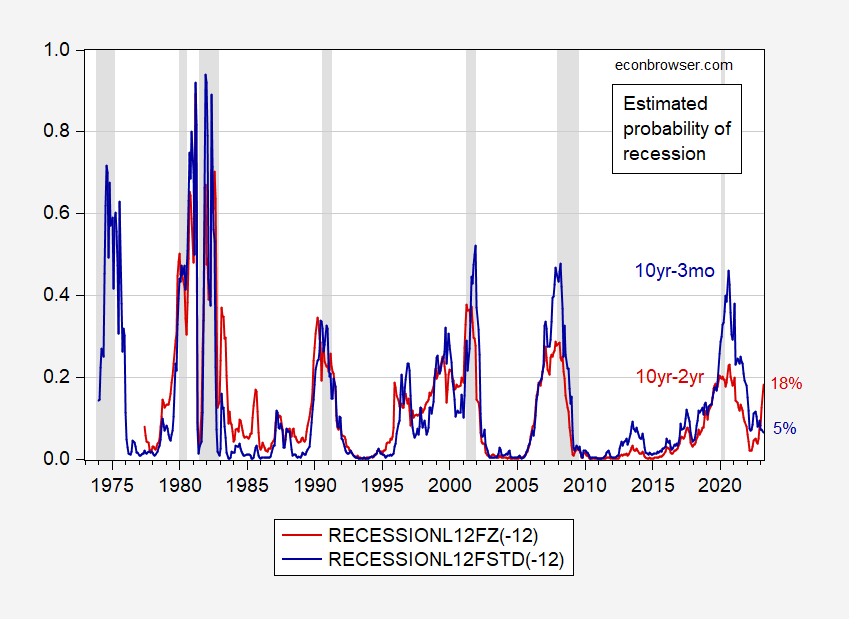

What do simple 10yr-3mo and 10yr-2yr Treasury spreads imply about recession probabilities?

Figure 1: 12 month ahead estimated probability of recession using 10yr-3mo Treasury spread (blue), and using 10yr-2yr spread (red). NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, NBER and author’s calculations.

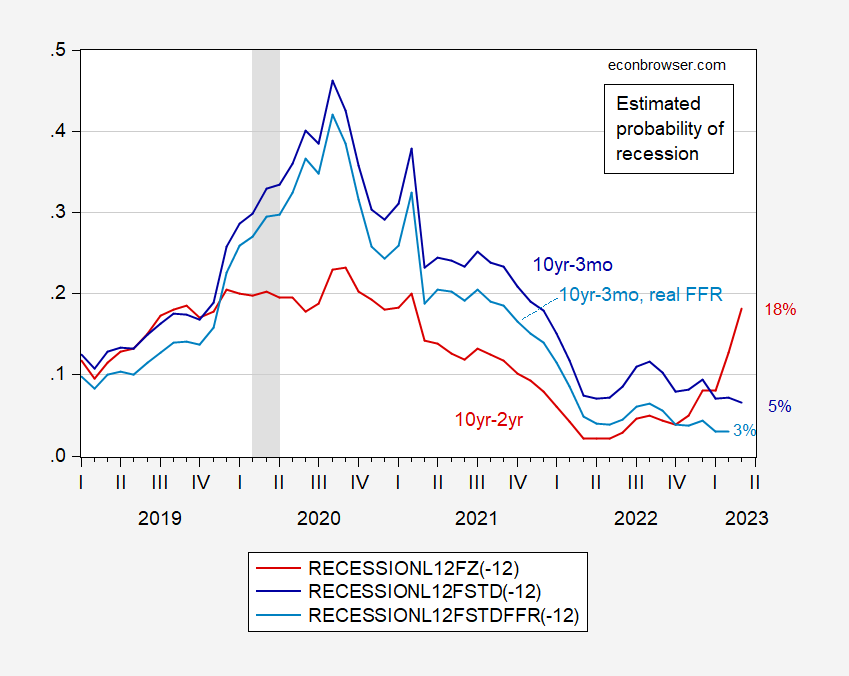

Reflecting the drastically diverging trajectories of the spreads, the probability estimates also diverge. A common alternative specification includes the inflation adjusted level of the fed funds rate. In the detail below, I show the two forecasts above and this alternative.

