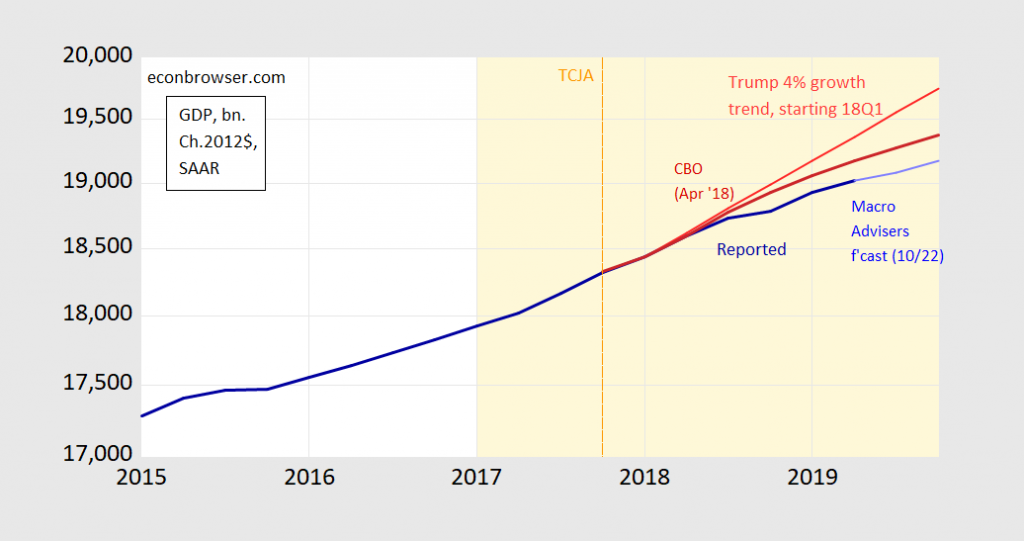

By April 2018, the Tax Cut and Jobs Act and the Bipartisan Budget Act of 2018 had been put into law. The CBO projected a bump in GDP growth, relative to counterfactual. (According to the CBO, the TCJA alone should have pushed output 0.6 percentage points above baseline in 2019.) However, the actual record has been fairly plodding, as shown in the below figure.

Figure 1: Reported GDP (dark blue), Macroeconomic Advisers nowcasts of 10/22 (light blue), CBO projection of April 2018 (dark red), and Trump 4% prediction starting from 2018Q1, all in billions of Ch.2012$, SAAR, on log scale. Trump administration shaded orange. Source: BEA 2012Q2 3rd release, Macroeconomic Advisers, CBO, and author’s calculations.

Note that Trump’s December 2017 prediction:

I think [GDP growth] could go to 4, 5, and maybe even 6%, ultimately.

Did not come to pass, as the trajectory is below the light red line of 4% (forget 5%). And in fact realized output was below the CBO current law projection (dark red line).

There are several possible explanations for this outcome: (1) the counterfactual no-stimulus trajectory was worse than projected; (2) the multipliers associated with TCJA and the BBA were smaller than anticipated, perhaps due to the fact that output was already close or above potential GDP; (3) GDP, while stimulated by tax cuts and spending increases, was depressed by economic policy uncertainty both at home and abroad; or (4) combinations of all of the above.

Tax cuts for the rich balanced by tax increases on everyone else through tariffs. Results are about as expected.

Good point. The rich buy more luxuries while the rest of us buy less food. Let them eat cake!

Of course one might explain the low multipliers as Menzie put it by …. wait for it …. CROWDING OUT. That could take two forms: (1) higher real interest rates suppressing business and residential; or (2) real devaluation depressing net exports. Of course our Trump sycophants might whine:

(1) blame the FED;

(2) go onto the gold standard like Nobel Prize winner Stephen Moore said.

Or they could blame the Bidens! MAGA!

Use real 2012 chained GDP data from 2009Q3 thru 2018Q1 to fit a braindead simple ARIMA(1,1,0) with constant model and then forecast out-of-sample for 2018Q2 thru 2019Q2. The out-of-sample forecast errors are less than one deviation from actual GDP. Trump did not sprinkle the economy with magic fairy dust. The economy is chugging along at pretty much the same full employment steady state growth rate that we’ve seen over the last twenty years. All Trump’s tax cut did was make life miserable for future generations, but since most of Trump’s base already has one foot in the grave and the other foot on a banana peel, I suppose they don’t care about that problem.

2slugs,

What model would you use if not using a “braindead simple ARIMA(1,1,0) with constant model” ?

