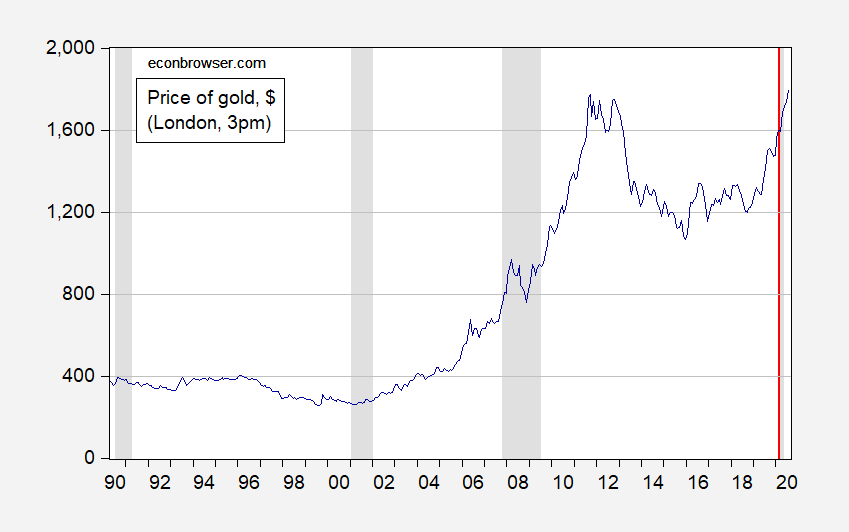

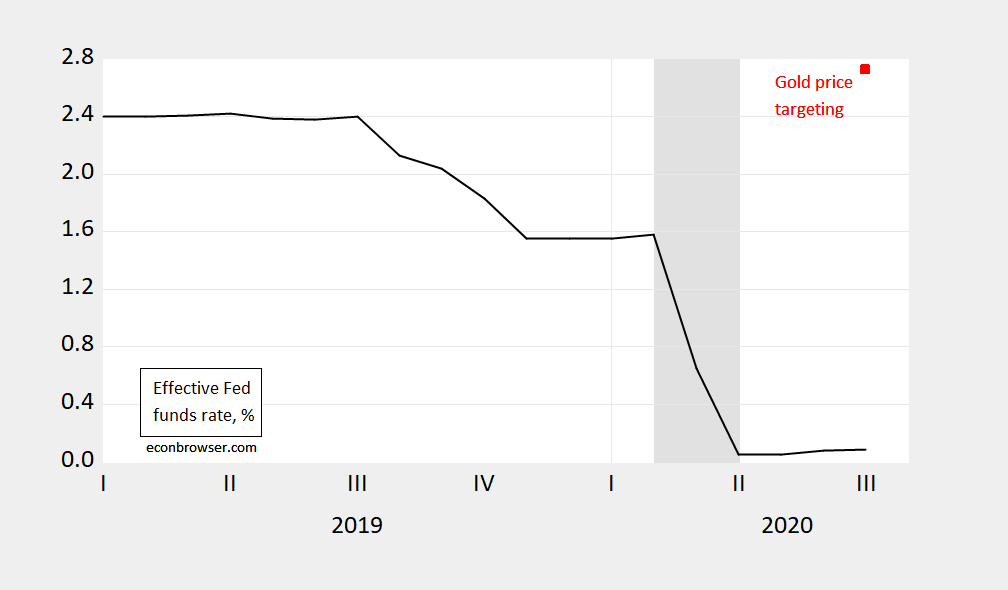

Given the Senate Banking Committee’s approval of Judy Shelton’s nomination to the Board of Governors of the Federal Reserve, it seems like a good time to see what stabilizing the price of gold in US dollars would’ve required in terms of the policy rate (akin to how the exchange rate is managed). Using the policy rate to stabilize the dollar price of gold at February 2020 levels would required the increase of the Fed funds rate by 1.15 percentage points higher than it was at that time. The Fed actually decreased the Fed funds rate by 1.5 percentage percentage points by June 2020.

Figure 1: Price of gold (blue). Red line at NBER defined peak. Source: London bullion market 3pm via FRED.

