While there was a big downside NFP surprise (194K vs. Bloomberg consensus of 500K), the overall picture is not much altered:

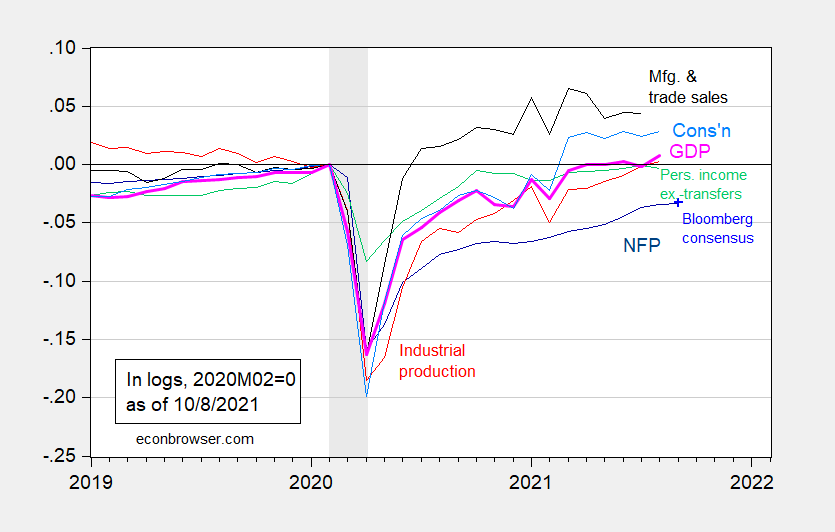

Figure 1: Nonfarm payroll employment from August release (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (10/1/2021 release), NBER, and author’s calculations.

There are reasons to believe that the September figures are perhaps distorted somewhat by seasonal issues (including school related), as well as real-world factors like the rise of the delta variant’s impact, to be discussed in the next post. For now, it’s useful to consider private employment, which experienced a smaller miss (317K actual vs. 455K consensus).

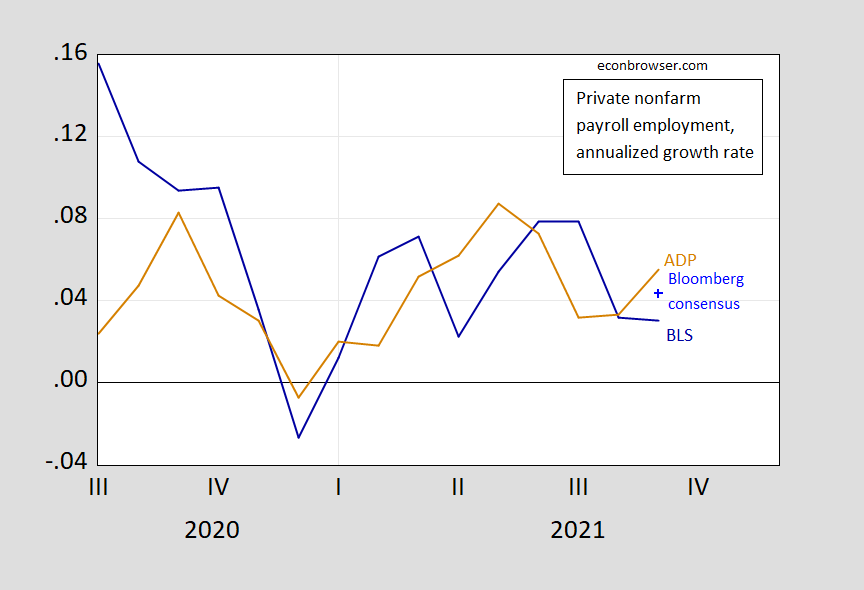

Figure 2: Annualized growth rate of official private nonfarm payroll employment (blue), ADP private NFP (brown), and Bloomberg consensus (blue +). Growth rates calculated as log differences. Source: BLS, ADP via FRED, and author’s calculations.

What is true is that growth seems to be decelerating. Current nowcasts for Q3 GDP are 1.4% (IHS-MarkIt), 1.3% (Atlanta Fed), and 3.25% (Goldman Sachs). As reported by CR, Merrill 2%.

