We first constructed the index nearly 20 years ago! See the website for the data.

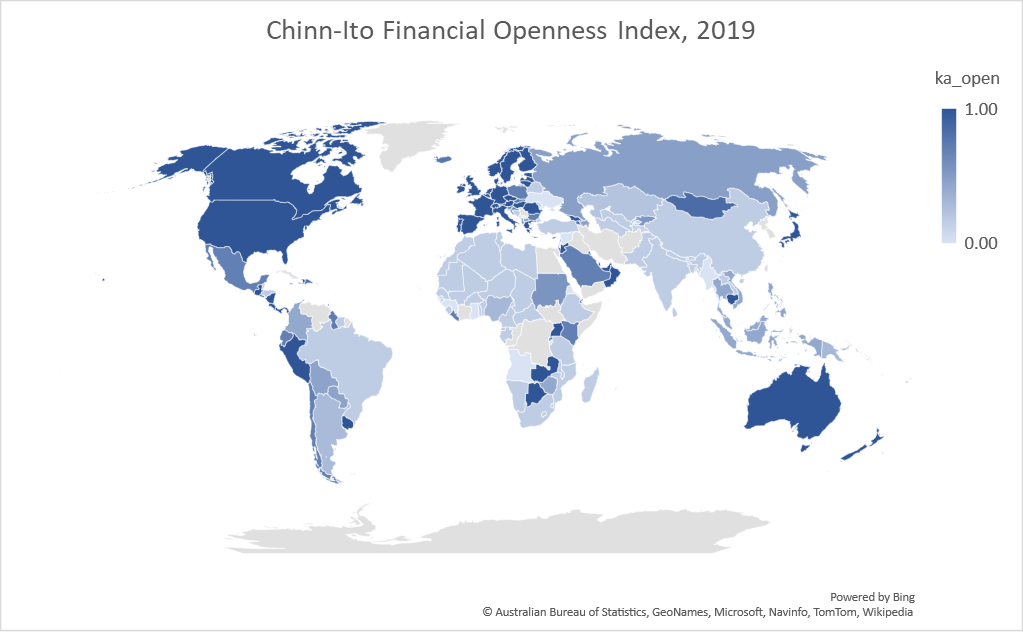

Here’s a map of financial openness in 2019 (normalized index, 1 to 0). The darker, the more open.

The description of the current dataset is Ito and Chinn (2021).

Hiro Ito and I constructed the index because there was few single, widely available and consistently updated measures of financial openness at the time, with the exception of Quinn’s (APSR, 1997) measure, which at the time was more limited in coverage. Individual dummy variables based on the IMF’s (old) de jure classification of controls (on exchange rates, export proceeds, capital account, current account) didn’t prove informative in one of my early empirical analyses of financial development (Chinn, 2004, ungated version here). The Chinn-Ito index, based on the aforementioned IMF de jure classifications, was converted into a single index using by taking the first principal component (essentially — the capital account component is smoothed), and was developed for a project to assess how financial openness correlates with financial development, published in JDE (2006) (with lots of help from friends, including Ashok Mody, Antu Panini Murshid).

