From Mr. Trump’s speech at the Economic Club of New York yesterday:

…we’ve added nearly $10 trillion of new value to our economy. That’s in a short period of time. Remember, I only use numbers from the time of the election because I can’t go to January 20th. It’s not fair. We picked up tremendous stock market and economic numbers. They actually went wild the day after I won.

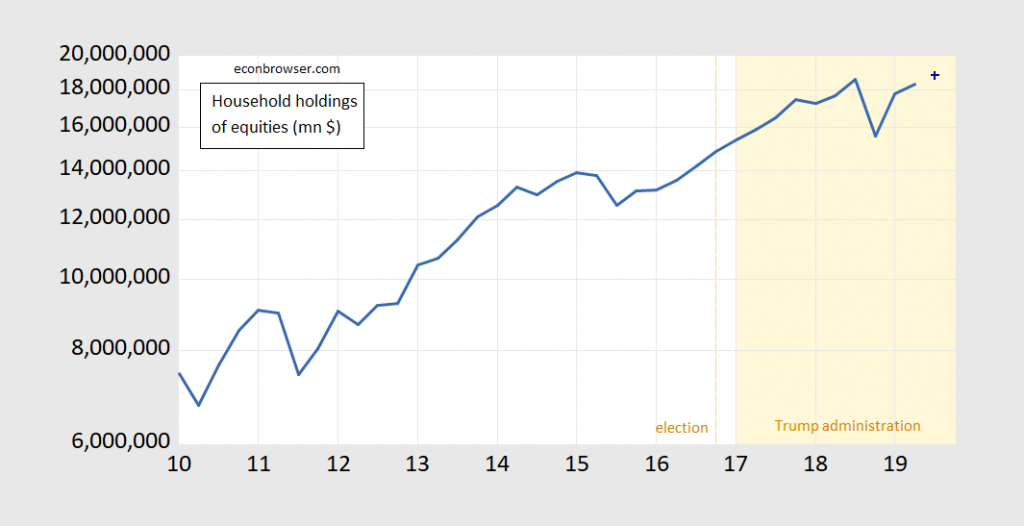

Where does this number come from? I downloaded household holdings of corporate equities, from the Fed’s Flow of Funds release, FRED series HNOCEAQ027S, which extends to 2019Q2. I extrapolated to 2019Q3 using the SP500 (in a first differences log-log specification 2010-2019Q2, Adj-R2 = 0.60). This yields this graph:

Figure 1: Value of household holdings of corporate equities in millions of dollars (blue), estimate for 2019Q3 based on SP500. Light orange denotes Trump administration. Source: Fed Flow of Funds via FRED and author’s calculations.

The difference between end-2019Q3 equity wealth and that at end of 2016Q4 is $4 trillion (a cumulative 27% in log terms). I don’t know where the other $6 trillion Mr. Trump cites came from.

On average, market capitalization has grown a respectable 9.4% per year since 2016Q4 (log terms). In contrast, during Obama’s second term (election to election) capitalization grew 11.3% per year…

On another point, Mr. Trump writes:

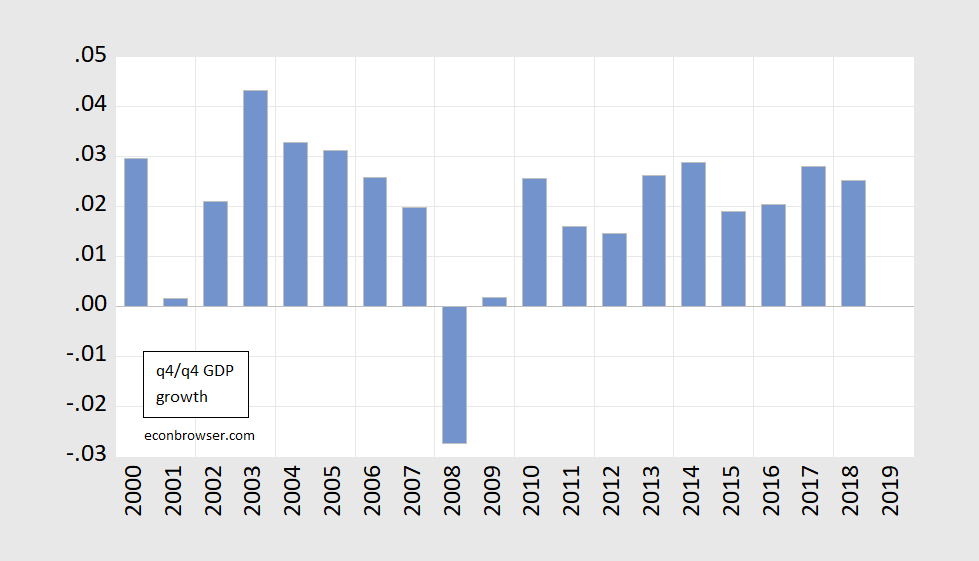

Last year, GDP growth matched the fastest rate in more than a decade…

I don’t know how he gets this either — unless his speechwriter forgot to update the numbers (the GDP figures get revised, after all…). Using the latest series, I find y/y on annual data the 2.9% figure in 2018 is matched by the 2015 figure of 2.9%. On a q4/q4 basis, the 2018 figure of 2.5% was exceeded by the 2017 figure of 2.7% which was in turn exceeded by the 2.9% in 2014…

Figure 2: Q4/Q4 real GDP growth rate (blue bar). Source: BEA, 2019Q3 advance release, and author’s calculations.

