Looks like this:

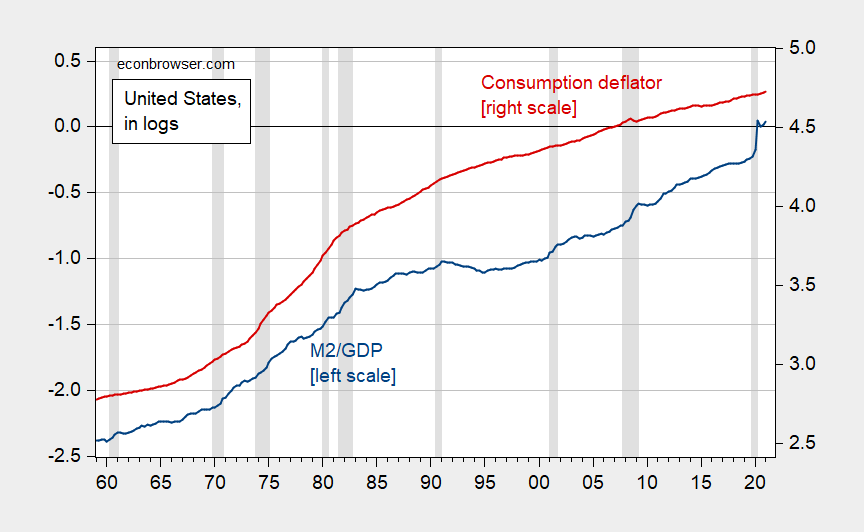

Figure 1: M2 to real GDP ratio (blue, left scale), and Personal Consumption Expenditure deflator, 2012=100 (red, right scale). NBER defined recession dates shaded gray, assumes last trough at 2020Q2. Source: Federal Reserve via FRED, BEA, NBER and author’s calculations.

As noted in this December post, the explanatory power of the M2 to GDP ratio is essentially zero for the price level at the year horizon.

In logs, the relationship appears similarly tenuous.

Figure 2: M2 to real GDP log ratio (blue, left scale), and log Personal Consumption Expenditure deflator, 2012=100 (red, right scale). NBER defined recession dates shaded gray, assumes last trough at 2020Q2. Source: Federal Reserve via FRED, BEA, NBER and author’s calculations.

For an examination of the instability of the quantity theory coefficients, see Sargent and Surico (2011), written in the wake of post-Great Recession quantitative easing.

I’ll take an extra large swig of alcohol later tonight, personally dedicated to anyone who can tell me who’s Twitter feed I found this paper in.

https://www.ssc.wisc.edu/~nwilliam/swz_hyper.pdf

HINT: Not Barkley Rosser’s Twitter feed, but still a kind of personal shame for me.

*whose Twitter feed

—Excuse me, I promise I never did that on a chalkboard/whiteboard in China. You DO believe me, right??

Answer coming at midnight and or when I get sleepy, whichever comes last. Can you feel the tension building?? My neighbor’s dog just barked…… obviously everyone’s nerves are on end to know this.

John “Grumpy Economist” Cuckrant’s twitter feed

Nobody will find anything on my twitter feed because I do not have one, shame on me.

When twitter first came out I got an account which seemed like a total waste. I did get a few tweets from some dude in Europe updating me on the Tour de France but otherwise I just stopped paying attention.

Did you understand what they wrote. Let’s try the opening:

We infer determinants of Latin American hyperinflations and stabilizations by using the method of maximum likelihood to estimate a hidden Markov

model that assigns roles both to fundamentals in the form of government deficits that are financed by money creation and to destabilizing expectations dynamics that can occasionally divorce inflation from fundamentals.

This is a lot like the Cochrane comment you mocked. Then again he likely read that Sargent and Wallace paper the authors referenced.

Sargent, T. J., and N. Wallace (1987): “Inflation and the Government Budget Constraint,” in Economic Policy in Theory and Practice, ed. by A. Razin, and E. Sadka, pp. 170–200. St. Martin’s Press, New York, New York

This follows their Unpleasant Monetarist Arithmetic paper which put forth the same long-run government budget constraint Menzie and I noted in defense of Menzie’s focus on the real (not nominal) interest rate. I only mention this because Macroduck had trouble with this issue under another post. Maybe I suggest people actually READ the relevant literature.

In the other comment section, you made no mention of this. So it’s a bit misleading to suggest I “had trouble with it”. The literature you mention is larger than anyone can read, which is why links and references are so useful.

But then, you spend so much time bad-mouthing other commenters, perhaps you are to busy for useful discussion. The id needs what the id needs, I guess.

And I think that in your eagerness to sound smart, you actually misunderstood my question about Menzie’s comment. You’d rather grandstand than clarify.

