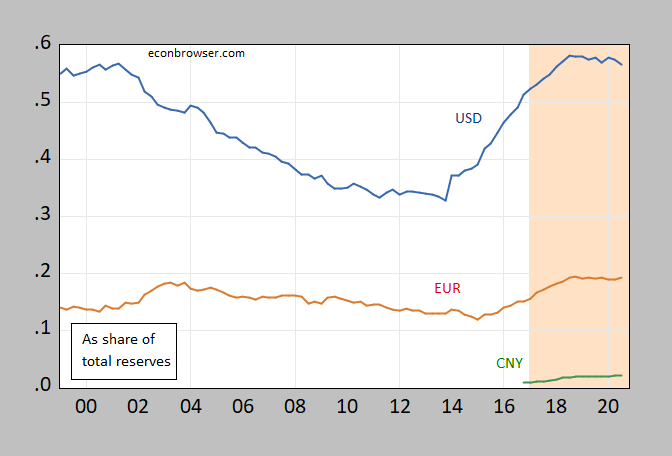

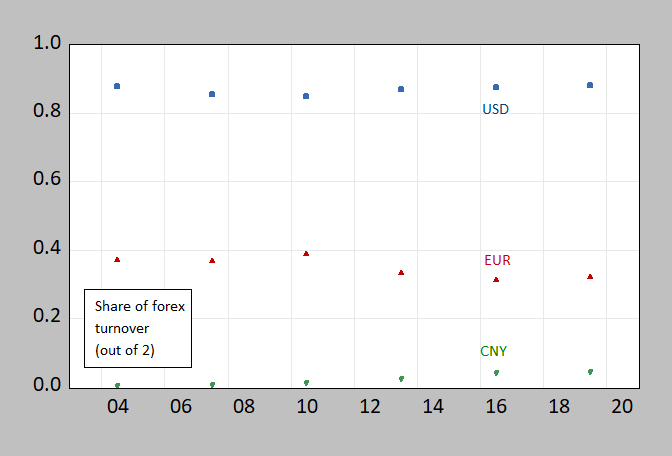

The rapid ascent in CNY reserves was in 2018, with some resumption in 2020. From 2016 to 2019, Renminbi turnover rose from 4% to 4.3% (out of 200%).

Figure 1: Foreign exchange reserves allocated in USD as share of total (allocated, unallocated) reserves (blue), EUR (red), CNY (green). Pink shading is Trump administration. Source: IMF COFER, various issues, author’s calculations.

FIgure 2: Foreign exchange turnover share in April in USD (blue square), in EUR (red triangle), in CNY (green inverted triangle). Shares sum to 2. Source: BIS Triennial Survey, 2019.

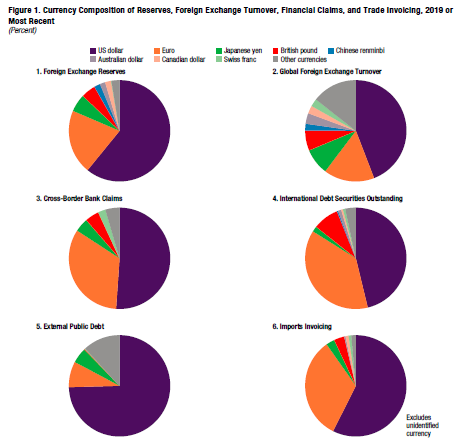

The IMF provides additional information on the use of the Renminbi in “Reserve Currencies in an Evolving International Monetary System”.

Source: IMF (2020).

National policies have played a role in supporting the internationalization of currencies for economic as well as political benefits, including international prestige and the enhanced ability to project military power abroad. More recently, China has been actively promoting a wider use of the renminbi for trade and investment, which was supported by the addition of the renminbi to the SDR basket in 2016.8 Between 2010 and 2014, 37 central banks have reportedly added the renminbi to their reserve portfolios (Liao and McDow-ell 2016), with the share of renminbi in global reserves reaching 2 percent in 2019. The next stage in the internationalization of the renminbi could depend, to some extent, on the landscape of China’s economic and political ties that emerge after the COVID-19 crisis.

Still, I think the Chinese remain conflicted about whether to take the tough steps necessary for RMB internationalization. From my discussion of Eswar Prasad’s 2015 paper:

The key question is then, what price in terms of policy autonomy are Chinese policymakers willing to pay in order to achieve renminbi internationalization? This question has been thrown in sharp relief by the faster than anticipated deceleration in growth. Will they be willing to give up the lever of exchange rate management in order to retain monetary policy independence? Will they relinquish control over the financial system (and ability to stem financial outflows) that would occur with capital account convertibility? The heavy-handed nature of intervention in the stock market over the summer of 2015 gives one pause for thought. We may see further backsliding on exchange rate flexibility (and cap-ital account liberalization) if foreign exchange reserves continue to decline…

Nothing I’ve seen since 2015 — from the increasing role of state-owned enterprises to the lack of momentum in the deregulatory drive in finance — has increased my optimism in this regard.

And Princeton Steve claims (falsely) that you never criticize the Chinese government. This is a very good question:

‘Will they be willing to give up the lever of exchange rate management in order to retain monetary policy independence?’

The US did so almost 50 years ago. Of course the Judy Shelton/Stephen Moore crowd wants us to go back to the ancient gold standard.

I fully agree with the analysis.

The Xi Administration has shown no signs, in any arena, of being interested in giving up one iota of power. Further internationalization is likely, under Xi, to be limited to pressing near neighbors to denominate trade in yuan. Eliminating capital controls (such as they are; a sieve has more integrity) or releasing restrictions on interest rates simply isn’t in the cards.

Yep. Xi’s tenure has been marked by a return toward authoritarianism at home and toward using foreign economic policy – most notably the belt and road initiative – to extend power abroad.

I’d offer one amendment to Menzie’s analysis. Xi is unwilling to do what is necessary under the post-WWII IMF consensus to internationalize the RMB. I suspect he would like to increase the role of the RMB under rules more to his liking. Whether he has a notion of what those rules may be I can’t say. He seems less interested in thinking about economics than his recent predecessors. In any case, I’d bet we’ll see further efforts to build a system of agreements that requires more use of the RMB in trade and financial dealings with China.

macroduck,

China has been building a replacement for the post-WWII IMF consensus (Bretton Woods) for more than a decade. Buying sovereign debt from heavily indebted nations, for example. Setting up Rmb-swap regimes, for example.