To obtain this estimate this out, consider the relationship between the log price of gold and the nominal Fed funds rate, estimated over the 1968M03-2019M02 period.

pgold = 6.423 – 10.210 fedfunds

Adj-R2 = 0.17, DW = 0.007 n = 612. Bold figures denote significance at the 1% msl, using HAC robust standard errors. fedfunds expressed in decimal form, i.e., 5% = 0.05.

In log terms, the price of gold is 11.8% higher in July (throught 20th) than in February 2020. This implies that the Fed funds rate would have to be 0.118/10.210 = 0.0115, i.e., 1.15 percentage points higher than in February 2020. That would mean the Fed under this targeting should have raised — not lowered — the Fed funds rate, as shown below.

Figure 2: Effective Fed funds rate, % (black), and implied gold price target at 2020M02 levels (red square). Source: Federal Reserve Board and author’s calculations.

More on the gold standard, here.

It’s pretty clear what is going on. Months earlier Republicans were expressing reservations about confirming this total nutbar to the Fed board, knowing that she would hurt the Trump economy.

But that has all changed as they realize that Trump is going to lose the election. In that case they definitely want a nutbar on the Fed board in order to sabotage any economic recovery under the Biden administration. It’s 2008 all over again.

It’s very cynical.

Merkel is doing some good things right now in the EU, so there are some positive players out there, even if seemingly none of them exist in the USA.

In other news, donald trump is sending more Nazi brown shirts into Chicago after using them in DC and in Portland, and is threatening to send more Nazi brown shirts into other cities. So I guess the ICE brown shirts have to “protect” even northern cities. I’m sure the mayors of those cities can’t wait for their citizens to have the crap beat out of them for no reason. Good times……

I don’t know why mayors and governors don’t just arrest those supposed federal agents. They don’t identify themselves, so why should mayors and governors naively assume they are acting IAW federal laws. Mayors and governors can always claim that they have no way of knowing who is hiding behind that camo and helmets. Arrest them, take them downtown and book ’em Danno. They can identify themselves downtown. Of course, once arrested their names will become a matter of public record. Local and state police should arrest any of these rent-a-cops if they step off federal property and make a move against protesters.

i had the same feeling. i am sure the local police unions are not happy about somebody coming in and taking their place, anyways. these stories sound more like what we saw in egypt during their demonstrations, than the good old usa. i am amazed how supportive many republicans have been for the trump forces invading america. the administration is more worried about protecting confederate statues than protecting citizens against the trump virus.

Lol, Nazi Brown shirts??? More like red shirts…….these agents ain’t american.

CDC on undercounting of COVID-19 cases:

https://www.cdc.gov/coronavirus/2019-ncov/cases-updates/commercial-lab-surveys.html

I was so hoping you would comment on Shelton getting to the Senate floor for a vote on her possibly getting on the FED. And to note what her idiocy would mean in terms of monetary policy now. Chairman Powell is doing the right thing. Don’t bother the man with a goofball like Shelton.

pgl: On odds her getting through, who knows? I’ll wait on the betting markets.

Mitt Romney has expressed doubts about Shelton. So far, he is the only Republican Senator to do so. Four Republican defections are needed to block Shelton (you knew that). In the committee vote, no Democrat voted for Shelton and Ranking Member Brown was quite dismissive of Shelton, so the odds of a Democrat voting for her are not great. McConnell will schedule a vote if the head count looks good for Shelton, in order to manufacture a win for Trump.

In monetary policy discussions, Shelton will probably be neutralized if she fails to fit in. Decisions are made by something like consensus. Only if other voting members side with Shelton will her position matter directly. Effectively, that means she can politicize monetary policy just a bit, by swinging close votes in favor of higher interest rates if Biden becomes president. Everybody else would know what she’s doing, and some fence-sitters might oppose her out of sheer indignation. Since Bernanke, the Chair has avoided Greenspan-like manipulation of policy, and Powell might feel obliged to set policy according to committee vote, even if he knows Shelton’s vote is aimed at doing harm.

Governors are relied on for their judgement and Shelton represents a sort of hollowing out of the Board – one less person whose judgement is helpful in thinking about policy. Luckily, senior staff are also relied upon for judgement, so the loss of one mind is not the end of the world.