Figure 1: 12 month ahead estimated probability of recession using 10yr-3mo Treasury spread (blue), 10yr-3mo spread and fed funds minus ex post lagged inflation (light blue), and using 10yr-2yr spread (red). NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, NBER and author’s calculations.

This alternative does not produce a substantially different forecast.

Hence, if past correlations hold into the future, then a recession in the next 12 months is not likely. However, it must be admitted that there are many different spreads that one can consider (see e.g. here).

Deutsche Bank notes that “the spread between the current conditions

components of the University of Michigan and Conference Board surveys” is highly correlated (80%) with the 10yr-2yr spread, and concludes (1) that spread should be yet smaller, and that hence (2) there is a 50% chance of a recession in the next year (Luzzetti, Ryan, Weidner, Yang, “Consumer sentiment gap is proving prescient for curve shape,” US Economic Notes, Deutsche Bank, March 29, 2022).

Discussion of domestic recession odds for the U.S. at this point in the Fed rate cycle is not normal. The FOMC has hiked rates just 25 basis points, to a target range of just 25 to 50 bps, and already the curve is being cited as warning of recession. This is a manifestation of both the low rate environment that has been with us since he Great Recession and the twin shocks of the Covid pqndemic qnd Russia’s invasion of Ukraine. Here’s a picture of the oddity of the present situation:

https://fred.stlouisfed.org/graph/?g=NzRL

I am not as familiar with the timing developing economies running into debt-payment trouble once the Fed starts hiking rates. My impression is that this is early in the cycle for such trouble, but with the debt increases due to Covid, the end of debt payment moritoria and the various stresses due to Russia’s war, payment problems are coming up fast:

https://blogs.worldbank.org/voices/are-we-ready-coming-spate-debt-crises

https://www.ft.com/content/f09f4864-fc81-4dbd-8086-25e70ed01019

https://unctad.org/system/files/official-document/tdr2021-update1_en.pdf

Debt restructuring will be needed, but attention to the debt problem is probably lacking, as is the necessary level of coordination. China has recently been the biggest new lender to developing economies and doesn’t have a history of participation in international debt restructuring. Both the World Bank and UNCTAD are sounding the alarm, but lender governments are not yet listening.

I’m not quite ready to get my bullhorn out yet, but on a separate but semi-related topic, I am wondering who is going to buy all of the Fed’s treasuries when they sell them?? I don’t see demand matching supply there, and with rates rising, who wants to hold them?? This is a situation I am kinda watching.

Excellent point.

Last I saw on FRED March 2022, the Fed holds $5.8 trillion in UST securities and $2.6 trillion in mortgage-backed securities.

Now, the built-ins: a trillion or two annual, deficits.

And, it’s all ‘priced’ at material, negative real rates.

@ T Shaw

Please don’t agree with me, it makes me re-think and wonder if what I am saying has any basis in fact at all.

they will take rubles?

from jan to sep 2018 the fed balance sheet declined/was reduced about $600b, $4.4t to 3.8t.

outside that; little experience reducing the balance sheet.

23 mar report $8.9t in assets.

That’s what recessions are for.

Another problem is that assumable mortgages are no longer commom. FHA mortgages are, agency mortgages aren’t. Assumable mortgages reduce the drag on residential construction just a bit.

Low rates haven’t done wonders for non-residential investment, but they’ve worked a treat for asset prices. Inducing scarcity of safe assets and soaking up risk also work through asset prices. This is gonna be an interesting experiment.

Offloading these assets may be a bit sticky, but a look at the Fed’s balance sheet shows that the lion’s share of the assets are US Treasuries. Mortgage backed securities are 2.7 trillion dollars and the vast majority come due in over 10 years.

So I see only some frictions at specific maturities and instruments.

As has been said the Fed can only sell to a willing buyer who agrees on a fair price.

Repos have gone away but can someone explain reverse repos to me?

Just a very casual definiition here—but I think it is basically a short-term tool the Fed can use to lower the supply of reserve balances in the banking system.

Moses, my fellow inebriant, an off-topic question for you –

Are you a fan of country wines (made from fruit other than grapes)?

I wouldn’t say I am a fan or not a fan, I just haven’t had the opportunity to try many out. I’m open to it if you have relatively cheap suggestions (Like at least under $25 for a decent sized bottle). I might pay as much as $10 for a regular sized can but I’d have to have a strong endorsement from you before I paid that much.

