Jim discussed elements of the 2020Q2 advance release on Thursday. Here, I amplify some aspects that he mentioned.

Confirmation: A Catastrophe in the Making

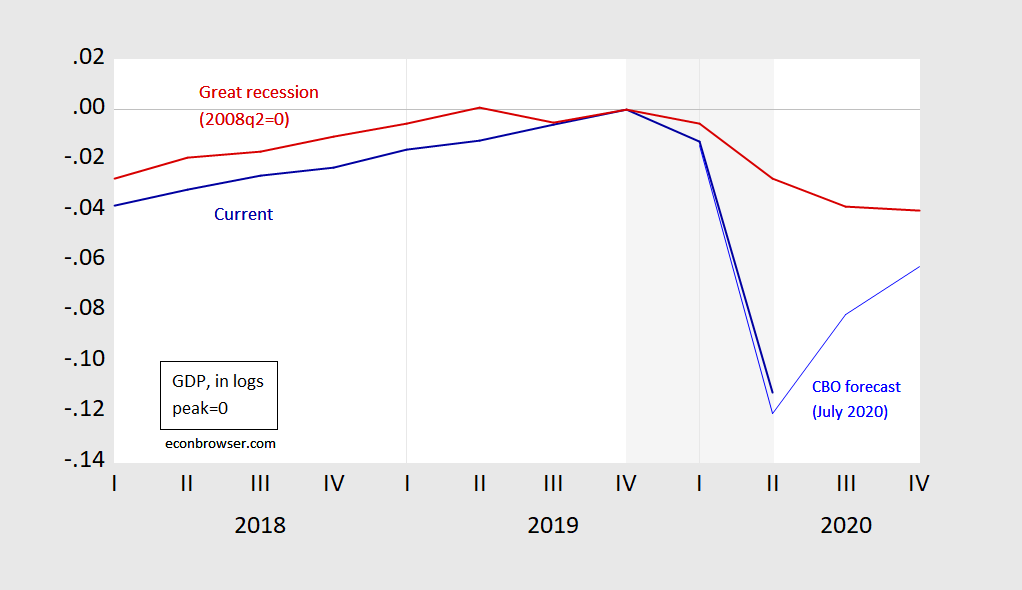

First, the Trump recession is truly catastrophic in scale; the pace of GDP decline is much greater than that in 2008. This is shown in Figure 1.

Figure 1: GDP in logs, normalized to 0 at 2019Q4 (NBER peak) (blue), and GDP normalized to 2008Q2 (red). NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, CBO An Update to the Economic Outlook (July), NBER, author’s calculations.

A “No Confidence” Vote in Administration Policy and Investment

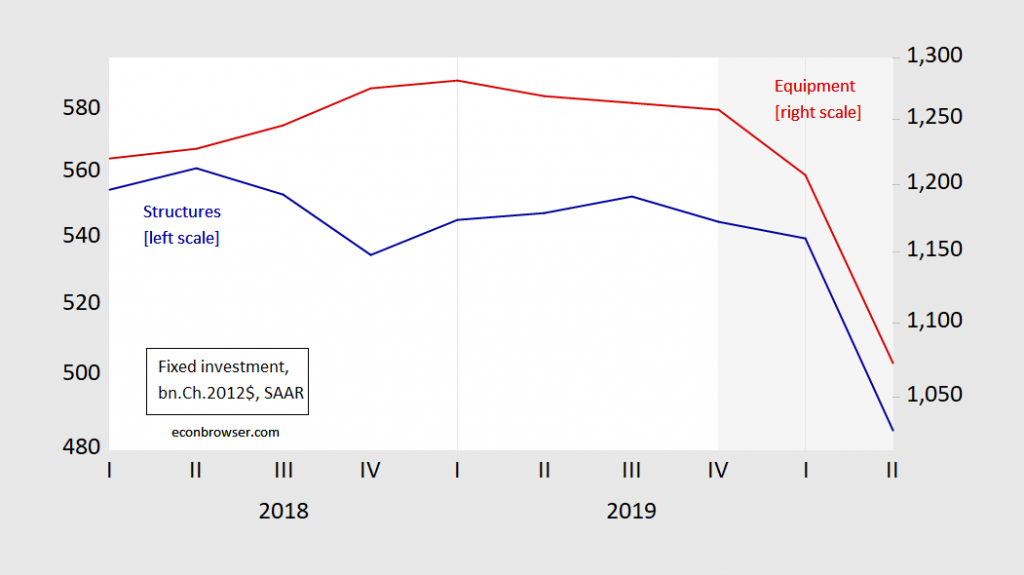

Second, investment has crashed — for both structures and equipment investment. That’significant insofar as capital investment is forward looking.