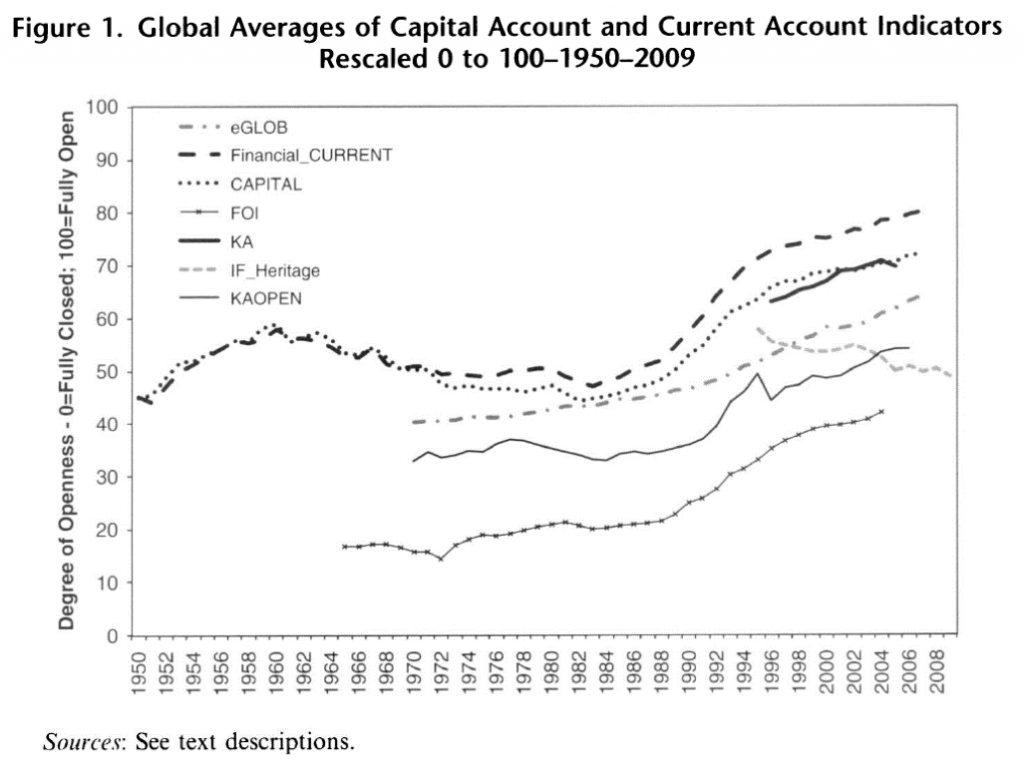

Quinn, Schindler and Toyoda (IMF Econ Rev 2011) provide an early comparison of measures.

Source: Quinn, Schindler, Toyoda (IMF Economic Review, 2011).

In the aggregate, the measures move together. However, on an individual country-year basis, the correlation of changes in the KAOPEN index and changes in other indices ranges from 0.01 to 0.29 (the latter significantly different from zero).

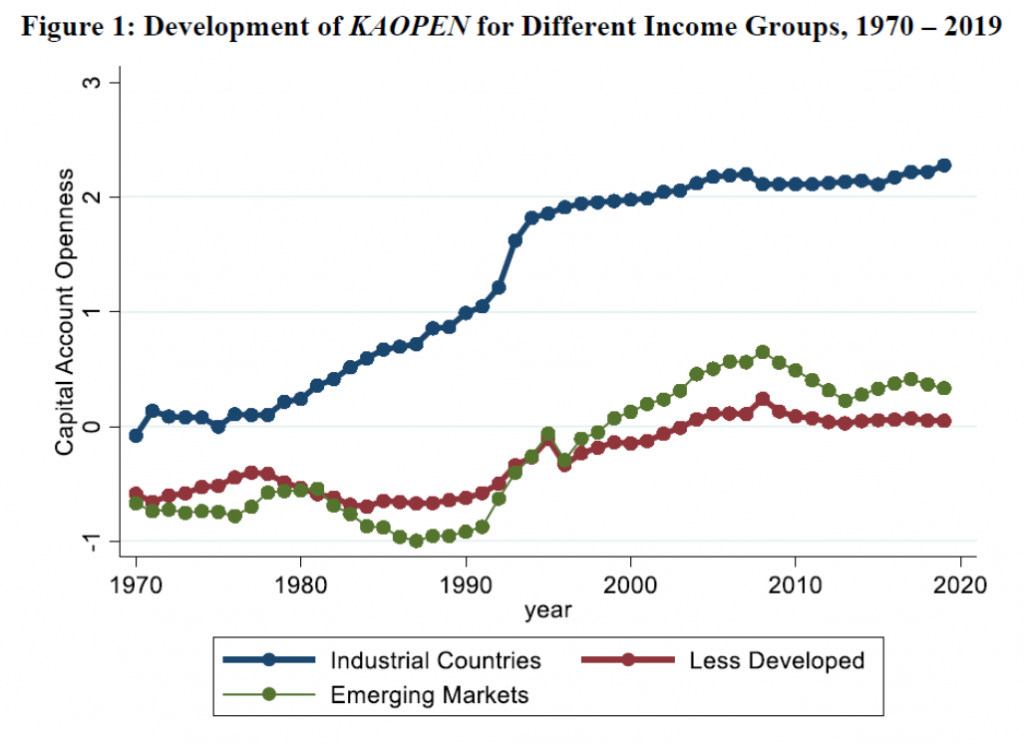

Here’s a picture of measured de jure financial openness according to the Chinn-Ito KAOPEN index (not normalized to [0,1].

Source: Ito and Chinn (2021).

