That’s what reader sammy asserts, trying to support the proposition that Chinese retaliatory tariffs on imports of US soybeans had no impact on US soybean prices.

… chart of soybean prices there are a number of other commodity price charts, such as copper, wheat, coffee etc. They are unaffected by the tariff war yet are remarkably similar to the soybean chart.

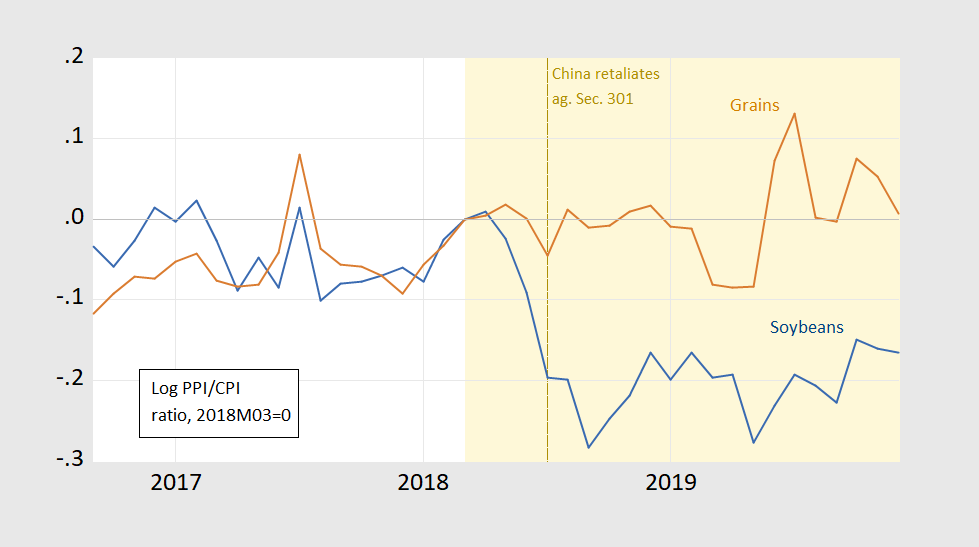

That might be true over the past 45 years (I haven’t checked), but we’re talking about tariffs. Since metals are affected by drastically different factors than grains and oilseeds, I thought it might be useful to see what has happened to the relative prices of two ag commodities — soybeans (blue) and grains (brown) — since the announcement of Section 301 actions and corresponding Chinese tariffs.

Figure 1: CPI deflated PPI for soybeans (blue) and grains (brown), in logs 2018M03=0. Orange shading denotes period during which China Section 301 action is announced/implemented. Brown dashed line is when Chinese tariffs on US soybeans goes into effect. Source: BLS via FRED, author’s calculations.

Interestingly, even though the Chinese imposed tariffs on US wheat, corn and sorghum (so prices of those US ag commodities were likely depressed as well), relative prices as of December were no lower than in March 2018.

Hence, it does appear that soybean prices have behaved in a different fashion than grains that did not have retaliatory tariffs imposed upon them. Soybean prices have declined since the Phase I deal was signed, so a drastic upward movement in January is unlikely.

Thanks for highlighting this with an aggregate for grains, Menzie. In the earlier figures sammy cited the grains ewere separated ad it was a bit hard to see what was going on at the end, although it did not look like it fit sammy’s claims. But this looks pretty clear and decisive.

Corn prices have not declined either even as Sammy tries to spin that they have. And yea – I went off on copper prices which Sammy mentioned which also have not declined. But of course this is quite right:

“Since metals are affected by drastically different factors than grains and oilseeds”.

I hope Sammy gets this but who knows?

Here is the link to pgl’s charts: https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

All the commodity charts shown at the bottom of the link show a sharp peak around 2018, followed by a sharp fall around 2019 (many much steeper than soybeans), followed by a meandering decline. Look at the charts. Could it be that there are other determinant factors besides tariffs?

You have either gone insane and you are another Trumpian liar. Corn prices have not fallen sharply or systematically. Neither have copper prices. And come on – these are not my charts as they are clearly labeled Macrotrends. So I do not get credit for their work. And I am not to blame for your stupidity or dishonesty.

I posted this Macrotrends (not my) chart of corn prices for Sammy under the other thread and noted how they have not followed the plight of soybean prices:

https://www.macrotrends.net/2532/corn-prices-historical-chart-data

Yes these prices rose and then fell. That is called volatility. It is not evidence that soybean prices and corn prices have behaved the same. Now maybe Sammy may think otherwise but that would make him dumber than even CoRev.

I remember when James Kwak mentioned a book review I had done on his first book with Simon Johnson as a blog post. I was flying on Cloud 9 for about a month as I had so much respect and admiration for Mr. Kwak. Of course I did not fool myself my book review was that great, Kwak mentioned my review as a great kindness to me, as he could perceive it would mean a lot to me on a personal level as an incessant commenter on his blog. I had not fooled myself that much, but it still meant a great deal to me and does to this very day. It was incredibly gracious of him. I also at one time thought that it would be “kinda cool” to be mentioned in a Menzie Chinn post. I have since revised my desire to be mentioned in a Menzie Chinn post, based on what it usually implies towards commenters. Not that I haven’t deserved this kind of “mentioning” of a commenter by Menzie. He has been kind enough to spare me this blood-letting.

Now if Sammy actually understood the event study methodology that our host introduced the discussion of tariffs and the effect on soybean futures and if Sammy had an ounce of integrity (yea I get that both assumptions are false but bear with me) then he would check out graphs like these:

https://www.macrotrends.net/futures/corn

Did future prices for corn drop in the same fashion as future prices for soybeans when that tariff war got started? Of course not. But we all eagerly wait the next set of really stupid lies from the Usual Suspects!

pgl,

check out wheat, oats, cotton, and coffee. They are virtually identical to the chart on soybeans. Why? Btw, thanks for your original link, very enlightening.

sammy: See new post for grain aggregate against soybeans…

Sammy disingenuously writes “pgl, check out wheat, oats, cotton, and coffee. They are virtually identical to the chart on soybeans. Why? Btw, thanks for your original link, very enlightening.”

The only thing enlightening here is that your grip on reality appears to have been lost. I know you are most likely just doing it for the “lulz” and to “trigger the libs,” but please, if you really do believe price trends for wheat, oats, cotton, and coffee are virtually identical to the chart on soybeans, seek medical attention.

sammy,

I just looked again at your set of figures, and frankly it looks like for most of the ag commodities they had their big drops a bit earlier, with the exception I think of oats. Sorry, your figured do not show what you claim they do, and you need to address Menzie’s figures, which do the usueful aggregating yours do not.