And you still haven’t clarified, or provided a link so that I can discover whether you were addressing my point or some other point you mistook for mine. And before you assign me the task of figuring out which of the many, many of Menzie’s posts you mean, I’ll remind you this is not a classroom and there is no expectation that everyone has read everything posted here.

But you go ahead and get your jollies pretending to be important n the grand arena of this comment section.

Ever see Mel Gibson’s “Fatman”. I like it a lot although most would probably view it as B-movie fodder. Watch it and tell me if the character of Billy Wenan reminds you of pgl’s behavior on this blog.

My my, macroduck, you are really getting into your Junior Moses Herzog routine. Watch it, I am the only Junior around here.

As it is, since you evoked the recent thread where you and pgl were disagreeing about what matters among interest rates, when Menzie weighed in, it was to correct you for denigrating the importance of real interest rates. A bit silly of you to come on all self-righteious here on this thread, although Mr. Nice Guy Moses I am sure appreciates your desire to emulate and follow him.

Oh my – the literature is too much for you to digest. Nominal v. real is too foreign for you to grasp? Excuse me but now you sound like Princeton Steve. OK – Sargent and Wallace’s 1981 Unpleasant Monetarist Arithmetic is a classic that I have mentioned many times. Since you see me as your RA.

md,

Although, frankly, I do not think you deserve it, I shall make a substantive reply to your point in the other thread.

It is true that in a hard sense all we really know for sure are nominal interest rates at a given point in time for various securities of various types and time horizons. There is no definitive measure of real interest rates because there are so many completing measures of the inflation rate, not to mention of expected inflation.

That said, economic agents presumably do look at the current set of nominal interest rates as well as their perception of what the inflatino rate is, not to mention their own expectations of the future of it, and make decisions on this basis rather than simply the nominal rates because they have no idea what future inflation might be. Engaging in the latter may be what many agents do, but those agents are, sorry, stupid.

I also have a serious question for you, “macroduck”: By far the worst person on this blog for calling other people insulting names is “Moses Herzog,” way worse than pgl or even me. Why do you fail to mention his insults, but instead basically follow his abysmal and awful conduct? What is your problem? Why are you so effed up? You mostly make intelligent remars here, but right now you are kind of in a toilet somewhere. I suggest you get out of it and stay out.

@ macroduck

I think Menzie at least appreciate alternative views, or even just different angles of looking at something (which I for one appreciate you doing, because it often takes my mind on another tangent of thinking which I find edifying for myself) Others are more interested in sideswipes. I just don’t know what is the problem in presenting the links/literature and let it go at that. I mean I like clashing swords here on the blog, but continually is where it kind of wears a person out. It’s like some Hollywood films and the F-word, they get to the 30th f-bomb in the first 4 minutes of the film, and I’m like “Who in the world talks like this?? People living at a home in New Jersey 2 blocks away from the chemical plant??” Who are these people??

“Why have we written this paper now? For most of the last 25 years, the quantity theory of money has been sleeping, but during the last year, unprecedented growth in leading central banks’ balance sheets has prompted some of us to worry because the quantity theory has slept before, only to reawaken.”

So they are saying the Quantity Theory of Money failed during the Volcker and following years because we kept Volcker style monetary policy. And now we are seeing March 2010 on the calendar with QE to fight the Great Recession, they predicted that the Quantity Theory would reawake with inflation taking off. The prediction ranks up there with the 1999 book called DOW 36000.

I’m not making any kind of any argument here, this is actually just an earnest question, asked in very much layman’s terminology. If QE is mostly used when the predominant fear is disinflation (other factors keep prices “stuck in place” or slightly lowering), couldn’t we argue that some, perhaps a significant portion, of the inflationary effects of QE are “hiding” in the data, amongst the context of the other factors holding prices down?? Kind of like running a large fan directly into a semi-strong wind??

Yes. We have been in a disinflationary regime for some time. How much effect QE would have in other regimes is an open question, but also academic unless we enter a new regime.

Not that there is anything wrong with academic questions. They are just lower stress than questions about current policy and conditions.

Appreciate the reply. I can imagine some people going “well, yeah, obviously”, but I don’t know….. I just like to ask these questions intermittently to see if I’m as psycho as I sometimes feel I am. It seems like (on the factors hiding the effect of QE, not my psychoness) that it might be larger than some people think~~but I really have no idea, which is why I asked.

