The S&P 500 dropped 1.3% on Friday; many accounts attributed the drop to Fed statements indicating an accelerated pace of rate hikes (especially Bullard’s comment), presumably in response to prospects for higher than previously anticipated inflation. Interestingly, market indicators on Friday are not supportive of that interpretation.

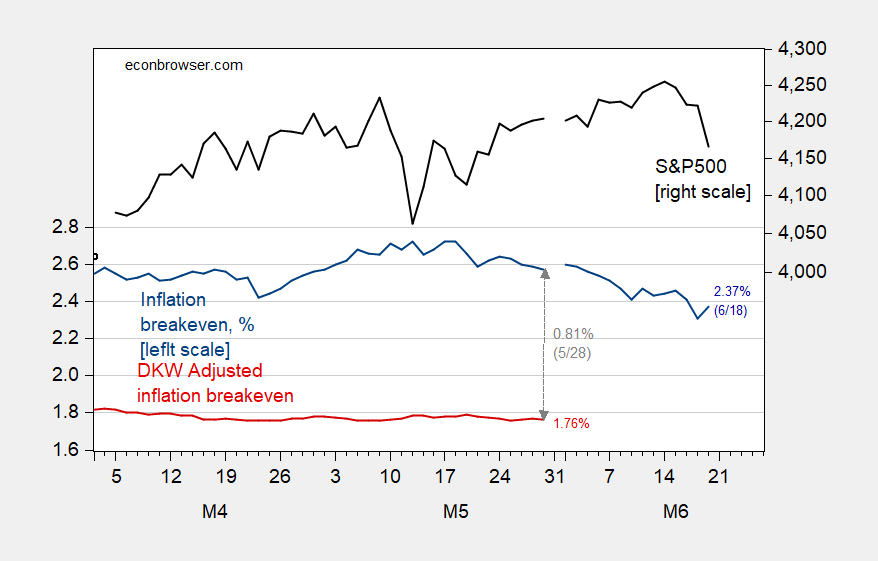

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %; and S&P 500 index (black, right log scale). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 6/4, and author’s calculations.

From 6/15 to 6/18, the five year breakeven drops from 2.46% to 2.37%, However, we know that changes in the inflation risk premium and the TIPS liquidity premium can lead to measurement error in expected inflation derived from the simple breakeven calculation.

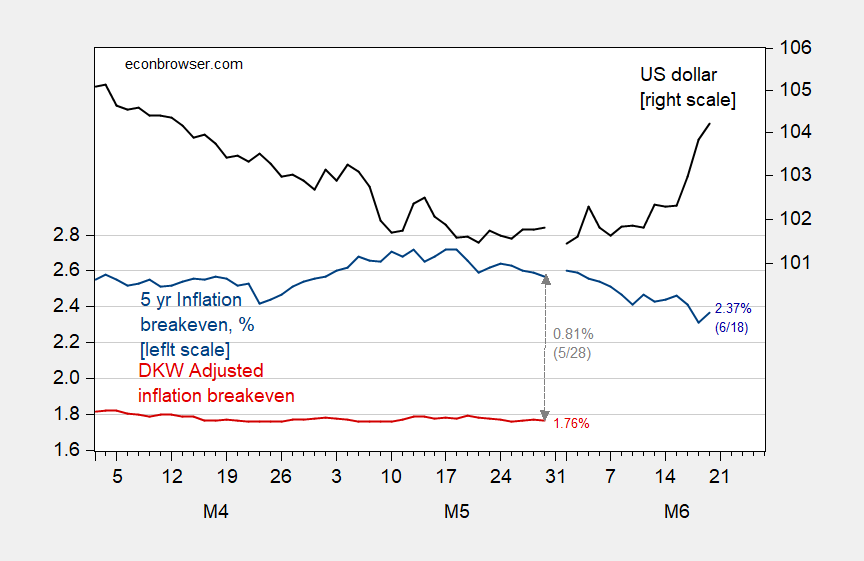

Interestingly, the US dollar appreciates, suggesting that the forex market takes seriously a monetary tightening (regardless of inflation expectations) that increases the real interest rate (five year TIPS rises from -1.67% to -1.48% from 6/15 to 6/18).

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %; and Fed nominal value of dollar index against advanced economy currencies, 2006M01=100 (black, right log scale); spliced to DXY index 6/11-6/18. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 6/4, and author’s calculations.

