows what happened to the consumer price index (CPI) for major appliances, which is broad category of goods that includes washing machines. As one can see in the figure, despite the fact that the CPI for major appliances had been falling steadily for years prior to the trade war, it began rising sharply after the imposition of the new tariffs.”

And on page 6:

“Figure 3 plots the evolution of these prices for each of the six waves of tariffs. We see a number of important facts in this figure. First, the prices for sectors not subject to tariffs are fairly flat, which suggests that whatever price movements we observe in protected sectors are likely due to the tariffs. Second, we see large increases in prices of goods that were subject to tariffs, with unit values typically rising from 10 to 30 percent in the wake of the tariffs. Given that these numbers are comparable in magnitude to tariffs that were applied, it suggests that much of the tariffs were passed on to U.S. importers and consumers.”

Maybe they did not teach Ed this in his “economic” courses at Trump University but the issue is the impact on relative prices – not the overall inflation rate. Take a look at Figure 2 Ed – the impact on the relative price for major appliances was YUUUGE. Of course we know you never learned how to use a washing machine so you’re good!

****

Oh wait – you always duck when good analysis and actual facts show your usual stupid comments are very, very stupid. Keep up trolling dude!

Bark

Probably clumsy wording. Tariff imbalance – unequal tariffs between countries on similar goods.

I refer to higher tariffs on US goods by major trading partners EU, Japan, S Korea than tariffs on their goods. BTW, I consider the EU customs union the most egregious of them all.

I also note that nary a peep from ‘Free Trader’ Menzie about the existence of a customs union in this modern era of global trade,

Ed

Sorry, Ed, but you do not have much of a case here. Probably you have been watching too much Lou Dobbs, as well as believing Trump and Navaroo.

As of 2017, hwew were the average tariff rates for major economic areas according to Wikipedia: US 1.66%, E?U 1.79% (same for Germany specifically), Japan 2.5%, China 3.83%. Yeah, lower in US, but especially compared to Europe not by much. This is a joke.

Don’t confuse Ed with actual facts. He needs to catch up on watching Fox and Friends!

Ed Hanson

Tariff imbalance – unequal tariffs between countries on similar goods.

I refer to higher tariffs on US goods by major trading partners EU, Japan, S Korea than tariffs on their goods.

So if your friends jumped off a cliff, you would jump too? Didn’t your mother ever ask you that? Just because other countries are stupid enough to impose tariffs on our exports, why should we be just as stupid and impose tariffs their exports to us? Stupid is as stupid does. Or do you believe two stupid actions cancel out?

slug

In general, I agree with you and generally accepted economic principles, that lower tariffs are good for a country, regardless of tariffs of other countries. But here are two things two consider.

One: Lower tariffs are good then lower tariffs are good for everyone. Equalizing tariffs at a low rate between major countries is better, than unequal rates, and it is a good time to push for that. As I have written, the EU is the most egregious violator of this idea.

Two: Affects of high tariffs on US goods are unequal among American workers and businesses. US steel production is the most technically advanced and environmentally clean in the world, but the industry was slowly being strangled by high tariffs on US steel product combined with low tariffs on world steel by the US. It was the tariff differential that impeded US export and gave advantage to imports. While likely a small net gain to the US economy as a whole, devastating to those steel workers and industry. I suspect if the world treated US steel with fairness, equalizing tariffs at a low level, the net gain to both the US economy and the world’s economy would be obvious. And no longer would a small element of America be sacrificed for the “good of everyone else. Win-Win if achieved. Again this is a good time to go for it.

Slug, Menzie won’t talk, so I ask your opinion of a custom union in this era of global trade.

Ed

Ed Hanson: You are frankly delusional. The fact I don’t respond to each of your misguided comments does not mean that I concur. The optimal currency union — if you want to avoid trade diversion — is the world. I’m going to add a graph at the end of the post to highlight exactly how delusional/misinformed you are. Breathtaking.

We asked Ed to define “customs union” already. To date he has not answered which strongly indicates he has no idea what the term even means.

Simply put – Ed has no clue what he is babbling about. Sort of like all of the Usual Suspects.

Ed Hanson: You do realize you have provided a reference free argument for trade protection.

“US steel production is the most technically advanced and environmentally clean in the world, but the industry was slowly being strangled by high tariffs on US steel product combined with low tariffs on world steel by the US.”

