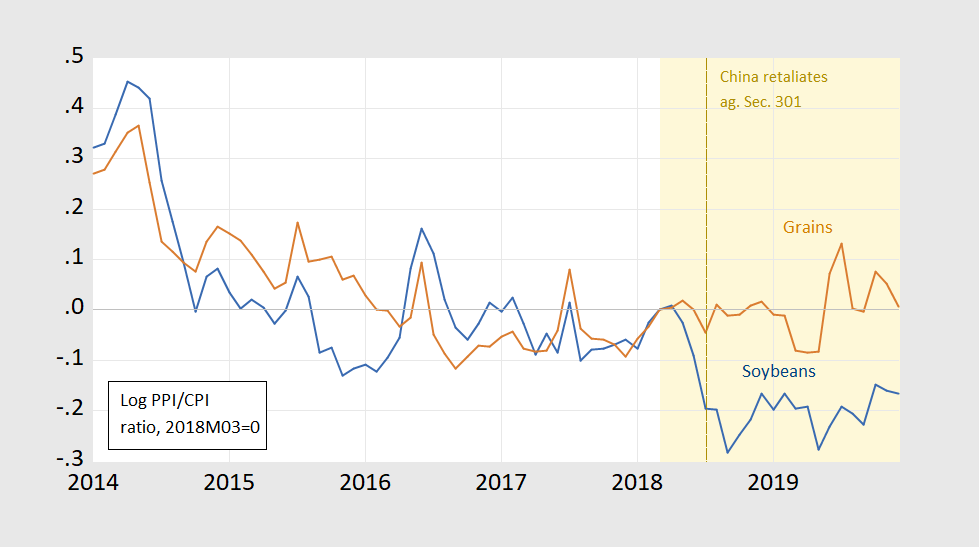

Reader Ed Hanson insists I plot soybean prices from 2014 onward, instead of 2016, to show how factors other than tariffs affect soybean prices. I am happy to accommodate his request. I wonder why soybean prices suddenly deviate from grains overall, starting in March 2018.

Figure 1: CPI deflated PPI for soybeans (blue) and grains (brown), in logs 2018M03=0. Orange shading denotes period during which China Section 301 action is announced/implemented. Brown dashed line is when Chinese tariffs on US soybeans goes into effect. Source: BLS via FRED, author’s calculations.

I am pretty sure I’ve mentioned the dollar as a determinant of US agricultural export prices, years ago. Indeed, see here (nearly two years ago), inter alia.

What is remarkable is how — while showing all this tremendous price variability — the soybean price deviates starting with the announcement of sanctions against, and retaliation by, the Chinese. Now, of course, like the OMB directive to hold aid to Ukraine 90 minutes after Mr. Trump’s asking “a favor” of the President of Ukraine, it’s all (according to some) a coincidence. But I doubt it.

(Ed Hanson: in the future, before asking for crazily irrelevant plots and/or going on a screed about ρ, could you plot the data on FRED yourself?)

One other way to determine the magnitude of the tariffs on soybean prices is to observe what happens when the tariffs are lifted. If the tariffs are a yuge determinant of soybean prices then one would expect a yuge jump in prices when the tariffs are removed, like in the recent China-US trade deal. Did we see a yuge spike? No.

sammy: No tariffs lifted immediately, some were put in abeyance. By the way, tariffs were not removed on soybeans, which seems relavent to your point. Thought that fact might be useful to you.

Someone does not have a clue what Trump’s trade policies have been. Of course if one gets one’s business news from Neil Cavuto and Lou Dobbs, it is no wonder one writes the bat$shit insane nonsense that you love to peddle!

I always enjoy cousin Sammy’s visits to the blog. Reminds me of an old cozy Christmas movie scene:

https://youtu.be/FGtpv_Tpzc0?t=18

“One other way to determine the magnitude of the tariffs on soybean prices is to observe what happens when the tariffs are lifted.”

you make a HUGE assumption with this argument, which is that none of the characters have changed behavior since the tariffs took effect. if china has found alternative sources, and us farmers have moved to more profitable crops, how effective is your measurement sammy? you are assuming a reversible action. it most definitely is NOT a reversible action.

