Reader CoRev continues to voice skepticism about the predictive ability of soybean futures. He asks for

proof, with successful predictions, of the validity of…your soybean price model….BTW, we are getting closer to the model’s magic validation date.

Recall, earlier, CoRev had written:

it’s a big IF that soybeans futures are LONG TERM predictors at all.

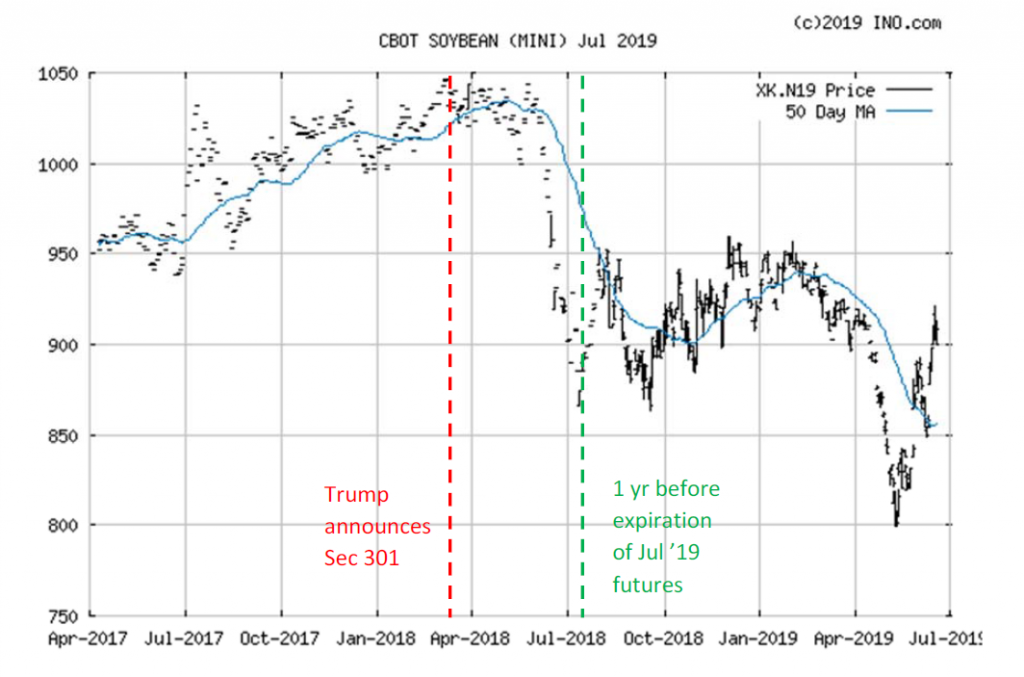

I keep on explaining “my” soybean price model (using futures, which is merely the model that soybean futures are the best predictor of future soybean prices), to no avail. It turns out “my” model (I think it better associated with Fama) works pretty well. To see this plainly and clearly, see the time series for the July 2019 soybean futures. I mark in red when Trump declares an intent to invoke Section 301 penalties on China; I mark in green the date one year before the expiration of the July 2019 futures.

Figure 1: July 2019 Soybean Futures, from CBOT. Futures contract expires July 12, 2019. Source: ino.com as accessed on 6/19/2019, and author’s annotations.

The astute reader will note that the July 12th 2018 reading for July 12th 2019 contract was about 900 ($9.00). The reading last I checked was 900.25…

By the way, the I wouldn’t make a similar argument for precious metals, and other commodity futures. However, as Oli Coibion and I documented in our paper (2014), soybean futures beat other reasonable comparators at the one year horizon.

To see this result, one can estimate the following equation, using OLS.

st+k – st = α + β(ft,k – st) + ut+k

Where st is the log spot rate at time t, ft,k is the log futures rate for a transaction k periods hence, and u is an error term that is under the efficient markets hypothesis null a random expectations error (an innovation).

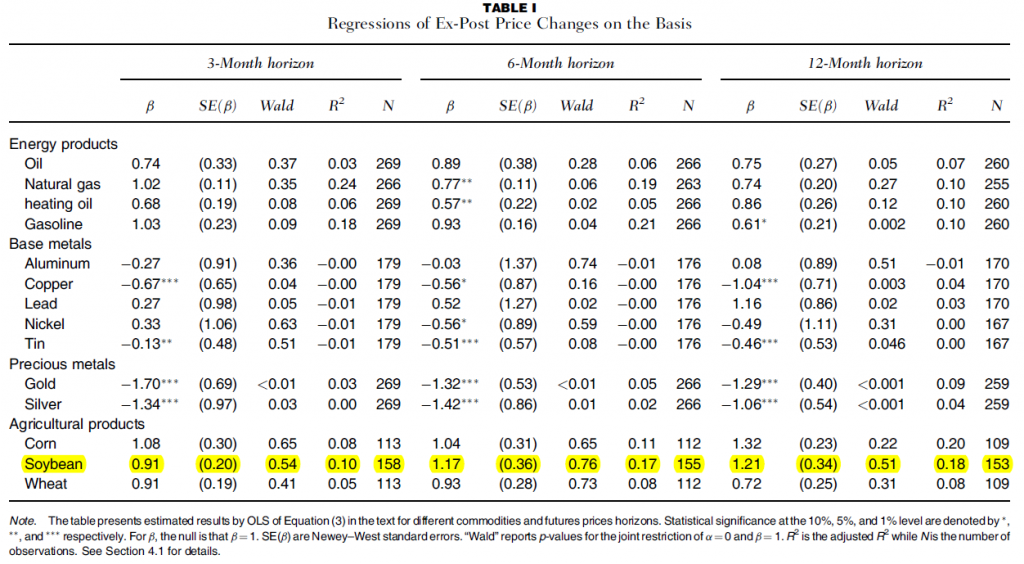

In Table I (from Chinn and Coibion, 2014), I highlight in yellow the SOYBEAN results of this regression for soybeans, at the 3, 6 and 12 month horizons.

