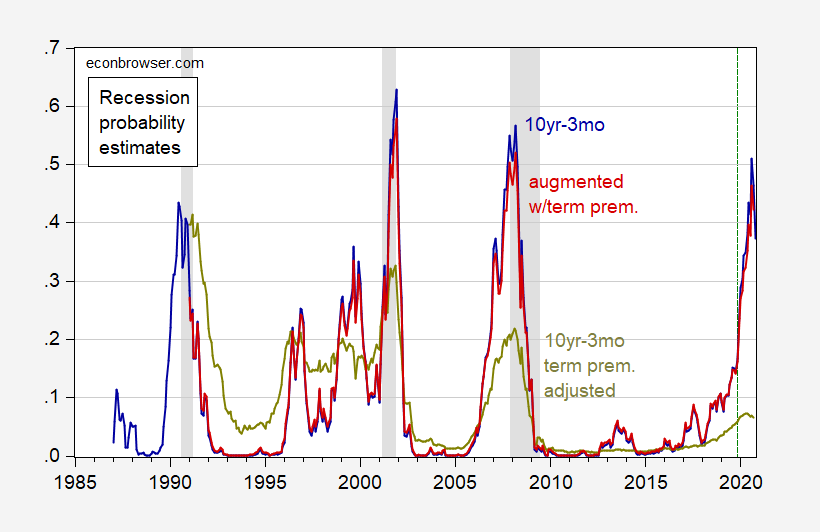

Plain vanilla 10yr-3mo probit yields 37% probability of recession in October next year. Adjusting the spread by the 10 year term premium estimate (Kim-Wright) implies only a 6.5% probability in September (vs. 46.4% plain vanilla). Augmenting the term spread with the 10 year term premium implies a 42.2% probability for September…

Figure 1: 12 month ahead probability from probit regression on 10yr-3mo spread, (blue), 10yr-3mo adjusted by 10 year term premium (chartreuse), and 10yr-3mo specification augmented with 10 yeR term premium (red). Kim-Wright term premium estimates from FRB via FRED. NBER defined recession dates shaded gray. Forecast period shaded light green. Source. NBER and author’s calculations.

A Wald test for whether the coefficient on (the negative of the) estimated term premium and the 10yr-3mo spread are the same is wildly rejected (alternatively, the coefficient of 0.01 on the estimated term premium is not statistically significant and the coefficient of 0.81 on the term spread very statistically significant). Hence, on statistical grounds, adjusting the term spread by the estimated term premium does not make sence. I obtain a similar result using the NY Fed’s ACM estimated term premium.

Bloomberg.com pegs the recession probability at 27% for the next 12 months. Elevated, but not critical.

For whatever it’s worth to anyone, I’m sticking to my prediction that a recession would occur before July 31, 2020. I would say my confidence in the prediction largely hinges on if the December tariff threats are actually enacted. Either way I’m sticking with the prediction, but will feel much better about the prediction itself if the tariffs are enacted. At this point, I put it roughly at 33% the December tariffs will be enacted and enforced.

I think equities play a major part here. If there’s a 10% downturn in stocks, which usually induces follow-up panic, people drastically change their spending habits and the whole ballgame changes. What would be happening if the Fed wasn’t providing funding with the Repos right now?? (And it is a funding issue. “Liquidity” is a camouflage term, in this particular case, to fool morons not paying attention in the Blue Ridge Mountains region). Apparently the Fed bureaucrats are worried enough to extend those Repos, even though they know people paying attention largely view that as BOTH sucking up to TBTF banks/dealers and sucking up to donald trump and feel the bad optics of that sucking up are worth it vs the alternative occurrence without the Repos.

Moses,

Here is a link to a NY Fed Staff Report, “What Predicts US Recessions” published in 2014. https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr691.pdf

The staff report shows a model for the six month forecast horizon which consists of the following elements:

1. The spread in the GS10 – TB3MS

2. The spread(-6)

3.The 12 month percent change in the S&P500.

Using this model (assuming correct interpretation), the six month probability of recession dropped from September to October.

September 6 month probability was about 42%

October 6 month probability is about 24%.

The model may be worth a look by other readers.

@ AS

Curious what was the major factor lowering the probability?? If it’s only the Fed enacted rates drop, for me it’s a hard sell (on the October lowering of probability).

