A reader observes, there are “So many ways to compare “performance”. That’s so true!

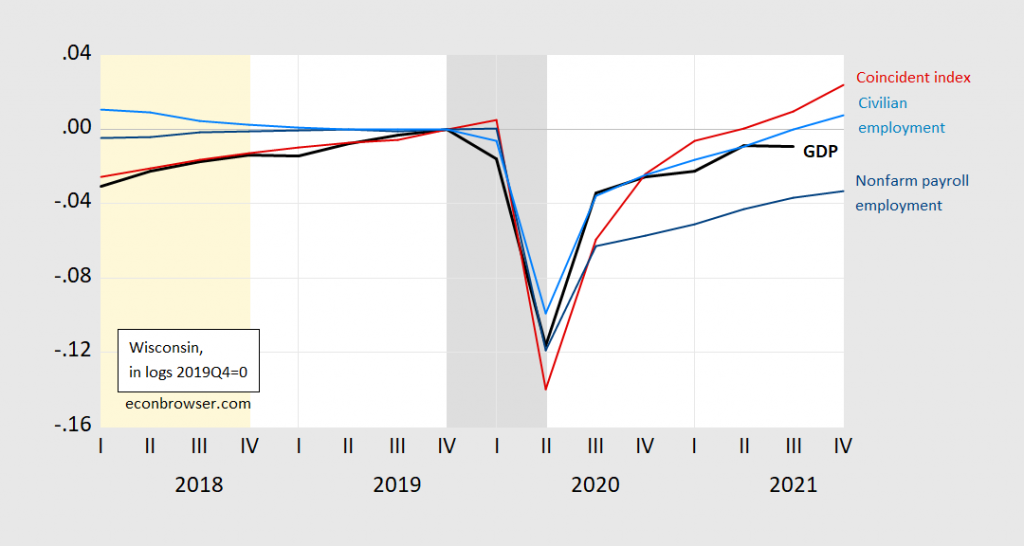

Figure 1: Wisconsin GDP in Ch.2012$ (bold black), coincident index (red), nonfarm payroll employment (blue), and civilian employment (sky blue), all in logs 2019Q4=0. NBER defined recession dates peak-to-trough shaded gray. Light orange denotes Walker administration. Source: BEA, Philadelphia Fed, BLS via FRED, NBER, and author’s calculations.

Interestingly, the coincident index has diverged from GDP in recent quarters, even though the index aims to track state level GDP. While over the past four years, growth rates are correlated with an adjusted-R-squared of about 90%, it’s dropped to 80% for 2020Q3-21Q3. Wisconsin GDP growth and national GDP growth are correlated with adjusted-R-squared at 98% over this same period. A nowcast using national GDP growth yields the following:

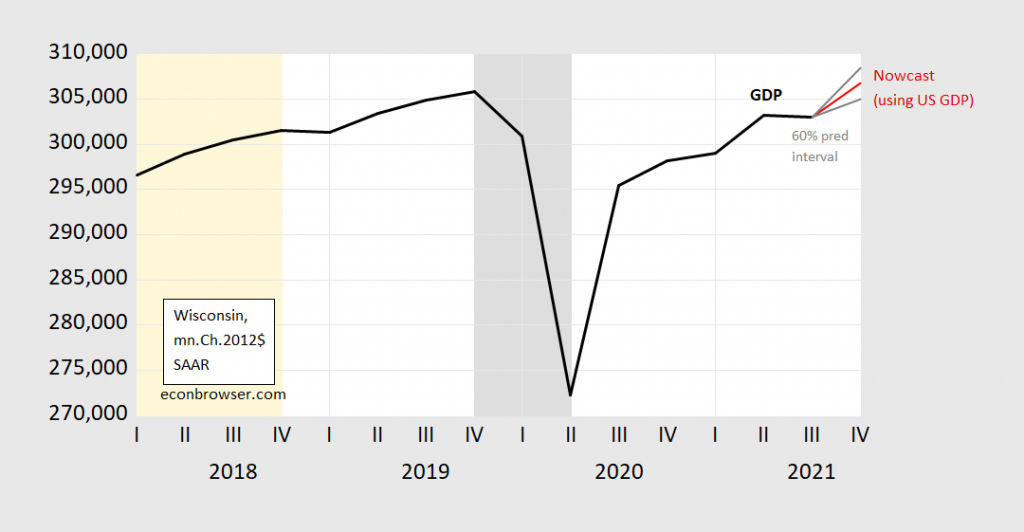

Figure 2: Wisconsin GDP in Ch.2012$ (bold black), and forecast from log first differences regression, 2020Q3-21Q3 (red), and 60% prediction interval (gray lines). NBER defined recession dates peak-to-trough shaded gray. Light orange denotes Walker administration. Source: BEA, NBER, and author’s calculations.