Back when I was on CEA staff (both Clinton and Bush), we meticulously fact-checked each number. Apparently, that is no longer the case in Trump’s 2019. In other, don’t trust a single number that comes out of Mr. Trump’s mouth. (Except when he said “I am the king of debt.“).

No-one knows not even Trump himslef

Between reading good quality sources (NYT, Bloomberg, WaPo, some podcasts, RSS feeds, etc) and the impeachment inquiry I can’t even watch Colbert anymore. It’s not that the joke writing isn’t very good, but it’s just to close now, it hits too close. So I either have to skip what’s going on and watch Colbert OR know what’s going on and skip Colbert. I just can’t watch that much of it because it’s too emotionally upsetting and it gets where it’s mentally unhealthy for me. I think I’ve always kind of been aware of how dumb the typical American is but I always just kinda try to force it to the back recesses of my mind. I’ve spent my younger years in rural areas, one poor urban area near a military base where roughly 60% of the school was black. Think about Nixon, Reagan. Think about Pat Buchanan’s run and the percentage numbers he was pulling in during the primaries. I think Buchanan is a well-educated and pretty sharp guy, but he doesn’t make much effort to hide he’s a racist and that he approves of all the unethical things Nixon did, and is even proud of many of them. So what years did Buchanan run?? I’m too lazy to Google it but in relative terms not that long ago. In reality none of this is new. Something like 1 in 3 Republicans voted for Buchanan and then he doesn’t win and then we act like the people who voted for Buchanan don’t exist and they aren’t a significant portion of America. They were there the ENTIRE time. donald trump didn’t bring us these people—these people brought us donald trump. Let’s quit fooling ourselves on that score. And then we can get into Roy Moore’s Republican numbers in Alabama. Should I pull out that link for like the 8th time on this blog?? And he’s going to run AGAIN. It’s nothing new people. And having SJW safe spaces and going “OK Boomer” isn’t going to make them disappear inside of a smoke bomb. Because another lie liberals and hipsters and “generation Zers” tell themselves is “it’s a generational problem”, but it’s really not. But you people under 35 keep telling yourselves that if it helps you feel “woke” because you apparently don’t even know your own generation’s demographic while you’re saying phoney tag lines to impress your female classmates. Whatever, but you’re not going to change reality by painting a fantasy dreamscape about “generation Zers”. Remember those people who protested in the late 1960s?? Where the F do you think most of them working now?? HINT: Not making solar panels.

Get offa my sidewalk, Moses. Lawn is not a cash crop, so I do not have one.

Never mind Generation Z and demographics. The point is that numbers from the White House do not make sense. That will become clearer to people, including those rural people we apparently bot started life as. When the rhetorical spout is not close to generally perceived reality, the spouting turns against the spouter. Trump will have to explain who benefited from growth, if any, provided that his political opponents are paying attention.

OK boomer

Look, it’s the 55–65 Boomer crowd in action below!!!! Warning to overly sensitive generation Zers, people in the first two linked videos below may appear closer to your age group than boomers. Please seek out a local mental health clinic if you find this psychologically disturbing to your world view. Especially when it dawns on you these were the majority of MAGA people handing donald trump the White House.

https://www.youtube.com/watch?v=2ZyUYAWFgRs

Remember, it’s not your fault (as nothing EVER is) you’re in denial about who voted for trump, it’s your parents fault. Old people similar to David Letterman are to blame. Who as everyone knows, was not a literate man like the bookish and socially mature Jimmy Phlegm.

https://youtu.be/kIGcosb22_Y?t=21

https://www.youtube.com/watch?v=Mub1CxOb8hM

“The difference between end-2019Q3 equity wealth and that at end of 2016Q4 is $4 trillion (a cumulative 27% in log terms). I don’t know where the other $6 trillion Mr. Trump cites came from.”

I think I know where the other $6 trillion comes from. Insider trading gains for Wilbur Ross and the Trump kids extracted from milking Rudy’s connections in Russia and the Ukraine!

BTW – Ivanka created 14 million new jobs. She’s a very powerful woman!

The original source for the Flow of Funds:

https://www.federalreserve.gov/releases/z1/current/default.htm

After all, FRED is third hand information aka hearsay evidence – right? Oh wait – the Federal Reserve is a bunch of deep state Never Trumpers.

