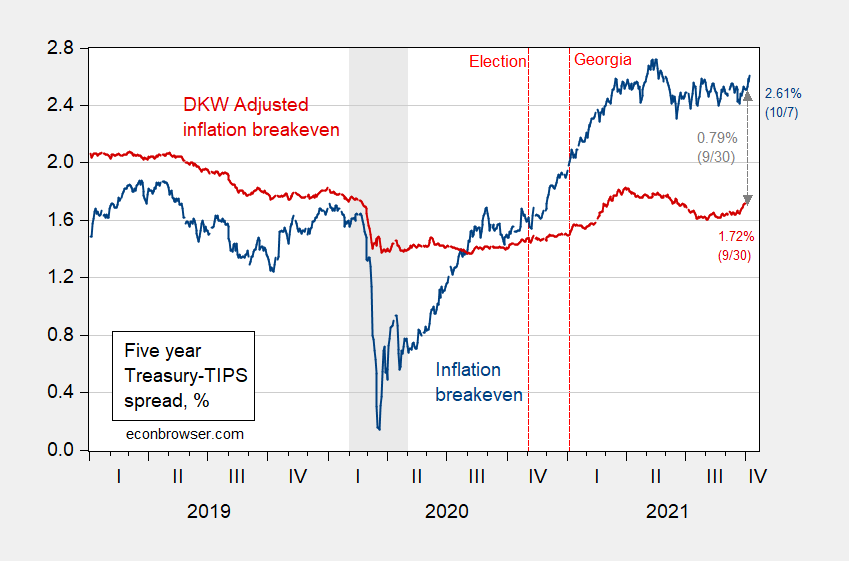

Still averaging around 1.7%, for the next five years.

As of today, the five year inflation breakeven was 2.61%, down from 2.72% in mid-May. The estimated inflation risk and liquidity premia adjusted 5 year breakeven was 1.72% as of 9/30 (when the corresponding actual breakeven was 2.51%).

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), all in %. NBER defined recession dates shaded gray (from beginning of peak month to end of trough month). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 10/7, NBER and author’s calculations.

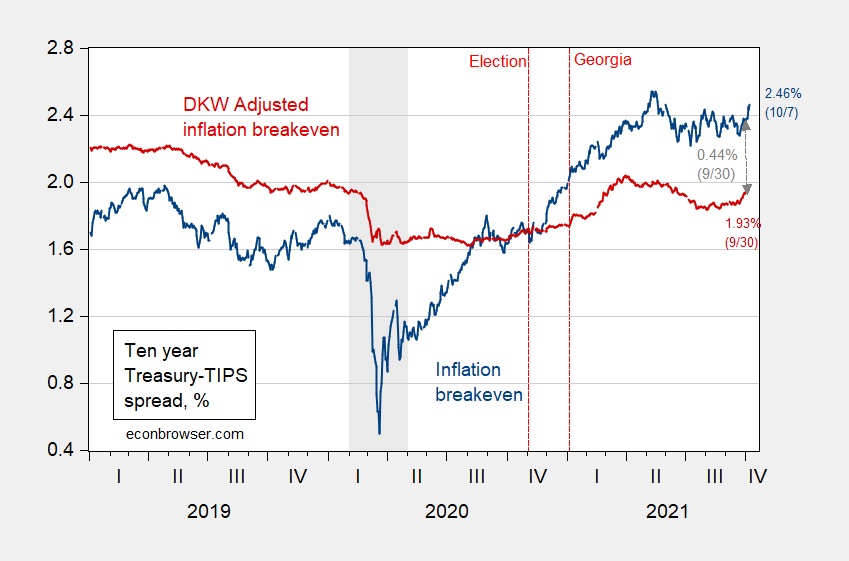

For the ten year horizon:

Figure 2: Ten year inflation breakeven calculated as ten year Treasury yield minus ten year TIPS yield (blue), ten year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), all in %. NBER defined recession dates shaded gray (from beginning of peak month to end of trough month). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 10/7, NBER and author’s calculations.