My regular drinks now (should I say this when someone might ID me by personal habits in the grocery store??). I get 6 cans of the “tall” cans of Corona Mango flavor, One 1.5 liter of cheap Pinot Noir (I’ll let pgl and Professor Rosser get the giggles by disclosing I usually get “Barefoot” brand now. I much prefer Beringers wine but my Grocers stopped carrying it, so I’m stuck with “Barefoot” brand wine for now) and then I usually pick up either one tall can of Modelo Dark, or one large can of “Miller High Life”. I don’t really like “Miller High Life” that much, but it makes me feel good to support a Labor Union made brand, which is what “Miller High Life” is. But for taste and quality, I probably actually prefer Modelo Dark over “High Life”. And that’s what I get nearly exact every 10 days, and it lasts me….. maybe 36 hours tops, more like 24 with a sleep in the middle.

If you’ve got a recommendation or recommendations I’m VERY interested to hear them, But I have drank the most rot-gut, in the true meaning of rot-gut Chinese white wines before. For me alcohol is about “getting to the point”. It’s a mental escape for me and a way to let off emotional steam, and taste is secondary for me.

I also get the tall can of Heinekin once in a blue moon, I think it cost me $2.66 for a tall can?? But mostly if they’re out of stock of Modelo Dark I might pick up the tall green can of Heinekin. It’s nostalgic for me because I would sometimes get that in the bars in China. It really doesn’t taste that great. I wish I could find the old tall glass bottles of “Bud Ice” because it also has nostalgia feeling for me when I was in China, but I think they stopped making “Bud Ice’. I’ll be damned if I can figure out why they stopped making it though, that stuff was SO SMOOTH tasting it really did taste like mountain water er something. Possibly the best beer I ever had in my life. Top 5 for sure.

Moses,

$3/bottle, 2 hours of your labor and patience for a month, give or take:

https://skeeterpee.com/recipe

You can do without most of the chemistry. Potasium metabisulfate, potasium sorbate aren’t strictly necessary, as lonnas you don’t want bubbly wine. A strong cup of black tea substitutes for tannin. Instead of yeast nutrient and booster, you can use the old moonshiner’s trick: one tablespoon of tomato paste per gallon. Santa Cruz organic lemon juice avoids the problem of preservatives.

Divide everything by 5 to make a one-gallon batch. It’s a learning experience, but it’s worth it. And it’s legal.

Moses,

I am not going to giggle about Barefoot. I simply know nothing about it. As for Beringer, it may not be Vosne-Romanee, but it is also far from being rot gut. Sorry your grocer not having it any more.

@ Macroduck

You have my word, I’ll give it a go and report back here. I’m mentally challenged on some of these things, but I’ll give it a go. I appreciate the recommendation. I’m lazy type and if I didn’t put faith in your word I wouldn’t do the effort.

God Bless.

well. let’s see how “alert” you are now Barley

The Fed takes one side of a repo transaction In a repo, adding liquidity in a temporary basis, the other side in a reverse repo, temporarily draining liquidity. Same transaction.

i think this item has been discussed on the blog previously, but probably serves a new discussion. as far as i understand, when the fed talks about unwinding the bond purchases, they do not imply they will sell any of the bonds. they will simply let them mature, however long that takes. the bond taper has to do with buying new bonds, not selling existing holdings. at least, this is the message i have been getting from the fed. that means everybody barking about the fed trying to find all these buyers are barking about a nonevent. certainly the fed could change their action, but currently their position is to not sell off existing holdings. just let them expire.

baff,

You are basically right. The Fed stopped piling up net more securities back in 2019, the end of its “quantitative easing.” But indeed it looks that they are not actively selling off securities to reduce the balance sheet, but rather simply retiring ones that mature, which is happening gradually. The main focus of the tightening policy is on raising interest rates, not substantially reducing the balance sheet.

Those all worried about who will buy them are worrying unnecessarily, and in a world at war, the USD is still the safe haven currency, despite Russia wanting people to buy their gas with rubles, and the Chinese trying to get more people to use the rmb/yuan. Sorry, not happening much.

“…the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.”

“Reduce” is all the guidance we have from the statement, but 8n the past that has meant not replacing some or all of the debt maturing from the portfolio.

As a practical matter, this means two thing. One, the portfolio is drawn down no faster than debt held by the Fed matures. Two, the Fed doesn’t need to find buyers.

However, Treasury does need to find buyers. The difference between selling and rolling off is a matter of quantity and keeping people from going ape.