Trump is just a run-of-the-mill con man, nowhere near the sophistication of Bernie Madoff.

So Trump’s cons are easily exposed immediately, while Madoff conned very astute people for years. I happened to have known one (not me of course because I never had the $$$ that Madoff was after).

Trump’s cons are very amateurish and stupid so most people don’t pay them attention, but they should because a large segment of the population is very gullible.

Ah, phone typo. We both apparently started as rural people. Not bot. There is little chance you are a bot, unlike some others who seem to have vanished.

Willie, it’s much more fun watching from the sidelines as the story lines get more bizarre.

>CoRev rambles incoherently “Willie, it’s much more fun watching from the sidelines as the story lines get more bizarre.”

How are those soybean prices coming along CoRev?

Dave, they are $9.0175 which still is not $8.72!

CoRev: Boy, you are stupid. Nobody said the price should be $8.72 in November 2019. But somebody did say best guess would be $9.36. https://econbrowser.com/archives/2019/10/what-does-it-mean-to-say-futures-contracts-forecast

And where were soybean prices before Trump’s stupid trade war? Oh wait – weather and all that. Too bad you are too poor to get a new coat as it is getting cold outside.

Dave and Menzie, if you remember my original point was that WEATHER was probably the more important factor in harvests and pricing. As I have said earlier, this year is a teaching opportunity; https://www.zerohedge.com/health/record-low-temps-50-degrees-below-normal-threaten-wreck-rest-harvest-season?fbclid=IwAR3mdKEACsPThKEuTh07xmVD2tkDD7j818O7ELJ9jKd1QAO4H4rzoY3udV0 Record Low Temps, Up To 50 Degrees Below Normal, Threaten To Wreck Rest Of Harvest Season

Just for PGL it notes:

“And right now we are facing a crisis because less than half of all U.S. corn has been harvested.

In fact, according to the latest USDA Crop Progress Report just 41 percent of all U.S. corn has been harvested so far…

In its weekly Crop Progress Report, the USDA pegged the U.S. corn harvest at 41% complete, below the trade’s expectation of 48% and below a five-year average 61%.”

A wet and late Spring now coupled with an early and cold Fall has dramatically impacted US crop harvests. Northern crops are especially hard hit: ” Minnesota is behind the most regarding picking corn: 22% vs. a 56% five-year average.”

As for soybeans, also planted late this year, at the end of Oct. the crop quality was the lowest in 5 years at 55%, and only ~70% harvested. These values also are terrible for food crops like potatoes.

I don’t expect a NY economist to understand the impact on his prices and availability, but next Spring and going forward he might notice it at his local store.

For the climate extremists this is a reminder that COLD not heat is the enemy.

Menzie, your current diatribe: “Boy, you are stupid. Nobody said the price should be $8.72 in November 2019. ” can be translated to mean: Since I was wrong on July 15, it is NO SURPRISE it would still be wrong in November.

CoRev: Since you continue to misconstrue my (as well as many others’) statements despite continued explanations, you are henceforth banned. If you can sometime demonstrate either (1) you admit you don’t understand mean error, RMSE, MAE, or (2) you demonstrate you understand these concepts as well as ex post historical simulations and out of sample forecasting, then you will be unbanned.

menzie, the argument corev is making is simply a distraction from the bigger mistake he made. he was arguing the trade war would be short lived and over long ago, with victory in hand, due to the negotiator in chief’s skillset. at best, it appears the trade war will end with the same conditions prior to the boneheaded trump trade policy.

CoRev managed to entirely remodel his house with cheap soybeans. Now in those weeks where he is too broke to buy groceries, he can just eat the house!

The numbers come from where all his numbers come from. Below the belt and from a orifice to the rear.

Below Trump’s belt or below Kudlow’s belt?! Of course, it likely does not matter.

Either the author of this piece is being disingenuous or is just not good at research. I easily found the following:

https://www.macrotrends.net/countries/USA/united-states/gdp-growth-rate

which puts 2018 GDP growth above 2017, and almost identical to 2015.

John Smith: When I read: “Last year, GDP growth matched the fastest rate in more than a decade…” I assume that means no equal or greater growth rate was exceeded *in the past decade*. Well 2015 is 4 years. In point of fact, I can’t replicate your result, partly because I suspect it’s outdated (note the underlying source is World Bank; I don’t even know what units it’s measured in).

Why don’t we go to the official BEA series (latest release)? Then as shown in the graph of q4/q4 growth rates, 2014 growth at 2 significant digits exceeded substantially 2018 (2.9% vs 2.5%). On y/y annual data basis, 2018 matches at 2 significant digits 2015.

So, two lessons: (1) reading comprehension is a useful ability when assessing claims (I learned it in an American grammar school). (2) check your data vintage/source.

(By the way, Trump’s claim to 3% growth disappeared with the (inevitable) data revisions.)

