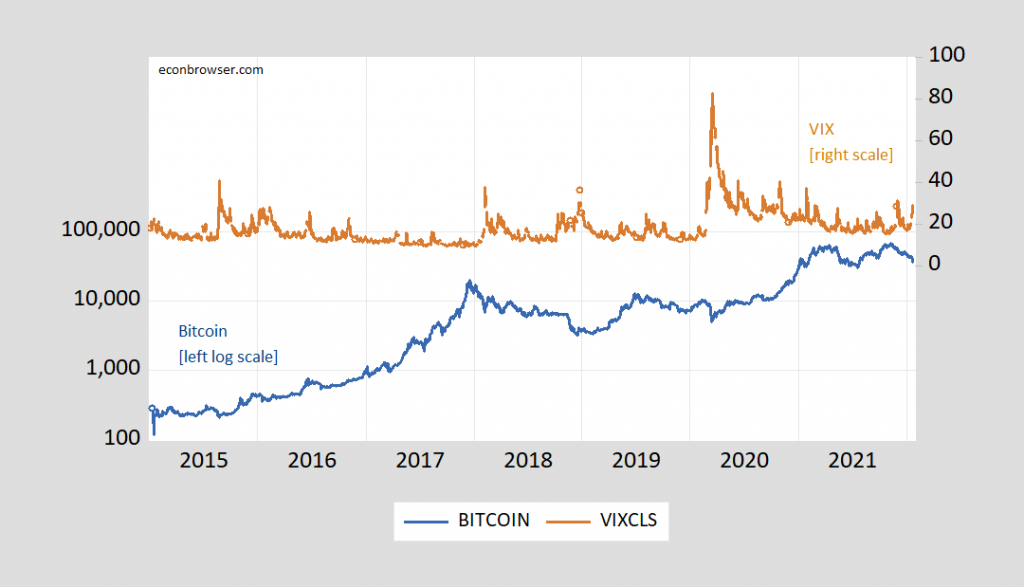

Bitcoin’s lost half its value since its recent peak. Could one explain this one’s students, quantitatively? First take a look at the the correlation with the most commonly discussed factor in the recent episode – risk.

Figure 1: Coinbase bitcoin (blue, left log scale), and VIX (brown, right scale). Source: Coinbase, and CBOE via FRED.

There is some apparent negative correlation between risk, as proxied by the VIX, and the price of bitcoin. However, there’s a big trend in bitcoin (even when logged), so estimating in first differences might be more appropriate at capturing a relationship. One finds for 1/14/2015-1/21/2022:

Δlogbitcoint = 0.0001 – 0.006ΔVIXt – 7.310 Δπet + ut

Adj-R2 = 0.04, SER = 0.048, DW = 2.45, N = 1371. bold face denotes significance at 10% msl using HAC robust standard errors.

Where πe is expected 5 year inflation from TIPS breakeven, in decimal. Interestingly, neither expected inflation, nor real interest rate (TIPS 5 year) are significant. However, even the identified relationship with the VIX doesn’t look particularly strong. If one looks for breaks using a Bai-Perron structural break test, a break is identified at 3/12/2020. Inspecting Figure 1, one sees this is just before the spike in the VIX.

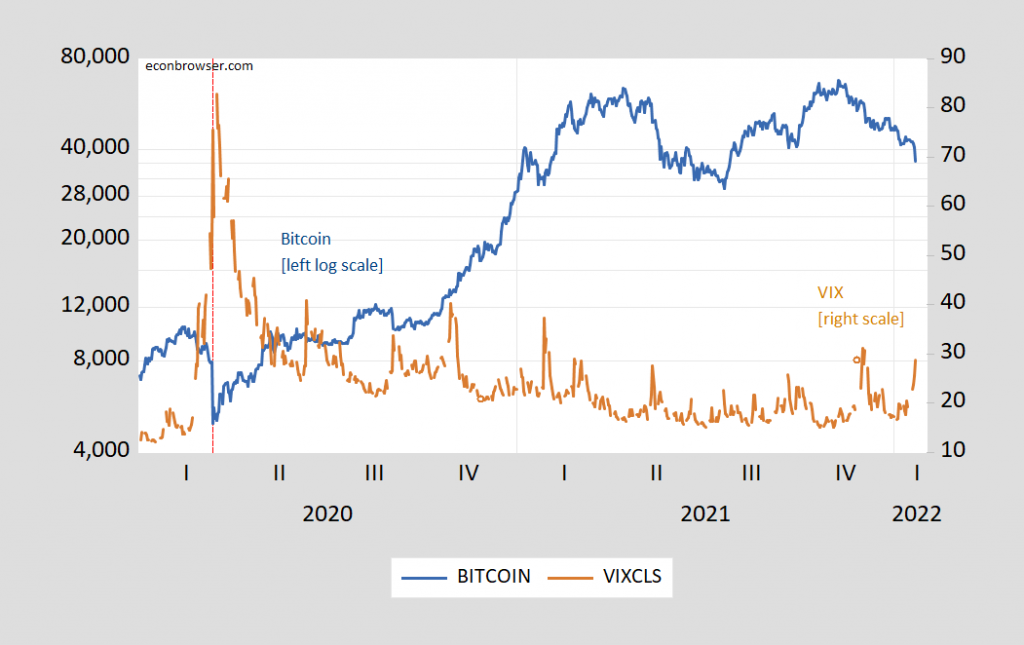

In Figure 2, I show the data from 3/1/2020 through 1/22/2022.