Table I from Chinn and Coibion, 2014.

Notice the point estimates are close to one, and statistically indistinguishable from that value, using standard errors robust to serial correlation and heteroskedasticity. Hence, the testing approach is conservative. A Wald test for the joint null α=0, β=1 is not rejected at conventional levels. That null hypothesis is consistent with the futures price being an unbiased predictor. In words, the results mean when the basis is 1%, the average change in the soybean price over the corresponding period will be…1%.

Interestingly, the R2’s are high for soybeans. In contrast, similar results are not obtained for metal commodities. In particular, the estimated β’s are often negative. Hence, we can conclude that futures are unbiased predictors of future spot soybean prices for horizons of up to a year, and have measurable predictive power. For more on prediction (warning: one needs to know at a minimum what an ARIMA is, better yet to know the characteristics of a DMW statistic, in order to understand the content), see this post.

I do not expect readers like CoRev to understand. So far he/she has not shown any evidence of trying to understand. CoRev concludes his comment today, in the misapprehension that he/she is close to proving “my” model wrong:

BTW, we are getting closer to the model’s magic validation date.

Let me re-iterate: The July 12th 2018 reading for July 12th 2019 contract was about 900 ($9.00). The reading last I checked (less than an hour ago) was 900.25.

Congratulations on that head-on call, Menzie. As it is, I worry that our CoRev may not even be able to afford one of those junk heap Belarus tractors for riding around on his gentleman’s farm at this rate.

Let’s see what Menzie’s prediction actually was:

“Conclusion

Soybean futures are remarkably good predictors of future spot prices of soybeans. Hence, my best guess of soybean prices one year from today is 872. ”

From that same article he showed the then futures price of $8.76.

So which estimate are we trying to prove? I dunno. prices change all the time so is he cherry picking???

BTW, why the concern: “…in the misapprehension that he/she is close to proving “my” model wrong” The data will validate or not your model. Not me!

CoRev: You were asserting a return to something closer to the status quo ante price of $10.25 (i.e., pre-section 301 announcement), if I recall correctly. Well, I think $8.76 is closer to $9 than $10.25 is to $9. Or do you have some type of non-Boolean arithmetic to show otherwise.

In sum, I asserted that futures were pretty good at prediction at 1 year horizon; I think that conclusion still holds.

Menzie, why do you forget the caveat in my assertion? This is what I consider my seminal comment:

”

CoRev

June 13, 2018 at 2:30 pm

Menzie, please quit mis-applying Economics issues over agricultural or any other industry. Instead of what would be the profits that might have been have been provided the world market wasn’t perturbed by weather. I’m surprised someone from the Upper Midwest doesn’t realize the basics of Ag pricing. Tariffs or other trade barriers/restrictions only are part of what makes up the price. As an economist you are ignoring annual supply and demand.

Ag especially is dominated by weather (world-wide) and area planted. Every planting season is a crap shoot with harvest amounts that can range from amounts too little to spend money on fuel for the equipment or all the way to bumper crop worrying about storage. For the Farmer one severe storm, early or late frost, too much rain, too little rain, rain at the wrong time, fire, etc. can wipe out a year’s worth of work. Only after the crop is being harvested or in planning what to plant can the farmer really worry about prices….”

After admitting the impact of tariffs, I concentrated n the actual BIG CRAP SHOOT FACTOR for farmers, weather. Then along came 2019-20 growing season, where, duel to weather, a large number of farmers have been unable to even plant their fields. Without insurance they are facing a total loss. Tariffs did not affect the weather.

As to your model’s successful predictions. too could have picked a day when prices were outside a reasonable range, to show the model to be incorrect. As you just did to prove its value/accuracy. We’ll just wait for the terminal date to evaluate your model’s prediction.

Now, where are those Barkley model predictions. Oh, he finally admitted the only model in which he actually participated in creating was incorrect. Incidentally, his use of the IPCC models, also know for doing incorrect predictions, didn’t add value to claims of expertise.

From: ”

CoRev

May 13, 2019 at 6:10 am

Using today’s 1 year/52 week prices, we find that US soybeans spot prices traded with a +/- ~12.5% range, $10.51 to $7.87. Since Menzie’s $8.72 prediction soybeans spot prices traded in a much narrower band, +/- ~3.6%, $8.14 to $7.87.

The question is will Menzie’s $8.72 prediction fall within the trading range since it was provided, 7/15/2018? The test is whether on 7/15/2019 spot prices fall between $9.04 or $8.4, +/- ~$.32? If measured today, it is a fail.

We’ll just have to wait.”

See how easy it is to cherry pick, but is it better or worse than Menzie’s????

BTW, yesterday;s price was 914.75, so as of yesterday, Menzie’s prediction was also a failure. Perhaps that’s why he changed his price baseline to ~$9.00.

Inquiring minds and all?

For pgl, who still does not understand what the “spot price is”: “What is spot price?

The spot price is the current market price at which an asset is bought or sold for immediate payment and delivery. It is differentiated from the forward price or the futures price, which are prices at which an asset can be bought or sold for delivery in the future.”