Macrotrends data: 2015 growth was 2.88% and 2018 was 2.86% – i.e. they are the same. Other years in the past decade are much lower. 2014 was just 2.45%.

Statista and The World Bank have the same data as Macrotrends.

So, according to the data I’m seeing, The President was correct to say that “Last year, GDP growth matched the fastest rate in more than a decade”.

John Smith: What the heck is Statista? I’m using the official statistics of the United States government.

It is a German online provider of data for which they charge fees. Not sure what John Smith is talking about as he provides no links so it is hard to verify if this for fee German outfit is quoting something else or what. But the official statistics for the U.S. economy are available from the source at no charge.

John Smith failed to provide a link to his alleged Statista data so permit me. Of course I do not subscribe to this for fee outfit so I will let Menzie and John Smith compare and contrast what it provides v. BEA:

https://www.statista.com/statistics/188185/percent-chance-from-preceding-period-in-real-gdp-in-the-us/

Quarterly growth of the real GDP in the United States from 2011 to 2019

It is quite unlikely that Trump’s live audience fell for his schtick. The Economics Club is not all economists, but it ain’t no Rotary Club meeting, either. Trump was talking to the same old people he always talks to. Those same old people will certainly repeat what they heard, without caring whether it was true.

“The Economics Club is not all economists, but it ain’t no Rotary Club meeting, either. Trump was talking to the same old people he always talks to.”

Exactly right. I live in New York City and I have never considered joining. Just check out how one becomes a member. Big shot business types who don’t mind spending $1000 a year to sit and listen to the type of BS Trump delivered!

https://www.econclubny.org/web/pages/members

Club Membership

The Economic Club of New York’s membership is curated from the senior executives and leaders in New York City. Members are committed to the ideals of respectful and thoughtful conversation and have demonstrated leadership in their field of work. The Club offers two categories of membership – full membership and associate membership.

Full Membership Criteria

Members are chosen from senior leaders, typically C-Suite, who have distinguished themselves in the areas of finance, technology, law, government, academia, healthcare, real estate and other economic sectors. This membership class requires proposal from two current members in good standing.

Membership Dues

The Club’s annual membership dues are $1,000. A one-time initiation fee of $1,000 is also required of new members upon their acceptance by the Membership Committee.

Associate Membership Criteria

The Economic Club of New York offers a new five (5) year term membership for individuals 45 years of age or under that are in a mid-level or above leadership position with approximately seven (7) years professional experience, demonstrating upward mobility and a successful track record. This Membership class facilitates deeper familiarity with the Club, networking opportunities and the ability to attend Club member events. Associate Members are encouraged to attend a minimum of three (3) Club events annually. Associate Members are only required to have one (1) current member proposer in good standing and go through the same membership process as the Full Membership class. After the five (5) year term, Associate Members may apply for Full Membership but there is no guarantee of admission.

Membership Dues

This five (5) year term membership annual dues are $700, with a one-time initiation fee of $700.

I would call this ECNY stuff pure snobbery, but then I might be labeled an ignorant resentful populist, and as everyone here knows, that’s my biggest fear in life. Either that or having a PhD and not being able to look at a data set and tell if it’s “skewed” or uniformly distributed. It all hinges on if I look like an A$$-hat at the end of the quarrel because I didn’t read the paper all the way to the end, and then I have to double-down on it being “skewed” after I get called out on it. Such is life when you have to keep up appearances.

https://www.youtube.com/watch?v=kGt-jvU5Iag

Not to mention make an A grade on every exam:

https://thehill.com/hilltv/rising/469977-krystal-ball-claims-warren-is-avoiding-tough-questioning-from-media

Thank baby Jesus it’s not something so low as a Rotary Club though. Oh My…… just the thought of rubbing elbows with a Rotary Club member is kind of frightening:

https://www.rotary.org/en/press-release-centennial-fundraising

Eeeewww!!! Oooooohhh!!! I just felt my entire upper body reflexively convulse back in fear!!!!

“I would call this ECNY stuff pure snobbery”. ALL of the Uppity East Side and Uppity West Side are pure snobbery. I used to live on the Upper East Side. Had to move and move happier in Brooklyn.

Oh my, at it again, are you, Mose?

For the umpteenth plus some times, a genome is not a population, and a uniform disribution on the former is perfectly compatible with a skewed distribution on the latter, which has been explainred to you by several people here many times. Do you really like going out of your way repeatyedly to make yourself look like a total idiot in public?

LOL.

Maybe Trump was referring to this NY Federal Reserve Bank report:

https://www.newyorkfed.org/microeconomics/hhdc

After all, like Menzie said, Trump is the king of debt.

Other facts (alternate variety): the tax cut is paying for itself; no more trillion dollar deficits “as far as the eye can see”; and that pesky national debt will disappear by 2024. Oh, and wall building on the Colorado/Mexico border is going well.