Figure 2: Fixed investment in structures (blue, left log scale), and in equipment (red, right log scale), in billions Chained 2012$, SAAR. NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

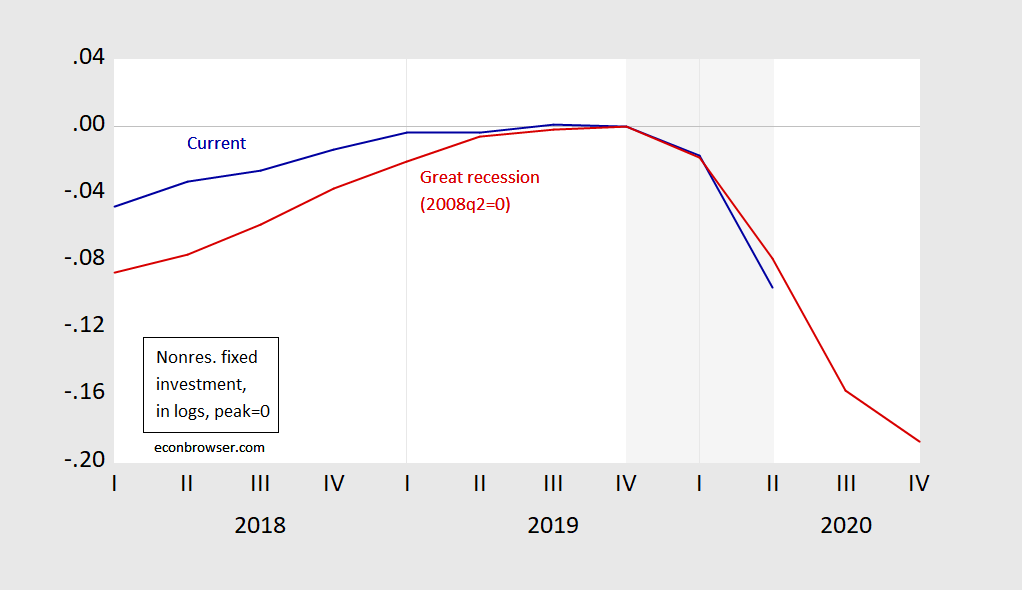

This decline is even more rapid than in 2008Q4; 31.5% now vs. 24% then.

Figure 3: Nonresidential fixed investment in logs, normalized to 0 in 2019Q4 (blue), and normalized to 0 in 2008Q2 (red). NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, author’s calculations.

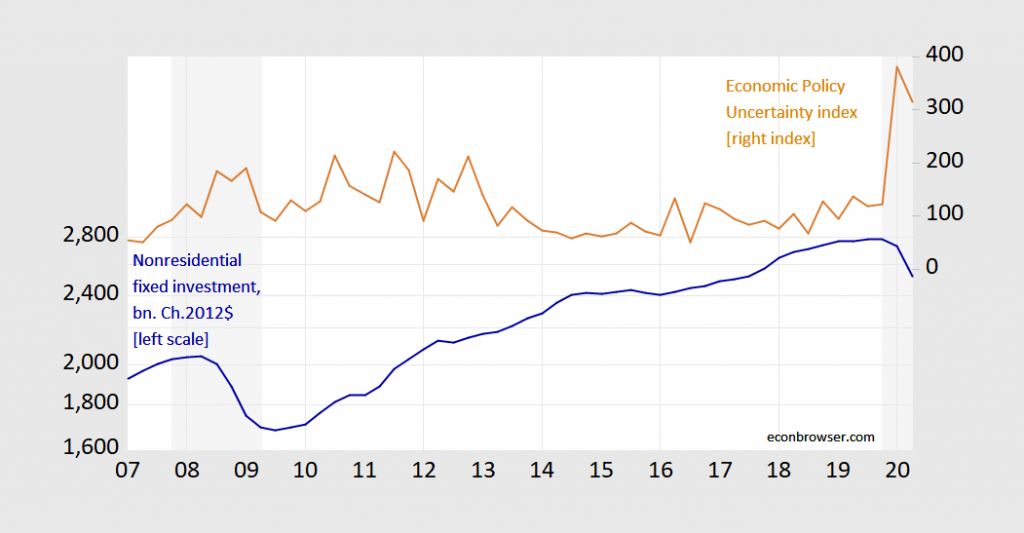

Certainly, some of the crash is due to the crash in aggregate demand — as in the 2007 recession — but some is due to uncertainty, including policy uncertainty. Policy uncertainty levels currently dwarf those of the Great Recession.