That is, using the recent historical correlation, Wisconsin GDP growth will accelerate to about 5% q/q SAAR in Q4 (recalling US GDP grew at 6.7% in Q4) (percent rates calculated using logs.)

For more on how these variables correlated pre-pandemic, see this working paper.

For high frequency tracking of state economies, see Baumeister et al. discussed here, and current Weekly Economic Indexes through end-December.

Is producing chart crime with noise “productive”?

“So many ways to compare “performance” is true, but also the sort of thing one might say if one had been caught making a dubious assertion about relative performance. Some folk use a wide range of data to gain understanding. Others use it to weasle away from falsifiability; a cheap debating trick.

That is sort of what I said but I really appreciate the way you said it!

I agree and I think it is one of the main problems in economic debates. If you start with a narrative it is often possible to cherry pick or torture a specific message out of the data. If you want insights and understanding you have to figure out what each parameter really measure (instead of what it is called) and look at those that are best at addressing the question you want to answer.

I was once accosted by Chinese PSB goons while at an internet bar, not doing so much as harming a fly. They are such cowards (I’ll save other noun descriptors here) it took 10-12 of them to escort me back to my apartment so they could look at my passport. They are so ineffectual as human beings they make America’s shopping mall security guards look like Mayo Clinic doctors:

https://twitter.com/NOS/status/1489578149507698689

Kind of interesting. This is the danger of variants and mutations. I’ll be surprised if we don’t see some semi-serious variant (equal to Omicron or worse in terms of severity to individuals) inside the next 18 months. I am hopeful of being made out to be a fool on this specific topic.

https://news.feinberg.northwestern.edu/2022/02/why-covid-19-surveillance-in-nigeria-is-critical/

I’ve heard a sort of Darwinian speculation from credible folk that disease mutation tends toward increased transmissibility and decreased mortality. It’s a numbers thing for the germ – less death keans kore spread. Doesn’t mean it works that way every time, of course, but that’s the natural progression over time. A truly successful microbe goes beyond enddimic disease to become ubiquitous and harmless. Fingers crossed Covid-19 is on its way to complete success.

Keans kore? You mnow what I keant.

But, as I noted, it doesn’t have to work that way every time:

https://www.science.org/doi/10.1126/science.abk1688

I think most of the time this is correct. I suppose probabilities would lean that way. I just kinda feel (maybe this is subjective thinking) that when people know that if you don’t vaccinate the African regions etc (any place where they can’t afford vaccines, it’s socio-economic problem, not racial) that mutations are going to increase, the richer nations are kind of “daring” or “calling the bluff” of the virus. If we were one person holding a poker hand, and Covid-19 is a personage holding a poker hand, and we’re counting cards thinking Covid-19 doesn’t have any face cards. That river can be a B.

probability wise, it is more likely that a mutation does nothing new at all. it probably has an equal chance of producing better outcomes than worse outcomes. in the long run, the worse outcomes are less likely to be favored, because of the reduction in hosts. in the short run, you can expect variants to be both good and bad, and more transmissible. transmissibility is the key. the end game is determined by how well our immunity holds up.

In all animals it is better for the virus to not make the host so sick it dampens the hosts ability to go out and spread the virus. In humans it may be even more pronounced since the virus will be better off if it doesn’t make the human host sick enough to go to the doctor and be diagnosed (which in itself can get people to stay away from others, even if they fell perfectly able to go out and mix). I am quite optimistic about us not seeing any new strains that have worse morbidity/mortality.

“So many ways to compare “performance”.

Some add to the discussion but then there is the list of Kelly Anne Conway approved Alternative Facts.

https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/deaths/bulletins/deathsinvolvingcovid19byvaccinationstatusengland/deathsoccurringbetween1januaryand31december2021

February 4, 2022

Deaths involving COVID-19 by vaccination status, England: deaths occurring between 1 January and 31 December 2021

Age-standardised mortality rates for deaths involving coronavirus (COVID-19) by vaccination status, broken down by age group; deaths occurring between 1 January and 31 December 2021 in England.