This is a sincere question, not an antagonistic question.

AS I suspect my snark got in the way of my point. I was simply saying that even a very naïve time series model could outperform whatever nonsensical model Team Trump was using to predict 4% or 5% growth.

In the old days there used to be an ongoing argument about the predictive abilities of big (some would say clunky) structural models along the lines of the Fed’s model or MacroAdvisors’ versus a simple atheoretical, non-structural time series model. I’m not an economist, but I suspect those big structural models are much improved since the old days and this no longer seems to be a lively argument. In any event, my only point was that it doesn’t say much for Team Trump’s economic model if it can’t even beat a very naïve time series model.

Unfortunately, the “improvements” to large structural models like Macro Advisors, Oxford Economics, Moody’s, etc. are solely in terms of the number of variables they claim to forecast. The fact is that all the commercial models are so large and complex that no one — even the grunt workers who actually maintain them — really have a firm idea of how they work. With thousands of equations and countless inter-dependencies, the unknown and unforeseen feedback mechanisms are impossible to disentangle. I have no faith in those models.

The FRB/NY model is about the best of the old-school Keynesian models and is far, far better than the private offerings. It’s only got a few hundred equations, but all the major, truly forecastable variables are in there. Reading the documentation, it’s clear that the developers have tried to take seriously modern academic macro research and incorporate it into the model.

John: Depends on what you consider structural models. Agree the adaptive expectations structural models with hundreds of equations might not do very well. But then not clear NK DGSE’s do that well either, while I think models with model consistent expectations (stand in for rational expectations) with allowance for rule-of-thumb consumers and adjustment costs and sticky prices are in-between. Time series models on average do best when one doesn’t have to do policy interventions… (Do you mean FRB/US rather than FRB/NY?)

I agree with these remarks by Menzie, which correspond with my understanding of this situation.

My only further comment is that I regret that there has not been more effort to develop serious agent-based model alternatives, with some having been developed, but more in other central banks such as England the ECB. It may be that they also do not perform better, but it would be nice to see more effort with them to reall find out.

2slugs,

Thanks. Again, I was not trying to distract from your point as you mention, but just interested In learning about forecasting models from those who are more experienced and more skilled compared to me.

If the forecast is for the entire quarter, I try to forecast the main elements of GDP as a means of forecasting GDP for the quarter. If the forecast period has monthly pertinent data, I use a mixed frequency model for my forecast attempt.

For an entry into the FRED forecasting game,

I forecasted GDP at 1.8% for 2019Q3, when we had to make an entry as of August 20, although my forecast has bounced around from 1.5% to 1.8%.

As of October 20, an entry was required for 2019Q4. My entry is 2.1%, based upon a full quarter model, with no monthly data for 2019Q4. I may be optimistic on this entry.

I notice that the WSJ forecast survey shows forecasts for 2019Q3 and 2019Q4 at 1.8% rounded to one decimal place.

https://www.wsj.com/graphics/econsurvey/

Subscribers can download an Excel spreadsheet.

Menzie,

Which options do you think most likely?

Choice (2) depends on some kind of evidence that we were up against a supply constraint that caused inflation to increase and led to interest rate hikes by the Fed. I don’t see much support for that, although the FOMC probably did speed up its ill-advised tightening cycle?

tom,

Actually, that’s only one channel through which crowding out occurs; it’s the standard story but not the only one.

There is a real-economy channel that can, and almost surely does, have an effect. If the economy is at or near capacity, growth becomes harder at any given interest rate.

Why (through what mechanism)? Distribution effects (lower profits) perhaps?

It needn’t be that complicated. The real economy operates on real resources. Scarcer resources mean less capacity for additional growth. A low jobless rate indicates scarce labor resources. It is possible to substitute capital for labor, but the pace of capital investment does not suggest that is happening.

Your suggestion of lower profits as a mechanism by which capacity constraints could limit growth fits textbook models, but textbook models do a bad job of explaining the pace of capital investment in recent years. Very low capital costs and very high income shares to capital should, in a textbook world, lead to strong investment in new productive resources. That has not been the case in this cycle.

Rather, we seem to be stuck with an economy that is less responsive to now than in the past (or in the textbook) to the spread between the cost of capital and returns to capital. Surveys of firms find that hurdle rates for new capital investment are in the teens, little changed from two decades ago. In that period, the cost of capital has fallen sharply,widening the spread between the cost of capital and returns without increasing the likelihood of capital investment. This does not bode well for monetary policy as a tool for controlling aggregate demand. By the same token, it probably means that distributional effects on growth are not strong.