Figure 4: Nonresidential fixed investment in billions Chained 2012$ SAAR (blue, left log scale), Economic Policy Uncertainty index (tan, right scale). NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, policyuncertainty.com via FRED, and author’s calculations.

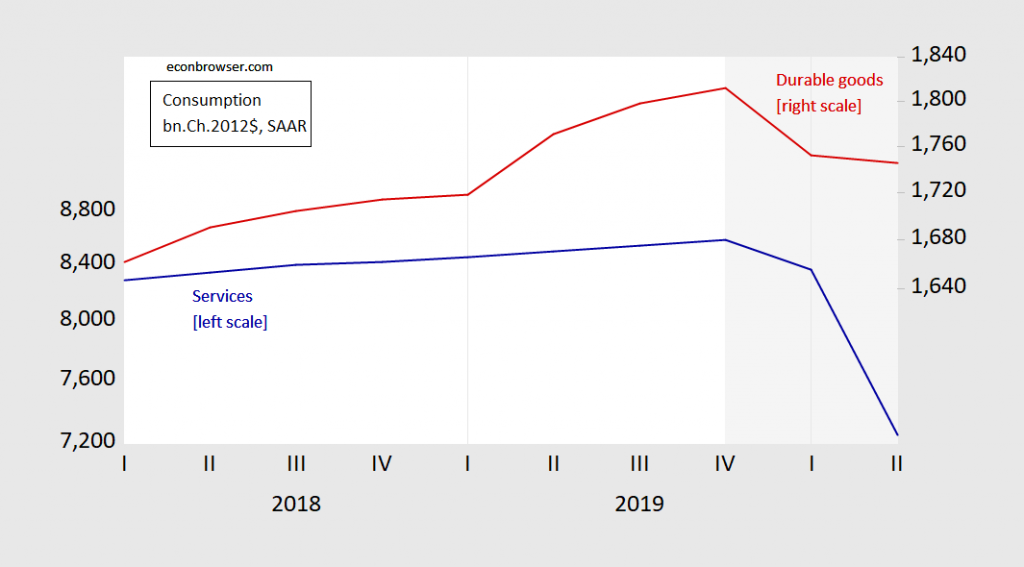

No Recovery Without Recovery in Services Demand

Third, this is a different kind of recession, in many ways, but importantly in the sectoral origin. As Jim Hamilton noted, the decline in services consumption was 43.5% on an annualized basis, while durable goods consumption was relatively flat.

Figure 5: Services consumption (blue, left log scale), and durable goods consumption (red, right log scale), all in billions Chained 2012$ SAAR. NBER defined recession shaded gray, assuming trough at 2020Q2. Source: BEA, 2020Q2 advance release, NBER, and author’s calculations.

Of the 9.8 percentage point decline in GDP (not annualized), 5.9 percentage points were accounted for (in a mechanical sense) by services consumption decline. Jim provides a breakdown of the services consumption decline in his post.

Services consumption will not fully recover until such time as the Covid-19 infection rates are at manageable levels that do not deter such consumption activities. The Administration’s current policy stance is unlikely to encourage that development; one could argue that it — in toto — is impeding that outcome.