Let me add something else. I’m assuming the better the S&P does the lower the probability to recession is, according to the NYFRB 2014 model. But I disagree with this particular conclusion of the model. Why would I say that?? Because in my personal opinion (I have no empirical data to back this contention) the farther the S&P’s market value separates from the general economy’s productivity (and/or the farther the equities markets are untethered from their intrinsic value [read overvalued here]) the higher the probability you have an equities triggered recession. So in my opinion the higher that separation (between intrinsic value and market value) becomes the higher the chance for a drastic move down in equities

I saw a recent bank produced chart (inside the last month) that showed stock values are priced higher than they have been in a long time (years) in relation to the general economy’s performance. To me this is a big red flag, not something that should lower the chance of a recession. If I can access the chart or at least find the name of the bank that made it I will put it lower down in this thread. I will try to read the staff paper.

Moses,

The October lower probability of recession compared to September seems to be caused mainly by the Y/Y percentage return on the S&P500. The Y/Y percentage return on the S&P capital return for October is about 12% compared to about 2.2% as of September.

Regarding the US market capitalization as a percentage of GDP, it is shown as about 153% for 2017 compared to 141% for 2016. The data is the latest available that I found from the World Bank via FRED,

https://fred.stlouisfed.org/series/DDDM01USA156NWDB

Maybe someone else can find newer data.

Your opinion about the value of the market compared to GDP and the risk of recession may be correct or may be foretelling a market decline without a recession.

Sorry, Brilliant One, but you are seriously off again here. The figure most people look at is the price-earnings ratio. For the S%P 500 it is up slightly over the last two months or so, but at just aboe 20 is only a bit over long tern averages, which going decades back have tended to be in the mid-teens. At the time of the dot.com bubble peok it was over 40 and in 2007 got to be over 50. When it gets to those levels then you are in danger of having a major stock market crash leading to a recession, not when it is barely above 20, which it has been many times with nothing happening.

And again, when you start writing words with bold letters, it is prima facie evidence you are in over yiour head again and not knowing what yiou are talking about, if not outright dead wrong.

@ Barkley Junior

I just hope Uncle Warren is taking notes on PE ratios from the guy who lectures bankers that those evil meanies with Basel III are making them keep the minimum capital requirements “too high”. Was that a super “hard sell” for you, Barkley, in a room full of bankers??—or could even a half-wit mouth-breather like you manage that sales pitch??

https://www.bloomberg.com/opinion/articles/2019-08-26/warren-buffett-s-quiet-but-his-philosophy-still-speaks-volumes

Note that in the discussion of which specific stocks Buffett is buying the discussion turns to price-earnigns ratios, just like I said. note also that Buffett’s recent performance has been sub-par. He is getting a bit old, you know.

There is a very obvious explanation why comparing capitalization/GDP ratios over time can be misleading, Moses. It is that proifts and share of profits in GDP have risen a lot in recent years. So a high cap/GDP ratio doe not indicate as high a price earnings ratio as it used to. Warren may like his cap/GDP ratio, but again, when it gets to looking at individual sectors and stocks he falls back on price-earnings ratios like most observers.

Sorry, this one is not getting you anywhere much.

Speaking of morons, we have someone here who has argued that the problem has not been one of overly high capital requirements for large banks coming from the Basel III Accords but instead overly low ones leading presumably to too many bad loans, which was a problem back in the min-noughties, but not recently. Not too surprising to see same individual getting all hyped up about some unimportant supposed distinction between “funding” (put in bold letters just to really impress everybody with his supposed brilliance) and “liquidity,” somehow deemed to be a “camouflage term,” although indeed propping up the repo market is important, however one insists on labeling what is involved in the outcome of that.

As it is, last Monday I addressed a statewide conference of bankers here in Virginia and emphasized that Fed intervention in the repo market is not only ongoing, but I forecast that it will not stop in January as currently announced, but will simply become part of a new normal.

As for tariffs, Trump is incoherent and continues to brag about how “good” they are, even as the stock market drops every time he raises them and rises every time it looks like he might drop them. But he has on some occasions also backed off when it has come time to raise and enforce them on China. Strikes me as unwise to make any firm forecasts based on what he might or might not do about tariffs in December.

Interesting charts:

https://ycharts.com/indicators/us_m2_money_supply_growth

https://ycharts.com/indicators/us_total_assets_held_by_all_federal_reserve_banks

ilsm,

These charts are interesting why? Nobody has given a phoo about M2 for some time now, and while it is going up at a modestly sharp rate, it is lower than it was some years ago. Of what significance is this?

As for Fed reserves, yes, we know they were gradually drawing them down over the last couple of years as part of their undoing Qquantitave Easing ans trying to get back to an unattainable old “normal,” with this effort coming to an end with the repo tucks in mid-September about which the brilliant Moses Her r has had a lot to say, including even in this this thread. Yes, ilsm, that ruckus caused a reversal of policy, so now their balances are creeping back up again. Quite a few of us, including also me, have commented on this already. Have you been paying any attention here?

