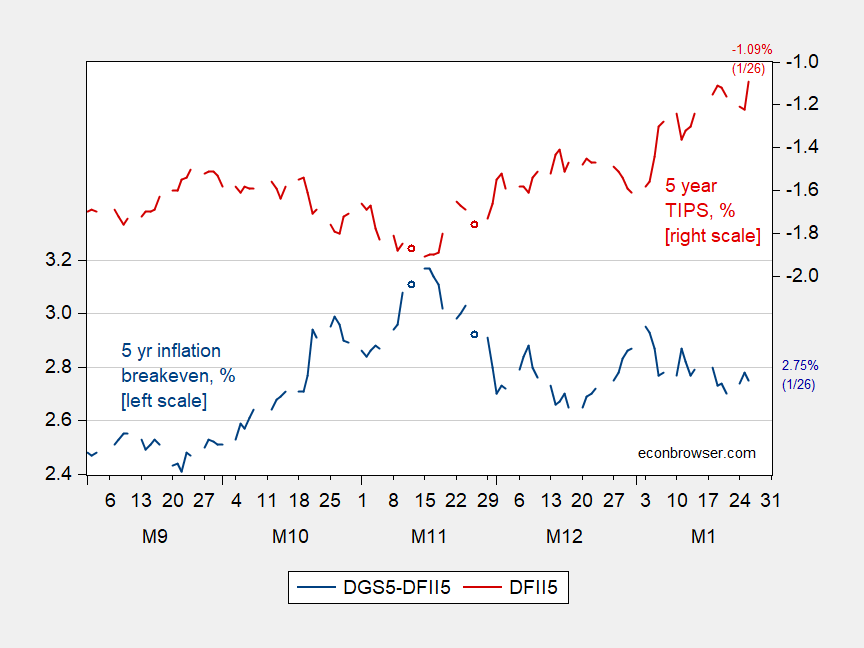

Given the indications of tightening in the Fed’s statement today – both on rates and tapering – it’s surprising how little inflation breakeven moved. On the other hand, 5 year TIPS jumped 13 bps.

Figure 1: Five year inflation breakeven calculated as 5 year Treasury minus 5 year TIPS (blue, left scale), and five year TIPS yield (red, right scale). Source: Federal Reserve via FRED, Treasury, author’s calculations.

Note that neither indicator is adjusted for term and/or liquidity premia.

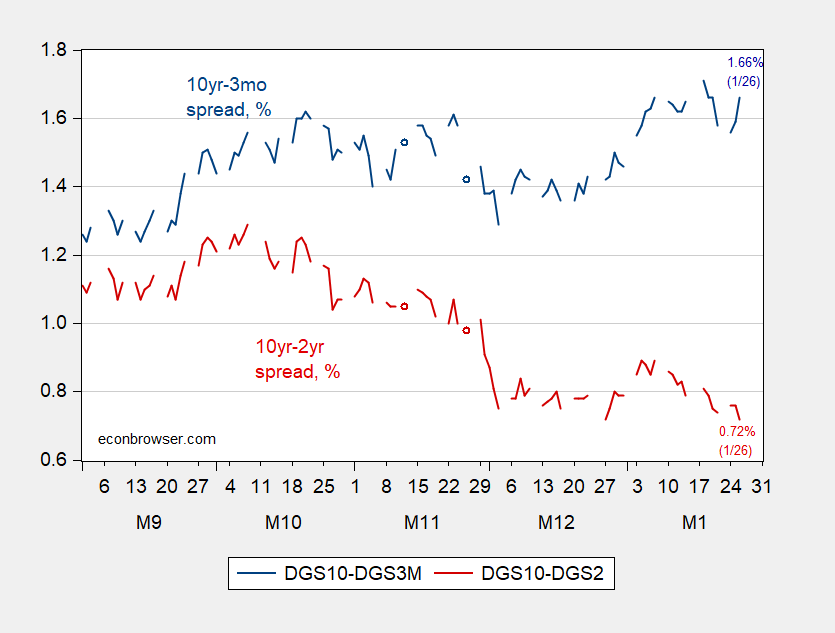

In line with the interpretation of rate changes moving forward, the 10yr-3mo term spread has trended sideways, while the 10yr-2yr has shrunk (i.e, the yield curve at the 2 year plus horizon has flattened).