In the aggregate, there’s been some retrenchment in the less developed countries since the global financial crisis in 2008. There’s a less pronounced patter for emerging market economies, but also generally a retrenchment up through 2019. In contrast, after a slight drop, industrial countries have re-attained their previous levels of openness.

Additional disaggregations (by region, region/income level) here.

Economics visual data porn!!!!!!!!

https://www.imf.org/-/media/Files/News/Speech/2021/jackson-hole-symposium-presentation-2021.ashx

Still need to read you and Ito’s Reserve Currency paper. Always behind on something, or rather many things.

I think the Chinn-Ito Financial Openness Index grand, but a political-economic question troubles me. When the British leave the European Union structurally, does Britain remain a relatively financially-open economy?

Better than China. Too easy, but I still couldn’t stop myself from saying it.

When the British leave the European Union structurally, does Britain remain a relatively financially-open economy?

[ I apologize for the question, which was only asked to better understand Simon Wren-Lewis who has argued that Britain leaving the EU means a relatively limited Britain as a financial center. ]

It probably mostly means they have at least one trait very similar to useless Beijing-based bureaucrats. A certain affection for nation self-determination. They don’t like having the EU’s and IMF’s foot shoved on their neck like Greece was.

I personally don’t think Brexit has hurt UK too much. But I keep waiting for the other shoe to drop with one of Menzie’s posts covering the topic.

Given that Britain never abandoned the pound sterling, nor adopted the euro, and maintained its own monetary and fiscal policies independent from the EU, and it could and can issue debt in its own currency, it was not, is not, and will not “become another Greece,” ceteris paribus. And that’s without even broaching the matter of differential levels of indebtedness.

If there was no Brexit, there would have eventually been a strong pull to join in the same currency. Possibly even a “bullying” to do so. And if you or anyone else on this blog believes otherwise, you’re a bit on the naive side.

moses, that is a hypothetical that never did occur. and based on current status, will never occur in the future as well. in that context, not sure its appropriate to call the opposite outcome “naive”. this was a real world measurement, we know exactly what the outcome is.

When the British leave the European Union structurally, does Britain remain a relatively financially-open economy?

[ This foolishly written question was meant only for “me” to think about. The Chinn-Ito Financial Openness Index is transparent and grand. Again, I am sorry to have written so carelessly. ]

I don’t have time to go back and reread Mainly Macro, but IIRC, at the time I understood SW-L’s point to be that banks wishing to do business in the EU would likely move a very significant part of their operations out of the City to an EU member country. The reduced employment and reduced international banking activity would greatly diminish the UK’s prominent position in world banking. So, the UK could remain as open as it is now in law, regulation and banking practices, yet have less exposure to and influence in international capital markets.

I am glad to be corrected if my memory has proven to be unreliable on this subject.

Of course, even if I am correct, BoJo the clown could react to the City’s lowered profile with some cockamamie policy changes that would indeed make the UK’s capital markets less open, all the while proclaiming that he is doing the opposite. He is a wild card, i.e., an agent of chaos, in this and many matters, just as Trump was in this country.

Seems interesting: https://lawandcrime.com/2020-election/days-after-kraken-sanctions-ruling-wisconsin-governor-asks-judge-to-force-trump-to-pay-up-personally/

https://news.cgtn.com/news/2021-08-29/Chinese-mainland-reports-33-new-confirmed-COVID-19-cases-1377RevVjLG/index.html

August 29, 2021

Chinese mainland reports 33 new COVID-19 cases

The Chinese mainland recorded 33 new confirmed COVID-19 cases on Saturday, all from overseas, the latest data from the National Health Commission showed on Sunday.

In addition, 20 new asymptomatic cases were recorded, while 446 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 94,819, with the death toll unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-08-29/Chinese-mainland-reports-33-new-confirmed-COVID-19-cases-1377RevVjLG/img/04f4e18c82464256b5226144ec2d864c/04f4e18c82464256b5226144ec2d864c.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-08-29/Chinese-mainland-reports-33-new-confirmed-COVID-19-cases-1377RevVjLG/img/c43da0d7a41542f6acac3e4045cd2663/c43da0d7a41542f6acac3e4045cd2663.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-08-29/Chinese-mainland-reports-33-new-confirmed-COVID-19-cases-1377RevVjLG/img/30b14f8f1e7046f28fb317c3d5c0a5e1/30b14f8f1e7046f28fb317c3d5c0a5e1.jpeg

http://www.news.cn/english/2021-08/29/c_1310155502.htm

August 28, 2021

Over 2.03 bln doses of COVID-19 vaccines administered in China

BEIJING — Over 2.03 billion doses of COVID-19 vaccines had been administered in China as of Saturday, data from the National Health Commission showed Sunday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 2.032 billion doses of Chinese vaccines administered domestically, another 800 million doses have been distributed to 100 countries internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