Hence, the news appears not to be indications of higher inflation (which for previous CPI releases seems to have a relatively small effect), but rather FOMC member inclinations toward raising rates earlier rather than later (it’s also possible the market believes the Fed has inside information regarding inflation).

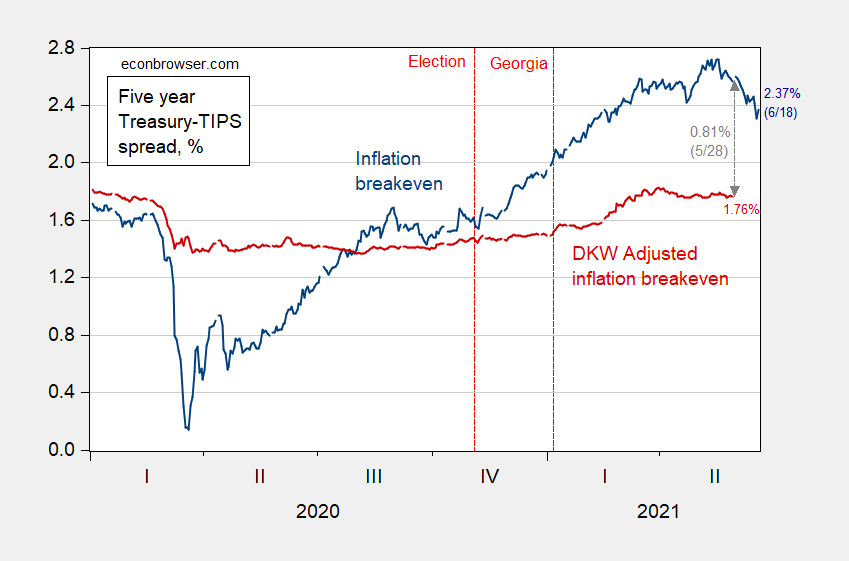

Just to put into perspective current inflation expectations, adjusting for estimated inflation risk and liquidity premia, here’s a reprise of the data from 2019 onward.

Figure 3: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW, all in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 6/4, and author’s calculations.

Hmmm. I am skeptical of the apparent change of mind by Jim Bullard that inflation may persist more into next year than he had been saying earlier this year, but it is clear the markets know that he carries a lot of weight at the Fed as I have repeatedly said here, for better or worse.

It is curious in the discussion of his remarks that he does not seem to say why he has changed his mind or which prices are those he thinks will keep rising and not slow down as the clearly temporary supply shortages get taken care of as this year proceeds. My suspicion is that it is tied to what he says at the end of his remarks where he focuses on the housing market and also hinting at where we might see a tighter Fed policy, the housing market and him saying that perhaps the Fed should slow the purchase of MBSs as they seem to be firing up a hot housing market perhaps excessively. So maybe it is the housing sector where he sees a heightened danger of inflationary persistence.

If people are worried about asset inflation, then slowing down the mbs purchases would be a reasonable approach. Leave fed rates alone, however.

baffling,

I agree with you and Jim that whenever they shift policy, a reduction of MBS purchases, looks like the place to start.

@ Menzie

Please classify this question as my sometimes poor reading skills than any error in your post. You are not saying the market drop was a market reaction “misinterpretive” of Fed policy, but that the specific inflation indicators (DKW and subset data thereof) indicate that market participants’ (or more specifically media accounts’) interpretation of the Fed move as indicatory of higher long-term inflation is wrong. (???)

Menzie does not own the NBER but we see Moses has decided to emulate Econned’s laziness at providing proper references to papers. And I bet this troll will also emulate Econned’s temper tantrums as well!

Five Facts about the UIP Premium by Ṣebnem Kalemli-Özcan & Liliana Varela

https://www.nber.org/papers/w28923

@ pgl

At least you don’t overreact to things much (in some kind of, eh, emotional way). So you’ve got.that going for you.

Have you sent Menzie your pamphlet “How To Do a Key Word Search for Recently Uploaded NBER Working Papers” so he doesn’t feel too intimidated using the site??

Wow – Econned should give 5 stars to your endorsement of his arrogant laziness!

I do appreciate the free rent… it’s incredibly spacious!!!

Moses Herzog: Market drop could be due to (1) solely news that Fed officials contemplate sooner rate hikes, or (2) Fed has inside information that inflation is higher than market believes, or (3) combination. Dollar appreciation suggests tightening rather than higher inflation news.

