If current nowcasts are accurate, we see erosion in some real wages, but not even those for hospitality and leisure. That’s not true for total private NFP using the PCE deflator. [italics denote correction 12/5]

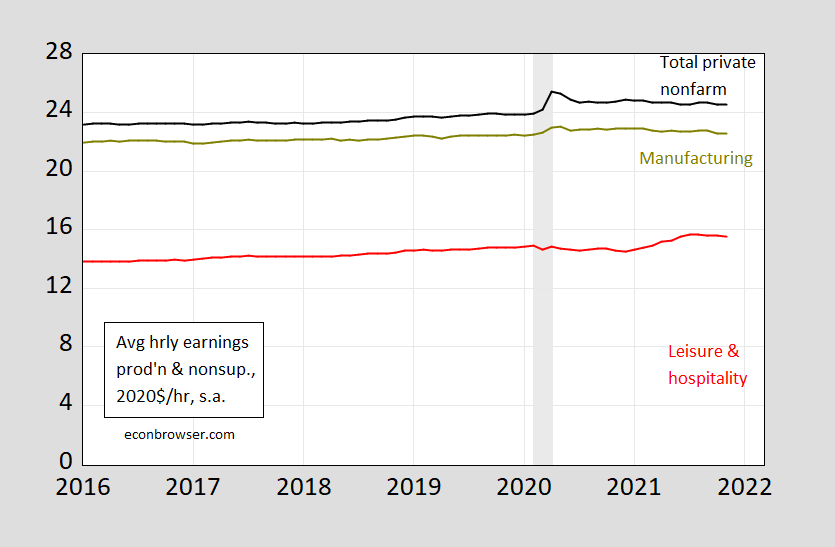

Figure 1 shows wages deflated into 2020$ using the CPI.

Figure 1: Average hourly earnings of private sector nonsupervisory and production workers (black), manufacturing (chartreuse), leisure and hospitality services (red), all in 2020$/hour, s.a., on a log scale. Deflated using CPI, November 2021 observation using Cleveland Fed nowcast of 12/3. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Cleveland Fed, NBER, and author’s calculations. [correction 12/5, added Nov. observation for leisure/hospitality]

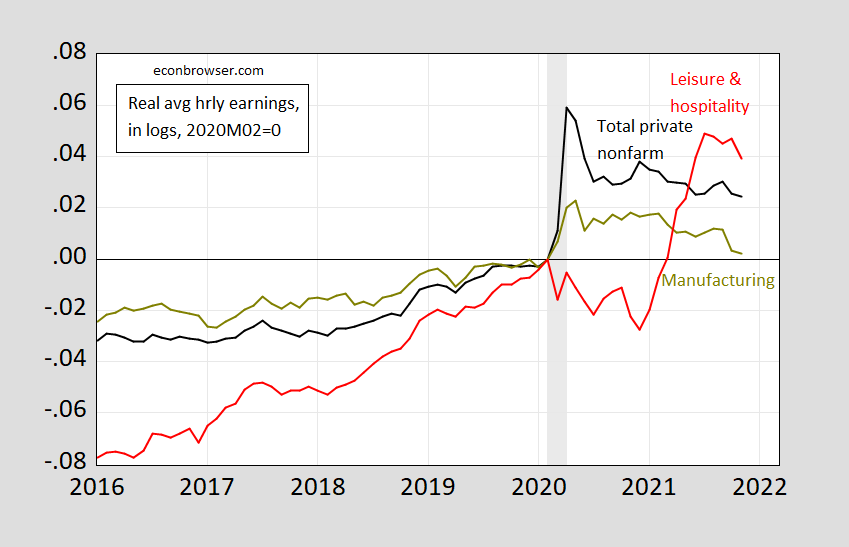

It’s hard to see how these levels compare to 2020M02 on this scale, so in Figure 2, I normalize to the NBER peak levels.

Figure 2: Average hourly earnings of private sector nonsupervisory and production workers (black), manufacturing (chartreuse), leisure and hospitality services (red), all in 2020$/hour, in logs 2020M02=0. Deflated using CPI, November 2021 observation using Cleveland Fed nowcast of 12/3. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Cleveland Fed, NBER, and author’s calculations. [correction 12/5, added Nov. observation for leisure/hospitality]

So real wages are above 2020M02 levels in the cases of overall and manufacturing, and very much so leisure and hospitality services (which are 5.2% above).