Baffling coherently writes ” how effective is your measurement sammy? you are assuming a reversible action. it most definitely is NOT a reversible action.”

THIS THIS THIS. This is the key point that morons like Sammy and CoRev just can’t seem to grasp. Global market share has been lost. Brazil and Argentina agricultural plantings for export have gone way up. We just handed them free money, and they grabbed it (good for them). In a decade the famous american farmer may yet regain market share, but the damage is real and done. It is not a blip.

Everything I read is saying Brazil is getting more and more efficient at making soybeans and other crops. I’m not even certain we get that back after a decade. More ports, more efficiencies of scale, better ag tech. Some of this is definitely not registering with people. And it’s definitely not registering with the idiots at the rural cafe/diner with their red caps on—-AMAZINGLY, many of them being farmers. The cognitive dissonance is at satirical and surreal levels.

“(Ed Hanson: in the future, before asking for crazily irrelevant plots and/or going on a screed about ρ, could you plot the data on FRED yourself?)”

OK but does Ed get why you did this in inflation adjusted terms? Or more importantly does he even have a clue HOW to calculate relative prices?

The Usual Suspects (Ed, CoRev, Sammy et al.) not only want us to go back to the Obama years but they also want to talk about corn exports to China, which one can find here:

https://www.census.gov/foreign-trade/statistics/product/enduse/exports/c5700.html

Gee we exported $1.34 billion of corn to China in 2012 but less than $60 million in 2018. Sammy is all excited that corn prices are not at record highs but they are still pretty decent. But for some reason Trump has failed U.S. corn farmers in terms of how much they can see to the Chinese.

Of course, this bilateral stuff Trump peddles is total BS. Census also reports that we are still exporting a lot of corn to someone somewhere:

https://www.census.gov/foreign-trade/statistics/product/enduse/exports/c0000.html

Then again corn is not subject to these trade wars so both overall exports and corn prices are doing OK – thankfully. But given how the Usual Suspects cherry pick data and then get all confused, I bet the deep state press can scare the heck of Iowa farmers peddling the BS we get from the Usual Suspects!

“Harvest Public Media” had a short but interesting radio story on the China/US trade deal. I was trying to find the link as I thought even Menzie might take interest. I can’t find the link for the radio audio story, maybe after 3-4 days they will put it up online.

Bowen Chen was name dropped in the story. It looks like he has a terrific blog, though not updated often:

http://bwchen.blogspot.com

Not entirely certain, but I think the article mentioned in the story is this one—this will probably do an automatic download if you click the link, but I am 98% certain the link source is safe:

https://ageconsearch.umn.edu/record/274275/files/Abstracts_18_05_23_15_24_47_79__129_130_52_246_0.pdf

This is off-topic but this is also an interesting article related to USA food safety, which might be a good read for anyone responsible for purchasing food in your family:

https://www.bostonglobe.com/2020/01/23/metro/is-fda-ready-next-e-coli-outbreak/

Kind of interesting he studied in Beijing, now at K-state (or recently finished his post-grad studies/degree). Here is another something that Bowen Chen wrote. Although, similar to above linked paper, it doesn’t directly answer any questions related to the USA domestic grain market. But still makes for interesting reading as far as understanding the matrix of economic interrelationships involved, and if USA decisions related to bilateral trade do in fact “punish” China, or even leave them worse off than the self-inflicted damage the USA does to itself in these moves. I have only read part of the intro, but something tells me this paper is well worth a read to the end (but a huge paper, bordering on book-size) Hey kids, it’s FREE, and probably better than most of the trade related sh– you can get on Amazon, so….. ENJOY!!!!!!

https://krex.k-state.edu/dspace/bitstream/handle/2097/39834/BowenChen2019.pdf?sequence=3

Dear Folks,

This is not to take a position in this fight, which seems to be getting on Menzie’s nerves a bit. But it is to point out that the deviation really begins about 2 weeks before the retaliatory tariffs are formally announced. News reports indicated that the Chinese stated they would impose the retaliatory tariffs. One example is

https://www.npr.org/sections/thetwo-way/2018/04/02/598730606/china-hits-back-on-trade-dispute-slapping-tariffs-on-128-u-s-products

To make a good argument against tariffs being the cause of the deviation, it would be valuable to find other factors (possibly including seasonality, or some sort of reaction by Brazil), that would explain what is going on.