In sum, if we can’t rely on investment to offset capacity constraints to a strong degree, then capacity constraints act directly as a limit to growth, because the dynamic mechanism for addressing capacity constraints is weak.

Maybe the responsiveness of the participation rate to wages will do the trick and prove me wrong. That would turn the notion that lower profits limit growth upside-down.

Crowding-out can come from higher interest rates – yes. But anything that leads to a real appreciation can crowd out net exports.

Just in passing, as you all know, economic growth is ultimately finite, and exponential rates do lead to some rather absurd projections once you go out long term.

I have always found it a bit baffling that economics is one of the fields that is so heavily restrictive when looking into the future.

Was Keynes that influential when he cracked, “In the long run we are all dead”?

I don’t know if Keynes was influential, but he certainly has been proven correct on a repeated basis. The dead part, too.

The TCJA is often discussed as Trump’s tax cut, but it is entirely in line with post-Reagan Republican tax policy and was passed by a Congress with Republican majorities in both chambers. It is also not very popular with voters. Chris Collins made clear why voters’ views were ignored:

https://www.businessinsider.com/chris-collins-donors-trump-tax-plan-bill-2017-11

There are earlier cases of tax cuts not living up to claims made for them. (There’s a pattern, if you look for it.) In earlier cases, one excuse offered was “we didn’t get all the policies we wanted, so growth was slower than we said it would be.” So I guess tax cuts are a stimulus only in a world in which everybody gets a pony.

Trump and his Republicans have not made that excuse, as far as I can tell. They seem to have learned that the numbers don’t really matter, so there’s no need to make excuses when the numbers aren’t what you promised. That’s smart. If voters’ care about their own situation rather than overall performance, then pandering works a lot better.

Warren and Sanders seem to have figured that out, too, and have convinced a number of their Democratic rivals. Not clear whether Biden has learned that message fully. Other centrist Democrats have caught on in greater measure, but struggle because centrism has long been a very comfortable political idiom for the wealthy.

Is QE about to become a political problem?

Former Fed Chair Janet Yellen, who presided when the balance sheet reduction operation began in October 2017, remarked that the process would “run in the background” and be “like watching paint dry,” remarks that are now widely derided in the finance community. Similarly, current Chairman Jerome Powell said in December that the process was on “autopilot,” another characterization that rankled markets as it signaled more tightening to come.

“We’re learning it’s a much bigger deal that what the Federal Reserve stated it was,” Bianco said. “They should acknowledge that movements in their balance sheet matter a lot more than they say.”

The [current] balance sheet expansion “represents a necessary step that serves to fix the reserve hole the Fed dug itself into by continuing QT for too long, should firmly place the Fed back into an ‘abundant reserve regime,’ and represents a rapid shift away from repo operations to permanent balance sheet growth,’” wrote Athanasios Vamvakidis, a forex strategist at BofAML.

So, we were sold QE on the basis that positions could be unwound anytime, no problem. Now, those massive loan volumes on the Fed’s balance sheet look like they might be permanent. Is QE then still an acceptable tool, or is it about to become radioactive politically?

I would certainly welcome a post by Menzie or Jim.

https://www.cnbc.com/2019/10/22/fed-repo-worries-continue-over-the-efforts-to-fix-funding-issues.html

Watching paint dry in the repo market part 2

At his latest press, Chair Powell said this about the spike in the Effective Fed Funds and Repo rates:

“Going forward, we’re going to be very closely monitoring market developments and assessing their implications for the appropriate level of reserves. And we’re going to be assessing the question of when it will be appropriate to resume the organic growth of our balance sheet… It is certainly possible that we’ll need to resume the organic growth of the balance sheet sooner than we thought.”

But why has the Fed panicked so quickly? Perhaps it is because Jerome Powell only has (7) 25bps rate cuts left before he returns to the zero-bound range. That is not nearly enough ammo left because the Fed normally has needed in the neighborhood of 20 such cuts to be effective in lower borrowing costs enough to jump start the economy. In addition, the Fed’s unprecedented destruction of $100’s of billions in base money supply has left banks with a dearth of reserves. The Quantitative Tightening (QT) process took excess reserves down from $2.2T to $1.4T. That may still sound like a lot of liquidity, but given the demand for US dollars and the predilection on the part of banks to hoard cash, it is clearly not nearly enough. In any case, the Fed’s prediction that is QT program would be a boring and harmless exercise goes down as another stark illustration of the completely opaque condition of its crystal ball.

https://www.kitco.com/commentaries/2019-09-30/Watching-paint-dry-in-the-repo-market-part-2.html

You take the musings of Michael Pento seriously? Lord – you are even dumber than I gave you credit for!

