Should he? FRB Minneapolis Fed President was at UW Madison today, and stated:

“The fact that the yield curve is now uninverted gives me some indication that we have taken the brakes off the economy,”

Should we rest easy? In some sense, the answer is “yes”.

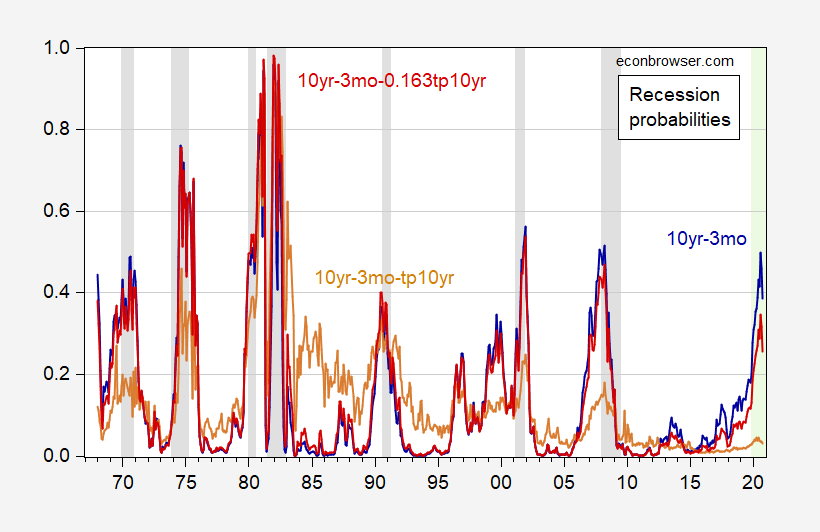

Take the plain vanilla term spread model; run a probit regression of recession 12 months ahead on the simple 10yr-3mo spread, and one obtains an 50% probability of recession in August 2020, declining to 39% by October. This point supports Kashkari’s view. In addition, as many have pointed, the historical correlations may not provide a reliable guide to recession probabilities, given the drastic change in the size and sign of the term premium, and the implied recession probability is actually substantially lower.

Simply subtracting off the term premium from the term spread an estimated 10 year term premium should in principle isolate the pure expectations hypothesis of the term structure component. Define spread as the 10yr-3mo term spread in percentage points, and tp10 as the ten year term premium, as reported by the New York Fed. (Data in XLS file here.)

Prob(recession=1)t+12 = -0.442 – 0.794(spreadt-tp10t)

McFadden R2 = 0.18, SSR = 64.76, Nobs = 622, sample 1967M01-2019M10. Bold face denotes significance at 1% msl.

The predicted probability of the recession peaks at 5% in April 2020.

However, one could let the data speak, and allow the coefficients on the term spread, and on (the negative of) the term premium be unconstrained to be the same. Doing so leads to the following regression estimates.

Prob(recession=1)t+12 = -0.442 – 0.794(spreadt) + tp10t)

McFadden R2 = 0.32, SSR = 53.85, Nobs = 622, sample 1967M01-2019M10. Bold face denotes significance at 1% msl.

Notice the McFadden R2 increases substantially, while the sum of squared residuals drops. A Wald test for equality of coefficients on spread and (negative of) tp10 rejects wildly (p-value = 0.0000).

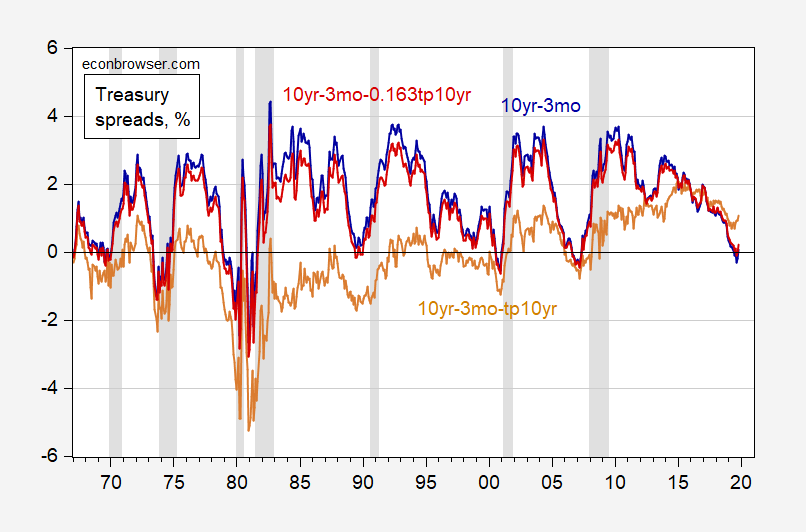

In Figure 1, I show the various spreads (unadjusted, adjusted, and unconstrained adjusted).