Julian

Julian writes “the deviation really begins about 2 weeks before the retaliatory tariffs are formally announced . . . To make a good argument against tariffs being the cause of the deviation, it would be valuable to find other factors (possibly including seasonality, or some sort of reaction by Brazil), that would explain what is going on.”

I’m not sure I follow. It seems that you are ignoring Trumps action that initiated the retaliation? Also, why are we supposed to believe that neither the Trump administration, nor the Chinese government, did not leak any information?

Any rational expectations model would have the impact begin as soon as the market expected tariffs to be imposed even if the official imposition came later. A lot of times it turns out that government officials keep their intentions closer to the vest so the imposition of some policy act represents the first time market participants could have incorporated such expectations. But in the age of Trump – he tweets on all sorts of stuff all hours in the day. Which of course is your excellent point. I bet some graduate student is working on a thesis of how to revive rational expectations in the age of Trump tweets. Should be an interesting paper!

Julian Silk it would be valuable to find other factors (possibly including seasonality, or some sort of reaction by Brazil), that would explain what is going on.

Sounds reasonable, especially given the fact that the soybean and grains data are not seasonally adjusted and the CPI data is seasonally adjusted. Dividing a non-seasonally adjusted numerator by a seasonally adjusted denominator could cause some problems. But as it turns out, there isn’t a lot of evidence of seasonality in the soybeans data. I ran an X-13 ARIMA-SEATS in the automatic selection mode and it recommended ARIMA (1,1,0) against the Box-Jenkins “Airline” model ARIMA([0,1,1],[0,1,1]). OTOH, the grains data did show some evidence of seasonality, with X-13 ARIMA-SEATS recommending ARIMA ([0,1,0],[1,1,1]). NOTE: The SEATS feature includes the automatic model selection from TRAMO-SEATS. BTW, I used data from Jan 2014 thru Dec 2019.

@2slugbaits

My comp broke down a few weeks ago. Lost some things probably (I have a boot-up disc somewhere I may try to recover at least some of the files that way). The good news is I should be able to download and install many of the “R” packages that weren’t working before because my hardware was too old. I already have “R” and “R studio” DL’ed on the new comp. Going to pick it up again soon, read up on the OLS regressions again. Hopefully towards the end of this year I might be able to crunch some of these numbers Menzie does that I have been wanting to do on my own for awhile now. Going to feel so good when I get that done. I wish I could find that reddit package that was very new—-I put the link up in here once but I have a feeling that one is going to be hard to run back down. Will try in the next 2 weeks or so. Hope Frank in Georgia is still with us here on the blog. And the other dude with the acronym name that was crunching numbers, gone braindead and can’t remember his name. I am going to have a big damned drinky-winky the first time I can get one of Menzie’s semi-hard OLS regressions answers my own damned self. Or what was the other one?? Binary regression?? Started with a B…… anyway…….

Menzie

Thank-you for the chart. It shows that farmers deal with sudden changes in prices from time to time. In fact, they had to deal with a much greater slump in prices in the 2014 fall then they had to deal with the trade war drop. I am impressed with their adaptability.

Since you seem to be accommodating with your post, perhaps you know of some statistics that may give a hint of how they adapt. Do seed prices drop? What about fertilizer and herbicides? I suspect that like all of us when income is reduce, farmers put off investment in capital equipment, unless those prices too, become affordable.