CoRev: Yes, but for several weeks, in your comments you seemed to conflate futures prices, spot prices, and future spot prices. Just for clarification, front month futures are often used as proxy for spot prices in commodity markets, especially since those are comparable over time (b/c of standardized contracts). Glad you have enhanced your understanding of definitions. Now, if you could understand event studies and EMH, *that* would constitute substantive progress.

Menzie claims: ” Glad you have enhanced your understanding of definitions.” I also provided that or a similar definition when pgl got confused with what a spot price was. I’ve also provided this link several times without anyone commenting. https://markets.businessinsider.com/commodities/soybeans-price The search returns this title: “Soybeans PRICE Today | Soybeans Spot Price Chart | Live … ”

I am tracking this chart for historical purposes: https://markets.businessinsider.com/commodities/historical-prices/soybeans-price/usd/15.7.2018_20.6.2019

“Yes, but for several weeks, in your comments you seemed to conflate futures prices, spot prices, and future spot prices. ”

As far as I am concerned the only one confused is pgl, and now you for accepting his unsupported complaint. If I have been confused, then show me. If you have a different link then show it.

I wonder how the climate change perpetual drought will affect soybean prices in a few month.

https://www.usda.gov/media/blog/2019/06/14/nations-wettest-12-month-period-record-slows-down-2019-planting-season

Bruce, I’m not sure but that may be the reason Menzie chose to revisit his estimating model, comparing recent rises with futures.

‘Menzie claims: ” Glad you have enhanced your understanding of definitions.” I also provided that or a similar definition when pgl got confused with what a spot price was.’

I generally ignore your incessant and pointless chirping but this LIE cannot stand. No CoRev – you serially get confused with what a spot price is and I try to help your understanding.

Look we all know you refuse to learn even the basics but to accuse others of being as stupid as you is really beneath the pale.

And oh yea – I see you were bragging earlier about a “seminal” comment. I guess you have no clue what seminal even means. BTW – how is that submission to the American Economic Review coming?

Pgl, show my confusion. What I remember is your confusion because my link included the terms “future prices”. Because you didn’t understand what a spot prices consisted of, you ignorantly believed that they were prices for future contracts. I’ll repeat the definition I gave you then: “The spot price is the current market price at which an asset is bought or sold for immediate payment and delivery. It is differentiated from the forward price or the futures price, which are prices at which an asset can be bought or sold for delivery in the future.”

Apparently you are confused. You do not understand the term “asset” in a FUTURES CONTRACT MARKET?

I wonder how this will affect demand for Brazilian soybeans?

https://www.washingtonpost.com/business/the-deadly-african-virus-thats-killing-asias-pigs/2019/05/30/6dbfea18-832f-11e9-b585-e36b16a531aa_story.html?noredirect&utm_term=.6ea316beeca8

Bruce Hall: You’re kinda late to this story. We were debating the impact of ASW in posts from April.

Menzie, sorry I missed that April discussion. However, it appears that external factors may weigh quite heavily on the near and more distant future of soybean production.

https://www.drought.gov/drought/data-maps-tools/outlooks-forecasts . Lower than normal temperatures and very wet soil conditions could dramatically reduce soybeans grown in the U.S. this year. Will that have an impact on soybean prices globally? Well, you’re the expert.

The longer term impact on soybean demand in China and elsewhere may bode for a significant surplus and switching away from soybean farming. https://www.bloomberg.com/graphics/2019-eliminating-african-swine-fever/

So, yes, tariffs have affected current soybean pricing, but may simply be a pimple on a much larger rash.

Bruce Hall: Weather has *supported* prices thus far…but you are right that Trump’s decision gave impetus to a permanent shift by China to other sources, much like Nixon’s embargo pushed Brazil to enter into soybean production.

Menzie, yes weather and tariffs are current issues, but the swine virus looms as the “killer app”.

• https://www.iasoybeans.com/news/articles/swine-disease-further-erodes-soybean-demand/

• http://www.agrinews-pubs.com/opinion/policy-pennings-african-swine-fever-could-impact-soybean-prices/article_9bae3e53-e175-5e91-a5ef-67f24565e5d4.html

Fortunately for many soybean farmers, they can move to other feed crops (corn, alfalfa) or human food grains (corn, wheat) within limits. Actually, many, if not most, soybean farmers rotate their crops in and out of soybeans so they are able to switch pretty quickly. My brother leases out a small 40-acre Michigan plot to local farmers who do just that. Soybeans are grown every 1-3 years depending on conditions and markets.

• https://www.cropscience.bayer.us/learning-center/articles/cereals-elevate-your-crop-rotation-program

Menzie, ASW??? Or African swine fever (ASF)?

CoRev: You are correct – ASF.

Another minor victory.

This is from some one who does not even understand the difference between spot prices v. future prices. Oh yea – you are too busy writing 200 pieces of intellectual garbage a day to actually read even the basics on this issue. Quantity TRUPMS quality I guess!

pgl: That confusion CoRev evidenced between futures and future prices was pretty Monty Pythonesque worthy, I will admit.

Sigh! The only one confused has been pgl.

More lying about this? You really are a sad little boy.

CoRev What is the standard error for beta?

“So which estimate are we trying to prove? I dunno.”

Yep – you do not even know what the word price means. Do you even know what a soybean is?