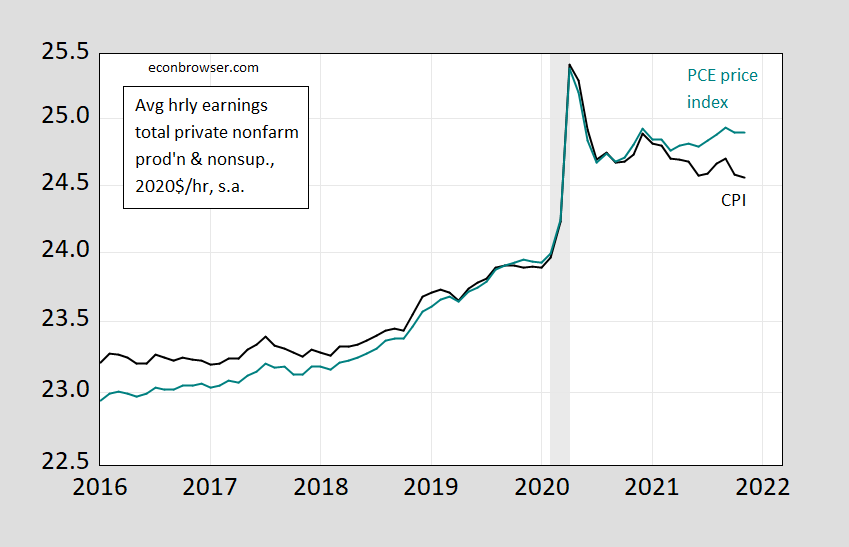

Note one’s view of what’s happening to total average wages depends on the deflator.

Figure 3: Average hourly earnings of private sector nonsupervisory and production workers deflated by CPI (black), by personal consumption expenditure deflator (teal), all in 2020$/hour, s.a., on a log scale. November 2021 observation using Cleveland Fed nowcast of 12/3. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Cleveland Fed, NBER, and author’s calculations.

Why are you analyzing noise? What is the refusal rate on the wage survey? Are you telling tales about a self-selected sample that has no generalizing power? How would you evdn know, when you wilfully flout statistical practice by steadfastly refusing to report standard errors, and refusal rates?

Why are economists so dismally stubborn?

rsm,

I speak with my brother who knows [engineering background] and says you are probably correct.

BUT, [me not the engineer] this is what is available and, I think, the best circumstances in this World where one will not get ‘better data,’ more acceptable standard errors, more likeable refusal rates, and whatever else is bothering you.

I come here b/c it’s the best econ site I’ve found [as far as giving me food for thought and ways of thinking being 50 years away from academics], plus Dr. Chinn hasn’t banned me yet. And, some commenters are a hoot.

In addition to the stats business, come up with additional vectors to criticize government and academic economists. I am not worthy for such business.

T. Shaw,

I am not interested in picking on our brother, not knowing either the extent of his knowledge or what type of engineering he does. But I would say that his comment is not very useful. The problem is that there are lots of things in economics where there are no standard errors, as has been repeatedly pointed out here. So rsm’s demands for them are just ignorant and silly. Also, for some of them there are major kurtotic fat tails, including most financial series, which means that standard errors do not tell the whole story, indeed undertell the degree of non-certainty. In most parts of engineering it is far more frequent for standard errors to be available and also for things to driven by Gaussian normal distributions, so they are meaningful Thus it is unsurprising that your brother might be inclined to agree with rsm, given that he probably does not understand that a lot of economic variables and data do not look like or behave like most engineering variables and data do.

OTOH, there have been problems sometimes when engineers have messed up. These have sometimes not involved some failure to measure or report standard errors according to their model, but because they were using a mathematically incorrect or insufficiently sophisticated underlying model. The dramatic example the Tacoma Bridge that fell down in (I think) 1943 because its structure allowed wind to set up oscillations not forecast in the model used to analyze it before it was built. The proper model involved certain nonlinear dynamics now uderstood, with it now understood how to add certain features to bridges to keep them from doing that.

I note that failures by economists to properly model or report errors rarely lead to such bad outcomes as bridges falling down.

Liar.

During the Christmas Season no one on Econbrowser is a liar. They are “people who take liberties with facts”.

rsm,

There is a difference between “noise” and “noisy.” What you spout here is the former, utterly worthless noise. Economic data is noisy, although, again, as has been pointed out repeatedly, much of it does not have standard errors. You have been drinking too much yet again in Macroduck’a Error Bar.