@ Menzie Thanks. Appreciate the reply. Especially the #3 as it gives me some insight I didn’t have before. I was reading something recently, and I scan a bunch of stuff in recent days so It’s hard to remember the source, but for the most part I try to keep it to high quality source material/publications, and they said that they thought the increase in the value of the dollar hurts some economies (mainly emerging market) because they have to borrow in dollars.

Lots of central banks are increasing rates, and WSJ says (my paraphrase) that this kinda puts U.S. Federal Reserve in a difficult position because they don’t want to repeat “taper tantrum” but also they still have to eye inflation. So the main signaling from Fed here seems to be “Yes, we will raise rates, but it will be ‘methodical’ “.

Another thing I think bears saying. Powell is trying to continue a “new tradition” (can I say those to words together??} Arguably started by Bernanke, of transparency and honestly with the public on Fed moves. I actually have mixed feelings on this, because I think Fed moves can be more “powerful” (have a grander effect) when the Fed keeps its poker hand close to its suit blazer. But I pretty strongly lean to Fed transparency doing more good than harm. This observation about Powell continuing Bernanke’s transparency (in this “new tradition”) may seem obvious, but I think it’s wholesome and healthy to the system, and that Powell (who I am not a fan of generally) should be recognized by the public and praised for this transparency.

Or, it could be the result of options expiration after a period of relative market calm. Calm markets lead to long gamma strategies in options. Expiration leads to offloading of long gamma trades, which amounts to offloading of the underlying asset. Sometimes, it ain’t about economics or the cost of carry.

I’ve long wanted to meet the person who explains the market’s behavior to us every night on the news. Who is this person? Is s/he a descendant of Freud or Jung?

I suspect that the unidentified person is female because of its infallible intuition. Does she occupy an office on the same floor as Dear Abby? Was she the one who informed us that it was Putin that brought down that hapless power plant in Vermont? I mean, why Vermont? Does Putin have something against Bernie?

So many questions, so few answers. Is she on retainer to the rich and powerful? Did she regularly advise the generals in Afghanistan that they had just turned the corner? Did she ever mention how many corners there are in Afghanistan?

If she rents out her services, why doesn’t she tell us why the dollar behaved the way it did last week? Or Brent crude?

And is she available to help me with those confounded tea leaves that for all I can figure, are just taking a random swirl every morning in my tea cup.

HIs name is Lou Dobbs. OK – Lou Dobbs is a carnival barker but this latest tirade from you tells me you are his alter ego.

At least we know that this market know-it-all isn’t pgl. Otherwise he would have known that Dobbs got cancelled months ago!

Pointless as always. And you double down on the pointlessness!!!

Some handsome and debonair man, also has a relatively new paper up on NBER, and this wild, coastal, ocean surfing kinda guy, also has something up over on Youtube. Now, personally, I think only people of very questionable character (“questionable” here in its most derogatory implication) congregate on Youtube. But I refuse to judge people, unless I can judge them anonymously, in which case, they are all disgusting.

https://www.youtube.com/watch?v=Rraaep1mV8U

https://econweb.ucsd.edu/~jhamilto/H1.pdf

My advice is to ignore this guy, unless you want lots of deep knowledge about Economics and life from an affable and friendly guy, in which case, hey, it’s your life.

https://www.multpl.com/shiller-pe

June 19, 2021

Valuation

The Shiller 10-year price earnings ratio * is currently 36.95 so the inverse or the earnings rate is 2.71%. The dividend yield is 1.38%. So an expected yearly return over the coming 10 years would be 2.71 + 1.38 or 4.09% provided the price earnings ratio stays the same and before investment costs.

Against the 4.09% yearly expected return on stock over the coming 10 years, the current 10-year Treasury bond yield is 1.45%.

The risk premium for stocks is 4.09 – 1.45 or 2.64%.

* https://en.wikipedia.org/wiki/Cyclically_adjusted_price-to-earnings_ratio

The cyclically adjusted price-to-earnings ratio, commonly known as CAPE or Shiller P/E 10 ratio, is a valuation measure usually applied to the US S&P 500 equity market. It is defined as price divided by the average of ten years of earnings (moving average), adjusted for inflation.