Fed governors have responsibilities other than making monetary policy, and Shelton’s quackery could cause problems there. I don’t know which role she would fill as governor. Banking oversight, financial regulation, international coordination, small business – she’d make a mess in any of those.

its a step towards delegitimizing and politicizing the federal reserve. this is out of the bannon playbook which tries to damage the integrity of the government. and i agree with joseph, this is a spite move to weaken the fed when biden is in office. expect scorched earth action as trump is pushed out of office.

Shelton becoming a governor is as absurd as Trump being President.

what a bunch of fruit loops you have

Damnded Durnded furners and their truth telling. I tell you, it makes me wanna have 3-4 pints of grog with a platter of barbecued kangaroo ear.

Honestly, I still cannot wrap my head around Shelton being both a goldbug and a proponent of “MMT” (yes, I did it, I used scare quotes around “MMT”).

As for her prospects in the full Senate, I know that the Republican Party is home to more than it’s share of goldbugs. After all, we were on the gold standard during the decade they rhapsodize over, the 1950s, and wingnut TV and radio are rife with ads for gold

scamsinvestment opportunities.On the other hand (this is an econ blog, right? It’s OK to use this phrase? I always did with my classes, after relating the story about Truman), all but the most delusional and rabid right-wingers recognize that the odds of a Biden presidency starting in January are quite high right now, so I very much doubt that they would want an MMTer pooh-poohing deficit spending with a Democrat in the White House.

As with everything else since 1/20/2017, it feels like we’ve gone through the looking glass.

Meh, the 1950’s moral degeneration of the bourgeois was well underway. The gold standard ended in 1933. BW was only a partial. Get rid of national banking, usury and gold would just be a lump of rock. Capitalism never worked outside a small window when the industrial revolution crested new products so fast malnutrition and famine were kept down. By 1925 the process was over. 1929 was its end game. Then the bailout era started.

Where did you read she was an advocate of MMT?? We’re gonna have to change your moniker to Dr. Delirious. Either that or make you a research assistant to Barkley Junior. You’ll never look at leather pants the same way again.

No, Moses, you’re right, I am wrong about that. That’s what I get for commenting after working 8 out of the last 9 days. I should have waited until after I’d slept last night.

BTW, I agree with dilbert dogbert (I think that’s who it was). I wish you’d put a sock in the near-constant potshots at Barkley Rosser. This is an econ blog, and he’s an accomplished economist. And from what I’ve seen over the years, he’s not a crank, nor is he given to beating the same theoretical dead horse for decades like some on the right. He doesn’t comment in bad faith.

Every economist who’s trying to do something positive makes mistakes, and learns from them. But your obsession with this, and him, long ago became just as childish as Trump is. You have a lot to offer as a commenter, especially as a Westerner who spent serious time in China and is willing to discuss both positive and negative experiences equally. Your persistence in your misguided crusade seriously degrades your credibility. Just learn some econ. Don’t create imaginary enemies. After all, there are already enough readers who actually do comment in bad faith to give you a target-rich environment.

@ Dr. Delirious

You mean you’re butt-hurt because I called you out on an asinine comment?? Yeah, you should get some medication for your sore there, because if you’re credentialed as an econoomist (as your ID name implies), just like Barkley Junior, you should walk around butt-hurt, because if you are credentialed and telling lies or false information, it badly represents your profession.

I would guess that annoys your professional colleagues more than it does me, but I don’t know, maybe Menzie gets a warm fuzzy in his heart when he sees you think Shelton is MMT. I don’t know.

Moses:

I was wrong. I admitted I made a mistake. In my fatigue, I confused myself based on Shelton’s history of intellectual fluidity in service to political constancy. I did not, do not, and will not complain about being called out when I’m wrong. As I stated, that’s how we learn things.

As for your use of the word “asinine,” if you had more experience in academic discussions, you would know that honest mistakes made in good faith are by definition not “asinine.” Even ill-informed mistakes are not necessarily “asinine” unless the possession of poor information is intentional, as is the case with several longtime commenters here and one newcomer who agrees with them.

What I complained about was your attacks on and childish name-calling of anyone who (a) points out one of your many errors, or (b) points out that you engage in ad hominem attacks and name-calling.

And in response, you did more of the same. That is what’s asinine.

I’m done with this topic, so go ahead and get in another Trumpish cheap shot, since that is obviously your nature.

