The gap between the market valuation of the net international investment position (NIIP) and the cumulative current account has waxed and waned over the years (see the discussion in this post). Some of this effect is due to the dollar’s value. Does the same hold true for net primary income (investment and wage income)?

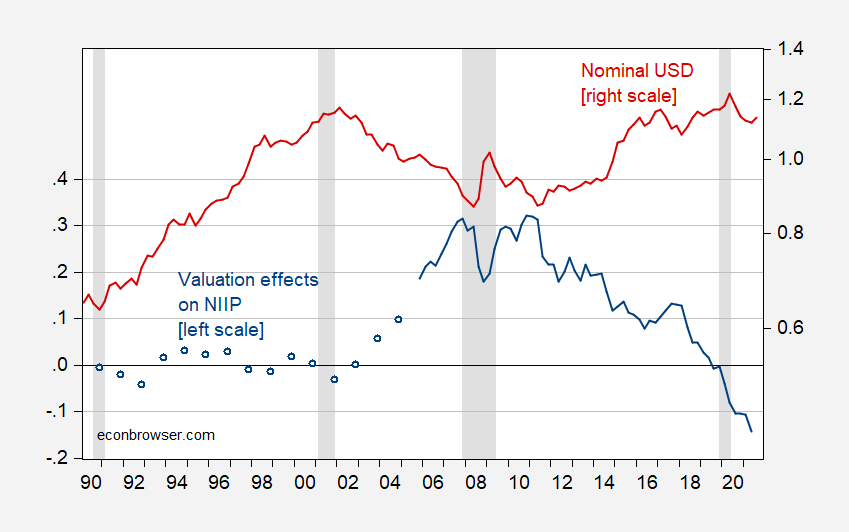

First, lets look at the valuation effect proxied by the gap between NIIP and cumulative current account (both as a share of GDP).

Figure 1: Valuation effect on Net International Investment Position (NIIP) measured as market NIIP minus cumulated current account (1989Q2=0) expressed as a ratio of GDP (blue, left scale), and nominal value of US dollar against a broad basket of currencies (spliced), 2006=1 (red, right log scale). NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

From 2007 to 2011, the valuation effect was equivalent to 30% of GDP. Movements in the dollar showing up in valuation effects around that time reflect in part rising cross-border holdings of assets. The valuation effect has switched sign. In this latter period, exchange rate effects are not so apparent, signaling that exchange rate effects are not the only factor.

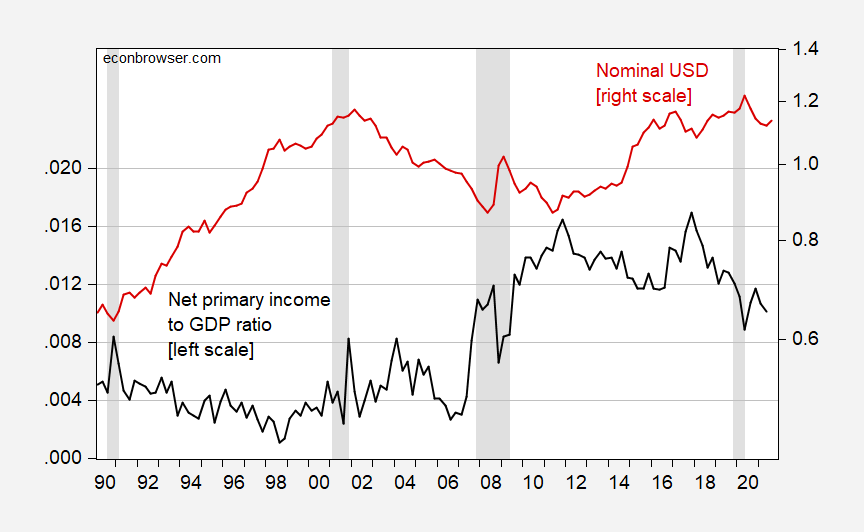

Next, what about for net primary income? Here’s the corresponding graph:

Figure 2: Net primary income expressed as a ratio of GDP (blue, left scale), and nominal value of US dollar against a broad basket of currencies (spliced), 2006=1 (red, right log scale). Net primary income using NIPA definitions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

There is some apparent correlation. However, exchange rate changes affect receipts and payments in different ways (in an accounting sense). Since the flows are denominated in dollars, payments are not converted from one currency to another in the tabulation, while receipts are. One might want then conjecture a bigger (accounting) effect on receipts than payments. This is not apparent.