Why are you so dismally stubborn when it is clear that you are a deranged ignorant fool?

https://fred.stlouisfed.org/graph/?g=Jxar

January 30, 2018

Real private weekly earnings for United Kingdom and United States, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=JxaF

January 30, 2018

Real private weekly earnings for United Kingdom and United States, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=Jxb1

January 30, 2018

Real Hourly Earnings in Manufacturing for Germany and United States, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=Jxdb

January 30, 2018

Real Hourly Earnings in Manufacturing for Germany and United States, 2007-2021

(Indexed to 2007)

College football rankings:

(1) Alabama

(2) Michigan

(3) Georgia

(4) Cincinnati

Bama plays Cincinnati in Dallas while the other game will be in Miami!

https://econbrowser.com/archives/2021/12/business-cycle-indicators-as-of-december-1st-2#comment-263176

Ah – little boy has no one to play with. Like I said – pointless as ever.

You’re the one who has “no one to play with” in the real world. Here we have yet another edition of Econbrowser’s serial offender of commenting about topics completely unrelated to the given thread. PaGLiacci is so desperate for interaction that they create a reply about college football on a thread about real hourly wages. What. A. Clown. PaGLiacci the tragic clown strikes again.

Hey if you insist on doing nothing more than hurl pointless insults – fine by me. You just further prove my point that you are nothing more than a worthless troll.

It has to be fine by you because my comment was only a reply to your pointless insult in an earlier thread.

HonkHonkHonkHonk

http://www.news.cn/english/2021-12/04/c_1310350562.htm

December 4, 2021

China-Laos Railway opens, putting Laos on track from landlocked to land-linked

— The China-Laos Railway, a landmark project of high-quality Belt and Road cooperation, started operation on Friday.

— As a docking project between the Belt and Road Initiative and Laos’ strategy to convert itself from a landlocked country to a land-linked one, the line will slash the travel time between China’s Kunming to Lao capital Vientiane to about 10 hours.

— The railway could potentially increase aggregate income in Laos by up to 21 percent over the long term, the World Bank said in a report last year.

KUNMING/VIENTIANE — The China-Laos Railway, a landmark project of high-quality Belt and Road cooperation, started operation on Friday.

Xi Jinping, general secretary of the Communist Party of China (CPC) Central Committee and Chinese president, and Thongloun Sisoulith, general secretary of the Lao People’s Revolutionary Party Central Committee and Lao president, jointly witnessed the opening of the railway via video link.

The electrified passenger and freight railway runs 1,035 km, including 422 km in Laos, from the city of Kunming, southwest China’s Yunnan Province, to Lao capital Vientiane….

https://fred.stlouisfed.org/graph/?g=FwYX

August 4, 2014

Real per capita Gross Domestic Product for China, Thailand, Vietnam, Cambodia and Laos, 1995-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=FwZ1

August 4, 2014

Real per capita Gross Domestic Product for China, Thailand, Vietnam, Cambodia and Laos, 1995-2020

(Indexed to 1995)

forget about anything but the CPI.

Real wages have fallen.

https://fred.stlouisfed.org/graph/?g=G5Ya

January 4, 2020

Real Average Hourly Earnings of All Private Workers, 2020-2021

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=G5WZ

January 4, 2020

Real Average Hourly Earnings of Private Production and Nonsupervisory

Workers, * 2020-2021

(Indexed to 2020)

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

Another sad tale on how the lobbyists for rich fat cat multinationals can stop even the most sensible attempts to limit the abuse of transfer pricing to strip US taxable income. It has to do with some called section 163(n) which I will try to explain by example below. We were told it was part of Trump’s 2017 tax cut for the rich. This says it did not make the final cut – go figure, Republicans advertising something useful but in the dead of the night, cave into the fat cats. So Biden makes it part of the propose BBB legislations and of course the lobbyists for the fat cats are trying to destroy what is part of the rules for most other nations but not here!

https://thefactcoalition.org/fact-sheet-the-case-for-ending-u-s-base-erosion-through-excess-interest-deductions-via-163n/

Let’s envision a German multinational invests $10 billion in some new factory here that generates $1 billion per year in operating profits. Under the old outdated rules, it can set up some tax haven financing affiliate to loan the US affiliate $700 million at an obscene 7% interest rate and cut its taxable income in half. Now couldn’t the IRS challenge this 7% interest rate? Maybe but the IRS track record sort of sucks. Section 163(n) was supposed to limit this obscene deduction to only $300 so we get to tax at least $700 million out of the $1 billion in profits.

Sensible – right? Well the fat cat lobbyists will once again do all they can to stop even this. Which is why I say the worst kind of slime ball lawyer is an international tax law. Shakespeare had it right!

