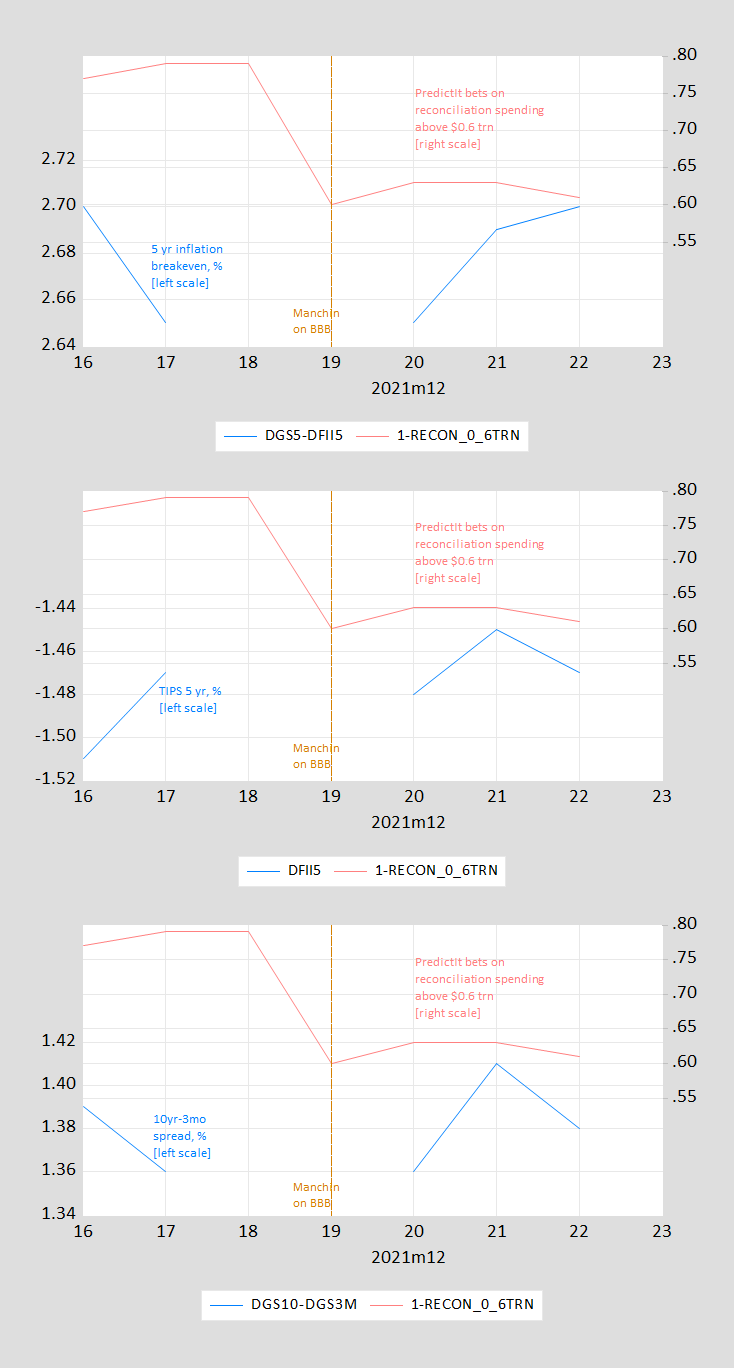

Following up on the previous post on expectations responses from the market to Manchin, Just putting together all the pieces of betting odds on the size of the reconciliation package, and the impact on implied expected inflation, real rates, and future economic activity. I plot on a 7 day frequency so as to include the odds from PredictIt, which do not stay constant over the weekend.

Figure 1, Top Panel: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield, % (sky blue, left scale), sum of contract prices for reconciliation package passed by 7/1 in excess of $0.6 trillion (tan, right scale). Middle Panel: Five year TIPS yields, % (sky blue, left scale), sum of contract prices for reconciliation package passed by 7/1 in excess of $0.6 trillion (tan, right scale). Bottom Panel: Ten year-three month Treasury term spread (sky blue, left scale), sum of contract prices for reconciliation package passed by 7/1 in excess of $0.6 trillion (tan, right scale). PredictIt contract prices at end-of-day. Source: FRB via FRED, PredictIt accessed 12/23.

In reading market “thinking” from prices, it’s worth remembering that machines drive most of the first response. Machines respond to data – Machin said “no BBB” – without looking outside of their programming. Reconsideration follows, when humans become more heavily involved.

This time, though, reconsideration didn’t change things all that much. Machines were not told to respond strongly to a “no” from Manchin with respect to rates and when humans got involved, the response was even smaller. BBB is not seen as having much inflationary effect, one way or the other. Manchin’s inflation argument is hollow.

“Machines respond to data – Machin said “no BBB” – without looking outside of their programming.”

Maybe the machines thought BBB meant that the US government had its AAA credit rating downgraded!

If they do not stay constant over the weekend, then by definition there is data over the weekend. It that case you can use 1) opening values, 2) closing values or 3) the value when you pulled the data (‘latest’).

But you just said you use Friday’s closing data for both Saturday and Sunday claiming that was technically correct. HELLO?!

If you have data for Saturday and Sunday, why wouldn’t you use it?

Excuse me but what Central Bank publishes interest rate day for close of Saturday and for close of Sunday? Not the Federal Reserve, ECB, Bank of England, Bank of Canada, Reserve Bank of Australia, Reserve Bank of New Zealand. But maybe Hungary’s Central Bank do so?

I believe you mean “by assumption”. Unless you mean the price change itself is news in the same sense as Manchin’s statement. That’d be a bit circular.

It IS becoming more and more a circular economy. [ dumb joke, can’t resist ]

off-topic film recommendation:

Have any of you seen “The Card Counter” yet?? I have always been a huge Paul Schrader fan. In my personal opinion it’s a near masterpiece. It is a little dark natured, but still very enjoyable. Get it on your favorite streaming service or support real artists and buy the disc. Probably not a good film to watch for warm Christmas fuzzies or with children younger than about 16 I would say.