I like your comment here. Related to high PE ratio—separate from anything Shiller is doing, just a general market number, High market PE ratio has been a pet peeve of mine for along time. Back int the 1980s the rule of thumb was anything above 15 was starting to get too high. Of course these are different times and that has been thrown out the window. Maybe it’s the German segment of my DNA, but the fact hardly anyone cares about this metric in the year 2021 and many years prior gets under my skin in a major way.

Technology growth stocks started to appear in the late 90s and continue to be rather dominant features of the market through today. P/E ratios in the traditional sense do not make much sense with these stocks. By those measures, stocks like amazon are way overvalued and should not be owned. Amazon is a case study in how the traditional P/E ratio aint what it used to be. The market has changed fundamentally, as companies seem able to grow much faster than two decades ago.

Amazon has an incredibly high P/E but that does not necessarily mean it is overvalued. One has to take into account expected future earnings. Aswath Damodaran wrote a marvelous book called the Dark Side of Valuation about 20 years ago.

yes, growth in technology seems to appear much faster compared to a couple of decades ago. overvalued becomes undervalued in about 6 months, rather than a couple of years now. the reverse, loss of growth (and contraction) also occurs much faster. the problem with expected future earnings, is that it is very hard to predict accurately.

my biggest stock failures have not been from tech stocks imploding. they have come from more established companies who simply fell behind technology, and could never catch up again to justify any valuation.

https://twitter.com/paulkrugman/status/1406245614770343943

Paul Krugman @paulkrugman

So, while I was away the case for inflation panic died. Or actually the cases, plural. For these past few months there have been two inflation stories, both crucially requiring a key failure on the part of the Federal Reserve. Now we know both stories are wrong 1/

9:40 AM · Jun 19, 2021

Story #1 said that the Fed’s intellectual framework — which makes a key distinction between volatile commodity prices and inertial “core” inflation — was all wrong, and that things like soaring lumber prices were harbingers, not transitory shocks 2/

Timberrrrrr! (Spot lumber prices) 3/

https://pbs.twimg.com/media/E4P9l4OXoAY-yud?format=jpg&name=small

Excellent Council of Economic Advisers post explaining why supply-chain problems look temporary 4/

https://pbs.twimg.com/card_img/1405552932586655745/eOmjDnyT?format=png&name=small

Why the Pandemic Has Disrupted Supply Chains | The White House

By Susan Helper and Evan Soltas

These are times of rapid transition for the U.S. economy. With the winding down of the worst of the pandemic, businesses have added jobs at a rate of 540,000 per month…

https://www.whitehouse.gov/cea/blog/2021/06/17/why-the-pandemic-has-disrupted-supply-chains/

The other inflation story was that the economy would overheat as a result of big fiscal stimulus, and that the Fed — dead set on maximizing employment — would ignore the warning signs and let inflation get embedded. 5/

But last week’s Federal Open Market Committee statement plus the “dot plot”, while not extremely hawkish, suggested an institution aware that inflation might become a risk and willing to act if necessary 6/

https://www.federalreserve.gov/newsevents/pressreleases/monetary20210616a.htm

Federal Reserve issues FOMC statement

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment

I never expected the supply-chain issues to be more than transitory, or the Fed to be irresponsible. But if you were worried about either possibility, this past week should have reassured you. Runaway inflation isn’t coming 7/

http://www.xinhuanet.com/english/2021-06/17/c_1310014035.htm

June 17, 2021

China to further release metal reserves to ease commodity price hikes

BEIJING — China will further release its state reserves of copper, aluminum and zinc to ensure stable prices of commodities and ease cost pressure on firms, the country’s top economic planner said Thursday.

The National Development and Reform Commission will work with other departments to release the nonferrous metal reserves in multiple batches as needed in light of market price changes, said Meng Wei, a spokesperson with the commission.

The National Food and Strategic Reserves Administration on Wednesday announced that it would release national reserves of copper, aluminum and zinc via public bidding.

The release will be open to nonferrous metal processing and manufacturing enterprises, and small and medium-sized enterprises will be favored in participating in the bidding, Meng said.

The commission has taken various measures to rein in market speculation and correct the overly high commodity prices, Meng said, adding that price declines have been seen in commodities including iron ore, steel and copper.

Chinese authorities recently unveiled a slew of measures to ensure a solid market supply of staple goods together with price stability….