Interesting numbers, all of them. I mean, they really are fascinating, but I’m kinda drawing blanks on what to conclude on this. Other than maybe these numbers reinforce that most of the transitive inflation is being caused by supply issues. I wonder if ZH has a more detailed breakdown on the banker/dealers’ GDP forecasts?? They usually have more stuff from JPM than the other banks for whatever reason. I should check back with WSJ hardcopy. I have so much stuff on my reading list and the fact I’m lazy doesn’t help much. But I think before Monday morning I’m gonna try and do some speed reading (or my sad version of speed reading) on ZH and WSJ and see if I can get a grip on this stuff. Even though it’s a crock they only pushed off the debt limit to December, it’s still “good news” so, we can take some mild form of contentment and good feeling from that.

A falling 3-month average (which we have) is more troubling than a downside miss against the median estimate. Median estimates exist because financial traders wanted to know how to trade data releases. To those traders, mediane estimates are a proxy for trading positions,xand are useful (sometimes) in making money. Some data series are easy to forecast most cases of the time – CPI and GDP within two weeks of release, for instance – while others are not so easy. Monthly job gains are not so easy, so misses are likely. Forecastig misses don’t tell us much about the economy. Similarly, data “surprise” indices don’t tell us whether the economy is weak or strong relative to some average, but rather whether it’s better or worse than expectations – expectations which are important to financial tradrw, but not so much for the purpose of economic analysis.

The strengh in ADP and the household hiring number relative to the payroll hiring number is interesting. Three independent surveys of hiring activity give us a better indication of labor market activity than a single survey does. The impression from all three togeher is a good bit stronger than the headline payroll hiring figure. Much of the weakness in the payroll number is from the public sector (teachers in particular), and ADP ignores public sector hiring.

ADP and households reported over 500,000 new hires in September (household data do not exclude public sector workers) and the establishment survey counted over 300,000 private-sector hires. Given that government added 307,000 new jobs in the prior two months before shedding 123,000 jobs in September – mostly in the education category – we might want to take the government hiring numbers with a grain of salt. Smear the three month average of government hiring over each of the past three months and you get roughly 379,000 new hires in September and 418,000 in August, vs 902,000 in July. That’s still a sharp slowdown, but nothing like the headline figures suggest.

Which makes the Fed’s apparent reliance on short-term jobs data right now problematic.

Speaking of distortions, we may be in for a doozy in Q4 employment numbers.

Retail employment typically rises by something in the range of 400,000 to 750,000 in Q4. Seasonal adjustment takes out all but a few thousand of that gain. In recent years, on-line shopping has drained demand from “retail” while adding to other categories. This year, a big shift toward on-line shopping and big inventory problems may combine to limit retail hiring even more than last year. So we may go from Q3, when front-loading of teacher hiring gives the impression of sharply slowing job growth lqte in tha quarter, to Q4, when a shift from “retail” hiring to warehouse, delivery and similar hiring gives the impression of a sharp slowdown in hiring.

In other words, structural change and supply problems may show up camouflaged as slack demand. Amazon and FedEx will try to hire more people, but they already have hired more people. Their hiring doesn’t match existing seasonal patterns, so we’ll get scary numbers.

Well, I get teased about my YT links here. The person who probably has the most right to tease me about my YT links, Menzie is very good natured about it and never gives me any flack. But I wanted to let people know the NBER channel on Youtube is doing a “working group” on the Chinese economy. Some of the lectures are good, some not so good. But if you take a strong interest in the Chinese economy and peccadillos, you can learn some things by watching. It can be dry, but again if you take strong interest in such things, you’ll probably like it.

Danke sehr.

Michael Hudson contrasting the US economy to the Chinese: “ China understands the difference between earned income and unearned income, between productive investment and unproductive investment. And in the United States, if they do recognise this difference, they realise that unearned income you can make wealth by parasitically much quicker than you can actually create wealth. It’s cheaper to be a parasite than a host. And so most of the financial strategy of Wall Street thinks, how can we get something for nothing? How can we get a free lunch? Well, let’s begin by telling people, having Milton Friedman as a kind of sock puppet saying there is no such thing as a free lunch, when the whole of Wall Street is looking for a free lunch. They’re looking to grab Chinese assets on the cheap, like Soros is grabbing post-Soviet assets. They’re looking for monopoly rights.”

https://michael-hudson.com/2021/10/the-affront-of-chinese-sovereignty/

Yep. You finally found an acorn.

I don’t disagree with everything Michael Hudson says, but as time wears on, he strikes me as a Joel Osteen of left-wing economics. Continually telling a certain demographic what they WANT to hear. This strikes me as utter garbage, and without even bothering to read one sentence of Hudson’s blog post, I’d be curious to hear or read a single example of Chinese based assets that American corporations have “robbed” from the Chinese in the last quarter century.