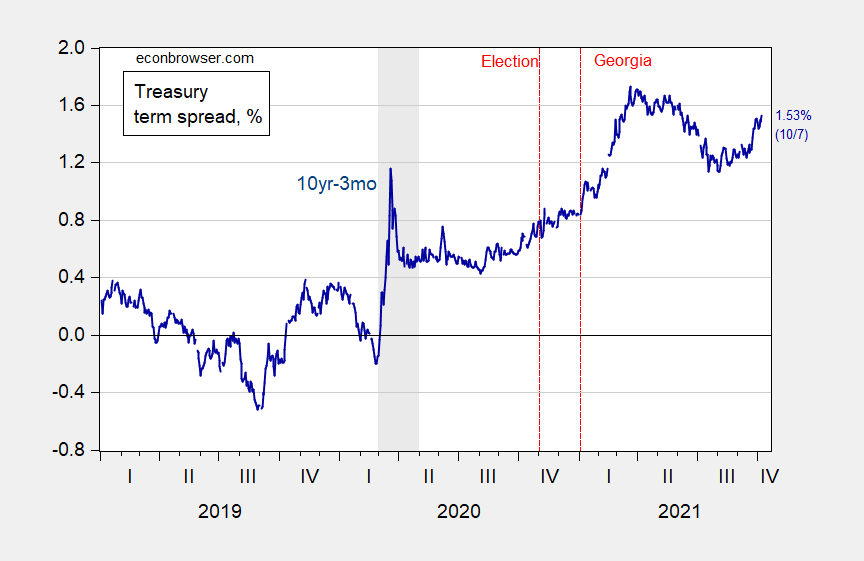

On a side note, the yield curve continues to steepen (10yr-3mo):

Figure 3: 10 year-3 month Treasury spread (blue), constant maturity yields, in %. NBER defined recession dates shaded gray (from beginning of peak month to end of trough month). Source: FRB via FRED,

Well, I have what might be perceived to be a “scatterbrain” type comment. And maybe it is a bit scatterbrained. But to me, long-term inflation expectations are almost more valuable in terms of what they tell us about now. People’s expectations inside this moment. Because I think, if you look at ECB, Federal Reserve, and a host of other outfits we could run down, long-term expectations on inflation end up being horribly wrong a significant amount of times. Think of pre-Covid right?? Totally different world for the “GVC”~~and hence, shortages induced transitive inflation. So to me, to use a wild “analogy”, looking at long term rates (which are a type of “prediction”) is kind of like being a runner in a marathon race, leading 85% of the pack, and turning your head back to see where the other runners are behind you. It tells you where the other runners are in one moment in time, but it has very little relation to who is going to win the race when you are 2k progression point in a 10k marathon race. It’s more apt to tell you where people will be at the 4k mark, and then be very different at the 10k finish line. Are long-term rates “useless”?? NO, but I honestly think they tell us more about now than anything else useful. Instead of “Where are these other runners in the race right now??” Long term rates tell us the answer to “Where do most other people think rates are going right now???

That last sentence in my above comment would probably better read “Comparative to” rather than “Instead of”, as it relates to my weird analogy.

https://fred.stlouisfed.org/graph/?g=qfC8

January 15, 2018

Ten-year breakeven inflation rate, 2017-2021

https://fred.stlouisfed.org/graph/?g=qfm7

January 15, 2018

TIPS 5-year spread, * 2017-2021

* Breakeven inflation rate (difference between rate on nominal Treasury Notes and on Treasury Inflation-Protected Securities)

https://fred.stlouisfed.org/graph/?g=rbMS

January 4, 2020

United States Employment-Population Ratio, * 2020-2021

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=tQiS

January 4, 2020

Employment-Population Ratios, * 2020-2021

* Bachelor’s Degree and Higher, Some College or Associate Degree, High School Graduates, No College; Employment age 25 and over

https://fred.stlouisfed.org/graph/?g=wmjW

January 4, 2020

Employment-Population Ratios for White, Black, Hispanic and Asian, * 2020-2021

* Employment age 16 and over

Job growth of 194,000 in September, with government a big drag, shedding 123,000 workers. Employment of teachers fell. School reopening did not work magic on female participation.