Figure 2: 10 year – 3 month Treasury spread (blue), and 10 year – 2 year Treasury spread (red). Source: Federal Reserve via FRED, Treasury, and author’s calculations.

No inversion yet, but flattening does suggest slowing growth.

The 5-year breakeven inflation rate may be 2.75% but note the 10-year breakeven inflation rate is only 2.38%. So is the market signaling that its expects inflation to recede over time?

https://news.yahoo.com/spotify-removing-neil-youngs-music-231222964.html?fr=sycsrp_catchall

I have yet to use Spotify and now I never will. Choosing Joe Rogan over Neil Young? Morons!

neil young would have done this better.

https://www.youtube.com/watch?v=czUx2gvjdJk

Relevant for our president toughness toward putin.

Of course Military Madness was a protest song re the Vietnam War. Biden has no attention of sending troops into Ukraine. Let’s hope Putin does not either.

If they keep this up people who own TIPS might actually make money someday. Even stupid people make money sometimes.

a clock is right twice a day unless the led is out or the hands fell off.

There was some increase in rate hike expectations in rate futures, but not enough to change the end-of-year expectation of four 25 basis point rate hikes. There has been a gradual increase in rate hike expectations and the Fed has avoided inducing sudden adjustments.

Curious to see what the Fed will do if price increases become more narrowly based, mostly housing and energy for instance.

Questions of what to do with the Fed’s portfolio only begin to be addressed with cutting purchases. Fed assets are now about 3 1/2 times GDP, compared to 1 3/4 times GDP in Q3 2019 and a pre-Covid peak of 2 1/2 in 2014. The Fed’s goal is to make rates “the” policy instrument during normal times, but the bigger the portfolio, the more likely that changes to it will affect market conditions.

Duck,

You’re way off. Fed balance sheet as of 9/21 was $8.5 trillion. That’s about 36% of GDP. Where do you get your data?

Here’s from the Fed: https://www.federalreserve.gov/monetarypolicy/files/balance_sheet_developments_report_202111.pdf

He probably got a couple numbers mixed up in his head. If you’re a vociferous reader (which I’m sure macroduck is) it’s pretty easy to get numbers intermingled. Macroduck doesn’t have my problem where I do it nearly every time so almost every time I have to go back and doublecheck myself.

I just went out to get some motor oil, and these too old ladies (hopefully that doesn’t sound derogatory, because I don’t mean for it to sound derogatory) who were standing in line, just started talking to me like I was their next door neighbor and we had known each other 20 years. ONe offered to let me go ahead of her because she had 6 items and I just had the bottle of motor oil. Of course I refused but thanked her. Sometimes, when we watch people like the orange abomination, Steve Bannon etc on our TV, we forget there are many many many good people “out there”. Don’t forget that people (as I often do)

Your right.. Big calculation error. I used quarterly data, not annual data.

The problem remains the same, though. Much bigger portfolio means more risk of trouble managing the portfolio without mishap.

@ Menzie

Menzie, I have one of my bohemian questions for you, that you are often kindly and gracious enough to answer me on. You have hinted more than once on this blog that you think consumers’ opinion on inflation doesn’t amount to much, at least as it relates to professional economists opinions, which seem to “get it closer” in their educated guesses on inflation (I have no strong objections on this), but I wanted to ask you a question loosely related to that. And I can’t “look up” or “research” this question as I am attempting to probe your subjective opinion on this. If we can’t trust consumers’ expectations on inflation vs, professional economists, why would we be any more apt to trust a “typical homeowner” to tell us what the “owners equivalent rent” of his home is, when this is probably a person who has never rented out a property (that he himself owns) in his/her entire life??

So the TIPS rate is going up but the inflation breakeven rate is flat. That seems to indicate the market is happy with the Fed’s Goldilocks policy. They expect the Fed to increase the real interest rate to cool the economy slightly and for inflation to be controlled.

Macroduck: “Fed assets are now about 3 1/2 times GDP …”

I’m not following you here. The Fed’s total assets are around $9 trillion and GDP is about $23 trillion.

https://fred.stlouisfed.org/graph/?g=GzwO

January 15, 2018

Federal Reserve Bank Assets, 2007-2021

https://fred.stlouisfed.org/graph/?g=Lj2D

January 15, 2018

Federal Reserve Bank Assets as a percent of Gross Domestic Product, 2007-2021

The Fed’s $8.9 trillion Total Assets read is noteworthy.