I’m setting a low bar here people, just ONE example will suffice.

Maybe there’s a good reason that US corporations haven’t stolen Chinese assets…but you don’t have to look far to find grabitization in action. Pretty much every time a Washington Consensus bailout got implemented, Wall Street got to grab a country’s Crown Jewels for pennies on the dollar. Eventually counties wise up… the Asian tigers in particular got the message.

“Continually telling a certain demographic what they WANT to hear. This strikes me as utter garbage.” After listening to a constant drumbeat of the glories of the “free” market and corporate friendly “free” trade deals, I find it refreshing it to hear an alternative point of view, particularly one that one that spotlights financialised capitalism.

Piketty and Hudson had a “debate” recently. It seems that the agreed on much more than they siagreed on.

https://michael-hudson.com/2021/10/piketty-vs-hudson/

September 23, 2021

Thomas Piketty vs Michael Hudson

I think you’ll find very few people (certainly regular commenters on this blog) more sympathetic to the base arguments of Piketty or Hudson (although I feel Piketty attains much heavier intellectual weight than Hudson, and makes much more substantive arguments). I find many of Hudson’s arguments to be vacuous, aimed at the type of folks who in times past would have paid tickets to the carnival freak show (which is fine if you know what you are actually paying for).

Still, you haven’t given the example of Chinese based assets and/or working capital that Wall Street has “robbed” from them in the last quarter century. I’m eagerly awaiting that single example.

@ JohnH

Was this where you were under the impression Americans were swindling/fleecing the Chinese?? I’d like to see how your math works out on that:

https://www.forbes.com/sites/jonathanponciano/2021/08/20/us-listed-chinese-stocks-have-lost-another-150-billion-in-market-value-this-week-as-beijing-targets-excessive-wealth/?sh=6009546244f7

https://www.bloomberg.com/news/articles/2021-08-25/sec-chief-warns-clock-is-ticking-on-delisting-chinese-stocks

Hell, if we’re exceedingly lucky, maybe Peter Gal of Bethereum will revisit Menzie’s and Professor Hamilton’s blog and tell us all what a “stupendous reward” Chinese stocks are for America’s small indidvidual investors. Another exciting moment to be had by all Econbrowser readers.

can anyone explain how health care employment fell by 17,500 in September, as hospitals lost 8,100 jobs and nursing homes and residential care facilities employed 37,600 fewer than in August, when the latest JOLTS report showed nearly 1.8 million job openings in the sector?

whatever the case, i imagine it would be a bad time to be hospitalized or in a nursing home….not likely there’d be anyone available to fetch you water if you were thirsty, or empty your bedpan when it was needed….

https://www.nytimes.com/2021/09/25/business/home-health-aides-industry.html

September 25, 2021

Long Hours, Low Pay, Loneliness and a Booming Industry

The ranks of home health aides are expected to grow more than any other job in the next decade. What kind of work are they being asked to do?

By Liz Donovan and Muriel Alarcón

For 15 years, Yvette Dessin spent long work days with her elderly patients, accompanying them on walks, cooking them meals and bathing those who needed that most intimate kind of care. If a patient died, Ms. Dessin and her adult daughter attended the funeral services to pay their respects.

Ms. Dessin worked up to 60 hours a week as a home health aide, her daughter said, making minimum wage. She often worried about being able to pay the mortgage on her Queens home. She was one of roughly 2.4 million home care workers in the United States — most of them low-income women of color and many of them immigrants — who assist elderly or disabled patients in private residences or group homes.

The industry is in the midst of enormous growth. By 2030, 21 percent of the American population will be at the retirement age, up from 15 percent in 2014, and older adults have long been moving away from institutionalized care. In a 2018 AARP survey, 76 percent of those ages 50 and older said they preferred to remain in their current residence as they age. In 2019, national spending on home health care reached a high of $113.5 billion, a 40 percent increase from 2013, according to the most recent data from the Centers for Medicare and Medicaid Services.

The ranks of home care aides are expected to grow by more than those of any other job in the next decade, according to the Bureau of Labor Statistics. It’s also among the lowest paying occupations on the list.

