Reader JohnH points us to an article entitled “Lumber prices have fallen, but the stage is set for a potential 65% rally through the end of the year, an expert says”. What do markets say about this?

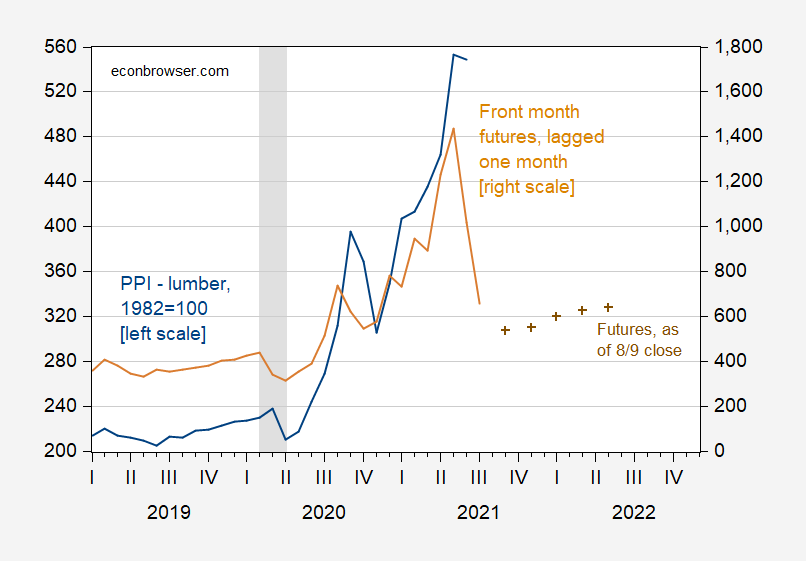

Figure 1: PPI for lumber and softwood (blue, left scale), and front month futures, lagged one month (brown, right scale), futures as of 8/9/2021 close (dark brown +). NBER recession dates shaded gray. Source: BLS via FRED, macrotrends.com, ino.com, NBER and author’s calculations.

The futures prices are rising gradually (but they usually are, i.e., commodity futures are usually in contango due to storage costs).

Now, it would be wrong to interpet the futures as one-for-one predictors. A one percentage point basis — futures price change relative to current spot price — is associated with about a 0.55 percentage point change in actual lumber price for futures maturing 2 months hence, as reported by Mehrotra and Carter (2017) . The coefficient goes up to 0.67, 0.71, and 0.77 as horizons go from 4 to 8 months.

If indeed the possibility of passage of the infrastructure bill was going to spark the rally as speculated on in the article, then I would’ve expected the futures contracts for say January 2022 to rise last week as the likelihood of passage rose markedly (at least according to PredictIt). They didn’t.

So, the market doesn’t seem to be betting on a 65% rally. But of course, anything can happen, and nothing guarantees the markets will be right. After all, they probably missed the recent spike. (And futures are often very wrong, consistently so for gold and silver for instance). Still, count me skeptical for the 65% rebound.

(July PPI data come out on August 12.)

I’ve always kind of mildly dreaded (can you “mildly dread” something??) being identified in the post upload section of this blog. I’ve stayed away from most stuff that would probably get me there. I think maybe Menzie was tempted to give me flack on my Brexit statements. Glad I never got there though. Of course my reverse fantasy would be getting there for other reasons like running some regressions in “R” or some other such and making some great insight. The odds seem small. But maybe…. Hope reigns eternal kids.

@ JohnH, My Brother, please read more WSJ (external to editorials) and Bloomberg, and LESS MSN.

One of the things about lumber prices that shocked me is how they find their way in unexpected ways into inflation. In this case they affect carrying charges for home owners, which, of course, will soon find their way into rentals via carrying charges on rental property.

Last week I met with my homeowner’s insurance agent. I had just received my annual bill, and it had risen by about 20%. I assumed that it was simply a reflection of surging home prices. But that was only half the story. My agent ran the replacement cost of the house, and it was above the market value of the house a couple years ago. And that doesn’t include the property value! As we all know, real estate appraisals are often done on the basis of both cost and market value. The outlandish price of my house can probably now be justified on the basis of cost, and much of the rise is attributable to the cost of lumber.