I’m hoping Krugman goes beyond his twitter parade on this issue of timber prices. His graph on soft lumber prices paints a very different picture from this June 10 story by Fortune:

https://fortune.com/2021/06/10/lumber-prices-2021-chart-price-of-lumber-production-wood-supply-costs-update-june/

Not that I trust Fortune to get the data right but Krugman’s graph is not exactly sourced. I’ve tried to find it using Google searches but alas I have not. If someone else could tell us what Krugman is using as a source for his graph, that would be appreciated.

https://www.nasdaq.com/market-activity/commodities/lbs

June 18, 2021

Lumber

Well one can look at this for the last few weeks and go wow – prices fell from 1500 to 900. But click on the 5 year window and see they used to be around 300. So what’s the time perspective matters a lot.

https://fred.stlouisfed.org/graph/?g=CTYW

January 15, 2018

Producer Price Index for lumber, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=EfqG

January 15, 2018

Producer Price Indexes for lumber and wood pulp, 2007-2021

(Percent change)

I appreciate that you pointed out FRED has this index of lumber prices but why express it in percentage changes when the discussion was on levels:

https://fred.stlouisfed.org/series/WPU081

Now for May 2021 prices were still very high but I suspect they have been falling in the last few weeks. FRED will report on June numbers shortly.

If one compares this lumber price index over the period from Jan. 1994 to Dec. 2019, it is interesting that it shows a bit of volatility but the nominal price rose by a mere 4% over this 26 year period. So we started with really low real timber prices.

This pandemic seem to be the only time that lumber has had a bit of a challenge in keeping stable prices during a crisis. They are probably the best example of capitalism and supply/demand forces working the way they are supposed to. Trees can be left to grow or harvested a year or two early, depending on demand. And saw mills can be mothballed or reactivated fairly quickly to adjust supply. Even the trained workforce is somewhat flexible because you can attract back previous or retired workers with increased wages – and many current workers will be willing to earn a lot of money working long days/weeks knowing that you got to take it when its there.

Another specific fact about the plywood industry in particular is that it has quite a lot of cooperatives in it, which tend to be much better at managing ups and downs of demand without constantly laying off and then rehiring workers. They are better at “sharing the pain” when demand is lower than usual.

https://news.cgtn.com/news/2021-06-20/Bernie-Sanders-to-Washington-Don-t-start-a-Cold-War-with-China-11eQSPAPdGo/index.html

June 20, 2021

Bernie Sanders to U.S. establishment: Don’t start a Cold War with China

U.S. Senator Bernie Sanders warned the political establishment in Washington against casting China as an “existential threat” to the United States and urged it not to start a new Cold War with China on Thursday.

In his opinion piece * for Foreign Affairs, “Washington’s Dangerous New Consensus on China,” Sanders wrote that it is “distressing and dangerous” to see what he called a fast-growing consensus in the U.S. establishment to view the U.S.- China relationship as a zero-sum economic and military struggle.

“The prevalence of this view will create a political environment in which the cooperation that the world desperately needs will be increasingly difficult to achieve,” he said in the article.

Listing the unprecedented global challenges that the U.S. faces today as climate change, pandemics, nuclear proliferation, massive economic inequality, terrorism and corruption, Sanders called them shared global challenges that require improved international cooperation, including with China.

He said the growing bipartisan push for a confrontation with China will “deflect attention from the shared common interests the two countries have in combating truly existential threats such as climate change, pandemics and the destruction that a nuclear war would bring.”

Sanders, chairman of the Senate Budget Committee, accused some politicians and representatives of the U.S. military-industrial complex of using the establishment’s beating of the drums for a new Cold War as the last pretext for larger and larger defense budgets.

“Americans must resist the temptation to try to forge national unity through hostility and fear,” said the independent of Vermont who caucuses with the Democrats and ran unsuccessfully for the party’s presidential nomination in 2016 and 2020….

* https://www.foreignaffairs.com/articles/china/2021-06-17/washingtons-dangerous-new-consensus-china

These comments by Bernie look mostly reasonable. It is true that there is a kind of bipartisan feeding frenzy going on in the US over China that is getting somewhat out of hand.

But I must also note to ltr, to repeat slightly differently a point I have made recently here, that it is not just the US where this sort of reaction to China and Chinese policy is going on. It is happening in many European nations, many nearby nations, including most recently the Philippines, and elsewhere. I have even seen analysis claiming that one reason the Biden-Putin summit seems to have gone as well as it did, with Putin saying highly complimentary things about Biden, is that he is pulling back a bit from the great new Chinese alliance he has going, although that is still mostly going to continue to be going.

