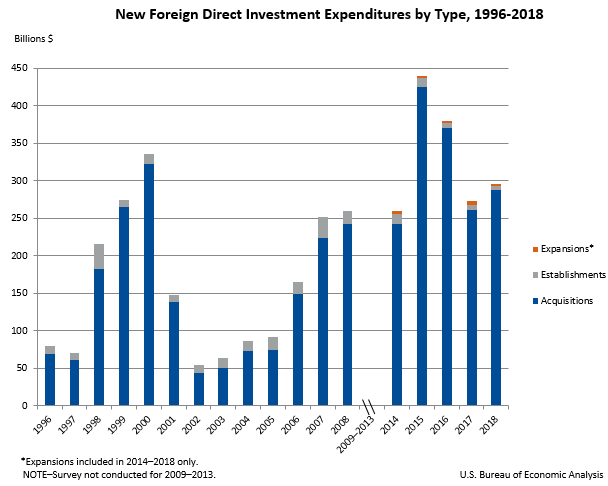

Some people think that foreign direct investment into the United States has surged as confidence in the American economy has risen under Mr. Trump’s administration. The data do not support such a supposition. From BEA:

It is useful to make distinctions between stocks (particularly at market value) and flows. The flow into the US has decreased relative to 2016. The stock can deviate from the cumulation of flows due to valuation changes and movements in the dollar. And in 2017, the inflow of FDI declined by 33.1% (in log terms).

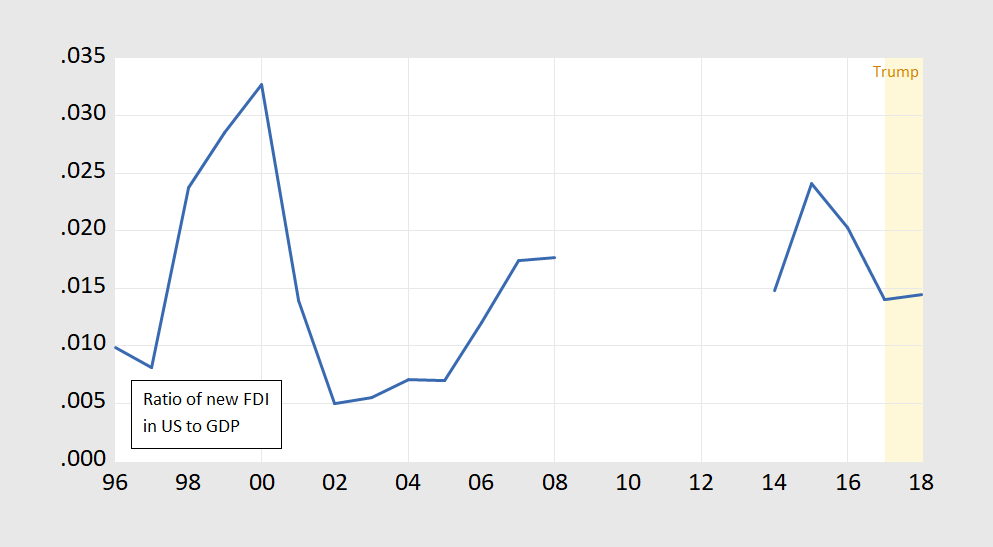

It is useful to consider what the flow of new FDI looks like as a share of GDP. This is shown in Figure 1.

Figure 1: Ratio of new FDI in the US divided by GDP. Source: BEA, and author’s calculations.

Thanks.

Another Trump cheerleading claim bites the dust. Try checking the actual data before your next cheerleading session.

Acquisitions?

May simply lead to consolidations plant closings and job cuts

Where’s the number for hires and co struction of new productive facilities

Yes nice for capitalists looking at asset values and for the sifted few those looking at BoP movements

But for us wage hogs ???

Where’s the Extra hires and production ????