Pre-Omicron Goldman Sachs was forecasting 4.2% growth for 2022. Now it is forecasting 3.8% growth:

https://www.cnn.com/2021/12/04/economy/goldman-sachs-us-gdp-omicron/index.html

Omicron is irrelevant. Faster 4th quarter growth reduced output going forward.

https://news.cgtn.com/news/2021-12-05/Chinese-mainland-records-59-confirmed-COVID-19-cases-15JLsABavmM/index.html

December 5, 2021

Chinese mainland reports 59 new COVID-19 cases

The Chinese mainland recorded 59 confirmed COVID-19 cases on Saturday, with 42 linked to local transmissions and 17 from overseas, data from the National Health Commission showed on Sunday.

A total of 21 new asymptomatic cases were also recorded, and 459 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 99,142, with the death toll unchanged since January at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-12-05/Chinese-mainland-records-59-confirmed-COVID-19-cases-15JLsABavmM/img/4b868ba6734e4ffab6c125c0d80a29e7/4b868ba6734e4ffab6c125c0d80a29e7.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-12-05/Chinese-mainland-records-59-confirmed-COVID-19-cases-15JLsABavmM/img/5bd3a7ba7e3f48a08cd11ea063f84f81/5bd3a7ba7e3f48a08cd11ea063f84f81.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-12-05/Chinese-mainland-records-59-confirmed-COVID-19-cases-15JLsABavmM/img/030b9d835ba24a53bdf2b358087eb4cd/030b9d835ba24a53bdf2b358087eb4cd.jpeg

http://www.news.cn/english/2021-12/05/c_1310352947.htm

December 5, 2021

Over 2.54 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Over 2.54 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Saturday, data from the National Health Commission showed Sunday.

https://www.worldometers.info/coronavirus/

December 5, 2021

Coronavirus

United Kingdom

Cases ( 10,464,389)

Deaths ( 145,605)

Deaths per million ( 2,129)

China

Cases ( 99,142)

Deaths ( 4,636)

Deaths per million ( 3)

Maybe some good news for a fast growing industrial sector. Now at over 10% of the workforce, employment in leisure and hospitality grew by 30% in the past decade. Perhaps their conditions might also improve. Less than half (48%) have paid vacations and less than a third (32%) have employer funded health insurance (BLS: Industries at a Glance).

Based on weak black Friday/ cyber monday sales, consumption will pull back in December reducing inflation going forward.

Whatever happened to Princeton Steve whining that he has to pay more for his bagels? Imagine the anger when residents of NYC are told there is no cream cheese for their morning bagel!

https://www.nytimes.com/2021/12/04/nyregion/cream-cheese-shortage-nyc-bagels.html?smid=li-share

http://www.news.cn/english/2021-12/06/c_1310354515.htm

December 6, 2021

Means of production prices fall in China

BEIJING — Most of capital goods monitored by the Chinese government registered lower prices in late November compared with mid-November, official data showed Monday.

Of the 50 major goods monitored by the government, including seamless steel tubes, gasoline, coal, fertilizer and some chemicals, 16 reported rising prices during the period, 29 registered lower prices, while five saw prices remain unchanged, according to the National Bureau of Statistics.

Hog prices gained 2.8 percent in late November compared with that in mid-November.

The readings, released every 10 days, are based on a survey of nearly 2,000 wholesalers and distributors in 31 provincial-level regions.

Off topic – here’s a reasonable explanation for the outrage 9n the right at the Fed proposing to include climate risk in strees-testing of banks:

https://voxeu.org/article/bond-versus-bank-financing-transition-low-carbon-economy

Turns out the bond market responds naturally to the risks associated ith climate change, leaving banks to pick up more of the risk. Stranded asset problem. So the Fed was just doing its job and the fossil fuel industry wants it to stop.

AG Garland announced that DOJ is taking on the racist Texas voting deform act as it violates the 1964 Civil Rights Act! We need DOJ to do the same in other racist states.

In 2019, thanks to the new Kavanaugh majority, the Supreme Court ruled 5-4 that partisan gerrymandering is not unconstitutional. Justice Roberts wrote:

“We conclude that partisan gerrymandering claims present political questions beyond the reach of the federal courts.” Federal judges have no license to reallocate political power between the two major political parties, with no plausible grant of authority in the Constitution, and no legal standards to limit and direct their decisions.”

Roberts also said that excessive partisanship in the drawing of districts does lead to results that “reasonably seem unjust,” but he said that does not mean it is the court’s responsibility to find a solution.

So there you have it. According to Roberts, partisan election rigging is “unjust” but there’s nothing that the justices can do about injustice.

Prior to the Voting Rights Act of 1965, presumably Roberts would have said the same thing about Jim Crow laws disenfranchising African Americans. “Sorry, nothing we can do about it. Don’t be fooled by our pretentious Justice titles. Justice is not our job.”