Listening to Mastodon’s “Remission” album right now, really nice after just a small can of drinky. I just noticed this album came out around 2002. That would have been my first year in China or at the beginning of my 2nd year in China. Wow. I didn’t even know about Mastodon back then, that is so weird to think about…….. I could have used this album for my mind back then. I think my Chinese neighbors in the teacher’s dorm did not like the live version of Immigrant’s Song or a London SYmphony orchestra Version of Stravisnky’s “Rite of Spring”, and on volume level 11 or something. I have no idea why that bothered them so much in a every echo-prone building. Weird……

Actually I did that during the October National Holiday when 98% of the teachers are out of the building, just screwing with you guys trying to make you laugh. Although I did that a FEW time on the weekend in regular term. Also fun……

Moses,

What? You screw with us guys in order to make us laugh? Well, LOL! And I thought you were doing it to put some of us into our rightful shameful places, although I suppose it has all been for the purpose of making those not being put into their places laugh. So again, LOL!

http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

February 25, 2015

Monetarism in Winter

By Paul Krugman

Brad DeLong is writing about “cognitive closure” on the right, and focuses on the case of Allan Meltzer, * the long-time monetarist standard-bearer and co-founder of the Shadow Open Market Committee. ** Meltzer has been predicting inflation, just around the corner, for six years; the experience apparently has had no impact on his conviction that he understands the economy better than the Federal Reserve. And he considers it rude and unprofessional when some of us point out how wrong he has been for how long.

But there’s one thing that struck me in particular about the last entry *** in Brad’s bill of particulars, where Meltzer says this:

“The Fed’s third major error is its baffling inattention to the growth of monetary and credit aggregates. Central banks supply the raw material on which financial markets build the credit and money magnitudes. The reason given for neglecting these aggregates is usually a claim they are unstable. That is true only, if at all, of quarterly values. It is not true of medium- and longer-term values, as many researchers have shown.”

I’m not sure what Meltzer is saying here, exactly. Surely the claim is not so much that the aggregates are unstable as that the relationship between those aggregates and variables of interest — like inflation — is unstable. Now, where might the Fed have gotten that idea? Maybe from this:

[Graph]

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable. Once upon a time Milton Friedman called for slow, steady growth in M2 as the key to a stable economy; surely you can’t think that makes sense given developments since the mid-1980s.

But here we have Meltzer insisting that the Fed is making a terrible mistake by not worrying about monetary aggregates, and complaining bitterly about those who question whether, given his track record, he has any authority to lecture the Fed. It’s really very sad.

* http://www.bradford-delong.com/2015/02/five-years-ago-meltzer-on-inflation-econtalk-library-of-economics-and-liberty.html

** http://en.wikipedia.org/wiki/Shadow_Open_Market_Committee

*** http://www.economics21.org/commentary/allan-meltzer-fed-reserve-financial-crisis-2015-02-05

https://fred.stlouisfed.org/graph/?g=BkzA

February 25, 2015

Velocity of M2 money stock, * 1960-2014

* http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable.

Paul Krugman

The notion that inflation results from “too much money chasing too few goods” (poor man’s monetarism) requires that money chase goods. Since around late 1997, the share of money chasing goods appears to have slowed: https://fred.stlouisfed.org/series/M2V

And there’s the question of “too few goods”. Imports have largely prevented this condition (except during tariff spats) since the late 1990s: https://fred.stlouisfed.org/series/BOPBM

Lately, consumers have more or less resumed third pace of spending after a slowdown:https://fred.stlouisfed.org/series/PCEC96 but haven’t made up for lost spending, so money is still not chasing all that hard.

So in the non-pandemic scheme of things, too much chasing too few hasn’t been a good description of reality.

In the pandemic scheme of things, we have too few goods. Cars, lumber, food, plastic, homes, furniture, chicken, paper goods all in short supply and so is the labor to transport goods: https://www.federalreserve.gov/monetarypolicy/beigebook202104.htm

It is an open question whether labor in general is in short supply or there is simply too little money chasing labor. The Beige Book says the pace of input cost rise is faster than the cost of rise in final goods, which would naturally lead to wage restraint, but the Beige Book reports what business contacts say, which may introduce a bias.

In the past, Fed officials have expressed reluctance ( to put it mildly) to ease in response to supply interruptions. This time is different. That’s probably because other problems outweigh inflationary concerns from supply disruptions and because the disruptions are likely to be transitory.

Pretty reasonable on this one, macroduck. You have not completely lost it, despite my poking at you.

Dear Folks,

Just two points.

1) For the conservatives, it will always be 1979, when money growth and inflation went hand in hand. We would need an explanation of why “this time is different” beyond banks trying to keep what to some might seem excess reserves.

2) For there to be continuous inflation, there would have to be a continuing rise in wages, which would support the continuous rise in prices. There will probably be some increase in wages, as a jump, but it is something else altogether to believe it will continue indefinitely.

J.

well, i am one to admit when i am wrong. i wrongly stated that trump’s new web page would be hacked and shut down in short order, because it would be a bright target with limited security. i was wrong. the site shut down because a lack of interest and traffic. apparently even the hackers could not find, or were not interested, in the commentary of the orange blight. i hate being wrong. the hacking story would have been much more fun.

https://www.cnbc.com/2021/06/02/trump-blog-page-shuts-down-for-good.html