Main points

In the period July to December 2021, the age-adjusted risk of death involving coronavirus (COVID-19) was 93.4% lower for people who had received a third dose, or booster, at least 21 days ago compared with unvaccinated people.

In the period July to December 2021, the age-adjusted risk of death involving COVID-19 was 81.2% lower for people who had received a second dose at least 21 days ago compared with unvaccinated people; for January to June 2021, this was 99.5% lower….

https://www.worldometers.info/coronavirus/

February 5, 2022

Coronavirus

United Kingdom

Cases ( 17,749,999)

Deaths ( 158,243)

Deaths per million ( 2,312)

China

Cases ( 106,297)

Deaths ( 4,636)

Deaths per million ( 3)

https://news.cgtn.com/news/2022-02-05/Chinese-mainland-records-27-confirmed-COVID-19-cases-17oGwaL9DFe/index.html

February 5, 2022

Chinese mainland reports 27 new COVID-19 cases

The Chinese mainland recorded 27 confirmed COVID-19 cases on Friday, with 9 linked to local transmissions and 18 from overseas, data from the National Health Commission showed on Saturday.

A total of 60 new asymptomatic cases were also recorded, and 887 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 106,297, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-02-05/Chinese-mainland-records-27-confirmed-COVID-19-cases-17oGwaL9DFe/img/b60dbe606d7147409f0bc6b2b64bd692/b60dbe606d7147409f0bc6b2b64bd692.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-02-05/Chinese-mainland-records-27-confirmed-COVID-19-cases-17oGwaL9DFe/img/00af9eed7d3143ab9ad092dbee5bdcf6/00af9eed7d3143ab9ad092dbee5bdcf6.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-02-05/Chinese-mainland-records-27-confirmed-COVID-19-cases-17oGwaL9DFe/img/ccc9df6429874600962c06200495873d/ccc9df6429874600962c06200495873d.jpeg

https://www.worldometers.info/coronavirus/

February 4, 2022

Coronavirus

United States

Cases ( 77,496,860)

Deaths ( 924,530)

Deaths per million ( 2,767)

China

Cases ( 106,270)

Deaths ( 4,636)

Deaths per million ( 3)

Oil is getting dangerously close to Hamilton’s “hundred dollars here to stay” (summer 2014).

https://econbrowser.com/archives/2014/07/the-changing-face-of-world-oil-markets

Dr. Hamilton’s conclusion began with:

“Although the oil industry has a long history of temporary booms followed by busts, I do not expect the current episode to end as one more chapter in that familiar story.”

But oil prices did not fall. Yea – they are getting closer to $100 a barrel but there is no assurance that they will stay there. Forecasting commodity prices is a tricky business.

Oh, I just read the story in today’s WaPo about yhr joiny statement from Xi and Putin. Apparently it says nothing about Ukraine, with it apparently the case that Xi does not support any invasion. However, Xi does support Putin’s demand for no further eastward expansion of NATO.

of course xi does not support any expansion of nato. why would he support any collective action that could take on china? he has no concern about russia. but they have a common enemy (of sorts) with nato.

Last time oil got above $100/bbl, the oil sector got sloppy with credit. The subsequent widening in BBB corporate spreads was a mirror image of the collapse in oil prices from mid-2014:

https://fred.stlouisfed.org/graph/?g=LHuE

Fortunately, the collapse in oil prices meant the Fed was not eager to withdraw liquidity and there was little contagion (if memory serves). Let’s hope private equity and majors stay on the hook for oil-field credit this time.

MD: That’s something you hear in Bloomberg style articles (not written by economists or even by MBAs). But if you look at the reality, the lending window is very much open for oil producers.

1. Most of the major independents (CLR, COP, DVN, MRO, PXD, XEC, etc.) have ample internal cash flow to fund growth–as they are actually making cash dividends, now.

2. CLR, not even the fanciest of the bunch, that would be EOG or maybe PXD, placed 5 and 10 year bonds at under 3%, in November.

https://seekingalpha.com/news/3768240-continental-resources-prices-two-senior-notes-offering-due-2026-and-2032

Well, I appreciate you facility with dismissive turns of phrase, what with the Bloomberg reference and all (though I’m not aware of any particular inadequacy on Bloomberg’s part), but dismissals ng an argument is not at all the same as refuting it.