No buyers needed for securities that mature and are paid off. They simply go away.

Menzie kind of “corrected” me on this once before, and I had a slightly (but not cage match with ladders and metal folding chairs and thumb tacks level) heated exchange with some in the thread. I think Menzie was largely right to correct me on this (that the Fed just lets the securities mature, and holds them to maturity), and I waved the white flag on it as I recall…… however, I made a small timid defense of myself at the time, which I think Menzie 95% disagreed with me on at the time, but Menzie “let it rest”….. that just because the Fed “has never done this before” is no guarantee they won’t do it in the future. We don’t know they won’t sell those treasuries, and some folks much sharper than Joe Six-Pack Uncle Moses have stated this is a possibility:

https://www.bloomberg.com/news/articles/2022-01-22/the-fed-might-end-up-needing-to-actually-sell-some-of-its-bonds

If I misrepresented Menzie’s thoughts on this, it’s been weeks since we discussed this, he is encouraged to correct me and correct the record.

macroduck,

My last comment televant for Fed. Yeah, fir Treasury it still needs to find buyers for fresh debt, but in fact the rate of borrowing will be lower with the new budget and the end of the ARP, for better or worse. Budget deficit likely to be only half what it was last year, so does not need to find as many buyers.

Moses, thanks for the link. unfortunately, I did not find it very convincing. I think the fed will continue to do what it has done in the past. if it were to change course, and of course they can do so, I think they would very deliberately change the narrative ahead of time so that this possibility was more seriously considered. the markets would probably hit turmoil if they suddenly starting selling bonds back into the market without a rather long lead time suggesting this could happen.

normally I like Bloomberg links, as they are typically written in a pretty informative way. I was disappointed in the quality of the work in this link.

baff,’

Well, the link actually said that “most analysts” expect a continuation of the past Fed policy of just letting securities mature. However, the article foscuses on this one analyst at Credit Suisse who disagrees with that and says they will probably sell some securities. Heck, they might, but it looks for now mostly like they are continuing the let securities just mature while emphasizing interest rate policy.

Why get distracted by trader plays when funding costs are the real causes of recessions?

resm,

Um, when was the last recession whose “real cause” was “funding costs”? The most recent one was largely due to lockdowns triggered by the first wave of the Covid-19 pandemic, not funding costs involved there. Going back to the Great Recession, we had the collapse of a various investment banks as the housing bubble collapsed. Looks more like “trader plays” than “funding costs” there. The one before it was tied to the collapse of the high tech stock bubble, again, more like trader plays than funding costs.

So, where did you come up with this latest fantasy of yours?

In other news, Lindsey Graham tries to slam Biden by taking something the President out of context but the Twitter blew up turning Graham’s little rant against him:

https://www.msn.com/en-us/news/politics/lindsey-graham-s-attempted-diss-of-biden-backfires-when-twitter-users-flip-the-script/ar-AAVEDg8?ocid=uxbndlbing

Why does this remind me of the chirping from Bruce Hall? Of course Bruce would reply to the come back with his usual whining and denials. We’ll see if Senator Graham does the same.

Graham is worse than a teenage girl. Even he doesn’t believe three fourths of the stuff that comes out of his mouth. He’s like that proverbial girl “crying” burying his face in his hands, and then peaking out her eyes peripherally, dry faced, to visually inspect if anyone’s buying it. It’s not like we haven’t known the type of person Graham is over the last two decades, but any doubts a person could have had would have been erased by the golf outings with the Orange Abomination.

Lindsey Graham’s speech telling us why he voting on Ketanji Brown Jackson was so chocked full of lies and little girl whining, it is not worth listening to but Durbin’s reply to Graham’s last garbage is worth the listen:

https://www.bing.com/videos/search?q=lindsey+graham+ketanji+brown+jackson&view=detail&mid=BD95498540E475A2FDB4BD95498540E475A2FDB4&FORM=VIRE

No truism is ever the full truth; the view that recessions happen for business cycle reasons or fiscal reasons and never due to external events is a popular one, but there are been three overlapping forces in this case that cannot be ignored: the “end” of recovery from the Great Recession, the disruption from a pandemic (with the accompanying “supply chain” issues), and an actual large-scale shooting war.

I think that means that predicting a recession based on a chart of past circumstances has a lower degree of confidence than typical – and it was not high to begin with.