Finally, and I may have missed it in your post, how has the multi-billion dollar aid to soybean farmers affected them? Has it given back a reasonable profit. I know it showed the Chinese that the USA was not going to allow political and economic attacks of sectors without some positive reaction.

Ed

Ed Hanson: There was an Econbrowser post that linked to an extensive EconoFact article two weeks ago. I suggest you consult the footnotes to the EconoFact article.

“Finally, and I may have missed it in your post, how has the multi-billion dollar aid to soybean farmers affected them? Has it given back a reasonable profit. I know it showed the Chinese that the USA was not going to allow political and economic attacks of sectors without some positive reaction.”

I love how all these “freemarket” zealots are always so much in favor of corporate welfare. The cognitive dissonance truly does boggle my mind. I wonder how they even manage to put their pants on.

@ Ed Hanson

This “aid” to farmers, as you call it, is also known as a government subsidy—or what is often called government welfare. YOU, yes you, dumb-A$$ are going to have higher U.S. debt and assumably more taxes to pay because of donald trump’s trade policies. Congratulations. I guess government welfare doesn’t bother Ed Hanson unless it’s going to black people. Ed Hanson thinks government welfare is awesome when it goes to middle aged white men who cannot “pull themselves up by their bootstraps” but instead hold their hands out to donald trump and the Republicans to pay their bills for them. MAGA has now achieved nothing more than putting USA farmers (mostly white men) on the government dole and some other farmers committing suicide because they have no marketable skills to feed their families. Congratulations MAGA!!!! You still can keep your red dunce caps as the sweat and smell on the cap rim makes it undesirable to others, Maybe a dairy farmer or soybean farmer who committed suicide can wear it inside his casket, just to remember all the “good times”.

Moses, my MC (Ca. 1) is a rice grower who’s collected millions in subsidies since the mid 90’s The government also subsidizes his crop insurance. During that period, he’s also collected salaries and generous benefits from the state and feds as an elected legislator. Six figures plus.

However, as a bootstraps Republican, he’s adamantly opposed to SNAP benefits. Subsidies to those who grow the rice is ok. Those who eat it on limited incomes? Not so much.

His campaign slogan: “He’s one of us” . Of course, he is.

Well, you already know what he’d say if you confronted him with that nauseating hypocrisy face-to-face don’t you. He’d use the worn out BS stand-by narrative “But see, I’m a ‘job creator’ “. At which point you’re supposed to start licking his shoes with your tongue, tell him you’re incredibly enthusiastic about joining his Nxivm cult, and then ask which part of your own body he wants you to mutilate to get Private E-1 rank. But they can never explain the next point, which is “If you’re creating a product/service demanded by the private economy, why do you need government subsidies to stay in business??” There’s two possible answers there, either your MC’s business can’t survive without a government hand out, or they can, and your MC doesn’t mind the government and low-middle income families involuntarily increasing his profit margins with government revenue.

There are some U.S. Senators who have been in the news lately that have made millions collecting government subsidies. Much to the robbery and suffering of Indiana residents.

https://www.latimes.com/archives/la-xpm-2012-jan-12-la-na-bain-subsidies-20120113-story.html

No worries though, Barkley Rosser says the kookball Mormon is a hell of a guy. Kookball and Bolton are going golfing next Saturday.

https://www.youtube.com/watch?v=c_6L_zpIZUQ

Menzie

Again thank-you. It is good to see that the USA has reasonable weapons to counter economic, political, and sector attacks by foreign countries. More and more it seems that the that USA is winning the trade war. In exchange for some short term difficulties, the change in long term fairness for the USA is more apparent..

Ed

Ed Hanson: I don’t see how you conclude on the basis of information in this post that the US is winning the trade war as it is being conducted by the Trump team. China has not relaxed tariffs (it provides waivers), there was no progress on subsidies, there was talk about intellectual protection but almost all agree the US side punted, and soybean prices are in real terms 17% below what they were pre-Section 301… So how are we winning, and perhaps we might have made more progress on intellectual property and subsidies if US had stayed in TPP *which had specific chapters on these subjects*.