Despite Macroduck’s statistics error – it’s still 37.4% [(8.9T / 23.8T) * 100] of GDP.

The Fed taper is weak tea. Fed total assets rose $300,000,000,000 to $8.9 trillion from October 2021 to now.

M1 rose 22% [(20.6 / 16.9) * 100] from August 2020 to December 2021.

The Fed has repressed short rates at 0% – 0.25% since 2009 – with a two-year hiatus 2017 and 2018 raising rates to 2.25 – 2.50%. The target FF rate was 1.50% – 1.75% in December 2019.

Four, quarter-point rises in a year will result in a one-year out FF target of 1.00% – 1.25% – still wildly accommodative in historic terms.

The Fed needs to sell off assets and more quickly raise rates.

But, it can’t.

“The Fed needs to sell off assets and more quickly raise rates.”

I don’t think that is true. inflation will moderate this year. I can certainly live with 4-5% inflation without fear of financial catastrophe.

It can raise rates sooner but it should not. But he did get the balance sheet data right. OI guess the accountants are applauding!

Is it too obvious to note that price is a liar?

That price? Do you know WTF you are babbling about? Of course you do not. BTW – prices do not lie but people (like you) do.

BEA releases its advance estimate for 2021QIV:

https://www.bea.gov/sites/default/files/2022-01/gdp4q21_adv.pdf

Fire away!

Dean Baker has looked at the details and this seems to be led by inventory accumulation and not some surge in final demand.

Turns out Kudlow was right. GDP can grow faster than 5%!

Kudlow is a lying dunce. An economy far below full employment can grow faster than 5% but when this Klass Klown made that statement – we were near full employment thanks to the sensible macroeconomic policies preceding 2017.

And the Washington Post says that the GDP growth is due to price inflation! Yikes, can’t they get anyone who understands economics to proofread for them.

I would like to read what Fox on 15th Street actually wrote. I guess they do not realize that nominal GDP growth exceeds real GDP growth by the inflation rate. A paper that relies on Robert no relationship to Paul Samuelson is indeed that stupid.

Following up on Dr. Chinn’s Data Sources post, FRED has some bad news for us. They will no longer report LIBOR rates after 1/31/2022:

https://news.research.stlouisfed.org/2022/01/ice-benchmark-administration-ltd-iba-data-to-be-removed-from-fred/

Given how useful this reporting was – I am wondering if there is another way to source historical LIBOR rates?

Is your comment meant to be humor?? The number will be meaningless from this point on, and was corrupted by improper bidding to begin with.

I also imagine you can download it into a file if you are being serious here.

Interestingly, the Vanguard Inflation-Protected Securities Fund has returned 5.36% yearly since 2000 when formed. The fund securities are government guaranteed. The fund allows checking writing, being often used as a high-earning money market fund. The fund has about $42 billion in assets:

https://investor.vanguard.com/mutual-funds/list#/mutual-funds/asset-class/month-end-returns

This is an earnest question (most likely the first and last earnest question I would ever ask you “ltr”). Do you know how much (percentage) of that Vanguard fund is composed by TIPS themselves alone??

http://www.xinhuanet.com/english/20220127/0f2b0a8096c04b99af9e0ddc5323b1ed/c.html

January 27, 2022

Tibet leads the country in resident income growth

LHASA — The per capita disposable income for residents in southwest China’s Tibet Autonomous Region expanded 14.7 percent year on year to 24,950 yuan (around 3,936 U.S. dollars) in 2021, leading the country in income growth.

The average annual increase of the past two years was 13.1 percent, the regional government announced at a press conference on Thursday.

