Back in July 2018, reader CoRev wrote:

…no one has denied the impact of tariffs on FUTURES prices. Those of us arguing against the constant anti-tariff, anti-Trump dialogs have noted this will probably be a price blip lasting until US/Chinese negotiations end. We are on record saying the prices will be back approaching last year’s harvest season prices.

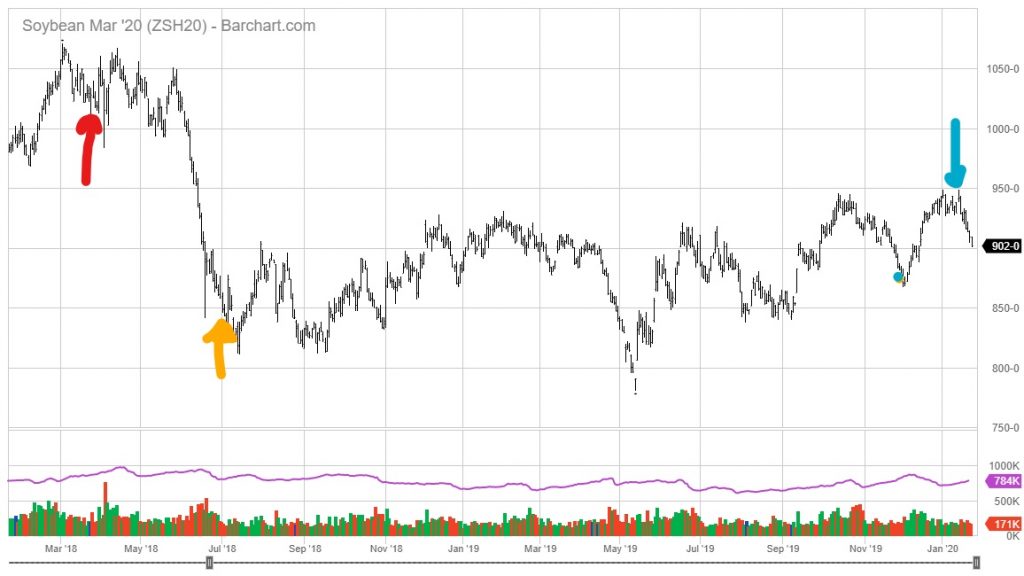

Back on March 23rd, when Mr. Trump announced intent to launch Section 301 actions, nearest month soybean futures closed at 1028. Latest today is 902. Indeed, prices have been falling since Mr. Trump signed the much heralded (by some) Phase 1 deal. This is shown in Figure 1 below.

Figure 1: Front month soybean futures (black). Trump announces intent of Section 301 action against China (red), Section 301 tariffs and Chinese retaliation in effect (orange arrow), and Phase 1 deal signed (blue arrow). Source: barchart.com.

Front month futures prices are now 14% lower now, while the CPI is 2.2% higher (both in log terms). You can do the math. The “blip” is not over.

“no one has denied the impact of tariffs on FUTURES prices.”

I guess CoRev did write that sentence. But wait CoRev did deny the impact of tariffs on future prices. Is CoRev admitting he is “no one” or does he still not understand the difference between spot v. future prices?

“Front month futures prices are now 14% lower now, while the CPI is 2.2% higher (both in log terms). You can do the math.”

Well most of us can do this simple arithmetic but we have seen many times where CoRev does not know how to do so. So I guess we’ll have to help the lad out!

I do not wish to turn blue in the face and faint, so I shall not hold my breath waiting for CoRev to provide a reply to this.

If he does, well, I am sure it will be very amusing, probably driven by some weird theory backed up by some account of his being a farmer himself, blah blah blah.

You left off the standard insults to our host but then Dave took care of that!

I have trained an ML text generator on CoRev’s textual samples. See the following output samples:

– ASF, ASF, ASF!

– Much Wow! Amaze. The answer is simple Menzie. Negotiations have not ended yet.