Nearly one in five aides lives below the poverty line. In six states, the average hourly wage for home care aides is less than $11, and nationally, the median pay has increased just $1.75 an hour over the last decade, when adjusted for inflation….

https://fred.stlouisfed.org/graph/?g=FTIL

January 4, 2020

Average Hourly Earnings of Private Production and Nonsupervisory Workers, * 2020-2021

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

[ Where average hourly earnings of nonsupervisory workers is now over $26, average earnings for health care aides is below $11. This in a field that has become significantly more difficult… ]

https://www.nytimes.com/2021/10/06/upshot/child-care-biden.html

October 6, 2021

How Other Nations Pay for Child Care. The U.S. Is an Outlier.

Rich countries contribute an average of $14,000 per year for a toddler’s care, compared with $500 in the U.S. The Democrats’ spending bill tries to shrink the gap.

By Claire Cain Miller

Typical 2-year-olds in Denmark attend child care during the day, where they are guaranteed a spot, and their parents pay no more than 25 percent of the cost. That guaranteed spot will remain until the children are in after-school care at age 10. If their parents choose to stay home or hire a nanny, the government helps pay for that, too.

Two-year-olds in the United States are less likely to attend formal child care. If they do, their parents pay full price — an average $1,100 a month — and compete to find a spot. If their parents stay home or find another arrangement, they are also on their own to finance it, as they will be until kindergarten.

In the developed world, the United States is an outlier in its low levels of financial support for young children’s care — something Democrats, with their safety net spending bill, are trying to change. The U.S. spends 0.2 percent of its G.D.P. on child care for children 2 and under — which amounts to about $200 a year for most families, in the form of a once-a-year tax credit for parents who pay for care.

https://int.nyt.com/chartmaker/2021/10/06/20211005-how-much-governments-spe/3/artboard-600px.png

The other wealthy countries in the Organization for Economic Cooperation and Development spend an average of 0.7 percent of G.D.P. on toddlers, mainly through heavily subsidized child care. Denmark, for example, spends $23,140 annually per child on care for children 2 and under.

“We as a society, with public funding, spend so much less on children before kindergarten than once they reach kindergarten,” said Elizabeth Davis, an economist studying child care at the University of Minnesota. “And yet the science of child development shows how very important investment in the youngest ages are, and we get societal benefits from those investments.”

Congress is negotiating the details of the spending bill, and many elements are likely to be cut to decrease the cost. The current draft of the child care plan would make attendance at licensed child care centers free for the lowest-earning families, and it would cost no more than 7 percent of family income for those earning up to double the state’s median income. It would provide universal public preschool for children ages 3 and 4. And it would increase the pay of child care workers and preschool teachers to be equivalent to elementary teachers (currently, the median hourly wage for a preschool teacher of 4-year-olds is $14.67, and for a kindergarten teacher of 5-year-olds $32.80.) …

https://www.nytimes.com/2021/10/09/us/politics/child-care-costs-wages-legislation.html

October 9, 2021

When Child Care Costs Twice as Much as the Mortgage

President Biden’s social policy legislation aims to address a problem that weighs on many families — and the teachers and child care centers serving them.

By Jason DeParle

GREENSBORO, N.C. — To understand the problems Democrats hope to solve with their supersized plan to make child care better and more affordable, consider this small Southern city where many parents spend more for care than they do for mortgages, yet teachers get paid like fast food workers and centers cannot hire enough staff….

Will tepid job numbers affect the Fed’s plans to reduce the $120 billion/month debt securities purchases?

Very well may. It depends on what was meant when Powell said the Fed wants to see more good employment reports before tapering. The September data were better than the headlines suggest, but not great.

https://www.nytimes.com/2021/10/08/opinion/coins-debt-ceiling-default.html

October 8, 2021

Wonking Out: Coins and credibility

By Paul Krugman

Franklin Roosevelt took the United States off the gold standard soon after his inauguration as president in 1933. It was an essential move: The nation was in the midst of a banking crisis, and to end that crisis the Federal Reserve needed the freedom to print money as needed. But even some of Roosevelt’s own aides were aghast: Lewis Douglas, his budget director, reportedly blurted out, “This is the end of Western civilization.”

Last time I checked, civilization was still here. But there are echoes of the gold standard debate in some of the discussions about how to deal with Republican brinkmanship over the debt limit. As I mentioned in my newsletter last week, * one possible way out would be to exploit an apparent legal loophole by minting a platinum coin with a huge face value, say $1 trillion, depositing that coin in an account at the Fed, then drawing on that account to pay the government’s bills.