March 9, ANDERS ÅSLUND: “ The Ruble: Convertible No Longer”

https://econbrowser.com/archives/2022/03/the-ruble-convertible-no-longer

March 30, NY Times: “ the Russian ruble made a staggering rebound approaching its prewar value on Wednesday..”

https://www.nytimes.com/2022/03/30/world/europe/russian-ruble-recovery-economy.html

I don’t expect this news to be highlighted. Instead of serving as a cheering section for US geopolitical ambitions in Ukraine, it was be nice if economists stayed in their lane and provided a thorough analysis of the blowback of US sanctions and related activities on the U.S. economy. The US government always paints the next or current war in glowing terms, but reality eventually sinks in, as it did in Vietnam and Iraq and Afghanistan. Since this war is being waged economics with economic weapons, economic analysis is more important than ever. But so far the analysis of the impact on Russia has not been stellar.

https://news2.wqidian.com/2022/03/30/ruble-shows-signs-of-recovery-but-may-not-be-strong-indicator-of-economy

Putin’s chief cheerleader is all excited that for now a dollar can buy only 83 rubles but let’s be clear – this is based on speculation that Putin will reverse his disgusting invasion. If Putin stays on course, the Russian economy is not about to recover. But this garbage?

“Instead of serving as a cheering section for US geopolitical ambitions in Ukraine, it was be nice if economists stayed in their lane and provided a thorough analysis of the blowback of US sanctions and related activities on the U.S. economy. The US government always paints the next or current war in glowing terms, but reality eventually sinks in, as it did in Vietnam and Iraq and Afghanistan.”

Sorry troll – your boy Putin is waging this war not Biden. It would be “nice” as you say if you stopped being the chief cheerleader for a murderous thug.

Ah, so it’s the job of economists to do your bidding (well, your masters’ bidding)? Economic analysis to order.

How nice of you to show your hand.

I guess macroduck thinks it’s too much to ask economists to tell us where the US economy, something they supposedly know a lot about, is headed in changing times! But they sure do know where the Russian economy is headed, despite little knowledge about it.

What a load of babble. But at least Putin gave you an extra bone for that.

JohnH,

Rise of ruble has nothing to do with the “blowback” you keep nonsensically going on about here. The main trigger for it has been the pullback by Russia of troops from Kyiv and the start of negotiations, with people hoping for an early end to the war. As it is, that is now looking overdone, with negotiations clearly going nowhere and it looking like Russian troops regrouping. So ruble heading back the other way, now at 85.

Oh, and yeah, being able to sell oil to India as well as China is helping even if it does so at a disscount. Those actions, of course, help keep the price of oil from going too high, now also well down from an earlier, high, with this helping to moderate that blowback you are so excited about. Not happening nearly as much as you hoped for.

LOL. “ The main trigger for it has been the pullback by Russia of troops from Kyiv and the start of negotiations, with people hoping for an early end to the war.”

Like believing in the confidence fairy…or Santa. Claus. Meanwhile nothing has changed in the fundamentals—sanctions and expulsion from SWIFT—that supposedly doomed theRussian economy and the ruble to oblivion.

But Russia’s requiring payment for oil in rubles might have been behind the rise.

JohnH,

Sorry, you are in total fantasyland. Nobody is going along with Putin’s demand that they pay in rubles for gas. He has been accepting euros, if not dollars. So, sorry, you are selling nonsense here. Ruble is still continuing to slide further, although reportedly the Russian central bank has been actively trying to prop it up in the markets through massive purchases.

Hard fact remains that while there is indeed pain being felt by othet nations, the decline in GDP in Russia far exceeds anything going on in any other nation. Putin may be able to sit on it and convince his citizens must put up with privation. But the Russian economy is without question suffering far more damage than any other.

Are you really an out and out Putin bot or just stupid, JohnH?

Not so far fetched as you might think. Russia and India are negotiating trade in rubles…and Saudi Arabia and China are talking about trade in yuan.

Gita Gopinath, a top official at the IMF, said that Sanctions on Russia could end up eroding the dominance of the US dollar.

https://markets.businessinsider.com/news/currencies/dollar-dominance-imf-russia-sanctions-finance-monetary-system-crypto-ukraine-2022-3?op=1

This is the kind of stuff that US economists can’t seem to imagine, much less talk about.