Behind a paywall—->> https://www.nytimes.com/2019/11/14/us/ice-detaining-veteran-michigan.html

It appears Bloomberg may have problems with female voters:

https://www.nytimes.com/2019/11/14/us/politics/michael-bloomberg-women.html

Most likely if this becomes widespread news he’s also looking at issues with black voters:

https://www.nytimes.com/2019/11/17/us/politics/michael-bloomberg-speech.html

The “apology” for the stop and frisk rings incredibly hollow and brings to mind Zuckerberg’s immediate “belief” in God when he found out atheists were offensive to broad numbers of American voters. I rarely pick up a Sunday hardcopy of NYT. I did so today because their incredible journalism getting the Chinese government documents related to the abuse of people in Xinjiang, and I wanted to give them some monetary compensation (however small) for that. If you can get past the paywall I also recommend reading that. HongKongers’ suffrage rights cause is exploding again and that’s worth watching as well. The Guardian is a good source if you can’t get past NYT paywall.

I forgot to note in my comment above (it’s also in the 2nd of the 3 links I gave above) that Michael Bloomberg called into question the multiple accusations against TV host Charlie Rose. Very few have called any of those claims into doubt other than Rose himself, who even himself was very mealymouthed and sheepish in his defenses. Rose really was a pathetic looking sap. This was years after interns had complained about the fact Rose didn’t even pay them for doing slave-like work for the bastard to prep for his show and do menial tasks for him. Then Michael Bloomberg post-claims defends the man to interviewers. It’s hard to see ANY way that one comes out clean in the laundry when they were made well after Rose had been publicly shamed.

Oh!!!! Stocks and flows!!! Increasing flows!!!! Decreasing flows!!!!! Decreasing flows that increase stocks!!!! Gets them every time.

https://youtu.be/wjLgekyOZA0?t=10

“Some people think that foreign direct investment into the United States has surged as confidence in the American economy has risen under Mr. Trump’s administration.”

The way the reduction in the corporate tax cut was sold had to do with an alleged surge in FDI (which BTW had nothing to do with “confidence” whatever that means). Let’s walk through what they would really mean even if it did happen. We might have a very modest rise in net domestic product (NDP) but the profits from the new investment in the U.S. economy by foreigners would be captured by foreigners and not Americans so we might also have a decrease in net national product (NNP). Most of the reliable forecasts had NDP rising by no more than the rise in profits captured by foreigners so there would be no increase in NNP.

Only someone as dumb as Bruce “no relationship to Robert” Hall could celebrate a policy of Make Foreigners Rich Again! MAGA – not.

Menzie

You have discussed foreign investment flow before. Generally, the big investors, allocate their foreign investments by determining its percent of their overall portfolio. Thus when their foreign investment value rise faster then their overall portfolio, they reduce the flow of new investment in that direction until the foreign portfolio percent returns to its set range. That also means if value of assets go down, generally, the flow will increase. Obviously these are general principles, and may not show in the short term.

Ed

Just a couple of thoughts on this:

1. The net numbers don’t really explain much; 2015 seems a “blip” which corresponded to a temporary slowdown in the U.S. economy. Were these “opportunity” purchases? Subsequent years returned to a more “normal” level.

2. The recent excess of foreign investment in U.S. versus U.S. investment in RoW could reflect a belief that the U.S. was a more attractive place to invest; the flip side being the the RoW was a less attractive place to invest. Difficult to tell from simply tracking variances.

It’s sort of like saying net population was positive or negative each year without understanding:

• birth rates versus death rates – what was causing the change over time

• immigration data – surges or declines and why

• policies related to child bearing and immigration – incentives versus obstacles

• child bearing demographics versus total population – smaller or larger proportion of the total population; are some groups more likely to have more/less children and are they more/less within the child bearing demographics

The New Foreign Direct Investment tells us the what, not the why. I was simply seeking more analysis concerning the why.

“The New Foreign Direct Investment tells us the what, not the why.”

Well duh! This is always the case. Now if you were seeking some real analysis, you are generally searching in all the wrong places. Try reading some actual ECONOMICS for a change and not those absurd “sources” you peddle here.

“I was simply seeking more analysis concerning the why.”