Ad hominem; no content.

You actually think Stevie’s guru has anything of substance to offer? Come on Bruce – you can’t be that dumb. Oh wait.

Gotta love this from your new monetary guru!

“Heck, even the Secured Overnight Financing Rate (SOFR) shot up to 5.25% on September 17th from 2.43%, which is particularly concerning given that SOFR lending is collateralized by Treasuries!”

Hey – Stevie. Do you even know what the SOFR even is? I did not think so. It is being billed as the replacement for LIBOR. Now if you bother to check (assuming you know how), LIBOR rates did not spike on 9/17. But your new guru has his panties twisted up over something that likely matters not.

The Fed made a guess about where the cost of reserves would be insensitive to fluctuations in demand for reserves. Balance sheet reduction would “run in the background” as long as the supply of reserves was well into the flat part of the demand curve, and was meant to stop before exiting the flat part. The kink in the demand curve was perhaps not where the Fed thought it would be. Oops, maybe.

Monetary policy is always politically sensitive. Some folks like low interest rates. Some folks like high interest rates. Some folks like a steep curve. Some folks will blame the Fed no matter what. Self interest and political responsiveness to self interest means policymaking is stressful. It is also why monetary policy should be shielded from politics.

Well, we’ve been discussing whether the Fed has the tools to handle the next recession, and I agree with Barkley that they probably don’t. Or to be more clear: they don’t.

The repo thing arose for a couple of reasons. First, Williams in his interview with Jim last month says that trouble in the repo market at that time was just technical and in passing. Well, it clearly hasn’t worked out that way, and because financial crises are made of financial markets freezing, this has now become a point of interest.

Once you start to look at the cause of tightness in the repo market, it seems to relate to QT, that is, the rolling off of the Fed’s massive holdings of debt resulting from three rounds of QE. Now, this is a problem on several levels. First, it does not appear, based on JIm’s work, that QE was particularly effective — it was pushing on a string. On the other hand, when trying to reduce balances, we appear pulling on a rope, that is, above the ZLB, those balances have real value and represent real reductions in the monetary base when run off. That is, the Fed was able to purchase those securities under QE, as I understand it, by creating $4 trillion of shareholder’s equity on the liability side of the Fed’s balance sheet and creating $$4 billion in cash assets at same time. The Fed then used this cash to purchase long-dated securities to drive down long term interest rates, an initiative which seems to have been marginally successful, if at all. Now, we were promised that unwinding these positions would be like ‘watching paint drying’, and it turns out to be nothing of the sort. Rather, it represents a material withdrawal of liquidity from the market, driving up interest rates and causing certain markets to falter.

The Fed finally seems to be reacting. On Wednesday, it comes out with this gem:

Repurchase Agreement Operational Details

In accordance with the most recent Federal Open Market Committee (FOMC) directive, the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York will conduct a series of overnight and term repurchase agreement operations (repos) at least through January of next year to ensure that the supply of reserves remains ample even during periods of sharp increases in non-reserve liabilities, and to mitigate the risk of money market pressures that could adversely affect policy implementation.

https://www.newyorkfed.org/markets/domestic-market-operations/monetary-policy-implementation/repo-reverse-repo-agreements/repurchase-agreement-operational-details

Thus, QE appears to be headed towards becoming a four letter word. And what’s more, it would appear that the Fed did not understand the limitations of QE going in, did not — does not — understand the impacts of QT, and has let the matter devolve into a mini crisis in the repo market. Not a great advertisement for Fed credibility or independence. Does QE then remain a tool in the Fed’s toolkit, or are we down a a 1.75% interest margin to cushion the next downturn? I think we’re down to the 1.75% cushion, which is effectively nothing.

Perhaps we should not have let PhD economists run the Fed.

In any event, this is not my area of expertise, one which I have assiduously attempted to avoid. But when Williams says, ‘No problem’ and then day after day in the following weeks I read about rumblings from the repo market, well, that reminds me of similar rumblings about the MBS, CLO and CDO market in 2007. And we all know how that turned out.

So, as before, I would be more than grateful if Jim or Menzie could parse this back for us.