Shelton may not be an MMT advocate (essentially, a Keynesian with sugary sprinkles), but she is highly flexible in her views on appropriate interest rate policy. As a gold bug, she wanted higher interest rates. As a Trump advisor, she did an about-face and cheered for lower interest rates. She also favors free trade except when Trump says otherwise. She is skeptical of Fed independence except during her confirmation hearing, when she spoke about the importance of Fed independence. She has worked on three Republican presidential campaigns – Dole, Carson and Trump. The Dole-to-Trump leap clearly demonstrates her commitment to principle.

Republicans don’t have to worry about Shelton’s policy views. She will back whatever Republican leaders tell her to back, as she has done her entire career.

By the way, has anybody been to her plantation home? It’s lovely: https://en.wikipedia.org/wiki/Moss_Neck_Manor

Macroduck,

I agree. To the best of my knowledge, Shelton has never explicitly endorsed MMT and I doubt she would. But indeed her advocacy of the most expansionary possible monetary policy (and not a whisper about restraining any expansionary fiscal policy) all of this prior to this pandemic period when clearly we need both expansionary monetary and fiscal policy has been consistent with the public positions of MMT advocates such as Stephanic Kelton. Even if not full-on MMT advocacy, Dr. Dysmalist was certainly correct in noting that Shelton has taken clearly contradictory positions between her hawkish goldbuggery when Obama was in and her more recent “let her rip” approach to policy, with all of this obviously done for political purposes, and I have no doubt that if Biden gets in, she will suddenly become the biggest advocate of Fed independence around, which will coincide with her switching back to pushing hawkish gold bug policies.

For the record to whomever, I am trying to stick to my promise to avoid replying to specific personal jibes coming from Moses, which just led to silly rounds of us going back and forth. However, this does not seem to be slowing him down from issuing them, obviously. I shall continue to comment on clearly factual matters not related to him or me personally, and I recognize that he accepted that he had been mistaken about the church across from the White House being Catholic, even thought it was I who pointed it out.

Just to deepen the nightmare, any idea whether Shelton is up for a full term or a partial one? Fourteen years is a long time.

“Shelton has taken clearly contradictory positions between her hawkish goldbuggery when Obama was in and her more recent “let her rip” approach to policy”

So has Kudlow as well as Stephen Moore. None of these clowns have an ounce of integrity on anything. Which is why Trump loves them.

following macroducks question on the term of shelton, what options, if any, exist in removing a fed governor?

After many of my comments have indeed been off thread topic, I suppose it’s moot for me to claim I am sensitive to that—I AM sensitive to that. But anywayz, the Shelton thing seems to be a bit of the circus freak show, so I’m hoping for Menzie’s usual tolerance here. And also I believe it’s important in any thread to keep on hitting on how donald trump keeps on shoving the line on not just “normal” but the line of a general morality the nation should have.

Here we have a sitting U.S. “president” in essence, wishing Godspeed to a woman who deals and trades in the rape of children:

https://www.youtube.com/watch?v=tAIO93Zcid8

Does anyone else see this as one of the most socially demented public scenes they have EVER seen in their lives?? Because I have to say I’m stumped to find one that matches this, other than maybe donald trump’s photo with known pedophile George Nader.

https://www.rollingstone.com/politics/politics-news/george-nader-trump-associate-mueller-witness-russian-probe-pleads-guilty-child-sex-crimes-937150/

https://images.app.goo.gl/kqxa8fszB9G855cUA

Here’s another one from the donald trump “Best of” collection:

https://www.youtube.com/watch?v=KLcfpU2cubo

From Rachel Siegel at Washington Post:

Claudia Sahm, a former Fed economist, acknowledged that Shelton’s views on the gold standard, for example, are on the fringe. Sahm said she was more alarmed by Shelton’s views on the Fed’s independence.

Sahm said that as a Fed governor, Shelton alone would not have the power to sway her fellow policymakers. But during an economic crisis, when so much depends on the central bank, Sahm said she wished Shelton was seen less as an outlier and instead as more of “a contributor to the work the board has to get done.”

“If she goes off in a really different direction as a governor, she will not be able to do damage,” Sahm said. “And yet, she’s not going to add value. And we need value.”