But that is not all. I looked at the prices of some houses my relatives live in. Of course, prices have surged. But what is noteworthy is how much property taxes have surge. This is, because the assessment is tied to the price, and as I mentioned the price can be justified not only by the market but by the cost. And the high cost was directly related to the cost of lumber.

Of course, not all property taxes are calculated the same way. Not all jurisdictions tie the assessment directly to the market price. Many have laws that limit the rise in property taxes. But those who do not are in for a rude awakening when the mortgage company recalculates the monthly escrow amounts. We’re talking tax increases of $10-15,000 per year on some fairly modest houses. And when you’re talking about a real median household income of about $70K, this becomes are really BIG DEAL.

I don’t know how BLS factors in carrying charges on houses, but we are talking about serious inflation in areas where assessments are tied to current market prices.

JohnH: Any thoughts on the plausibility of the 65% rebound in lumber prices?

Personally, I doubt it, though the wildfires in the West have been consuming a LOT of timber the past few years. if this continues, at some point lumber will become increasingly scarce.

Also, call off those rises in property taxes. Zillow must have a glitch. According to them, my sister in law’s house, which is only 1500 sq ft., has doubled in value to $400,000 in the past few years would have seen an enormous increase in property taxes. Same is true of other houses on the market in this area. However, other real estate search engines project only modest increases in property taxes. However, insurance rates are rising.

Have you been following those Princeton Steve housing price freak outs. It seems he is alarmed that housing prices have soared and he is predicting a major crash. Of course his freak outs only prove he flunked Finance 101. Yes the fundamentals have led to a dramatic increase in your relative’s home equity value. Good for her. If she finds the property taxes tough to pay – two options: (1) sell; or (2) take out a low interest rate loan. I trust your relative is a lot smarter at basic finance than our arrogant consulting who calls himself Princeton Steve even as he complains about his Cape Cod neighbors!

Why does this all remind me of CoRev and soybeans?

I have never heard of this Joshua Mahony fellow but Business Insider has declared him to be some sort of expert. Huh – I wonder if Mr. Mahony works for Princeton Steve who insists oil prices will top $100 a barrel any day now.

It seems IG provides this profile of Joshua Mahony along with his writings:

https://www.ig.com/us/profile/joshua-mahony/page-6

It says he follows foreign exchange as in currencies. He has been writing 3 columns a week all on foreign exchange. Nothing this year on lumber prices. I guess Business Insider thinks writing columns for IG on foreign exchange makes one an “expert” with respect to lumber prices.

If the market expects lumber prices to rebound, one would think the stock prices for timber REITs would be soaring. I just checked on the financials for the largest timber REIT:

https://finance.yahoo.com/quote/WY

Sales and operating profits right now are quite strong but note that the stock price has fallen from almost $41 a share in late May to just over $34 a share. But hey – what do people who trade on these stocks know?

BTW a REIT is a well known tax dodge. I guess we should all be bashing Paul Krugman for not writing on this particular tax dodge.

I’ve checked on retail lumber prices around the country. What I’m seeing is a split in the market.

Dimensional lumber is quickly returning to normal. Dimensional lumber is stuff like 2x4s and floor joists. Dimensional lumber is produced by hundreds of small, low-tech mills where you shove a log in one end and 2x4s pop out the other.

What hasn’t changed yet is the price for engineered wood products. This is stuff like plywood, oriented strand board and laminated beams. This requires more high-tech mills that haven’t yet caught up to the demand. These products are essential to the building industry for walls, floors and roofs. It is still in short supply. These prices are still 400% of normal.

It’s worth noting that the futures option market cited above only follows dimensional lumber, not engineered wood products which are actually a bigger portion of cost in a house.