“that reminds me of similar rumblings about the MBS, CLO and CDO market in 2007. And we all know how that turned out.”

i do not know where the repo market issues will lead us, but i do not feel this is similar to the MBS, CLO and CDO market of 2007. we are talking about completely different quality of securities, from what i understand (and I may not understand this correctly). is the quality of securities involved in the repo market deteriorating? the financial crisis of 2007 was driven in large part by fraudulent securities. not sure this is happening today. if a problem does exist today in repo, it would seem to me to be a more manageable fix than 2007.

Its the same thing. When manufacturing is shedding 100-200k jobs a month and the industrial/producer led recession hits, corporate junk bonds will implode and spread to the high end shit. Then it spreads to the banks. This unlike 2007 is like 1929. Nationalization of investment will come and debt expansion will be outlawed.

“i do not know where the repo market issues will lead us”. You know more than little Princeton Stevie ppoh and his Kitco Klown. Good point there.

wanted to clarify, i do not mean to assume there is no problem with the repo market. something does seem to be going on there. but the MBS, CLO and CDO issue was easier for me to digest the issues at hand. people owned securities that had to be written down, margins were called, and liquidity dried up. in the current case, it does appear we are having liquidity dry up once again. not sure why? are people dumping quality securities into the fed in order to access cash, or are they dumping crap into the fed? this is what is not clear to me-and the difference is crucial to what may be ahead. the distinction becomes the difference between a problem, and a crisis. the fed needing to pump $100 billion into the market is not a trivial issue, as steven points out. we still need to figure out why. but steven presents a possible cause (QE and QT), and not sure i buy that argument either.

Several comments here.

Fist of all, pgl and others are right that all this is off topic, this thread supposedly being about the effect of Trump’s fiscal stimulus (not a whole lot mostly). That said, I do agree with quite a lot of what Steven says about monetary policy, but not all his remarks here. I note that I have posted on Econospeak about the “repo ruckus” that happened in mid-September, and most of what I have to say now has been said either there or here already.

So, stepping back to when Yellen was in as Chair, there was more broadly in light of the economy having largely recovered from the Great Recession an effort by the Fed to “get back to normal” in terms of our financial markets and banking system, even though everybody at least suspected that these had changed in many ways whose implications simply were not known or understood, with this not being a matter of wise banking practitioners knowing with dumbbell PhD economists not knowing. Nobody knew. In any case, it was not unreasonable to attempt to move in the direction of said pre-Great Recession “normality” if just to see how close we could get, and also to put various Fed policy tools back more into a situation where they could be used in a loosening way to fight a recession. So this effort involved both raising the target interest rates and drawing down the balances, aka “tightening QE policy,” which I do not think is “about to become a political problem,” too obscure for that.

In any case, the repo ruckus was the sign that the Fed had hit the limits on all this, with the most likely curlprit being on the balances side rather than the interest rate side. But this has led to a cessation of that policy, with in fact the move to turn around interest rate policy to start lowering them again having already happened. So now after the ruckus we have seen the end of the lowering of balances, and may soon see a move to actually increasing them again.

More significantly, as SK notes in this last post, the Fed has ever so quietly moved to essentially daily interventions in the repo markets to keep them stable and quiet, with a supposed January end dated for this, which I suspect will not come. I think these probably daily interventions will simply become the new norm for the foreseeable future, whatever is done with balances or target interest rates.

And again, nobody saw the ruckus coming that I have seen step forth publicly and claim, whether PhD economists or practical and less well education bankers or financiers. Nobody. This is exactly why Williams was so inarticulate in his comments with Jim Hamilton, engaging in essentially a vacuous handwaving exercise. But then, what is one supposed to do when one does not know why something has happened that one must deal with on a policy level?

Again, we have a lot of theories, with none of them for sure the explanation. Moses H. decided to sneer at all this, while having zero to offer as serious alternatives. So a widely spread theory involves those darned large bank capital limits imposed b the Basel III Accords banging up against heightened seasonal demand for liquidity due to impending end-of-quarter matters. That this might be it is supported by all the reports that indeed the ruckus seems to have emanated initially from the largest banks and then spread further. But, again, this is not definitively what happens, and Williams’s embarrassingly weak answer on all this is the sign that ultimately we still do not really know what it was or why it hit when it did.

But for sure it has shifted Fed policy to stop further drawdowns of reserves (ending the tightening of QE policy) as well as pushing the Fed back into regular interventions in the repo market). The effort to move back to “normality” has come to an end. The financial and banking system has simply changed too much, whatever the aspects of that change are most responsble for what has gone down.