With the new 6-3 majority, the Administration’s Texas case is doomed to fail.

I sometimes wonder if conservative justices have ever read section 2 of the 15th Amendment. I would hope Congress would do its job but that would require electing at least 60 reasonable Senators or killing the filibuster.

pgl: “I would hope Congress would do its job but that would require electing at least 60 reasonable Senators or killing the filibuster.”

Congressional action is no cure. In 2013 in Shelby County v. Holder, the Supreme Court decided to ignore the requirements of the 1965 Voting Rights Act in a 5-4 decision.

Judge Roberts wrote that the Voting Rights Act was “based on 40-year-old facts having no logical relationship to the present day.” In other words, they decided that racial discrimination in elections simply does not exist anymore so they are free to ignore Congress’ laws.

And then, just this summer in Brnovich v. Democratic National Committee, with the new Barrett 6-3 majority, the court ruled that racial equality must be subordinated to states rights, significantly raising the bar for discrimination claims and turning the Voting Rights Act upside down.

So with a radical right Supreme Court that simply ignores Congress’ laws, there may be nothing Congress can do short of dismantling the Supreme Court or diluting its right wing majority.

joseph,

Wasn’t the 2019 ruling essentially that the Court had no authority to object to purely political gerrymandering, but could take action against racial bias in redistricting?

So if the DOJ case claims racial bias, the 2019 ruling will not matter. The make up of the Court will matter, of course. Conservatives built this Court for a reason.

Macroduck: “Wasn’t the 2019 ruling essentially that the Court had no authority to object to purely political gerrymandering, but could take action against racial bias in redistricting?”

That was then and this is now. In 2021 last summer, the Robert’s court went even further in Brnovich v. Democratic National Committee and said that racial disparity is subordinate to states rights. They added a five-part test that raises the bar for discrimination claims so high as to effectively gut the Voting Rights Act.

The court has continually been moving the line, inventing new excuses each time – 2013, 2019, 2021 – until there isn’t much left to the Voting Rights Act. They’ve simply chosen to ignore the laws of Congress in league with the Republican Party.

Remember the Roberts confirmation hearing where he swore that he’s only there to call balls and strikes and not to pitch or bat? Yeah, not so much. He’s been throwing a lot of curve balls for his team.

I notice using EViews breakpoint unit root test, Core CPI FRED series: CPILFESL now appears to be trend stationary from at least 2020m04 to 2021m10. Trend stationary was not the case for prior data.

Two questions:

Are you convinced by 18 month’s data?

What are the implications of such a break?

Bonus question: Can you think o a structural change which would account for a shift from non-stationary to staionary.

Really like your comments.

So, I have this 91-year-old, high-school educated relative. Housewife from the age of 22. Quite often, when we discuss the news of the day, she’ll say something which sounds like she’s paraphrasing the work of some famous economist. Joan Robinson, Dean Baker, even Daron Acemoglu. (Adam Smith, too, but he doesn’t count.) She has no economic training, but has read newspapers and news magazines all her life. She just comes up with this stuff.

Then, I read comments here and on other economics blogs and shake my head. How is it that so many commenters with so little understanding have such strong opinions? I don’t expect formal training, jus some understanding of how things work. Luckily, we have AS and a few others to balance the scales.

macroduck: I find that in the comments on this blog the belief in ones own infallibility in economic analysis is positively correlated with lack of higher economic education, on average.

I’m actually hesitant to make this comment/query for fear I am both incriminating myself placing it in this portion of the thread and openly asking you to take a Kirschbaum sword to my lower ribs. Can you put a post up comparing UK annualized GDP post Brexit with USA annualized GDP post-Brexit and show us the differences??

Please don’t use a dull blade as my fragile ego can only take the one quick slice.

macroduck,

Thanks for the kind words. Kind words seem not to be the norm.

To try to answer your questions:

1. I am not convinced by 18 months of data but thought it interesting. Given the past non-stationary nature of Core CPI, my assumption is that we will see non-stationary behavior again in the future.

2. Given the concept of “persistence” and given that as I understand, trend stationary is not mean reverting, we could experience longer inflation than may have been thought. Also, trend stationary seems to conflict a bit with the various breakeven concepts of inflation at least for the short-term (one year or so).

3. Seems like the structural change that may account for a shift from non-stationary to trend stationary is Covid with all of the ensuring policy changes such as stimulus payments and supply chain constraints which have unbalanced supply and demand, causing price increases.

Should be “ensuing” policy changes, not “ensuring”.

Auto-correct is nobody’s friend.