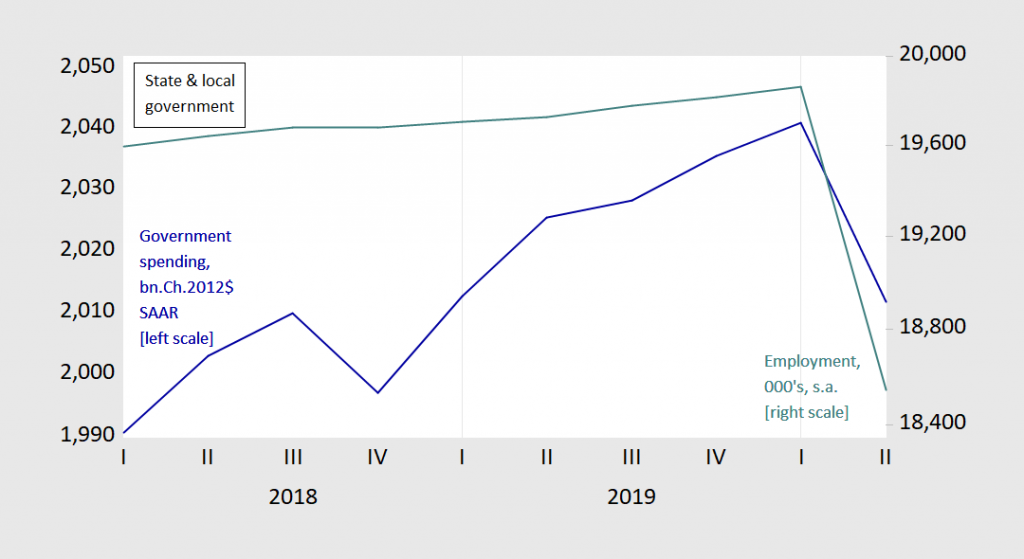

State and Local Government Spending Collapses

Fourth, the biggest threat to the economy may be avoidable. One of the lessons of the Great Recession is that constraints on state and local government spending — exacerbated by ill-advised state income tax cuts — was one of the reasons for the torpid pace of recovery. So far, we have not replicated completely that experience, but with Republican opposition to further Federal transfers to the state, we are in danger of repeating that error.

Figure 6: State and local government spending, billions Chained 2012$ SAAR (blue, left log scale), and state and local employment, 000’s, s.a. (teal, right log scale). Source: BEA 2020Q2 advance release, BLS employment situation June release.

This is why it is critical, as many economists have argued, for the next recovery package to include substantial aid to the states and localities.

Well, the CBO forecast in Figure 1 looks like a V that flattens, something I have been calling since at least June 22 on Econospeak. Does it look like anything else to anybody else?

I apologize if I responded to a bully who beats up on anybody here who stands up to him,. I had been restraining myself, not responding to lots of simply unwarranted and uncalled for attacks. But I admit it got to be too much and I responded in kink.

But then we are back to brass tacks: a V that flattens or not? Anybody?

“But then we are back to brass tacks: a V that flattens or not? Anybody?”

I confess to being totally baffled. Gold is over $2K and the NASDAQ is way up. The S&P 500 is mildly positive for the year. What is a bubble these days? It is difficult to tell. I look at all the business closures and the lack of travel and see black clouds. I look at the stock market and see a partly sunny day. I go out and flip a coin ten time and it still comes up five heads and five tails. At least something is obeying the laws of probability. My prediction was always for double digit unemployment throughout the end of the year. The third of the population that I am in (people >60) are still not going to be big spenders and that is what’s needed to get things moving.

To answer Professor Rosser’s question, it flattens.

Barry Ritholz points out that the gains in S&P 500, DOW, & NASDAQ have been driven by large Tech companies whose incomes have actually risen during the pandemic & also receive substantial overseas profits. From 1930s through 60s the U.S. was almost 1/2 of the world economy. When we sneezed the world caught a cold. Now we are perhaps down to 15% with China, Non-China East Asia, & EU larger economies and India catching up. And the Fed basically told the Stock Market that it will not let a Bear Market set in. So that explains the recovery of stock market.

The yield spread between 10-year treasuries and the S&P has been narrowing for decades, and has been historically narrow since the Great Recession. Since 2010, that spread has run between 1.5% and 2.1%. With tens now yielding 0.6% and the dividend yield on the S&P at around 1.8%, the spread is narrow even by recent standards – stocks are expensive.

There are a couple of possible explanations for the narrowness of the gap. One is a perception that the Fed “put” is now out in the open and undeniable, which is to say that the risk on equities is being kept within limits and probably will be for the time-value-of-money-relevant future. Thus, a lower , equity risk premium is required. Another is that the yield on risk-fee assets will remain low long after earnings recover, so that a high P/E is just anticipation of a time when the S&P/Treasury yield spread will widen, favoring equities.

Disclaimer: I’m holding very little in the way of equities right now.

I agree. The V is flattening. Today’s ADP numbers clearly suggest that. Actual new jobs were 167,000 versus expectations of 1.25 million from June to July. That’s a big miss and indicative of recovery slowing down.

https://www.calculatedriskblog.com/2020/08/adp-private-employment-increased-167000.html

As for the ad hominem stuff, I neither can nor will take it. Incredibly boring, entirely pointless, and frankly sad.

@ “Princeton”Kopits

What if I offer you 3 minutes on FOX News at the 4:20am time slot in exchange for sticking a note on your back that reads “Worst Forecaster of Brown People’s Excess Deaths Ever”?? I’ll throw in a private meeting with Stephen Miller, where you can brainstorm together on how to get the southern wall from collapsing.

You know you want it.