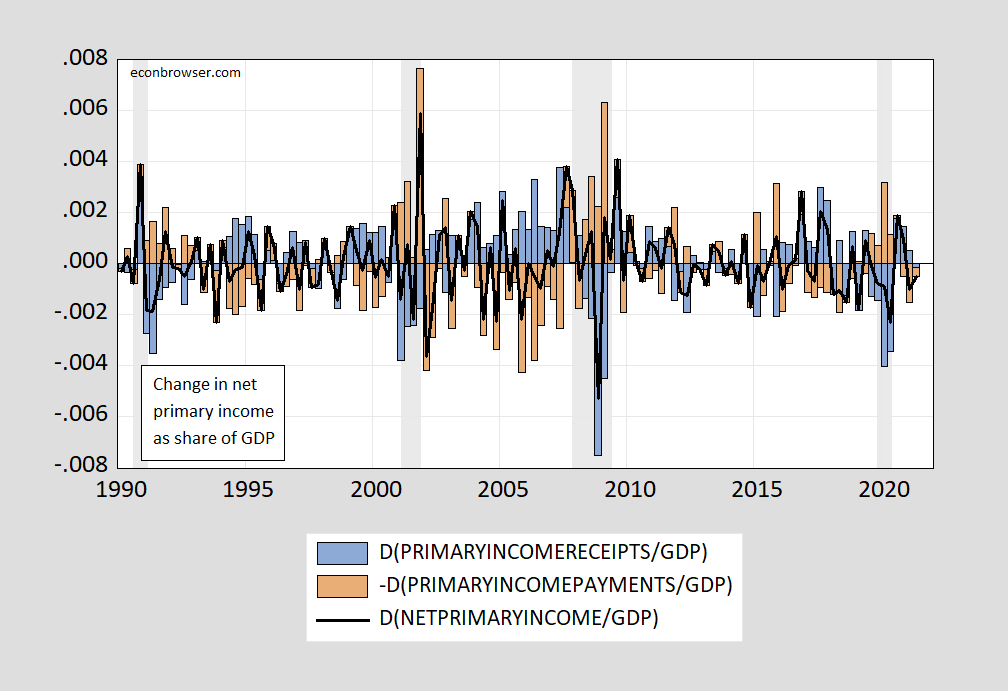

Figure 3: Primary income receipts (blue bar), payments (brown), and net primary income (black line), all expressed as a ratio of GDP. Primary income using NIPA definitions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Receipts trend upward as the dollar depreciates, fitting the exchange rate valuation story. However, payments also trend upwards. This suggests that something more complicated is happening (although the exchange rate effect might be part of the story).

Let’s consider what Brad Setser wrote about 2007:

What of the income balance. It too can be decomposed into the balance on FDI and interest (for simplicity, I have not tried to pull dividend payments on portfolio holdings out of the non-FDI data. These payments are small and we don’t yet have 2007 data, so this is not a major source of error)

…

Four things jump out:

First, FDI receipts are much larger than FDI payments. It you plot the implied rate of return on US investment abroad v the implied return on FDI in the US, this stems from the very low reported return on foreign investment in the US. Almost all of the difference reflects different reported rates of reinvested earnings, not actual cash payments. I still that reflects tax arbitrage more than anything else – foreign FDI hasn’t consistently produced lower returns than holding treasuries, as the US data implies.

Two, directionally, though the FDI balance has improved a lot both because of stronger US returns abroad and weak foreign returns in the US. The sharp fall in FDI payments on direct investment in the US suggests the US is in recession.

Three, interest payments have increased sharply – rising to around 4% of US GDP. But so too have interest receipts. That reflects the growth in both US borrowing and lending – whether from true financial globalization or the growing use of London and other offshore financial centers by the “shadow banking system.” Carlyle Capital (which recently failed) used a London entity to borrow dollars to buy US mortgage backed securities.

Four, the increase in both interest payments and receipts has stopped and is now heading down. Most US lending and borrowing is denominated in dollars and fairly short-term. The fall consequently reflects the fall in US rates.