– My comment was that SPOT prices will be back approaching last year’s harvest season SPOT prices. Yet you continue to quote front month FUTURES prices. You clearly do not understand anything.

On the basis of the above, I have a new hypothesis. CoRev is a machine learning classifier trained by the GRU to pollute rational discourse on the internet with nonsense statements that appear to have some validity to a certain gullible fraction of non-experts in any given field.

Dave: If CoRev is a GRU bot, they need to get better programmers.

Brilliant! If one wants to track the nominal spot price over time, this source provides on a daily basis going back for 45 years:

https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

Now CoRev has lectured us that this chart is his measure for future prices even though the chart is clearly labeled spot prices. But hey the current $9.10 per bushel is not the lowest of all time. Then again this series is not inflation adjusted. I wish I could remember how I found this but there are historical series on inflation adjusted soybean prices. But shhh – don’t tell CoRev. Nominal v. real is beyond his limited abilities!

The projected $1.1 Trillion 2020 deficit is also a blip that will last until the tax cuts pay for themselves. Or until next year’s budget when the deficit will increase and another blip will, uh, blip.

Now, now. We all know how Trump wants to balance the budget. Eliminate all those unimportant Social Security checks and cease those socialistic health care policies. This way a lot of those people who vote against will just die.

there have been several stories in the corporate press that farmers have committed suicide, and filed bankruptcy . Thus, the farmers who bet the farm on Trump…lost.

One of those stories:

https://www.forbes.com/sites/chuckjones/2019/08/30/amid-trump-tariffs-farm-bankruptcies-and-suicides-rise/#1981bb062bc8

Pompeo abuses a woman NPR reporter who dared asked the fatso arrogant lying ba$tard about Ambassador Marie Yovanovitch. Pompeo then suggests she was the one responsible for his own blow up. But this is what is really funny:

https://slate.com/news-and-politics/2020/01/mike-pompeo-tirade-npr-reporter-ukraine-interview.html

“Then, according to Kelly, he asked her if she thought she could locate Ukraine on a map. He had his aides bring him a world map without labels. “I pointed to Ukraine,” she said. “He put the map away.”…. While Pompeo’s statement focused on accusations of ethical violations, he did not deny his tirade. Nor did he deny that he had said Americans do not care about Ukraine. But he did imply that Kelly, who is an experienced reporter on international affairs, had failed the test he’d given her. At the end of his statement, he added: “It is worth noting that Bangladesh is NOT Ukraine.”

No Mikey – she pointed to Ukraine. You failed the test as you thought she pointed to Bangladesh when she pointed to Ukraine. Of course Pompeo works for another idiot named Donald Trump who thinks India does not share a border with China even though it is over 2500 miles long!

I don’t know if you’ve read American Carnage by the Politico reporter Tim Alberta, but he paints a pretty unflattering portrait of Mike Pompeo…and Tim Alberta is no leftie liberal. He’s a moderate Romney style Republican. Pompeo comes across as a man utterly consumed with ambition and an arrogance that only a Tea Party, Bible thumping party hack could love. Few things worse than an amoral moralizing pig.

I have not but should read this book. Here is a review of it:

https://www.theguardian.com/us-news/2019/jul/13/american-carnage-review-tim-alberta-politico-trump-republicans

But there is that wall to be built where Colorado borders Mexico.

Pompeo (first in the 1986 class at West Point/USMA?) is “troubling”, in a different swamp than Ms. Clinton and Kerry…… good thing Trump folded when Iran responded to the US drone murdering Suleimani and al Muhandis.

On Ukraine it “ain’t what Americans care about Ukraine, it’s why Americans should care that just ain’t so”.

Schiff’s “close ally”, sorely needing succor, indeed!

I ask again – how many drugs are you on? This is just more meaningless babbling. Seek professional help.

“I ask again – how many drugs are you on?” Not sufficient to be enthralled by 24 hours of Schiff, Nadler, Lofgren, Jeffries (Brooklyn!)… babble on the level of Fidel Castor’s marathon tirades in Havana.