Let me say right away that there are some good reasons to be uneasy about minting the coin. The Fed, which is semiautonomous, might not agree to play along. The strategy might face legal challenges. And by resorting to this gimmick we would be sending the world a signal that we’re a messed-up nation having big problems governing itself — although the truth is that we are a messed-up nation thanks to the nihilism of one of our two major parties, so minting the coin would arguably just be acknowledging the obvious.

But I’ve been told that some senior administration officials have been making another argument against the coin or any similar strategy, one that echoes Lewis Douglas — namely, that going that route would undermine the credibility of the dollar. And that’s all wrong.

First things first: Minting the coin would not amount to financing the budget deficit by printing money.

What we actually mean when we talk about “printing money” is an increase in the monetary base — the sum of cash in circulation and the reserves held by private banks, mainly in the form of deposits at the Fed. The Fed’s economic influence comes from its ability to increase the monetary base at will, normally by buying federal debt from banks and paying for those purchases by crediting the banks’ accounts with money that’s essentially created out of thin air.

So wouldn’t allowing the Treasury to pay its bills by drawing on an account also created out of thin air — on accepting the coin, the Fed would simply declare that the Treasury had a $1 trillion account — mean increasing the monetary base? Not if the Fed didn’t want it to.

You see, past monetary operations have left the Fed in possession of a huge portfolio, including more than $5 trillion in U.S. government debt. And the Fed could and surely would “sterilize” any effect of federal withdrawals on the monetary base by selling off some of that portfolio.

Think of the Treasury and the Fed — which has some policy independence but is financially just part of the federal government — as a single entity….

* https://www.nytimes.com/2021/10/01/opinion/biden-coin-democrat-republican-debt-limit.html

https://www.nytimes.com/2021/10/01/opinion/biden-coin-democrat-republican-debt-limit.html

October 1, 2021

Wonking Out: Biden should ignore the debt limit and mint a $1 trillion coin

By Paul Krugman

It’s hard to believe now, but before Donald Trump became the G.O.P.’s presidential nominee in 2016, Senator Marco Rubio of Florida was widely seen as a champion of the “reformicons” — conservatives who wanted the Republican Party to become more moderate and flexible, to move beyond its obsessive focus on cutting taxes for the rich and slashing benefits for the poor. Since then, however, Rubio has become a pathetic figure — not just a Trump toady, but someone who routinely tweets out stuff like this: “The $3.5 trillion Biden plan isn’t socialism, it’s Marxism.”

Indeed, we all remember the stirring passage in The Communist Manifesto where Marx declared, “Workers of the world, unite to spend 1.2 percent of G.D.P. on popular programs over the next decade!”

The fact that Republicans routinely say such nonsense is why the Biden administration should mint a $1 trillion platinum coin or declare that the Constitution gives it the right to issue whatever debt is needed to fund the government — or use some other trick I haven’t thought of to ignore the looming crisis.

Some background: We all learned in civics class — do students still take civics? — that federal policy on spending and taxing is set by a straightforward legislative process. Congress passes bills and if the president doesn’t veto those bills, they become law. End of story.

But there is, it turns out, a quirk in the budget process: Congress must also separately authorize the federal government to take on more debt.

Historically, this was considered a mere technicality: Of course Congress would approve borrowing if the spending and taxing bills it had already enacted led to a budget deficit. Not doing so would make no sense — not just because it would cripple government operations, but also because it would threaten financial havoc: U.S. government securities are the bedrock of the global financial system, used for collateral in many transactions. Threatening federal cash flows could therefore provoke a worldwide meltdown.

But U.S. politics aren’t what they once were. The Republican Party has become both radical and ruthless; let’s not forget that most G.O.P. legislators refused to certify President Biden’s election. And while this radicalized party cheerfully authorizes trillions in borrowing whenever it holds the White House, it weaponizes the debt limit whenever a Democrat is president.

During the Obama years, Republicans used the debt limit for blackmail, refusing to raise it unless President Barack Obama agreed to spending cuts — spending cuts the G.O.P. wouldn’t have been able to get passed through the normal legislative process, despite having partial control of Congress.

What’s happening now is even worse….

use an executive order!

lik, hitler did with mefo bills.

biden can do the same.

Better yet, just have the Dems bite the bullet and use reconciliation to simply eliminate the debt ceiling entirely. The sooner it goes, the better. No need to play silly games with a trillion dollar or other amount coin.

At least, Professor Krugman is consistent.