A plot of net FDI payments v net interest payments (the difference between the redish lines representing FDI income and bluish lines representing interest payments and receipts above) can help us understand the improvement in the income balance

…

The net balance on FDI improved sharply – mostly because of the fall in payments on FDI in the US. And – -more surprisingly – at least to me, the income balance stopped deteriorating. It actually got better over the course of 2007. Falling rates helped. But there is a bit more going as well. I had expected in late 2006 the interest rate on US borrowing abroad to rise relative to the interest rate on US lending as long-term rates caught up with rising short-term rates. Historically the US pays more on its borrowing than it gets on its lending (likely because of the term premium). The opposite though happened.

The impact (or not) of exchange rate changes can also be inferred by decomposing the change in net income as a share of GDP.

Figure 4: Change in ratio to GDP of primary income receipts (blue bar), payments (brown), and net primary income (black line). Primary income using NIPA definitions. NBER defined recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Increase in receipts push up net income, but decrease in payments also do, in 2007. Of course, this is a mechanical decomposition – it’s possible the dollar depreciation induced economic affects both receipts and payments (and likely did).

Update, 10/6, 9am Pacific:

A digression: It’s interesting that the valuation effect continues in a negative direction despite the depreciation of the dollar since mid-2020.

https://fred.stlouisfed.org/graph/?g=vkYq

January 30, 2018

Net International Investment Position as a percent of Gross Domestic Product and Narrow Effective Exchange Rate for an American Dollar, 2007-2018

(Percent and Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=vkYq

January 30, 2018

Net International Investment Position as a percent of Gross Domestic Product and Real Narrow Effective Exchange Rate for an American Dollar, 2007-2018

(Percent and Indexed to 2007)

https://news.cgtn.com/news/2021-10-06/The-Bitcoin-fountainhead-148H3OuDhJK/index.html

October 6, 2021

The Bitcoin fountainhead

By Daron Acemoglu

With the price of Bitcoin reaching new highs, and El Salvador and Cuba deciding to accept it as legal tender, cryptocurrencies are here to stay. What implications will this have for money and politics?

Money depends on trust. It is accepted in exchange for goods and services only because people can confidently assume that others will accept it in the future. This is as true for the U.S. dollar as it is for gold. To argue that cryptocurrencies like Bitcoin are merely a confidence game – or a speculative bubble, as many economists have emphasized – is to ignore their popularity.

And yet, cryptocurrencies lack the stable institutional foundations needed to bolster the public’s trust in them. Trust thus ebbs and flows, making them fragile and volatile, as Bitcoin’s wild gyrations have amply demonstrated.

Moreover, with Bitcoin and other cryptocurrencies that rely on “proof-of-work” mechanisms, transactions must be continuously verified and logged in a decentralized ledger (in this instance based on blockchain). This requires millions of computers to operate continuously to update and verify transactions – work that is incentivized by the opportunity to be rewarded with newly minted Bitcoin.

The energy consumed in these “mining” operations now exceeds that of a medium-sized country like Malaysia or Sweden. Now that the world has awoken to the dangers of climate change (and to the paltriness of our response to it so far), this massive waste should make Bitcoin highly unattractive.

And yet, despite its volatility, fragility, and massive carbon footprint, five factors have conspired to make Bitcoin an attractive proposition to many people: its political narrative; the criminal activities it enables; the seigniorage it distributes; the techno-optimism of the current age; and the desire to get rich quick at a time when few other economic opportunities beckon. Let’s consider each in turn, going in reverse order….

Daron Acemoglu is professor of economics at MIT.

The increasing use of economic sanctions by the United States, alone, encourages the use of the likes of Bitcoin. Although President Obama had ended much of the economic blockading of Cuba, the Trump administration imposed a range of sanctions and the Biden administration has added to those sanctions even during a period of pandemic.

A time of pandemic, of China breaking promises to Hong Kong and the UK, of China committing gross human rights abuses, of China harassing Taiwan, of China breaching trade agreements, of China reversing course in allowing greater domestic liberty…

My finger is getting tired, but I could go on…adding coal-fired power generating capacity, paying people like ltr to pollute comments sections…oops, like I said, my finger is getting tired. But China does so much wrong…like using weak domestically produced Covid vaccines when better ones are available overseas…sorry… China does so much that is bad for the world that the U.S. inadvertently providing an incentive for Crypto-currency use pales by comparison.