Schiff might play to Mao’s red guards’…….. or DNC neocons. Facts in dispute, mind reading at the core!

That sly fox Pompeo.He must have known that Kelly’s Harvard and Cambridge educations left her woefully unprepared to find Ukraine on a map.

That, with Russia being the largest country in the world and with Ukraine bordering it, there was no easy way of locating this meaningless place without using her phone.

How, with such a meager education, would she have known any history of the place either? I mean, who remembers the old USSR and its satellites? A West Point grad maybe but an Ivy League elitist? No surprise to anyone if she did confuse it with Bangladesh.

Good catch, ilsm. Keep up the good work.

I wonder if Trump would have passed the “where’s Ukraine on a map test”? Only if he had a hotel in Kiev.

Trump thinks there is no border between India and China. Yes 2520 miles just erased!

pgl,

Below your 45 year chart of soybean prices there are a number of other commodity price charts, such as copper, wheat, coffee etc. They are unaffected by the tariff war yet are remarkably similar to the soybean chart.

They are not similar in the final two years, which is what matters. There is more similarity earlier in the post-2010 period across many of the ag commodities, but soybeans clearly rake a price dive in the latter period none of the others do.

Sorry, sammy, you are lying, although if Chief Justice Roberts were here he would upbraid me for pettifogging.

Precisely right there. But I’m still looking for sammy or CoRev to tell us how the weather affects copper prices.

Copper prices are volatile? Really? Come on Sammy – everyone knows that. Well everyone except Stephen Moore with his commodity price rule for monetary policy. BTW Barkley nailed you. The issue is not whether a price is volatile or not. The issue is the impact of tariffs. Do try to keep up with the conversation.

BTW Sammy, I’ve been asked to write a paper on the transfer pricing for copper in light of some battle between Glencore and the Australian Tax Office regarding the Cobar mines. As I noted your claim that the price of copper has fallen just like the price of soybeans since the Trump tariffs (that is after all the discussion here), I decided to ask Macrotrends if this is true. BTW – this is not my chart as I do not work for Macrotrends. But I do thank you for giving me credit for their work. But let’s see:

https://www.macrotrends.net/1476/copper-prices-historical-chart-data

Just as I thought – copper prices today are certainly higher than they were 4 years ago. But I fail to see how anyone could claim they have been very depressed by the Trump tariff period. But do mansplain your claim for us!

Friends of mine who I greatly admire, hosted Poopeo at their house for a fund raiser. So sad. I spent a week with them watching FUX poison their minds. Lucky the house is big enough I could escape the poison.

Sammy notes China did not impose tariffs on corn but then claims corn prices fell with soybean prices. Of course, corn prices today are the same as they were before the Trump tariff war. But let’s go ahead and check out this story:

https://www.ttnews.com/articles/tariffs-or-no-tariffs-us-corn-may-be-too-expensive-china

“With or without retaliatory tariffs, Chinese companies probably will show little interest in buying U.S. corn because the jump in Chicago benchmark futures since May has wiped out the price advantage over domestic supplies, according to Yigu Info Consulting Ltd. Commercial firms are not expected to sign deals as “they have no profit from importing U.S. corn,” said Feng Lichen, chief analyst at the consulting company. The government also has no interest in buying American corn for stockpiles after an increase in prices caused by heavy rains and flooding that cut U.S. planting to the slowest ever, according to Feng. The United States and China concluded their latest round of trade talks in Shanghai on July 31 after a hiatus of almost three months, with little immediate evidence of progress. China has said it will continue to buy U.S. farm products, including corn, and has waived retaliatory tariffs on some imports, but there are no signs of any significant new purchases.”

The story continues but you get the idea. Corn prices did not as Sammy suggested. Barkley is calling Sammy a liar. But maybe he is just too stupid to check the facts. Who know? But as usual Sammy is wrong!