The per capita disposable income for the region’s farmers and herders grew 16 percent, placing it first nationwide for the seventh consecutive year; while that for urban residents rose 13 percent, 4.8 percentage points higher than the national average.

isn’t tibet the country china invaded militarily a handful of decades ago? interesting that the ccp would be crowing about the economic growth of a region under control through military conflict. why does china continue its suppression of the people of tibet?

https://www.republicworld.com/world-news/china/china-forcing-tibetan-tribesmen-to-surrender-their-lands-report.html

They took over Tibet some 70 years ago ans Xi is now seizing the property of the residents in Tibet. But do you hear about this from abuse the PRC spokeswoman ltr? Of course not.

https://news.cgtn.com/news/2022-01-27/Chinese-mainland-records-63-confirmed-COVID-19-cases-179KEwx5Hig/index.html

January 27, 2022

Chinese mainland reports 63 new COVID-19 cases

The Chinese mainland recorded 63 confirmed COVID-19 cases on Wednesday, with 25 linked to local transmissions and 38 from overseas, data from the National Health Commission showed on Thursday.

A total of 55 new asymptomatic cases were also recorded, and 784 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 105,811, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-27/Chinese-mainland-records-63-confirmed-COVID-19-cases-179KEwx5Hig/img/93d27623183841c193ee36f2127fcc59/93d27623183841c193ee36f2127fcc59.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-27/Chinese-mainland-records-63-confirmed-COVID-19-cases-179KEwx5Hig/img/d26ccfb3979b4ca09a6aa19e9adecb8f/d26ccfb3979b4ca09a6aa19e9adecb8f.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-27/Chinese-mainland-records-63-confirmed-COVID-19-cases-179KEwx5Hig/img/53e02ae6229e4d05b6b2049ed8ca2a7c/53e02ae6229e4d05b6b2049ed8ca2a7c.jpeg

https://www.worldometers.info/coronavirus/

January 26, 2022

Coronavirus

United States

Cases ( 74,176,403)

Deaths ( 898,680)

Deaths per million ( 2,690)

China

Cases ( 105,749)

Deaths ( 4,636)

Deaths per million ( 3)

PRC spokeswoman —

PRC spokeswoman —

PRC spokeswoman —

[ Lesson taken from from traditional European anti-Semites as Lion Feuchtwanger described or prosaically by the likes Joseph McCarthy. ]

https://news.cgtn.com/news/2021-06-08/Xi-inspects-Gangcha-County-in-Qinghai-10VRACmI20U/index.html

June 9, 2021

Xi Jinping calls for ecological protection on Qinghai-Tibet Plateau

https://video.cgtn.com/news/2021-06-08/Xi-inspects-Gangcha-County-in-Qinghai-10VRACmI20U/video/3bcf866b347c4da3a9d9db92c567ada4/3bcf866b347c4da3a9d9db92c567ada4.jpeg

China is now taking center stage in the world’s biodiversity and environmental protection drive.

That is the solemn promise made by President Xi Jinping at the United Nations Summit on Biodiversity last year. “We need to take up our lofty responsibility for the entire human civilization, and we need to respect nature, follow its laws and protect it,” Xi said last September.

Sitting on the northwestern Qinghai-Tibet Plateau, Qinghai Lake is known as the country’s largest inland saltwater lake. It is also a crucial body of water to maintain ecological security. People often refer to it as the plateau’s “gene pool.”

On Tuesday, President Xi paid a visit to the lake, learning about achievements made in comprehensively addressing environmental problems and protecting biodiversity.

He was also briefed on the environmental protection efforts in the Qilian Mountains and Qinghai Lake.

https://video.cgtn.com/news/2021-06-08/Xi-inspects-Gangcha-County-in-Qinghai-10VRACmI20U/video/81947eef9be24391b09bada404d975b2/81947eef9be24391b09bada404d975b2.jpeg

Hailing Qinghai Lake’s important and strategic position in ecological civilization, Xi called for more efforts to build the ecological civilization and protect ecological resources in Qinghai, implement the national ecological strategy and build national parks.

Ecology is our resource, wealth and treasure, Xi stressed.

The Chinese president previously urged an innovation-driven development strategy during the annual session of the country’s top legislature. Based on its advantages and resources, Qinghai should accelerate the building of a world-class industrial base on salt lake, he noted in March.