I wonder whether Xi’s falling popularity at home isn’t one reason for his adventures abroad. It’s practically a cliche, but there’s a reason it’s a cliche – sometimes the distraction works. It got Shrub re-elected.

Good lord, if Xi is Shrub, then China is going to have a Tibetan leader next.

Or perhaps Uyghur.

I have great regard for Acemoglu. The logic of this sentence, though, seems to fall well short of his usual standard: “With the price of Bitcoin reaching new highs, and El Salvador and Cuba deciding to accept it as legal tender, cryptocurrencies are here to stay.”

Surely, the policy decisions of two very small countries do not tell us much about the future of finance. If “new highs” was a guarantee, ponzi schemes would dominate the major stock indices of the world. Not his best sentence.

MD,

Oh, it has been clear for some time that “cryptocurrencies are here to stay.” The question is if anybody will actually use them on a regular basis, especially in place of other means of payment, such as credit cards using actual money. That remains pretty unlikely, despite some countries deciding to give btc some sort of legal status. Really, if they insist on doing that it should be Ethereum, which is not nearly as polluting, an issue Acemoglu does emphasize.

https://fred.stlouisfed.org/graph/?g=zxv8

January 30, 2018

Exports minus Imports of goods & services, 2017-2021

https://fred.stlouisfed.org/graph/?g=HsZn

January 30, 2020

Exports minus Imports of goods & services, 2020-2021

https://newsaf.cgtn.com/news/2021-10-07/WHO-recommends-broad-use-of-Mosquirix-vaccine-for-children-in-Africa-149f8m0tLkk/index.html

October 7, 2021

WHO recommends broad use of Mosquirix malaria vaccine for children in Africa

The World Health Organization (WHO) has recommended the broad use of a malaria vaccine for children in Africa.

The WHO Director-General Tedros Adhanom said on Wednesday that the RTS,S, or Mosquirix, a vaccine developed by British drugmaker GlaxoSmithKline (GSK.L), could play a major role in the struggle to eradicate malaria deaths.

“Using this vaccine in addition to existing tools to prevent malaria could save tens of thousands of young lives each year,” he said.

The recommendation is based on results from an ongoing pilot program in Ghana, Kenya and Malawi that has reached more than 800,000 children since 2019.

The latest development marks another milestone in the global war against malaria, which kills hundreds of thousands of people globally every year.

According to the WHO data, there were 229 million cases of malaria in 2019 compared to 228 million cases in 2018.

The estimated number of malaria deaths stood at 409,000 in 2019, compared with 411,000 deaths in 2018.

Africa is the hardest-hit region by the disease, accounting for 94 percent of all malaria cases and deaths.

In 2019, six countries accounted for approximately half of all malaria deaths worldwide: Nigeria (23%), the Democratic Republic of the Congo (11%), Tanzania (5%), Burkina Faso (4%), Mozambique (4%) and Niger (4% each).

The WHO notes that children under 5 years of age are the most vulnerable group affected by malaria. In 2019, they accounted for 67 percent (274,000) of all malaria deaths worldwide….

https://fred.stlouisfed.org/graph/?g=EdXp

January 15, 2018

Life Expectancy at Birth for China, India, Brazil, Nigeria and South Africa, 1977-2019

https://fred.stlouisfed.org/graph/?g=vYLA

January 15, 2018

Infant Mortality Rate for China, India, Brazil, Nigeria and South Africa, 1977-2019

The increasing use of economic sanctions by the United States, alone, encourages the use of the likes of Bitcoin. Although President Obama had ended much of the economic blockading of Cuba, the Trump administration imposed a range of sanctions and the Biden administration has added to those sanctions even during a period of pandemic.

[ Perfectly expressed and critically important as 139 countries affirmed at the United Nations Human Right Council meeting in Geneva this September. ]

http://www.xinhuanet.com/english/2019-09/14/c_138390990.htm

September 14, 2021

China on behalf of 139 countries calls for full realization of right to development at UN

GENEVA — On behalf of 139 countries, China on Friday called for full realization of the right to development at the ongoing 42nd session of the United Nations (UN) Human Rights Council here.