Beijing — not just the Xi Administration — has very little voice in the Bretton Woods system, and less interest in following its advice on how to run the Chinese economy.

The China Dream is to replace the IMF, World Bank, ADB, WTO, and similar organization with Chinese-designed, Chinese-run institutions.

Yep. All reasons Menzie isn’t seeing Chi.ese policy moving toward greater RMB internationalization while China claims to be seeking greater integration.

What remains to be seen is whether China’s desired arrangement can achieve China’s goals. The IMF consensus is that it can’t.

https://news.cgtn.com/news/2021-03-01/m-CBDC-Bridge-project-showcases-future-of-global-banking-Yh3x1QTdbW/index.html

March 1, 2021

m-CBDC Bridge project showcases future of global banking

By Matteo Giovannini

China’s relentless effort to elevate its role and prestige in global finance is proceeding through continuous technological advancements towards a not-so-distant future where all transactions are going to be conducted in a totally digitalized form, and has marked another decisive milestone this week.

As reported by several business media outlets the People’s Bank of China (PBOC) has joined this week central banks from Thailand, United Arab Emirates (UAE) and Hong Kong in a project nicknamed m-CBDC Bridge that is aimed at developing a distributed ledger technology for real time cross-border transactions involving domestic and foreign currencies.

The initiative is no surprising since China and the UAE have simply expanded an initiative started last year under the name of Project Inthanon-LionRock by the Hong Kong Monetary Authority (HKMA) and the Bank of Thailand (BOT) whose goal was to utilize central bank digital currencies (CBDC) in order to circumvent the banking network and allow direct payments among banks.

In my view, this move represents a major breakthrough in the development and implementation of China’s virtual currency since, for the first time, it shows an attempt to test the digital yuan outside of the country’s borders giving a significant acceleration to a development process that has lasted for over five years.

In this sense, the decision to join the m-CBDC Bridge project can be read as a demonstration of strength and confidence that China wants to showcase to the rest of the world after the successful launch of domestic pilot tests in the cities of Shenzhen, Suzhou, Chengdu, Xiong’an New Area and, above all, Beijing during the last Spring Festival holiday.

Moreover, the strong support by the Bank for International Settlements Innovation Hub Center in Hong Kong guarantees the official mark of validation of the oldest global financial institution, whose mission is to foster stability and cooperation among central banks, while endorsing the start of the second phase of Project Inthanon-LionRock.

From a strategic perspective, China is demonstrating it can be in the leading position in terms of development of a sovereign digital currency with at least five years of advantage over large economies such as the United States and the European Union and to have a clear long-term strategic goal of making the renminbi a truly international legal tender.

In this respect, the decision to join the m-CBDC Bridge project directly shows China’s commitment for an increased role in global finance as demonstrated by the recent announcement of a joint venture between SWIFT and PBOC’s China National Clearing Center, a deal aimed at further opening up China’s domestic financial market to the rest of the world and at promoting the yuan as a key global currency….

Reads like a press release from a government agency. Nothing in the story contradicts Menzie’s point. What we see here is the adoption of a new payment system under the same policies.

As to ” a deal aimed at further opening up China’s domestic financial market to the rest of the world”, saying it doesn’t make it true. Again, this has more to do with the mechanism for moving money than the rules under which investments can be made.

https://fred.stlouisfed.org/graph/?g=mGFd

January 30, 2018

Total Reserves excluding Gold for China, United States, India, Japan and Germany, 2007-2020

https://fred.stlouisfed.org/graph/?g=mZQS

January 30, 2018

Total Reserves excluding Gold for China, United States, India, Japan and Germany, 2000-2020

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2020

(Indexed to 2007)

Once again, we come back to the same problem: China’s governance systems no longer matches the economic, technical and military capabilities of the country. In order to have a reserve currency or international capital markets, a country needs rule of law in which property rights are protected by independent courts and subject to predictable due process — exactly what Hong Kong had — and mainland China lacks.

China needs to become a democracy to step forward. Under Xi, Chinese is a threat not only to the global community, but to itself. Autocracy is holding China back.

The rule of law? Oh my – you sound like Lindsey Graham lecturing Democrats about how only Republicans are allowed to violate basic norms.

What is with you, man? Why are you so bitter and vindictive? If you disagree with the comment, disagree with it. But why this? Do you think it makes you more respected with anyone here? I reviewed a bunch of your comments, and historically, you could provide constructive insights. But now, you read like a bitter, old retired guy who has nothing to share but anger. Is this the best you can contribute?

Steven, I’m thinking that pgl is a narcissist who requires that behavior for self-esteem.

You are correct, pgl could contribute in a positive manner, but more often simply chooses not to do so. If I provide some information, pgl will automatically revert to ad hominem responses. If I provide a link, pgl will denigrate the source even if it provides the same information that his “respected” source does.

I pointed out once to him that “If you cannot prove a man wrong, don’t panic. You can always call him names.” – Oscar Wilde

But I believe Mr. Wilde is not on pgl’s list of “respected sources”.

Bruce Hall: I believe pgl has been pretty restrained given your continued dissembling and forwarding of clear disinformation of the like of Mr. Moore. And I do not think anyone who wrote almost exactly 1 year ago:

should be lecturing anyone.

Information? Try lies. Sources? Try checking those sources Kelly Anne Conway feeds you before trying to convince us that someone fired by Fox News is reliable.

No Bruce – you make criticizing your intellectual garbage way too easy.

I don’t think that’s right, Bruce. Read some of his earlier comments. Pgl is capable of skillful argumentation. But the indications suggest he had a life event in late 2017: he retired, was fired or lost his wife. Since then, he has posted much more and really been more about abuse than refutation. There is an objective reason for that, I think.

He is capable of the technical work though.

“But the indications suggest he had a life event in late 2017: he retired, was fired or lost his wife.”

My only life event was seeing a wannabe tyrant and flaming racist enter the White House. The rest of the world has wondered for the last 4 years whether that Shining Star on the Hill aka our democracy was dead. It almost died on 1/6/2021 and voter suppression is still alive and well in many red states.