JohnH,

Sure we can imagine it, but do not be surprised if neither the Saudi-Chinese negotiation or the Indian-Russian one leads to anything. We have already seen Putin’s demand to be paid in rubles by the Europeans fall apart. Even if those two deals happen, they are a pretty small part of world trade, not going to change things much.

The more interesting matter involves crypto, although apparently systems in Russia right now are seriously not well set up for doing a lot of crypto trading, but that might happen, probably more than these regular currency deals that have you so excited and that somehow you think no US economists are aware of, just as you somehow think none of us know anything about the Russian economy, gag.

Your own links said what Barkley noted. Try learning to READ.

Economist Peter Navarro yesterday: “It was a tragedy that Mike Pence decided to be a traitor to the American Caesar of Trump”.

They are not even being coy about it anymore. They want an imperial dictator.

I’d love to see a certified and well-credentialed psychologist sit down with Navarro for 2 weeks of sessions and then tell us what he thinks. I’m not even joking but I wonder if it’s a chemical imbalance. What’s striking is you have to assume he was relatively with it when he did the book with our good blog host. So what happened for the drastic change??

he got old. and angry. and bitter. i see this progression with many, but not all, conservatives.

Caesar was taken out on the Ides of March. I was hoping back on March 15 a group similar to the Roman Senators would take a little trip to Maro Largo. And yea – I really hoped some people in the Kremlin had the same idea.

To which Caesar was the obviously addled Navarro referring: Julius, Sid, or Caesar from War for Planet of the Apes?

Inquiring minds.

Given that Navarro followed it up with “Et tu, Brute?” referring to Pence, it’s pretty clear to which Caesar he was referring, although I appreciate your joke.

And Navarro takes the wrong lesson from Shakespeare’s “Tragedy of Julius Caesar.” Caesar’s death isn’t the tragedy, although Caesar is the proximate cause of the tragedy. Caesar is only a minor character in the play although central to the plot.

The tragedy and the entire play is really about the protagonist Brutus and his conflicted feelings regarding loyalty to a tyrant or loyalty to the Republic. That internal conflict eventually leads to Brutus’ own tragic death,.

That Navarro misperceives the death of Caesar as the tragedy in the play simply reflects his devotion to tyrannical dictatorship.

https://mainlymacro.blogspot.com/2022/03/pretending-pandemic-is-over-has-been.html

March 29, 2022

Pretending the pandemic is over has been the disaster most experts said it would be

As I wrote over a month ago Boris Johnson, in an attempt to gain support among at least half of his MPs, the newspaper oligarchs and his party donors, threw science to the wind and all but declared the pandemic was over. No more compulsory masks in public spaces, no more free testing, no more having to self isolate, and a cut back in how we monitor Covid. It was a decision of utmost stupidity, and that stupidity has now become clear.

We knew about the BA.2 variant at the time Johnson made his decision, but he ignored it. The media, and the broadcasters are as much to blame here as the right wing press, translated Johnson’s politically motivated edict as a proclamation that the pandemic was over. Most people stopped wearing masks and acted as if the pandemic really was over. No doubt BA.2 would have led to another wave of infections anyway, but people acting on the signals the government and media gave them have undoubtedly made it more severe than it needed to be..

You don’t have to believe me or the experts to believe that. Our health minister has also said that recent increases were “primarily down to the increased social mixing we are seeing, as our country has opened up”. So cases and hospital admissions now look like they are similar to the previous Omicron peak. 1 in 16 is infected with Covid in England, and it’s even higher in Scotland….

— Simon Wren-Lewis

https://www.worldometers.info/coronavirus/

March 30, 2022

Coronavirus

United Kingdom

Cases ( 21,073,009)

Deaths ( 165,187)

Deaths per million ( 2,411)

China

Cases ( 147,437)

Deaths ( 4,638)

Deaths per million ( 3)

So why are China’s largest cities on lock down? And why are you not reporting this? Oh yea – your credibility is already less than zero.

https://www.worldometers.info/coronavirus/

March 29, 2022

Coronavirus

United States

Cases ( 81,686,628)

Deaths ( 1,005,056)

Deaths per million ( 3,006)

China

Cases ( 147,437)

Deaths ( 4,638)

Deaths per million ( 3)

Wren Lewis makes the same mistake as the Chinese government, he does not have an useful exit strategy. Of course Johnson was gambling in December 2021 considering the low ICU capacity in UK, but basically the strategy is correct: vaccinate many people and let a milder variant infect them.