“Development is the eternal theme of human society and the key to solving all problems. The human history, especially the success experience of developing countries, shows how critical development is for the realization and enjoyment of human rights,” Chen Xu, head of the Chinese Mission to UN at Geneva, told the council.

“Currently, unilateralism and protectionism are gaining ground, eroding mutual trust and coordination among countries; development across countries remains uneven, lopsided and inadequate; poverty and hunger have not yet been eradicated. The right to development is not yet fully guaranteed around the world,” the Chinese ambassador said.

“We should adhere to the Declaration on the Right to Development to realize the right to development, promote innovative, coordinated, green, open and shared development, guarantee the people’s equal right to participate in development, and ensure a life of dignity for all,” he added.

Stressing that the pursuit of happiness is a fundamental human goal, Chen said that in order to lift humanity out of poverty as soon as possible and promote and protect human rights, the international community should uphold the purposes and principles of the UN Charter, work for the realization of the 2030 Agenda for Sustainable Development, and achieve inclusive and sustainable growth.

The international community should also focus the efforts on meeting people’s aspiration for a better life and achieve development of the people, by the people and for the people, Chen said….

https://news.cgtn.com/news/2021-10-06/Chinese-mainland-reports-26-confirmed-COVID-19-cases-148fitgdLq0/index.html

October 6, 2021

Chinese mainland reports 26 new COVID-19 cases

The Chinese mainland recorded 26 new confirmed COVID-19 cases on Tuesday, including 2 local transmissions, data from the National Health Commission showed on Wednesday.

In addition, 12 new asymptomatic cases were recorded, while 352 asymptomatic patients remain under medical observation.

The Chinese mainland now has a total of 96,310 confirmed cases, with the death toll remaining at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-10-06/Chinese-mainland-reports-26-confirmed-COVID-19-cases-148fitgdLq0/img/374c32af7eac4b1b84c8c8d0ab83c44b/374c32af7eac4b1b84c8c8d0ab83c44b.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-10-06/Chinese-mainland-reports-26-confirmed-COVID-19-cases-148fitgdLq0/img/070596d1a6a1474585b6643239851484/070596d1a6a1474585b6643239851484.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-10-06/Chinese-mainland-reports-26-confirmed-COVID-19-cases-148fitgdLq0/img/e3c3e77f1855432f9b171786177c5d0b/e3c3e77f1855432f9b171786177c5d0b.jpeg

http://www.news.cn/english/2021-10/06/c_1310228845.htm

October 6, 2021

Over 2.215 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Over 2.215 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Tuesday, data from the National Health Commission showed Wednesday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 2.215 billion doses of Chinese vaccines administered domestically, more than 1.25 billion doses have been distributed to 100 countries internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

October 5, 2021

Coronavirus

US

Cases ( 44,781,200)

Deaths ( 724,728)

Deaths per million ( 2,173)

China

Cases ( 96,284)

Deaths ( 4,636)

Deaths per million ( 3)

@ Menzie

I’m trying to think of your usual choice of phrase which I enjoy seeing, but my brain is failing me. You sometimes say something like “I have no intellectual attachment to…..” (See, I’ve gone and ruined it now, yours is much better). You seem pretty neutral or “undecided” or “agnostic” on the Question: “Does the same hold true for net primary income (investment and wage income)?

Am I reading you correctly on this??

Moses Herzog: A priori one should think that there is *some* valuation effect on (even) a flow variable like net primary income. However, because we are talking about much smaller quantities than gross asset positions (as in the IIP), it’s going to be much harder to see it, and will likely be dominated by other factors, including cyclical.

Appreciate it Menzie, as always.

BTW, I appreciate this post, including the commentary by Brad Setser. However, I remain still unclear on why US net capital income was so clearly substantially higher during the teens than the decade prior, even as the NIIP continued to get more and more negative.

Oh, and this post and Brad’s comments make it clear that the claim made here by somebody that Fried claimed none of this had to do with the composition of assets held by various parties looks not to be the case. Brad is pretty clear: Americans hold assets that are paying higher returns on their FDI abroad than are the foreigners who have continued add to their FDI in the US are getting. But maybe that is not a matter of “composition of assets.” If so, then I do not know what Fried meant by his claim, which certainly failed to clarify anything about this.