Figure 2: Coinbase bitcoin (blue, left log scale), and VIX (brown, right scale). Red dashed line at 3/12/2020. Source: Coinbase, and CBOE via FRED.

Over the subsample identified by the Bai-Perron procedure (3/12/2020-1/21/2022), the regression yields:

Δlogbitcoint = 0.0001 – 0.010ΔVIXt – 3.559 Δπet + ut

Adj-R2 = 0.27, SER = 0.041, DW = 2.13, N = 365. bold face denotes significance at 10% msl using HAC robust standard errors.

So, yes, it looks like changes in bitcoin prices — particularly right now — are being driven by risk appetite as proxied by the VIX: over the past month, about 42% of the variation.

Little estimated sensitivity to inflation expectations suggests bitcoin is not a good hedge against inflation; statistically significant correlation with the S&P 500 suggests it’s not a good hedge for stocks.

For more speculation on what drives bitcoin prices particularly over longer horizons, see here.

Update, 5;15pm Pacific:

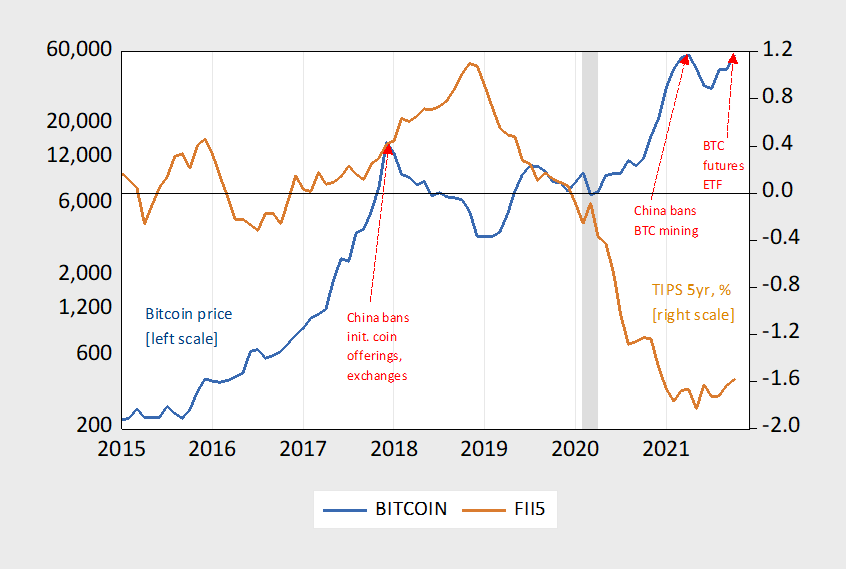

Reader Joseph points out that political/regulatory events matter too, and I agree. Here’s a graph I generated for my students in the Fall.

Figure 3: Bitcoin (blue, left log scale), and TIPS 5 year yield, % (brown). NBER defined recession dates shaded gray. Source: Coinbase and Federal Reserve via FRED, NBER.

Update, 1/23 10am Pacific:

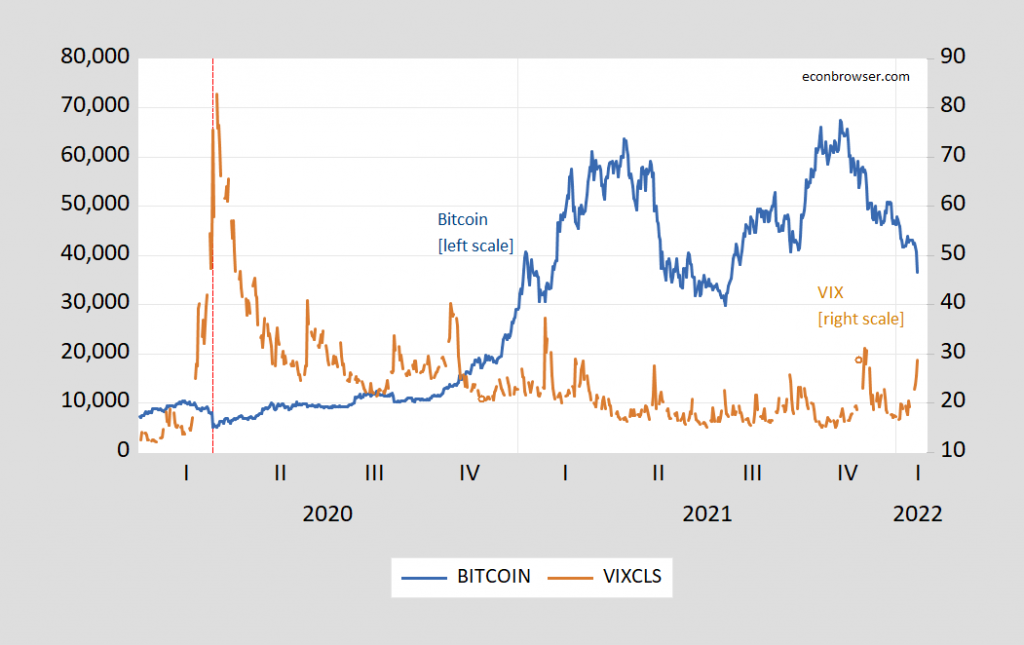

Figure 4: Coinbase bitcoin (blue, left scale), and VIX (brown, right scale). Red dashed line at 3/12/2020. Source: Coinbase, and CBOE via FRED.

You are looking for economic correlations. Perhaps political correlations might be more appropriate. China and Kazakhstan and Russia have all recently announced crackdowns on bitcoin mining operations and citizen transactions. For a while, Kazakhstan was second only to the U.S. for the number of bitcoin mining operations after being run out of China.

joseph: Yes, I agree they should be in their, but I didn’t have an opportunity to look up all the political/regulatory events that would likely have an impact. See Figure 3 I’ve added to the post, at the end. If you have a list of dates that I can generate a dummy variable with, send along.

Hey, I would love to help but I don’t follow the travails of cryptocurrency in any detail except to occasionally shake my head in disbelief.

I am not sure the reliability and accuracy of this webpage Menzie, but on a skim read it seems to read true. Apparently Sept 24, 2021 was the last major crackdown. Other crackdown dates might be more ambiguous or indefinite.

https://www.coindesk.com/learn/china-crypto-bans-a-complete-history/

To my naked eye, looking at the graph, your date on the banning of BTC mining looks earlier than the date Sept 24, but it wouldn’t be the first time my eyes failed me. Your judgement is WAY better than mine on if demarcating those times, especially the more inexact times in the graph from a learning perspective is worth it or not. They obviously seem to “correlate” with times that Beijing gets more crotchety on capital controls going in and out, which communist party bureaucrats break all the time trying to protect their own asset values. Confucius says “Do as I say, not as I do”.

https://www.nytimes.com/2022/01/10/opinion/crypto-cryptocurrency-money-conspiracy.html

January 10, 2022

Crusading for God, Family and … Bitcoin?

By Paul Krugman

Josh Mandel, a Trump disciple seeking the Republican Senate nomination in Ohio, recently tweeted out what he stands for: “Ohio must be a pro-God, pro-family, pro-Bitcoin state.” Indeed, there has long been a strong connection between support for Bitcoin and right-wing extremism — like the traditional association between conservatism and an obsession with gold, only more so.

So what’s that about?

Now, the fact that many Bitcoin enthusiasts say bizarre things does not, in itself, mean that cryptocurrencies are a bad idea. People can support the right things for the wrong reasons. I’m sure, for example, that many people accept the scientific consensus on, say, vaccine effectiveness not because they value peer-reviewed research but because they are impressed by people in lab coats who use big words.

Still, it does seem important to understand the cultish aspects of the cryptocurrency movement.

First, however, a bit (ahem) about the economics.

I still sometimes encounter people who say that we live in a digital age, so we should be using digital money. But we already do! Like many people, I pay for most things by clicking a mouse, tapping my debit card or pressing a button on my phone. I used to keep singles in my wallet to buy fruit and vegetables from New York’s ubiquitous sidewalk stands, but these days even they often accept Venmo.

All of these payments, however, depend on trusting a third party: People accept debit cards, Apple Pay, Venmo and so on because they’re linked to a bank account. Bitcoin’s whole purpose, as laid out in its original 2008 white paper, was to remove the need for that kind of trust: It would validate payments using methods related to cryptography — coded communication. The goal was to create a “peer-to-peer” system of payments independent of financial institutions.

But why do this? Are banks that untrustworthy? …

https://www.nytimes.com/2022/01/11/opinion/bitcoin-inflation-deficit-spending.html

January 11, 2022

Is government money creation actually enabling deficit spending?