I bet old ilsm think the “velocity” of M2 is constant. FRED notes how wrong any such assumption is:

https://fred.stlouisfed.org/series/M2V

JBR,

Something to watch….. I was interested in the effect of intervening on the balance sheet. M2 may be a stat to follow.

That’s already been assumed for WEEKS now that Repos would extend past 2019–and bankers didn’t need an old simpleton to tell them what they already knew. I’d like you to show me anyone not having the family name Rosser that thought the Repos would stop after December, as you can’t find any market participants who hold such a dumb-A$$ belief that it was simply an “end month liquidity problem”, which is how you were portraying it until everyone including the village mutt knew otherwise. I’m sure if you felt that was “enlightening” the bankers got their humor for the day though. Liquidity is something based in the short-term or even immediate term. Funding problems might be something that drags out over MONTHS. Sadly….. you are only just now figuring this out.

BTW, if I was a banker, looking for a schmuck to repeat back to me, and regurgitate back to me my own banker propaganda that the Repos were necessary for “end of month liquidity” and therefore “caused by Basel III bank regulations related to minimum capital requirements”, Barkley Rosser is the very first birdbrain I would phone and send VIP invitation to speak.

Well, they did, Moses, and they sure as heck did not call you. And I did not hear anybody disagreeing with me or coming on with how much this was all just old news to them. After all, have you figured it out yet that the problem is not one of overly low capital requirements for banks? I mean if “funding” is the problem, would overly low capital requirements lead to that problem or exacerbate it if it existed? LOL, Moses, lol.

BTW, if you think that not only bolding letters and then making them not only capitalized but really big will now really impress people with your brilliance, well, more lol, Moses

This may have been the first constructive interaction I’ve ever had with you Barkley Junior. I finally found something you’re talented at: Reading back banker talking points to bankers. Reciting banker propaganda verbatim has to be a challenge for you. I’m glad those bankers give you a strong feeling of self-esteem after having engaged in that. You must feel exactly like Lawrence Kudlow feels whenever donald trump pats him on the back in the Oval Office. Or possibly you feel like Michael Brown did after being praised by “W” Bush??

https://www.youtube.com/watch?v=h9pXS5RgfGg

Do the bankers say “Heckuva job Rossie!!!” with some subtle giggling in the background when you’re finished??

Actually I think it might be instructive to various readers for me to recount in more detail this session as week ago before about 60 bankers from around the Commonwealth of VA, who do not obviously have some unified party line as the overworked imagination of Moses believes.

So it was actually a three person panel. I shall not name the other two panelists given the likelihood Moses might abuse them, but one knew Jim Hamilton well at UVa, a more senior guy who is quite conservative leaning GOP and may even have voted for Trump, but playing a non-partisan above-the-board stance, and then a more junior guy expert on international economics whose political views I do not know, although his talk was obviously somewhat critical of Trump, although nobody ever used his name. Those two went firdt.

Jim’s old friend spent most of his time talking about public perceptions of policy by the Fed and others, with a typical comment being his opening, that presidents get both more credit and more blame for the overall state of the economy than they deserve, a point I agree with and nobody in the audience disagreed with. Most of his remarks remained like that, safe and non-partisan, and fairly obvious.

The international guy noted that recent policies have tended to push the value of the dollar up thus tending to raise trade deficits, a point made by Menzie and others here quite frequently. He then talked about impacts of the new trade policies, posting some charts of exports of certain goods from Virginia, with some of them, such as wine, showing patterns of generally rising in recent years up to the beginning of Trump’s trade wars, since when they at first dropped noticeably and since have continued to generally decline. No comments by anybody on all that.

We were all asked to forecast probability of recession by end of next year. First speaker said 50-50, second said 40%, I quoted latest Econbrowser estimates and mentioned Jim Hamilton by name, which drew forth appropriate remarks from first speaker who has known him.

In my talk I covered three items. First I explaiined the origins and justification for the 2 percent inflation target, emphasizing that it was really a loose target, really standing in for a “low, but positive target,” and then quoted John Williams from Jim Hamilton’s interview with him on the topic: “4 percent is too high, and zero percent is low, so 2 percent is about right.” There was no futther discussion of this point.

My second point was on the repo ruckus, laying out basically things I have said here, the stuff that Moses finds so wrong. I note that when I mentioned that the Basel Accords might have played a role through larger banks, there was no reaction, and when I mentioned that end of quarter financing needs may also have played a role, I actually saw some heads nod. (Sorry, Mose, nobody backing you on your rejection of that one). There were no general questions on this. However, afterwards I spoke with a VP of a bank in Richmond who was a student of mine back in 1979, taking math econ from me. He remarked that he had done repo trading for his bank for awhille and said that “it is a rough market” and that he was glad to get out of it, and that “the Fed needs to make sure it behaves well,” as I had made my forecast that they will probably continue to intervene in it after January (a point Moses apparently agrees with, for whatever that is worth, not much).