And check the vaccination status of people in ICU beds, around 70-80% are not vaccinated.

https://news.cgtn.com/news/2022-03-30/Chinese-mainland-records-1-629-new-confirmed-COVID-19-cases-18OEcdhKW4w/index.html

March 30, 2022

Chinese mainland reports 1,629 new COVID-19 cases

The Chinese mainland recorded 1,629 new confirmed COVID-19 cases on Tuesday, with 1,565 linked to local transmissions and 64 from overseas, according to data from the National Health Commission on Wednesday.

A total of 7,196 new asymptomatic cases were also recorded on Tuesday, and 49,421 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 147,437, with the death toll at 4,638.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-03-30/Chinese-mainland-records-1-629-new-confirmed-COVID-19-cases-18OEcdhKW4w/img/3e101c40515e4c3aaf5b54b2ffffdddc/3e101c40515e4c3aaf5b54b2ffffdddc.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-03-30/Chinese-mainland-records-1-629-new-confirmed-COVID-19-cases-18OEcdhKW4w/img/205b7f9f864a4626aa6f432d88e8596c/205b7f9f864a4626aa6f432d88e8596c.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-03-30/Chinese-mainland-records-1-629-new-confirmed-COVID-19-cases-18OEcdhKW4w/img/df9e0afca1474ba7b2fdd50413b15bd4/df9e0afca1474ba7b2fdd50413b15bd4.jpeg

“Chinese mainland reports 1,629 new COVID-19 cases”

this becomes very problematic for a virus that spreads in an exponential manner. once it gets out, it becomes very difficult to contain. china had done a good job of containment so far, but i think they are eventually going to reach a point that cannot overcome the exponential nature of the virus.

The issue in China is that they do not have a good exit strategy. Lock-downs will not work in the longer run.

what makes the exit strategy all the more difficulty, is by the process of natural selection, each wave of the virus tends to be even more transmissible. that means your lockdowns, today, must be even more effective than the ones last year. that is difficult to achieve in the long run. china’s biggest issue is that the vaccines they have given to much of the population lack the efficacy of those used in the west. this is the primary reason why their lockdowns have continued, and they know it. but unless they can find a cure, at some point they deal with the exponential spread of an even more infections virus. this will break the health care system in china for a period of time, unfortunately.

Interesting thought from former NY Fed member, Bill Dudley, about an inevitable recession due to the Sahm rule.

https://finance.yahoo.com/news/recession-inevitable-fed-policy-missteps-172307163.html

https://www.nytimes.com/2022/03/29/opinion/inflation-prices-interest-rates.html

March 29. 2022

Keep your eye on the three F’s

By Paul Krugman

High inflation in the United States basically reflects two forces.

On one side, there’s a lot of disruption: rising oil and food prices (made worse by Russia’s invasion of Ukraine), snarled supply chains and so on. These factors are the reason inflation is way up everywhere, not just in America. For example, here’s Britain:

https://static01.nyt.com/images/2022/03/29/opinion/krugman290322_1/krugman290322_1-articleLarge.png?quality=75&auto=webp

British inflation is surging, too.

On the other side, the U.S. economy is running very hot, with widespread labor shortages. You can see this overheating in lots of data, but it’s also visible to the naked eye. Here’s what I saw on the roads of New Jersey the other day (don’t worry, my wife was driving):

https://static01.nyt.com/images/2022/03/29/opinion/krugman290322_2/krugman290322_2-jumbo.png?quality=75&auto=webp

It’s tight out there.

So far, at least, there’s no sign of a third possible factor: inflation driven by entrenched expectations of inflation — in which businesses raise prices because they believe other businesses will raise prices. But that factor could emerge if inflation stays high, so prudence demands that we try to rein in prices now. And while the disruptions will fade over time (there are already hints of improvement in supply chains), it pains me to say that we can’t safely let the economy keep running this hot.

The reason this pains me is that there are many very good things about a tight labor market in which jobs are easy to find. A buoyant job market is especially important for the young: Recent graduates who have the misfortune to enter a weak market can suffer long-term damage to their career prospects.

Unfortunately, we do need some cooling off. What I’m not sure people realize is the extent to which policies and events have already set the stage for the big cool-down.

Start with the Federal Reserve, which is under widespread attack for being behind the curve. It’s true that so far, the Fed has raised short-term interest rates — which are what it directly controls — by only a measly 0.25 points.