So, you claim adequate internal cash to fund operations, then point to new borrowing as evidence of…what? Inadequate internal cash? That an oil field company rated BBB can borrow at slightly above the BBB average?

You seem to have missed the point. Let me repeat it, more slowly: The…oil… sector… was…the …driver …of…corporate…spread …widening …from…mid-2014…to…2016. Sloppy … underwriting …was …a …problem. Oil… field …firms …now …rely …less …on … corporate …credit …than …prior …to …the …2014 …price … collapse. Maybe …credit … markets …will …be …spared .. similar …trouble …this …time.

I hope that helps.

Having debt is not an indication of inability to fund capex, or dividends. It’s a normal part of a tax optimized capital structure for companies, other than those with extreme venture risk.

WACC. Weighted means including debt.

MD,

Also the industry had massive growth in 17, 18, and 19. How do you square that with learned a lesson from 14-16?

Your comments on this credit spread sort of surprised me but then I was enlightened. There are many sources for data to measure this spread including that from THE BLOOMBERG (which is highly overrated). I wrote something back in 2009 on the spike in this spread and then wrote something else when this spread temporarily spiked after COVID got nuts. I failed to note this episode. My bad.

Of course I have an excuse – I was writing this from the damn transfer pricing morons who are basically lawyers and CPAs that would make Bruce Hall look honest and JohnH look smart. Yea – they think I’m a good writer but no – the standards in that world sort of suck.

“It’s a normal part of a tax optimized capital structure for companies,”

but is that what is happening now?

Anonymous et al,

Yes, crude is getting close to $100 per barrel, and what could put it over is something I have mentioned here previously: Putin outright invading Ukraine, with the threat of this certainly part of why the crude price has gotten above $90. Curiously I suspect we may have Xi Jinping to thank if Putin does not invade in the near future. I suspect he has asked Putin not to do it while the Winter Olympics are going on as Xi does not want something like that messing up the publicity about the games. Given that Xi is one of the few world leaders supporting Putin on the Ukraine matter, and certainly the most important one, I think Putin will be taking his advice seriously, although we do not know for sure what they have sad to each other in this recent meeting in Beijing. Anyway, if Putin does invade, I think he will hold off until after the games are over.

That said, I shall remind you and everybody else that about a year ago I said there were non-trivial chances that crude could either go up a lot ort down a lot, up to $100 as Steven Kopits forecast, or down below $40. Frankly, while nobody is talking about it, the latter remains a possibility. I have noted what could put it there, something I hope does not happen, just as I hope Putin does not invade Ukraine. It would be the appearance of a much deadlier and more transmissable variant of Covid.

I know people are now speculating that maybe evolution will lead to future variants looking more like omicron: more transmissable while less deadly. But there is no guarantee that will happen. I remind everybody that the largest single one day change in crude oil prices last year was the more than $10 per barrel decline that happened on Nov. 26, when omicron was first reported. Fortunately it has turned out not to be all that deadly, but if it had been as deadly or worse than delta, that decline could have been repeated for a couple more days, which would have put the crude price down into the $40 range. Again, I do not want to see the economic crash that would lead to this coming from such a variant. I hope it does not happen, just as I hope there will not be an invasion of Ukraine. But such a possibility cannot be counted out.

“crude is getting close to $100 per barrel, and what could put it over is something I have mentioned here previously: Putin outright invading Ukraine, with the threat of this certainly part of why the crude price has gotten above $90.”

Oh the irony in Princeton Steve’s little world. Stevie has literally praying that oil prices rise above $100 a barrel. But something tells me that he too does not want this former KGB thug to invade another Eastern Europe democracy. Careful want you wish for Stevie.

“Fortunately it has turned out not to be all that deadly, ”

Barkley, it has been more deadly than delta. only the peak of December 2020 was greater. just imagine the number of deaths if we did not have a vaccine. it would have dwarfed the December 2020 peak. omicron is/was deadly. the vaccine has worked. that is why this is a worrisome variant.