Anyway, I am not going to list the various things the Chinese leaders are now doing that are getting so many of these nationa’s leaders upset, but it is not all just a bunch of political swag in the US. There are several of these that they could make moves on to improve relations with others that would not involve them being all embarrassed or shamed or whatever. They could easily make some moves that would ease world tensions. Biden would be open. Xi needs to make some moves now aside from having people like ltr bragging about their indeed successful space program (and I do not know why China was kept off the international space station, now a curious item).

https://news.cgtn.com/news/2021-06-20/Over-1-billion-doses-of-COVID-19-vaccines-administered-in-China-11fkZm1666k/index.html

June 20, 2021

Over 1 billion doses of COVID-19 vaccines administered in China

More than 1 billion doses of COVID-19 vaccines have been administered across China as of Saturday, the National Health Commission (NHC) said Sunday.

China accelerated its pace of free COVID-19 vaccinations for the whole nation since late March. The country hit the landmark figure of 100 million vaccinations on March 27.

The vaccination rate spiraled further to hit 200 million on April 20. The pace of inoculation kept speeding up with 300 million jabs on May 7, 500 million on May 23 and 1 billion on June 19.

https://news.cgtn.com/news/2021-06-20/Over-1-billion-doses-of-COVID-19-vaccines-administered-in-China-11fkZm1666k/img/e4b063ff7a994495b9e7bfa317cde320/e4b063ff7a994495b9e7bfa317cde320.png

At present, the country is conducting clinical trials for 21 COVID-19 vaccine candidates. While four vaccines have been granted conditional marketing approval, three have been authorized for emergency use in the country.

China’s nationwide vaccination campaign is open to people aged over 18. The country has also approved the emergency use of domestic inactivated vaccines on people aged 3 to 17. Detailed policies will be formulated for the immunization of this age group based on the specific COVID-19 situation….

I thought the story about Credit Suisse cutting off ties with SoftBank was interesting. Is something to be “read into” this as it relates to SoftBank’s solvency?? I’ve always been amazed at the amount of capital SoftBank has been able to raise for so many deals. It has a smell to it if you ask me. And I’m wondering which other banks are “exposed” to SoftBank’s deals?? If you stop and think about it, SoftBank’s credit set-up has some similarities to the picture of some of donald trump’s real estate arrangements before the orange creature went bankrupt.

If I was a shareholder in a bank, and I read statements that said that bank had major exposure to SoftBank I would be asking a lot of questions right now.

WSJ’s Margot Patrick and Phred Dvorak: “HIs other share-based lenders include Nomura Holdings Inc, UBS Group AG, and Mizuho Financial Group Inc, according to filings

I would trust Mr Son with my investment funds about as much as I would trust him to make a long golf putt in a heavy rainstorm.

More from WSJ: “In March 2020, the proportion of Mr. Son’s SoftBank holding’s pledged as collateral grew as high as 72%, as SoftBank’s share price plummeted and banks called for more collateral.”

Although no new leader (largely figurehead in many ways) is going to get rid of the Iranian terrorist militias and other innumerable Iran based problems, I’m hopeful they will announce Hemmati was the winner of the Iranian Presidential elections. Iranians are more literate than they get credit for, and I think they have the smarts to elect Hemmati, who is the obvious superior choice. If nothing else, a Hemmati vote signals to Iran’s real extremist religious leaders that citizens are paying attention and know where they want to go.

So much for that.

https://www.theguardian.com/commentisfree/2021/jun/20/iran-elections-president-elect-ebrahim-raisi

Hemmati came in third. I have a long post on the election on Econospeak. Juan Cole also has useful comments on it, with me adding to that post from his very well informed remarks.

I shall note one item from his comments. Rouhani is in for another six weeks. Cole thinks Khamenei wants Rouhani to cut the JCPOA renewal during that time so that if anything goes wrong, he can be blamed, while Raisi can get the credit for any economic upswing that results.

@ Barkley Rosser

It’s the type of theory that seems interesting when you read it, but I’ll be very surprised if Khamenei cuts the JCPOA (certainly under Rouhani, and really in general). If they were going to cut it, they would have signaled that awhile back. It’s not their style. It’s the type of thing someone writes when they’re desperate for blog clicks/visits.