By Paul Krugman

[ The President of chronically low income and poorly developed El Salvador is using state funds to buy Bitcoin as the national debt obligations are increasing and while this seems like madness to me the buying appears to be generally accepted nationally. ]

Mandal isn’t a Trump disciple. Mandal is a globalist con man. A elitist elitists. Much like bitcoin, a foreigners currency(invented in China). Educate yourself Paul.

Much like bitcoin, a foreigners currency(invented in —–)

[ This is, of course, incorrect. ]

Well, a lot of educated mainland Chinese will tell you AIDS/HIV originated in the United States, and that SARS originated in Hong Kong. Both blatant lies encouraged by the Communist party apparatus and then “taken up” by China’s education system and state TV. So, we can forgive these type errors, right ltr???

What is the point of this numerology that still ends up in self-admitted noise? Do you simply enjoy showing off your command of jibber-jabber?

rsm,

Sheesh. I am still waiting for you to make a remotely sensible remark here. This one is just noise.

How is all this “self-admitted noise” Do cryptocurrency traders announce that what is happening is noise? Do the numbers come with a little asterisk that says “we are noise”? Did Menzie say this is all noise? Or did you just intuit on your own that this is the case, more likely?

That you call his efforts to look for a correlation between bitcoin price movements and changes in measures of market perceived riskiness is only “jibber jabber” to somebody who knows zero about econometrics or either of these markets. That would seem to characterize you, a total ignoramus who loves to display it here regularly with your utterly stupide questions and claims.

Is it just completely off the mark though to observe that your posts are just noise, too?

Sorry, rsm, you are the one spouting noise. Menzie found a correlation between the two variables he looked at, and there are not completetly absurd reasons to believe that indeed these variables might have a correlation.

Your reaction is to simply declare that his finding is probably some irrelevant accident because the data is a teem you like to loudly, or shal I say noisily, like to use here a lot about a lot of things that it does not apply to. And here you are st it again, making yourself look like a totally ignorant moron, just as you have been repeatedly doing constantly since you started showing up here.

Let me agree that bitcoin price dynamics look pretty noisy, highly volatile and all that. But “noisy” is not the same as “noise.” Information can still sometimes be extracted from noisy data, and Menzie looks like he may have found some. But all you can so is stupidey jeer.

I would argue the ease with which bitcoin can be traded has evolved tremendously over the years. I tried to purchase bitcoin prior to 2016, and had trouble doing so easily. Today i can do it on an app. Bitcoin price has steadily increased as more buyers have gained easy access to purchase. That has not always been the case. Probably as big, or bigger, of an issue than mining.

baff,

“big of an issue” in which sense? Maybe in terms of the functioning of the market. In terms of the social value or cost of bitcoin, mining is a very serious business. The latest estimate I have seen of electricity usage for mining of bitcoin is that it is now on the same scale as the electricity consumption of Italy. That is a lot. I saw a bitcoin defender on MR claiming that 60% of bitcoin mining electricity comes from “clean” sources. Maybe, but even that lower amount is a lot of GHGs.

There are a few benefits of cryptocurrencies, not necessarily bitcoin, which is probably the worst of them, especially for its pollution generation. But they do allow people to transfer larger sums across borders much more easily than via alternatives, with me thinking of legal movements. Otherwise, not many social benefits from any of them. Of course blockchains have other uses, which are good, accounting systems for banks and insurance companies, and they are getting such usage. But one does not need bitcoin for any of that.

Of course blockchains have other uses, which are good, accounting systems for banks and insurance companies, and they are getting such usage….

[ Please, if possible, can a specific significant usage of Blockchain by a bank or insurance company be referenced? Thank you. ]

bblockchain is useful in supply chain: can facilitate tracking a part moving through transportation nodes.

a lot of technical data uses. it is very useful for configuration management of complex parts as well as end items like automobiles. it can record changes made to components and improvement s to performance of a complex item. very useful in aircraft where the right parts are critical to safe performance….

it is a facilitator of the internet of things. IoT.

lol,

Yes, that. XRP is used by commercial banks for transactions. I do not have a link, but it is my understanding that at least some insurance companies are using blockchains for more complete accounting systems. It does not get played up by all the crypto fans who think it is going to be the new money, but in fact blockchains really are like super full and detailed accounting systems.

https://www.jpmorgan.com/insights/technology/blockchain

blockchain has a great many uses. it is not limited to crypto. it is simply another way of creating an approval process. rather than let one central figure approve/deny an action, it creates a system where the collective make those decisions.

baff,

Recent reports have it that despite the apparently decentralized nature of how cryptos operate, there are certain gates in the system where central players are crucial. They are not nearly as decentralized as publicized. And a problem is that who these people are at these locations is not publicly known.

barkley, I think most people who really look into the crypto blockchain understand they are not completely decentralized and nor anonymous. it is very hard to eliminate all pinch points in any engineered system. since these are man made, the builders have some control over how many pinch points, and how concentrated the control is. some blockchain systems will be better than others, depending upon the need of the system. if you want a fast system, you cannot be completely decentralized, for example. this is why you are seeing many different blockchain platforms emerging-they each have pros and cons, which work best for some applications and not others. bitcoin is an example of that. at any rate, I don’t think the item in your comment diminishes the use of cryptos and blockchain. users simply need to be aware of how they operate. a Ferrari is a great car, but not necessarily for your morning commute to a jam packed parking garage, right?