Yeah, thank you for this. Very helpful. Yes, it looks like some portion of the QEs have become permanent. I am also curious about the liability side of the Fed balance sheet, all those reserves deposited there.

Some context:

Regular intervention was normal in the days before IOER. The Fed adopted a goal of avoiding daily intervention when daily intervention was easy to avoid, and is now learning by doing. Not a surprise. Also not necessarily a big deal; operational decisions can change.

The Fed was near ending the run-down of the portfolio when rate cuts started and further portfolio reduction would have seemed bull-headed. The earlier planned target portfolio size was a guess and the realized portfolio size was an artifact of the decision to cut rates. If the Fed needs to continue frequent intervention in the overnight market to limit volatility, then the target portfolio-size guess was wrong. Again, not a surprise.

Why has the Fed not already decided its portfolio is too small? The claim is that we are in the part of the year when liquidity is tight, so that money market stresses are not clear evidence of a too-small balance sheet. Is that just an effort to save face? Could be, but the Fed often gathers evidence in the face of howls from the market, often finding that market howls were wrong, so maybe Fed folk really are just waiting for more evidence before deciding whether a larger portfolio is needed.

I wonder whether repo market wobbles are really a threat to the Fed’s legislative mandate. Yes, the Fed chose the goal of limited reserve market intervention and is now intervening regularly, but I’m not sure why price stability and maximum sustainable employment would be jeopardized by regular intervention. The financial market stability goal (which exists in service of the inflation and jobs goals) is closer to the issue, but if the Fed intervenes successfully to stabilize the repo market, how is financial stability threatened?

The Fed’s obligation to financial markets grows out of financial market’s role as handmaiden to the economy. The Fed has no obligation to make financial market participants happy or rich – merely to assure that they function as successful handmaidens. Is that function at risk because repo markets need a bit more tending now than in the recent past?

Your opening is something Stevie pooh needs to read over and over:

“it is increasingly clear that it is not clear why it happened or if it will happen again. There was an outbreak of completely unexpected volatility in the repo market, where in the past the Fed had carried out open market operations, although that had largely passed. Indeed in more recent years when the Fed has intervened in markets it has been in the reverse repo market.”

It was a very short termed blip. But Stevie thinks this is going to lead to another Great Recession? Lord!

One quick point for Barkley. Zoltan Pozsar saw the repo ruckus coming at least a year ago. His Global Money Notes have been remarkably prescient. Including predicting temporary QE. It seems likely to me we will see a standing repo facility in the near future.

“Williams in his interview with Jim last month says that trouble in the repo market at that time was just technical and in passing. Well, it clearly hasn’t worked out that way, and because financial crises are made of financial markets freezing, this has now become a point of interest.”

WTF? The graph you little guru presented had the spike in that particular interest rate lasting a single day. And FYI – banks have multiple ways of getting funds overnight. Come on Stevie boy – stop writing such long winded gibberish as you have no clue what you are babbling about.

“Perhaps we should not have let PhD economists run the Fed. In any event, this is not my area of expertise, one which I have assiduously attempted to avoid.”

Damn straight this is not your expertise but you babble on and on about monetary policy even though you are even dumber than Stephen Moore. Oh wait your boy Trump hates Ph.D. economists too. Yea – I can see Princeton Stevie boy being Trump’s next nominee for the FED. It would be a bipartisan moment in the Senate. Yeas 0 Nays 100!

Steven, i dont think we were sold on QE based on your unwound argument. That is not accurate.

You are right – Stevie blatantly misrepresents the case made for QE. BTW – this post is about fiscal policy not monetary policy. But of course Stevie pooh does not understand the difference.

“we were sold QE on the basis that positions could be unwound anytime, no problem.”

Seriously Stevie – this is either a lie or another example of your incredible stupidity. Please stop embarrassing your poor mother this way.

Rick stryker just announced trump is immune from prosecution even if he shoots someone dead on fifth avenue. Can somebody say “emperor”? Can you imagine rick defending obama in this way?

Former AG Matt Whitaker told us that Abuse of Power is not a crime. So Trump’s treasonous acts are all good!

Peter Navarro in an interview today was asked several times if an investigation of Joe Biden had come up in the talks with China. Although he was asked repeatedly, he refused to answer and was unable to say “No.”

Seems like a very simple question. Perhaps he fears going to jail. Perhaps he is now compromised because a leak of those discussions by the Chinese could send him to jail.

Puts Navarro in a rather weak bargaining position if the Chinese now hold compromising information over him.