So anyone who has not called out this degradation of America’s democracy (and you have not) has no business dictating that other nations must practice democracy. Like I said you sound a lot like war monger Mike Pompeo. After all – how else are we going to dictate the form of government in China? War? Please.

We could start by restoring democracy here. But what is Princeton Steve doing about that? Not a damn thing.

Menzie, I don’t practice “dissembling”. When I write a comment, my intentions are clear and so are my sources. If they prove to be incorrect, then I accept that.

As far as COVID-19 being overblown, I’d say that is still accurate. It is primarily a disease that affect those with other health issues; over 80% of deaths associated with COVID-19 are people 65+ years old while many others have problems such as severe obesity, diabetes, heart disease, and cancer. Practically no deaths are among the elementary, high school, and university students… about the same as the flu. So policies like shutting down schools and universities do not follow the data regarding risk. Data also show that states that implement strict lockdown protocols did not fare better, in general, than states that allowed people and businesses to conduct themselves with far fewer restrictions. In fact, in the states that governors herded the infected elderly back into nursing homes seem to be particularly hard hit which follows from the fact that the elderly and ill are most at risk. https://data.cdc.gov/NCHS/Provisional-COVID-19-Death-Counts-by-Sex-Age-and-S/9bhg-hcku This is the same demographic that die from the flu (which tends to be more serious for young children).

As far as pgl’s “restrained” responses, I’d have to say you have a unique interpretation of that word. For example, when I offered up a bit of information about the Chinese government’s testing of digital currency (for which I had no “ulterior motive”), pgl immediately attacked the source rather than responding to the actual information. So, I offered a similar article from the NY Times. It appears that pgl has an “approved reading list” and everything else is met with a “Kelly Anne Conway” snarky reply (which pgl must believe is clever although it is rather pathetic). I don’t believe he actually critiqued the information itself.

“Bruce Hall

March 3, 2021 at 2:59 pm

Menzie, I don’t practice “dissembling”. When I write a comment, my intentions are clear and so are my sources.”

Your sources tend to be akin to the QAnon crowd but yea your intent is clear. Tell what every lies Kelly Anne Conway needs you to tell that day. Quit pretending you are an honest broker because everyone knows better.

“As far as COVID-19 being overblown, I’d say that is still accurate.”

This from the troll you told us last summer that daily death counts would continue to decline. Yes – Bruce Hall was basically telling us we would only see 50 thousand deaths. Try ten times that amount and still rapidly rising. But half a million deaths and counting is still no big deal as long as his mommy can shop for his food so Bruce Hall can hunker down in the basement.

Next this MAGA hat wearing clown will tell us 1/6 was just a few people practicing their 1st Amendment rights.

No integrity and no soul. None whatsoever.

Pgl –

You raised your commenting not after Trump’s election, but almost a year later, and substance turned to abuse for matters well outside Trumpian issues.

The first step in championing democracy in China is championing democracy in China, and perhaps even before that, understanding why that is a strategic imperative for the US and indeed the global community.

An economic analysis would suggest that the Chinese public is in fact ready for democracy now. Our efforts should focus, at least in part, on planting the seed in the minds of the Chinese public. I would add that Chinese-Americans should be calling for this most loudly, as did we Central Europeans and Cuban exiles during the Soviet era. Let’s start there.

steven, i have had some conversations recently with those from the chinese mainland. the topic discusses the response to the coronavirus. the people in china really cannot comprehend why the us response has been such a spectacular failure in comparison to how mainland china handled the situation. the chinese i know have questioned why they should embrace a democratic system when their system produced much better and quicker outcomes than the usa. the freedom to run around maskless and spread a dangerous virus amongst the population is incomprehensible to them. they saw maga rallies and were in disbelief. if you want to change the mind of the chinese, you need to come up with an answer to these concerns. our recent example of democracy has been a very poor selling point to the chinese.

S.Kopits: while championing democracy in China, might not be a bad idea to champion democracy in places like Arizona and Georgia where the party in charge is hell bent on limiting it.

But, if we can aid establishment of democratic norms on the Asian mainland, maybe doing the same in Mississippi and Alabama can succeed.

Let’s start with noneconomist:

I’m not sure what you mean. I am all for democracy in Georgia, Arizona, Alabama and Mississippi. Best I can tell, the elections in all these states were run pretty cleanly. Certainly the Trump team was unable to provide any credible evidence of systemic fraud in any of these places. So I think democracy is working there, at least best I can tell. Why do I need to call for democracy in states where it appears to be working?

Baffs –

Communist regimes are historically better at collective response. This was true, for example, in Hungary pre-1989. For example, I seem to recall a bedbug incident there and the government basically ordered everything fumigated and forced everyone to comply. And it worked.

Centralized governments can often react quicker, and that’s because they can dispense with niceties like due process, a free press, and public opinion. I don’t think this point is disputed in general. The question is whether you want to live in a country without individual rights.

Again, I think it important to highlight why democracy is China is paramount. That is because China represents a systemic risk to the world, because it lacks proper checks on its military, economic and technical capabilities. The coronavirus, the belligerent treatment of Taiwan and Hong Kong, and the inability to create a reserve currency commensurate to its economic stature are but three examples of what I mean. I think democracy is a good thing overall, but my interest in democracy in China is not principally due to principle, high-minded ideals or deep-seated humanitarianism, but rather because China has the power to destroy us all. As readers know, I believe the balance of evidence suggests that Covid-19 came from a Chinese lab. I didn’t enjoy being housebound for a year and daily watching the death and hospitalization tallies. That’s the risk I am talking about.

” I didn’t enjoy being housebound for a year and daily watching the death and hospitalization tallies. That’s the risk I am talking about.”

in the usa being housebound for a year was true. in china that was not the case. again, you are not coming up with very good arguments to convince somebody in china to embrace democracy. the reality of the world today does not agree with your assessment.

steven, i am a proponent of democracy. i also believe democracy only works when the people of the nation prefer it. they must be convinced of its benefit. we (the usa, you and I) have not been able to provide a convincing argument recently. so before we go off and tell somebody else to become a democracy, we need to create a much better version of ourselves.