Khamenei is many bad things, but he’s not dumb (similar to Qaddafi, an a number 1 psycho, but smart). He knows anything they build Israel is going to blow up and incinerate anyway, so why lose economic benefits for something that turns into ash, cinders, and radioactive waste?? Even religious extremists have their limits on ineptitude.

Oh dear, Moses, this is one of the most incoherent, stupid, and ignorant posts I have ever seen you put up here. I understand that you do not wish to ever read Econospeak, but you really should not make such barely comprehensible comments here without having done so. I understand that you like to pretend that I and my wife are nobodies, but in fact we have defined for official comparative economic systems the nature of the Iranian economic system, a matter only briefly discussed near the end of the Econospeak post.

Indeed, the late Paul Samuelson once declared that what was most important for him was writing the defining textbooks, which he did for the Principles of the Economics in the late 40s, that version basically dominating until somewhere in the 80s when the not-so-obviously superior Mankiw text took over.

So for the last couple of decades people studying to become state department/foreign ministry or intel people in nations all over the world have been reading the dominant textbook in comparative economic systems. My wife, Marina, and I , are the authors of that book, out from MIT Press in 2018 in its latest edition. We defined the nature of the Iranian economy in our first edition over a quarter of a century ago. That is described briefly near the end of my long Econospeak post you refuse to tead.

So, boy, if you wish to drool all over yourself here making barely coherent comments on Iran without having actually read my post on Econospeak, well, sorry, we already know that you are a horrid horrid person, and this time I am not adding a joke emoji. That is what you are, very deeply. Really.

I will add here why it has taken so long to get the JCPOA renewed, even when both Biden and Khamenei want it to be.

The problem is that both nations are now out of compliance with it. The US was the first to do so under Trump in 2018. For a year the Iranians continued to adhere to it, hoping that the Europeans would either ignore Trump’s demand that follow his economic sanctions (he threatened European companies dealing with Iran with not being able to do business in the US, and he got away with it) or that they would convince Trump to back off. But Trump did not.

So in 2019 a year after Trump removed the US from the agreement and reimposed economic sanctions that seriously tanked the Iranian economy, the Iranians then moved to violate the agreement by among other things enriching uranium to 60% (90% is weapons grade) rather than the allowed 3.75%, aomong other things.

So there is this sticky wicket of timing: who goes first to get back into the agreement. Over on A?ngry Bear a commenter has said the US should go first since we left the agreement first, and I agree with that in principle. But the hard political reality is, that with many in the US not supporting Biden on even getting back into the agreement, he is under pressure not to look like he is caving or being weak with them, with the Iranians in a similar situation, especially given that indeed Khamenei has made a lot of negative statements about the deal, despite it being very clear that indeed he wants the sanctions to end and knows they must get back into the deal to get that.

So there has been this big delay while talks have gone on and on. But I think Cole may be right (and he knows more about Iran than I do) that for Khamenei and the Iranians, this is the obvious window to do the deal. Maybe it will not happen, but it clearly is a matter of finally getting the order of who does what when and in what order. I imagine they already basically have it agreed to, but the Iranians were holding back partly because of the election. But now that is over, so time to cut the deal and go home. We shall see.

https://twitter.com/paulkrugman/status/1406237371419566086

Paul Krugman @paulkrugman

Zach Carter has a characteristically fascinating article on Milton Friedman and his fading legacy. Somehow I never appreciated how Friedman started from right-wing politics, and built a reputation as a technical economist to serve that cause 1/

https://newrepublic.com/article/162623/milton-friedman-legacy-biden-government-spending

The End of Friedmanomics

The famed economist’s theories were embraced by Beltway power brokers in both parties. Finally, a Democratic president is turning the page on a legacy of ruin.