Back in February, after a confirmation hearing, several Republicans on the Banking Committee expressed concerns about Shelton’s economic policy views. Opposition from only one Republican on the panel could have thwarted Shelton’s chances of advancing.

Please, bring back the good standard. We can destroy capitalism once and for all.

It would destroy more than capitalism. Then what would we have? Feudalism? Some kind of despot driven political economy? Capitalism needs repair and pruning now. Not destruction.

White rejection of capitalism and the rerise of social nationalism. Destroying the last 2000 years of history.

It is unfortunate that both Shelby and Toomey seem to have shifted from raising reasonable doubts about Shelton to declaring they will vote for Shelton, which will send her nomination to the Senate floor. Maybe there will still be some GOPs on the floor who will stand up and say no, Romney maybe?, but clearly several are needed.

In terms of Fed independence the real fear has to do with what happens if Trump gets reelected. Shelton on the Fed board will be bad news, but if Biden wins, Shelton will not have much power or influence and will probably end up as a largely ignored nothing. But if Trump is reelected rumor has it she will be appointed to replace Powell as Chair. That would be a much more serious matter, especially as Trump would fill the board with more Sheltons.

Something I have just seen on the internet that apparently there is some sort of plan being hatched at the European Central Bank to move toward a gold standard. Supposedly this has been floating around the EC for a long time, but the claim is that the new push there is tied to a plan to get the world off the US dollar. I do not know how credible this report is, but this is certainly a curious rumor, especially given how Shelton’s nomination seems to be moving forward.

Common sense alone should tell you there’s no way the gold standard gets implemented. It’s similar to the “herd immunity” conversation on COVID-19. Maybe fun BS convo by the water cooler or at Starbucks, but you have to be an absolute moron to believe it ever gets implemented. The biggest potential competitor to the US dollar thus far has been the IMF’s SDRs. Nothing else has come close. It’s conceivable SDRs could, only America has enough power, they’re not going to let it happen for the foreseeable future, and no other country has the volume or the trust. You need BOTH volume of currency used in international trade and trust as a savings deposit. China could (conceivably) have the volume, but nobody trusts the Chinese government with their savings, not even Chinese citizens, which is why you see them use Bitcoin to transfer some of their savings overseas, and Bitcoin/cryptocurrency value is so closely tied to the Chinese markets.

Not going to happen—and not credible.

Moses,

Sorry, but no way SDRs are an alternative to the US dollar as a world reserve currency. There is a very simple reason for this: there are no SDRs. They do not exist. When you look at the reserves of central banks one will find US dollars, gold, euros, maybe some UK pounds and Japanese yen and even the occasional Chinese rmb, although both of the latter two are scarce because the home nations consistently run current account surpluses, which means few of them get out to go sit in central banks as reserves, much less to be used in international trade or investment transactions, although I gather the Chinese are now insisting on many transactions they are involved with being denominated in yuan/rmb.

The SDR is an intetnational unit of account, and its overwhelming use has been for denominating and valuing loans made by the IMF. There have been nations, never very many, that peg their currencies to the SDR, but that is about it. I would supposed that if we were to return to a fixed exchange rate system, which I think is not at all on anybody’s agenda plate seriously at the moment, I would agree that the SDR would be the obvious international peg, although if you really had a fixed forex system, it would not matter which currency was the peg.

Frankly, in terms of trade, investment contracts, and reserves in central banks, as well as fluidity in sue in capital markets, the only serious alternative to the US dollar is the euro, not gold, not SDRs, and not the yen or yuan/rmb, although the PRC might have fantasies about the latter.

@ Barkley Junior

And just about how many physical shipments of paper currency did you imagine were shipped back and forth in international trade?? Or do you think it was done by accounts?? Don’t think too long there boy wonder. Why do you think something is labeled “reserve” currency??

4th question for you Junior, this one isn’t rhetorical, so take a few seconds to rest on the porch with Joe Biden if you need it. Who (which country) do you think holds veto power over the issuance of SDRs?? HINT: NOT China.

Moses,

Are you aware of the fact that cash is a very small percentage of any nation’s money supply, about 10 percent for the US right now? They are all overwhelmingly accounts of one form or another whose physical existence amounts to magnetic wiggles in some computers. Shipping paper money around or even having it in banks has nothing to do with any of this and is not involved in international trade, aside from illegal and black market transactions, although I gather these days bitcoin and its relatives has largely replaced paper money for those that involve any serious amounts of money.