“Best I can tell, the elections in all these states were run pretty cleanly.”

steven, you are either woefully ignorant or intentionally ignoring the voter suppression that occurs throughout the south and other states. these states develop restrictions that intentionally inhibit people of color, low income and limited means from freely and easily accessing the voting booth. this impacts a properly functioning democracy. and yet i hear very little from you on these issues.

ZZZZZZZZZZZZZZZZZ!!!!

The heavy-handed nature of intervention in the stock market over the summer of 2015 gives one pause for thought….

[ China is a country of 1.4 billion, developing remarkably to the extent of having even ended severe poverty through the country. The development has been managed and the success of the management means this will continue. Stock market instability in China in 2015 was a reason a prominent University of California economist gave for predicting an economic crash and the undoing of the Chinese economy. Chinese managers however wanted no economic undoing and chose to intervene in the stock market and the economy and growth were protected and the stock market recovered quickly and has been relatively stable since.

Words such as “heavy-handed” are pejorative, and the resolving of a possibly severe economic problem in quick and order only gives me “pause for thought” that is congratulating. ]

https://fred.stlouisfed.org/graph/?g=BtM4

January 15, 2018

Total Share Prices for All Shares for China, United States, India, Japan and Germany, 2012-2020

(Percent change)

ltr: “heavy handed” could be good, or bad. I’m hard pressed to think of an appropriate synonym which yet describes how interventionist the measures were. Would you prefer “dirigiste”?

Dirigiste or interventionist would be perfect. Benignly resolving an stock market fluctuations that could limit economic growth is just what financial regulators need to be about, and what Chinese regulators learned to do in 2015. Problems in the Chinese economy are always becoming evident, but Chinese engineering tradition is about problem solving. Financial regulators in the tradition of engineers are supposed to be problem solvers. Of course, Mario Draghi was a remarkable problem solver for the Euro Area in 2011…

No one has outlawed the business cycle to date.

Outlawed the business cycle? Is this like calling cold weather a felony? Are you trying to get hired by Cellino and Barnes? Geesh!

What was done to resolve the stock market fluctuations and protect economic growth, in several steps, was to increasingly limit trading as opposed to holding shares and to have institutions including the sovereign wealth fund buy and hold indexes of stocks. Hong Kong’s government successfully bought the island stock market index in the late 1990s, * much against international financial advice, to protect the market from speculators in the wake of the Asian financial crises.

* Malaysia used capital flow controls to settle the stock market in the late 1990s.

In terms of reserve currencies, China is punching well below its weight. But there is only so far you can go without rule of law. There’s a reason that all the advanced economies, bar the oil monarchies, are established democracies. The form of governance follows the level of economic development. Back many years ago, The Economist had an article which concluded ‘no middle class, no democracy.’ But the opposite is also true: If you have a middle class, you will be a democracy because the form of government will ultimately follow the requirements of that society’s property rights.

So, we will either have a world war or China will become a democracy, or perhaps both. And pretty soon. I would personally prefer only the latter.

“Benignly” carries a judgement, just as “heavy-handed” does. If you insist on neutral language from others, cheer-leading from you is hypocritical.

“The development has been managed and the success of the management means this will continue.” Really? So Rome still rules Much of Europe, North Africa and the Middle East? Britannia still rules the waves? Whatever happened to “past performance doesn’t ensure future success.”

Menzie has offered data showing that the RMB’s role as a reserve currency is small and offered his professional opinion that China has not taken the steps necessary to increase that role. Your response, distilled to it’s essence, is “Big meanie! Stop saying mean things!”

You do not want to get in an argument over whether Xi or Menzie is the bigger meanie.

ltr (aka anne) adores everything the Chinese government does while Princeton Steve abhors everything this government. Calling Match.com as these two should go on a date. Or maybe not – geesh!

Chinese regulators intervening in the stock market were successful after several efforts in stabilizing the market. Investors were protected, the economy was protected, general growth continued. Stock market stability has been maintained since. Looking to general well-being, which is what economic policy should be designed for, and looking to protect investors as opposed to speculators, the stock market intervention was “benign” to me.

However, since I was critical of the expression “heavy-handed,” I should have used a neutral expression in turn.

“Chinese regulators intervening in the stock market were successful after several efforts in stabilizing the market. Investors were protected, the economy was protected, general growth continued.”

i know i will sound like some free market conservative here, but “investors were protected” is not necessarily a great thing with respect to a stock market. they should be protected from malfeasance and fraud, sure. but should they really be protected from a stock market bubble? over exuberant investors? if a stock is overvalued, and the government does things to prop up and maintain that value, that can pose a problem. among many issues, it possibly inhibits the reallocation of capital to another stock which may have better growth prospects for itself as well as the nation. there are inherent risks to having a stock market. both sides may disagree with terms like benign or heavyhanded. but you are hard pressed to describe the action as simply neutral. it was not.

Ham-fisted?

Blunt?

Unsubtle?

Draconian?

Counter-productive?

As someone who spent a career explaining the NICs development, and looking for euphemisms for “wow,” I feel your pain.

Correcting my writing and adding:

“The heavy-handed nature of intervention in the stock market over the summer of 2015 gives one pause for thought….”

Words such as “heavy-handed” are pejorative, and the resolving of a possibly severe economic problem in quick order only gives me “pause for thought” that is congratulating.

I meant no disrespect in this response, but consider the Chinese intervention in the stock market in 2015 to have been successful in protecting economic growth. Long-term stock market investors were protected. Currency reserves, counting the sovereign wealth fund, were protected. The real value of the Yuan remains relatively high.

“Long-term stock market investors were protected. ”

long term investors have absolutely no concern about short term volatility. if i am a long term investor whose stock drops 50%, and if i am convinced the company is good, i simply buy more of the stock at a cheaper price. or simply ride out the volatility. that is what a long term investor should be taught to do.

China is looking at its currency in a slightly different fashion for internal use.

https://dnyuz.com/2021/03/01/china-charges-ahead-with-a-national-digital-currency/

Not a credit card or a blockchain cryptocurrency. Not exactly a debit card either. One interesting aspect:

In a hint of the currency’s unusual nature, recipients have only a few weeks to spend the digital money before it disappears. So far, only a limited number of retailers have taken the currency. But early users said the experience was so similar to Chinese digital payment options like Alipay and WeChat Pay that it would not be hard to switch to it if it rolled out nationwide.