Menzie,

I think you’re the one in error here. According to the Federal Reserve Z.1 release, household net worth has gone from $96.9 trillion in 16Q4 to $113 trillion in 19Q2. Non-financial assets have gone from $33.7 trillion to $39 trillion.

I suspect you’ve neglected house price appreciation (?).

Bob: Maybe — but I usually read in context (that’s what I learned in American grade school, at least). Trump mentioned employment, GDP, and stock markets directly before citing $10 trillion. He didn’t cite debt so wasn’t apparently talking about liabilities; and didn’t cite Federal debt…hmm. Should I read what he says in context, or *search* diligently for *some* number that validates his assertion?

The Flow of Funds reports not only assets but also reports debt as you note. In fact, it reports net wealth for the mentally impaired people in the White House who seem incapable of calculating assets – debt!

I could have done without the snark. I have a PhD, fyi, and I know how to read.

I just looked over the speech again, and the words “All together” seem to support my interpretation.

Also, fine, ignore liabilities. Assets are up $10 trillion plus.

“Also, fine, ignore liabilities. Assets are up $10 trillion plus.”

Defining the increase in net wealth as the increase in assets ignoring any increase in debt? Which third rate school gave you a Ph.D.? Maybe they should be revoking it.

Assets does not equal wealth. Go back and calculate the increase in debt. Then take the difference.

Perhaps Trump was talking about total asset value of the U.S. as opposed to GDP or some other economic measure. Hard to say; harder to find statistics.

Perhaps he was talking about the total valuation of just the stock market:

“Moreover, the run-up in value since President Donald Trump was elected is some $6.6 trillion, in just about 14 months. That’s half the entire gain seen under the eight years under” [Obama]>/i> https://www.barrons.com/articles/the-u-s-stock-market-is-now-worth-30-trillion-1516285704

Since that was nearly two years ago, it’s not hard to see where a $10 trillion dollar might come from.

GDP is not the only measure of an economy or nation’s wealth.

Bruce Hall: Did you not read the first part of the post, which was *nothing* about GDP, and *all* about stock market capitalization?

Menzie, you are correct. I did overlook the statement about market capitalization as I was drawn to the very large and imposing chart about GDP, so I apologize. I should have been more careful.

Are you then in agreement with my conjecture (based on the Barron’s article) that Trump may have been referring to the “run-up in value” of $6.6 trillion in the first 14 months plus the subsequent run-up to date? The Wilshire 5000 has gone from ~23K (Jan ’17) to >31K at present. The Russell 3000 (referenced in the Barron’s article) has gone from 1.3K to 1.8K during the same period.

I believe this does not include the change in privately held assets, but I’m not sure how that is calculated or by whom.

Bruce Hall: Might’ve been. Either way, it’s a wrong number for the variable he describes.

“I believe this does not include the change in privately held assets”.

There you go again. Wealth is not the same thing as assets. It is assets minus liabilities. Lord – you suck at even the most basic accounting.

Bruce Hall GDP is not the only measure of an economy or nation’s wealth.

Just so there’s no confusion, GDP is NEVER a measure of a nation’s wealth. GDP is a flow variable. Wealth is a stock variable.

Guess who else mangles flow variables like GDP and stock variables like wealth. Lawrence Kudlow who we all know is a flaming moron. But hey Larry is Trump’s main economist. BTW – everyone knows stock equity = the market value of assets minus the value of debt for the corporation. Oh wait – Bruce Hall thinks wealth = assets. Yes he is THAT stupid.

BTW when Brucie says data is hard to find – I guess he did not notice my links to the Federal Reserve Flow of Funds data Menzie mentioned!

“Perhaps Trump was talking about total asset value of the U.S. as opposed to GDP or some other economic measure.”

OK Bruce – then why don’t you report this figure? I know, I know actual research is over your head. As are basic concepts as in:

Net wealth = assets minus debt.

But forgive me for bothering you with reality. You may now go back to your sand box.

It was 70 minutes including the Q&A. I think Trump set a new record for number of lies per minute during this little speech in Manhattan. Menzie plugged only two but one could run blog posts for the rest of the year citing the incredible dishonesty Trump put forth here.

I’ll address only one of Trump’s many lies:

‘Three years ago, I came to speak before this storied forum as a candidate for President. And at that time, America was stuck in a failed recovery and saddled with a bleak economic future. And it was bleak. Under the last administration, nearly 200,000 manufacturing jobs had been lost; almost 5 million more Americans had left the labor force, and jobs were not exactly what you would call plentiful; and 10 million people had been added to the food stamp rolls. In 2016, the Department of Labor predicted that Americans would continue dropping out of the workforce in record numbers. They predicted and projected a decade of sluggish growth, and they expected unemployment over 5 percent — and, really, 6, 7, and even, in some cases, 8 percent — for many years to come….Back in 2016, before I took office, the Congressional Budget Office projected that fewer than 2 million jobs would be created by this time in 2019. Instead, my administration has created nearly 7 million jobs, and going up rapidly. We beat predictions — (applause) — thank you. We beat predictions more than three times the highest estimate that I saw during the campaign.’

