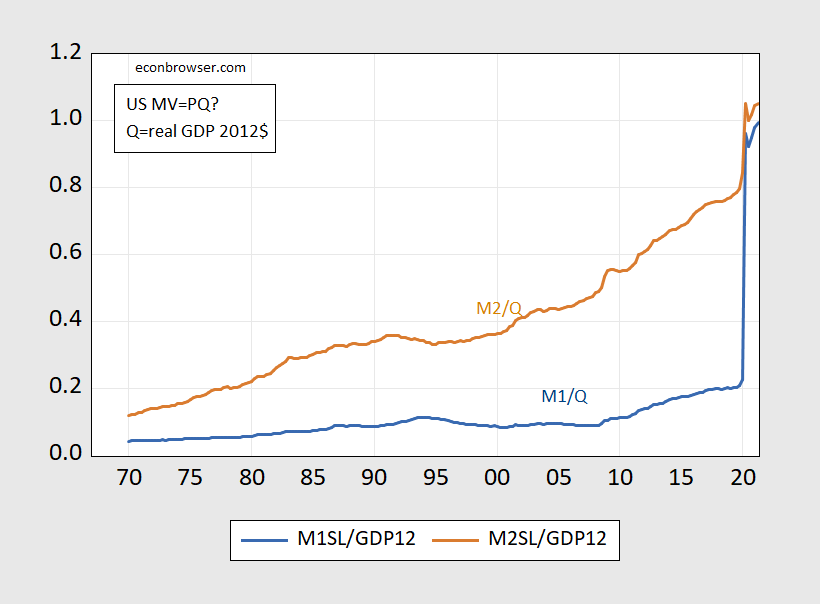

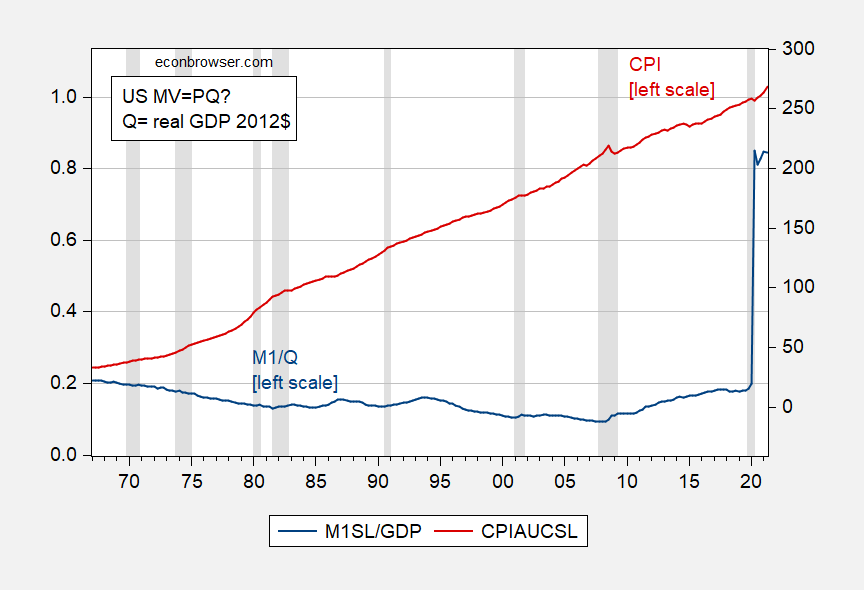

[For my Econ 435 students] Consider the following graphs. Figure 1 is M1 and M2 to real GDP (0.80 means 80%) for the United States. Figure 2 is M1 to real GDP on left scale, and CPI-all urban on the right scale (taking on a value of 100 in the period 1982-84).

Figure 1: M1 in billions of $ divided by real GDP in billions of Chained 2012$, Seasonally Adjusted at Annual Rates (SAAR) (blue), and M2 divided by real GDP (brown). Money is seasonally adjusted, end-of-quarter figures. Source: Federal Reserve via FRED, BEA, and author’s calculations.

Is this picture cause for worry, in terms of inflation? Can you explain why you think it is, or is not? Now consider this graph.

Figure 2: M1 in billions of $ divided by real GDP in billions of Chained 2012$, Seasonally Adjusted at Annual Rates (SAAR) (blue, left scale), and Consumer Price Index for all urban consumers (red, right scale). NBER defined recession dates shaded gray. Money is seasonally adjusted, end-of-quarter figures; CPI is average of monthly data. Source: Federal Reserve via FRED, BEA, and author’s calculations.

Does this picture change your views? Why, or why not?

https://images.app.goo.gl/L1Daqdb3GmYYyVSE9

If accelerating money growth is necessary but not sufficient for accelerating inflation, then what other conditions are necessary for inflation? What necessary factors in combination are sufficient for inflation?

Before the recent episode of money growth required a rescaling of this chart, there had been other charts which likewise showed money growth accelerating and which likewise suggested accelerating inflation ahead. Didn’t happen. Other necessary conditions weren’t present. This picture doesn’t tell us about those conditions.

I guess Menzie didn’t like my cutesy pic. Well, my hint is, it comes after the letter U and before the letter W, and has nothing to do with the shape of economic recoveries.

Money is a claim on future products and services. What few seem to understand, is that so is every asset in the world. Assets are money and money are assets. It is just that assets (such as stock, bonds, real estate, minerals, art, bitcoins, etc.) have to be converted to currency (sold) before you use them to lay claims to products and services (priced in your country currency). The stock market can create (or lose) more money in a week than the Fed does in a year. The Feds direct influence via its money creation is minuscule. What really counts is how the Fed can manipulate much bigger asset markets by what it says or does.

Prices are not particularly sensitive to the amount of money (claims on future products and services). Prices are created by supply and demand. You have to restrain supply and/or increase demand (beyond supply) to get substantial increase in prices. Excess (whatever that is) of money can only create inflation if you get a panic that makes a lot of people eager to convert their money into consumable products and services. Panics that makes people convert one kind of money into another (stocks to bonds, real estate to stocks, bonds to minerals, etc) are not going to create inflation outside of the specific asset classes involved.