…

Some economists said China’s digital currency would also make it easier for the renminbi to compete with the U.S. dollar as a global currency because it can move internationally with fewer barriers. But Chinese officials and analysts have said that many other changes would be necessary for that to happen.

Beyond those ambitions, the eCNY could immediately give the Chinese government more power to monitor finance flows because a digital currency system can record every transaction. That poses privacy concerns, with China having used many tools in the past to crack down on dissidents.

DNYUZ? Is your only source of news hacks likes these clowns?

https://mediabiasfactcheck.com/dnyuz/

Seriously Bruce – you claim you provide only published information but being published does not mean reliable. Who feeds you this garbage? Oh yea Kelly Anne Alternative Facts Conway.

pgl,

you like to shoot messengers, don’t you?

https://www.nytimes.com/2019/10/18/technology/china-cryptocurrency-facebook-libra.html

Go ahead.

I’m practicing the restraint that Menzie requested.

You know – you can provide something other than a hack job if you actually tried. Of course knowing you – you did not read your own link here. But hey!

My God I was right – Bruce Hall stopped reading after the title and missed the very 1st paragraph:

‘When Facebook announced plans this year for a cryptocurrency called Libra, it said its goal was to reinvent money for the internet age. What the company probably didn’t imagine was that its efforts might spur China to get there first.’

So if creepy Mark Zuckerberg can track our spending habits, Brucie boy thinks that is fine. But if Facebook faces competition – then we are all prisoners. Maybe this clown might figure it out – one does not have to use Libra if one does not want to.

Second paragraph:

China wants to start replacing the cash that people carry with a digital currency soon, a long-discussed project that went into overdrive after Libra was unveiled in June. Facebook has been fighting to defend its initiative against skeptical regulators, and key corporate partners have pulled out of the project. But Beijing’s ambitions appear to be moving ahead at full speed.

Ooops!

The point isn’t that Facebook was doing something along those lines; the point was that China had been thinking about it and decided to press forward.

A state-issued e-currency would help China’s government know more — much, much more — about how its citizens spend their money, giving it sweeping new powers to fight crime and manage the economy while also raising privacy concerns.

“It’s extraordinary power and visibility into the financial system, more than any central bank has today,” said Martin Chorzempa, a research fellow at the Peterson Institute for International Economics in Washington.

Oh, dear, but what is Facebook doing?

Chinese officials have indicated that their aim is less to copy Libra than to get ahead of a potentially momentous shift in the global financial order.

Beijing has long wanted China’s currency, the renminbi, to be used more in international trade and finance. If Libra proves convenient for moving money across borders, then it could become a currency of choice in many countries, particularly those with unstable economies.

So, the connection to Menzie’s post?

China’s leaders would also love to have an alternative to SWIFT, the Western-dominated messaging network that helps money move across borders and between banks. Western governments have previously restricted access to SWIFT to punish Iran for its nuclear program, and as Washington and Beijing feud over trade and security, the Trump administration has considered sanctions of various kinds against Chinese companies.

A digitized renminbi is not likely to become the world’s new favorite currency overnight. China tightly regulates conversions of the renminbi into other currencies to keep exchange rates stable, and similar strictures are likely to bind the crypto-renminbi.

So, China is developing a tool to push toward the renminbi becoming an international currency, but it “is not likely to become the world’s new favorite currency overnight.”

But hey, the first paragraph.

Can’t help but wonder if those won’t be one of those things that happens ‘slowly at first, then all at once’ (with a credit to Ernest Hemingway in A Sun Also Rises).

Menzie,

On the important final point of your post I have no new special information, although I am trying to keep track of this. It seems that PRC continues to maintain various restrictions on capital flows, although I am uncertain of all the details. Perhaps ltr can enlighten us on this, presumably with a defense of whatever the current policy is. But there is no question that any idea of the yuan/rmb becoming some sort of serious reserve or global currency is dead in the water as long as any of those restrictions remain in place. The PRC government absolutely faces a choice on this: do they want to maintain various restrictions on capital flows, which we must note certainly provide some economic advantages to the PRC; or do they wish to pursue having the yuan/rmb replace the dollar, or even just become a substantial rival to the USD and the euro, as an international reserve currency.

It should be noted that there are substantial costs for a nation to have its currency be the world’s leading currency, with this something well known for decades. I gave a talk attended by a large group of people in August, 1971 on the eighth floor of the (Seward) Social Science Building at UW-Madison after Nixon made his initial moves to separate the USD from gold and to move to weaken its role as the world currency (although it still is), with at that time, as I explained to the audience, Nixon acting tu upend the poat-WW II international economic system because it was bringing about economic problems for the US , notably a mounting trade deficit especially with crucial rising trade partners due to the high value of the USD that was being maintained the then-existing fixed exchange rate system. Of course, the US would fully move out of the system to let the USD float two years later.

In any case, I can well imagine that while some in the PRC might like the idea of an increasing role for the yuan/rmb in the international financial system, they really are not ready for going whole hog on this, and that maintaining at least for some more time at least some of the restrictions on capital flows they have will continue to seem appealing to them.

https://fred.stlouisfed.org/graph/?g=xcH8

January 15, 2018

Real Narrow Effective Exchange Rate for United States, 1964-2018

(Indexed to 1964)

https://fred.stlouisfed.org/graph/?g=zm3k

January 15, 2018

Real Narrow Effective Exchange Rate * and Net Exports as a share of Gross Domestic Product, 1964-2018

* (Indexed to 1964)

https://fred.stlouisfed.org/graph/?g=sCbZ

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=sCc3

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2019

(Indexed to 1977)

What Chinese development is fundamentally about, the Yuan or domestic currency simply being a tool for that purpose:

http://www.xinhuanet.com/english/2021-01/23/c_139691881.htm

January 23, 2021

China poverty reduction miracle in “wrinkles of Earth”

— More than half a million people living on the southwestern Chinese border have thrown off the shackles of poverty.