Let’s see. The Trump tax cut for the wealthy has led them to consume more. So national savings has declined – a lot. So the market responds in such a way to crowd investment in a closed economy. That is certainly going on. But if a company still has some desire to invest, we as a nation can do so by borrowing from foreigners or getting them to invest in that American company since we are not doing so. Of course that means the foreigner gets the profits and not us.

pgl, that’s the how, not the why. Looking at Menzie’s second chart, the FDI is not out of line with other years except for the brief blip in 2015 (I’m interested to know why that happened, too).

Of course that means the foreigner gets the profits and not us. True, but wouldn’t you also be arguing that at least a portion of that leads to job expansion and addition state/federal tax revenue? Toyota, Hyundai, BMW and other foreign automotive manufacturers may make profits here, but they also add to our economy. That seems preferable to having vehicles made overseas and shipped as finished products here.

I’m not too interested in who owns assets in the U.S. if it benefits the economy, adds to employment, and generates tax revenues… unless there are other reasons to deny such access to the U.S. as in the case of Hauwei. I’m not sure that relying on Chinese state-owned business to supply our infrastructure development is a good thing. Likewise, I’m not sure approving Russian ownership of our uranium resources is a good thing. They may generate jobs and tax revenues, but could be serious strategic mistakes. Under normal business and trade, FDI is fine and does keep manufacturing and jobs in the U.S. As you know, while it generates profits for foreign investors, they also take the risks. https://www.lovemoney.com/galleries/75445/burned-in-the-usa-foreign-companies-that-failed-to-conquer-america?page=1

As to the national savings rate, I’m not sure which statistics you are using. The Trump tax cut for the wealthy has led them to consume more. So national savings has declined – a lot. https://fred.stlouisfed.org/series/PSAVERT . This doesn’t seem to reflect that. The big drop occurred at the beginning of Obama’s second term.

Bruce Hall: I think you should read up on the reforms of the Exon-Florio legislation underlying the CFIUS process; a primer here

Most of your latest comment was the usual “blah, blah, blah” but your last paragraph demonstrated your usual stupidity. I would hope you might realize that the national savings rate is not the same thing as the personal savings rate. But you don’t. Then there is this:

‘The big drop occurred at the beginning of Obama’s second term.’

Are you blind and just making stuff up. There was a spike that reversed itself. That is not a big drop dumbass. The personal savings rate – which I repeat is not the same thing as the national savings rate – was 6.4% as of Dec. 2008 and 6.7% as of Dec. 2016 per your graph.

Come on Brucie – can you be more stupid? Oh wait, we know you will be!

pglI asked for your source of the national saving rate data; none offered. Since the national savings rate includes deficits by the U.S. government, it would appear that government spending is the real issue here, not consumers and businesses savings.

Oh, no! Oh, my! We have to have our government spending! Let’s just increase our government spending and fund it with an unconstitutional (aimed at a group or class of people while other people are exempt) wealth tax. We’ll have a wealth tax for MFA, and free tuition, and guaranteed income for all, and…. https://blog.ceb.com/2019/05/13/is-a-wealth-tax-unconstitutional/

I will concede that Trump has been in concert with the left-wing progressive as far as government spending is concerned… https://s.thestreet.com/files/tsc/v2008/photos/contrib/uploads/3f73c040-3a17-11e9-9b32-dd0cd5f17f15.png . Just look at the huge annual percentage increases under Trump than, say, Obama. Of course, Trump has been pumping money into the military while Obama pumped it into banks.

“I asked for your source of the national saving rate data; none offered. Since the national savings rate includes deficits by the U.S. government, it would appear that government spending is the real issue here, not consumers and businesses savings.”

Two really dumb comments even for you. On the first, one should consult http://www.bea.gov. Oh wait – you are so clueless you have no clue what to look for. Try NNP minus private consumption minus government purchases. This is what taught in freshman macroeconomics so I would have thought even the dumbest person on the planet would know this. But I guess it is above your head. DUH!

Your 2nd sentence is even dumb for the Faux News MAGA wearing mental midgets. Trump did pass that tax cut – right? Consumption has been rising but in real terms government purchases have not. Oh wait – you do not know to how to check the National Income Accounting tables as they too are reported by http://www.bea.gov. Do you need help finding this source or what? DAMN!

Come on Bruce – stop wasting everyone’s time with your incessant stupidity.