“Brad is pretty clear: Americans hold assets that are paying higher returns on their FDI abroad than are the foreigners who have continued add to their FDI in the US are getting.”

At the risk of repeating myself, this is the basic accounting which the data has clearly shown for decades. The economic question is why the measured returns on the foreign assets we hold are consistently higher than the return on US assets held by foreigners. Measurement problems from book value of assets differing from market value (a point macroduck has smartly noted), transfer pricing issues, other factors?

@ Barkley Rosser

Your reading comprehension is getting as horrid as pgl’s. Or is it the other way around??~~ pgl’s reading comprehension has gotten as bad as yours?? Well, both horrid.

My quoting of Daniel Fried (page 9 of the CBO paper) was “Differences in the mix of international assets held by foreign investors and U.S. investors explain a SMALL PORTION of the international yield differential.”

Now, for the dimwitted of Harrisonburg way, small portion is very different than “none of this”. For example if I said I have a small portion of respect for Barkley Rosser, that would be very different from the reality, of zero respect. You see the difference now??

Now, if I have taken that one sentence from Daniel Fried’s paper and misrepresented it, or taken it out of context, I welcome correction from either Professor Chinn or From Mr. Fried. Not from people I have zero respect for.

Folks: Look at the BEA report. You will find that 2021Q2 stats indicate about 30% of US assets are FDI, about 28% of US liabilities are FDI. The balance on each is essentially portfolio. Within portfolio, debt is about 13% of total assets, while it’s 26% of liabilities. So at a high level, the composition is similar, while at a finer level shares differ.

But the composition effect Setser mentions — high return vs. low return — does not conform to these categorical definitions. Rather, US FDI abroad is high yield, foreign FDI in US is relatively low yield. That drives the differential.

Thanks, Menzie. So Fried can get away with his statement that misled poor Moses, and indeed there is nothing in particular involved in all this regarding the details of the composition of the assets involved that is involved here. Somehow it is the totality of them, that somehow those held abroad by Americans earn high returns while those held by foreigners in the US yield low returns. So, it is an as yet unexplained difference that cuts across all the assets held by both sets of parties rather than any particular detailed difference in the relative composition of those asset holdings by each group. The difference cuts across all, or most, categories of assets with little explanation, certainly none by either Fried or Moses, much less even the much more knowledgeable Brad Setser.

Well, not wanting to sound simplistic about this, per Barkley’s “grand mystery”, Would we not assume most of a yield would be related to the amount of risk?? And that when an American is going to put money to work overseas they are going to expect a higher yield based on risk and that when foreigners invest in America they want safety of the principal value of the asset and not expecting the higher return. Which part of this is shocking exactly??

Moses Herzog: No, in this case, I don’t think the differential is due to risk in the sense you mention.

@ Menzie

I stand corrected then. I have to say, looking at just the surface view, it struck me as a very plausible reason. But I mean it in all seriousness and earnestness (and none of my usual sarcasm) on the topic of Economics~~when Professor Chinn tells me to cross the Jordan River, I’m probably going to do it. If I can attain more knowledge, I am happy to do it. I just have to figure out where I’m going to put this golden calf.

Moses Herzog: I should qualify: I don’t think the differential is *primarily* due to political risk of expropriation, when we are talking about 2007 onward.

Moses Herzog: 15 years ago, during the discussion of “dark matter”, there was extensive discussion of why US FDI assets abroad received much higher return than foreign FDI assets in the US. Main candidates were the older age of US FDI abroad, and early mistakes by foreign residents (e.g., Rockefeller Plaza?).

I have dug up the 2005 CBO report that discusses why (at that time) US FDI had higher returns. I would assert that political risk has probably declined in importance over time as (proportionately) more US FDI has headed to advanced economies, and accounting issues (e.g., Apple) have risen in importance. (Full disclosure: I was a visiting fellow at the time some of this report was written).

@ Menzie

I know with your professorial duties, and no doubt other things, your time is extra valuable (can I say, like a bond paying a higher interest rate than the current market rate, your time has a “premium”?), so when you take the time to reply to my questions, it means a great deal to me (on some kind of deep level of appreciation that would most likely surprise you). Especially the digging up of the paper, which I will read, start to finish. As far as you being a visiting fellow there at the time some of the report was written, I view that as a positive attribute.