— The canyon area of the Nujiang River originating from the Qinghai-Tibet Plateau is one of China’s poorest regions.

— The area has been transformed thanks to a nationwide poverty-relief campaign.

By Wu Xiaoyang, Zhao Jiasong, and Zhao Peiran

KUNMING — More than half a million people living on the southwestern Chinese border have thrown off the shackles of poverty, their ancestors having long been isolated from the rest of the world.

The Nujiang Lisu Autonomous Prefecture in Yunnan Province sits in the Hengduan Mountains. Its fold ranges, dubbed the “wrinkles of the Earth,” were shaped by the most intense plate movements on the planet.

The canyon area of the Nujiang River originating from the Qinghai-Tibet Plateau is one of China’s poorest regions, home to those who make humble livings by farming the land with limited acreage. But now, it has been transformed thanks to a nationwide poverty-relief campaign.

BUILDING LIFELINES …

Chinese financial transactions, from farm to factory to services are generally, likely overwhelmingly, digital transactions. Farmers on a rice or fruit tree cooperative have a ready-made system of accounts and businesses and bank using phones. Digital business possibilities, digital currency transactions, are critical through the Chinese countryside. That digital transactions are recorded is what fish farmers or a rural family with a hopeful guest home available need, let alone fish buyers and guests.

The Yuan is a tool, a development tool, the digital Yuan an advanced tool. That the Chinese should protect such a tool is only reasonable.

On the status of China’s capital controls …

A limit on conversion of rmb to usd by individuals has been maintained at $50,000/yr since 2010. Enforcement has tightened during periods of rmb depreciation and loosened during periods of rmb appreciation, but the regulatory magnitude has remained fixed. With recent rmb appreciation, authorities are considering relaxing the uses for which conversion can be undertaken according to a 19 Feb 2021 piece in Bloomberg linked below. But the attachment to the $50,000 figure doesn’t seem to be in question.

Bloomberg: China Mulls Easing Capital Controls, https://www.bloomberg.com/news/articles/2021-02-19/china-mulls-easing-capital-controls-on-offshore-investments

Thanks, Calla. So they are looking at some relaxation of the current limits, but not looking at ending them. And moving to a digital currency will make it easier to monitor and control the flows rather than moving to a non-monitored free system as one sees with currencies that either are or have been leading reserve currencies, i.e., USD, euro, and UK pound. PRC will have to do more in reducing the controls and developing a digital currency that is used internationally will not move the y/rmb to major international status unless those controls are fully elimnated.

right now, most of the people i know from mainland china are moving capital OUT of the country. those capital controls can stop mass exodus, but it is not very difficult to get $100k out of the country each year. now you may not think that is much, but many of the chinese are also quite patient as well as clever in their efforts. $500k can be moved in about five years. they are not moving out all of their capital, but a significant amount nevertheless. these transactions are not free, and folks seem to be willing to take a 10% tax happily to move the capital.

what should be more concerning is WHY they are moving out their capital. the response i get is they do not TRUST the government, its monetary policy, and possibility of confiscation of assets. this will not change any time soon. the fact that communist party members are a part of this movement speaks volumes. i find it rather difficult to believe that the yuan could become a major international currency while this mentality is maintained in the mainland. once the citizens with means of the nation begin to believe in the yuan, then perhaps the rest of the world will begin to believe. but i have seen this happening for at least the past 7 years.

Calla Wiemer,

Pre-COVID, apartments in Hong Kong were regularly sold to people with baskets (red-white-and-blue striped nylon zipper “Amah bags”) of Rmb worth well over US$50,000. The personal capital controls are a joke; if one can’t move money into or out of China, one simply isn’t trying.

Larger-than-physically-mobile transactions are another matter altogether. In that case, under- and over-invoicing, round-tripping FDI and similar schemes make it extremely easy to move many, many millions without breaking a sweat.

Now, when it comes to moving the currency markets, it’s the options at the margin that do the dirty work.

Since 1994, the Yuan has in real terms been among the strongest currencies in the world. The strength of the Yuan has served China in facilitating trade and international investment. Protection of the currency allowed China to avoid the Asian currencies crises of the late 1990s. Also, protection of the Yuan allowed China to avoid the mistake made by Japan in dramatically increasing the price of the Yen after the Plaza Accord of 1985.

The currency is a development tool for China and so far as I understand there is no prospect of changing the nature of what has been so effective a tool. Using a digital Yuan should in time make for more flexibility and stability in international transactions, and Chinese emphasis on trade and international investment growth makes use of a digital Yuan likely to be increasingly important.

That Chinese currency protections may be other than a “market guy” like Milton Friedman would have cared for, I would argue is precisely what is necessary for persistent Chinese development. The unfortunate currency experience of Japan or Korea or right now a Turkey is understood.

Question to Menzie. This comment sounds like the type of endorsement for pegged exchange rates that we might hear from the likes of Judy Shelton. I’m no expert on Chinese monetary policy so I thought we should seek our host’s reaction to these claims. I’m sure Milton Friedman might have something to say about the alleged need for pegged exchange rates to promote trade.

Interesting. During the Reagan years, the dollar was dramatically managed with the Plaza Accord of 1985. During the Clinton years, the dollar was managed with the Treasury refrain “a strong dollar is in America’s interest. China has in effect allowed the Yuan to strengthen in real terms since 1994. From the time of the Asian currency crises, China both allowed the Yuan to strengthen and made sure stability would be no problem by building international currency reserves. Other Asian countries built reserves from the late 1990s on as well. Korea was not about to lose control of the Won again.

I find no problem with Chinese currency policy.

https://fred.stlouisfed.org/graph/?g=gxkQ

January 15, 2018

Real Broad Effective Exchange Rate for China, Germany, India, Japan and United States, 1994-2020

(Indexed to 1994)

ttps://fred.stlouisfed.org/graph/?g=km1L

January 15, 2018

Real Broad Effective Exchange Rate for China, Japan and Korea, 1994-2018

(Indexed to 1994)

“I find no problem with Chinese currency policy.”

OK, I find many problems with Chinese currency policy. See how easy that was?

You are a consistent apologist for China, with no real objectivity. As a result, only your masters care about your stated opinions. (Of course, they REALLY care.) If this is what you must do to keep your masters happy, I understand, but your effort here is limp. It is simply beside the point to provide links without context and to sing Xi’s praises.