Steven, I’m wondering if there is a typo in the reference above: “Private sector employment increased by 167,000 jobs from June to July according to the July ADP National Employment Report…”. Shouldn’t this be from July to August? BLS estimates for June were ~4.8 million: “Total nonfarm payroll employment rose by 4.8 million in June,…” https://www.bls.gov/news.release/pdf/empsit.pdf

Big forecasting misses are normal when economic data are volatile. The July ADP number will, likely as not, turn out to be a worse predictor of the payroll employment number than usual. Both ISM employment series point to job losses in July. ADP points to a respectable gain.. New weekly jobless claims continue to show an historically high rate of layoffs, while continuing claims suggest a high rate of re-employment – labor market churn on a vast scale which makes counting hard to do.

There is a seasonal quirk in teacher hiring which ADP probably didn’t pick up and which will add to the payroll job count. That does not mean one should expect a job gain in Friday’s report, though it does make a reported gain more likely. It is always the case that a single data point is an unreliable indicator of economic (or labor market) conditions. That is truer now than at any time in my life.

macroduck,

Your point about the volatility of the economic data now in this tumultuous period is very important. many normal relationships are simply not there right now. One sign is not just the massive whiplashing of an unprecedentedly sharp macro plunge, but then it being followed by a very sharp upturn producingj a certin letter in the short run. But less noted but probably more important are the massive intersectoral shifts going on. Some sectors are zooming, such as the big hi tech firms, with them powering the NASDAQ to solid all time highs, while other sectors are in disastrous free falls. This means that any data depending on index numbers or relationships across sectors is just not just noisy but overwhwelmed by deafening thunder. It is completely unsurprising that so many forecasts by so many people and groups have been missing, although maybe things are getting a bit less discombobulated.

@ Menzie

I have been following the IGM/538 survey. I already said the results from question 9 are semi-surprising. Another one I thought is interesting (but don’t necessarily expect you to comment on, it puts you on the spot, and if I was in your shoes I would be very reticent). But the question on “UI” was also very fascinating to me. If you add up the 33% number that the best move is to reduce the $600 payment and the 7% number that the best policy would let “UI” lapse, you have 40%. Now that’s 33 economists and (please correct me if I’m wrong) each assigning their own probability to “which policy gets the best results for the overall economy”.

We often say “Well these congressman and politicians don’t have the economic literacy it takes to make optimal decisions”. But these are all respected economists saying they put it at 40% the “UI” should be reduced and/or in essence be cut off?? That one kinda threw me.

“investment has crashed — for both structures and equipment investment. That’s significant insofar as capital investment is forward looking.”

And the proponents of the 2017 tax cuts for the rich was supposed to lead to the great investment boom ever.

Fixed investment is a forward indicator for at least two reasons. One is that today’s investment is an input to future production. The other is that expectations of future returns on capital are based on relatively good forecasts.

Expectations of future returns condition demand, but not supply. Supply of fixed investment has recently been conditioned by the pandemic. It could be that fixed investment exaggerates pessimism about the future.

Could be, but there is reason to worry that it does not. Hysteresis is not our friend. I admire what the Fed has tried to do to prevent financial chaos, but the economy is being fed through a tube, and that is not a good sign for future health.

Entrepreneurship cannot be (well anyhow, is not being) protected as readily as financial capital and corporate interests. Our collective business memory for some time to come is likely to push our economy toward financial assets and away from productive assets. We already had too much of that.

So while I can cook up a reason to think that the crash in fixed investment is a pessimistic indicator of future activity right now, I think we’re pretty badly screwed.

I was hunting for something that might explain what is going on with the Turkish Lira recently, and basically by happenstance found this. I have mentioned this before, and what the world may possibly look like around mid-November. I also think regular citizens need to be prepared, and even willing to take more drastic actions than just marching or congregating protests.

https://www.lawfareblog.com/contingency-planning-presidential-interference-election

I have always been against things such as militias, and for the first time in my life, I think this is something people on the left need to start pondering in their minds, in “what if” type scenarios, and to prepare. The military generals showed us what they are all about both with ICE in Portland and General Mark Milley terrorizing regular citizens in D.C. Now we know what General Milley and friends are capable of~~that behavior will not improve over time. With Milley’s types, it NEVER does.

I agree that there is a serious danger of Trump attempting to use security forces to stay in power after the election, presumably in connection with him making claims about the election being “rigged” or whatever. However, I suspect that he would be less likely to use the regular US military and much more likely to use the sort of unidentified quasi-secret police he used in Lafayette Square and more recently in Portland, with these forces being officially within the Dept of Homeland Security and the Dept of Justics.

