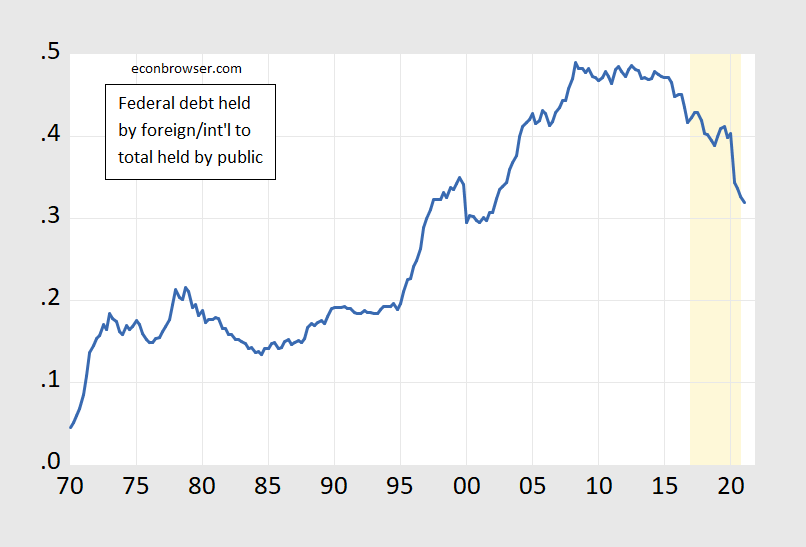

As a share of debt held by the public (i.e., excluding intragovernmental holdings).

Figure 1: US Federal debt held by foreign & international investors as share of Federal debt held by public. Source: FRED and author’s calculations.

The recent decline in the ratio arises due to the large increase in total debt held by the public (held by the public includes Fed holdings).

If I am understanding correctly, the most recent amount of China Government holdings of U.S. government debt is about $1.1 Trillion vs $1.24 Trillion it held at the end of 2015. Doesn’t seem like a drastic drop. Happy to be corrected if I got those figures wrong. Some people might try to peddle the idea that drop in the graph was due to China dumping treasuries, which may have been subtext of Menzie’s finishing sentence.

WSJ had a recent article saying foreign demand for U.S. Government bonds is quite strong, which may put pressure on rates to lower in the near, intermediate term.

https://youtu.be/BcGEBhiV1a4?t=98

Atlanta Hawks LOSE at home in Atlanta, by 16. No word yet on if Trae Young is taking Stephen A. Smith’s advice on how to get his girlfriend to be the “ideal” quiet NBA wife.

Trae Young had three missed 3-pointers and 4 turnovers. Great point guard, just like Russell Westbrook is a great point guard for his teams. With a .472 winning percentage with the Wizards this year it’s hard to imagine why Houston traded Westbrook.

I was watching Minions tonight. Great cartoon. I learned more about basketball watching Minions than I do watching commentary of people who say things just to push reactionary idiots’ buttons. But there’s enough of them in the NYC area to consume that garbage, so I guess it pays well.

Trae is scoring 29 points a game and making 10 assists a game but he has not rejected Embid’s slam dunks or defended a very impressive bench performance from the number one seed so he has to be the worst player ever. Oh wait – I’m replying to the worst basketball analyst ever. Silly me.

@ pgl

Yes, Trae Young scored 28 points in Game 3, and what did I say about that??—before posting the Ben Simmons video, I posted before both Tuesday’s game and Friday night’s game, which you, the “basketball expert”, somehow with that “brain” of yours turned Ben Simmons highlights into a “Celtics game”. I told you that winging up 3-pointers and hogging the ball at the top of the key, and scoring 35 points with 5 assists is not how a point guard plays, that’s a how a 2-guard (shooting guard) plays. You can’t play that way and lead your team as a point guard. But you, the “basketball expert”, would hear nothing of it.

https://www.espn.com/nba/story/_/id/31615814/ben-simmons-goes-attack-half-lead-philadelphia-76ers-game-3-rout

According to data compiled by ESPN Stats & Information, Simmons ended the game guarding Young 42 out of 85 plays.

I have some more sad news for our resident “basketball expert” and Stephen A. Smith fanboy. When your function on the court is to play point guard, and you need roughly 120 points to win most games, 8 assists and flailing up threes near halfcourt, is not gonna do it. But you keep believing that if it makes you feel good inside I don’t want to ruin your fantasyland you got going there with a small piece of reality. I certainly am hopeful that does not make me a “KKK” for telling you this fact.