I have never listened to a Joe Rogan podcast and never will but he has quite the following for some damn reason:

https://thehill.com/blogs/blog-briefing-room/news/592989-joe-rogan-apologizes-for-repeated-past-use-of-racial-slurs

Oh wait – he spreads COVID disinformation and is rather open with his racism. No wonder the MAGA hat crowd loves this jacka$$.

https://fred.stlouisfed.org/graph/?g=Kkl5

January 15, 2018

Global Price Index of Commodities, Energy and Food, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=LHxx

January 15, 2018

Global Price Index of Commodities, Energy and Food, 2007-2021

(Indexed to 2007)

https://www.nytimes.com/2022/02/03/business/economy/food-prices-inflation-world.html

February 3, 2022

Food Prices Approach Record Highs, Threatening the World’s Poorest

The prices have climbed to their highest level since 2011, according to a U.N. index. It could cause social unrest “on a widespread scale,” one expert said.

By Ana Swanson

WASHINGTON — Food prices have skyrocketed globally because of disruptions in the global supply chain, adverse weather and rising energy prices, increases that are imposing a heavy burden on poorer people around the world and threatening to stoke social unrest.

The increases have affected items as varied as grains, vegetable oils, butter, pasta, beef and coffee. They come as farmers around the globe face an array of challenges, including drought and ice storms that have ruined crops, rising prices for fertilizer and fuel, and pandemic-related labor shortages and supply chain disruptions that make it difficult to get products to market.

A global index * released on Thursday by the United Nations Food and Agriculture Organization showed food prices in January climbed to their highest level since 2011, when skyrocketing costs contributed to political uprisings in Egypt and Libya. The price of meat, dairy and cereals trended upward from December, while the price of oils reached the highest level since the index’s tracking began in 1990….

* https://www.fao.org/worldfoodsituation/foodpricesindex/en/

Kevin Drum noted this report earlier and even charted out the inflation adjusted increases in these prices.

“while the price of oils reached the highest level since the index’s tracking began in 1990”.

In nominal terms yes but prices should be done in real terms if one does such comparisons over a 30 plus year period.

“Food Prices Approach Record Highs, Threatening the World’s Poorest”

Looking to the data and article, I am not as yet prepared for an analysis. I do not even know how much flexibility there may be in food production in a range of developing countries, but obviously governments should if possible already be focused on broad scale food supply and storage increases. “If possible” is an uncomfortable but necessary expression.

Also, I hope to learn whether efforts are being made to increase food production in developed countries. A directly related issue is that food production growth has slowed in developing countries through the last decade though need has grown.

https://fred.stlouisfed.org/graph/?g=Ixap

January 30, 2018

Producer Price Index for Fertilizer Materials and Phosphates, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=LICR

January 30, 2018

Producer Price Index for Fertilizer Materials and Phosphates, 2017-2021

(Indexed to 2017)

Some people find stories like this to be very dark. It makes them sad, depressed. Possibly wondering “what is the meaning of life??”. “Why do bad things happen to good people??”. “How can a ‘God’ allow these things to happen??” No doubt had I followed this story from the beginning, it would have been gut-wrenching to hear of the boy’s death after hoping for days. But reading about the story, after the fact, I actually find it heartening. I think it speaks to the inherent goodness of mankind. And although we think in the year 2022 that mankind is numb and callous to the value of human life, a single life still means a great deal to people. People DO care, and many people still have empathy.

https://www.nytimes.com/2022/02/05/world/africa/morocco-boy-well.html

Now if we could just get people like Xi Jinping, donald trump, and Putin to think in this same way about human life, we’d have a much better world.

It is better to give than to receive.

And, I care about people.

Last year, when my elderly neighbor could not find any to buy anywhere, I gave him a box of 12 gauge 00 Buck shot cartridges.

I generally try to stay away from requests for blog posts from the blog hosts. At least in terms of the ratio of ideas that come to mind and the ones I put up in comments. But I was wondering if we might have a post on the “supplier deliveries index”, is it a meaningful number?? And if it is a meaningful number, can we take the fact the number had improved recently as a good sign, in light of the fact it is not seasonally adjusted?? How much hope/weight can we give that most recent number, and is there any way to “front-run” that number with other data??

It’s interesting to observe in the year 2022, folks who are still very unsophisticated about how the internet works. Just from an IQ standpoint this makes her look very bad.

https://www.politico.com/news/2022/02/04/former-clerk-rewrites-supreme-court-wikipedia-bios-00005914

If Biden chooses her this becomes another billboard sign on his potential senility, because she is going to be crucified on the Senate hearing if they bring her up. Changing one’s own wiki page might be “given a pass”, but changing other SCOTUS candidates’ bios?? She’s finished, DOA.