I found this interesting and educational. I don’t want to assume Menzie doesn’t already know this stuff, but I would put it at 60% he doesn’t (why would he, he’s not an agriculture economist), and I would even encourage Menzie to watch this. I put it at 40% Menzie already knows what is in the video link below because I know Menzie is a voracious reader, has a wide breadth of knowledge, and lives in an agriculture state. I learned a lot by watching it, and got a kick out of the video. I’m assuming CoRev is not familiar with any of this as CoRev has stated be believes soybeans and other crops stay good for eternity when you sprinkle them with the “Magical MAGA Powder” produced by donald trump hotels.

https://www.youtube.com/watch?v=ywBV6M7VOFU

Smarter Every Day! Of course with CoRev – its Dumber Every Day.

Here are a couple more videos related to “silos” (silos are technically the very tall ones), they are also sometimes called “elevators” but I think a more general term would be grain bins. These two are not as good as the first link I put higher up in this comment thread, but could still be educational or present other aspects:

https://www.youtube.com/watch?v=YEY_HlKjc8E

https://www.youtube.com/watch?v=8gPF4L5NP34

Professor Chinn,

Seems like a great model! Did you post the data for soy beans? It would be fun to replicate the results. As I recall there was an issue related to posting the data last year.

I am always surprised by readers who challenge Professor Chinn or Professor Hamilton regarding econometric models that the professors have developed and generously present on Econbrowser. I can understand political arguments, but not arguments about econometrics, when the challenger has not recomputed the models. Would a layman argue with a chemistry professor about a chemical reaction that the professor has studied and experimented with?

AS: I could post the data for the Chinn-Coibion data, but in order to do the more recent exercise, all we need to know is the July 12th observation on the July 2019 futures contract (which expires on 12th of July). We then compare the two values (where I follow the convention of using the futures price as a proxy for the spot price — according to the Samuelson hypothesis the two need to converge).

AS: I’ve uploaded the Chinn-Coibion data set on my research web page. As you can see, our data ends in 2012.

Referring to the link, “Chinn-Coibion data set”, I notice on the Excel spreadsheet,Ag comm. prices tab, the farthest-out date seems to be S8. I thought we needed S12. If I am reading your blog correctly we also need the spot rate at time t and the spot price at time t+k. I am neither doubting your model nor calculations, I am just trying to learn and use a model I have never used before. If I am being too slow, or if this is too much trouble, we can take a pass.

I am having a difficult time envisioning how to collect the data easily. It seems like the data would be difficult to collect given the linkages.

AS: Remember, there aren’t soybean futures contracts for everymonth; in fact there are 8 a year. You’ll have to correlate them with dates, I’m afraid.

AS, look at the July 15, 2018 Soybean estimate article to get the needed data. https://econbrowser.com/archives/2018/07/interpreting-evidence-on-forecasting-capabilities-of-futures-relative-to-other-methods#comments Which conclude with his prediction:

“Conclusion

Soybean futures are remarkably good predictors of future spot prices of soybeans. Hence, my best guess of soybean prices one year from today is 872….”

This discussion began when I and others suggested Tariffs were not the preeminent concern for farmers, but weather was. The along came the 2019-20 growing season, which has been tremendously perturbed by … BAD WEATHER. My assertion proven true, but the Menzie price prediction still TBD. Ergo my comment about the model’s approaching validation date, which triggered even another article.

“This discussion began when I and others suggested Tariffs were not the preeminent concern for farmers, but weather was.”

Write the following 500 times on your chalk board:

EVENT STUDY

Then go read the relevant literature on this issue starting with Fama. This was Menzie’s original point which to date you still do not get.

Of course you write a lot of gibberish not related to the original discussion. Sort of like monkey’s pounding on typewriters thinking they are about to write a Shakespearian play!

Have CoRev and Bruce Hall done some Vulcan mind meld? Bear with me as I note how both of them have tried to explain LOW soybean prices.

Bruce Hall: “Lower than normal temperatures and very wet soil conditions could dramatically reduce soybeans grown in the U.S. this year. Will that have an impact on soybean prices globally?”

Well yea but as Menzie notes, an inward shift of the supply curve should increase soybean prices.

CoRev done further in this comment section: “This discussion began when I and others suggested Tariffs were not the preeminent concern for farmers, but weather was. The along came the 2019-20 growing season, which has been tremendously perturbed by … BAD WEATHER.”

CoRev is asserting that an inward shift of the supply curve is the reason U.S. farmers are suffering lower prices.

Listen fellows – some first graders are better at economics than this idiocy. CoRev goes on and on and on in his utter confusion. I don’t know about you – but this is even funnier than those dumb Trump tweets!

Pgl, what a memory? How many times do I have to admit that tariff/trade restrictions have lowered the price for soybeans. Now let’s do another event study on WEATHER, and see how that has impacted prices. 2018 ?? weather in Brazil caused the supply to ??? and fill China’s demand. 2019 US weather has caused supply to be ??? and prices are ???

Trade uncertainty since the 2018 tariff implementation(s) has caused prices to fluctuate as negotiations possibilities AND ADDED TARIFFS are leaked or announced.

Do you understand any of that? If you do, fill in the ??? I will be surprised if you can or will fill in those blanks. Because this comment:

“CoRev done further in this comment section: “This discussion began when I and others suggested Tariffs were not the preeminent concern for farmers, but weather was. The along came the 2019-20 growing season, which has been tremendously perturbed by … BAD WEATHER.”

CoRev is asserting that an inward shift of the supply curve is the reason U.S. farmers are suffering lower prices.”

Clearly shows you do not understand much in this market.

I know this is a complex subject for you, but the 2019-20 growing season has caused many farmers t not plant. For a New Yorker that means price is inconsequential when ya farmer can not plant. No planting no harvesting.