BTW – since you now acknowledge that the government and business sectors matter in the definition of national savings, why on earth did you use personal savings which excludes the flow of funds for both? This is my simple point Bruce – almost everything you cite as data on a point is so incredibly dumb and wrong that even a retarded dog would be laughing at you 24/7.

Deep. Do you employ “The Barkley Junior Method” and speak in a pretentious voice as you describe your own farts?? I’m mainly asking for the “why” here, not the “what”. I’ll try to remember not to breath in either my nose or mouth any time you’re discussing FDI numbers or “blips”.

To think I’d never know the complex implications of “blips” without CoRev, Ed Hanson, and Bruce Hall….. all the wide voids in my education are frightening.

*breathe— See that’s what I get for being a smart aleck kids.

Moses,

I may be going blind, but I do not see anybody on this thread identifying themselves as “Deep.” So just whom do you think you are addressing when you warn “Deep” not to imitate me by speaking “in a pretentious voice” while they supposedly “describe your own farts”?

You seem to have completely reentered fantasyland again, Mose. Please get better psychiatric assistance.

Trump met with Jerome Powell today. It seems the meeting did not go that well:

https://talkingpointsmemo.com/news/trump-powell-meeting-interest-fed

Politico strangely posted this same story 3 hours earlier.

https://www.politico.com/news/2019/11/18/powell-trump-federal-reserve-071353

Surprised TPM waited that long to transcribe it. I guess Bloomberg broke it.

“Powell tells Trump that Fed will remain nonpolitical at rare meeting”

Love that title. I guess it is the polite way of having Powell to tell Donald FUC$ OFF!

And people say donald trump isn’t fighting hard for women’s rights on the job. Really……

https://twitter.com/JohnJHarwood/status/1196406564925706241

When they announced Grisham I thought she’d never survive 2 days on the job—another Scaramucci in the making. How silly am I people?? Please don’t answer that. I guess if you see plagiarist Kearns Goodwin sauntering around on talk shows and Oprah like she’s royalty how surprising is this?? Being very honest, I still find myself mildly surprised even though I shouldn’t be at this stage of the events.

How about some enlightenment on the FRED series “Rest of the world; foreign direct investment in U.S.; asset (current cost), Flow (ROWFDIQ027S)” as it relates to the above?

https://fred.stlouisfed.org/series/ROWFDIQ027S#0

For ROWFDIQ027S, the Y/Y percent change is what I intended to link, but the dollar amount is what linked.

Dear Folks,

We heard that the trade war has reduced Chinese investment in LNG facilities at the monthly meeting of the energy economists in Washington (the NCAC chapter of the USAEE) on Friday. This is backed up in

https://www.cfr.org/blog/geopolitics-liberalizing-lng-market-primer

which reported that “But the U.S.-China trade war remains a potent geopolitical force despite a liberalizing market. The United States’ role in LNG supply to China has been marginalized—only four LNG vessels have landed in the country since tariffs on the fuel went into effect in September 2018. Some analysts believe short-term effects on U.S. producers will be limited; but the trade war clearly delayed some U.S. developers from finding equity investors in 2018. Chinese buyers have turned to Australia, Mozambique, and Russia for long run natural gas supply.”

The situation for LNG in Japan is ambiguous, as reported officially in

https://www.export.gov/article?id=Japan-Liquefied-Natural-Gas-LNG

Any further tariff activity directed against the Japanese could clearly affect their FDI in the U.S. The Department of State is arguing that U.S. FDI elsewhere is robust, in

https://www.export.gov/article?id=Japan-Liquefied-Natural-Gas-LNG

But the U.S. methanol industry has also been hurt. Chinese retaliation on methanol and other energy commodities is detailed in

https://www.reuters.com/article/us-usa-trade-china-commoditiestariffs-fa/factbox-chinas-tariffs-on-u-s-commodities-and-energy-idUSKCN1VG158

In all, the energy market seems to be a good specific example of how the FDI trouble is playing out on a market level.

Julian

The news from Lake Wobegon in southern Canada:

https://www.youtube.com/watch?v=_r2IZ1b_rj4