You do get that I stopped reading your long winded garbage a long time ago. But I guess you think quantity eclipses quality when it comes to “analysis”.

Fox and Friends have selected Uncle Moses to be their sports reporter. His top story this morning will be how the Utah Jazz is done because they lost to the Clippers last night. And of course this was due to Donovan Mitchell playing poorly and not finishing the game. After all Uncles Moses has basketball confused with the French Open. Of course his audience does not know basketball is a team game and that single elimination is not the rule. Neither does Uncles Moses.

But his lead story will be how Denmark lost to Finland in that soccer match yesterday. And Uncle Moses blames Christian Eriksen for not finishing the game. Uncle Moses is that kind of guy!

https://www.msn.com/en-us/sports/more-sports/analysis-soccer-denmark-can-hold-heads-high-despite-finland-defeat/ar-AAKZ0Q4?ocid=uxbndlbing

“scoring 35 points with 5 assists is not how a point guard plays”

About to watch the Nets play so I decided to see what you claimed v. what the box score claimed. Trae was getting 10-11 assists but yea he only got 8 assists Friday night. He is not getting 35 points a game but I wish he would. Of course I respect the 76ers bench and defense. But I also know you keep writing the same old lie over and over again. Moses – you not only suck at basketball but you are a Sarah Palin type – pointless liar. Why you insist on lying about this one player is a mystery. Did your wife leave you for him or what?

https://fred.stlouisfed.org/graph/?g=v1Nn

January 30, 2018

Federal Government Debt held by public, foreign & international investors and Federal Reserve Banks as shares of Gross Domestic Product, 1970-2021

https://fred.stlouisfed.org/graph/?g=u5AA

January 30, 2018

Federal Government Debt held by public, foreign & international investors and Federal Reserve Banks as shares of Gross Domestic Product, 2007-2021

https://www.nytimes.com/2021/06/12/business/private-equity-taxes.html

June 12, 2021

Private Inequity: How a Powerful Industry Conquered the Tax System

The I.R.S. almost never audits private equity firms, even as whistle-blowers have filed claims alleging illegal tax avoidance.

By Jesse Drucker and Danny Hakim

There were two weeks left in the Trump administration when the Treasury Department handed down a set of rules governing an obscure corner of the tax code.

Overseen by a senior Treasury official whose previous job involved helping the wealthy avoid taxes, the new regulations represented a major victory for private equity firms. They ensured that executives in the $4.5 trillion industry, whose leaders often measure their yearly pay in eight or nine figures, could avoid paying hundreds of millions in taxes.

The rules were approved on Jan. 5, the day before the riot at the U.S. Capitol. Hardly anyone noticed.

The Trump administration’s farewell gift to the buyout industry was part of a pattern that has spanned Republican and Democratic presidencies and Congresses: Private equity has conquered the American tax system.

The industry has perfected sleight-of-hand tax-avoidance strategies so aggressive that at least three private equity officials have alerted the Internal Revenue Service to potentially illegal tactics, according to people with direct knowledge of the claims and documents reviewed by The New York Times. The previously unreported whistle-blower claims involved tax dodges at dozens of private equity firms.

But the I.R.S., its staff hollowed out after years of budget cuts, has thrown up its hands when it comes to policing the politically powerful industry….

https://www.nytimes.com/2021/06/11/opinion/economic-nationalism-biden-trump-trade.html

June 11, 2021

Wonking Out: Economic nationalism, Biden style

By Paul Krugman

If you’re under 50, you probably don’t remember when Japan was going to take over the world. But in the late 1980s and early 1990s, many people were obsessed with Japan’s economic success and feared American decline. The supposedly nonfiction sections of airport bookstores were filled with volumes featuring samurai warriors on their covers, promising to teach you the secrets of Japanese management. Michael Crichton had a best-selling novel, “Rising Sun,” about the looming threat of Japanese domination, before he moved on to dinosaurs.

The policy side of Japanophilia/Japanophobia took the form of widespread calls for a national industrial policy: Government spending and maybe protectionism to foster industries of the future, notably semiconductor production.

Then Japan largely disappeared from America’s conversation — cited, if at all, as a cautionary tale of economic stagnation and lost decades. And we entered an era of self-satisfied arrogance, buoyed by the dominance of U.S.-based technology companies.