Your point is a good one. But I think there’s a lot of unknown there. If he got General Milley to babysit him at the D.C. church, it’s kind of hard to say. But I lean to agreeing with you on this topic. What I would say, is even though the odds are lower for him using military, I’d rather people mentally prepare themselves for anything.

Moses,

It is my understanding that Gen. Milley felt that he was used and issued some sort of semi-apology about his involvement in the events in Lafayette Square. Again, there were no regular military there, although there were National Guard from certain states with pro-Trump governors. The shock troops were badgeless Dept. of Justice forces under the control of AG Barr, coming from several different agencies, with the most important being the Psrk Police who have had a bad rep for a long time, as welll as prison guards trained to deal with prison riots, and some other groups. In Portland it was ICE and border patrol troops that were wearing camo with no IDs and violating rights of protesters.

If Trump really does try to pull something like this, we could well see a spectacle where indeed regular military end up combating some bunch of these unidentified Trumpist secret police at the White House. I suspect the ultimate crucial group will be the Secret Service, currently under the awful DHS, although they used to be in the Dept. of Treasury. That woman who runs the House whom you have suggested is as senile as I am has said that the Secret Service, whom Trump has called the “SS” on occasion, will be the decisive group, and that if Joe Biden is sworn in on Jan. 20 by the Chief Justice of the Supreme Court, they will recognize Biden as the legitimate president and not Trump. Let us just hope that Biden wins sufficiently decisively that Trump is unable to try to pull anythign like this off, and there is a normal peaceful transfer of executive power.

I think that’s very likely. I know that in 2016 a lot of general officers agonized over the possibility that they might have to disobey an illegal order from a President Trump. Their main consolation was the unlikelihood that Trump would win. GEN Wesley Clark once remarked that back then he was hearing the same kinds of agonized whispers in 2016.

I can imagine a highly unlikely but not impossible scenario where the official military might get into it on Trump’s side. This would involve Trump declaring martial law. However I think the only way they would go along with it would be if there were something dramatic happening that we have not seen yet, maybe some major terrorist attack. He has been trying to remove officers he perceives as being his flunkies, but as of now I think it would take pretty extraordinary circumstances for the official military to go along with this, but anything can happen between now and early November.

Meant to say that Trump trying to install flunkies in the military and removing those who do not totally follow him, pretty much like in many other departments as well.

I agree that Trump would not rely on the regular military, because he could not rely on them. That raises a pretty serious question about his ability to use force to remain in office. If the military refuses to obey Trump, then he is effectively out of power. The Supreme Court, for all its political bias, now has Roberts as the swing vote, and he is proving to be a strong institutionalist. The Court would not back Trump. Any effort by Trump to stay in office is likely to fail. Putting aside the immediate consequences of an attempted power grab, the damage to our tradition of peaceful transition of power would be an incalculable loss.

Meanwhile, if Trump tried to hold power and failed, there would be no future outside of prison for him. All his records would be seized, leading to perhaps an utter loss of wealth.

To avoid the risk, we need retired military officers to start educating the public on the utter dedication of the military to our tradition of civilian rule and democracy. The particular point that peaceful transition of power is necessary for democracy should be made loudly and often.

i would make it very clear to the mercenaries working for DHS, that after this is all over, they WILL be held responsible for their behavior. i would reinforce to them that the us military will behave properly. trump may cause confusion for a couple weeks, but we all know how this will ultimately end. those complicit will be prosecuted to the fullest extent of the law. i would start advertising this now. if trump sees he has no puppets to leave hanging, he won’t pursue this dangerous path.

The military is us. Most of us are related to somebody in the military, personally servrved, are in, or at least know somebody serving. The military is not some alien force that bunker boy can call on. It is us. The military will not prop up his failing fat butt.

agreed willie. that is why i would advertise NOW to those mercenaries in the DHS. there is a us military standing by which will maintain a peaceful democratic handover of power. they will consider any forces that act against a democratically elected government as an invading force, and act appropriately. those mercenaries at DHS need to understand there will be no cover to hide behind and they are the inferior force in strength and numbers. nor will there be a “friend” in the white house providing them with a pardon. they will go to jail for a LONG time. i would also point this out to ICE and border patrol who are currently enforcing illegal trump policies. a day of reckoning is coming, with no place to hide.