I am certainly no farmer, so I can not analyze data beyond the above chart, such as cost of seed, fertilizer, and land; but I see in the chart a gradual uptick in price since decision time whether to buy and plant soybeans this year. And since no one particularly wants to work for nothing, I suspect there might be profit in soybeans.

And speaking of off the chart, I see that Menzie continues not to include the much greater and sudden price drop that occurred in 2014. No explanation except maybe it just does not fit the agenda

Ed

Come on Ed. At least CoRev tried to put this irrelevant babble into an Excel spreadsheet.

Or maybe you haven’t paid any attention to the multiple explanations you’ve been provided, and that you’re content to remain happily clueless.

Ed Hanson: I could put in soybean prices to 1947M01 if you’d like.

Here is where I should suggest to Macrotrends that they should update their charts for marketing reasons. The headline says 45 years of data but the data actually starts in 1971. And it is daily data. OK – one could go back over 70 years but only on a monthly basis.

Of course we would need to inflation adjust such long series but alas that would confuse folks like Ed, Sammy, and CoRev!

Menzie

2014 would be just fine.

Ed

Rather fun to see CoRev being wrong about other things instead of just climate change.

I thought CoRev wrote a dissertation on the effect of climate (or was that weather) on soybean prices. Too bad no university entertained it to give him his Ph.D. in ag econ!

Trump does not know Parnas? Of course he does but this is not the real scandal here:

https://apnews.com/b8f3620a62c633658199f1fe85fe4647

WASHINGTON (AP) — President Donald Trump inquired how long Ukraine would be able to resist Russian aggression without U.S. assistance during a 2018 meeting with donors that included the indicted associates of his personal attorney Rudy Giuliani. “How long would they last in a fight with Russia?” Trump is heard asking in the audio portion of a video recording, moments before he calls for the firing of U.S. Ambassador to Ukraine Marie Yovanovitch. She was removed a year later after a campaign to discredit her by Giuliani and others, an action that is part of Democrats’ case arguing for the removal of the president in his Senate impeachment trial.

Why is he asking Parnas this question and not the people in our government that actually supported Ukraine? Oh yea – Parnas was part of team RUDY that conspired to withhold aid from Ukraine in their war with Putin’s Russia. It is like Trump was hoping Putin would beat Ukraine.

pgl,

Why ask Fiona Hill, Amb. Yovanovitch,, Anne Appelbaum, Bill Kristol, Vickie Nuland, Bob Kagan? They are experts accomplished at running back and forth between Foggy Bottom and foreign policy humbug factories supporting the military industry complex’ need for militarized foreign policy.

How come no one (Trump’s side either?) wants to follow the Normandy Format? “Let Europe handle it” is not in the best interests of war profiteering progressives?

Do you think Mr. Vindman is qualified to be minster of defense in Ukraine like Hunter Biden on the board of a Ukraine energy company?

Here is the link to pgl’s (h/t pgl) charts: https://www.macrotrends.net/2531/soybean-prices-historical-chart-data

Most of the commodity charts shown at the bottom of the link show a sharp peak around 2018, followed by a sharp fall around 2019 (many much steeper than soybeans), followed by a meandering decline. Like soybeans. Look at the charts. Could it be that there are other determinant factors besides tariffs?

sammy: Yes, interest rates and value of US dollar are other determinants. See here, here.

You do realize I trust that stock prices are volatile. And one can imagine that stocks prices respond to a variety of factors such as expected future cash flows as well as the cost of capital. Similarly, commodity prices depend on various factors. Now if one saw the price of a pharmaceutical company falling when some drug was not approved by the FDA, only a complete moron would tell us that tariffs on soybeans could not a reason to believe that domestic prices for an exporter to decline.

Let this sink in Sammy as you insistence on writing your usual gibberish proves only one thing – your brain has rotted.

“Could it be that there are other determinant factors besides tariffs?”

just to be clear sammy, you are arguing tariffs are NOT a significant factor in the decline, correct?