Now the truth is that Japan’s failures have, in their own way, been overhyped as much as the country’s previous successes. The island nation remains wealthy and technologically sophisticated; its slow economic growth mainly reflects low fertility and immigration, which have led to a shrinking working-age population. Adjusting for demography, the economies of Japan and the United States have grown at about the same rate over the past 30 years:

https://static01.nyt.com/images/2021/06/11/opinion/krugman110621_1/krugman110621_1-jumbo.png?quality=90&auto=webp

Japan has done better than you think.

In any case, however, we seem to be entering a new era of worries about the role of the United States in the world economy, this time driven by fears of China. And we’re hearing new calls for industrial policy. I have to admit that I’m not entirely persuaded by these calls. But the rationales for government action are a lot smarter this time around than they were in the 1980s — and, of course, immensely smarter than the economic nationalism of the Trump era, which they superficially resemble.

Which brings me to the 250-page report on supply chains that the Biden-Harris administration released a few days ago. This was one of those reports that may turn out to be important, even though few people will read it. Why? Because it offers a sort of intellectual template for policy-making; when legislation and rules are being drafted, that report and its analysis will be lurking in the background, helping to shape details of spending and regulations.

Now, the world economy has changed a lot since the days when American executives were trying to reinvent themselves as samurai. Countries used to make things like cars and airplanes; nowadays they make parts of things, which are combined with other parts of things that are made in other countries and eventually assembled into something consumers want. The classic — and at this point somewhat tired — example is the iPhone, assembled in China from bits and pieces from all over. Last year’s World Development Report from the World Bank, obviously written prepandemic, was devoted to global value chains and had a nice alternative example: bicycles.

https://static01.nyt.com/images/2021/06/11/opinion/krugman110621_3/krugman110621_3-jumbo.png?quality=90&auto=webp

Spinning globalization.

I’m a bit surprised, by the way, to learn that Japan and Singapore have so much of the market for pedals and cranks. I thought America really led the world in cranks (charlatans, too).

Anyway, the World Bank offers a measure of the global value chaininess of world trade — the share of exports that cross at least two borders on the way to their final buyers:

https://static01.nyt.com/images/2021/06/11/opinion/krugman110621_5/krugman110621_5-jumbo.png?quality=90&auto=webp

Global value chaininess on the rise.

This measure shows that the big growth of globe-spanning supply chains isn’t new; in fact, it took place mostly between 1988 and 2008. But the dangers associated with fragmented production have been highlighted by recent events….

https://fred.stlouisfed.org/graph/?g=EFtX

January 30, 2018

Real Gross Domestic Product of Working Age Population * for United States and Japan, 1994-2021

* Aged 15 to 64

(Indexed to 1994)

https://news.cgtn.com/news/2021-06-12/China-s-Jan-May-foreign-direct-investment-up-35-4–1129VsJjQoE/index.html

June 12, 2021

Jan-May: Foreign investment to China jump by 35.4%

Foreign direct investment into China surged by 35.4 percent year on year to 481 billion yuan ($75.2 billion) in the first five months of 2021, official data showed on Saturday.

Foreign investment in the service industry came in at 381.9 billion yuan during the period, up 41.6 percent year on year, the Ministry of Commerce data showed. Foreign investment inflows to the high-tech industry grew by 34.6 percent in the first five months.

In terms of source, investment from countries along the Belt and Road Initiative and Association of Southeast Asian Nations raised by 54.1 percent and 56 percent, respectively, and that from the European Union raised by a year-on-year 16.8 percent.

China’s actual use of foreign investment hit a record of nearly 1 trillion yuan in 2020, up 6.2 percent year on year amid a coronavirus-led global recession.

Prof. Chinn,

Why does Uncle Sam’s debt held by the Fed count as “held by the public?”

When the Fed buys a T-bill, why don’t they just stamp in big red letters “Paid in Full”, and ship them to the Treasury to be destroyed or filed.

As I understand it, instead of doing this, the Treasury pays interest to the Fed for federal debt it holds, and then the Fed returns these interest payments to the Treasury as banking profits.

Seems odd to me.

@ Humidity loving Bernard

I’m not certain but this may answer part of your query. It’s a semi-complicated topic, around which there is much confusion. If the Fed ever took its regulatory function/mandate over commercial and investment banks seriously (which they rarely do) it’s my belief a large part of this confusion could be eliminated.

https://www.stlouisfed.org/on-the-economy/2018/september/fed-payments-treasury-rising-interest-rates

Menzie probably has a better answer for you, but maybe that will help a little.