Pollution is barely there. Don’t make sloppy arguments. Undermining governments for plutocracy is what it’s about.

Pollution is barely there….

[ This is wildly incorrect. ]

“Pollutions is barely there.” You got a source on that? Even producing 60% of Italy’s electricity with fossil fuels will generate quite a lot of CO2 and other pollutants. It may not be screamingly obvious in any locality because it is scattered around the globe. But we are talking about a non-trivial amount of contribution to global warming.

Just how out of it are you, Gergory>

““big of an issue” in which sense?”

impact on price and volatility. the population people accessing bitcoin today is much different than those of 5 years ago. their behavior is also different. hence i would expect an evolve behavior in the marketplace.

don’t think of items like bitcoin as static. they are expensive in term so of mining, today. they have the ability to change that in the future. look no further than ethereum, as an example of a crypto which is changing how it operates to become more efficient.

there is nothing environmentally friendly about mining for gold. and it also does not have the ability to simply change its mining conditions like cryptos, going from proof of work to proof of stake protocols.

Which makes a bubble easier to inflate and then pop.

1. I think of Bitcoin as more of a neoliberal tulip bulb that is endangered by governments outlawing it. I don’t see it as a vol trade. Except…yeah…crazy speculators. OK.

2. With students, I would use the term volatility versus the term risk. Vol is what you’re actually measuring. True risk is difficult to measure.

2.5. I guess if it were an industry, you could get Barra betas and all that. (looking at the non-diversifiable volatility of the industry itself, how CAPM WACCs are computed). But it’s a crazy tulip bulb. They just (literally, and not how millenials use that word) waste energy doing pointless computer gyrations. I hates it. I hates it.

3. Other than that, not crazy about this sort of chartsmanship. Worry that these regressions give you the wrong impression since the dramatic changes are relatively small in number (not the sawteeth, but the larger trends). there are a lot of individual data points, but it’s not really IID. But it’s the metatrends that probably mathematically drive your regression. But the point is degrees of freedom.

4. Other than that, think you should go further back in the time series. Especially since the true degrees of freedom are probably much lower than the daily trade data imply (given point made in 3). How does this correlation hold in 2019, 2018, etc?

5. I’m not crazy about the log transform either. When I look at my portfolio, I sort of live in the linear world. I mean sure, I want a % increase of an investment (above inflation), so you could say logs But the scales are dramatically different with Bitcoin. Think you might be losing the story with regressing a log variable. This is more of a vague concern, since I get out of my depth with the math here.

Belay point 4. You did the whole series. I was looking at wrong chart, where you just showed last two years. :embarrassed:

Anonymous,

On your point 2 and “true risk.” I think you should think in terms of a distinction at least some economists make that has been around since it was first made in 1921 by both Frank Knight and J.M. Keynes independently in books they published then. It is between “risk” and “uncertainy.” The former is measurable. There is a known or assumed probability distribution, and one can use that with data to estimate a probability about something. True uncertainy, there is no known probability distribution. This is equivalent to the Rumsfield’s “unknown unknowns” Taleb’s black swans.

I don’t think we know the probability distributions on these highly volatile cryptocurrencies, but that does not mean they are full blown black swans, perhaps more like Taleb’s intermediate form, grey swans.

Here’s an analytical challenge after you finish up with Bitcoin. Explain to me how Rodgers, Adams and Lefleur combined for ten points, at home, while a Joe Barry (yikes) defense allowed only two field goals. 🙂

Easy – Lefleur is not a very good coach.

Rogers quit. Something he will do.

I wonder if Rogers will move to New Orleans so I can hate him even more!

Menzie,

I think your figures show the general pattern of price changes for bitcoins, but I do not see actual numbers that look real. You note in your text that btc has fallen to about half of its peak value, but your figures do not show that, and the numbers do not reflect prices I have seen. Whassup?

Barkley Rosser: Figure 2 has bitcoin price in logs, in which case a log change is 39%. I post as Figure 4 in levels; there it’s clear is a halving.

Ah yes. OK, thanks.

https://news.cgtn.com/news/2022-01-23/Chinese-mainland-records-56-confirmed-COVID-19-cases-1735DycHtBK/index.html

January 23, 2022

Chinese mainland reports 56 new COVID-19 cases

The Chinese mainland recorded 56 confirmed COVID-19 cases on Saturday, with 19 linked to local transmissions and 37 from overseas, data from the National Health Commission showed on Sunday.