Dude, ICE is owned by the rich who traffick in illegals for the wealthy with laundered money. The military proper had little to do with reality show segments that were in those cities.

https://twitter.com/JoshNBCNews/status/1291020897873264641

This could be a rough night for the White House resident Baby-in-Chief.

https://www.washingtonpost.com/technology/2020/08/05/trump-post-removed-facebook/

I guess there’s always 4chan.

There’s another platform he could use, but I have an account there and I don’t want to give him any ideas.

What Trump posted on this virus and kids was fully in line with the intellectual garbage from Bruce Hall on this issue. The Baby in Chief is mad that his disinformation is not being carried by Facebook. Brucie boy gets all huffy when we call him on his lies. Go figure!

We’ve had some commenters here complaining about economists giving their opinions on government policy. Do those same complaints apply to Hoover Institution??

https://twitter.com/paulsperry_/status/1291175216387956743

It’s interesting that in Sperry’s bio on wiki, you can’t find anywhere where it says the guy graduated from university. Can anyone locate his Hoover “fellow” bio page??

Paul Sperry

https://bridge.georgetown.edu/research/factsheet-paul-sperry/

“Paul Sperry is an American conservative journalist who previously served as a Washington bureau chief for the right-wing, conspiratorial website, WorldNetDaily. Sperry is a former media fellow at The Hoover Institution and has authored several anti-Muslim books, including Infiltration: How Muslim Spies and Subversives Have Penetrated Washington. Sperry has a long record of promoting anti-Muslim conspiracy theories. In April 2020, President Donald Trump promoted an anti-Muslim tweet by Sperry about Ramadan and COVID-19.”

The discussion continues noting how this right wing media darling loves to smear Muslims. Of course Trump does the same thing so these two clowns admire each other. He received a B.A. from the University of Texas at Austin and since then has basically written a bunch of anti-Muslim trash. He does not appear to have any training in economics.

OK, so Sperry at least has his bachelor’s. That’s what I was curious about. He lists himself as a “fellow” at Hoover. Even for them this seems like scraping from the bottom of the barrel. Is this how they want to attract guys like Professor Hamilton to give speeches at Hoover?? I would think things like this would give professors pause before associating with them. Especially the type that considered themselves “above the fray” of the type of back and forth you might see on some blogs. Heavens and sweet baby Jesus……..

What I find interesting is that the recession started in Q4 of 2019. It did not seem like the start of a recession yet then. Or maybe I am just isolated from it for the first time in my working career.

It is bizarre so far, but I have seen quite a few vacancy signs go up in storefronts recently. Those will be there for a while.

I understand that crackpots like Peter Navarro are still pushing the snake oil known as hydroxychloroquine, which it seems has gotten in the way of research on my viable COVID-19 treatments:

https://www.nbcnews.com/health/health-news/work-hydroxychloroquine-delayed-promising-studies-convalescent-plasma-n1235867

Robust scientific studies on convalescent plasma, a potentially promising COVID-19 treatment, have gotten off to a slow start in the U.S., in part because some researchers were more focused on enrolling their sickest patients in other trials, including some for hydroxychloroquine. “You always have that hindsight and say, oh man, we should have put our efforts into something else,” said Dr. Todd Rice, an associate professor of medicine at Vanderbilt University Medical Center. Early on in the pandemic, Vanderbilt was involved in multiple clinical trials, including those on remdesivir and hydroxychloroquine. Even though the hospital system had also developed a randomized, placebo-controlled trial for convalescent plasma, Rice said, the other trials took priority.

Peter Navarro belongs to a death cult that pushes things like that, and tries to take healthcare away from his fellow Americans. Pushing snake oil is part of the deal.

Don’t forget donald trump also thinks drinking bleach is a great idea—though he’s never tried it himself, he wants to see if he can get twat Deborah Birx to nod in agreement and be a good little Nazi girl. Well, I don’t know if Menzie thinks this is a “misogynist” opinion or not, because I know we can’t hurt adult women’s feeeee-wings here. That’s how adult women become strong, we keep patting them on the shoulder when anyone says something hurtful. That way we don’t huuuuht adult women’s feeeee-wings. Deborah may be too dainty to handle this, and we have to treat adult women dainty or we are rude cads, but I think poor little Deborah has been wavering, she’s been wavering on the bleach drinking so……