In Figure 2, the associated probabilities are shown. The unconstrained specification confirms that Kashkari should be reassured; the probability of recession falls from 35% to 26% in October. But maybe not too relaxed.

I haven’t watched this YET, but I assume it’s what Professor Chinn is referencing. Kashkari comes in at about the 18 minute mark. Never let it be said Uncle Moses didn’t do something kind for you kids:

https://www.youtube.com/watch?v=RdawVGbIJq8

He is scheduled to speak in La Crosse Wisconsin at 12:30pm central time tomorrow (Wednesday) and it looks like you can watch that LIVE here:

https://www.youtube.com/watch?v=UY_60dWrMwE

If I find any recent ones where Kashkari has slides similar to what Menzie has above I’ll try to put it in this thread inside the next 4 hours.

Off-topic

There are at least two people saying Ohio Republican Jim Jordan knew what Strauss was doing:

https://www.si.com/more-sports/2019/11/08/referee-told-jim-jordan-about-richard-strauss-sexual-abuse-ohio-state

Sports Illustrated sees this story as genuine enough and legitimate enough to print, I guess CoRev, Ed Hanson, and Bruce Hall will have to sit around doing mental gymnastics on how Sports Illustrated is some dirty liberal media outfit. The rest of us, with some semblance of sanity and morality will have to wonder how Republicans thought a guy who shrugs his shoulders at sexual abuse of college students should head an impeachment inquiry.

Jim jordan is simply a dishonest, unethical turd. Only fools like rick stryker continue to tout him as a pillar of ethical behavior. Can you imagine a normal person turning a blind eye to rape and shrugging it off as locker room behavior? That seems to be a common defense of despicable behavior from turds like rick. Same defense of trump and his grabbing.

The yield curve sometimes un-inverts before the recession. I’m less confident that we will have a full-blown recession in mid-2020, but with the expansion in consumer debt that’s just been reported, I do expect a slowdown next year. There will be a pullback, as there nearly always is. There’s just too many things to look at that say it’s coming, and the mixed signals for the last year or so have not yet convinced me that the downturn is not coming.

I think an argument can be made, that the inversion was deterred because of artificial moves by the Fed to protect banker/dealers and insulate itself from criticism from donald trump. What were the market and economic causes of that inversion??—have those underlying economic causes of the inversion been eliminated because of the recent Fed moves?? Willie, you have, I think, the intuitive ability to answer these questions yourself if you even follow business news in a cursory fashion (which It appears you do, or possibly more than cursory when compared to most Americans)

Off-topic

It’s interesting that during Jim Jordan’s running commentary to Ambassador Taylor they mention at least one Politico story where they broke their own news. They haven’t mentioned perennial transcribers “TPM” during any of this impeachment inquiry. I wonder….. as this inquiry continues if we did a count on how many times Politico stories are referenced (again where they actually broke their own news) and “TPM” transcriptions of other media sources’ stories, which one will end up being mentioned more?? Just thought some New York commenters here might take note, and what that may signify as to quality of journalism.

I guess all journalists (or maybe if they all acted this way we could just call them transcribers) should do what “TPM” does, and wait around all day for others’ to do the dirty work, then parrot that dirty work, and watch what happens to democracy in the meantime. Would be a fascinating little Sh*tshow. Or are we already halfway there??

Agreed that slower growth lies ahead, but I would be cautious about attributing that slower growth to rising household debt. Household debt as a share of GDP is very low, suggesting households could take on more debt if they want. Some are debt=restricted, but many are not.

Slower job growth and weak investment seem more likely culprits, along with slowing abroad.

Now, if you wanna talk about CORPORATE debt, you could get me worried.

uninverted???

Why don’t you Yanks speak english

Because we speak American, of course. Why do you ask?

Why don’t you tell us the preferred lexicon. Lay some of that deep Aussie knowledge on us that we’re craving.

After a brief period of dis-uninversion, the yield curve has resumed its natural uninverted shape.

A person speaking english would say now the yield curve is no longer inverted.

OK, this round is won by the Aussies. I’ll just be here…… behind this bush…… waiting for your next weak moment……..

https://youtu.be/x8oLu7znwQ0?t=28

Why not simply, the yield curve is verted?

Seems like a “badly verted” statement.

God l9ve you Mr C

You are athe emperor of empirics

Related to rates (specifically low rates):

Link has paywall—–>> https://www.nytimes.com/2019/11/13/business/insurance-negative-interest-rates.html