August 28, 2021

Coronavirus

United Kingdom

Cases ( 6,698,486)

Deaths ( 132,376)

Deaths per million ( 1,936)

China

Cases ( 94,786)

Deaths ( 4,636)

Deaths per million ( 3)

Menzie,

I suggest having a (ok) student look into the relation of financial openness to fiscal multiplier. My (uninformed ) idea is that for each country openness makes fiscal bigger because (say) China is doing he saving, but for the world as a whole the aggregate fiscal multiplier would be smaller and behave differently than the country-by country. Also it would be a neat illustration of marginal vs average. Best B

Bob Flood: Great idea. I can think of several additional reasons why financial openness should matter – in old Mundell-Fleming framework, should matter depending on import propensity for instance.

This indeed looks like something consistent with Mundell-Fleming. There is this tradeoff between the effectiveness of monetary and fiscal policy, and financial openness is usually thought to weaken the effectiveness of the former. So one should expect latter to be at least relatively stronger in that case. Whether it is absolutely stronger may need further conditions.

https://www.nytimes.com/2021/08/26/opinion/california-newsom-recall-economy.html

August 26, 2021

California Could Throw Away What It’s Won

By Paul Krugman

If you live in California and haven’t yet voted or made plans to vote on the proposed recall of Gov. Gavin Newsom, please wake up. This is a situation in which apathy could have awesome consequences: California, which isn’t as liberal a state as you may imagine but is nonetheless considerably more liberal than the nation as a whole, may be about to absent-mindedly acquire a Trumpist governor who could never win a normal election.

This would happen at a moment when control of statehouses is especially crucial because it shapes the response to the coronavirus. MAGA governors like Greg Abbott in Texas and Ron DeSantis in Florida aren’t just refusing to impose mask or vaccination requirements themselves; they’re trying to prevent others from taking precautions by issuing executive orders and backing legislation banning the imposition of such requirements by local governments and even private businesses. And that’s the kind of governor California will probably find itself with if the recall succeeds.

How is something like this even possible? Because the recall process is crazy. Voters answer two questions: Should Newsom be recalled? And who should replace him? If a majority vote “yes” on recall, whoever is chosen by the largest number of people on the second question becomes governor, even if that person receives far fewer than the number of votes to keep Newsom in office.

And the most likely outcome if Newsom is ousted is that Larry Elder, a right-wing talk-radio host who is vehemently opposed to mask and vaccine mandates, will end up in the governor’s office despite receiving only a small fraction of the total vote.

What would make this outcome especially galling is that California is in many ways — with the glaring exception of housing, which I’ll get to — a progressive success story.

The Golden State took a sharp left turn in 2010, with the election of Jerry Brown as governor. Two years later, Democrats gained a supermajority in the Legislature, giving them the power to enact many progressive priorities. California soon raised taxes on the rich, increased social spending and increased its minimum wage. It also enthusiastically implemented the Affordable Care Act.

Conservatives predicted disaster, with some saying that the state was committing economic “suicide.” And California gets a lot of negative coverage in the business press, where one constantly finds assertions that business is moving en masse out of the state to lower-tax, less-regulated states, like Texas.

The data, however, say otherwise….

https://www.nytimes.com/2021/08/27/opinion/California-housing-price-economy.html

August 27, 2021

The gentrification of blue America

By Paul Krugman

In my latest column, * motivated by the California recall, I pointed out that the Golden State’s left turn on policy hasn’t produced the economic collapse that conservatives predicted. On the contrary, the state’s economy has boomed, even as it keeps getting trash-talked by the business press: Between the election of Jerry Brown and the Covid-19 pandemic, both output and employment grew about as fast in California as they did in Texas.

It has, however, been a peculiar kind of boom, one in which more Americans have moved out of California than have moved in.

Economists trying to understand the rise and fall of regions within a country often rely on some form of economic base analysis. The idea is that a region’s overall growth is determined by the performance of its export industries — that is, industries that sell mainly to customers outside the region, such as the technology firms of Silicon Valley and the Los Angeles entertainment complex (or, here in New York, the financial industry). Growth in these industries, however, generates a lot of growth in other sectors, from health care to retail trade, driven by the local spending of the base industries’ companies and employees.