But short-term interest rates aren’t directly important for the economy. A business considering, say, borrowing to pay for a software upgrade that will be obsolete in two years doesn’t care much what interest rate it has to pay. Monetary policy mainly works through the effect of interest rates on long-lived investments, especially housing construction, which in turn means that long-term interest rates are what matter.

And long-term rates reflect not just what the Fed has already done but also what it’s expected to do. The Fed’s pivot to inflation fighting has already sent long rates — especially mortgage interest rates — way up:

https://static01.nyt.com/images/2022/03/29/opinion/krugman290322_3/krugman290322_3-jumbo.png?quality=75&auto=webp

The Fed’s pivot is already having a big effect….

Just read that Bruce Willis has aphasia. Bummer……

Hope he recovers. Wouldn’t mind seeing John McClane or Paul Kersey ride one more time.

Why don’t you simply grab a weapon and do him yourself, sweetheart?

The same reason I don’t do Rambo. I like the fantasy and living vicariously threw some of these guys. I like Wade Whitehouse in “Affliction” too. BOTH the book (which I love) and the film (which I love). I mean I actually have a lot of affection and relate to his character in a lot of ways. But I would never do what Wade Whitehouse does at the end of that film.

*through, damn it. One of these days I’m gonna stop doing that.

aphasia is a symptom, what is the medical issue?

one issue is stroke/damage to a region of the brain.

willis had how many pfizer jabs?

Oh yea – your credibility is already less than zero.

Oh yea – your credibility is already less than zero.

Oh yea – your credibility is already less than zero.

[ Ceaseless, maniacal intimidation. ]

Now pointing out reality is “Ceaseless, maniacal intimidation”.

If you can’t take proper criticism – try being honest for a change.

ltr, still waiting on your apology for the unfounded racist claim towards me. such unprovoked and mean spirited comments should result in an apology from you. it was ceaseless and maniacal intimidation on your part. but it will not silence me.

This is the same thing as what mainland Chinese people feel about Xinjiang people and Tibet people in China. At the same time they pick at how whites treat blacks in America, they can’t identify the racism inside themselves. I have biases on race, I try to fight them inside myself. I believe most people have these same racial biases. HE’s not going to apologize. His (ltr’s) responses seem “canned” or “cliche”. All the less reason you should take it personally. ltr’s comments sound like a script telemarketers use. It’s not a natural response. So….. everyone here sees that for what it is.

Rand Paul has finally agreed not to block those trade sanctions against Putin’s regime but only after the rest of the Senate agreed to loosen up and let Putin get away with certain human rights violations:

https://news.yahoo.com/rand-paul-cuts-deal-russia-180642336.html

One has to wonder if Senator Paul is on Putin’s payroll. We know Donald Trump, JohnH, and Bruce Hall are.

We now have two Senate Republicans who will vote in confirm Biden’s selection to the Supreme Court – Susan Collins and Joe Manchin.

…try being honest for a change.

…try being honest for a change.

…try being honest for a change.

[ Ceaseless, maniacal intimidation. ]

@ ltr

I gotta say, it would be fascinating to know your background and personal motivations. it might be a semi-education to know your background I can extend myself out VERY far for people in terms of their words and behavior. Give them the benefit of the doubt. But I smell the bad odor of disingenuousness on your part. So, I think I just find you tiresome mostly.

ltr confirms she is dishonest and any plea for her telling the truth is “Ceaseless, maniacal intimidation”. Glad we cleared that up!

calling somebody racist, and then remaining silent in response is very improper behavior, ltr. if you make a false statement, you should apologize. rather than remain silent and act like that is some noble action on your part. I am still awaiting your apology. otherwise you simply display the behavior of a bully.

It may be funny woman, funny as can be……”You now if we have any ‘little ones” You know they got the same impigment like ME. When we move…… WAY on the “outskirts” of town……. You know I don’t want nobody always hangin’ ’round

“Well, alright……”

i don’t understand how a 0.3% increase in February retail sales is recorded as a 1.0% decrease in nominal PCE goods and a 2.1% decrease in real PCE goods by today’s income and outlays report. there were no intervening revisions that i know of. any ideas?

(NB: pulling out food services sales accounts for 0.3% of it, still leaving a big difference)

see tables 5 & 7 here: https://www.bea.gov/sites/default/files/2022-03/pi0222.pdf