Moses Herzog: The Fed has taken its regulatory function seriously, certainly since the global financial crisis. Remember, the financial crisis hit investment banks and government sponsored enterprises (GSEs – Fannie, Freddie) that were lightly regulated. The primary regulatory authority was the SEC in this case. Primary regulation of commercial banks was FDIC, OTS, OCC, and state regulators *and* Fed (for bank holding companies).

You realize Menzie, if the Federal Reserve gets any more punitive with these bankers, they won’t even be able to pay their golf country club fees anymore.

https://money.cnn.com/2016/10/13/investing/wells-fargo-ceo-resigns-compensation/index.html

https://fortune.com/2016/10/13/wells-fargo-ceo-john-stumpfs-career-ends-with-133-million-payday/

I tell yeh Menzie, you’re gonna have me crying with this draconian Federal Reserve of yours. They’ve got all those TBTF bank executives shaking in their Christian Louboutins now, don’t they?? Wait…….. what year was it Stumpf got that severance package??

Well, it doesn’t matter, other bank CEO’s will learn from this Federal Reserve banishment.

Moses Herzog: By regulation, I’m talking about enforcing standards on quality of assets, form of financing, capital-to-asset ratios, etc. which pertain to systemic risk posed by banks that don’t conform to financial regulations. Now, getting a golden parachute was not restricted to my knowledge under Dodd-Frank etc. If there’s no law, what exactly is the Fed to do? (I’m not saying there shouldn’t be a law – just that I don’t know of one that restricts exercising stock options in the way Stumpf did).

@ Menzie

That’s fair enough. All of those points are good. I apologize for being overly-snarky and sharp-elbowed but it’s one of those topics that’s a sore point with me. I do think more should be done in the law about clawbacks and things a long those lines, but as you rightly point out, that’s kind of outside of the Fed’s dominion.

Left Coast Bernard: Because the Fed (like many central banks) is treated as a separate entity. That is odd, I agree, although the fact that the Fed *system* is a quasi-public/private entity makes it a little less odd.

@ Humidity loving Bernard

I think also, what you are asking relates strongly to what is called “unwinding” or “tapering”. Another common term used in the article below is “normalization”. The Fed Res is often buying (during a “crisis” or serious downturn) the treasuries to give commercial banks temporary cash. When the economy recovers, the commercial/investment banks don’t necessarily need all that “useless” cash, then they want those interest bearing assets (treasuries or possibly other) returned back on their balance sheets. This isn’t easy and often has to be done “slowly”.

https://www.afr.com/opinion/why-unwinding-qe-is-turning-out-to-be-the-hard-part-20190211-h1b3az

This QE (the initial buying of the treasuries, bad assets, etc) can also be thought of as a kind of government welfare for fatcats (mostly old white guys), but Bernard you’re not allowed to call it “government welfare” for fatcats, because by federal statute, and CNBC office rules, that’s illegal language, and you’ll have to be sent straight to jail. In fact, Joe Kernen has personally had to handcuff and do the perp walk for many CNBC anchors who called any money going to rich people government welfare for fat cats, and has even had to beat some of them with a bamboo cane. Kernen says it’s only welfare and/or evil and Satanic when you send checks to actual low income people. Low-income people are “filthy” and “disgusting” that is why the term “welfare” is only reserved for “those people”. Also Kernen finds this QE much more upsetting under a Democrat White House~~~if the QE or the FOMC lowering of rates happens under a Republican White House, then it becomes “All American” and “patriotic” so who is in the White House also effects how CNBC on-air staff can use terminology. Pay attention closely Bernard.

What you are proposing is called by the inflationistas “monetizing the debt.” The Fed creates new money by buying government bonds and depositing newly created money in the bond sellers accounts, increasing the money supply and reducing interest rates. This process can be reversed if the Fed sells its bonds and debits money from the buyers accounts, reducing the money supply and raising interest rates.

The Fed maintains the polite fiction that its monetization is “temporary” and that at some future date it intends to shrink its balance sheet by selling back its bonds to the public. This keeps the inflationistas from foaming at the mouth if the Fed were to just cancel the debt. But temporary monetization can last a very, very long time. As long as the Fed keeps its bonds, you can consider them as “cancelled debt” since they refund the interest to the Treasury.

There is another reason that the Fed doesn’t just cancel the debt. The bonds the Fed holds provide a way of reacting to unexpected inflation by raising interest rates. The Fed can reverse their monetization process by selling their bonds to the public which will raise interest rates and reduce the amount of money in bank reserves. The bond buyers remove money from their accounts and pay it to the Fed for the bonds they purchase and the Fed destroys the money the previously created, reducing the money supply