Pgl, can you multiply the numbers of bushels in a non-harvest times any price? The ignorance of this comment: “CoRev is asserting that an inward shift of the supply curve is the reason U.S. farmers are suffering lower prices.” indicates you can not do that simple math. So let me help you (zero times any price)=? I’ll let you prove you have even an inkling by completing that simple arithmetic problem.

BTW, I wrote it in English so that a New Yorker wouldn’t get confused by complex symbology.

pgl,

Bruce Hall: “Lower than normal temperatures and very wet soil conditions could dramatically reduce soybeans grown in the U.S. this year. Will that have an impact on soybean prices globally?”

Well yea but as Menzie notes, an inward shift of the supply curve should increase soybean prices.

Well, we agree that lower supply should put upward pressure on prices, but with the roughly 20% reduction of pig population in China from ASF, that should place downward pressure on prices.

So, I was asking what the best guess was on the overall direction over the next year. I presume you have a prediction and I’d be interested in knowing what it is.

I also pointed out that many farmers who raise soybeans rotate that crop with others and can adjust their crop mix according to forecasted demand. Not perfectly, of course, because if all of the soybean production is shifted to corn, for example, then the price of corn should have downward pressure due to significant supply increases, unless it all goes into 15% ethanol content in gasoline. Oh, predictions are so subject to the whims of reality.

CoRev This discussion began when I and others suggested Tariffs were not the preeminent concern for farmers, but weather was.

This is nuts. A lot of revisionist history. Last July you were not predicting record floods and exceptionally cold temperatures in the soybean belt. You just weren’t. You were fairly confident that the tariffs would be short-lived, which has turned out to be false. But even with the bad weather and slightly higher prices for soybeans due to bad weather, any farmer that followed your advice would have been making a mistake. You thought storage was the answer and that farmers should just sit tight until Trump won his little tariff war. Well, a lot of stored beans didn’t survive the flood. And prices have not recovered anywhere near enough to cover the storage costs and opportunity costs associated with storing beans for an extra year.

2slugbaits: I have now posted a rejoinder to CoRev’s original prediction that there would be nothing more than a “price blip”, and upon successful completion of US-China talks, prices would recover to Oct/Nov 2017 levels (by the way, they haven’t).

You make a great point AS. This is a running strain on this blog, or I guess the popular cliche is “a running theme”. Why indeed. Even some who should know much better, including 2slugbaits attempt this. I guess the large ego pulls them in, the thrill of playing “gotcha” with a Phd prof.

https://econbrowser.com/archives/2019/05/yield-curve-inversion#comment-225795

I expect it from the MAGA, Teabagger crews, and cottage industry “experts” selling immigration fears like a liquid medicine cure for baldness. I do not expect it from 2slugbaits. My inoculation to this is having a sensitive ego and very thin skin. I don’t like being called out in class for being wrong, especially on things I had prior stated as an objective fact. I also pretended to be a teacher for a few years (no teacher certification or education degree). I had certain codes that I tried to enforce on myself. Such as a teacher’s version of a Hippocratic Oath. That is to say, I better have my ducks in a row before class, and if I don’t know the answer to something I look the student straight in the eyes and say “I don’t know” when I indeed don’t know. Many teachers (high school and college level) have a hard time articulating the words “I don’t know” from their mouths. You do much more damage giving false answers and false facts as a teacher when vanity becomes an issue. I’d rather lose face in a class room setting (and believe me I have) saying “I don’t know” than pass out information that damages students when they “get out into the real world”

Two of the best blogs I have ever found on the net—the now mostly inactive “BaselineScenario” blog by James Kwak and Simon Johnson, and this blog, Econbrowser allow commenters to make VERY strong criticisms and let those float through their filters after reading them. It speaks VERY HIGHLY of those blog hosts. The facts will lay down either way—So it shows a strong degree of self-asssurance, healthy level of self-esteem, and tolerance to let those arrows fly. But these guys have enough self-esteem to know even though they let those arrows fly, they will hit (or mostly NOT hit) their intended mark on the strength of the argument itself.

I’ve seen Paul Krugman call himself out at least twice on his blog. Again with the good ones the goal is learning, not being right all the time.

The past couple of days we’ve been inundated with passages from “CoRev and Sammy’s Excellent Adventures”, a less than comic look at the bumbles and stumbles of our least knowledgeable economics misfits.

Their acting out of the “Excellent Adventures” screenplay is very convincing. It seems so very real that they are both vacuous of knowledge. What if we made a sequel with Kato playing CoRev and Paris Hilton playing the part of sammy, and we add a road-trip romance element to the story??

https://www.youtube.com/watch?v=56SuCzulrxY

https://www.youtube.com/watch?v=KxMcHunIo14

OTOH, we have not heard from either Peak Trader or JBH for a good while now, not that I am encouraging either of them to show up to grace us with their comments, which rarely are any better than those of CoRev or sammy.

I bet they went with Rudy Giuliani on his adventures in Ukraine:

https://talkingpointsmemo.com/muckraker/rudy-giuliani-ukraine-dirt-biden-telizhenko?fbclid=IwAR0yf0iVdjdIH7yk-Uirl4WdJQNTP-KBI8HBKdmracLIviJgAgaydmh78ho

noneconomist,

If you find anything factually wrong, or have a different opinion, on my posts, feel free to comment.

Dude, your adventure through economics has yet to take a most serious tone. (Not to mention factual)

So your answer is no to Sammy!