A total of 34 new asymptomatic cases were also recorded, and 751 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 105,603, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-23/Chinese-mainland-records-56-confirmed-COVID-19-cases-1735DycHtBK/img/30d3ce777ac045ceaf2039250300408e/30d3ce777ac045ceaf2039250300408e.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-23/Chinese-mainland-records-56-confirmed-COVID-19-cases-1735DycHtBK/img/cad653c56162482a9dcef9dc5beeadb1/cad653c56162482a9dcef9dc5beeadb1.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-23/Chinese-mainland-records-56-confirmed-COVID-19-cases-1735DycHtBK/img/6dfe5c010f7442f3a6aeec49bba8256a/6dfe5c010f7442f3a6aeec49bba8256a.jpeg

https://english.news.cn/20220123/07cd038b5f90496aa24890a86b38f32a/c.html

January 23, 2022

Over 2.96 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Over 2.96 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Saturday, data from the National Health Commission showed Sunday.

[ January 15, 2022

Over 1.22 billion fully vaccinated against COVID-19 on Chinese mainland. ]

https://www.worldometers.info/coronavirus/

January 22, 2022

Coronavirus

United States

Cases ( 71,728,557)

Deaths ( 888,623)

Deaths per million ( 2,660)

China

Cases ( 105,547)

Deaths ( 4,636)

Deaths per million ( 3)

I would quantitatively cover the magnitude of greed and speculation [and total denial of any existence of risk] evident in the running up of the price of btc from $100 to $60,000 in the space of six or seven years.

It makes the dot.com boom pale in comparison.

The 1630’s Dutch tulip boom may be comparable.

And, see Elon Musk employed about $1 billion of Tesla cash to buy a billion dollars of btc at just under $60,000 per. Another tech billionaire did the same.

What could go wrong?

I don’t much like linking inflation expectations to VIX stock – investors/traders expectations/fears. I look at the price movements of more traditional inflation ‘hedges’ like gold or real estate. In 2021, Gold did not ‘signal’ untoward inflation risk. Maybe it was crowded out by crypto.

Re: gold. In 1971 the exchange rate was $35; in 1973 – $42; 1974 – $195; 1980 – $875. Contemporary gold was rising YE 2019 – $1,520; rising YE 2020 – $1,902 [high $2,075 August 2020]; falling YE 2021 – $1,831.

Well inflation was 2.9% between 2020-21. Not quite 78-79.

Does that explain the drop in gold YE 2021?

Anyhow, where did you get the number? Reported YoY monthly inflation was 5.4% and over each month from July to December 2021.

Maybe it will be 2.9% for January 2025.

https://fred.stlouisfed.org/graph/?g=C6lz

January 15, 2018

Consumer Price Index and Consumer Price Index Less Food and Energy, 2017-2021

(Percent change)

Yearly inflation was 4.7%+1.2%. YrY inflation is a con game by bls bean counters. Misrepresentation.

Are you the love child of Jack Welch and Judy Shelton?

https://www.nature.com/articles/s41566-021-00928-2

January 17, 2022

Twin-field quantum key distribution over 830-km fibre

By Shuang Wang, Zhen-Qiang Yin, De-Yong He, Wei Chen, Rui-Qiang Wang, Peng Ye, Yao Zhou, Guan-Jie Fan-Yuan, Fang-Xiang Wang, Wei Chen, Yong-Gang Zhu, Pavel V. Morozov, Alexander V. Divochiy, Zheng Zhou, Guang-Can Guo & Zheng-Fu Han

Abstract

Quantum key distribution (QKD) provides a promising solution for sharing information-theoretic secure keys between remote peers with physics-based protocols. According to the law of quantum physics, the photons carrying signals cannot be amplified or relayed via classical optical techniques to maintain quantum security. As a result, the transmission loss of the channel limits its achievable distance, and this has been a huge barrier towards building large-scale quantum-secure networks. Here we present an experimental QKD system that could tolerate a channel loss beyond 140 dB and obtain a secure distance of 833.8 km, setting a new record for fibre-based QKD. Furthermore, the optimized four-phase twin-field protocol and high-quality set-up make its secure key rate more than two orders of magnitude greater than previous records over similar distances. Our results mark a breakthrough towards building reliable and efficient terrestrial quantum-secure networks over a scale of 1,000 km.

The carbon cost of Elon Musk’s purchase of $1.5 billion in bitcoin just about offsets the carbon savings of every Tesla ever sold at that time. So much for his claims about being motivated by saving the planet. He’s in it for the money.

I doubt it. Coin mining creates very little carbon. A electrified vehicle and Truck fleet is 40% reduction in carbon emissions.

You mean mining for copper is cheap and clean? That is absurd.