So, the vast majority of international trade and investment is done using accounts, not moving physical monies around in any form. Thus, the vast majority of the form of those US dollars, euros, UK pounds, Japanese yen, and Chinese rmbs that sit in central banks as reserves are indeed in the form of accounts, not paper money or anything else, although those that have some gold in their reserves, that is in physical form somewhere.

No bank anywhere in the world, aside arguably from the IMF itself, holds any accounts in the form of SDRs, and there are definitely no SDRs in the form of paper money or any other physical form, even at the IMF. You may not be aware of it, Moses, but when the IMF loans a nation money, it does not give that nation SDRs. It gives that nation some combination of national monies like dollars and euros that adds up to the notional amount of SDRs. The nation receives no SDRs, again, because they do not exist in any form. And when the nation repays its loan it does so in the form of whatever national currencies the IMF is willing to accept, as long as the amount of that combination of currencies adds up to the notional value of the loan in SDRs based on the exchange rates of those national currencies with the purely abstract SDR unit of account.

Got it?

2slugbaits: “I don’t know why mayors and governors don’t just arrest those supposed federal agents.”

Who is going to arrest them? The police are working in collusion with the feds. Police union reps are meeting with the Department of Homeland Security to invite the feds in.

“Although Portland leadership roundly decried the federal presence, the president of Portland’s police union met with the head of the Department of Homeland Security last week to discuss the agents, apparently without the knowledge of the city’s police chief. The president of Chicago’s police union made his own envoys, asking Trump for federal intervention.”

https://www.thedailybeast.com/police-unions-tell-trump-to-send-in-the-feds-to-cities-like-portland-and-chicago

There is no longer civilian control over police. They operate as rogue agencies on their own agenda. They are the guys with guns and armored vehicles. What are you going to do?

The orange creature is “testing the waters” on what he can get away with. That’s the WHOLE AND ENTIRE POINT of moving federal agents into large cities for ZERO reason. He wants to know what he can get away with in Mid-November if he challenges democratically held elections. The orange creature is like a child taking Dad’s car out for a spin to see if Dad notices the mileage gauge has changed. If people don’t realize that they are being naive. Even people on the left have a line. Poke the sleeping bear enough and watch what happens.

Yes. That’s probably true.

Trump has also turned up his appeals to the worst elements on the right and the fearful, and I suspect that is to raise concern among elites about political unrest should Trump lose (or be incarcerated). He’s diverting campaign funds to his businesses, too. Taken together, these efforts can be read as Trump preparing for various post-election futures.

There is still time for President Pence to pardon Trump for his federal crimes. State crimes are another matter, and Trump has committed a lot of them. That makes a federal pardon problematic. A pardon implies an admission of guilt. An admission of guilt to a federal tax law violation, for instance, implies an admission of guilt to a state tax law violation. This is a very different set of circumstances than when Ford pardoned Nixon.

https://www.mercurynews.com/2020/07/22/friedman-trumps-wag-the-dog-war/?fbclid=IwAR17puoPnmvZF24dXTXgjeIW5qkKSvPSXJzlT9xmQ8UxCOMwMqdtI7lWRV0

Thomas Friedman pens a decent oped for a change:

Trump is starting a wag-the-dog war at home

President is adopting the same broad approach that Bashar Assad did back in 2011 to retain power in Syria

I won’t leave the link, I’ll just say Susan Rice was on the Trevor Noah show tonight on Youtube. She was impressive, as she always is. No one can tell me this woman isn’t the best choice for VP or Secretary of State. If I was Biden I would ask her in a private phone call which job she wanted. But being that Biden is at the age he is, I think her best spot for this nation is VP. If Biden was a younger man then Secretary of State would be better because she can use her versatile skills more in the Secretary of State job. But I think here she has to self-sacrifice because of Biden’s age. Most people in public service would kill for either job, and she could still have strong influence on policy as the VP.

Gold prices have risen a lot this year but check out the surge in silver prices since mid-March:

https://fred.stlouisfed.org/series/SLVPRUSD/

Stephen Moore thinks his commodity price rule would be better than Shelton’s focus on gold prices but I have my doubts.