About the business cycle, which was mentioned. Avoiding recessions is important in general and especially so for developing countries, since we find recoveries following recessions even when roughly v shaped do not tend to readily restore pre-recession growth paths. Even Korea took years to recover the pre-recession growth path after the Asian currency crises.

Australia grew with no recession from the early 1990s till now, while China has grown steadily since 1977. The trade relation between Australia and China was an especially important growth foundation for Australia, but is now lessening in importance. China’s high growth has been important, but steady growth as well while the emphasis from here appears to be advancing-technology, environmentally-sound, inclusive growth that is persistent.

China is just now working through the coming 5-year plan.

“Even Korea took years to recover the pre-recession growth path after the Asian currency crises.”

if anything, over the past decade, we learned that a recession caused by a business cycle is different than a recession caused by a financial crisis. you should not mix the two.

ltr,

China’s economy may have grown consistently since 1978 (insert data quality caveat here), but it most certainly has not be smooth. In what my colleague called the “boom, bust, and readjust cycle,” the pace fell from an average 8.9% in 1978-80 to 5.2% in 1981; from 13.1% p.a. in 1983-85 to 8.9% in 1986; and from 11.5% p.a. in 1987-88 to 4% p.a. in 1989-90.

An interesting tax reform idea written published back in July (recently posted on the MNE Tax blog):

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3743202&dgcid=ejournal_htmlemail_tax:law:tax:law:policy:ejournal_abstractlink

A New Corporate Tax

TAX NOTES FEDERAL, JULY 27, 2020

8 Pages

Posted: 8 Feb 2021

Reuven S. Avi-Yonah

University of Michigan Law School

Date Written: July 27, 2020

Abstract

This article will argue that we should tax corporations for the same reason we originally adopted the corporate tax in 1909: to limit the power and regulate the behavior of our largest corporations, which are monopolies or quasi-monopolies that dominate their respective fields and drive their competitors out of business (the best example being Big Tech — that is, Amazon, Apple, Facebook, Google, and Microsoft). But if that is the reason to have a corporate tax, it should have a different structure from the current flat corporate tax of 21 percent. Instead, the tax should be set at zero for normal returns by allowing the expensing of physical capital, but at a sharply progressive rate for supernormal returns (rents).

The entire paper is a bit involved but the idea is intriguing.

i understand off topic, but still a pretty good story for those interested in the market failure in texas recently.

https://www.forbes.com/sites/edhirs/2021/03/02/texas-grid-failure-why-more-heads-need-to-roll/?sh=7e2de15f5093

Please notice that the market failure across Texas had an exception, and that was El Paso:

https://www.texasstandard.org/stories/self-sufficient-and-upgraded-how-el-pasos-electric-grid-weathered-the-storm/

February 18, 2021

‘Self-Sufficient’ And Upgraded: How El Paso’s Electric Grid Weathered The Storm

Not just El Paso but a portion of eastern Texas and the rather large northern part that includes Amarillo. These are the parts of Texas connected to the national grids and not part of the isolated Texas grid. The problems were overwhelmingly in the part not connected to the national grids, which was due to ERCOT not wanting have to follow FERC regulations, which included requirments for having substantial backup capacity to cover such situations.

backups would not have even been needed if you simply demand that energy producers winterize their devices. this was recommended after a similar incident in 2011. surrounding states were able to do so without incurring significant costs. it is doable if once chooses. unfortunately texas chose to remain hands off.

The governor of Texas has done an awful job of leadership here but have no fear – he is now following the Bruce Hall approach to addresses coronavirus. If his leadership continues, Texas is going to have a much smaller population.

Notice the price of natural gas on February 17:

https://fred.stlouisfed.org/graph/?g=rdk0

January 15, 2020

Prices of Oil and Natural Gas, 2020-2021

(Indexed to 2020)

Henry Hub is a futures price for natural gas. Spot prices spiked a lot more:

https://www.bloomberg.com/news/articles/2021-02-17/gas-prices-soar-in-central-u-s-as-cold-paralyzes-production

Oh wait – you found their spot price. I was looking at FRED’s Henry Hub’s future price which rose to $25. I guess I should pay for an advanced version of FRED.

You are a consistent apologist for China, with no real objectivity. As a result, only your masters care about your stated opinions….

[ The words here are obviously meant to be demeaning, frightening and intimidating. I make a point of being polite, but evidently there is a need to be insulting to me; a need to demean and frighten and try to intimidate me. After the administration efforts made these last years at vilifying selected peoples, I do understand the insulting. Please though, try to stop. ]

ltr, i don’t think such words are intended to demean, frighten or intimidate (maybe demean?), even if they are not nice. the real purpose of such words is to bring about a truth which you will not admit. you want to portray an image that you are a simple independent onlooker who sees the world as biased against the chinese, and would like to shed some light on that topic. but we both know that is not truly the case on your part. you are not a simple independent onlooker, are you? i try to be reasonably respectful towards you, if for no other reason than you tend to be quite respectful on this blog for the most part. but to be fair, you cannot be a propaganda machine and then cry foul when somebody calls you on the issue. presenting propaganda in a polite way does not prevent one from receiving criticism. you are not allowed to let the rudeness of the response override the validity of the criticism.

You are a consistent apologist for China, with no real objectivity. As a result, only your masters care about your stated opinions. (Of course, they REALLY care.) If this is what you must do to keep your masters happy, I understand…

[ Using imagery from a racially charged film of 1962 for an insult is especially disturbing, even if the very imagery has been used in the New York Times. Please do stop. ]

Randy Andy (Governor of NY) is getting hammered for inappropriate sexual conduct and generally being a jerk. I guess Trump sycophant Ronny Jackson was not be to outdone for being a jerk and sexual harassment:

https://news.yahoo.com/cnn-pentagon-watchdog-says-ronny-050018134.html

General Walker – commander of the DC National Guard – could have had his people at the Capitol by 2PM on 1/6 but they needed authorization from Trump’s hand picked Sec. of Defense. The request for that authorization went out at 2 but the authorization itself came only at 5:08 PM.