Here is the history.

In 1933, the US did not depart from the gold standard and the unconstitutional money/gold confiscations did not resolve the 1933 banking crisis.

One, In 1933 FDR issued an unconstitutional [Art. I, Section 8] executive order banning Americans from owning money i.e., gold coins, and ordering them to turn their gold money in to the Federal Reserve or face up to ten years in prison, plus a fine. In 1934, FDR devalued the dollar by 69% from $20.67 per ounce to $35 per ounce: The 1934 Gold Reserve Act [Congress] made the confiscations constitutional. From then on the Federal government owned all domestic, monetary gold. Gold was used in international transactions until August 1973 when Nixon closed the gold window.

Two, that which resolved the 1933 bank crisis was The Emergency Banking Act of 1933, which was signed on March 9, 1933, three days after FDR declared a nationwide bank holiday. And, that combined with the Federal Reserve’s commitment to supply unlimited amounts of currency to reopened banks, which created effective 100 percent deposit insurance. Among other benefits, this allowed banks to pay interest rates at risk-free rates and, more importantly, ended depositors’ concerns over the financial conditions of the banks into which they deposit their savings. Banks reopened on March 13, 1933 with depositors returning stashed cash to the banks. The Fed never had on hand more than one-third of the gold needed to pay Federal Reserve Notes in circulation

Three, I hope the Fed/Treasury Siamese twins have lucky numbers, as his lucky number was one of FDR’s considerations when setting the price of gold:

“Theoretically, Roosevelt’s idea of reflating can be defended. More money might mean more growth.

“But, the exposure to investors that Morgenthau was getting through the gold purchase project of 1933 was already teaching him something. Investors didn’t like the arbitrariness. It took away their confidence. One day Morgenthau asked FDR why the president had chosen to drive up the price of gold by 21 cents. The president cavalierly said he’d done that because 21 was seven times three, and three was a lucky number. “If anyone ever knew how we really set the gold price through a combination of lucky numbers etc., I think they would be frightened,” Morgenthau wrote in his diary. And they were: In the second half of 1933 a powerful stock rally flattened.

But, 21 was the price ‘we chose.’”

Four, 9 November 2016, “If the question is when markets will recover, a first-pass answer is never.”

The DJIA is up 16,400 points, or 90%, from November 2016.

https://fred.stlouisfed.org/graph/?g=E6Hp

January 30, 2020

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2020-2021

https://fred.stlouisfed.org/graph/?g=E6cy

January 30, 2020

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2020-2021

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=DDif

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2007-2021

https://fred.stlouisfed.org/graph/?g=DDj3

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 2007-2021

(Indexed to 2007)

Last week [4 Oct 2021], a Barron’s article reported aggregate US household net worth at $141.7 trillion, as of 30 June.

So, if we all send in 20% of our net worth . . . .They’ll simply spend it all, too.

https://fred.stlouisfed.org/graph/?g=DCDl

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 1990-2021

https://fred.stlouisfed.org/graph/?g=DDi5

January 30, 2018

Share of Total Net Worth Held by Top 1%, Top 90 to 99% and Top 50 to 90%, 1990-2021

(Indexed to 1990)

There is something weird about the September employment numbers. Private employment was up a robust 316K and if state and local employment had increased as expected, the numbers would have been close to expectations.

But instead, state and local employment, mostly schools, was down 161K which was completely the opposite of expected. This accounts for almost all of the the miss from expectations. Is this a temporary effect due to disruptions from starting up in-person schools after a year and a half? Were support personnel laid off and haven’t returned yet? I guess we will have to wait until the October report to find out.

It was a pretty good employment report but something very strange is going on in government jobs, especially schools.

https://fred.stlouisfed.org/graph/?g=tRKp

January 4, 2018

State and Local Government employment, 2017-2021

https://fred.stlouisfed.org/graph/?g=tRJR

January 4, 2018

Local and State Government Education Employment, 2017-2021

Here is the history….

[ Thank you, but with no references I am unable to check and understand what is “here.” ]

Here is the history….

[ This will suffice for a review and references:

https://en.wikipedia.org/wiki/Gold_Reserve_Act

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. It also prohibited the Treasury and financial institutions from redeeming dollar bills for gold, established the Exchange Stabilization Fund under control of the Treasury to control the dollar’s value without the assistance (or approval) of the Federal Reserve, and authorized the president to establish the gold value of the dollar by proclamation…. ]