Average hourly earnings up 0.8%, perhaps because private hiring so strongly outpaced public hiring.

The Fed has pointed to employment as important to the decision to taper asset purchases.

Ah but the household survey suggested employment increased by more than 500 thousand, which is one reason for that big reported drop in the unemployment rate (labor force participation fell a bit).

IDA impacts on the initial survey.

So you must be forecasting a 700,000 increase for October.

Female unemployment rate 16 and up 4.5% vs 5.0% in August and 8.0% a year ago. Not bad.

Females unemployment rate 20 to 24 years of age 6.5% vs 9.0% in August and 12.2% a year earlier. That seems odd. Nearly a year since anything that big happened in this series.

The rate for males in this age group is twice as high and didn’t flop around nearly as much. In fact, no other category did. I don’t think BLS publishes any participation series for 20 to 24 year olds (probably another one of those data conspiracies we read so much about in this comments section), but it would be useful today. Looks like a data problem having to do with young women – teacher-mom demographic.

https://fred.stlouisfed.org/graph/?g=tNIb

January 4, 2020

Unemployment rates for men & women, * 2020-2021

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=tGuT

January 4, 2020

Unemployment rates for Whites, Blacks and Hispanics, * 2020-2021

* Employment age 16 and over

Oh, and that business about extended jobless benefits discouraging work? That’s apparently not true. Who’d have guessed?

https://fred.stlouisfed.org/graph/?g=FU9h

January 4, 2020

Average Hourly Earnings of All Private Workers, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=G5Ya

January 4, 2020

Real Average Hourly Earnings of All Private Workers, 2020-2021

(Indexed to 2020)

The headline news from the BLS Employment Report shows: (1) payroll survey indicates an increase in employment less than 200,000; but (2) the unemployment rate fell from 5.2% to 4.8%. OK the latter reflects the household survey where the labor force participation rate fell a bit and the employment to population ratio rose from 58.5% to 58.7% as this survey suggests employment rose by more than 500 thousand.

Those are the figures – now time to listen to both the political spin and the more informed views on what just happened!

Private forecasters should have realized IDA was going to temporarily reduce NFP and LFPR for September. Shame on them. I figure part of Households surge was also IDA related.

There is no evidence in the data of an unusual effect from weather. Public jobs down, private jobs up? That’s not weather.

But why use logic when data will do? Unable to attend work due to weather in September 2021: 97,000. September 2020: 91,000. September 2018: 313,000. September 2017: 1.5 million.

Ida? Wrong, wrong, wrong.

Shame on Bott.

Steve Bannon’s lawyers is a real piece of garbage:

https://www.msn.com/en-us/news/politics/bannon-lawyer-says-he-won-e2-80-99t-cooperate-with-house-probe-of-jan-6/ar-AAPhSwh?ocid=uxbndlbing

Let’s break down this excuse for stiffing the 1/6 committee. Bannon’s lawyer is asserting his client cannot comply as Executive Privilege is being asserted by Donald Trump – except Trump is not the President. The current President is not asserting Executive Privilege.

Where does this end up? Maybe Bannon’s fat rear end lands in jail where it belongs!