Leave it to KITCO news to invite some gold bug like Todd ‘Bubba’ Horwitz Chief Market Strategist, BubbaTrading.com to discuss gold and silver prices. Old Bubba actually said the Central Banks of the world are engaged in “currency manipulation”

https://www.kitco.com/news/video/show/Kitco-NEWS/2892/2020-07-14/Silver-prices-to-climb-another-30-if-currency-manipulation-continues#_48_INSTANCE_puYLh9Vd66QY_=https%3A%2F%2Fwww.kitco.com%2Fnews%2Fvideo%2Flatest%3Fshow%3DKitco-NEWS

KITCO is a laugh riot are they not?? Closely tied with ZeroHedge blog BTW. Similar type gold/silver outfits sponsoring conservative am radio because they have the ready-made audience of illiterates to sell their scams to. I guess MyPillow and gold is all they need for the bunker. Or 3 easy payments of 19.99 for flowers or chocolates they could get at Wal Mart for $5 including tax.

Instead of “a fool and his money are soon parted” it should be “a fool and his money always listening to ‘conservative’ radio”

I could only listen to the first few minutes of that pathetic clip. Their babble was already beginning to inflict my brain. Then again – I have tried to listen to some of Judy Shelton’s discussions and she is not any better.

Dear Folks,

This is not to comment directly on the Shelton nomination. But if the Federal Reserve were to include gold as part of its standard for the money supply, wouldn’t smart traders anticipate this beforehand and buy up gold to be able to profit? It would thus seem that Menzie’s estimate of the interest rate increase might be an underestimate, at least in the short run.

Julian

Would traders buy or sell? Wouldn’t any significant role for gold in monetary policy require the Fed to adjust policy to hold down gold prices?

Over the long run the demand for gold tens to exceed the supply.

To balance supply and demand the real price of gold has to increase

some 3% to 5% annually.

This comment made me curious. FRED provides historical series on the nominal price of gold but that would require inflation adjustment, which this does for the 1970 to 2015 period. In real terms the price shot up but then fell back to close to its 1970 period by 2015.

https://goldprice.org/inflation-adjusted-gold-price.html

Of course the real price of gold has risen since 2015.

I prefer several ton granite disks to gold, as long as we are going to trade money in for petty rocks. Large granite disks, even with a hole drilled in the middle, are far more stable than gold. Plus they are harder to steal and you just can’t hide stolen 9′ diameter stone disk. You can’t melt it down and carry it out of the country as big, blingy earrings. Massive stone disks are a far better idea. Somebody needs to alert Ms. Shelton.

Lets also remember the FED pretty much used gold price targets until 2000 to set the effective rate. Your graph shows where the effective rate should probably be, which generally runs 1-2% above the core inflation rate. My guess central banks are tiring of helping create excess liquidity which tends to hurt hard assets companies would prefer right now..

Wanna give us a bit of evidence for that claim? Your claim amounts to a claim about causation, not just correlation. In the world of institutional action, causation runs through an institutional mechanism. What institutional mechanism was employed to link the rate target to gold prices?

Rage,

I think you are wrong. From what I have heard from my contacts at the Fed, they have always kept an eye cocked on the price of gold, but not any more seriously or closely than they do on certain other commodity prices, with that of oil frankly a lot more important than that of gold. When was the last time a change in gold prices had any noticeable impact on the world economy at all? Maybe in the 1890s or the 1930s? Oil is far more important, but nobody is talking about pegging anything to oil. All of that paying attention to gold has simply been an unofficial and not very important sideshow at the Fed since 1971, and still is.

“Lets also remember the FED pretty much used gold price targets until 2000 to set the effective rate.”

This is not even remotely true. Of course Stephen Moore claimed Volcker ran a version of his commodity standard. Then again Mr. Moore is a liar. Congrats Rage – you have lowered yourself to the level of Stephen Moore.

The thing Democrats need to ask themselves with stories like this is “Why doesn’t Nancy Pelosi get this kind of vitriol and abuse from Republicans??”

