Monthly GDP figures were released by IHS-Markit today, showing a rebound in April. In the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

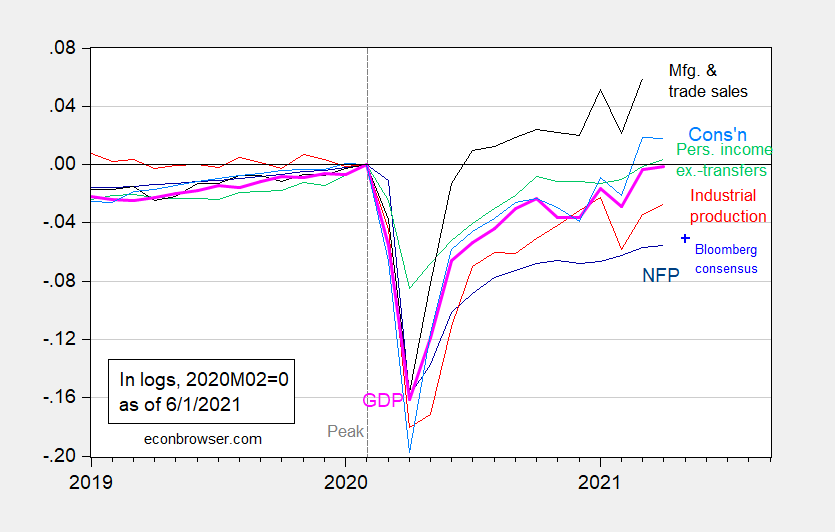

Figure 1: Nonfarm payroll employment from March release (dark blue), Bloomberg consensus as of 6/1 for May nonfarm payroll employment (light blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (6/1/2021 release), NBER, and author’s calculations.

The monthly GDP is only slightly below peak levels recorded in 2020M02. For a comparison against the official (2nd release) figure and the current IHS-Markit (formerly Macroeconomic Advisers) nowcast, see the below figure.

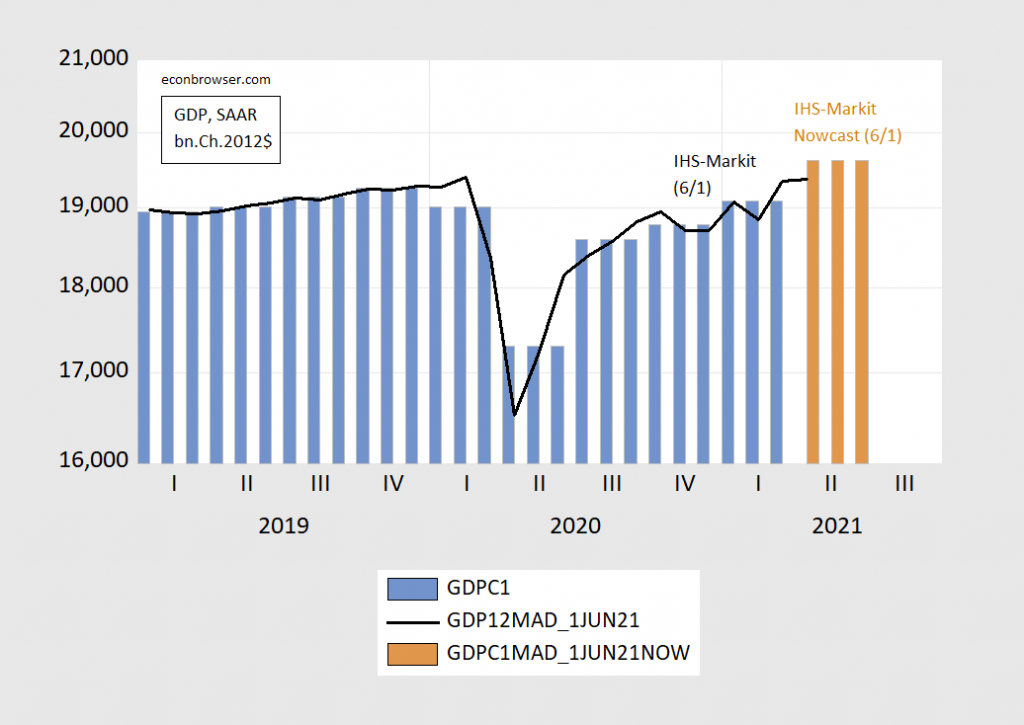

Figure 2: GDP from advance release (blue bar), IHS-Markit monthly GDP (black line), and IHS-Markit nowcast of 6/1 (brown bar). Source: BEA 2021Q1 2nd release, IHS-Markit.

https://www.nytimes.com/2021/06/01/business/coronavirus-global-shortages.html

June 1, 2021

How the World Ran Out of Everything

Global shortages of many goods reflect the disruption of the pandemic combined with decades of companies limiting their inventories.