Menzie

You are selectively blind to what is going on. China never would have entered TPP without using its leverage for changes. The USA does not need another ridiculous bureaucratic multi-nation treaty on trade. It is much better to continue country to country trade agreements.

The USA is the plum for trade by any country. Somehow for decades, the US had forgotten this and continued to allow unfair trade practices against its interests. At least for now, that is not happening. American leadership has remembered that their interest lie first for America and its citizens. Long term expanding world wide trade will result when now that USA has put such emphasis on fair trade practices.

Ed

Ed Hanson: Thank you for explaining the inner workings of Zhongnanhai. I am now incredibly edified, as so much is now illuminated regarding (1) the party-state dynamics, (2) the history of China’s behavior after WTO accession, and (3) the impact of Chinese trade on the US economy, and (4) security implications of China’s industrial espionage and other direct investment activities, including those monitored by CFIUS before and after the reforms. I was lost, and now am found!

Question for you: If Trump is doing such a good job on national security issues as they pertain to China, why did he let ZTE out from under sanctions (of course after Trump Org affiliated hotel project got multi-million dollar loan from Chinese sources…).

The Trans-Pacific Partnership (TPP) involved Agreement Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam but not China. John Whalley and Chungdig Li wrote a nice piece back in 2016 on how China might have responded to the implementation of TPP:

https://www.cigionline.org/publications/china-and-trans-pacific-partnership-agreement

Menzie wrote;

“Question for you: If Trump is doing such a good job on national security issues as they pertain to China, why did he let ZTE out from under sanctions (of course after Trump Org affiliated hotel project got multi-million dollar loan from Chinese sources…).”

Is that all you got? I guess that means even you are running out of dire predictions of the ‘trade war’ now that MCA and the first real trade agreement with China have become realities. The direction of trade negotiations is good. and America is gaining against unfair trade practices.

Ed

Ed Hanson: What successes? Stopping further US-China tariff tit-for-tat temporarily, when tariffs are higher now, with no tangible progress on IP and/or subsidies; USMCA being mostly status quo ante after years of trade uncertainty (actually USMCA is arguably *worse* because of tighter ROO), cascading steel/aluminum tariffs as US downstream steel users cannot compete? And have you not looked at the relative price of soybeans, which was the topic of the post you are commenting on; refer to the EconoFact article on the current state of the ag sector.

Stop…drinking…the…kool…aid.

“It is much better to continue country to country trade agreements.”

ed, your evidence for this approach is what???? that is a pretty strong statement of policy. i assume you have some rationale for this, rather than gut feeling?

Ed Hanson China never would have entered TPP without using its leverage for changes.

Huh??? WTF are you talking about? China entering TPP??? Really? Do you have any idea what TPP was and who was going to be included? Any idea at all? These are the countries that would have been part of TPP: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam, and the United States. Did you see China in anywhere? One of the objectives of TPP was to present a united front against China and use that united front as leverage. As a closet fascist (alluding to the old Roman “fasces” or bundle of sticks), you should know that there is strength in numbers.

Slug

Look above, it is Menzie that linked China and TPP in terms of protection of IP. I found it strange. Your beef is with him.

Ed

Ed Hanson: No, his beef is with your argument that TPP was going to be diluted by China wanting “in” into TPP. The idea of TPP was to provide a united negotiating front — instead of fragmented uncoordinated response — to the Chinese. Why do you persist in commenting on things you obviously have no understanding of, ranging from statistics to trade policy?

this is what happens when the ignorant are educated by the faux news echo chamber. facts no longer mean what you think they mean. and after this conversation ends, ed will still believe he is knowledgable about the tpp.

Menzie

A.) “your argument that TPP was going to be diluted by China wanting “in” into TPP. ”

I never said nor implied anything of the sort. Only you linked China and the TPP with some absurd notion that it would pressure China on IP.

