In assessing market views on future lumber prices, reader JohnH writes:

Futures markets aren’t foreseeing a decline in lumber prices any time soon.

https://www.barchart.com/futures/quotes/LS*0/futures-prices

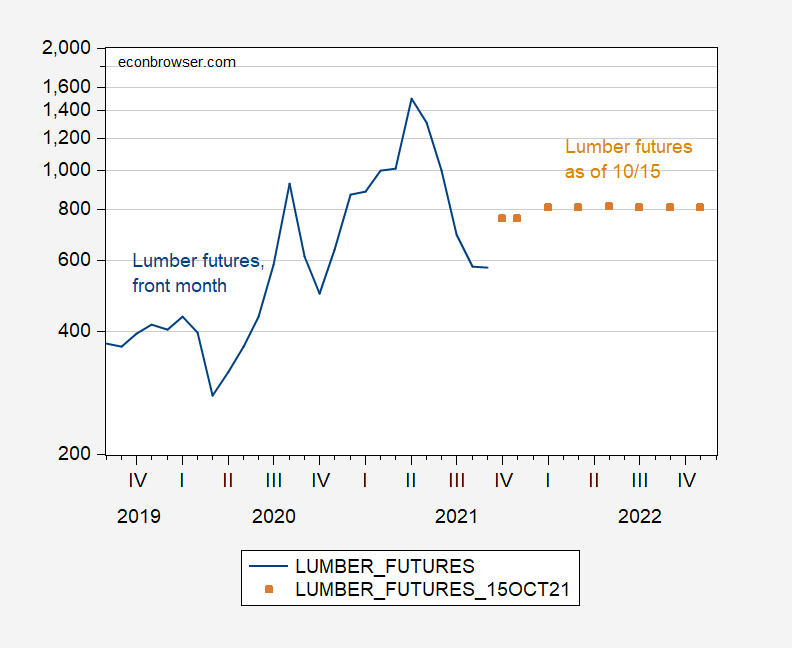

Here’s a graph of lumber prices over time, and futures as of 10/15:

Figure 1: Front month lumber futures, monthly average of daily data (blue), and lumber futures as of Oct. 15, 2021 (brown squares); price per 110,000 board foot, from CME. Source: Macrotrends.com and barchart.com.

While it is tempting to conclude that futures are good predictors of future spot rates, as Olivier Coibion and I have documented for a variety of commodities (Chinn & Coibion (2014), post), this is not always an appropriate thing to do (i.e., futures are so biased a predictor that it would be better to use a random walk). While we did not assess lumber, Lee in “A Comprehensive Study on Normal Backwardations in Futures Markets” (2013) has, and notes:

The most acute form of contangos in commodities can be found in the cocoa and lumber markets. For some reason, the buyers (e.g., chocolate makers, and lumber users like home builders) have lots of incentive to buy in this market to hedge their risk.

“Contango” is the condition wherein the futures price is above the expected future spot price, and lumber apparently exhibits this condition. (Kolb, J.Fut.Mkts (1995) also characterizes lumber as usually in contango, so this is not a unique finding).

Coibion and I estimate:

st+k – st = α + β(ft,k – st) + ut+k

Where st is the log spot rate at time t, ft,k is the log futures rate for a transaction k periods hence, and u is an error term that is under the efficient markets hypothesis null a random expectations error (this is sometimes called the Mincer-Zarnowitz regression). Mehrotra and Carter (2017) find the null hypothesis of beta=1 rejected at 10% msl at horizons up to 6 months, and the joint null hypothesis of alpha=0 & beta=1 rejected at 2% msl, at all horizons.

In sum: friends don’t let friends use lumber futures to forecast future lumber prices willy-nilly.

JohnH’s understanding of lumber prices is right up there with Sammy’s understanding of soybean prices.

Exacerbating the problem is that “Tariffs on Canadian lumber will also likely double from 9% to about 18% by November, pending the Department of Commerce’s final determination.”

https://markets.businessinsider.com/news/commodities/lumber-price-outlook-renovation-home-wood-supply-canadian-log-wood-2021-10

Interesting, isn’t it that there was an uproar among economists of a certain political persuasion when Trump raised tariffs on washing machines, a piece of equipment that most people probably buy once or twice in their lives. But the silence has been deafening since Biden kept those tariffs in place!

And there is silence about a tariff on lumber, a commodity that serves as a leading indicator.

Which seems to indicate that some economists’ concerns—or lack thereof—are more about partisanship than economics.

JohnH: Well, this economist isn’t keen on retaining the Trump tariffs — although it’s useful to keep in mind the lumber tariffs are CVDs. They were not imposed under either Section 232 or Section 301. We have been imposing CVDs and ADs for a heckuva long time, pre-Trump.

“ JohnH’s understanding of lumber prices is right up there with Sammy’s understanding of soybean prices.”

OK…and your point is? That’s why I seek out and quote industry experts, whose inside knowledge of the industry does at least as well at forecasting as models and algorithms.

“That’s why I seek out and quote industry experts”

Seriously? You look for any fool who agrees with you. Some expert.

https://fred.stlouisfed.org/graph/?g=EWfg

January 15, 2018

Producer Price Index for lumber and wood products, 1980-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=HRSM

January 15, 2018

Producer Price Index for lumber & wood products and Industrial Production Index for wood products, 1980-2021

(Percent change)

Before starting, home builders make calculations of what they expect the home to sell for after it is finished. When that calculation has at least a 15-20% profit, they build. That doesn’t leave a lot of room for substantial increases in cost of the main material. It makes sense for them to hedge against increases in lumber prices even if they end up paying a price for that certainty. It’s hard for them to hedge much against the other main uncertainties such as falling house prices and increased labor costs. The increased lumber futures market are more a reflection of the uncertainty on those other factors (builders want to make absolutely sure to not also get burned on lumber). You have to look at the underlying factors in lumber supply. There are no permanent factors to suggest that the supply cannot fairly quickly be raised to meet the increases in demands – we are talking months not years. Look at the lumber production numbers – then look at housing starts – that will tell the story of when prices will fall. This is actually a place where market forces and capitalism functions pretty well.