By Peter S. Goodman and Niraj Chokshi

In the story of how the modern world was constructed, Toyota stands out as the mastermind of a monumental advance in industrial efficiency. The Japanese automaker pioneered so-called Just In Time manufacturing, in which parts are delivered to factories right as they are required, minimizing the need to stockpile them.

Over the last half-century, this approach has captivated global business in industries far beyond autos. From fashion to food processing to pharmaceuticals, companies have embraced Just In Time to stay nimble, allowing them to adapt to changing market demands, while cutting costs.

But the tumultuous events of the past year have challenged the merits of paring inventories, while reinvigorating concerns that some industries have gone too far, leaving them vulnerable to disruption. As the pandemic has hampered factory operations and sown chaos in global shipping, many economies around the world have been bedeviled by shortages of a vast range of goods — from electronics to lumber to clothing.

In a time of extraordinary upheaval in the global economy, Just In Time is running late.

“It’s sort of like supply chain run amok,” said Willy C. Shih, an international trade expert at Harvard Business School. “In a race to get to the lowest cost, I have concentrated my risk. We are at the logical conclusion of all that.”

The most prominent manifestation of too much reliance on Just in Time is found in the very industry that invented it: Automakers have been crippled by a shortage of computer chips — vital car components produced mostly in Asia. Without enough chips on hand, auto factories from India to the United States to Brazil have been forced to halt assembly lines.

But the breadth and persistence of the shortages reveal the extent to which the Just in Time idea has come to dominate commercial life. This helps explain why Nike and other apparel brands struggle to stock retail outlets with their wares. It’s one of the reasons construction companies are having trouble purchasing paints and sealants. It was a principal contributor to the tragic shortages of personal protective equipment early in the pandemic, which left frontline medical workers without adequate gear.

Just In Time has amounted to no less than a revolution in the business world. By keeping inventories thin, major retailers have been able to use more of their space to display a wider array of goods. Just In Time has enabled manufacturers to customize their wares. And lean production has significantly cut costs while allowing companies to pivot quickly to new products.

These virtues have added value to companies, spurred innovation and promoted trade, ensuring that Just In Time will retain its force long after the current crisis abates. The approach has also enriched shareholders by generating savings that companies have distributed in the form of dividends and share buybacks.

Still, the shortages raise questions about whether some companies have been too aggressive in harvesting savings by slashing inventory, leaving them unprepared for whatever trouble inevitably emerges….

The following is a perfect example of the mind boggling insanity of Bruce “no relationship to Robert” Hall who on the one hand whines about chip shortages in the auto sector and on the other hand insists Just in Time is the only logical way to run inventory policy. Yes – Bruce that mixed up on everything!

*******

In a time of extraordinary upheaval in the global economy, Just In Time is running late.

“It’s sort of like supply chain run amok,” said Willy C. Shih, an international trade expert at Harvard Business School. “In a race to get to the lowest cost, I have concentrated my risk. We are at the logical conclusion of all that.”

The most prominent manifestation of too much reliance on Just in Time is found in the very industry that invented it: Automakers have been crippled by a shortage of computer chips — vital car components produced mostly in Asia. Without enough chips on hand, auto factories from India to the United States to Brazil have been forced to halt assembly lines.

It is Junior MBA syndrome run amok. Slash, stab, and push off everything until there’s nothing left to work with. Oh, well. The pendulum will swing back too far the other way.

this is part of the reason some argue that management salary should have some component related to company ownership, and have that locked up for some time-think the vesting concept. it is easier to make cuts than grow earnings in the short term. i don’t think they learn the concept of growing earnings well enough coming out of school. in the long run, it takes an entrepreneurial mindset rather than a cost control mindset.

I think Menzie has a high degree of respect for IHS Markit, which seems appropriate. I sometimes wonder what makes IHS-Markit so special?? I mean they are pretty damned good at what they do. I guess it’s nothing anymore “mysterious” than Goldman’s Sachs success—just a continual drive and magnetizing the most talented folks to your “salon shop”?? I guess. One thinks of Drexel and debt trading waaaaaaay back in the day. Bear Stearns before the egos got out of control. Yeah, maybe someday someone will write a book about IHS-Markit.. Might be interesting. I just wanted to present a semi- intelligent daydream for exhibit before I get sauced tonight. That was therapeutic, [ insert guffaw guffaw here ]

As opposed to Goldman’s Flute success. OK, I can see I’m making this proper name spelling nightmare become worse. Quitting while I’m behind. Mork signing off.

Moses Herzog: Macroeconomic Advisers was set up by Larry Meyer, formerly a professor economics at Washington U., w/MIT PhD, who also served as a Fed governor. Its work had a good reputation in the USG when I was there. Investment bank/commercial bank research departments can be excellent in terms of their analysis, but they might have biases in their analyses (despite Chinese Walls).