@ sammie

If someone walks up to you in the middle of the day straight-faced and says “the sky is red”, at that point are you really going to make the effort?? If they tell me it’s a mild teal green, maybe I’ll argue. If they tell me the sky is orange at sunset when it’s the clouds that are orange maybe I’ll argue. But argue with them that the sky is not red?? Do I then point my index finger and say “See!!!!”??? Generally I don’t interact with CoRev. After I leave a link which shows the facts of what a research paper says and does not say, I’m not going to go 15 “reply” rounds with a professor in Virginia who doesn’t want to read to the end of “article X” three-quarters of the time. 1–3 replies is about right, then I’ll let him talk to his own echo.

What will you say to a soybean farmer who loves donald trump?? What will a person say to a man just fired from the Harley Davidson plant who loves donald trump?? What will you say to the semi-truck driver who lost 10% of his 2019 hauls because of donald trump?? With all the news about how trump treats immigrants and the way he discusses Mexican Americans and Latin American people and an endless list of other minorities, what do you say to people like the people in this link??

https://okcfox.com/news/nation-world/a-closer-look-at-latino-voters-and-border-issues-ahead-of-the-2020-race

At some point you tabulate the possible returns of trying to educate certain IQ groups, and then you move on.

We have comments many times. Alas you follow the CoRev model of just skipping anything based in the real world.

Ditto for me! Careful now, many of the articles include multiple subjects or less than perfect interpretations.

That’s right – if you did not hear it on Fox & Friends, it must be “fake news”!

When will this “witch hunt” on CoRev end?? I for one am trying to concentrate and hyper-focus my attention on the real news, such as Stevie “Princeton”Kopits, and reliable sources such as the following:

https://www.youtube.com/watch?v=MzIOidaeFC0

Be careful friends, Satanic Martians are using the fluoride in your toothpaste to brainwash you as we speak, and until all minority ethnicity “Puh-huds” at La Follette show us their birth certificate, in a public forum, I am assuming they are from the Satanic Martians’ Earth colony, hidden in Inner Mongolia. Their end-goal is killing all those with MAGA red hats. Stick your head in your toilet bowl tonight at 22:00 military time USA central and CoRev will be updating our underground soldiers through coded brown formations in the bowl water.

This is “Likes Playing Soldier in my Backyard Treehouse” (my Alabama militia codename) signing off……

Here’s an interesting story. Apparently Mike Pence is now getting foreign affairs advice from Maria Butina.

https://www.washingtonpost.com/opinions/2019/06/19/state-department-official-didnt-disclose-ties-boyfriend-russian-agent-maria-butina/?noredirect=on&utm_term=.e2a4b33e23fc

Erickson, who officiated Andrea Thompson’s (Mike Pence’s top foreign affairs adviser) wedding, was Butina’s boyfriend. Erickson was Thompson’s friend over many years (obviously if he is officiating her wedding ceremony). Thompson never disclosed this during her confirmation process, or after, until roughly 36 hours ago, when a Washington Post reporter directly asked her.

Also, Hope Hicks is refusing to give testimony to Congress—-which is, as commenter “sammy” likes to say, is ILLEGAL.

Also the Dutch government is bringing official criminal charges against 4 Russians for the murdering of 298 people on MH17. Which—was most probably an ordered killed by Vladimir Putin—the man donald trump keeps telling us is America’s best friend.

(paywall) https://www.nytimes.com/2019/06/19/world/europe/mh17-ukraine-russia-suspects.html

Another slow news day under Orange Excrement.

There are some things that get me going and then it’s hard to stop laughing, and I will think about it multiple times later and it still makes me laugh. This Meme is one of those thing (OK, I know, I’m easily entertained). It’s good I’m not drunk right now as I probably would have laughed at this a solid 20 minutes straight.

https://i.redd.it/bk2zhv5e5b531.jpg

Maybe because my Dad was 46 when I was born and never liked new generation type humor, so somehow it makes this even more humorous for me?? I don’t know.

Let us know what it was like after you attend his first concert Sir ChinnMeister

https://www.youtube.com/watch?v=Ne_8kG1h5hQ

Strikes me as a touch narcissistic. But I don’t think there’s much denying the guy has some talent.

Brad DeLong’s latest is on point:

https://www.bradford-delong.com/2019/06/hoisted-from-six-years-ago-to-steal-a-line-from-leon-trotsky-every-man-has-a-right-to-be-stupid-but-john-cochrane-abuses.html

Leon Trotsky – “every man has a right to be stupid” … Brad was not reading CoRev but rather Cochrane but these two were on the same page worrying about hyperinflation!

Cochrane is a smart person, there’s no getting around that. But he also strikes me as a “different cat”. I always get this weird sense that there is something seedy about him that has not come up to the surface yet. What am I basing this on?? Nothing, only what my gut tells me sometimes. I got this feeling about John Roberts before the story broke publicly about him (I know no one will believe me on this, and I have no way of proving it, I may have made some comments under an internet pseudonym, but I’m to lazy to backtrack it). Before the story happened, I had no tangible thing to base my thoughts on with Roberts. I just knew something wasn’t adding up on Roberts. When I watch Cochrane in interviews—I get that same exact weird feeling in my gut–something isn’t adding up there, the equation is not balancing out on the opposite side of the equals sign.