During his inspection, Xi also visited a village of Shaliuhe Township to learn about the lives of local Tibetan residents.

https://video.cgtn.com/news/2021-06-08/Xi-inspects-Gangcha-County-in-Qinghai-10VRACmI20U/video/e5fcc70304ef43fe944389914cd84936/e5fcc70304ef43fe944389914cd84936.jpeg

“We are all one family. We are all brothers and sisters,” Xi said….

http://www.xinhuanet.com/english/2021-05/21/c_139959978.htm

May, 2021

Tibet Since 1951: Liberation, Development and Prosperity

From State Council Information Office of the People’s Republic of China

Contents

Foreword

I. Tibet Before the Peaceful Liberation

II. Peaceful Liberation

III. Historic Changes in Society

IV. Rapid Development of Various Undertakings

V. A Complete Victory over Poverty

VI. Protection and Development of Traditional Culture

VII. Remarkable Results in Ethnic and Religious Work

VIII. Solid Environmental Safety Barriers

IX. Resolutely Safeguarding National Unity and Social Stability

X. Embarking on a New Journey in the New Era

Conclusion

From State Council Information Office of the People’s Republic of China

This is your source? PRC spin 24/7.

https://english.news.cn/20211229/6e52d2168f8a4e64949e4c1346c3cfc8/c.html

December 29, 2021

China’s Tibet sees booming tourism in first 11 months

LHASA — Southwest China’s Tibet Autonomous Region received 40.43 million domestic and overseas tourists in the first 11 months of this year, up 15.9 percent year on year, local authorities said on Wednesday….

Wonderful, that with 40 million tourists traveling through Tibet from January through November 2021, the reports were repeatedly of a sparkling people and environment. There will be many, many visits to come through the province with high-speed all-year rail and fine roads extending city to city, village to village. Tibetan family heads have been recording autobiographical memories since the beginning of 2021. The records I have heard and watched are inspirational.

too bad those 40 million tourists have been lied to about the history of tibet. they are touring through a militarily occupied nation independent of china. it is a military occupation in tibet. that is NOT inspirational.

Sorry for a newbie question, but what does it mean that the TIPS is negative? /Oliver Twist asking for more gruel

https://fred.stlouisfed.org/graph/?g=xLHj

January 15, 2018

Interest Rate on 10-Year Treasury and 10-Year Inflation-Indexed Bonds, 2017-2021

https://fred.stlouisfed.org/graph/?g=onCV

January 15, 2018

Interest Rates on 5-Year and 5-Year Inflation-Indexed Treasury Securities, 2017-2021

https://fred.stlouisfed.org/graph/?g=qfm7

January 15, 2018

TIPS 5-year spread, * 2017-2021

* Breakeven inflation rate (difference between rate on nominal Treasury Notes and on Treasury Inflation-Protected Securities)

https://fred.stlouisfed.org/graph/?g=r5VO

January 15, 2020

TIPS 5-year spread, * 2020-2021

* Breakeven inflation rate (difference between rate on nominal Treasury Notes and on Treasury Inflation-Protected Securities)

You just linked to the time series. My question is what is the significance of the bond being negative? The implication.

https://news.cgtn.com/news/2021-05-22/What-about-Tibet-What-a-story-indeed-10td2hPbV1C/index.html

May 22, 2021

What about Tibet? What a story indeed

By Timothy Kerswell

As a foreigner in China, especially as a political scientist, something I get asked about most by people outside China is “What about Tibet?” I’m never surprised given the deluge of misinformation from Western media, from India and from separatists attempting Tibet’s destabilization. The State Council’s White Paper * entitled “Tibet Since 1951: Liberation, Development and Prosperity” provides a good opportunity to reflect on Tibet’s experience since liberation in 1951. The White Paper has been made publicly available in English on May 21, and I would encourage anyone with an open mind to go and read it.

Like with Hong Kong and Macao, Tibet has been a part of China’s multiethnic society since antiquity. Also, like Hong Kong and Macao it’s only with the arrival of European imperialism on the world stage that ideas about separatism/independence were intentionally spread, as they have been worldwide in an attempt to undermine countries’ sovereignty through a strategy of divide and rule. Separatism in China is indivisible from imperialism and accordingly, China’s sovereignty has depended on its ability to remove the influence of imperialism from its territory.

Whereas separatism is a foreign and imperialist idea, the defense of national integrity is as “local” in Tibet as in the rest of China. On the day the People’s Republic of China was founded, the 10th Panchen Lama telegrammed Beijing with just one request “Please send troops to liberate Tibet and expel the imperialists as soon as possible.” This was the beginning of Tibet’s future of shared prosperity….

* http://www.xinhuanet.com/english/2021-05/21/c_139959978.htm