The Republican spin machine is all in for keeping something called GILTI, which was part of Trump’s tax cut for rich people. Not only did the 2017 tax deform lower the corporate tax rate to only 21% – certain income (Global Intangible Low Tax Income) gets taxed at half of that. Biden rightfully wants to scale back this blatant tax dodge.

Now as you read this intellectual right wing garbage from the PACE Coalition, keep in mind PACE is a collection of usual suspects from the business community who lobby for every special interest break they can find.

https://keeppace.us/pace-coalition-responds-to-biden-administrations-proposal-to-increase-gilti-rate/

I saw this intellectual garbage on LinkedIn which does not surprise me as LinkedIn attracts a lot of folks who kiss up to corporate America. I would have added a comment noting how GILTI applies to affiliates abroad so their crapola about costing American jobs and domestic investment is how do I say – a LIE. But it seems the comment box has this message:

‘There was an error, please refresh the page’

LinkedIn has cut off critical comments it seems. Go figure!

“onerous tax changes” Pbthbth!

And don’t they realize by now that the obligatory “America’s job creators” has become self-parody? Yertle McConnell and his co-conspirators has kinda ruined it for everyone else

http://www.xinhuanet.com/english/2021-06/02/c_139984888.htm

June 2, 2021

Over 681 mln COVID-19 vaccine doses administered across China

BEIJING — Over 681.9 million doses of COVID-19 vaccines had been administered across China as of Tuesday, the National Health Commission said Wednesday.

[ Five Chinese vaccines are being administered domestically at a rate of 20 million doses daily. Another 350 million Chinese vaccine doses have been distributed internationally. ]

And yet no statement from our re efficacy. Yep – you are not being exactly honest on this issue. Surprise, surprise!

From PACE’s utter BS:

“The Administration’s proposal to increase the GILTI rate and make other onerous tax changes to how the minimum tax is calculated means fewer American jobs, less domestic investment and economic growth, and higher prices for consumers. The proposed change will significantly increase the tax burden on globally engaged American companies, making it harder to compete abroad with foreign competitors that are not subject to a similar level of taxation. This proposal puts the 71 million American jobs that depend on globally engaged American companies at risk at a time when policymakers should be working to accelerate economic growth in the wake of the pandemic. Simply put: The Biden Administration’s proposal to raise taxes on America’s job creators is the wrong approach, and we urge them to forgo these plans.”

Keep in mind that GILTI applies to income created by foreign based affiliates hiring foreign workers not American workers. OK – they are a few American workers supporting this tax give away – international tax attorneys and Big Four accountants. Any one that thinks PACE cares about blue collar US workers is beyond dumb.

https://news.yahoo.com/suspect-arrested-sucker-punch-asian-162200656.html

Shocking video from China Town in Manhattan. A 50 plus Asian lady just walking down the street when some thug who should have been in jail sucker punches this lady hard. Yea – he is now in jail. Do not release this punk.

China has administered 681.9 million coronavirus vaccine doses domestically, and the vaccines have proven completely effective. Twenty million doses of 5 Chinese vaccines are now being administered daily in China. Additionally, 350 million doses of Chinese vaccines have been distributed internationally. The World Health Organization has approved 2 Chinese vaccines. Separately, a range of countries have approved a Chinese vaccine. Presidents and Prime Ministers repeatedly express gratitude.

Chinese vaccines are saving lives and preserving and protecting health, and recipients understand and are grateful:

http://www.xinhuanet.com/english/2021-05/31/c_139981227.htm

“proven completely effective”

Since “completely” means 100%, we know that’s a crock. No vaccine is 100% effective. Should we let your masters in Beijing know that you’re starting to slip a little bit?

The known efficacy rates for this vaccine are not anyway close to 100%. Some say the rate is barely over 50%. ltr is publishing state sponsored lies.

ltr, exactly what does “proven completely effective” mean?

i agree with another commenter on the blog. i suppose you cannot stop ltr from directly posting propaganda, but i would certainly maintain a position that no links to chinese propaganda sites are permitted on the site. just a recommendation, to keep from spreading too much misinformation.

‘The China-developed vaccines have showed reliability that “no one could have expected in difficult times and circumstances,” Serbian Prime Minister Ana Brnabic said at the reception of the latest batch of Chinese vaccines last week.’

Brnabic has less credibility than Donald Trump. I guess when Rudy Giuliani is done making ads for My Pillow, he too can promote China’s vaccine.

“Separately, a range of countries have approved a Chinese vaccine. Presidents and Prime Ministers repeatedly express gratitude.”

Approving a vaccine is a legal process, this does not necessarily require prove of efficacy. And whether some presidents kiss the ass of the Chinese government does not add any scientific quality. Got it?

Hint: I grew up next to a socialistic state which peoduced propaganda, which was of much higher quality than the nonsense you offer. Therefore, spare me such BS. You have still to lean a lot to come even close to the TV propaganda program “Der schwarze Kanal” by Karl Eduard von Schnitzler. :-))