BTW, Cochrane’s book on valuing of assets etc is a superb book as far as I can tell (I even purchased it some years back). And the book has no errors in it as far as I have ever been able to tell (though doubtless some of the math escapes me). So I’m not just taking a cheap shot here, I just get that feeling about people sometimes. Am I always right?? No, but I’d give my gut about a 66%—80% rate in the “being correct later dept”

I am out on a limb, but I have never paid too much attention to futures markets.

Futures and spot prices always seem to move in lockstep. What do futures traders

know that spot market prices do not know?

Could you run the same model using spot prices rather than futures prices

and see what is the difference?

spencer: Futures regression is s(+1)-s = alpha + beta(f-s) + u . We can run regression on ex post realizations of s(+1).

But what do you propose to substitute for f when you say same model using spot prices. I can re-arrange, to obtain s(+1) = gamma + theta(s) + v which is just random walk model. Futures seems to work better in soybeans case.

how much better?

spencer: 10% improvement on random walk at the one year horizon, according to Table II in Chinn-Coibion (2014). I was surprised, myself as well.

how much better?

Is the results because the futures market is a much thinner market?

Back in the day of fixed exchange rates we use to intervene in the futures market rather than the spot market for dollars because the futures market was easier to manipulate– it was a smaller market so an intervention of X dollars had a bigger impact.

spencer: I know of no case at short horizons where *forwards* (or futures) work better than a random walk, as far as currency markets are concerned. That is a vast literature. I only learned about commodity market differential behavior when at CEA.

i get that there is somebody on this site who believes the weather is the major factor controlling soybean prices as we have seen them over the past year and a half, and not the trump trade war. and it is possible that both the trade war and weather drove down the price of soybeans last year-too much supply due to lack of overseas demand and record crops. however, it seems to me the prices have continued to drop over time, more likely due to the trade war. now this spring, we have had another round of weather, this time in a manner which destroys production. this should make soybean prices recover. now we have seen a recovery from the very low 800 level seen a month and a half ago, followed by a dramatic spike back up. some could argue this was weather introducing a reduction in supply-a possible valid argument. it could also simply be a resumption in some soybean trade to china resulting in a more normalized market rather than that bear? the drop is an interesting behavior that i would like to know more about.

however, the recovery off of that bear market has only returned soybean prices to the range they have been in since the trump trade tantrum took affect. if weather truly were the driving issue, and we have moved from record oversupply to lack of even planting acreage this year, i would expect that the price of soybean should rise above where it has been for the past year. but it has not done so. it seems to me the futures market is a better predictor than an ad hoc approach which uses “weather” as an excuse for both failures and success in the prediction.

menzie, in your article, you indicate ag commodities worked well with futures. since “weather” impacts both corn and soybean, could you disentangle the ‘weather” issues by comparing those two ag commodities over the past couple of years? i know they are not indpendent commodities, since cheap soy can replace some corn and help drive down the price of corn as well, but it is probably instructive nevertheless.

baffling Normally there is a seasonality component to ag commodities due to the timing of new crop coming on top of old crop. As a general rule mid-summer is when soybean prices are highest, ceteris paribus. So we would have expected some uptick in soybean prices about now simply because of seasonality factors. Soybeans are a real crapshoot this year. Prolonged cool soil temperatures and soggy fields prevented planting and emergence. But the floods also affected the barge traffic on the Mississippi River, which prevented seed and fertilizer deliveries to the heart of the soybean areas of Iowa and Illinois. And even when farmers were able to plant soybeans, emergence has been hindered because the top layer of soil has a hard crust from the mud that plants have to break through. You see a lot of fields that will be pulled from production this year. Here’s a pretty nice update on corn and soybeans:

https://www.agweb.com/article/millions-of-corn-soybean-acres-remain-unplanted/

2slugs actually accepts that weather makes farming a crap shoot. My position from the beginning was that weather made it so – EVERY YEAR. 2slugs’ comment incudes an interesting list of weather related impacts: “Soybeans are a real crapshoot this year. (He agrees with me) Prolonged cool soil temperatures and soggy fields prevented planting and emergence. But the floods also affected the barge traffic on the Mississippi River, which prevented seed and fertilizer deliveries to the heart of the soybean areas of Iowa and Illinois. And even when farmers were able to plant soybeans, emergence has been hindered because the top layer of soil has a hard crust from the mud that plants have to break through. (His weather related list of impacts) You see a lot of fields that will be pulled from production this year.” (The effect just on farmers fields)

2slugs, earlier had claimed I made a prediction of this year’s weather. Which is obviously untrue. I did claim it was an every year issue for farmers, along with the then being placed TARIFFS. My radical position is now confirmed by the 2019/20 growing season’s weather.

Earlier, 2slugs, also pointed out that my position was that storage would help resolve the farmers tariff dilemma. He also pointed out my belief that the tariffs would be short lived. In these he was correct. Mea Culpa!

Still, the TDS driven want price impacts to be solely based upon the tariffs. That is not true. How much of an impact we will see soon.

CoRev 2slugs, earlier had claimed I made a prediction of this year’s weather. Which is obviously untrue.

Here’s what you said:

This discussion began when I and others suggested Tariffs were not the preeminent concern for farmers, but weather was. The along came the 2019-20 growing season, which has been tremendously perturbed by … BAD WEATHER. My assertion proven true

Now think about that for a moment. No one doubts that farmers are concerned about weather; but it’s a little hard to believe that in July 2018 soybean farmers were more concerned over the possibility of bad weather one year from the versus the immediate impact of tariffs. Perhaps you didn’t intend it this way, but what you wrote suggests that you were predicting that bad weather in 2019 would affect soybean prices and that concern overrode any concerns that farmers might have about tariffs. To see what I’m getting at, think about the counterfactual. Suppose 2019 weather had been ideal. Are you saying that instead of saying your assertion “proved true” you would have told us that your assertion about the role of weather had been proven false? I don’t think so, which suggests that your comment was meaningless. The only way that your comment about how bad weather proved your assertion true would be if you had actually predicted bad weather for 2019. So I think you’re left with two choices. Either your 2018 comment about weather in 2019 was meaningless or you were in fact predicting bad weather in 2019.