An interesting and important aspect of Chinese preparation for the Olympics, is that the preparation would become a way of extending anti-poverty programs in otherwise forbidding locations that can be turned attractive to winter visitors and sports participants. The response of the Chinese has been dramatic:

http://www.xinhuanet.com/english/20220206/1b3b1ec573fc4673a7efed689c5067b9/c.html

February 6, 2022

China sees winter sports boom around Spring Festival

BEIJING — For many Chinese, this year’s purchases for the Spring Festival became even more special as the Winter Olympic Games opened on the doorstep.

In addition to traditional festive goods such as flowers, pastries, and dried fruits, Chinese consumers are getting their hands on winter sports gear and equipment for the weeklong holiday celebrating the Chinese New Year.

Data from the online marketplace JD.com showed that the turnover of ice and snow equipment increased by 107 percent year on year, winter sportswear increased by 99 percent, and related protective gear up 41 percent during its “2022 New Year shopping festival.”

The Spring Festival holiday arrived with the temperature lowering to minus 10 degrees Celsius in northwest China’s Ningxia Hui Autonomous Region. Passionate skiers, however, have geared up.

Forty-year-old Luo Wei got up early in the morning on the first day of the new year, taking his skis to the Yuehai ski resort in the city of Yinchuan in Ningxia.

Stepping on the board, edging, carving, then braking. These beautiful moves are now so riveting to Luo. He was born and raised in southern China and used to have few chances to experience the charm of winter sports.

“I enjoy sliding on the snow, especially the speed that makes me exhilarated,” he said.

Spurred by the Winter Olympics, this snow season has seen more and more skiing learners, said coach Wang Zijie at the resort….

https://news.cgtn.com/news/2022-02-02/What-winter-sports-development-and-poverty-alleviation-have-in-common-17bxetCShI4/index.html

February 2, 2022

What do winter sports development and poverty alleviation have in common?

By Djoomart Otorbaev

The previous piece * on this topic showed that the upcoming winter Olympic Games in Beijing would be a key catalyst for the explosive development of winter sports in China. The effect of the Winter Olympics has already had a considerable impact on society. More than 346 million Chinese have participated annually in winter sports since Beijing successfully bid to host the 2022 Winter Olympics. According to a survey released on January 12 by China’s National Bureau of Statistics, a quarter of China’s total population is involved in winter sports. The survey results show that China has achieved the goal of “getting 300 million Chinese people to participate in winter sports” much earlier than anticipated.

Thus, another essential target will soon be reached through society’s efforts – to put 55 million people on skis. China will become the world’s largest country in terms of the annual turnover of this sport. By 2025, the industry will become a one-trillion-yuan business….

* https://news.cgtn.com/news/2022-01-27/The-center-of-the-global-winter-sports-industry-is-moving-to-China-16YURV8omQM/index.html

Djoomart Otorbaev is a former prime minister of the Kyrgyz Republic, a distinguished professor of the Belt and Road School of Beijing Normal University.

I’m going to watch “Halloween Kills” now. Wish me luck Michael Myers does not walk up behind me in this semi-darkened computer room while I watch this, OK Barkley?? And don’t you suggest ways he should do me in while that disturbing Carpenter piano is playing either. I know how you work Bark.

Wait, what was that creaking noise??

Moses,

For the record, while I sometimes find you annoying and frustrating, I do not fundamentally dislike you, although you have at times said you hate me. I actually wish you well and suspect that if we were to meet face to face, we would get along OK..

I’ll just add one more thing here, cuz I know what our village idiots crew is going to say. I can see it 5 hours before they type it. We’re supposed to believe “a group” of former law clerks for Jackson knew, along with Godi himself, but “Jackson had no idea”. NONE of Jackson’s law clerks passed on to her what Godi was doing, or Godi himself “never asked” before trying the stunt?? If you’re that stupid about human nature and how these things work (like when NCAA head basketball coaches go untouched while members of their coaching staff fall on the sword) I feel sorry for you. And when Doris Kearns Goodwin got busted for severe plagiarism who did she point her finger at 2 seconds into being caught?? And Cohen and how many trump lawyers take the fall for who?? And on and on and on……. “Jackson didn’t know, but we, ‘a group’ of her law clerks knew”. What a joke. The woman is a buffoon.

I still love you, man.

So did your mother.

NO wait, let me guess, your mother died as a nurse in the Vietnam War?? Right before she birthed your younger brother in a live Afghanistan war zone??