9:08 AM · Jun 19, 2021

Carter talks about the declining influence of Friedman’s economic doctrines, but maybe I can add a little, having done some of this myself and also having watched macro evolve over 40 years 2/ https://nybooks.com/articles/2007/02/15/who-was-milton-friedman/

Monetarism — the claim that monetary aggregates like M1 or M2 drive the economy, and that stabilizing them is all policy needs to do — is dead, and should never have had the influence it did. 3/

James Tobin was right in 1970: to the extent that there was a correlation between monetary aggregates and GDP (there hasn’t been much of one in recent decades), Friedman had the causation reversed 4/ https://cowles.yale.edu/sites/default/files/files/pub/d02/d0283.pdf

I am surprised that Krugman so fully bought this article lock, stock, and barrel. It admits but glosses over Friedman’s early years in the 30s and through WW II when he worked on various New Deal policies. He was known principally as an econometrician and not a policy-oriented economist. When the University of Wisconsin-Madison refused to rehire in 1941 after one year, an episode not mentioned in the article, part of that was shameful anti-Semitism, but a lot of it was opposition by institutionalist economists in the department who did not like quantitative analysis such as the statistics that Friedman was teaching.

The later parts of the article are mostly reasonable, and it may be that when in 1946 Friedman went to Chicago he had long really been their follower due to a masters degree from Simons et al. But prior to 1946 there really is no sign of any of this. The basic claim that Krugman repeats that Friedman started out in right wing politics and this drove his economics is simply not supported, and the article even identifies a number of leftist positions he took before and during the war. If anything, the article provides data to believe it went the other way, that his later right wing politics followed his shift to strongly pro-laissez faire economics that basically happened in 1946.

http://www.xinhuanet.com/english/2021-06/18/c_1310014181.htm

June 18, 2021

China-built tallest skyscraper in Africa topped out in Egypt’s new capital

By Xu Supei and Wu Danni

CAIRO — With a commanding view of the modern buildings sprouting up in the central business district (CBD) of Egypt’s new administrative capital, guests from China and Egypt on Thursday held a topping-out ceremony for the 385-meter-high Iconic Tower, which will be the tallest building in Africa upon completion.

“This is the most important building in modern Egypt, which marks the latest achievement of our country,” Egyptian Minister of Housing, Utilities and Urban Communities Essam el-Gazzar said at the ceremony.

The Iconic Tower, whose construction started on May 2, 2018, is a composite high-rise building integrating office, hotel, business, sightseeing and other functions. It covers a total area of 65,000 square meters, with two floors underground and 78 floors above ground.

Being built some 50 km east of the Egyptian capital Cairo, the Iconic Tower is the most striking skyscraper of the CBD project being built by the China State Construction Engineering Corporation (CSCEC). With a total area of around 505,000 square meters, the CBD project includes 20 new high-rise buildings and some municipal projects.

Egyptian and Chinese guests, including workers, engineers, owners and officials, joyfully took selfies with the landmark building during the ceremony.

“Since the construction of the tower’s core tube started in April 2019, workers and engineers have been working around the clock to finish the project,” Hossam Berry, structural manager of the DAR Supervision Company in Egypt, expressed deep gratitude to the CSCEC.

The tower’s core tube “has been constructed at the fastest speed of one floor every four days, and finally climbed to the top today,” Wei Jianxun, general manager of the Iconic Tower project, told Xinhua.

In late February, the Iconic Tower’s base, built with about 18,500 cubic meters of concrete and 5,000 tons of reinforced iron bars, was completed with a 38-hour non-stop operation, which was hailed by Egyptian Prime Minister Mostafa Madbouly as “a miracle by all means.”

“We have joined hands with Egypt to maintain the work momentum amid COVID-19,” said Chang Weicai, general manager of CSCEC Egypt, explaining that the construction of the project has been continuing without any disruption despite the raging COVID-19 pandemic since early last year.

“Our employees will take the capping as a new start, and continue to build the most beautiful urban skyline in the Middle East under strict precautionary measures,” Chang said.

The Iconic Tower is emblematic of the friendship between Egypt and China, as it has provided opportunities to Chinese and Egyptian engineers for exchanging their experiences on modern construction methods, he said.

Egypt’s new administrative capital is designed to relocate major governmental institutions from the increasingly congested and overpopulated capital of Cairo, which is home to about one-fifth of the country’s 100 million population.

The Egyptian government also expects the new capital, whose inauguration is expected to be held at the end of this year, to create around 2 million job opportunities….

https://fred.stlouisfed.org/graph/?g=E5xM

August 4, 2014

Real per capita Gross Domestic Product for China, Turkey, Egypt and Saudi Arabia, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=E5xR

August 4, 2014

Real per capita Gross Domestic Product for China, Turkey, Egypt and Saudi Arabia, 1977-2019

(Indexed to 1977)