I have no clue where Trump pulled these alleged Department of Labor and CBO forecasts. I think he is lying here but if Menzie knows – great. But we were struck in a failed recovery in October 2016? OK employment has grown by almost 7 million since October 2016 but check out what happened to employment from October 2013 to October 2016:

https://fred.stlouisfed.org/series/PAYEMS

Gee it rose by around 8 million under those three Obama years. Of course, no one at this Manhattan event had the intelligence or integrity to call Trump out on this blatant lie.

Bernie Sanders and Ocasio Cortez announce public housing legislation:

https://www.youtube.com/watch?v=_YpUN-lhZM4

This is REAL fiscal policy instead of banker welfare handouts by QE and Repo sales. This is what America needs. If this is “MMT” vs the last 40 years of “trickle down” crap, then give me the “madness” of MMT. Let the bankers put more assets and equity capital on their balance sheets or go F themselves.

A few people have wondered if Trump could be vindicated by a broader measure of wealth (Bruce Hall mentioned assets but everyone who passed basic accounting knows that is stupid as one must include debt). Well the Flow of Funds is a wealth of data. It has been a while but here is what I’m seeing:

https://www.federalreserve.gov/releases/z1/20190920/html/default.htm

L.100 Domestic Nonfinancial Sectors

Domestic nonfinancial sectors; total financial assets

This has risen by almost $16.2 billion since 2016.

Domestic nonfinancial sectors; total liabilities

This has risen by over $8.4 billion since 2016.

So properly measured net wealth broadly measured has increased by less than $7.8 billion.

pgl, good analysis. The question I have is why line one is labeled net wealth (see footnote 1)? I always understood “net” to be gross assets minus liabilities. But maybe there is a more esoteric definition related to the Fed data.

One does not need to include terms like gross versus net to get the most basic accounting definition down. Yes – you suck at economics, basic research skills, and now even simple, simple accounting 101 concepts. Should we buy you for Christmas a copy of Accounting for Dummies?

pgl, you avoided the question with ad hominem nonsense. Sorry, I thought after your previous comment you could actually provide reasoned comments. Was line 1 net or not? Reference footnote 1.

You seem obsessed with me which is both creepy and complimentary. But I was impressed that in your previous comment you were able to provide a link for your argument. Unfortunately, you seem unable to provide an answer to a question about your link. Perhaps someone else can.

For the love of God. Even 18 year old students in freshman accounting know wealth does not equal assets. It equals assets MINUS liabilities. This is not a difficult concept – except for you. So cease and desist with the childish whining. It is embarrassing to your poor mother.

Gross vs. Net Value of the Business

The Gross Value of a Business normally represents the market value of all of the Assets of the Business.

This value can often be found in the balance sheet of the Business.

The only qualification is that many balance sheets omit any substantive Goodwill value of the Business.

Therefore, if you use the balance sheet to determine the gross value of the Business, then it might be necessary to add the total market value of the Assets and the Goodwill, in order to arrive at the total Gross Value of the Business.

A balance sheet is not only a source of information about the Assets of the Business.

It contains information about the Liabilities of the Business as well.

The Net Asset Value of a Business is the Gross Value less the Liabilities.

Therefore, in order to arrive at the Net Value of the Business, you must deduct the Liabilities from the Gross Value of the Assets. http://www.completesuccession.com.au/page%2006.0.24.html

pgl, I hope this helps you out in responding to my question.

Gross value so defined is STUPID. Yea – we all know balance sheets have two sides. One side shows the composition of assets. The other side shows the composition of liabilities as well as equity. BTW equity = the difference between the value of the assets and the value of the liabilities. If some CFO told shareholders to look at the “gross value of the business”, he would likely be fired on the spot by the CEO. Otherwise, the company risks shareholder lawsuits.

Thank God you were never the CFO of a company as you make the most basic issues beyond complicated as well as incredibly stupid for no reason.

Damn Bruce Hall finds the most pathetically worthless websites:

http://www.completesuccession.com.au/

Nothing against Australians but this?

‘Most business owners know you need a Business Succession Plan. You probably hear about them all the time. The problem is nobody can tell you what a Succession Plan looks like or what “jobs” it can do! This simple issue is the cause of the three most common problems of Business Succession Planning!’

These hacks are promoting “business succession” plans. They sound to me like snake oil sales people trying to rob your business equity. Way to go Brucie – a new record even for you in worthless garbage ala the internet!

Trump’s numbers come from here:

https://fred.stlouisfed.org/series/WILL5000PRFC

That is the total market cap of the US stock market. It shows a total market cap of $21.5 trillion right before the election and $31.5 trillion today. That’s a $10 trillion increase in nominal dollars, of course. That is not household wealth. That is the total market value owned by individuals, pension funds, insurance companies, and something like 25% is owned by foreigners.