. https://www.nbcnews.com/politics/congress/aoc-says-house-republican-accosted-her-steps-outside-capitol-n1234465

Sure, Pelosi gets the cliche insults for TV, but inside themselves, Republican legislators love Pelosi. Why?? Because she is easy to manipulate, and shove around on the playground. She doesn’t represent low-income and the disenfranchised. Pelosi represents herself and those who keep her decrepit circus show rolling:

https://www.opensecrets.org/members-of-congress/industries/nancy-pelosi?cid=N00007360&cycle=CAREER

https://www.washingtonpost.com/business/on-small-business/firm-linked-to-pelosis-husband-got-virus-loan-data-show/2020/07/06/ddbfe428-bfbd-11ea-8908-68a2b9eae9e0_story.html

Want proof?? Watch Pelosi crumble when the Republicans demand liability immunity for businesses that want to abuse employees who attempt to protect themselves and their families from acquiring the COVID-19. Republicans also want to be able to abuse teachers and nurses who want to protect themselves from the virus. And Pelosi will happily oblige Republicans in legally accommodating the abuse of teachers, nurses, and any other group they so desire to demand they expose themselves and their families to the virus.

Republicans want/need a turnaround in the economic numbers to give donald trump a better chance of winning the election. Pelosi can demand anything she wants at this point. But what will Pelosi do on the liability issue?? She will allow employers to have carte blanche to abuse employees any way they like. She’ll crumble like a badly built sand castle in a light California rain. You can take that one to the bank right now.

She has not crumbled yet. And I do not see much sign she will just yet. My crystal ball is as worthless as ever. But so far so good. I do not understand your antipathy to Ms. Pelosi any more than I understand you antipathy to Mr. Rosser.

In any event, neither of those issues has anything to do with the fed or the gold standard.

“Antipathy” is a nice word Willie. I prefer the description “borderline hate”. But you’re a considerate and amiable person Willie, and we’ll leave it at that.

if aoc were in control, there would not be any agreement with any senate legislation. so nothing would pass. would that be a win for the low income and disenfranchised? if both sides are willing to throw a tantrum if they don’t get everything they want, as a nation we will have even more problems. aoc can take the positions she takes, because ultimately she is not responsible for delivering the goods. that may change in time, but it is the reality today. other than being the party of no, what did the tea baggers accomplish in legislation?

@ baffling

You speak like a true Democrat lawmaker. I suggest you try to get a job on Pelosi’s staff, you’ll fit perfect. Get a poster of McConnell’s face and practice nodding your head up and down to his froggy chin. Eventually you can move up to lobbyist. I see bright things in your future. Don’t forget to get Pelosi’s shopping list on your first day at work. She likes ice cream. Be a good boy now.

With all due respect, Pelosi is exactly the right person. She is a shrewd operator who knows when to go in and when to hold her fire. She will not tilt at windmills, as Bernie has a tendency to do. If Shelton does not get past, thank Pelosi and Schumer. They are practical people. Results are more important than pure ideology.

and moses, you will still be pissing into the wind. that accomplishes a lot-you may even think you took a shower.

Professor Chinn,

Would you explain a couple items related to the log (gold), Fed Funds regression model as a teaching moment?

1. I could find data for FRED series: GOLDPMGBD228NLBM back to 1968M04, but not to 1968m03. Thus I had only 611 observations instead of 612. The elements of the regression model matched your outcome very closely, so this is not an argument, but a quest for enlightenment.

2. What is the basis for regression of log (gold) on nominal Fed Funds rate? Log (gold) seems to have unit root and Fed Funds seems to reject unit root at 0.1051 using the Augmented Dickey Fuller test. Again, questions related to enlightenment, not argument.

I was thinking that regression of two unit root processes may be appropriate if cointegration exists and regression of two stationary processes may be appropriate, but I seem to be foggy about regressing a unit root process on a maybe stationary process.

Thanks

AS: 1. Probably I used part of 1968M03 daily data to aggregate up to 1968M03 monthly observation. Probably one should drop 1968M03 for consistency. 2. If I use ADF (constant, no trend) on Fed funds, I fail to reject null at about 20% msl. For log gold price, I fail to reject at about 43%. Probably we are using different unit root tests, and different nulls.

I think you are right: To do the experiment correctly, I should’ve done full fledged Johansen ML (which fails to reject no cointegration on quick experimentation) or in first differences. Estimating in first differences makes the implied interest rate adjustment larger…have to think more about this result.