https://twitter.com/Daniel_Lewis3/status/1253482576699969537

Can I put her in the Pelosi club?? “nice but useless”?? It’s a half compliment, right?? OK, I’ll call her a “strong woman”. You’re right, all of you are right, Dr. Birx is a “strong woman”. I’m so sick, what was I thinking?? This is working, let’s keep patting her on the shoulder and telling Dr. Birx she’s a “Strong woman”. This labeling of Deborah Birx as a “strong woman” is adjusting her behavior well. Either way we didn’t huuuuht her feeee-wings, so I feel good about patting her on the shoulder and telling her she’s a “Strong woman” while she sits silent while someone 10 feet away says “drink bleach”. Can we call William Barr a “strong woman”, and Peter Navarro and Mike Pence “Strong women” also?? I think Gary Cohn was a very “Strong woman” while standing 6 feet from donald trump’s right when he said Nazis were “very fine people”. I like this…… benign treatment of “strong women” who act passive to fascists. Dr. Birx was probably afraid someone (a “misogynist”???) was gonna huuuuht haw feeeee-wings. This is gonna work out well. Everyone gets a “strong woman” badge now. I feel “mature” and “progressive” now. How long do I have to be “mature” and “progressive” before I can get my self-righteous ribbon, anyone know the time lag on that??

i am not a fan of birx. she has enabled trump. by comparison, fauci is looking better and better. i know you did not like fauci either. but which would you rather have in the mix now? by staying on with trump, fauci has been able to maintain a soap box that he could never have attained otherwise. birx has not risen to the occasion. fauci at least did not become impotent.

Semi-OT:

https://fred.stlouisfed.org/series/DRTSCILM

IMO, the worst is still to come, with tightening lending standards in a recession!?!?

Sebastian

This makes this recession far more familiar. Construction is already slowing a little. That means projects are becoming riskier, which means fewer of them. Then there’s the rising mortgage defaults. That’s going to make banks pull in their horns. I’m in known territory now.

“I’m in known territory now.”

right. this puts us squarely in the territory of known behaviors caused by recessions and financial crisis. and we KNOW how these will play out. the entire idea behind a strong stimulus response is to keep from being in this territory in the first place. this is what is so frustrating with the republican approach to the stimulus. they want a bare minimum the will NOT keep us out of recession or financial crisis. and we KNOW how that will play out in the long run if we do not support unemployment, and state and local governments. we are currently in a deeper hole that the great recession, and republicans think it will magically just fill itself. kind of like the trump virus will just magically disappear.

Always happens, always makes the recession worse.

And they successfully blame the Democrats and escape punishment. Pure magic. It seems to happen every time. And the people they hurt worst are their base, so far as i can tell. There are things rational people are not meant to understand.

I think Barkes is making a very valid point IF I understand him.

He is saying the virus is creating problems for seasonally adjusting data.

Aussie humor now giving British humor a run for its money.

But I have good news for you Not Trampis, Barkley says if you have a record surge in May’s consumer spending, there’s no way you will see a GDP contraction.

https://www.reuters.com/article/us-australia-economy-retail/australia-retail-sales-see-record-surge-in-may-as-economy-reopens-idUSKBN24407U

https://uk.reuters.com/article/us-australia-economy-rba/australia-central-bank-warns-of-gdp-hit-from-victoria-lockdowns-idUKKCN25306M

Calm down, calm down, those are RBA numbers not BEA numbers. Barkley has a gift for these things, so, pay attention.

NT,

At the time I said that I was still erroneously looking at the measurement from the end of Q1 to the end of Q2, as has been explained elsewhere. And as we have seen, indeed the US GDP did grow during that period by an annualized (not seasonally adjusted) rate of about 9.0%, even as the official SAAR BEA number for the average GDP in Q1 moving to that of Q2 fell by a -32.9% rate. But, mate, you probably did not need to be reminded of that, despite the humorous declarations just presented.

sorry but retail trade will detract from growth in the June GDP. It wil be negative and victoria has ensured so wil the Sepremver qtr.

Can you believe people who have the virus still go to work???l

It’s especially “shocking” if you think of the number who live paycheck to paycheck and are told the job won’t be waiting for them on Wednesday if they don’t show up to work on Tuesday. Almost enough to make you think some people don’t live in a hollywood film fantasyland.

I tell yeh, next we’ll find out humans are putting chemical compounds used to make plastic in baby formula

https://qz.com/1323471/ten-years-after-chinas-melamine-laced-infant-milk-tragedy-deep-distrust-remains/

You know I’ve been informed there are some jobs where they don’t even offer tenure to save those who make horrendous statements in regards to facts?? Wait ’til Barkley Junior finds out.

Yes, and it is a valid point.

https://www.marketwatch.com/story/feds-mester-says-labor-market-is-even-weaker-than-data-suggests-2020-08-05?mod=newsviewer_click

Layoffs in swing states will leave a mark.