Thanks for this reminder – which is basically what I have been saying. Moses for some reason wants us to focus on some obscure sentence which has little to do with this puzzle. And then he goes off on how Barkley and I have poor reading skills? Yes – he is truly confused and irrelevant.

OK, Moses, ooh, we are all so surprised that you “have zero respect for” some people here. But as someone worthy of negative respect as you are, this is not too impressive.

So, I am going to drop two bottom lines, neither of which I see Menzie clearly offsetting or explaining (no criticism of him intended with that observation).

One is this ongoing mystery regarding why this net income was higher in the teens than the decade before. I do not wish to get on anybody’s case here about the fact that nobody, not Brad Selster, not Menzie, not pgl, not me, and sure as heck not you, Moses, much less Fried, or even the person here who somehow thinks you are a great expert on various thingsm nobody. knows why I have pointed out that this is a very weird anomaly repeatedly, but not a single person has provided even the remotest shred of an explanation. And I myself still do not have one. But this is an unexplained mystery I pointed out, and not you and not Fried and not anybody you claim to respect has an answer. Or do you want to claim that this is not a mystery?

The other is the somewhat older matter of the relation of Evergrande to the shadow financial sector of China. I pointed this out, based on my personal knowledge based on personal connections there. You ridiculed this, but in fact it looks like nearly half of Evergrande’s debt is in that sector, and the one public report I have seen on this indicates that indeed it is a much bigger worry than the publicly known debt. Now it may be that the PBOC has all this under control, as you have claimed, with ltr agreeing with you, and for now global markets as well. But in fact I am the person here who noted that this is a problem and an issue, and it looks like it really is. But, for obvious reasons, there is nearly zero reporting on it. Whatever happens with it, for better of for ill, will happen behind closed doors, as I warned initially.

Of course when your great admirer appealed to you to explain what was going on you responded that you needed to find the latest FT article on the matter. Right. And you did eventually find an article about how an SOE had bought one of Evergrande’s troubled properties in Guangzhou, even as you were telling us that they were going to keep all their actions on this secret. Great expert you are, just full of all sorts of inside information….

In the middle of the usual irrelevant babbling from Moses, give the clueless wonder a little credit for eventually mentioning at least something that has potential relevance to the observed return differential. He actually came up with RISK. Not that he has a clue where this fits in but it is generally known to people who get basic finance (which clearly excludes Princeton Steve) that investing in the assets of corporation tends to get a higher expected return than the risk-free rate. Now if we could only have Moses try to mansplain something as basic as CAPM. That should provide a few chuckles!

Our host provided an excellent 2005 CBO report with the abstract reading:

‘Three factors may account for the difference in returns on cross-border direct investment. First, U.S. subsidiaries abroad have generally been in business longer than foreign-owned subsidiaries in

this country, which contributes to their greater

profitability. Second, in some cases, U.S. subsidiaries abroad face greater risks of political or economic

disruptions than subsidiaries of foreign corporations face in the United States. U.S. investors may require higher returns because of that difference in risk; however, compensation for risk appears to explain a much smaller portion of the difference in returns than some analysts may believe. Third, some observers argue that U.S.-owned subsidiaries abroad appear to be more profitable because they overstate their profits—and foreign-owned subsidiaries in the United States understate their profits—for tax reasons. However, the extent to which such

misstatements affect the difference in returns is unknown. —Douglas Holtz-Eakin Director’

Yep – transfer pricing manipulation may play a role as folks like me as well as Brad Setser have said several times.

And while Moses quoted this Fried as claiming that “composition of assets” played no role in all this, which maybe it did not, and I have not looked at the actual numbers so do not know, I do think Moses is partly right that attitudes about risk have played some part in this, particularly the whole view of the USD as a “safe haven” so at least some of the money coming in is certainly from highly risk-averse investors.

Anyway, my bet is that this would be more likely in fact to show up as a difference in composition of assets, with these foreign scaredy-cats more likely to buy US bonds, especially Treasuries. So these matters of how old the corporate subsidiaries are and the differences in transfer policies would be less important. But, again, if indeed Fried is right that there is no difference in composition of assets, then this would not be an explanation.

Anyway, I remain mystified about the apparent higher net income in the teens than the decade earlier, when indeed there may have been higher political risk abroad, as Menzie noted.