CoRev BTW, I’ve mentioned this before, but bad weather improves prices. So it’s a little hard to see how this year’s bad weather can be responsible for today’s low prices. Bad weather hurts farmers because it reduces yield and total production, but it puts upward pressure on the price of each bushel. What every farmer wants is perfect weather for his fields and lousy weather everywhere else.

2slugs, this is just an inane interpretations or more likely projection because of ignorance: “but what you wrote suggests that you were predicting that bad weather in 2019 would affect soybean prices and that concern overrode any concerns that farmers might have about tariffs.” No. It does not suggest a prediction. It does suggest a truism for farming, weather is always a concern and too often a major concern.

In July, months from harvest weather can devastate a harvest. Just as the Spring’s weather did. Weather can definitely impact harvest totals and dates. Just as the Spring’s weather did. Weather can impact the need and costs for drying a harvested crop. Just as the Spring’s weather did. Weather can also impact on the ability and costs associated with shipping a harvest. Just as the Spring’s weather did.

As we both agreed: Soybeans and farming in general are a real crap shoot this year, as they are every year. The difference this year is the crap was shot at farmers in a large portion of agriculture America early so that it impacted their ability to even plant a crop. That is a catastrophe.

What I tried to impart was that it is the chance for a weather related catastrophe that farmers face all seasons of the year, but most seriously during the planting, growing and harvesting seasons. Just as the Spring’s weather did.

2slugs, We both agree that tariffs have impacted prices. I even said that they plateaued the price at a lower level. What price do you suggest soybeans should be for (fill in your month here) after implementation of a 25% tariff? This is the past year’s price history: https://markets.businessinsider.com/commodities/soybeans-price

What I see is a fractional price drop of that 25% tariff.

Many thanks to CoRev for the startling information that weather can affect farm production and prices. That’s the kind of knowledge that makes the undereducated sit up and take notice.

That followed his breakthrough reveal that Congress consists of a House of Representatives and a Senate. Who knew?

We should all feel fortunate that such a steely mind is around to enlighten us on complex issues.

noneconomist, “That followed his breakthrough reveal that Congress consists of a House of Representatives and a Senate. Who knew?” Obviously, you didn’t, because it was you who needed the correction. Now that we have the evidence of the weather’s impact on growing season 2019/20, you now have evidence how weather impacts farmers. Your sarcasm is misplaced.

Your welcome!

Great news, CoRev. The EPA has also noted your research and begins its website on “Agriculture and Natural Events and Disasters”: “Every year natural disasters such as hurricanes, floods, fires, earthquakes, and tornadoes challenge agricultural production. Because agriculture relies on weather, climate, and water availability to thrive, it is easily impacted by natural events and disasters.” Stunning news though it is, it was only through your relentless efforts that such information has finally been made available to the public. ( but every year must mean, well, every year….for centuries?)

RE: the House and Senate. Somehow, I missed the fact that there are 53 House seats/districts in California. Seems like in 2018 many Republicans in the Central Valley and the north were running against the same opponent: Nancy Pelosi. So, it was only natural to assume that Pelosi was a candidate in districts 1, 4, 7, 10 (and others) in addition to her own (CA 12) .In fact, Tom McClintock–who is safely in a red district (one of few remaining)–has been running against her since 2008. He keeps getting re-elected, and somehow so does she!

Thanks also for the stunning news that there are two United States Senators. I stumbled on their names recently, and would never have known much about them had not you surprised me with your expose of the constitutional requirements involved. Your junior high civics training was not wasted.

Oh, and thanks to you–and every television station in northern California–I now know why the price of cherries is skyrocketing. The May rains doomed what was to be a bountiful crop. Only bonus, with nothing to sell, growers won’t be affected–like growers of almonds, pistachios, citrus, stone fruits, et. al.–by those dastardly Chinese tariffs.

Thanks again for being unafraid to tell the truth, and to remain your humble self while doing so.

Your sarcasm is is still misplaced.

Your welcome!

ten year yields drop below 2%. we have a president who claims to be presiding over the best economy ever, partially spurred by huge tax cuts and loose (or nonexistent) regulations, and yet the 10 year yield continues to drop and the president himself argues that we need to lower fed funds rate below what is already a historically loose position. exactly what economic policy are we running here in the states? peak loser used to argue against the obama recovery where we had one foot on the gas and one foot on the brake. this is exactly what trump is doing with his tariffs and anti-business rhetoric. why are interest rates falling in the best economy ever?

CoRevJune 20, 2019 at 11:40 am

“Now let’s do another event study on WEATHER”

CoRev – we’ve been there and done that many times. Both you and Bruce Hall want to talk about how “bad weather” led to an inward shift of the supply curve. Both of you are a bit vague on the timing but that is not the worst part. Both of you seem to think an inward shift of the supply curve lowers prices.

Hey CoRev – you win. You win the Stupidest Man Alive Award. Take a bow!

Fishy, I see you are making a mistake similar to your spot versus futures price. Please learn to read and understand. Stop engaging your typing fingers before thinking.