PK, Grwgory, this is the second time you have made this claim. You had better provide a source for this claim that I see lots of claims to the contrary to. You are making yourself look like some looney conspiracy theorist or dingbat with this stuff.

Gregory,

Google “carbon footprint bitcoin mining.” There is a long list of links, including an article in Nature. Looks like the latest estimate is that if you buy a coffee with bitcoin, the mining involves spews half a ton of carbon into the atmosphere. It is 11 times as bad on this front as mining for ethereum, and 15 times as bad as mining gold.

I saw not a single link arguing that these estimates are exaggerated, none, but a whole lot from many sources pretty much in agreement.

You do not have a leg to stand on with this ridiculous claim. Do you also think Covid vaccines cause more illness than Covid itself? What other wacko garbage do you believe? Actually, please do not pollute this blog with more blazing nonsensical lies.

“Looks like the latest estimate is that if you buy a coffee with bitcoin”

you should not do this. you also pay too much for your coffee in fees with such a transaction. bitcoin is not meant to be a digital transaction dollar for everyday life. there is a reason it is referred to as digital gold, not digital dollar. part of what will reduce the electricity use of bitcoin is the high transaction costs. markets at work. other crypto do this much better.

I googled it, not convinced. There isn’t enough mining to boost carbon emissions. Your dialectical mumbo is irrelevant. I could care less about covid vaccines or anti-vax morons. Your just mad I don’t agree with their conclusion.

“Google “carbon footprint bitcoin mining.” ”

many miners locate themselves near to renewable energy sources, because the energy is cheaper. they have been doing this intentionally for a while. that also has an impact on the carbon footprint.

Latest estimates have bitcoin mining at about 0.2% of total global carbon emisssions.

I think if you’re trying to “pound the point home” into people’s heads, the better way to express bitcoin mining’s negative influence on emissions would be to give the dollar figure, rather than the percentage. But I have neither a teaching certificate or a teaching degree, so……..

barkley, does that number include the energy source? or is it based upon gross energy used?

A recent NYT report said “91 terawatt-hours of electricity annually” and they claim that’s very close to 0.5% of all the electricity in the world which I presume is different (would be higher) than “carbon emissions” being strict about the meaning. Those numbers were quoted in September and claimed they were still growing.

https://ccaf.io/cbeci/index

I know many here are dying to know, so I thought I’d tell you I got my new ASUS external drive to work. The weird thing is it won’t work with the USB-C cords, but it will work with the old school USB cord. And strangely, when I try to hook up the USB-C cords, they do not “cinch up” like I am used to power connections doing , so I do not know WTF I am doing wrong. But I still got it to work using the old cables, so that’s the most important thing.

Coin mining creates very little carbon….

[ This is wildly and dangerously incorrect. ]

https://www.nytimes.com/2022/01/23/climate/led-light-bulbs-dollar-store.html

January 23, 2022

Old-Fashioned, Inefficient Light Bulbs Live On at the Nation’s Dollar Stores

A Trump administration weakening of climate rules has kept incandescent bulbs on store shelves, and research shows they’re concentrated in shops serving poorer areas.

By Hiroko Tabuchi

For years, Deborah Turner bought her light bulbs at one of the many dollar stores that serve her neighborhood in Columbus, Ohio.

But the bulbs for sale were highly inefficient, shorter lasting, incandescent ones — the pear-shaped orbs with glowing wire centers — meaning that over time Mrs. Turner, who lives in a neighborhood where a quarter of the residents are below the poverty line, would spend hundreds of dollars more on electrical bills, because of the extra power they use, than if she’d purchased energy-saving LED lights.

It’s a pattern repeated nationwide. Research has shown that lower-end retailers like dollar stores or convenience shops still extensively stock their shelves with traditional or halogen incandescent bulbs, even as stores serving more affluent communities have shifted to selling far more efficient LEDs. One Michigan study, for instance, found that not only were LED bulbs less available in poorer areas, they also tended to cost on average $2.50 more per bulb than in wealthier communities….

There was a discussion on Econbrowser about lower income persons generally paying more by shopping in stores rather than online. I would reference that discussion, but cannot find the reference. I wonder though roughly how much of a price penalty lower income persons may pay for neighborhood store shopping.

Please reference the Econbrowser discussion, if remembered.

Oil down a couple bucks. Despite war jitters. Markets are so darned multifactorial.

someone in one of the banks said with war brent could hit $150!

sabre rattling, advocating immense human tragedy.

germans want nothing to do with breaking up russia which is the intent of nation building in ukraine (as serbian conflicts, kazakhstan, chechhnya, ossetia, kiev 2014….)

us options in ukraine are limited, it is the end of to be determined supply chain and russia can interdict all around ukraine.

that said when bill kristol wants something….

progressives become strong on the pentagon!