Navarro, like Bolton, is a policy guy. Neither of them backs particularly wise policies, but they seem to see power as a tool for pursuing policy, rather than for (egregious*) personal enrichment.

Navarro could lie to a reporter without increasing his legal jeopardy. He evaded rather than lied. I don’t mean to say anything nice about Navarro, but his sins appear, to me, to be of a very different kind than those of Flynn or Manafort or Rudy or (add your favorites here….).

*”Egregious” because income and wealth well above the U.S. median is necessary to being taken seriously in D.C.

Oh, I not accusing Navarro of lying to a reporter. That is not a crime. I am assuming Navarro was telling the truth – that he could not deny that investigating the Bidens had come up in trade discussions. If it were not the case that that Biden had been part of trade discussions, it would have been very simple for Navarro to say “No.” He did not say no. I can only assume that is because the answer is yes.

Navarro’s legal exposure comes from two directions. First, soliciting a thing of value from a foreign government to help your re-election is a federal campaign crime. If you think that is trivial, thing again. Campaign crimes are one of the reasons Michael Cohen is sitting in a federal prison today.

Second, if Navarro were offering trades concessions in exchange for dirt on Biden, then that is a quid pro quo – extortion.

So Navarro may have had a very good reason not to answer the question. It could put him in legal jeopardy. Worse, it means the Chinese have compromising information on Navarro which puts him a risk of blackmail, which weakens his trade negotiations.

My theory is the deep state stole it all

Models are for insight not foresight

Feed back from fast data flows

guiding

A system of extractors and injectors

can pilot

A market based economy

Even if the ability to reliably forecast

is

Extremely limited

beyond now casting

and badly

noise plagued

The limitation on the state to improve

Spontaneous macro performance is mostly class politics

The state is not locked into a pro corporate

Short run

Bottom line paradigm

But corporate class control of the economy must be protected

Corporate confidence must be respected and never ignored

“…the counterfactual no-stimulus trajectory

was worse than projected…”

Always a limitation

“…. the multipliers associated with TCJA and the BBA were smaller than anticipated …”

Again always possible

But

“..perhaps …output was already close or above potential GDP…”

NO

This is model induced blindness

The plucked string is plain class politics from

The notion of over employment to NAIRU

To the vertical Phillips relation

I recall Spain had a nairu at 15% unemployment

The fact corporate hegemony blocks reforms that could remove these absurd taboo lines ..

See Vickrey hyper employment

and Lerner price level regulating markets

as examples considered out of bounds to practical reformers

Employment max with a Beveridge ratio always

O>A

threatens bottom lines long range

(3) GDP, while stimulated by tax cuts and spending increases, was depressed by economic policy uncertainty both at home and abroad; :

Number three

is a perfect example of corporate hegemony guided thought

Bark

“stepping back to when Yellen was in as Chair…”

..”in light of the economy having largely recovered from the Great Recession..”

The time frame was horribly long to get there

And then instead of plowing ahead with adequate injections

We get

” an effort by the Fed to “get back to normal” in terms of our financial markets and banking system”

This is corporate macro

Not peoples macro

even though everybody a

“.it was not unreasonable to attempt to move in the direction of said pre-Great Recession “normality”

If reason is whats senisible for corporate prospects

“.. to put various Fed policy tools back more into a situation where they could be used in a loosening way to fight a recession. ”

The great moderation paradigm

Aka the secular wage stag era

Fine for staying

within a safe corporate profit

cruising channel

And ending bottom half real wage rate climbs

Like we saw between 1950 and 1970

We need a peoples macro

We need to push employment max

Thru an adequate fiscal net injections macro policy

No we don’t know

the outcomes of net injections

with any precision

but we can plow ahead

and adjust to data as it comes in

there was never going to be a stimulus. the tax cuts were eschewed to the wealthy who do not consume. They have their living expenses paid for already by their trust fund income and other income. Also, they do not need to purchase homes or cars. The rest was for business who had money “parked outside of the US.” this was a trick. the money was always here. the fact it was overseas was an accounting gimmick. the economy slowed down due the interest rate hikes (thanks Powell), and Trump’s trade war.

BTW the economy is already in recession.

Selling tax cuts to corporations as job producers

Should be countered

with proposals

to cut employee side payroll taxes

And increase social security payments

A direct attack on the bi partisan

Great pay roll class robbery

That blossomed out of

Moynihan Greenspan

Promise the bottom 60

real take home cash

And of course job growth will accelerate too

I don’t agree with you that the economy is in recession now. It will be in recession by mid- next year, according to my cloudy plastic crystal ball. However, it’s not in recession now by any overall measure. Manufacturing may be, but there are other parts of the economy that are still doing just fine.