We have a new winner for the most absurd comment ever. No Ed – it has been US steel producers who have historically wanted trade protection from the more efficient foreign steel producers. This is a long and excellent literature on this which of course in your usual ignorance you have not bothered to read. PLEASE STOP with these really stoooopid comments.

just to follow up on ed’s eduction, us steel fell behind precisely because they were NOT the most technically advanced and environmentally clean in the world. us steel producers continued to run inefficient blast furnace systems until very late in the game, producing steel from the raw iron ore. other countries such as japan and korea moved quickly to electric furnaces which used recycled steel, much cleaner and efficient. this allowed the “foreign” steel to be imported and much lower cost. it also permitted the production of cleaner (environmentally) steel, as well as steel with much more controlled chemical content. this allowed foreign produced steel to be of higher quality overall. any tariff issues were secondary to the fact that for a period of time, foreign produced steel really was cheaper and better quality. much of the us problem could be attributed to corporate management decisions that did not allow the industry to modernize in order to squeeze a out a few more years of profit. inappropriate allocation of investment in R&D as well as latest technologies was a major problem with the industry. as an example, one of the largest steel projects was the alaska pipeline, built in the early to mid 70’s. the producer of the steel for the pipeline was………………japan. why? us producers could not make pipe in the grade required. that was 800 miles of 48 inch pipe. foreign competition made inroads in the us because of their capabilities, not tariffs. today, the equation is a bit different with us quality and capabilities. but they originally lost their market share through incompetence, not tariffs.

Yep. Of course Ed is ducking this issue like he ducks EVERY issue where his babbling is contradicted by basic facts and good analysis.

You see – Ed is just another really dumb Trump troll. MAGA!

Menzie

I am not delusional, just deeply disagreeing with you. (I know, to you that means delusional)

If you think I am defending trade protectionism, than it is you who is delusional. It is the EU , Japan, Korea, etc who have practiced trade protectionism. The time has come for this to end. And history shows it will not come to an end by actions of these trading partners who politically like protectionism. So they have to be motivated. You don’t like the method, tough, the USA had decades to make this protectionism to end, but efforts were sporadic at times, but non-existent most of the time.

Solution is simple, have the world follow Menzie Chinn’s advice, lower tariffs to a non-protectionist rate. Start by matching the US rates of 2017. Then the US and President Trump would no longer have a basis of complaint.

And BTW, I really don’t care for your diversion of requested custom union discussion. I am not talking about the world but, as you know, the EU customs union. If you want to discuss the subject, please, I am interested in your remarks about the EU before expanding it to the world.

Ed

Ed Hanson: Have you ever been involved in trade policy evaluation and formulation? I have. I don’t know what you mean that EU, Japan and Korea have been practicing protection, and implying the US does not. If you believe that easily falsifiable fact, then…you…are…delusional.

Ed Hanson Maybe you should learn Japanese or Korean or German. Then renounce your US citizenship and become a citizen in one of those other countries. Then as a new citizen of one of those countries you should preach to the Japanese, Korean or German governments as to why they should lower tariffs. Look, we would all be better off if our trading partners would lower or eliminate their tariffs; however, that in no way changes the fact that our equalizing tariffs makes us worse off, not better off. Our trade policy should not be conditioned on what other countries do or don’t do. If the Japanese or Koreans or Germans want tariffs on US goods, that’s their problem, not mine. They are the ones who are made worse off, not me.

slug

Don’t mean to cherry pick your comments, so understand the following quote of yours is for emphasis, not to distort or slant your your opinion.

” Look, we would all be better off if our trading partners would lower or eliminate their tariffs”

I am glad you wrote this, I don’t believe Menzie or the rest of the usual suspects have gone as far to wrote such a thing. The statement, of course, is correct on its face. But you go on with,

“Our trade policy should not be conditioned on what other countries do or don’t do.”

That is where we disagree. You describe is that path the the US has tread for decades, until unequal treatment of the goods from the US became enshrined. President Trump made it a major campaign issue, and was rewarded with victory. His path is to change that unequal treatment. I have come to appreciate it.

Finally, you wrote;

“If the Japanese or Koreans or Germans want tariffs on US goods, that’s their problem, not mine. They are the ones who are made worse off, not me.”

If that was only the whole truth. Ask the steel worker laid off, permanently for all he knows, when the furnace his job depended on is shut down. Not shut down because of competition, but because unequal tariff protection. A less efficient steel maker in another country is both protected from US steel products by a higher tariff, but can export their product to the US more easily due to the lower tariff. The distortion of trade can cause that foreign country to over produce steel and leading to dumping. A low and equal tariff treatment should tend to reduce tendency of over production leading to dumping. Just to go outside the US for a moment, look at the EU anti-dumping tariffs imposed on Chinese steel. Anyway, no you aren’t worse off but many of your fellow Americans are.

Ed

Ed Hanson: I have one word for you – reciprocity. You clearly have no understanding of trade policy history. It really is pathetic that you are trying to debate the subject.

‘” Look, we would all be better off if our trading partners would lower or eliminate their tariffs” I am glad you wrote this, I don’t believe Menzie or the rest of the usual suspects have gone as far to wrote such a thing.’

No you are flat out lying here. Our host has endorsed full free trade. Oh wait – he has done so using the appropriate economic term. Which to you is writing in a foreign language.

Look – you have written a lot of annoyingly stupid things here but whenever you are rebutted with facts – you duck and run like the cowardly troll you really are.

Oh well – MAGA!

Menzie

Funny, you would say the same thing to President Trump. I like the company you put me in.

Ed

“Neoclassical means to me “frictionless”

“, equating marginal conditions

either inter- or intra-temporally,

with symmetric (full) information).”

Heroic clarity