Anonymouis,

Yikes! You have some seriously weird claims here. So “nation building in ukraine” somehow is involved with “breaking up of russia”? What? You mention in this regard “serbian conflicts, kazakhstan, chechnya, ossetia, kiev 2014,” but the only one of these that has anything to do with anything inside Russia is Chechnya. Otherwise they are all outside of Russia, not remotely connected with any “breaking up of russia.”

As for “nation building in ukraine” what on earth does that refer to. Russia invaded and annexed Crimea, a part of Ukraine, in violation of UN treaties, the Helsinki Accords, and the Budapest Accords. Then Putin supported separatists in the Donbas regime of Ukraine. This looks like Ukraine being broken up by Russia, not Ukraine somehow being involved in breaking up Russia. How out of it are you to spout this screaming rank nonsense?

BTW, Tucker Carlson has been loudly siding with Russia against Ukraine and saying the US should do so as well. He also has held his show in Budapest, praising the authoritarian regime of Victor Orban, something that has been picked up by others of his ilk. Is he taking this position because Trump used to be a bought-up patsy for Putin?

Heck, even Orban is siding with the rest of NATO in siding with Uktaine against this Unjustifiable threatened aggression by Putin against Ukraine.

https://news.cgtn.com/news/2022-01-24/Chinese-mainland-records-57-confirmed-COVID-19-cases-174OSx98sVi/index.html

January 24, 2022

Chinese mainland reports 57 new COVID-19 cases

The Chinese mainland recorded 57 confirmed COVID-19 cases on Sunday, with 18 linked to local transmissions and 39 from overseas, data from the National Health Commission showed on Monday.

A total of 27 new asymptomatic cases were also recorded, and 736 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 105,660, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-24/Chinese-mainland-records-57-confirmed-COVID-19-cases-174OSx98sVi/img/59677ae15fba47a88018c31de05310f1/59677ae15fba47a88018c31de05310f1.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-24/Chinese-mainland-records-57-confirmed-COVID-19-cases-174OSx98sVi/img/a0dce68f61f44c1a924d36bf0c0407b6/a0dce68f61f44c1a924d36bf0c0407b6.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-24/Chinese-mainland-records-57-confirmed-COVID-19-cases-174OSx98sVi/img/ceaa10e907e64859bd01574a5b846e99/ceaa10e907e64859bd01574a5b846e99.jpeg

http://www.xinhuanet.com/english/20220124/aa6e851788e74a5dbb25c1233d7ce729/c.html

January 24, 2022

Nearly 2.97 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Nearly 2.97 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Sunday, data from the National Health Commission showed Monday.

[ January 15, 2022

Over 1.22 billion fully vaccinated against COVID-19 on Chinese mainland. ]

https://www.worldometers.info/coronavirus/

January 23, 2022

Coronavirus

United States

Cases ( 71,925,631)

Deaths ( 889,197)

Deaths per million ( 2,662)

China

Cases ( 105,603)

Deaths ( 4,636)

Deaths per million ( 3)

It’s not just Fed governors who are insiders cashing out on the markets. Congress is profiting, too.

https://prospect.org/power/congress-beats-wall-street-at-its-own-game/

The Onion presciently notes their possible response to the market correction: “ Nancy Pelosi Introduces Landmark Legislation To Provide Aid For Struggling Personal Stock Portfolio.” https://www.theonion.com/nancy-pelosi-introduces-landmark-legislation-to-provide-1848393259

Are we soon to witness yet another case of reality imitating art?

One thing for sure— extending the child tax credit or raising the federal minimum is a totally outrageous idea and politically infeasible. Let the poor survive off their capital gains!

JohnH,

The key person responsible for why the child tax credit is not being extended is Joe Manchin, who singularly and specifically pointed it out as the part of the Build Back Better proposal he most opposed. He has put forward ridiculous arguments for his position, claiming recipients are using it to buy drugs and alcohol. Of course, he would not be in the crucial position to kill it if it were not the case that every single GOP senator also opposes it for reasons unclear other than wanting to deny Biden a “win,” McConnell’s old game.

But we know that you like to blame both parties as equally bad for the poor (hack, cough).

On a related issue, today’s financial press is on correction-watch for stock indices. Over the long haul 10% declines in broad market indices have led to 20% declines just under 40% of the time, less often in recent decades. Equity option gamma trades are a big driver of recent volitility, on top of fundamental issues,

The Fed is part of what is driving stock losses and the Fed is sensitive to negative market feedback, more from credit than equity markets. The BBB corporate interest rate spread had widened to just 200 basis points when the Fed’s last brief rate hike cycle was ended. The spread has so far been edging very slightly higher to around 126 bps. The KC Fed’s financial stress index is very low. Until we hear Powell say the Fed is “monitoring financial markets closely” (always the case, but not always mentioned in public statements), negative feedback may not be all that strong. Treasury orvthe White House saying it isn’t the same thing.