B.)The idea of TPP was to provide a united negotiating front — instead of fragmented uncoordinated response — to the Chinese.

Speaking of Kool-aid, what a bunch of crock. A horrible trade agreement with all its bureaucratic crap would never do any such thing. That statement approaches “you will be able to keep your Doctor.”

C.)”Why do you persist in commenting on things you obviously have no understanding of, ranging from statistics to trade policy?”

Answer a question with a question. So here’s mine. Why do you continue to slant your statistics and information on trade policy, rather than give full information?

Ed

Ed Hanson: A) If China didn’t want into TPP, how was it going to “dilute” it? Inquiring minds want to know….

B) United front? There was a whole literature on how Nafta spurred all sorts of other PTAs. You are apparently woefully ignorant of this (academic and policy) literature. C) I do give full information. That’s why I’m able to publish in nonpartisan academic journals.

On the other hand, you still haven’t provided a plausible explanation for hating on rho…

ed, still curious what evidence you have for the statement

“It is much better to continue country to country trade agreements.”

its a pretty bold statement to make without having strong evidence in support. as a monday morning economist, do you know something the professionals have overlooked?

“China never would have entered TPP without using its leverage for changes.”

Uh Ed – I trust you get that China was not part of TPP by our own design. TPP was a trade pact with the other Asian economic powers to counter the growing economic role of China. Which basically means your latest comment was dumb – even for you!

Ed,

China was not invited to be part of the TPP. It was partly a combination put together to stand up to China, in case you did not know that, which it appears you do not.

Ed,

Your writings are incoherent gibberish. “More and more it seems that the that USA is winning the trade war. In exchange for some short term difficulties, the change in long term fairness for the USA is more apparent..” More and more it is apparent that you have nothing to back this up. Define “winning.” Show me some data that supports this. Define “long term fairness” and show me where it is made “more apparent.” You can’t, because it does not exist.

-Dave

Dave

I do not have to define “winning,” it is Menzie’s expression. He uses it l0oosely so I feel it is proper to use it loosely.

One example, with hope that it might inspire you do go outside the propaganda mills. In the recent first agreement with China, the clause for resolution of intellectual property problems is 90 days. Not the years it takes within the WTO. More apparent.

Long term fairness is equal treatment of trade between countries, especially developed countries. One example would be unequal tariffs, such as the EU customs union placing higher tariffs on US goods than the US placed on EU goods. Short term pain is the imposition of high tariffs in order to produce action by the EU. Long term fairness is equal and low tariffs.

Really, not a difficult concept, but not a simple thing to achieve. If you are a free trader, than you should be on board with P)resident Trump’s actions. Its goals are fair and increased trade.

Ed

Couple uh gems from our good man Mr Setser:

“And soybeans were an obvious big target. I was surprised by the size of China’s impact on the market—I thought U.S. soy would prove to be more of a commodity, and the global market would adjust. But China is such a big share of the global market (two-thirds of global imports) and China was sufficiently ruthless in its absolute refusal to import from the United States in the fall of 2018 that the global market couldn’t adapt. U.S. beans traded at a discount to Brazil, (unambiguous evidence of an impact). Some of that was being arbitraged away over the course of 2019—when the United States is exporting beans to Argentina so Argentine beans can go to China uncrushed while Argentina crushers crush U.S. beans, you know something a bit unusual is happening (the ultimate arbitrage is U.S. beans feed Brazilian pigs and chicken, freeing up all of Brazil’s harvest for China).”

Setser later adds as a small addendum:

” I am not sure the considerable effort that the Obama Administration put into changing China’s legal rules on indigenous innovation procurement back in 2010 and 2011 yielded much in the end; they certainly didn’t change China’s basic policy approach. ”

I am a bigger fan of Obama than many on this blog—I have to admit that last sentence gave me a good chuckle. It does spell a certain amount of naivety from President Obama, does it not?? Was he really that dumb on that particular issue that he thought a rulebook would mean jacksh*t to Chinese bureaucrats??