But base analysis suggests that when a state has a booming export sector, as California does, it should be seeing growth in more or less everything. Instead, what we see in California is that while highly educated workers are moving in to serve the tech boom, less educated workers are moving out:

https://static01.nyt.com/images/2021/08/27/opinion/krugman270821_1/krugman270821_1-jumbo.png?quality=90&auto=webp

A giant Brooklyn Heights?

There’s no great mystery about why this is happening: It’s because of housing. California is very much a NIMBY state, maybe even a banana (build absolutely nothing anywhere near anyone) state. The failure to add housing, no matter how high the demand, has collided with the tech boom, causing soaring home prices, even adjusted for inflation:

https://static01.nyt.com/images/2021/08/27/opinion/krugman270821_2/krugman270821_2-jumbo.png?quality=90&auto=webp

The Golden State becomes the Unaffordable State.

And these soaring prices are driving less affluent families out of the state.

One way to think about this is to say that California as a whole is suffering from gentrification. That is, it’s like a newly fashionable neighborhood where affluent newcomers are moving in and driving working-class families out. In a way, California is Brooklyn Heights writ large.

Yet it didn’t have to be this way….

* https://www.nytimes.com/2021/08/26/opinion/california-newsom-recall-economy.html

My second daughter is a psychiatrist with VA system, and so pretty well paid. She and her family moved from San Francisco to Portland, OR where she has another position with the VA. They moved because of the the high cost of housing, even for a psychiatrist.

https://www.imf.org/en/Publications/WEO/weo-database/2021/April/weo-report?c=223,924,132,134,534,536,158,922,112,111,&s=NID_NGDP,NGSD_NGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2021

Total Investment & Gross National Savings as a Percent of GDP for Brazil, China, France, Germany, India, Indonesia, Japan, Russia, United Kingdom and United States, 2007-2021

2021

Brazil

Total Investment ( 15.4)

Gross National Savings ( 14.5)

China

Total Investment ( 43.7)

Gross National Savings ( 45.2)

France

Total Investment ( 23.7)

Gross National Savings ( 21.4)

Germany

Total Investment ( 21.5)

Gross National Savings ( 29.1)

India

Total Investment ( 30.1)

Gross National Savings ( 28.9)

Indonesia

Total Investment ( 32.4)

Gross National Savings ( 31.9)

Japan

Total Investment ( 25.4)

Gross National Savings ( 29.0)

Russia

Total Investment ( 23.4)

Gross National Savings ( 25.6)

United Kingdom

Total Investment ( 17.0)

Gross National Savings ( 13.1)

United States

Total Investment ( 21.6)

Gross National Savings ( 17.5)

The neighbors of old Uncle Moses have decided to buy him a MAGA hat in light of his screaming “fake news, fake news” at this story:

https://ktvz.com/videos/2021/08/29/fears-grow-for-those-left-behind-as-kabul-airport-evacuation-nears-end/

It seems ISIS-K has lined up a car bomb attack in Kabul but this was taken out by a US drone strike. But we were told such things could not happen with 50,000 American soldiers on the grounds by the likes of Lindsey Graham and his new Minnie Me Uncle Moses. So this has to be “fake news”.

where was isis-k before the us bugged out of bagram?

how cone the prisons were not emptied in to gitmo?

wait for taliban to invite the iirc/qud in to deal with usis k.

Aaannnddd, there it is, our daily dose of “authentic frontier gibberish.” h/t Mel Brooks

It wouldn’t be a day ending in “y” without that.

Mostly in the eastern provinces of Afghanistan, where they have been since around 2014. There simply has been little reporting about them, with the US having attacked their forces in those provinces more than once in recent years with the tacit support of the Taliban. Indeed, when Trump dropped “the mother of all (non-nuclear) bombs on Afghanistan soon after he became president, the target was not the Taliban but the apparent commanding hideout of ISIS-K with their then commander dying as a result. This was not reported at the time.

Of course for the last several years there has been little media coverage in the US of Afghanistan, apparently about 5 minutes per week during 2017-19 by the leading TV networks, with that dropping to 5 seconds per week in 2020 when Trump signed his surrender agreement with the Taliban with no input from the Afghan government. So of course almost no Americans have had any idea about what was going on with ISIS-K, but now with non-stop 24/7 coverage we are hearing about them.