Why the 3 hour delay? Likely because the Sec. of Defense saw his job as kissing Trump’s rear end and we know Trump was in the White House partying as his terrorists were ripping up to the Capitol.

Yet Trump sycophants like Bruce Hall and Princeton Steve wonder why their cheering on the garbage from Trump upsets people like me. Go figure.

This may be foolish thinking, but…

A matter I do not quite understand, but is possibly relevant and important, is the repeated and increasing United States use of financial sanctions for several years. Jeffrey Sachs explained that the technology company Huawei was accused by the US of dealing with Iran against sanctions. The result was the US petitioned arrest of a financial officer of Huawei who happened to be travelling though Canada to China. So a Chinese company could supposedly be penalized for and prevented from trading with a US sanctioned country. I would “guess” a fully digital currency would protect against unilateral sanctions being enforced through SWIFT.

This may be foolish thinking, but…

[ No, not foolish thinking but the use of country sanctions these last years naturally leading to a concern for completing international transactions without the need to go through SWIFT. *

* https://en.wikipedia.org/wiki/Society_for_Worldwide_Interbank_Financial_Telecommunication ]

https://finance.yahoo.com/news/u-yields-resurgent-inflation-expectations-171038508.html

Is there some point to this? OK the 5-year measure of expected inflation is now 2.5%. It was 2.5% in 2013 according to the link you provided. Excuse me but I do not recall any episode of high inflation for the period since 1980 (40 years ago).

“U.S. Inflation Expectations Hit Decade High as Yields Resurge”

Yahoo/finance is a quick useful tool for information on publicly traded companies but this title is not only dumb in its alarmist tone but also factually incorrect. Like 2013 was not 10 years ago.

One would think that an important consultant like Princeton Steve would have noticed this error. But may not!

Sorry I do not consult yahoo/finance for insights on macroeconomics.

Following up on the main theme and some comments by SK and ltr, I note another reason why even if PRC gets digital currency established and functioning well as well as outright eliminating cross-border capital controls it will probably be a long time before it can become the world’s leading currency, with it at a minimum needing to pass the US in nominal GDP terms, although if current trends hold that will probably come to pass fairly soon.

There is simply a large amount of momentum and inertia in this matter of currency usage, especially in terms of what major central banks hold as reserves. They are very slow to change those, so even at the maximum performance by the Chinese economy and financial system, it will be decades before it really seriously can challenge the USD, and probably will also take quite awhile before it displaces the euro in second place. This is one of those seriously lagging indicators. The UK pound continues to be a non-trivial central bank reserve currency, even though it is more than a century since it lost its top spot in the world economy in terms of real GDP. And gold continues to be held in substantial quantities although it as not had an official role backing any currency for nearly a half century now. This is something that changes only very slowly.

What China wants is being “East Asia’s” reserve currency and to end the dollar as the global reserve currency giving them that regional control. The U.S. Should give up globalist agenda and put on capital controls for a North American empire instead.

If we give up on Asia, who is going to assemble your next iPhone? And I hope you realize where your clothes and shoes are manufactured. It ain’t exactly some sweat shop in New Jersey.

…but to be fair, you cannot be a propaganda machine…

[ No matter how polite I am, no matter how I ask not to be bullied, no matter how I ask not to be demeaned and frightened, the need is to demean and frighten and try to intimidate me. How repeatedly shocking and how saddening. I will however go on writing just as I wish and just as I understand a matter. I am always afraid to write a word now, but I will go on and dismiss being afraid. I will continue boldly as I can.

Please though, now and then, try to think about and understand the prejudice that has been fostered these past several years. ]

ltr, that is not being bullied or frightened. you did exactly what i said you do. rather than address the criticism itself, you find something else to distract from the criticism. you do not want to address the real items.

i made an accusation against you. it was not bullying, demeaning or frightening.

“you want to portray an image that you are a simple independent onlooker who sees the world as biased against the chinese, and would like to shed some light on that topic. but we both know that is not truly the case on your part. you are not a simple independent onlooker, are you? ”

you did not address this with an answer. please provide an honest answer. i consider dishonest answers bullying and demeaning. are you a simple independent onlooker?

As for China, the intent is development; the intent is mutual development so far as partner countries and China repeatedly expressly explains hegemony is never to be an objective. The point of currency policy in China is general development, and looking to currency problems encountered by developing countries in the past the progress China has made is impressive indeed. Paul Krugman and Joseph Stiglitz watched and sought to assist when Argentina adopted a self-destructive currency policy in the 1990s. Stiglitz was even personally attacked by a prominent Harvard economist for working against the IMF to reshape Argentine policy. The matter is important, very important, and the need is for China to continue be forward looking and adept at currency policy.

https://fred.stlouisfed.org/graph/?g=o3Zh

January 15, 2018

Inflation Expectation and Inflation, 2007-2021

https://fred.stlouisfed.org/graph/?g=mjbD

January 15, 2018

5-Year, 5-Year Forward Inflation Expectation Rate, 2007-2021

Bruce Hall

March 3, 2021 at 3:19 pm

Damn! Bruce Hall finally read one of his own links to the end! Progress. But he sort of confirmed my point – Bruce is all in on Zuckerberg spying on us just so it is not someone from China doing the spying. Hey Bruce – Zuckerberg is married to some chick named Chen. So may he is letting someone from China spy on you. But that does not bother the village idiot Bruce Hall!

Mr Kopits,

China hasn’t got proper checks on its military? Have you looked at PLA representation on the Politburo or in the Central Committee? There are repeated cases of the PLA rising and falling in representation, which is exactly what one might expect in a single-party dictatorship with proper checks on the armed forces.

Mao purged the army; Deng purged the army; Jiang purged the army; and Xi purged the army. If the PLA is threatening Taiwan or the South China Sea, that’s CCP policy; it isn’t the rogue actions of field commanders out of control.

As for the Rmb as a reserve currency, I believe we already dealt with that further up the comment chain: as long as it requires a significant loss of actual power over economic outcomes, it ain’t gonna happen on Xi’s watch. You may think that’s dumb, and it may be. But, what it most certainly is NOT is a lack of proper checks.

As for the balance of evidence that COVID-19 is Chinese lab stuff, well trot out at least a shred of evidence.