“combinations of all of the above.”

Domestic rates (one year treasuries) had already started rising by late 2015.

Multipliers are likely overestimated, but the CBO does not use them, I thought?

By 2019 we had rebellions in Iraq, UK Brexit, France, Hong Kong, and Lebanon, as well as troubles in Italy making more uncertainty.

The real point here is that Trump threw out a number which was way too high and no one believed at the time.

Kevin: CBO does use multipliers, implicitly and explicitly; see https://econbrowser.com/archives/2011/02/cbo_on_the_stim

The Rage is raging about how credit spreads? FRED?

ICE BofAML US Corporate BBB Option-Adjusted Spread

https://fred.stlouisfed.org/series/BAMLC0A4CBBB

A 1.5% spread for BBB rated corporate bonds is not exactly high.

If it is not possible to regain manufacturing jobs, maybe the stimulus should be applied to help those inclined to “blue collar” work gain skills and knowledge to move up the job-chain.

Jeff Sparshott offers the following in today’s Real Time Economics from the WSJ.

When Chinese competition knocked out American manufacturing jobs, young men were hit hardest. The result? “Contractions in the supply of economically secure young adult men stemming from rising trade pressure spur a surge in male idleness and premature mortality, a decline in marriage and fertility, an increase in the fraction of mothers who are unmarried and who are heads of single, non-cohabiting households, and a growth in the fraction of children raised in poverty,” David Autor, David Dorn, and Gordon Hanson write in “American Economic Review: Insights.”

That’s one way to reduce population growth, if you needed one.

Link to “American Economic Insights”

https://pubs.aeaweb.org/doi/pdfplus/10.1257/aeri.20180010

Mondale started the sensible tax increase line

Used by moderate democrats

The whole budget prudence gig

Even when stoked by wealth envy

fantasy ops

Is not the way to mobilize the bottom 60

Cut their payroll taxed

Cut their health premiums

Attack with promises of higher payments and take home

Lower taxes interest rates and premiums

All this can become

promises kept

Once

the false fiscal barriers ( FFBs)

are blown thru

FFBs

Created to make neo liberalism

Totally TINA

For those of you who freaked out when overnight lending rates temporarily spiked, an interesting discussion is provided here:

https://tickertape.tdameritrade.com/market-news/what-is-repo-overnight-lending-rate-17716

‘Overnight lending rates topped at an annualized rate of 10% last week, four times higher than the prior week. That essentially meant some banks were willing to pay upwards of 10% interest rates for cash … a shortage of cash probably led to the situation. The Fed has spent the last two years shrinking its balance sheet, meaning banks’ excess reserves have fallen. The Fed acted last week to inject cash back into the system. That could be seen as a bandage, because the situation itself hasn’t fundamentally changed … As the Fed injected liquidity and banks quickly snapped it up, the overnight rate quickly fell back toward levels more in line with the Fed funds rate, which after last week’s rate cut is now between 1.75% and 2%…Fed Chair Jerome Powell sounded like he was trying to ease investors’ minds last week when he said he wasn’t concerned about how the New York Fed operated during the rate spike. Speaking at a press conference after the Federal Open Market Committee (FOMC) meeting, Powell said, “If we experience another episode of pressures and money markets, we have the tools to address those pressures. We will not hesitate to use them.” In other words, the Fed appears to have a handle on the situation and it’s not spiraling out of control. The fact that overnight lending rates fell quickly after the Fed’s intervention could help back up what Powell said.’

One thing the story did not explicit mention was the level of excess reserves:

https://fred.stlouisfed.org/series/EXCSRESNS

Excess Reserves of Depository Institutions (EXCSRESNS)

Yes they spiked at $2.7 trillion as of August 2014 and have dropped to $1.3 trillion of late. But it strikes me that $1.3 trillion of excess reserves is still a lot and if for some reason banks need more liquidity for a short period of time – the Federal Reserve is both able and willing to do. So to our Chicken Littles – the sky is not falling.

Something is very strange? The Fed is saying that $1.3 trillion is not enough reserves, yet a decade ago, those reserves were 1000 times smaller and everything was fine. So what is different now?

Exactly! But what is different now?

Let’s see – Princeton Stevie pooh has an answer – DEMOGRAPHICS!! Let’s see if this fool even gets your simple point as he rants and raves with his own incomprehensible babble!