These are solid numbers but no better than during the Obama administration.

joseph: The link goes to a Willshire 5000 cap price index…

An index is not the same thing as dollars. Just saying.

“total market value owned by individuals, pension funds, insurance companies, and something like 25% is owned by foreigners.”

Make Russians Rich Again! OK – some of the stock market is owned by incredibly rich Americans. And guess who attended this Manhattan event? His base – billionaires. We are not talking about the wealth of the average Joe.

Yes, but the Wilshire 5000 index is total capitalization of the stock market in dollars. It is the sum of the market cap of every company publicly traded in the US. Although nominally 5000, the actual number of stocks varies from year to year. It is the generally accepted measure for the total value of the US stock market. But as pointed out previously, about 25% of those stocks are owned by foreigners.

See more below:

https://wilshire.com/indexes/wilshire-5000-family/wilshire-5000-total-market-index

joseph: I understand now — it’s called a “price index” but it’s actually scaled to be a value. Well, while it might have wide coverage, it doesn’t cover all stocks, and further as noted, it doesn’t account for foreign ownership. That’s why Flow of Funds which indicates who owns what is “better” if we are to assess Mr. Trump’s assertion. But you are right, he might very well have used an “incorrect” figure. In fact, it’s almost a certainty.

Kudlow was with him during this little event. So Kudlow gave him his data which is a guarantee that all of the figures were either lies or otherwise wrong via Kudlow’s infamous stupidity.

@ Menzie

I’m not saying the link below is accurate or factual (and I am NOT saying how he is basing the number is solid methodology). Your main question seems to be “where did trump get these numbers??”. I think joseph’s theory is actually a pretty decent theory (in terms of how trump got his number). I also think this very well could have been donald trump’s source, dated from July of this year. “You know who” claims he’s getting his numbers from Nasdaq. I have neither the personal inclination nor the work ethic to check this bastard’s numbers—but color me doubtful.

https://thehill.com/opinion/finance/451857-americans-are-10-trillion-better-off-thanks-to-rising-stocks-under-trump

Moses Herzog: Certainly seems like a plausible source.

Oh, and each point in the index is nominally $1 billion in market cap value. So an index of 32,000 means $32 trillion in market cap value. I think today that the index is slightly more than $1 million per point because of esoteric adjustments that occur as companies are added, removed and merged, but most people just interpret the index as representing $1 million per point, so close enough.

“it doesn’t cover all stocks”

It covers all publicly traded stocks or at least 99.9% of them. Keep in mind that it is market cap weighted, so for example Apple represents about 3% of the total stock market. There can be thousand of tiny penny stocks that don’t add up to spit. So 3000 or 5000 stocks, that really is the sum total of the public stock market to several decimal places. In fact the S&P 500 largest companies represents 80% of the Wilshire 5000. Companies follow a power law size distribution so that once you get past the 1000 largest companies, there isn’t much left in aggregate.

The Wilshire 5000 does not include privately owned companies or pre-IPO corporations that are not traded on a public market. These can be small family businesses like the neighborhood dry cleaners or giant privately owned conglomerates like the Koch brothers. Some estimates are that non-publicly traded business represent as much as 50% of GDP.

joseph: Yes, I understood it covers most American headquartered stocks (even if the market value incorporates overseas operations of multinationals headquartered in the US). But if we are aiming for value of US household holdings, then, well, Flow of Funds…

It is true that some of Coca Cola’s stock is held by foreigners. It is also true that some of Toyota’s stock is held by Americans. We do live in the world of multinationals after all. And I’m sure the good folks at the Federal Reserve incorporate these realities into their Flow of Funds.

You do realize a lot of corporations have delisted over the past generation?

Speaking pulling numbers out of his fat butt, our stable strategic genius with his great and unmatched wisdom has decided that South Korea needs to pony up a lot more money if they want to keep US troops in Korea. I wonder what our Always Trumpers have to say about Trump’s latest shakedown (Mafia style):

https://www.cnn.com/2019/11/14/politics/trump-south-korea-troops-price-hike/index.html

Nice county you’ve got there. Sure would be a shame if something happened to it.

Even his own Pentagon and State Department have no idea where he got his 500% number as the cost for keeping US troops in South Korea. But Bruce Hall and Ed Hanson will assure us that Trump has a grand strategic plan to contain China. You betcha.

the damage trump is doing to our foreign defense allies is almost unimaginable. at this rate, there will be nobody left in the world who will stand next to us when the next real bullet crisis hits-and it will hit. we will continue to cede our influence around the world to china and russia. and regional powers will continue to grow. this will hit much closer to home when venezuela houses advanced weapons from china and russia. my guess is that brazil will also become quite susceptible to russian and chinese influences. trump will lose the western hemisphere before all is said and done.

2slug, now you are attempting to get a job at The Onion.