My final point was about negative interest rates are spreading around the world, and while they do not seem imminent in the US, they may come at some point. This got the most reaction of anything any of the three of us said by far, with several of them quite upset about it. One guy went on at length about how his deposiors would take out their deposits and put them into cash in their safe deposit boxes. He noted this is techmically illegal (in VA at least, I guess), but that “we do not check on what people put in their safe deposit boxes.” There were other negative comments on this prospect. This was the only time I cam close to dissing on Trump as this got caught up in a discussion of where interest rates are going, and I noted that “the president has been advocating going to a zero percent target Fed funds rate,” without further commentary.

The final question to me came from someone in a hostile tone about debt/GDP ratios and critical cutoffs of those. I answered that there were none and that interest payments/GDP ratios were more important. I noted this ratio was much higher in 1990 than now due to higher interest rates then. I closed by noting that the US paid off its national debt in 1836, which was followed by the Panic of 1837 and a depression, so there is no great virtue in paying off the national debt as so many rant on about (not professional economists thought).

BTW, a bit more from that banker’s conference.

When I was talking about the repo ruckus, I said it seemed to come out of nowhere, a big surprise for people at the Fed and elsewhere, which I found a bit unnerving. I then asked for a show of hands from anybody who saw it coming in the room. Nobody raised theirs, nobody.

Moses,

Why the heavy reliance on equity wealth effects? Is there evidence for that?

@ macroduck

I originally got on the topic because commenter AS was discussing the performance of the S&P 500 in the NYFRB staff report, I suspected (and was apparently right, though I haven’t read the report yet) that the better the S&P 500 performed over the year the NYFRB model lowered the chances of a recession (relative to that particular part of the model). I take issue with this particular part of the model, and I believe a rise in market price of equities when in the context of a highly overvalued/overpriced market would increase chances of a recession, not decrease them.

I think there’s a mixture of reasons, most of them blatantly obvious. But my main train of thought would be with the proliferation of 401k, Roth accounts etc, and that the average working man holds much more in stocks in both his early savings and retirement than say 40 years ago, and that a drop in equity prices can have a very immediate threat on consumer spending. I would argue depending on the context and the individual, literally overnight effecting consumer spending habits.

You might notice many recession models (not just NYFRB’s staff report) include equities performance in their calculation of probability now, and I dare say Menzie would agree with me this is common now in recession models.

Trump lies about the employment report?

https://thehill.com/policy/finance/468491-trump-confuses-with-inflated-october-jobs-claim

‘“Wow, a blowout JOBS number just out, adjusted for revisions and the General Motors strike, 303,000. This is far greater than expectations. USA ROCKS!” Trump tweeted….White House spokesman Judd Deere told The Hill in an email that Trump’s figure also included an additional 18,000 GM workers not reflected in the BLS report, and 20,000 temporary Census workers who completed their work in October.’

Does Judd Deere think 128,000 (payroll survey increase) plus 38,000 = 303,000? I know the Trumpsters are stupid but WOW!

Oh wait – maybe the liar sack of garbage looked up the household survey figure. I did. Only 158,000.

Now leave it to Kudlow to tell Trump he is allowed the add the payroll and household survey figures. And in Larry’s world 128 + 158 = 303! He is THAT STUPID!

Trump: “Wow, a blowout JOBS number just out, adjusted for revisions and the General Motors strike, 303,000.”

The black Sharpie strikes again. As usual, his cult will deny what they can see with their own two eyes and instead take the word of their Dear Leader.

Been reading about predictions and this came to mind:

https://en.wikipedia.org/wiki/Augury

NFP did not discount the striking workers fwiw. It did not compute in birth/death guesses.

Birth/death is for firms entering and exiting, not strikes. Strikes are reported separately, the strike report.

I have a shameful confession to make…… I found this link over on ZeroHedge:

https://www.fb.org/market-intel/farm-bankruptcies-rise-again

This whole MAGA thing seems to be going well for American farmers and they even get a FREE red dunce cap for participating in this sociological project.

I think Minneapolis Fed comes out with some kind of report around the 3rd week of November and they base it largely on bankruptcy court filings, so I assume the story will be quite similar whenever that comes out. I’m assuming there will be some sub-plots in the Midwest region related to flooding on the farms and what % portion of the issues can be connected to flooding, how flood insurance has helped/not helped etc.

https://www.calculatedriskblog.com/2019/11/black-knight-mortgage-monitor-for.html

Sebastian

Dowsing stick gave up looking for water and decided to say recession in mid-2020. It could be wrong, but its confidence remains unshaken.