People freaked out over a 10% increase in used car prices. Imagine the effect on the building industry of 400% price increases. There is a about $15,000 of lumber in a 2000 square foot home. With the price increases this cost soared to over $60,000. It pretty much shut down a large part of the residential building industry.

Informative – thanks. Of course this all started with Menzie making fun of some long winded rant from Victor Davis Hanson. I wonder if Victor even knows the difference between a 2×4 v. engineered wood products.

Hanson wrote:

“the small contractor doing a remodeling job with plywood at $80 a sheet”

Apparently referring to a 4′ by 8′ sheet 1/2 inch thick which Menzie found at Home Depot for only $48.

“Apparently referring to a 4′ by 8′ sheet 1/2 inch thick which Menzie found at Home Depot for only $48.”

$48 is almost five times the normal price. $80 was the price a few weeks ago but it has come down since, but still way above normal.

For the record, 15/32″ 4’x8′ sanded pine plywood, $36.95 as of today in Madison.

Coming down eventually is not the same as return to historic norms. Maybe Joseph is our new CoRev.

You don’t specify but sanded plywood is typically interior grade used for furniture and shelving. It is not made with exterior glue rated for construction of floors, walls and roofs.

There is not nearly the demand for interior grade plywood (a low volume specialty item) as there is for exterior grade plywood. Even so, $36.95 is still a ridiculously high price.

Joseph – Menzie never said prices have come back to their pre-pandemic level. I guess you have not been following the conversation.

What the heck are you going on about, pgl? I never said anything of the sort. I’ll repeat, in case you are slow, I never said anything of the sort. I’m simply providing information. Take it or leave it as you like.

You are now arguing with yourself. Sort of like a dog chasing its own tail.

I’ll repeat again since you seem to be slow. I never said anything of the sort. Go ahead and prove me wrong. If not, I’ll just assume you are

lying“making things up” — again.Kevin Drum proves that Tyler Cowen is as dumb as Princeton Steve but with a wee bit of a twist:

https://jabberwocking.com/are-we-in-another-housing-bubble/

Stevie thinks we are in a housing bubble now. Tyler says we are not and we were not in a bubble back in 2006. Both are looking at the inflation adjusted price of houses now v. 2006. But of course these comparisons flunk Finance 101 for reasons Kevin Drum ably explains. Kevin notes as I have two pieces of fundamentals: (1) real rents are higher today than they were in 2006; and (2) the cost of capital is much lower.

Now even freshman finance students would note that these changes in the fundamentals should lead to higher valuations today as opposed to 2006. We have explained this to Princeton Steve MANY times and he still does not get it. But no – he is not the dumbest person on the planet as that award goes to Tyler Cowen!

So, to the extent that one guy’s forecast is worth notice, the guy should maybe have some claim to credibility. Mahony’s day job is as a technical (voodoo) FX analyst for a trading platform. He generates FX buy/sell levels. Trading platforms use trade recommendations to generate billable transactions. Not the commodity “expert” advertised in the headline. Mahony could be right. Right or wrong, he could have strong reason for his view, but we aren’t able to know because he doesn’t show his work.

So other than the fact a reporter needed something on which to base a story, is there any reason to pay more attention to Mahony than, say, my mom? I can’t think of one.

By he way, to many technical analysts, round numbers are magical. Absent any evidence that he used some other form of analysis to generate his forecast, we can suspect Mahony may have no better reason to forecast $1000 by year end than that it’s a round number. (Techies call round numbers “psychological levels” even if their analysis doesn’t pick out a round number and even if the techie has no knowledge of psychology.)

Someone else knows how to check credentials. Please help poor JohnH with this skill set!

So in other words, this guy’s job is to generate a “technical” analysis that provides an “intellectual” justification for firms to churn the clients’ accounts. He has to give the advisors an excuse to generate more fee income.

Just like the banks that rely on fees for a lot of their income rather than good old-fashioned financial intermediation, these firms add inefficiency to a market. I thought they were supposed to make markets more efficient, not less. I thought that was the sole justification for their existence.