As an accomplished person in linguistics, you understand the difference between “contain” and “not enable”. A “not enable” strategy may “restrain” an emboldened adversary. “Contain” on the other hand is often associated with “confrontation and conflict”.

I posed the issue about maintain our role of “global policeman” nearly a decade ago. https://hallofrecord.blogspot.com/2010/08/us-military-trends.html

Can there be reasons for large numbers of U.S troops to be present overseas? Yes, but not indefinitely. Did our troops stationed in Germany stop the Russians in Crimea? Not so much. Has more than a decade in Afghanistan eliminated the Taliban? Not so much. After nearly seven decades, is South Korea unable to defend itself? Not so much. Can we have alliances without keeping a large military force inside every ally’s borders? Pretty much. Tanks and troops are pretty much grist for the technology grinder. https://www.stripes.com/news/germany-s-leopard-tanks-prove-vulnerable-in-islamic-state-fight-1.449278

AI, pilotless aircraft, space based weapons, and asymmetrical forces will be the future of warfare. Ground troops will be the clean-up crews, but not the permanent police force. For example, if North Korea was absolutely stupid enough to attempt an attack on South Korea, the North could be reduced to rubble in less than 30 minutes by U.S. air/sea forces. Kim knows that and his only concern is maintaining power within his own borders.

So, whatever the actual costs of keeping huge numbers of U.S. ground troops in Europe, the Middle East, and Asia, it is too much. That doesn’t mean “abandoning” our allies. It means a process of placing more of the allies’ defense onus on our allies. They have enough wealth to do that.

Bruce Hall is South Korea unable to defend itself? Not so much.

The 2nd ID isn’t in South Korea solely to defend against an attack from the North. Get a clue.

Tanks and troops are pretty much grist for the technology grinder.

There are very few tanks in South Korea. Line-of-sight weapon systems play a minimal role. It’s all about indirect fire.

. Did our troops stationed in Germany stop the Russians in Crimea? Not so much.

Is Ukraine part of NATO? Not so much.

if North Korea was absolutely stupid enough to attempt an attack on South Korea, the North could be reduced to rubble in less than 30 minutes by U.S. air/sea forces

Interesting theory. Are you a stable strategic genius too? You might want to share your deep knowledge of military science with these folks:

https://www.caa.army.mil/CoreCompetencies.html

As to those Leopard tanks, did you even read the article? Hint: no reactive armor.

It means a process of placing more of the allies’ defense onus on our allies.

The point of the CNN story was that Trump just made up some number that was unrelated to the costs of our troops being in South Korea. Things go badly when your allies believe you are shaking them down for money. Learn some history. Read what Thucydides said about the Delian League.

https://en.wikipedia.org/wiki/Delian_League

Sounding like the Onion? Wow, 2Slug sure called your number, Hall. You have even made yourself look as stupid as Moses Herzog by using lots of bolded words in your half-baked argument.

So, looks like you are fine with the South Koreans facing an outcome like the Syrian Kurds have, right? Pretty obviously what President Moon needs to do is to declare martial law and himself Dictator For Life, to be followed immediately by him sending many gushing “love letters” to our egregious president.

“Hall. You have even made yourself look as stupid as Moses Herzog by using lots of bolded words in your half-baked argument.”

Bruce Hall’s positions on our foreign policy are even dumber than those of Rand Paul. In fact they are almost as dumb as Trump’s claim that he did the Kurds a favor by letting the Turks invade their territory.

Look, I’m not defending Trump’s statement. He’s a moron. I’m just telling you where the statement came from. Trump is talking about an increase of $10 trillion in the value of the US stock market, which is a verifiable fact. It’s fine to argue that this is an inappropriate and simple-minded measure of “new value to our economy.” But you can’t make a valid counter-argument if you don’t understand what you are arguing against. We are supposed to deal in facts here.

The top 10% of income households own 85% of the stock market. This is Trump’s base. These are the members of the Economic Club of New York where he made this statement. I’m sure they were delighted to be reminded that in the last three years their wealth has increased by trillions of dollars.

how many folks in the trump orbit are currently serving prison time or under indictment? imagine how many more will fall before all is said and done, and the imposter in chief is removed from office. roger stone just sank. i think pence is even in the cross hairs. could we end up with a president pelosi in the process?

it is fascinating how the trump magnate has distorted the moral compass of all who have passed before him. pence. barr. pompeo. graham. the list goes on and on. never seen such a negatively influential person in my life. this will not end well for republicans. you all really should consider listening to george conway more.

Let’s wait for the sentencing on Stone before that is chalked up as a win for justice and law. The punishment has to be severe enough to deter the same behavior in the future. Sammy Gravano is walking free now after murdering how many people?? While blacks sit in jail decades on marijuana charges, Did Michael Milken’s term in a federal penthouse suite stop Steven Cohen from insider trading?? Charges don’t mean $hit without a punishment that discourages the activity from taking place.