Oddly prescient: “ Reader JohnH points us to an article entitled “Lumber prices have fallen, but the stage is set for a potential 65% rally through the end of the year, an expert says”. What do markets say about this?” August 9.

Well, It’s not over until it’s over. And the end of the year is not here, but prices have already risen over 60% since their August bottom. And futures forecasts, like they were back in August, are often wrong.

But the analyst in question had his reasons for making his prediction: “ The senior analyst also pointed to seasonal factors behind his outlook.

The last quarter of the year typically provides a “buoyant” period for lumber, Mahony said. Nine out of the 12 fourth-quarter periods ended in the green for the commodity, with the three quarters when lumber slipped notching minimal losses of less than 5%.

“There is good reasoning behind the idea that the losses we are seeing over recent months could soon enough bring another major buying opportunity for the bulls to come back into dominance,” he said.”

https://www.msn.com/en-us/money/topstocks/lumber-prices-have-fallen-but-the-stage-is-set-for-a-potential-65-rally-through-the-end-of-the-year-an-expert-says/ar-AAMMreC

Oddly prescient? Your latest comment was the kind of word salad gibberish one would expect listening to the talking heads on CNBC. And your discussion of the ups and downs of prices in the lumber market bear no resemblence to real world data. None.

One has to wonder what your game is here. We know Princeton Steve writes gibberish just to get invited onto Fox and Friends. Maybe he should take you with him during his next appearance.

“prices have already risen over 60% since their August bottom.”

Your data for this is ??? I just checked FRED for PPI_Lumber_Soft and the September price is lower than the August price. Of course, BEA reports monthly so they are not giving the daily updates you get from Fox and Friends.

‘And futures forecasts, like they were back in August, are often wrong.’

Well that was sort of Menzie’s point to that fellow named JohnH who was touting futures data as a great indicator of the future. Do call him and tell him to stop abusing your good name.

That information can be found at he Chicago Mercantile Exchange.

Earlier today, I ‘googled’ the lumber futures ‘price.’ As of 15 October 2021, the contract settled at $760 [rounded] down from prior settle $772. The 52-week high was $1,671, the low was $454. If that low was in August, the current price is up 68%, as of last Friday.

Before making a ‘global’ determination on whether lumber futures mean much, I would analyze the breadth and liquidity of the market; plus the myriad risks and rewards inherent in the commodity, how prevalent are speculators in the market compared to sellers and end users; and, if available, what volume of contracts are settled net rather than physical exchange. I imagine in lumber the spec number are low.

I’m retired and spend most of my time doing nothing – which sometimes takes all day and all my energy.

T.Shaw: No need to google: barchart.com is easy to use and comprehensive. Even got historical data.

Thanks for providing an up to date and reliable source of information.

This is JohnH’s idea of an expert at lumber economics???

https://www.ig.com/uk/profile/joshua-mahony

Seriously?

OK, we have (another) end-point problem here. The article cited was published on August 2 and mentioned prices at the end of July. The front-month future is up about 20% from that time, not 60%. The mid-August price you use for comparison isn’t the price on which the author based his claim.

So…maybe not so prescient?

Fiddling with end-points is not a very convincing way of making an argument.

By the way, a commenter to “Real Lumber Prices” claimed Goldman has predicted a 16% housing price increase by the end of the year. That’s not correct. Goldman has predicted a 16% housing price increase by the end of 2022. That would represent a slowing from the 1.5% average monthly rise over the past 12 months to a 0.9% monthly average pace over the coming 17 months. So says Bill McBride, and he’s good at this stuff, so I didn’t bother to check his math.

Bill also concludes that the Goldman forecast seems high and notes the GSEs and CoreLogic have substantially lower forecasts. So even if the commenter had his facts right, he’d still be cherry-picking.

Not sure why Goldman forecasts get so much attention. Their forecasts don’t stand out from the Bloomberg crowd.

If the general thesis is that a combination of an economic recovery plus the Build Back Better push for infrastructure investment is going to push up prices for certain commodities – why limit the discussion to lumber?

FRED provides all sorts of series on commodity prices. Iron ore prices had a similar boom reaching record levels only to retreat of late. I also checked copper prices which similarly boomed reaching record levels with the retreat being very modest.

Higher commodity prices will be good news for nations that have iron ore and copper mines, which includes Africa and South America.

Now we could also be talking about construction compensation which according to BEA has risen nominally by only 31% since 2001 even though CPI has risen by much more. Hopefully, real compensation in this sector will finally increase as the demand for workers increase.

I’m writing as a non-economist and something of an specifier/end-user in the lumber markets, so take this with a grain of salt (table salt or road salt futures–your choice.) The wild ride of lumber prices from last year through this year was unusual and probably not the sign of a significant trend. The bulk producers and buyers, who include people who remember the wild rides of the 80’s and 90’s as well as the housing bubble years, understand the fickle nature of this commodity. Some folks on the selling end probably made good money last year, but the smart ones know it was probably a once in decade event. The acres of timber stands and the number of mills hasn’t changed in the past 18 months. The demand for construction materials in 2022, of which lumber is actually minor component, will continue to be more influenced by shortages and delays in more complicated products like windows and mechanical equipment. Some of the people who bought dimensional lumber at or near the peak and are holding onto stock with the hope that prices will come back….well, they’re going to be as disappointed as Isaac Newton was with his stack of South Sea Company stock certificates.