So, here’s just an open question, for anyone who wants to answer it. The last debt ceiling limit happened August of 2019. When that happened, A Republican was in the White House, and the debt limit was moved TWO YEARS off. Now we have a Democrat as President, we hit that debt ceiling limit, and we move it off 3 months (4 maybe, if you wanna get nit-picky) . If Nancy Pelosi is as sharp as some people keep insisting to me that she is, why doesn’t she use this as leverage the same way Republicans use the debt ceiling limit as leverage during a Democrat Presidency?? i.e. Why does slur speech Pelosi and her elderly crew of dunce caps wearers she has slobbering on themselves around her at her village idiots press meet-ups so happily agree to the debt limit hitting again, only after it’s possible a Democrat has the White House again, instead of allowing the debt ceiling to hit again (say for example only 3-to-4 months after August 2019) and using that as leverage against Republicans on their “policy agenda”?? Is that a tough one for slurring Pelosi to figure out?? I’m just asking.

Moses,

“slur speech Pelosi”? What has set off this particular latest smear of her by you? Regarding blocking the Trump policy agenda they did not need to do something so irresponsible. they were able to do so regarding anything he wanted to go through Congress because they had control of the House. They did not need any extra “leverage.” Or do you think she should have done this in order to block particular executive actions?

In terms of the current situation the problem is in the Senate, not the House. It is Schumer and his colleagues who are the problem: not eliminating the filibuster and for that matter somehow not being willing to in fact do what should be done, which in fact is to go ahead do what McConnell has said he should, use reconciliation but instead of just raising the debt ceiling a bit or even for two years, just getting rid of it or doing something that effectively do that. But somehow he is too politically cowardly to do that.

But then we have seen you pull this before, somehow thinking that when Schumer fails to get things done in the Senate that should be done, you instead of blaming him or focusing on him you somehow decide it is time to unload another of your obsessively sick assaults on Pelosi that nobody here supports you on.

This one’s easy. Republicans are guided by self-interest and rely on extortion and hypocrisy. Democrats follow public welfare. When Republicans are in control, Democrats still want what’s best.

Is it best for the public, when you consciously fight with one hand tied behind your back?? When Pelosi signs on very quickly under a Republican president to shove away 2 years down under the next Presidency the next budget limit blow-up, while McConnell just has it pop up every 3 months under her own party. That’s “leadership”?? Ceding legislative leverage is “leadership”?? Wow, and you wonder how the Republicans make Democrats look weak year after year. Another “eternal mystery” with the answer right under “Republican-lite’s” nose. And “oh shucks!!! gosh darn!!! jiminy cricket!!!” Republican-lite Nancy Pelosi after 30 years being the House Speaker, just has “no idea” how to stop this perennial problem of budget limits hitting the fan blades again. And budget limits/ threats of default popping up every few months being used as a negotiating card to kill Democrat’s infrastructure policies. Just no idea. But when the next Republican (trump again??) takes office and they let her throw her 30th ace card from Democrat’s poker hand into the bar’s lavatory drain, Pelosi will just have to sign that bill to push the debt limit problem to the next Democrat administration~~”For the American people’s benefit” of course. Wow, some of you people should join Pelosi’s congressional staff. Don’t forget to bring your “man card” with you for incineration before joining her staff, and, also, don’t forget she likes soft foods like ice cream. Bring some instant oatmeal as your new intern’s suck-up gift, it’s gentle on her gums.

Mosers,

Oh, caught in another hysterical looney bin attack on Pelosi, you double down. With the Senate in GOP hands there was no way she could end the debt ceiling back in 2019? How out of it are you?

They could do it now, but the person holding back seems to be Schumer. He does not even want to use reconciliation, which is clearly the way to go. I find it weird that McConnell is actually right on this, although he is also deluded, somehow thinking the public will care if Dems end the debt ceiling all by themselves. They need to do it while they can.

But, again, Pelosi is not the problem here. Schumer is, the man you do not mention while going on about “slur speech Pelosi.” Wow. What t total sicko you are.

I have to agree, schumer is the one to look at. Pelosi can get the house votes. Schumer can get it through the senate. I would put it through reconciliation. And if dems can end the limit, they should. It is not the political talking point mitch thinks it is. People understand when you charge your credit card, you are obligated ti pay the bill. That is the pr message we should be sending. Simple sound bytes work with the public.